Buffettology by Mary Buffett & David Clark

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

“Buffettology,” authored by Mary Buffett and David Clark, is a comprehensive exploration of Warren Buffett’s legendary investment philosophy. Mary Buffett, Warren Buffett’s former daughter-in-law, brings a unique insider perspective, while David Clark, a seasoned Buffettologist and investment educator, contributes rigorous analytical depth. Together, they distill decades of Buffett’s wisdom into a practical, accessible guide for investors at all levels. The book was first published in 1997, a time when Buffett’s approach was gaining mainstream attention as Berkshire Hathaway’s performance continued to outpace the broader market. The historical context is significant: the late 1990s were marked by speculative excess, especially in technology stocks, making Buffett’s disciplined, value-driven approach both countercultural and prescient.

The main theme of “Buffettology” is to demystify the principles and techniques that have enabled Warren Buffett to achieve extraordinary, market-beating returns over a multi-decade horizon. The book’s primary purpose is educational — it seeks to empower readers to think like Buffett, not just by copying his stock picks, but by deeply understanding the logic and calculations behind each investment decision. Mary Buffett and David Clark emphasize a business-owner’s mindset, rigorous valuation, and the power of compounding, all while providing real-world tools and checklists that readers can use in their own investment process.

What sets “Buffettology” apart from other investment books is its granular dissection of Buffett’s approach, including specific mathematical formulas, valuation techniques, and qualitative criteria that Buffett himself has used. The book is not just a collection of anecdotes or broad principles; it is a systematic manual for analyzing businesses, determining intrinsic value, and constructing a durable portfolio. The authors blend narrative explanations with concrete examples, case studies, and Buffett’s own words, making the material both engaging and actionable.

This book is considered a classic because it bridges the gap between academic finance and practical investing. It is particularly valuable for individual investors, financial analysts, and anyone seeking to build long-term wealth through equities. Novices will appreciate its clarity and step-by-step approach, while more experienced investors will find depth in its advanced sections on valuation and business analysis. “Buffettology” also serves as a counterweight to the short-termism and speculative trends that often dominate financial media, reinforcing the virtues of patience, discipline, and independent thinking.

Ultimately, “Buffettology” stands out for its unique blend of insider access, analytical rigor, and practical utility. It is not just a biography or a collection of Buffett quotes; it is a toolkit for building lasting wealth. Readers come away with a deeper appreciation of what makes a great business, how to recognize value, and how to avoid the common pitfalls that ensnare less disciplined investors. For anyone serious about mastering the art and science of value investing, “Buffettology” remains an indispensable resource.

Key Themes and Concepts

Throughout “Buffettology,” several core themes emerge that underpin Warren Buffett’s investment philosophy. These themes are not isolated to individual chapters; rather, they recur and intertwine across the book, forming a cohesive framework for intelligent investing. The authors carefully build on each concept, moving from foundational principles to advanced techniques, always grounding their advice in Buffett’s real-world track record. Understanding these key themes is essential for grasping the full depth of Buffett’s approach and for applying these lessons to your own investment journey.

At its core, “Buffettology” is about thinking differently — adopting a business-owner’s mindset, focusing on intrinsic value, and maintaining discipline in the face of market volatility. The book repeatedly emphasizes the importance of long-term thinking, rational analysis, and a deep understanding of both quantitative and qualitative factors. The following key themes represent the pillars of Buffettology and provide a roadmap for readers seeking to emulate Buffett’s success.

- Business Perspective Investing: This theme is the foundation of Buffett’s philosophy and is woven throughout the book, especially in chapters 4, 5, and 6. Buffett’s approach is to treat every stock purchase as if he were buying the entire business. This means focusing on business fundamentals — earnings, return on equity, competitive advantages — rather than short-term price movements or market sentiment. The book provides numerous examples of how this mindset leads to better decision-making and helps investors avoid the pitfalls of speculation. For practical application, investors are encouraged to read annual reports, understand the company’s products and industry, and ask themselves whether they would be comfortable owning the entire business indefinitely. This perspective instills discipline and patience, two qualities that are essential for long-term success.

- Valuation and Intrinsic Value: Central to the Buffettology method is the rigorous valuation of businesses. Chapters 7, 9, and 10 delve deeply into how to calculate a company’s intrinsic value — the present value of its future cash flows. The authors provide detailed formulas and step-by-step instructions, demystifying concepts like discounted cash flow (DCF) analysis and owner earnings. This theme is critical because, as Buffett says, “Price is what you pay; value is what you get.” By focusing on intrinsic value rather than market price, investors can avoid overpaying and improve their long-term returns. The book also stresses the importance of a margin of safety, ensuring that investments are made with a comfortable buffer against unforeseen risks.

