Charles Brandes - Brandes Investment Partners, Lp Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

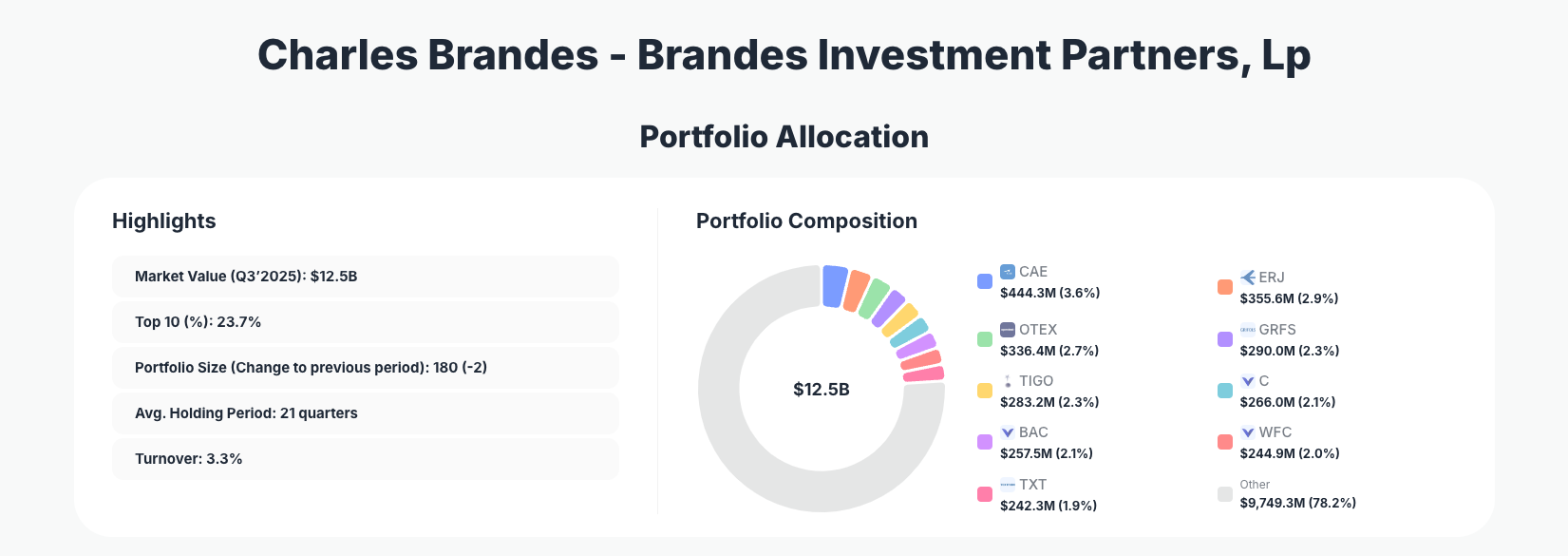

Charles Brandes, the legendary value investor and founder of Brandes Investment Partners, exemplifies patient global value investing through his latest moves. His $12.5B Q3 2025 portfolio showcases disciplined tweaks across aerospace, tech, healthcare, and financials, with low turnover signaling confidence in beaten-down international names amid U.S. market volatility.

Portfolio Snapshot: Diversified Discipline in a Concentrated World

Portfolio Highlights (Q3 2025): - Market Value: $12.5B - Top 10 Holdings: 23.7% - Portfolio Size: 180 -2 - Average Holding Period: 21 quarters - Turnover: 3.3%

Charles Brandes' approach at Brandes Investment Partners remains a textbook case of global value investing, blending broad diversification with meaningful top positions. With 180 holdings and just 23.7% in the top 10, the portfolio avoids over-reliance on any single name, yet the average holding period of 21 quarters underscores a buy-and-hold philosophy rooted in Benjamin Graham principles. The minimal 3.3% turnover reflects surgical adjustments rather than reactive trading, allowing compound growth in undervalued assets.

This structure suits Brandes' signature strategy: scouring international markets for companies trading below intrinsic value, often overlooked by growth-focused peers. The slight reduction to 180 positions -2 suggests prudent trimming of underperformers, maintaining flexibility in a portfolio valued at $12.5B. Tracking via ValueSense's superinvestor page reveals how this low-turnover engine has weathered market cycles.

Top Holdings Breakdown: Aerospace Adds, Bank Trims, and Healthcare Bets

The Brandes Q3 2025 portfolio leads with active management in its upper echelons, starting with CAE Inc. (CAE) at 3.6% after an "Add 1.26%" move, signaling conviction in aviation training demand. Embraer S.A. (ERJ) follows at 2.9% via a "Reduce 6.25%" adjustment, possibly locking in gains amid jet recovery. Open Text Corporation (OTEX) gained aggressively with "Add 7.54%" to 2.7%, betting on enterprise software resilience.

Healthcare and telecom see mixed signals: Grifols, S.A. (GRFS) rose "Add 3.85%" to 2.3%, reinforcing plasma therapy exposure, while Millicom International Cellular S.A. (TIGO) dropped "Reduce 11.92%" to 2.3%, trimming emerging market wireless risk. Financials show rotation with Citigroup Inc. (C) "Reduce 5.74%" to 2.1%, contrasted by Bank of America Corporation (BAC) "Add 2.62%" at 2.1%. WELLS FARGO CO NEW (_) climbed "Add 4.78%" to 2.0%, and Textron Inc. (TXT) "Add 5.64%" to 1.9%, favoring diversified industrials.

