Charles Jigarjian - 7g Capital Management, Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Charles Jigarjian - 7g Capital Management, Llc continues to refine a tightly focused, high‑conviction book. His Q3’2025 portfolio shows a deliberate tilt toward world‑class compounding franchises in technology and financials, led by dominant positions in Alphabet, Taiwan Semiconductor Manufacturing Company Limited, and Apple, while new buys in PayPal and MercadoLibre signal a renewed appetite for digital payments and Latin American ecommerce growth.

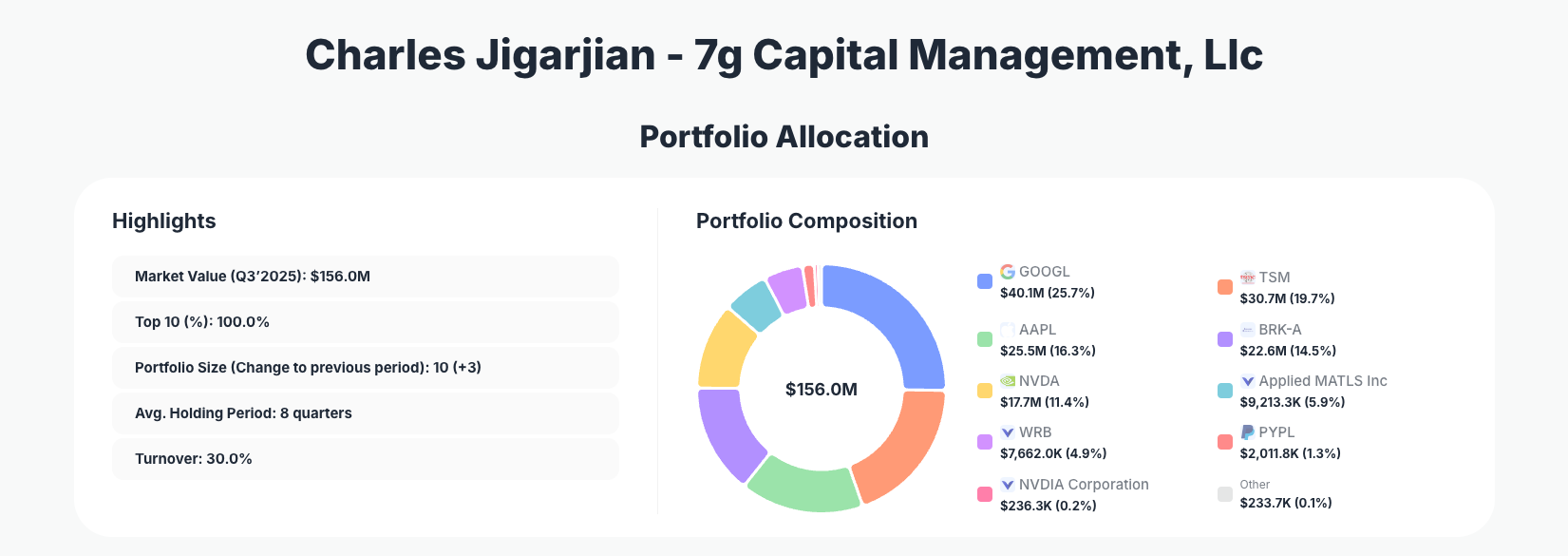

Portfolio Overview: Focused Compounding at $156M Scale

Portfolio Highlights (Q3’2025): - Market Value: $156.0M

- Top 10 Holdings: 100.0%

- Portfolio Size: 10 +3

- Average Holding Period: 8 quarters

- Turnover: 30.0%

At just 10 positions, the 7G Capital portfolio is fully concentrated, with 100% of capital in the top ten. This is classic high‑conviction institutional investing: every name must pull its weight, and there is effectively no “small tracking” basket or long tail of experiments. The addition of three positions versus the prior quarter, alongside a 30.0% turnover figure, indicates that while the core is stable, Jigarjian is not afraid to refresh the edges of the book when risk‑reward shifts.

The average holding period of 8 quarters underscores a fundamentally long‑term orientation. Rather than trading quarterly narratives, 7G Capital’s portfolio is built around multi‑year theses in scalable, asset‑light franchises such as global platforms and compounding financials. Turnover at 30.0% suggests selective pruning and opportunistic buying around that core—most visible in the modest trim to Apple and new capital deployed into PayPal, “NVDIA Corporation” (a small additional NVIDIA‑related line), and MercadoLibre.

From a sector and factor standpoint, the top of the book is heavily tech‑centric. Massive allocations to Alphabet, TSMC, Apple, and NVIDIA dominate the 7G Capital Q3’2025 portfolio, complemented by quality‑tilted financials like Berkshire Hathaway and insurance name Berkley W R Corp. The result is a barbelled bet on the long‑term growth of AI, semiconductors, and digital ecosystems, balanced by resilient, cash‑rich financial franchises.

Top Holdings Analysis: Global Tech Platforms and Quality Financials

The key moves this quarter are best seen by combining holdings with changes and the largest core positions.