- Identifying Excellent Businesses: Not all businesses are created equal. Buffettology emphasizes the need to find companies with durable competitive advantages — so-called “economic moats.” Chapters 11, 15, and 16 explore the characteristics of excellent businesses: high return on equity, consistent earnings growth, strong brand recognition, and the ability to raise prices without losing customers. The book provides checklists and real-world examples of companies that fit these criteria, helping readers develop an eye for quality. In practice, this means prioritizing businesses with predictable cash flows and sustainable advantages, rather than chasing hot trends or speculative opportunities.

- Mathematical Analysis: Buffett’s success is built not just on intuition, but on rigorous quantitative analysis. Chapters 30, 31, and 32 introduce readers to the mathematical tools used to assess investment opportunities, including compounding calculations, growth rate analysis, and intrinsic value formulas. The book breaks down these tools into simple, actionable steps, making advanced concepts accessible to non-experts. For investors, mastering these techniques is crucial for evaluating potential returns, comparing opportunities, and making data-driven decisions. The authors also highlight the importance of predictability in earnings, which is essential for reliable valuation.

- Long-term Investment Strategy: Patience is a recurring theme in Buffettology. The book advocates for a long-term, buy-and-hold strategy, emphasizing the power of compounding and the dangers of frequent trading. Chapters 12, 13, and 44 illustrate how Buffett’s wealth was built over decades, not months, and how time in the market is more important than timing the market. Investors are urged to focus on businesses with sustainable growth, reinvest dividends, and resist the temptation to sell based on short-term news. This theme is particularly relevant in today’s fast-paced markets, where short-termism often undermines long-term gains.

- Market Psychology and Behavior: Understanding human behavior is as important as understanding financial statements. Chapters 20, 21, and 22 delve into the psychology of markets, exploring how fear, greed, and herd mentality create opportunities for disciplined investors. The book provides strategies for maintaining emotional discipline, such as setting clear investment criteria and sticking to them even during market panics. By understanding the psychological drivers of market cycles, investors can better navigate volatility and capitalize on irrational price swings.

- Practical Application and Case Studies: One of the book’s greatest strengths is its focus on real-world application. Through detailed case studies and curated lists of Buffett-style companies, readers learn how to apply the principles of Buffettology to their own portfolios. The book provides actionable checklists, screening criteria, and step-by-step guides for identifying, valuing, and monitoring investments. This theme ensures that the lessons of Buffettology are not just theoretical but can be put into practice in today’s markets.

