Best Undervalued Cheap Stocks to Buy

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

True value investing involves discovering companies whose market prices significantly understate their intrinsic worth, creating compelling opportunities for patient investors willing to conduct thorough fundamental analysis.

At ValueSense, our comprehensive screening methodology evaluates companies across multiple dimensions including quality ratings, intrinsic value calculations, cash flow generation, competitive positioning, and operational efficiency. This rigorous approach helps distinguish between companies that are "cheap for a reason" and those representing genuine value opportunities trading below their calculated fair value.

The following selection represents our top undervalued cheap stocks spanning diverse sectors and geographic regions. Each company demonstrates attractive fundamental characteristics while trading at meaningful discounts to their estimated intrinsic values, creating compelling risk-adjusted return opportunities for informed investors.

Understanding Our Value Investment Framework

Our analysis focuses on companies that combine strong operational metrics with significant valuation discounts. We evaluate quality ratings that reflect operational excellence, competitive positioning, and financial strength, while our intrinsic value calculations consider multiple valuation methodologies including discounted cash flow models, comparable company analysis, and asset-based valuations.

This comprehensive approach ensures that our undervalued stock selections represent genuine opportunities rather than value traps, providing investors with a foundation for building diversified portfolios of quality companies at attractive prices.

Top Undervalued Cheap Stocks by Quality and Value

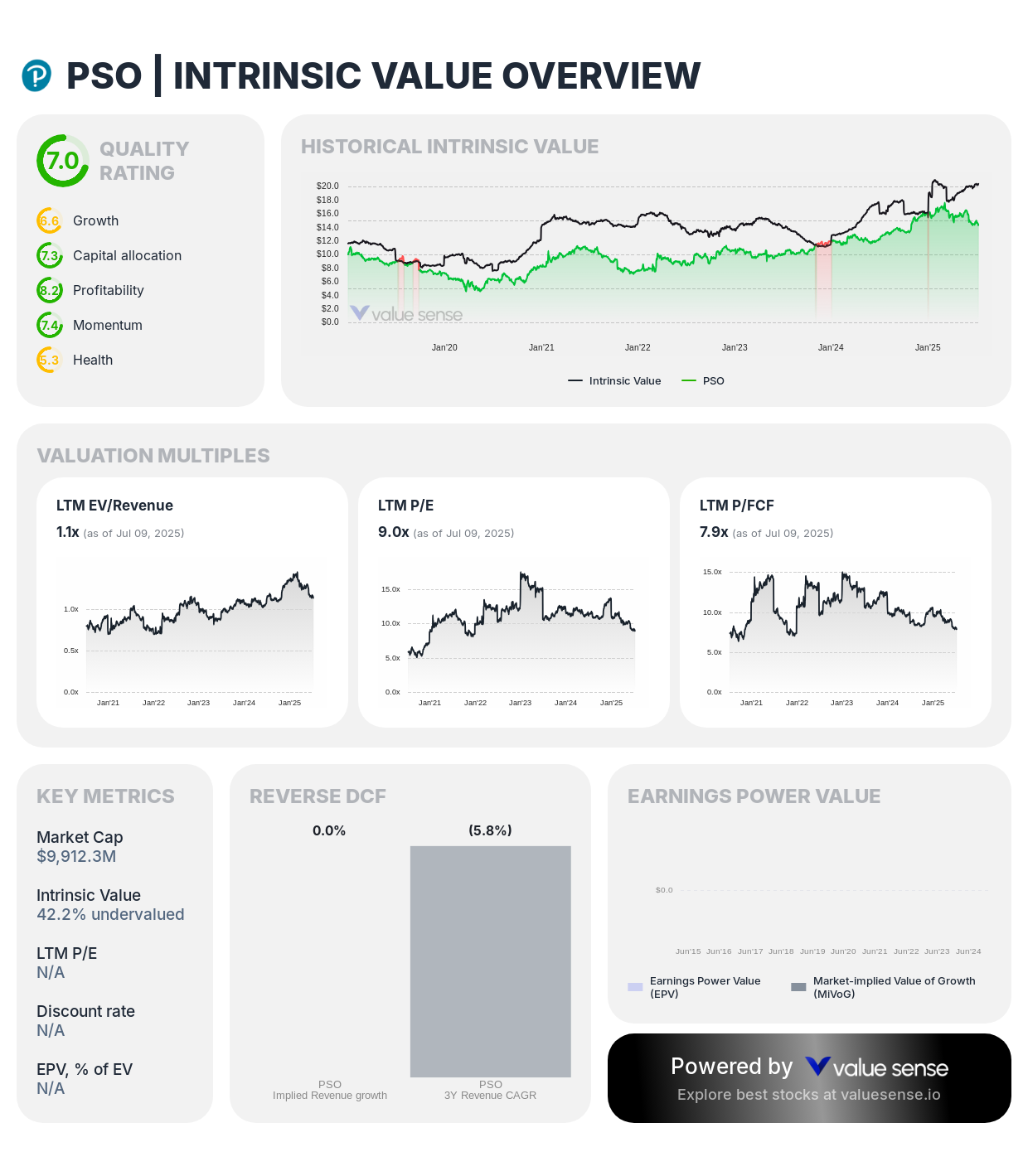

1. Pearson plc (PSO) - Global Education Leader

Pearson plc emerges as our top undervalued opportunity, combining educational content leadership with digital transformation initiatives at an exceptionally attractive valuation.

Key Financial Metrics:

- Quality Rating: 7.0 (Strong) - Solid operational excellence in global education markets

- Intrinsic Value: 42.2% undervalued - Most significant discount in our analysis

- 1-Year Return: 12.9% - Positive momentum with continued upside potential

- Revenue: £7,226.0M - Substantial revenue base across global education markets

- Free Cash Flow: £922.0M - Strong cash generation supporting strategic initiatives

- Revenue Growth: (0.6%) - Stable revenue during digital transformation period

- FCF Margin: 12.8% - Healthy profitability metrics

Pearson's dominant position in global educational content and assessment services provides a stable foundation for long-term value creation. The company's successful transition from traditional textbook publishing to digital learning platforms creates recurring revenue opportunities while maintaining competitive advantages in content creation and distribution. The significant undervaluation reflects market skepticism about education sector dynamics, creating an attractive entry point for investors who recognize the defensive characteristics and growth potential of digital learning solutions.