The most notable adjustment is in Apple, a 16.3% position where Jigarjian opted to “Reduce 6.98%” while still maintaining it as a top‑three holding. At $25.5M in value, Apple remains a central pillar of the strategy, but the trim suggests either valuation discipline after a strong run or capital reallocation toward higher‑conviction ideas in AI, payments, or emerging markets.

On the buy side, PayPal Holdings, Inc. (PYPL) is a fresh “Buy” at 1.3% of the portfolio, with 30,000 shares worth about $2.0M. While modest in size, this re‑entry into digital payments complements existing exposure to platform economics and network effects, signaling that Jigarjian sees asymmetric upside as PayPal navigates its transition from hyper‑growth to cash‑generating compounder.

Another disclosed “Buy” is the small 0.2% allocation to “NVDIA Corporation” at $236.3K and 450 shares. Although recorded separately, the name clearly represents an incremental NVIDIA‑linked exposure layered on top of the primary NVIDIA stake. Together, these positions reflect continued conviction that NVIDIA remains central to the AI infrastructure build‑out.

Rounding out the new activity, MercadoLibre enters the book as a “Buy” with 100 shares valued at $233.7K (0.1% of the portfolio). Though tiny, this initial position plants a flag in Latin America’s leading ecommerce and fintech ecosystem, suggesting an optionality‑driven approach: start small, learn the business through ownership, and scale if the thesis strengthens.

Beyond the changes, the core of the portfolio is anchored by several mega‑caps:

- Alphabet Inc. (GOOGL) at 25.7% of the portfolio ($40.1M, 165,000 shares, “No change”) remains the single largest position. Its scale, dominant search franchise, and growing cloud and AI stack make it the defining bet in Jigarjian’s book.

- Taiwan Semiconductor Manufacturing Company Limited (TSM) stands at 19.7% ($30.7M, 110,000 shares, “No change”), underscoring a structural belief in TSMC’s irreplaceable role in advanced semiconductor manufacturing.

- Berkshire Hathaway Inc. (BRK-A) is a substantial 14.5% stake ($22.6M, 30 shares, “No change”), functioning as a diversified, value‑oriented ballast that compounds capital through insurance float, high‑quality subsidiaries, and a large equity portfolio.

- NVIDIA Corporation (NVDA) accounts for 11.4% ($17.7M, 95,000 shares, “No change”) and, alongside TSMC, forms the portfolio’s backbone exposure to AI chips and accelerated computing.

The mid‑sized positions add sector diversification while retaining quality:

- Applied MATLS Inc (Applied Materials) at 5.9% ($9.2M, 45,000 shares, “No change”) adds another key semiconductor‑equipment link in the chip supply chain.

- Berkley W R Corp at 4.9% ($7.7M, 100,000 shares, “No change”) provides a high‑quality insurance exposure with disciplined underwriting and compounding book value characteristics.

Combined with the more tactical allocations to PayPal, “NVDIA Corporation,” and MercadoLibre, these names create a 10‑stock set that is both concentrated and thematically coherent around platform economics, data moats, and durable cash‑flow generation.

What the Portfolio Reveals About 7G Capital’s Strategy

Several clear strategic themes emerge from the current construction of the Charles Jigarjian – 7G Capital book:

- Quality over breadth

With just 10 positions and 100% of assets in the top ten, the portfolio explicitly rejects index‑like diversification. Jigarjian is willing to let a handful of global champions—Alphabet, TSMC, Apple, Berkshire, NVIDIA—drive overall returns. - Semiconductor and AI leverage

Heavy allocations to TSMC, NVIDIA, Applied Materials, and the incremental “NVDIA Corporation” buy collectively represent a strong conviction that AI, cloud, and edge computing will sustain multi‑year demand for advanced chips and equipment. - Platform and ecosystem bets

Alphabet, Apple, PayPal, and MercadoLibre all benefit from network effects and data scale. This indicates a preference for businesses where competitive advantages strengthen with size and time. - Risk management via quality financials

Allocations to Berkshire Hathaway and Berkley W R Corp introduce a more defensive, cash‑flow‑rich component that can perform across cycles, counterbalancing the cyclicality and valuation sensitivity of semiconductors and high‑growth tech. - Incrementalism at the margin

The buys in PayPal and MercadoLibre, and the small additional NVIDIA‑related line, reflect a “toe‑dip then scale” playbook. Core positions show “No change,” while new or more volatile ideas start small and can be adjusted with new information.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Alphabet Inc. (GOOGL) | $40.1M | 25.7% | No change |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $30.7M | 19.7% | No change |

| Apple Inc. (AAPL) | $25.5M | 16.3% | Reduce 6.98% |

| Berkshire Hathaway Inc. (BRK-A) | $22.6M | 14.5% | No change |

| NVIDIA Corporation (NVDA) | $17.7M | 11.4% | No change |

| Applied MATLS Inc | $9,213.3K | 5.9% | No change |

| Berkley W R Corp | $7,662.0K | 4.9% | No change |

| PayPal Holdings, Inc. (PYPL) | $2,011.8K | 1.3% | Buy |

| NVDIA Corporation | $236.3K | 0.2% | Buy |

This table highlights how top‑heavy the portfolio truly is. The top five positions alone total nearly 88% of assets, leaving less than 12% for the remaining names. Such concentration amplifies both upside and downside: if the AI and semiconductor thesis plays out, this structure can materially outperform; if it disappoints, tracking error versus the market will be substantial.