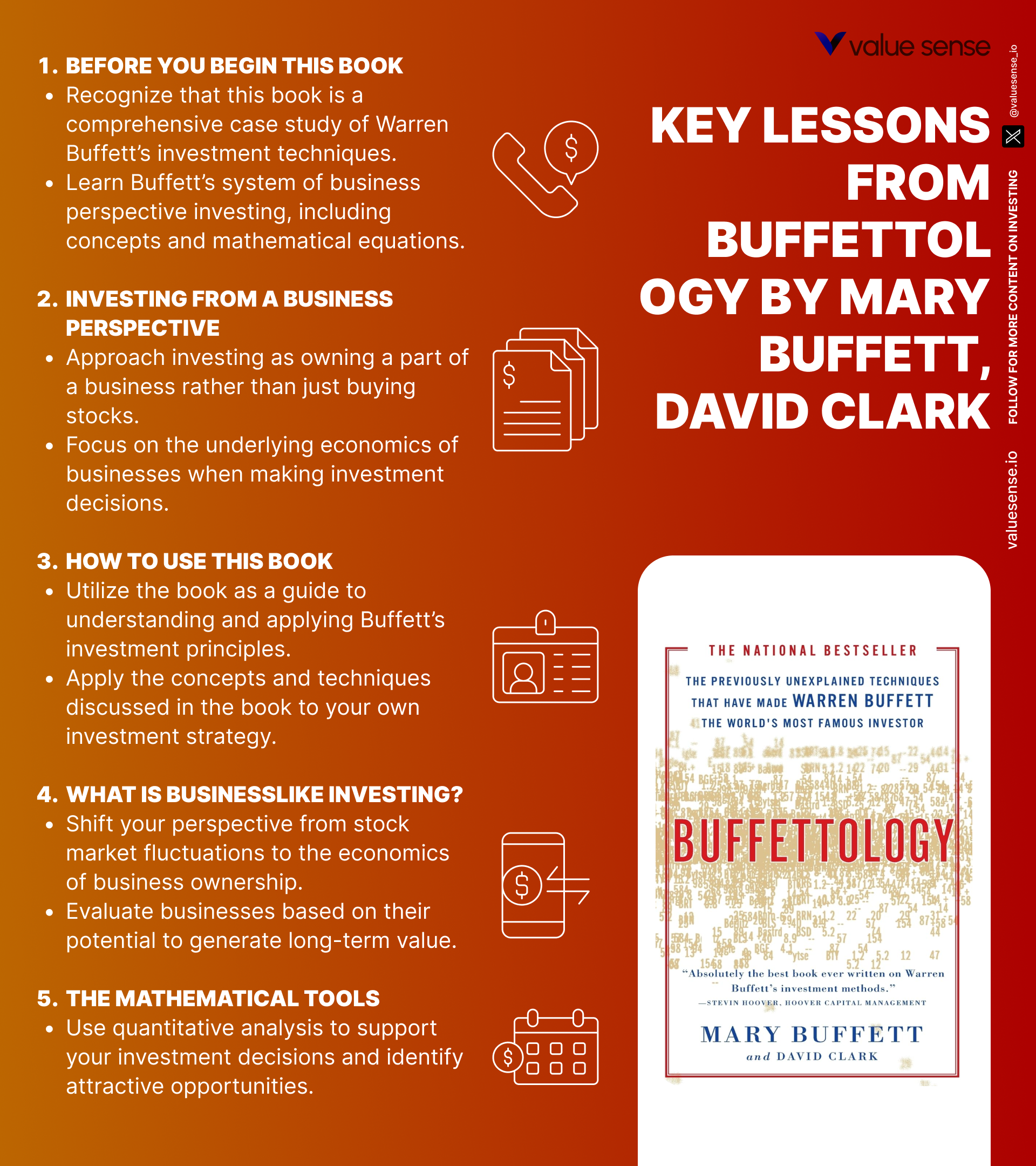

Book Structure: Major Sections

Part 1: Introduction to Buffett's Philosophy

This opening section, covering chapters 1 through 5, lays the groundwork for understanding Warren Buffett’s unique investment philosophy. The unifying theme is the transition from seeing stocks as mere trading instruments to viewing them as ownership stakes in real businesses. The authors introduce readers to the foundational principles that set Buffett apart from the crowd, emphasizing the influence of Benjamin Graham and the importance of businesslike investing.

Key concepts explored here include Buffett’s insistence on thinking like a business owner, the critical role of intrinsic value, and the discipline required to remain rational in volatile markets. The section dissects how Buffett’s early exposure to Benjamin Graham’s teachings — especially the concept of “Mr. Market” and the margin of safety — shaped his approach. Practical examples, such as Buffett’s investments in Coca-Cola and American Express, illustrate how he applies these principles in practice. The authors also highlight Buffett’s skepticism toward speculation and his focus on businesses he can understand.

For investors, this section provides a mindset shift: instead of chasing short-term gains or reacting to market noise, readers are encouraged to analyze companies as ongoing enterprises. The actionable takeaway is to read annual reports, study industry dynamics, and focus on economic fundamentals rather than price charts. This business perspective forms the bedrock of disciplined, long-term investing.

In today’s market, where algorithmic trading and speculative fads abound, Buffett’s philosophy remains profoundly relevant. The emphasis on understanding what you own, why you own it, and how it creates value is timeless. This section’s lessons help investors resist the temptations of market timing and instead build a foundation for sustainable wealth creation.

Part 2: Valuation and Business Analysis

Spanning chapters 6 through 10, this section is devoted to the core analytical tools of Buffettology: valuing businesses and understanding what determines long-term returns. The unifying theme is that price matters — and the price you pay for a stock determines your ultimate rate of return. The authors walk readers through the process of analyzing earnings, calculating intrinsic value, and comparing investment opportunities.

Key concepts include the centrality of earnings in valuation, the mechanics of discounted cash flow analysis, and the importance of buying with a margin of safety. The book provides detailed examples of how Buffett values companies, including step-by-step breakdowns of his investment in See’s Candies and GEICO. The section also covers how to distinguish between accounting earnings and true owner earnings, a subtle but crucial distinction for long-term investors.

For practical application, investors are encouraged to develop their own valuation models using the book’s formulas and checklists. This means not only calculating intrinsic value but also understanding the assumptions behind those calculations — such as growth rates, reinvestment needs, and the predictability of future earnings. The section empowers readers to move beyond price/earnings ratios and adopt a more nuanced, business-oriented approach to valuation.

In a world of rapidly changing accounting standards and financial engineering, the principles in this section remain vital. The focus on intrinsic value, owner earnings, and margin of safety helps investors avoid the traps of overvaluation and ensures that their capital is deployed in businesses with real, sustainable value.

Part 3: Identifying Excellent Businesses

This section, covering chapters 11 through 15, centers on finding businesses with exceptional economics — the kind of companies that can compound capital for decades. The unifying theme is the search for durable competitive advantages, or “economic moats,” that protect a business from competition and enable it to generate high returns on capital.

