Charles Bobrinskoy - Ariel Focus Fund Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

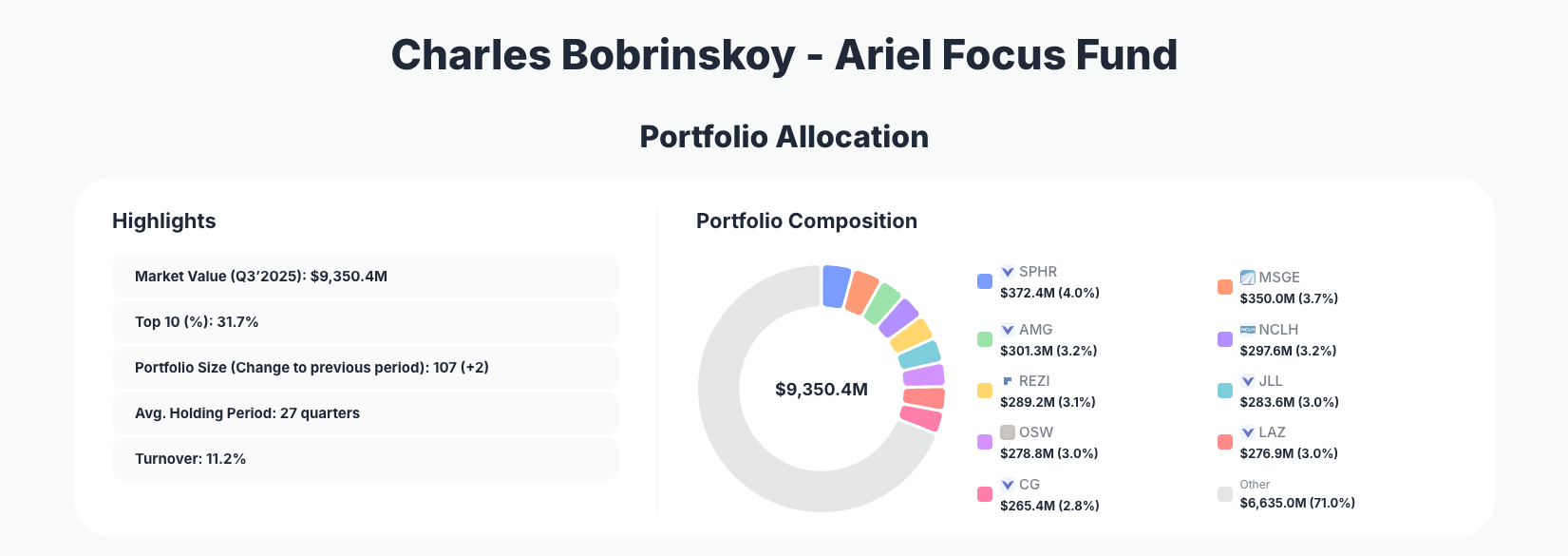

Charles Bobrinskoy of the Ariel Focus Fund demonstrates disciplined value investing amid market volatility through his latest 13F filing. His $9.35B Q3 2025 portfolio shows widespread reductions across top positions, reflecting a cautious approach to trimming overweight names while maintaining a diversified roster of 107 holdings characteristic of Ariel Investments' patient, long-term strategy.

Portfolio Snapshot: Disciplined Diversification with Proven Patience

Portfolio Highlights (Q3’2025): - Market Value: $9,350.4M - Top 10 Holdings: 31.7% - Portfolio Size: 107 +2 - Average Holding Period: 27 quarters - Turnover: 11.2%

The Ariel Focus Fund's Q3 2025 portfolio exemplifies a balanced value-oriented strategy, with top 10 holdings comprising just 31.7% of the total $9.35 billion value. This moderate concentration—far from the ultra-focused bets of some peers—allows for broad exposure across 107 positions, two more than the prior quarter, signaling ongoing opportunity hunting in overlooked names. The impressively low 11.2% turnover underscores a buy-and-hold philosophy, reinforced by an average holding period stretching 27 quarters, or over six years.

This structure highlights Charles Bobrinskoy's risk-aware approach at Ariel Investments, where diversification tempers conviction plays without diluting returns potential. While the portfolio expanded slightly, the uniform pattern of reductions in top holdings suggests profit-taking or reallocation amid rising valuations, a hallmark of value managers who prioritize margin of safety. Tracking these metrics via ValueSense's superinvestor tools reveals how such patience has compounded over time.

Top Holdings Breakdown: Reductions Dominate Entertainment, Cruises, and Asset Management

The portfolio's upper echelon reveals a clear theme of trimming positions across entertainment, real estate services, cruises, and asset management, with every top holding seeing reductions. Leading the pack is Sphere Entertainment Co. (SPHR) at 4.0% $372.4M, reduced by 15.58%, followed closely by Madison Square Garden Entertainment Corp. (MSGE) (3.7%, $350.0M, Reduce 2.01%). These entertainment names reflect Ariel's affinity for experiential businesses, though scaled back perhaps due to post-pandemic normalization.