The presence of only one meaningful trim—Apple at “Reduce 6.98%”—against a backdrop of widespread “No change” shows strong conviction in the existing lineup. New buys like PayPal and “NVDIA Corporation,” sized at 1.3% and 0.2% respectively, are clearly satellite positions intended to add optionality without diluting the dominance of the core five holdings.

Investment Lessons from Charles Jigarjian’s 7G Capital Approach

Several practical principles emerge from studying Charles Jigarjian – 7G Capital through this Q3’2025 13F:

- Concentrate where conviction is highest

A 25.7% stake in Alphabet and nearly 20% in TSMC show that when you deeply understand a business and its long‑term runway, concentration can be a feature, not a bug. - Let core winners run; adjust at the margin

“No change” for Alphabet, TSMC, Berkshire, and NVIDIA reflects a willingness to hold through volatility. The Apple “Reduce 6.98%” and selective Buy moves show that risk management often happens at the edges, not by constantly churning core positions. - Think in ecosystems, not isolated stocks

Groupings like TSMC–NVIDIA–Applied Materials, or Alphabet–Apple–PayPal–MercadoLibre, illustrate ecosystem thinking: own the critical nodes in value chains (chips, platforms, payments, ecommerce) rather than scattered, uncorrelated bets. - Use starter positions to learn

Tiny allocations to “NVDIA Corporation” and MercadoLibre show a pragmatic tactic: open a small position, follow it closely, and only scale when the thesis and execution continue to improve. - Balance growth with resilient cash generators

High‑growth tech is paired with quality financials like Berkshire Hathaway and Berkley W R Corp, reminding investors that even in a growth‑heavy portfolio, resilient compounding and downside protection matter.

Looking Ahead: What Comes Next for 7G Capital?

Given the current construction of 7G Capital’s Q3’2025 portfolio, several forward‑looking implications stand out:

- AI and chip‑cycle sensitivity

With large exposures to TSMC, NVIDIA, Applied Materials, and the additional “NVDIA Corporation” line, future performance will be heavily influenced by AI infrastructure spending, semiconductor pricing, and capacity cycles. - Room to scale new digital plays

If Jigarjian’s theses on PayPal and MercadoLibre play out, there is considerable room to grow these 1.3% and 0.1% positions over time. Future 13F filings will reveal whether these remain experiments or graduate to core holdings. - Potential trims for risk control

With more than half the book concentrated in three tech names—Alphabet, TSMC, and Apple—further partial reductions (similar to the Apple trim) are possible if valuations stretch or macro risks around supply chains and regulation rise. - Selective expansion beyond the top 10

The move from 7 to 10 positions hints that 7G Capital may continue adding a small number of differentiated ideas that fit its quality‑and‑platform playbook. Investors should watch for new geographies (like Latin America via MELI) or adjacent sectors (fintech, infrastructure, software) in upcoming quarters.

For investors following superinvestors, tracking future 13Fs via ValueSense will be key to understanding whether Q3’2025 marks a steady‑state portfolio or just the midpoint of a broader repositioning.

FAQ about Charles Jigarjian – 7G Capital Portfolio

Q: What were the most significant changes in Charles Jigarjian’s Q3’2025 portfolio?

The main change was a “Reduce 6.98%” action in Apple, while still keeping it at 16.3% of the portfolio. On the buy side, Jigarjian initiated or added to PayPal (1.3%, “Buy”), “NVDIA Corporation” (0.2%, “Buy”), and MercadoLibre (0.1%, “Buy”).

Q: How concentrated is the 7G Capital portfolio?

Extremely concentrated: there are only 10 positions, and the top 10 account for 100.0% of reported equity holdings. The top five positions alone—Alphabet, TSMC, Apple, Berkshire Hathaway, and NVIDIA—dominate the portfolio.

Q: What is Charles Jigarjian’s apparent investment style based on this 13F?

The Q3’2025 holdings suggest a quality‑growth and platform‑centric style: heavy bets on AI and semiconductors, dominant digital platforms, and high‑quality financials, combined with long holding periods and selective, incremental changes at the margin.

Q: Which sectors and themes does 7G Capital emphasize?

The portfolio emphasizes: - Technology (search, cloud, AI, semiconductors, hardware) via Alphabet, TSMC, Apple, NVIDIA, and Applied Materials.

- Financials and insurance via Berkshire Hathaway and Berkley W R Corp.

- Digital payments and ecommerce via PayPal and MercadoLibre.

Q: How can I track or follow Charles Jigarjian’s 7G Capital portfolio?

You can follow all quarterly 13F updates and detailed holdings on ValueSense’s superinvestor tracker. Visit 7G Capital’s portfolio to see current positions, historical changes, and visualizations. Remember that 13F filings are reported with a 45‑day lag after quarter‑end, so positions may have changed since the filing date; platforms like ValueSense help you interpret these disclosures in context and monitor trends over time.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!