Carl Icahn - Icahn Capital Management Portfolio Q3’2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

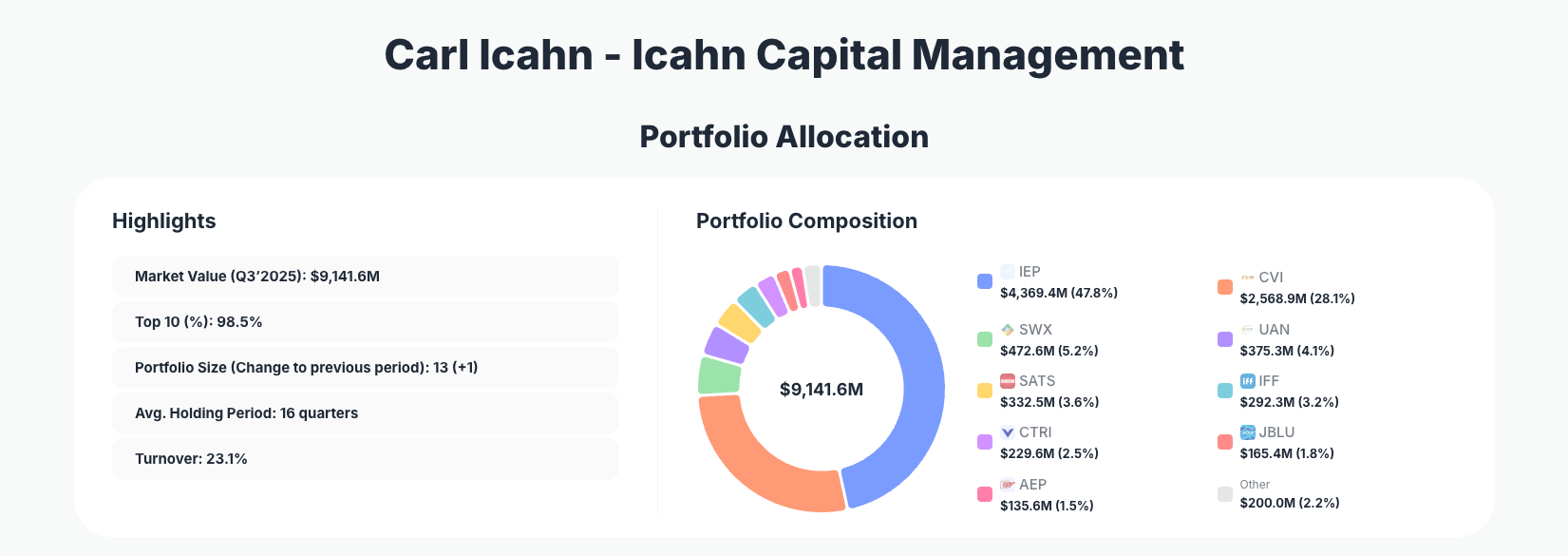

Carl Icahn - Icahn Capital Management remains one of Wall Street’s most concentrated and aggressive activist investors, and his latest 13F filing for Q3’2025 underscores that reputation. His Q3’2025 portfolio shows $9.1 billion deployed across just 13 positions, with outsized exposure to his own vehicle Icahn Enterprises L.P. (IEP) and energy-linked names, while selectively adding to special situations like EchoStar (SATS), International Flavors & Fragrances (IFF), and newly built stake Monro (MNRO).

Explore Carl Icahn’s full Q3’2025 portfolio on ValueSense

Portfolio Overview: Activist Conviction at Full Strength

Portfolio Highlights (Q3’2025): - Market Value: $9,141.6M

- Top 10 Holdings: 98.5%

- Portfolio Size: 13 +1

- Average Holding Period: 16 quarters

- Turnover: 23.1%

The latest 13F shows that Icahn’s portfolio is about as concentrated as it gets: 98.5% of capital sits in the top 10 positions, despite holding 13 stocks in total. This reflects a classic Icahn hallmark—large, activist-scale stakes where he can influence corporate strategy, governance, and capital allocation rather than a diversified “basket” approach. The moderate 23.1% turnover indicates meaningful but selective repositioning rather than wholesale change.

At the core of the Icahn portfolio sits a nearly 48% allocation to Icahn Enterprises (IEP), effectively making the 13F a look-through on his own publicly traded holding company. This is paired with a massive 28.1% position in CVR Energy (CVI) and meaningful stakes in related entities like CVR Partners (UAN) and utility/energy infrastructure plays such as Southwest Gas (SWX) and Centuri Holdings (CTRI). Together, this creates an energy-heavy, cash-generative core that fits Icahn’s preference for hard-asset and cyclical value.