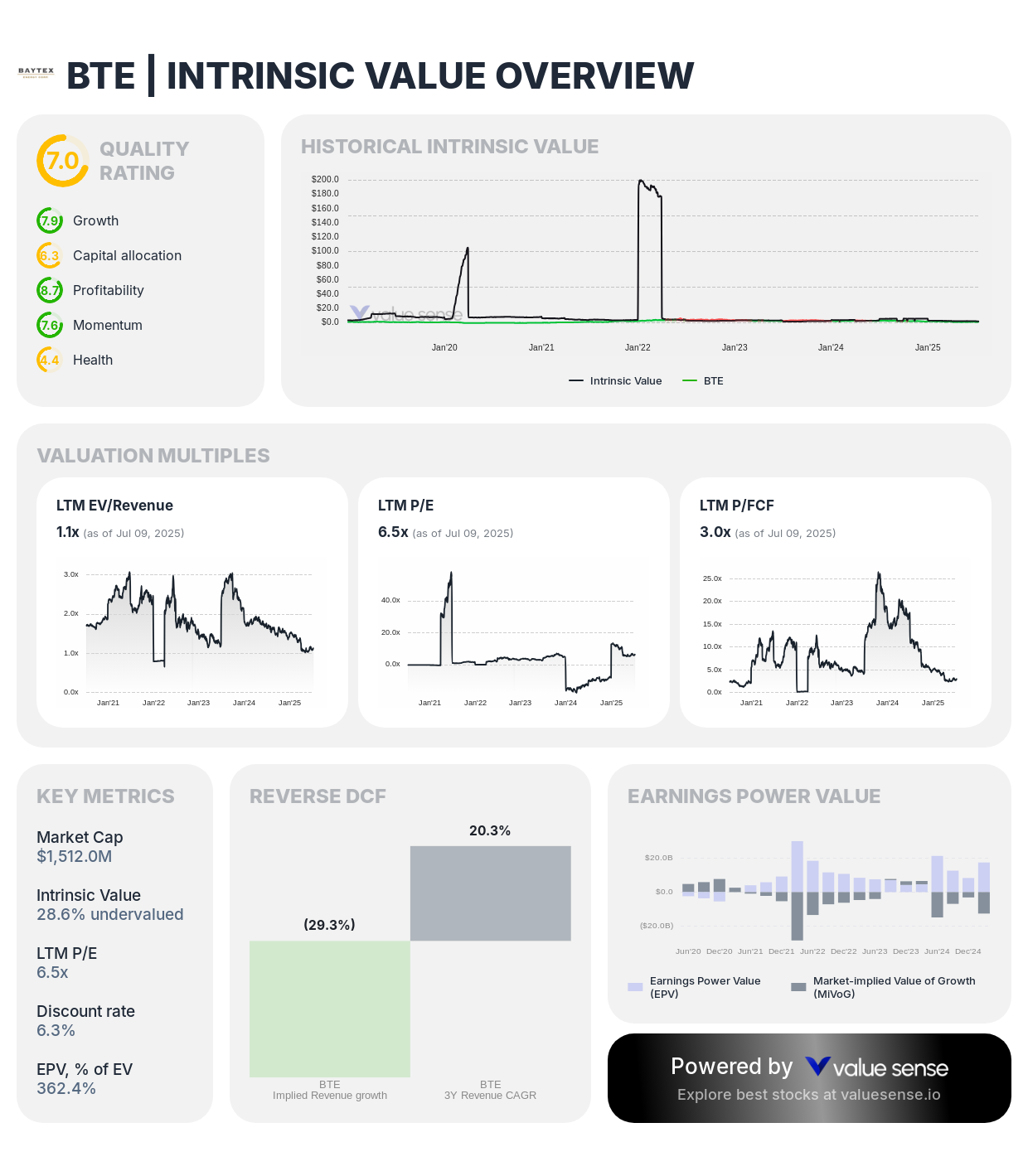

2. Baytex Energy Corp. (BTE) - Canadian Energy Value

Baytex Energy Corp. offers compelling value in the Canadian energy sector, combining operational excellence with attractive asset positioning despite recent market weakness.

Key Financial Metrics:

- Quality Rating: 7.0 (Strong) - Solid operational performance in energy sector

- Intrinsic Value: 28.6% undervalued - Significant discount to calculated fair value

- 1-Year Return: (44.4%) - Substantial recent weakness creates opportunity

- Revenue: CA$3,759.7M - Significant revenue from Canadian energy operations

- Free Cash Flow: CA$684.7M - Strong cash generation capabilities

- Revenue Growth: 4.4% - Positive growth in challenging energy markets

- FCF Margin: 18.2% - Solid profitability metrics

Baytex's focus on Canadian oil sands and conventional production provides exposure to long-life, low-decline energy assets with predictable cash flow characteristics. The company's operational improvements and debt reduction initiatives create potential for significant value creation as energy markets strengthen. The substantial recent stock price decline may represent an attractive entry point for investors with positive long-term views on energy commodity prices and Canadian energy infrastructure.