Beyond the top 10, Cigna Corporation (CI) stands out with a bold "Add 22.77%" to 1.9%, indicating fresh conviction in managed care amid sector consolidation. These changes across 11 key names highlight Brandes' focus on mispriced globals, blending North American stability with international upside.

What the Portfolio Reveals About Brandes' Enduring Strategy

Brandes' Q3 moves paint a clear picture of timeless value hunting: patience in high-conviction names, geographic diversification beyond U.S. borders, and opportunistic sector rotation.

- Global Focus Over Domestic Hype: Heavy weighting in Canadian (CAE), Brazilian (ERJ), and Spanish (GRFS) firms underscores a contrarian bet on non-U.S. recovery, avoiding overcrowded tech.

- Financial Sector Pruning for Quality: Reductions in Citi (C) and TIGO paired with adds in BAC and Wells Fargo suggest refining toward stronger balance sheets.

- Low Turnover as Risk Management: At 3.3%, changes prioritize margin of safety, holding through volatility while the 21-quarter average tenure favors dividend payers and cash generators.

- Healthcare and Industrials Upside: Boosts in CI and TXT reveal defensive growth bets in essential services.

This thematic mix balances cyclical recovery plays with stable earners, true to Brandes' Graham-inspired discipline.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| CAE Inc. | $444.3M | 3.6% | Add 1.26% |

| Embraer S.A. | $355.6M | 2.9% | Reduce 6.25% |

| Open Text Corporation | $336.4M | 2.7% | Add 7.54% |

| Grifols, S.A. | $290.0M | 2.3% | Add 3.85% |

| Millicom International Cellular S.A. | $283.2M | 2.3% | Reduce 11.92% |

| Citigroup Inc. | $266.0M | 2.1% | Reduce 5.74% |

| Bank of America Corporation | $257.5M | 2.1% | Add 2.62% |

| WELLS FARGO CO NEW | $244.9M | 2.0% | Add 4.78% |

| Textron Inc. | $242.3M | 1.9% | Add 5.64% |

The top 10 command just 23.7% of the $12.5B portfolio, exemplifying Brandes' aversion to excessive concentration despite meaningful position sizes—no single holding exceeds 4%. This table reveals balanced activity: six adds averaging 4.2% portfolio percentage increase, offset by four reduces up to 11.92%, demonstrating nimble reallocation without disrupting core holdings.

Such dispersion across sectors and geographies mitigates risk while enabling targeted value capture, as seen in aerospace (CAE, ERJ) and financials. Low top-10 dominance supports scalability in a 180-position book, prioritizing broad exposure to global bargains.

Investment Lessons from Charles Brandes' Value Discipline

Brandes' Q3 2025 portfolio distills decades of wisdom into actionable principles:

- Seek Global Margin of Safety: Prioritize international names like ERJ and GRFS trading at discounts to U.S. peers, ignoring short-term noise.

- Patience Trumps Turnover: A 21-quarter average holding period and 3.3% churn prove long-term ownership in quality undervalueds builds wealth.

- Active Trimming Sharpens Focus: Reductions in TIGO and C show discipline in reallocating to stronger bets like OTEX.

- Diversify Without Dilution: 180 positions with 23.7% top-10 weight balance conviction and prudence.

- Bet on Cyclical Recovery: Adds in industrials (TXT) and healthcare (CI) highlight timing undervalued sectors.

Looking Ahead: What Comes Next?

Brandes' low 3.3% turnover and portfolio trim to 180 positions suggest ample dry powder for opportunistic buys, especially if global markets correct. With adds in recovering cyclicals like CAE and ERJ, the setup favors aviation rebound and financial normalization. Healthcare expansions via CI and GRFS position for M&A tailwinds.

In volatile 2026 conditions, expect further international value hunts in emerging markets or U.S. banks, leveraging the 21-quarter tenure for compounding. Monitor Brandes' portfolio for signals on overlooked sectors.

FAQ about Charles Brandes Portfolio

Q: What are the most significant changes in Brandes' Q3 2025 13F filing?

A: Key moves include "Add 22.77%" to Cigna (CI) at 1.9%, "Add 7.54%" to OTEX 2.7%, and reductions like "Reduce 11.92%" in TIGO 2.3%, reflecting refined global value bets.

Q: Why does Brandes maintain such a large, diversified portfolio with low top-10 concentration?

A: At 23.7% in top 10 across 180 holdings, it embodies classic value investing: spreading risk while concentrating on high-conviction undervalueds, enabling patience over speculation.

Q: What sectors dominate Brandes Investment Partners' strategy?

A: Aerospace (CAE, ERJ), financials (BAC, Wells Fargo), healthcare (GRFS, CI), and tech (OTEX) lead, with global emphasis.

Q: How can I track Charles Brandes' portfolio and 13F filings?

A: Follow quarterly 13F filings on the SEC site, but use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/brandes-investment for real-time analysis, visualizations, and change alerts—note the 45-day reporting lag.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!