Key concepts include the magic of compounding, the importance of return on equity, and the characteristics that distinguish excellent businesses from mediocre ones. The authors provide checklists for identifying companies with strong brands, pricing power, consistent earnings, and low capital requirements. Real-world examples, such as Buffett’s investments in Gillette and The Washington Post, illustrate how these criteria play out in practice.

For investors, this section offers a roadmap for screening potential investments and focusing research on high-quality businesses. The actionable advice is to prioritize companies with predictable cash flows, strong management, and the ability to reinvest profits at high rates of return. The book’s checklists and screening criteria make it easier for readers to separate the wheat from the chaff.

In the current era of technological disruption and rapid industry change, the ability to identify businesses with sustainable competitive advantages is more important than ever. This section’s insights help investors build portfolios that can withstand market cycles and generate superior long-term returns.

Part 4: Advanced Investment Techniques

Chapters 29 through 33 comprise the advanced analytical core of “Buffettology.” The unifying theme is the use of mathematical tools and quantitative analysis to assess investment opportunities and predict future performance. The authors delve into the specifics of calculating intrinsic value, assessing earning power, and using mathematical models to inform decision-making.

Key concepts include the predictability of earnings, the application of compounding formulas, and the use of quantitative tests to screen investments. The book introduces readers to Buffett’s preferred metrics, such as owner earnings, return on invested capital, and growth rate calculations. Detailed examples show how these tools are used to evaluate companies like Coca-Cola and American Express, providing a step-by-step guide for readers to replicate the process.

For practical application, investors are encouraged to master the mathematical tools presented in this section. This means building spreadsheets, running scenario analyses, and stress-testing assumptions about growth and profitability. The section also emphasizes the importance of conservatism in forecasting and the dangers of over-optimism.

In the age of big data and algorithmic investing, the principles of rigorous quantitative analysis remain indispensable. This section’s focus on predictability, margin of safety, and mathematical discipline helps investors avoid the pitfalls of speculation and ensures that decisions are grounded in reality rather than hope or hype.

Part 5: Practical Application and Case Studies

The final section, spanning chapters 44 through 47, brings the principles of Buffettology to life through real-world case studies and practical checklists. The unifying theme is application — showing how Buffett’s methods have worked in practice and how readers can implement them in their own portfolios.

Key concepts include the analysis of successful investments, the use of screening criteria to identify Buffett-style companies, and the importance of learning from both successes and failures. The authors provide detailed breakdowns of Buffett’s investments in companies like Coca-Cola, American Express, and Gillette, highlighting what made these businesses attractive and how the investments played out over time.

For practical application, readers are given actionable checklists, lists of companies to study, and step-by-step guides for conducting their own investment research. The section also emphasizes the importance of continuous learning and adapting to changing market conditions.

In today’s dynamic markets, the ability to learn from real-world examples and apply proven principles is invaluable. This section’s focus on case studies and practical tools ensures that the lessons of Buffettology are not just theoretical but can be immediately put into action by investors of all experience levels.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 4: Investing from a Business Perspective

This chapter is critically important because it introduces the foundational mindset that underpins all of Warren Buffett’s investment decisions: viewing stocks as ownership in real businesses. Rather than treating shares as mere pieces of paper to be traded, Buffett insists on analyzing each company as if you were buying the entire enterprise. This shift in perspective is what separates successful long-term investors from speculators. The chapter explains how adopting a business mindset leads to more rational, disciplined decisions and helps investors avoid the emotional swings of the market.

Mary Buffett and David Clark use vivid examples to illustrate this concept, quoting Buffett’s famous line: “I am a better investor because I am a businessman, and a better businessman because I am an investor.” They recount how Buffett’s investments in companies like Coca-Cola and American Express were driven by his deep understanding of their business models, competitive advantages, and long-term prospects. The authors also highlight the importance of reading annual reports, studying management teams, and understanding industry dynamics — all practices that Buffett employs to inform his decisions. The chapter provides data on how this approach has led to market-beating returns for Berkshire Hathaway over decades.

Investors can apply these lessons by committing to thorough research before making any investment. Instead of relying on price charts or market rumors, readers are encouraged to study financial statements, assess the quality of management, and analyze the competitive landscape. The chapter suggests creating a checklist of business fundamentals to review for each potential investment, including revenue growth, profitability, industry trends, and capital allocation policies. By thinking like an owner, investors are more likely to make decisions that build long-term wealth.

Historically, this business perspective has set Buffett apart from the crowd, especially during periods of market mania or panic. For example, during the dot-com bubble, Buffett was criticized for avoiding technology stocks, but his discipline ultimately paid off when the bubble burst. In today’s market, where short-term trading and speculation are rampant, the lessons of this chapter are more relevant than ever. By focusing on business fundamentals and maintaining a long-term outlook, investors can navigate volatility and achieve superior returns.