The 16-quarter average holding period (roughly four years) reinforces that once Icahn’s portfolio enters a name, he is typically prepared to stay involved through full activist cycles—campaigns, board changes, asset sales, or spin-offs. Around this long-term core, he is still tactically active, as shown by double-digit percentage changes in several positions and fresh buys in Q3’2025.

Top Holdings & Recent Moves: Energy, Special Situations, and Turnaround Bets

The portfolio is anchored by Icahn Enterprises L.P. (IEP), which accounts for 47.8% of the portfolio after an “Add 4.88%” move in Q3’2025. This incremental increase tightens the feedback loop between Icahn’s personal wealth, his public vehicle, and his disclosed 13F holdings, signaling continued confidence in the holding company’s asset base and strategy.

Energy remains a dominant theme. CVR Energy (CVI) makes up 28.1% of the portfolio with No change in the quarter, underlining stable, long-term conviction. The related fertilizer MLP CVR Partners (UAN) sits at 4.1% of assets, also with No change, reinforcing Icahn’s persistent positioning across the CVR complex.

There was, however, notable repositioning within regulated utilities and energy-adjacent infrastructure. Southwest Gas Holdings (SWX) now represents 5.2% of the portfolio, but Icahn chose to “Reduce 19.91%” of the stake in Q3’2025, locking in part of the gains or rebalancing exposure after prior activist engagement. Offsetting that, he aggressively increased ownership in its spinoff Centuri Holdings (CTRI), a utility infrastructure contractor that has grown to 2.5% of the portfolio following a hefty “Add 69.39%” move.

Beyond energy, Icahn is leaning into special situations and turnaround plays. He initiated or increased a “Buy” in EchoStar Corporation (SATS), which now stands at 3.6% of the portfolio. The position suggests a thesis around telecom/satellite restructuring and asset value realization. Similarly, International Flavors & Fragrances (IFF)—a challenged specialty-chemicals and ingredients player—has become a meaningful 3.2% holding after Icahn chose to “Add 26.67%”, signaling increased conviction in a multi-year turnaround and margin improvement story.

Smaller but notable moves include incremental energy exposure via SandRidge Energy (SD), a 0.6% position where Icahn chose to “Add 1.07%”—a subtle but telling vote of confidence—and a fresh “Buy” in auto service chain Monro, Inc. (MNRO), which now accounts for 0.3% of assets. Monro fits the mold of a fragmented, operationally improvable business where activist pressure could unlock value via cost discipline, capital allocation, or portfolio optimization.

Rounding out the top allocations, transportation and utilities provide diversification and optionality. JetBlue Airways (JBLU) holds 1.8% of the portfolio with No change, likely representing a deep-value or event-driven aviation bet, while American Electric Power (AEP) sits at 1.5% with No change, offering a more defensive, regulated-utility counterweight to cyclical energy and special situations.

What the Portfolio Reveals About Icahn’s Current Strategy

Several clear themes emerge from this Q3’2025 13F:

- Extreme concentration and alignment

Nearly half of capital in IEP and almost three-quarters in IEP plus CVI highlight Icahn’s willingness to concentrate when he controls both the strategy and the narrative. This amplifies both upside and downside but keeps incentives perfectly aligned with shareholders. - Energy and hard-asset bias

With large stakes in CVI, UAN, SWX, CTRI, and SD, the portfolio leans toward energy, infrastructure, and regulated assets that can benefit from pricing power, inflation pass-through, and strategic asset value realization. - Turnarounds and corporate restructurings

Additions to IFF and SATS, plus the new MNRO stake, underscore Icahn’s ongoing focus on companies where margins, capital allocation, or portfolio structure can be improved through activist engagement. - Risk management via holding period, not diversification

The 16-quarter average holding period suggests risk is managed by buying at discounted valuations and then working actively over multiple years, rather than by holding dozens of unrelated small positions. Investors following Icahn’s holdings should recognize that patience and tolerance for volatility are embedded in this approach.

Portfolio Concentration Analysis

Using the reported top 10 positions:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Icahn Enterprises L.P. (IEP) | $4,369.4M | 47.8% | Add 4.88% |

| CVR Energy, Inc. (CVI) | $2,568.9M | 28.1% | No change |

| Southwest Gas Holdings, Inc. (SWX) | $472.6M | 5.2% | Reduce 19.91% |

| CVR Partners, LP (UAN) | $375.3M | 4.1% | No change |

| EchoStar Corporation (SATS) | $332.5M | 3.6% | Buy |

| International Flavors & Fragrances Inc. (IFF) | $292.3M | 3.2% | Add 26.67% |

| Centuri Holdings, Inc. (CTRI) | $229.6M | 2.5% | Add 69.39% |

| JetBlue Airways Corporation (JBLU) | $165.4M | 1.8% | No change |

| American Electric Power Company, Inc. (AEP) | $135.6M | 1.5% | No change |

This table makes the concentration explicit: the top two holdings alone exceed 75% of assets, and the top four surpass 85%. The remaining six positions, while meaningful in absolute dollar terms, are comparatively small satellites around the IEP/CVR core.