Financial services exposure remains robust but adjusted lower, with Affiliated Managers Group, Inc. (AMG) at 3.2% ($301.3M, Reduce 6.73%) and Lazard Ltd (LAZ) (3.0%, $276.9M, Reduce 8.83%). Travel and industrials also feature prominently: Norwegian Cruise Line Holdings Ltd. (NCLH) (3.2%, $297.6M, Reduce 2.30%), Resideo Technologies, Inc. (REZI) (3.1%, $289.2M, Reduce 25.22%—the sharpest cut), and Jones Lang LaSalle Incorporated (JLL) (3.0%, $283.6M, Reduce 5.30%). Wellness and private equity round out changes with OneSpaWorld Holdings Limited (OSW) (3.0%, $278.8M, Reduce 0.18%) and The Carlyle Group Inc. (CG) (2.8%, $265.4M, Reduce 10.03%). Extending to the next notable mover, Generac Holdings Inc. (GNRC) sits at 2.6% ($245.6M, Reduce 18.69%), highlighting industrials under review.

What the Portfolio Reveals About Ariel's Value Strategy

This quarter's moves paint a picture of prudent risk management in a frothy market. Uniform reductions across the top 10 suggest Charles Bobrinskoy is locking in gains from prior winners while preserving dry powder—the portfolio added two new positions amid 11.2% turnover.

- Sector Focus: Heavy tilt toward consumer cyclical (entertainment, cruises, spas), financials (asset managers), and industrials/real estate services, betting on recovery plays with durable demand.

- Quality Over Speculation: Long 27-quarter holds prioritize proven cash generators, avoiding high-flyers.

- Risk Management: Low top-10 concentration 31.7% and broad 107 holdings mitigate single-name risk, with trims curbing overexposure.

- Geographic Concentration: Primarily U.S.-centric, capitalizing on domestic service economies.

These patterns underscore Ariel's classic value discipline: patience in undervalued cyclicals, willingness to sell into strength.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Sphere Entertainment Co. (SPHR) | $372.4M | 4.0% | Reduce 15.58% |

| Madison Square Garden Entertainment Corp. (MSGE) | $350.0M | 3.7% | Reduce 2.01% |

| Affiliated Managers Group, Inc. (AMG) | $301.3M | 3.2% | Reduce 6.73% |

| Norwegian Cruise Line Holdings Ltd. (NCLH) | $297.6M | 3.2% | Reduce 2.30% |

| Resideo Technologies, Inc. (REZI) | $289.2M | 3.1% | Reduce 25.22% |

| Jones Lang LaSalle Incorporated (JLL) | $283.6M | 3.0% | Reduce 5.30% |

| OneSpaWorld Holdings Limited (OSW) | $278.8M | 3.0% | Reduce 0.18% |

| Lazard Ltd (LAZ) | $276.9M | 3.0% | Reduce 8.83% |

| The Carlyle Group Inc. (CG) | $265.4M | 2.8% | Reduce 10.03% |

The table illustrates Ariel Focus Fund's intentional lack of outsized bets—no single position exceeds 4.0%—creating a ladder of evenly sized stakes that collectively drive just 31.7% of the portfolio. This setup, with reductions averaging around 8-10%, signals tactical de-risking, particularly aggressive in REZI -25.22% and SPHR -15.58%, possibly reallocating to the two new holdings. Such measured concentration supports steady compounding via the 27-quarter hold period, ideal for value investors navigating volatility.

Investment Lessons from Charles Bobrinskoy's Ariel Focus Fund

- Trim Winners Ruthlessly: Even top holdings like REZI get cut by 25% when valuations stretch, preserving capital for better pitches.

- Diversify Thoughtfully: 107 positions with 31.7% top-10 weight balance conviction and safety, outperforming hyper-concentration in choppy markets.

- Patience Pays: 27-quarter average tenure demands understanding businesses deeply before acting.

- Cyclical Value Hunting: Favor service-oriented recoveries (NCLH, OSW) trading below intrinsic value.

- Low Turnover Discipline: 11.2% rate minimizes taxes and transaction costs, letting winners run.

Looking Ahead: What Comes Next?

With widespread trims freeing up capital and two new positions added, Ariel Focus Fund appears positioned for selective deployment into fresh undervalued opportunities. Low turnover hints at stability, but the $9.35B base offers firepower for cyclicals if economic data softens. Entertainment and cruises could rebound with consumer spending, while asset managers like AMG benefit from fee growth. In a high-valuation environment, expect continued caution, with ValueSense tracking key for spotting the next moves.

FAQ about Charles Bobrinskoy Ariel Focus Fund Portfolio

Q: Why the heavy reductions across top holdings in Q3 2025?

A: The uniform trims, like 25.22% in REZI and 15.58% in SPHR, likely reflect profit-taking amid rising prices, reallocating to two new positions while maintaining value discipline.

Q: What does the 31.7% top-10 concentration reveal about strategy?

A: It shows balanced diversification across 107 holdings, prioritizing risk control over aggressive bets, with a 27-quarter hold period emphasizing long-term ownership of quality cyclicals and financials.

Q: What sectors dominate Ariel Focus Fund's holdings?

A: Consumer cyclical (entertainment like MSGE, cruises via NCLH), financial services (AMG, CG), and industrials/real estate, targeting undervalued recovery stories.

Q: How can I track Charles Bobrinskoy's Ariel Focus Fund portfolio?

A: Follow quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/ariel for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!