Chapter 7: The Price You Pay Determines Your Rate of Return

This chapter is essential because it highlights a core principle of value investing: the price you pay for a stock directly determines your future rate of return. Mary Buffett and David Clark explain that even the best business can be a poor investment if bought at too high a price, while a mediocre business can yield good returns if purchased cheaply. This concept is at the heart of Buffett’s investment process and is critical for avoiding overvaluation traps.

The authors provide detailed examples, including Buffett’s investment in The Washington Post, where he bought shares at a significant discount to intrinsic value. They walk through calculations showing how buying at different price-to-earnings ratios affects potential returns, using real data to illustrate the impact of purchase price on long-term performance. The chapter also includes quotes from Buffett emphasizing the importance of patience and discipline in waiting for the right price, such as, “Price is what you pay. Value is what you get.”

To apply these insights, investors should develop a disciplined approach to valuation. This means calculating the intrinsic value of a business using discounted cash flow analysis or other methods and only buying when the market price offers a sufficient margin of safety. The chapter suggests setting target buy prices for each stock and resisting the urge to chase rising prices. By focusing on valuation rather than momentum, investors can improve their risk-adjusted returns and avoid the pitfalls of market euphoria.

Historically, Buffett’s adherence to this principle has protected him from bubbles and enabled him to capitalize on market downturns. For example, during the 1973–74 bear market, Buffett was able to buy high-quality businesses at bargain prices, setting the stage for decades of outperformance. In the current environment, where many stocks trade at lofty valuations, the lessons of this chapter are more important than ever. By insisting on a margin of safety and being patient, investors can position themselves for long-term success.

Chapter 9: Valuing a Business

This chapter is a cornerstone of the book because it demystifies the process of valuing a business — a skill that is essential for making informed investment decisions. Mary Buffett and David Clark break down the methods used by Buffett to estimate the intrinsic value of a company, emphasizing that successful investing requires more than just following market trends or analyst recommendations.

The authors provide a step-by-step guide to calculating intrinsic value, focusing on the present value of future owner earnings. They explain the concept of discounted cash flow (DCF) analysis, using real-world examples and detailed formulas. The chapter also discusses the importance of making conservative assumptions about growth rates and discount rates, and it highlights common pitfalls, such as overestimating future earnings or ignoring capital expenditures. Quotes from Buffett reinforce the importance of understanding what you are paying for and not relying solely on price-to-earnings ratios.

Investors can apply these lessons by building their own valuation models for potential investments. The chapter encourages readers to start with historical financial statements, project future cash flows, and apply a reasonable discount rate to arrive at a present value. By comparing this intrinsic value to the current market price, investors can determine whether a stock is undervalued or overvalued. The chapter also suggests maintaining a checklist of valuation metrics to review for each investment.

In real-world terms, Buffett’s disciplined approach to valuation has enabled him to avoid costly mistakes and focus his capital on high-quality businesses trading at attractive prices. For example, his investment in See’s Candies was based on a careful analysis of the company’s cash flows and competitive position. In today’s market, where financial engineering and accounting gimmicks are common, the ability to conduct independent valuation analysis is a critical edge for investors.

Chapter 15: How to Identify the Excellent Business

This chapter is critically important because it focuses on the qualitative factors that distinguish truly excellent businesses from the rest. Mary Buffett and David Clark explain that finding companies with durable competitive advantages — or “economic moats” — is the key to long-term investment success. The chapter provides a comprehensive checklist of characteristics to look for, helping readers develop a systematic approach to identifying high-quality businesses.

The authors use examples such as Coca-Cola, Gillette, and American Express to illustrate the traits of excellent businesses: strong brand recognition, pricing power, consistent earnings growth, high return on equity, and the ability to reinvest profits at attractive rates. The chapter also discusses the importance of management quality, industry structure, and barriers to entry. Quotes from Buffett reinforce the idea that “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Investors can apply these lessons by developing their own screening criteria for identifying excellent businesses. The chapter suggests focusing on companies with stable and predictable cash flows, strong competitive positions, and a track record of shareholder-friendly capital allocation. Readers are encouraged to study industry dynamics, assess the sustainability of competitive advantages, and avoid businesses that are easily disrupted or commoditized.

Historically, Buffett’s focus on excellent businesses has been a major driver of Berkshire Hathaway’s success. His investments in companies like Coca-Cola and Gillette have compounded capital at high rates for decades. In today’s rapidly changing economy, the ability to identify businesses with sustainable moats is more valuable than ever. This chapter’s insights help investors build portfolios that can withstand competition and generate superior returns over the long term.

Chapter 29: The Analyst’s Role in Ascertaining Earning Power

This chapter is vital because it addresses the critical task of analyzing a company’s earning power — the foundation of any reliable valuation. Mary Buffett and David Clark explain that the ability to predict future earnings with reasonable accuracy is what separates successful investors from the rest. The chapter outlines the key steps analysts must take to assess a company’s earning potential and avoid common pitfalls.