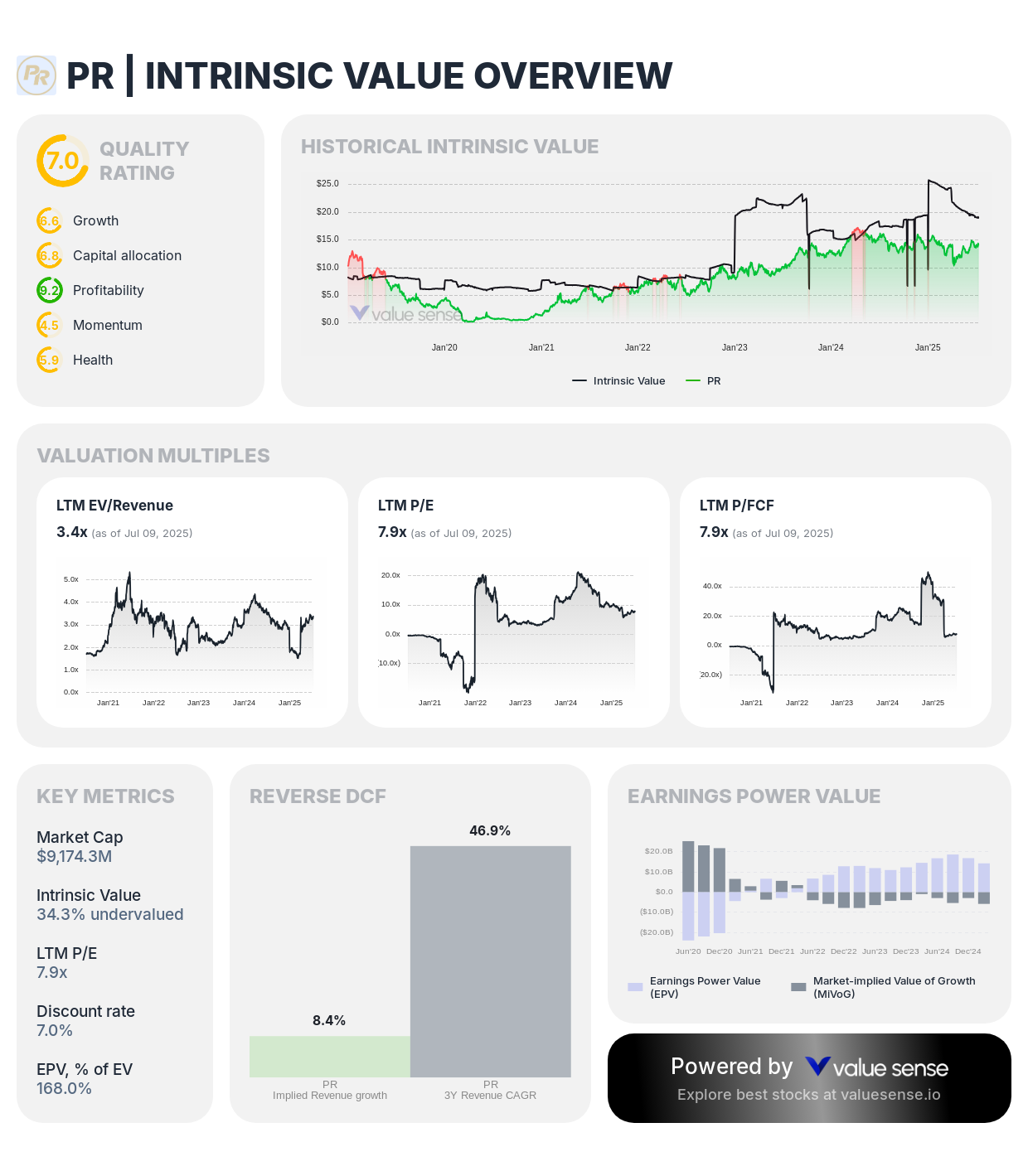

3. Permian Resources Corporation (PR) - Permian Basin Excellence

Permian Resources Corporation provides focused exposure to North America's most productive oil and gas basin with strong operational metrics and attractive valuation characteristics.

Key Financial Metrics:

- Quality Rating: 7.0 (Strong) - Excellent operational performance in energy sector

- Intrinsic Value: 34.3% undervalued - Substantial discount to intrinsic value

- 1-Year Return: (8.5%) - Recent weakness creates attractive entry opportunity

- Revenue: $3,757.7M - Significant revenue from premium energy assets

- Free Cash Flow: $1,161.2M - Exceptional cash generation capabilities

- Revenue Growth: 0.3% - Stable revenue in energy markets

- FCF Margin: 30.9% - Outstanding profitability metrics

The company's strategic focus on the prolific Permian Basin provides access to some of North America's most productive and cost-effective oil and gas resources. Strong operational efficiency and disciplined capital allocation create attractive cash generation characteristics that support sustainable returns to shareholders while maintaining financial flexibility for growth opportunities and market volatility.