The pattern of changes—adding to IEP, IFF, and CTRI, while trimming SWX—suggests active portfolio fine-tuning rather than a macro-driven shift. Icahn appears to be recycling capital within existing themes (utilities, infrastructure, special situations) rather than exiting sectors outright.

Investment Lessons from Carl Icahn’s Activist Playbook

Several takeaways from studying the Carl Icahn Q3’2025 portfolio:

- Concentrate when you control the narrative

Icahn is comfortable putting nearly half the portfolio in IEP because he effectively controls the strategy. For individual investors, the lesson is not necessarily to copy the concentration, but to recognize that high conviction should be rooted in deep understanding and influence—not blind faith. - Activism as a value-unlocking tool

Positions like SWX, CTRI, IFF, and MNRO highlight a core Icahn principle: when fundamentals and governance are misaligned, shareholder pressure can catalyze asset sales, spin-offs, or operational improvements. - Patience paired with decisive adjustments

A 16-quarter average holding period shows long-term commitment, yet Q3’2025 still includes sharp moves like “Reduce 19.91%” in SWX and “Add 69.39%” in CTRI. Long holding periods do not preclude decisive rebalancing when the risk/reward shifts. - Focus on cash flow and asset backing

Many Icahn names—energy producers, MLPs, utilities, and infrastructure plays—share strong cash-flow profiles and tangible asset bases. The lesson: cash-generative, asset-rich businesses can provide downside protection and optionality during activist campaigns. - Position sizing is dynamic, not static

Icahn actively resizes positions as theses play out. The Q3’2025 adjustments show that position sizing is a continuous process, not a one-time decision at purchase.

Looking Ahead: What Comes Next for Icahn’s Portfolio?

From the current positioning, several forward-looking implications emerge:

- More catalysts in utilities and infrastructure

The combination of a reduced SWX stake and a much larger CTRI holding suggests Icahn sees greater incremental upside or leverage to catalysts in Centuri. Investors should watch for corporate actions, contract wins, or margin-focused initiatives. - Ongoing work in turnarounds

Increased exposure to IFF and the new MNRO position point to a multi-year window of potential restructuring, cost-cutting, and portfolio simplification. These names may not move on quarterly noise but could re-rate meaningfully if operating metrics improve. - Energy exposure as macro hedge and opportunity

Concentrated stakes in CVI, UAN, and SD keep the portfolio highly sensitive to commodity cycles, refining margins, and fertilizer pricing. This can be a tailwind in inflationary or supply-constrained environments, but also adds volatility. - Capacity for new special-situation entries

With only 13 holdings and some smaller sub-1% positions, Icahn retains room to introduce entirely new campaigns if valuations or corporate governance situations become compelling. Future 13F filings may reveal fresh targets in distressed, cyclical, or under-managed sectors.

Investors using ValueSense can monitor these evolving themes by tracking updates on Carl Icahn’s portfolio each quarter and drilling into individual names for valuation and intrinsic value analysis.

FAQ about Carl Icahn’s Portfolio

Q: What were the most significant changes in Carl Icahn’s Q3’2025 portfolio?

The most notable Q3’2025 moves were an “Add 4.88%” to Icahn Enterprises (IEP), a “Reduce 19.91%” in Southwest Gas (SWX), a “Buy” in EchoStar (SATS), a 26.67% increase in IFF, a large 69.39% addition to Centuri (CTRI), a modest 1.07% add to SandRidge (SD), and a new “Buy” in Monro (MNRO).

Q: How concentrated is Carl Icahn’s portfolio and what does that imply?

Icahn runs an extremely concentrated book: 98.5% of capital sits in the top 10 positions, with nearly 48% in IEP and 28.1% in CVI. This implies higher idiosyncratic risk but also reflects deep conviction and an activist model where large stakes are necessary to influence corporate decisions.

Q: Does Carl Icahn typically hold stocks for the long term?

Yes. The reported average holding period of 16 quarters suggests Icahn usually holds positions for around four years, consistent with activist campaigns that require time for board changes, restructurings, and strategic shifts to play out.

Q: Which sectors and themes dominate Icahn’s current holdings?

Energy, utilities, and infrastructure dominate the portfolio through names like CVI, UAN, SWX, CTRI, and SD, complemented by special situations and turnarounds like IFF, SATS, and MNRO.

Q: How can I track Carl Icahn’s portfolio changes over time?

You can follow quarterly 13F filings, which U.S. institutional managers must file within 45 days of each quarter-end. Because of this 45-day reporting lag, positions may change before they are disclosed. Platforms like ValueSense aggregate these filings and provide historical trends, changes, and visualizations on Carl Icahn’s portfolio page.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!