The authors provide detailed guidance on analyzing historical financial statements, identifying trends in revenue and profitability, and adjusting for non-recurring items. They emphasize the importance of understanding the drivers of earnings growth, such as pricing power, cost control, and reinvestment opportunities. The chapter includes examples of how Buffett has used these techniques to evaluate companies like American Express and Coca-Cola, focusing on the stability and predictability of their earnings streams.

For practical application, investors are encouraged to develop a systematic approach to earnings analysis. This includes building financial models, stress-testing assumptions, and comparing results across different scenarios. The chapter suggests focusing on companies with a track record of consistent earnings growth and avoiding those with volatile or unpredictable results. By honing their analytical skills, investors can improve their ability to identify undervalued opportunities and avoid value traps.

Historically, Buffett’s emphasis on earning power has enabled him to invest with confidence in businesses that others overlooked. For example, his investment in American Express during the “Salad Oil Scandal” was based on his conviction that the company’s core earning power remained intact. In today’s market, where earnings manipulation and accounting complexity are common, the ability to conduct independent, rigorous analysis is a crucial competitive advantage.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 30: The Mathematical Tools

This chapter is essential because it introduces the mathematical tools that underpin Buffett’s investment decisions. Mary Buffett and David Clark break down the formulas and quantitative techniques used to calculate intrinsic value, assess growth rates, and estimate potential returns. The chapter demystifies complex concepts and provides step-by-step instructions for applying them in practice.

The authors cover key formulas for discounted cash flow analysis, compounding, and return on equity calculations. They provide worked examples using real companies, showing how small changes in growth rates or discount rates can have a significant impact on intrinsic value. The chapter also includes checklists for double-checking calculations and avoiding common errors. Quotes from Buffett highlight the importance of mathematical discipline and the dangers of relying on intuition alone.

Investors can apply these lessons by building their own valuation models and running sensitivity analyses to test different scenarios. The chapter suggests using conservative assumptions, double-checking all calculations, and maintaining a margin of safety. By mastering the mathematical tools of investment analysis, readers can make more informed decisions and avoid costly mistakes.

Historically, Buffett’s mathematical rigor has enabled him to identify opportunities that others missed and avoid overpaying for growth. For example, his investment in See’s Candies was based on careful modeling of future cash flows and reinvestment needs. In today’s data-driven world, the ability to apply quantitative analysis to investment decisions is more important than ever. This chapter’s insights help investors combine analytical rigor with sound judgment.

Chapter 44: Bringing It All Together: The Case Studies

This chapter is critically important because it demonstrates how all the principles of Buffettology work in practice. Mary Buffett and David Clark present detailed case studies of Buffett’s most successful investments, providing readers with concrete examples of how to apply the book’s lessons in real-world situations. The chapter bridges the gap between theory and practice, showing how disciplined analysis and patience can lead to extraordinary returns.

The authors analyze investments in companies like Coca-Cola, American Express, and Gillette, breaking down the factors that made these businesses attractive and the timing of Buffett’s purchases. They provide data on purchase prices, earnings growth, and long-term returns, illustrating how Buffett’s focus on intrinsic value, economic moats, and margin of safety paid off over time. The chapter includes quotes from Buffett reflecting on these investments and the lessons learned.

Investors can apply these lessons by conducting their own case studies of potential investments, analyzing historical performance, and learning from both successes and failures. The chapter suggests keeping a journal of investment decisions, reviewing outcomes regularly, and continuously refining one’s approach. By studying real-world examples, readers can develop a deeper understanding of what works and what doesn’t in investing.

Historically, Buffett’s disciplined approach to case study analysis has enabled him to avoid repeating mistakes and to capitalize on recurring patterns in the market. For example, his willingness to buy when others are fearful and to hold for the long term has consistently generated superior returns. In today’s fast-moving markets, the ability to learn from history and apply proven principles is a key advantage for investors.

Chapter 46: Fifty-four Companies to Look At

This chapter is uniquely valuable because it provides a curated list of companies that exemplify Buffett’s investment criteria. Mary Buffett and David Clark present fifty-four businesses that possess the characteristics of excellent investments — strong economic moats, predictable earnings, high return on equity, and shareholder-friendly management. The chapter serves as a practical tool for readers seeking to build their own Buffett-style portfolios.

The authors provide brief profiles of each company, highlighting the factors that make them attractive from a Buffettology perspective. They discuss industry dynamics, competitive advantages, and historical performance, using data to support their selections. The chapter also includes checklists for evaluating each company and suggests additional research to confirm investment theses. Quotes from Buffett reinforce the importance of focusing on quality and avoiding speculation.

Investors can apply these lessons by using the list as a starting point for their own research. The chapter encourages readers to conduct deep dives into each company, assess current valuation, and monitor changes in business fundamentals. By focusing on businesses that meet Buffett’s criteria, investors can improve their odds of long-term success and avoid common pitfalls.

Historically, Buffett’s focus on a select group of high-quality businesses has been a major driver of Berkshire Hathaway’s outperformance. His willingness to concentrate capital in his best ideas, rather than diversifying indiscriminately, has enabled him to compound wealth at extraordinary rates. In today’s crowded and competitive markets, the ability to identify and focus on truly excellent businesses is a key differentiator for investors.

Practical Investment Strategies

- Adopt a Business Owner’s Mindset: Begin every investment analysis by asking, “Would I be comfortable owning 100% of this business?” Study the company’s products, industry dynamics, and management as if you were buying the entire firm. Read annual reports, listen to earnings calls, and focus on understanding how the business makes money. This mindset shift helps you avoid emotional decisions based on price movements and instead prioritize long-term value creation.

- Calculate Intrinsic Value with Discounted Cash Flow (DCF): Use the book’s step-by-step DCF methodology to estimate the present value of a company’s future owner earnings. Start by projecting future cash flows based on historical growth rates and industry trends. Apply a conservative discount rate (often Buffett uses the long-term U.S. Treasury yield as a baseline) and subtract necessary capital expenditures. Only invest when the market price is significantly below your calculated intrinsic value, ensuring a margin of safety.

- Screen for Economic Moats: Develop a checklist to identify businesses with durable competitive advantages. Look for high return on equity, strong brands, pricing power, and consistent free cash flow generation. Use tools like ValueSense’s AI-powered screener to filter companies based on these criteria. Focus your research on companies that have demonstrated the ability to maintain high profitability and fend off competition over time.

- Focus on Predictable Earnings Growth: Target companies with a long history of stable and growing earnings. Avoid businesses with volatile or unpredictable results, as these are more difficult to value accurately. Use financial statement analysis to identify trends in revenue, net income, and free cash flow. Favor industries with low cyclicality and companies that have weathered multiple economic cycles without significant declines in profitability.

- Buy with a Margin of Safety: Never pay full price for even the best business. Calculate a conservative estimate of intrinsic value and only buy when the stock trades at a significant discount. This buffer protects against errors in your analysis or unforeseen changes in the business environment. Set target buy prices and stick to them, resisting the urge to chase stocks during bull markets or panic sell during downturns.

- Reinvest Dividends and Compound Wealth: Choose companies that not only pay dividends but also have a track record of reinvesting profits at high rates of return. Use dividend reinvestment plans (DRIPs) to automatically reinvest dividends and maximize the power of compounding. Monitor the company’s capital allocation policies to ensure that retained earnings are being deployed in ways that create long-term shareholder value.

- Maintain Emotional Discipline: Develop clear investment criteria and stick to them, even when markets are volatile. Avoid making decisions based on fear, greed, or market sentiment. Keep a journal of your investment decisions and the rationale behind them. Review your process regularly to identify areas for improvement and ensure that you are learning from both successes and failures.

- Continuously Learn from Case Studies and Mistakes: Study the case studies provided in “Buffettology” and analyze both successful and unsuccessful investments. Identify the factors that led to positive outcomes and the warning signs that signaled trouble. Apply these lessons to your own portfolio, adjusting your criteria and process as needed to improve results over time.

Modern Applications and Relevance

The principles outlined in “Buffettology” remain profoundly relevant in today’s markets, even as technology, globalization, and financial innovation have transformed the investment landscape. While the tools and data available to investors have evolved, the core tenets of Buffett’s philosophy — business perspective investing, rigorous valuation, and emotional discipline — are as applicable now as they were when the book was first published. In an era of algorithmic trading, meme stocks, and speculative bubbles, the disciplined approach advocated by Mary Buffett and David Clark offers a vital counterbalance.

One major change since the book’s publication is the increased availability of information and analytical tools. Investors today can access real-time financial data, advanced screening tools, and a wealth of research online. This democratization of information levels the playing field but also increases noise and the temptation to chase short-term trends. The timeless lesson from “Buffettology” is to filter out this noise and focus on the underlying economics of the business. The rise of passive investing and ETFs has also made it easier to diversify, but the book’s emphasis on quality over quantity — concentrating on a select group of excellent businesses — remains a key differentiator for those seeking market-beating returns.

Modern examples of Buffettology principles in action include Buffett’s continued investments in companies like Apple, which he has described as a consumer products company with a powerful brand and ecosystem, rather than just a tech stock. Similarly, his investments in financials like Bank of America and energy companies like Occidental Petroleum reflect his focus on predictable earnings, strong management, and attractive valuations. The COVID-19 pandemic and subsequent market volatility have further underscored the importance of a long-term perspective and the ability to remain calm during periods of uncertainty.

To adapt the classic advice of “Buffettology” to current conditions, investors should leverage modern tools — such as AI-powered stock screeners and real-time analytics — while maintaining the discipline and analytical rigor advocated in the book. The principles of business perspective investing, intrinsic value analysis, and margin of safety are universal, but the ability to process information quickly and efficiently is a modern advantage. Investors should also be mindful of new risks, such as technological disruption and regulatory changes, and incorporate these factors into their analysis.

Ultimately, what remains timeless is the human element of investing: the need for patience, discipline, and independent thinking. While markets and technology will continue to evolve, the fundamental truths outlined in “Buffettology” provide a reliable guide for navigating uncertainty and building lasting wealth. By combining classic principles with modern tools, investors can achieve superior results in any market environment.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Start with a Business Perspective: Before making any investment, study the company as if you were buying the entire business. Read annual reports, analyze financial statements, and understand the company’s products, customers, and competitive environment. Set aside at least two weeks for this deep-dive research phase, focusing on qualitative factors such as management quality and industry dynamics.

- Develop a Valuation Model: Build a discounted cash flow (DCF) model or use other intrinsic value techniques outlined in “Buffettology.” Project future owner earnings based on historical growth rates and conservative assumptions. Apply a reasonable discount rate (such as the yield on long-term government bonds plus a risk premium) and calculate the present value of future cash flows. Allocate at least one week to this process for each potential investment.

- Construct a Focused Portfolio: Select a concentrated portfolio of 10–20 high-quality businesses that meet your criteria for economic moats, predictable earnings, and attractive valuations. Allocate capital based on conviction, with larger positions in your best ideas. Diversify across industries to manage risk, but avoid over-diversification that can dilute returns. Review your portfolio allocation quarterly to ensure balance and alignment with your investment thesis.

- Implement Ongoing Portfolio Management: Monitor your investments regularly by tracking key financial metrics, industry developments, and management actions. Set a schedule to review each holding at least quarterly, updating your valuation models and reassessing the business fundamentals. Be prepared to sell if a company’s competitive advantage deteriorates or if the stock becomes significantly overvalued relative to intrinsic value.

- Commit to Continuous Improvement: Keep a detailed investment journal to document your decision-making process, outcomes, and lessons learned. Regularly review past investments to identify patterns of success and areas for improvement. Stay current by reading annual reports, industry publications, and books like “Buffettology.” Leverage online resources, investment forums, and tools such as ValueSense’s stock screener to refine your process and stay ahead of market trends.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Buffettology

1. What is the main difference between Buffettology and other value investing books?

“Buffettology” stands out for its practical, insider perspective on Warren Buffett’s investment process, combining both qualitative and quantitative analysis. Unlike many value investing books that focus solely on financial ratios or market timing, “Buffettology” emphasizes a business-owner’s mindset, detailed valuation techniques, and real-world case studies. The book provides step-by-step methods for calculating intrinsic value and identifying excellent businesses, making it a comprehensive manual rather than just a philosophical overview.

2. Can beginners use the strategies in Buffettology, or is it only for advanced investors?

The strategies in “Buffettology” are accessible to beginners, thanks to the clear explanations, checklists, and practical examples provided by Mary Buffett and David Clark. While some sections delve into advanced valuation techniques, the book is structured to build understanding from foundational concepts to more complex analysis. Beginners can start with the mindset and qualitative criteria, gradually incorporating the mathematical tools as they gain experience.

3. How does Buffettology address changing market conditions and new industries?

“Buffettology” focuses on timeless principles such as business perspective investing, intrinsic value, and margin of safety, which can be applied across different market conditions and industries. The book encourages investors to adapt these principles by thoroughly researching new industries, understanding their unique dynamics, and applying the same rigorous analysis to valuation and competitive advantage. While some examples are drawn from traditional industries, the framework is flexible enough to evaluate modern businesses as well.

4. What are some common mistakes investors make that Buffettology helps to avoid?

Common mistakes addressed in “Buffettology” include overpaying for stocks, chasing short-term trends, neglecting business fundamentals, and failing to maintain emotional discipline. The book teaches readers to focus on intrinsic value, buy with a margin of safety, and resist the temptation to trade frequently. By adopting a business-owner’s mindset and following a systematic process, investors can avoid the pitfalls of speculation and emotional decision-making.

5. How can I use Buffettology principles with modern investment tools and technology?

Investors can apply Buffettology principles using modern tools such as AI-powered stock screeners, real-time financial data platforms, and advanced portfolio management software. These tools can help streamline research, automate screening for Buffett-style companies, and monitor key financial metrics. However, the core discipline of thorough analysis, patience, and independent thinking remains unchanged — technology should enhance, not replace, the principles outlined in the book.