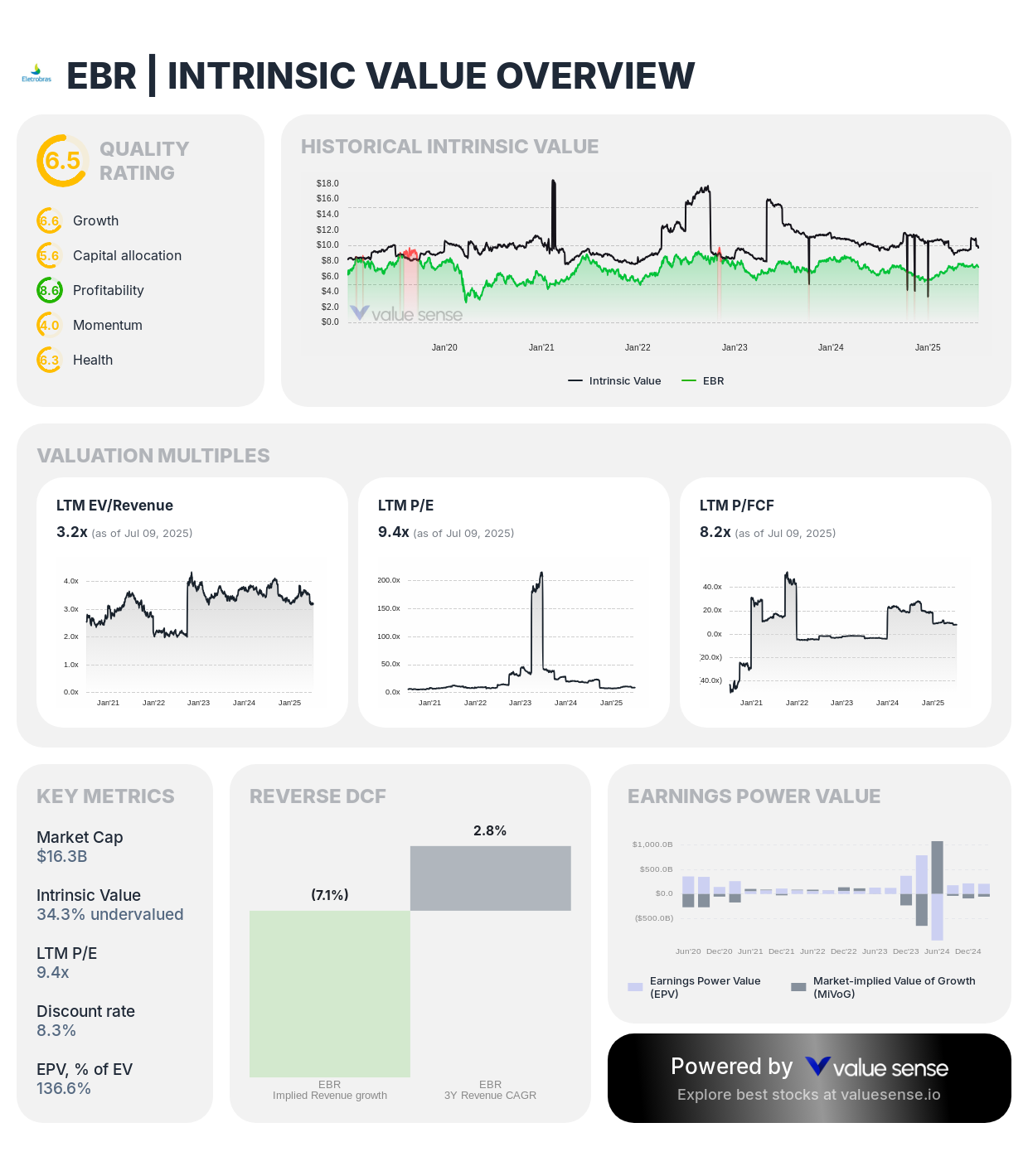

4. Centrais Elétricas Brasileiras S.A. (EBR) - Brazilian Utility Infrastructure

Centrais Elétricas Brasileiras S.A. represents Brazil's largest electric utility company, offering investors exposure to emerging market infrastructure with strong dividend characteristics and growth potential.

Key Financial Metrics:

- Quality Rating: 6.5 (Moderate) - Solid utility operations in emerging market context

- Intrinsic Value: 34.3% undervalued - Significant valuation discount

- 1-Year Return: 4.9% - Steady performance with upside potential

- Revenue: R$41.9B - Large-scale utility operations in Brazilian market

- Free Cash Flow: R$11.2B - Strong cash generation capabilities

- Revenue Growth: 14.2% - Excellent growth for utility sector

- FCF Margin: 26.7% - Outstanding profitability metrics

The company's dominant position in Brazil's electric utility sector provides stable cash flows and dividend income while offering exposure to one of South America's largest economies. Recent privatization efforts and operational improvements create potential for enhanced efficiency and shareholder value creation, while the company's strategic importance to Brazilian energy infrastructure provides stability and growth opportunities.

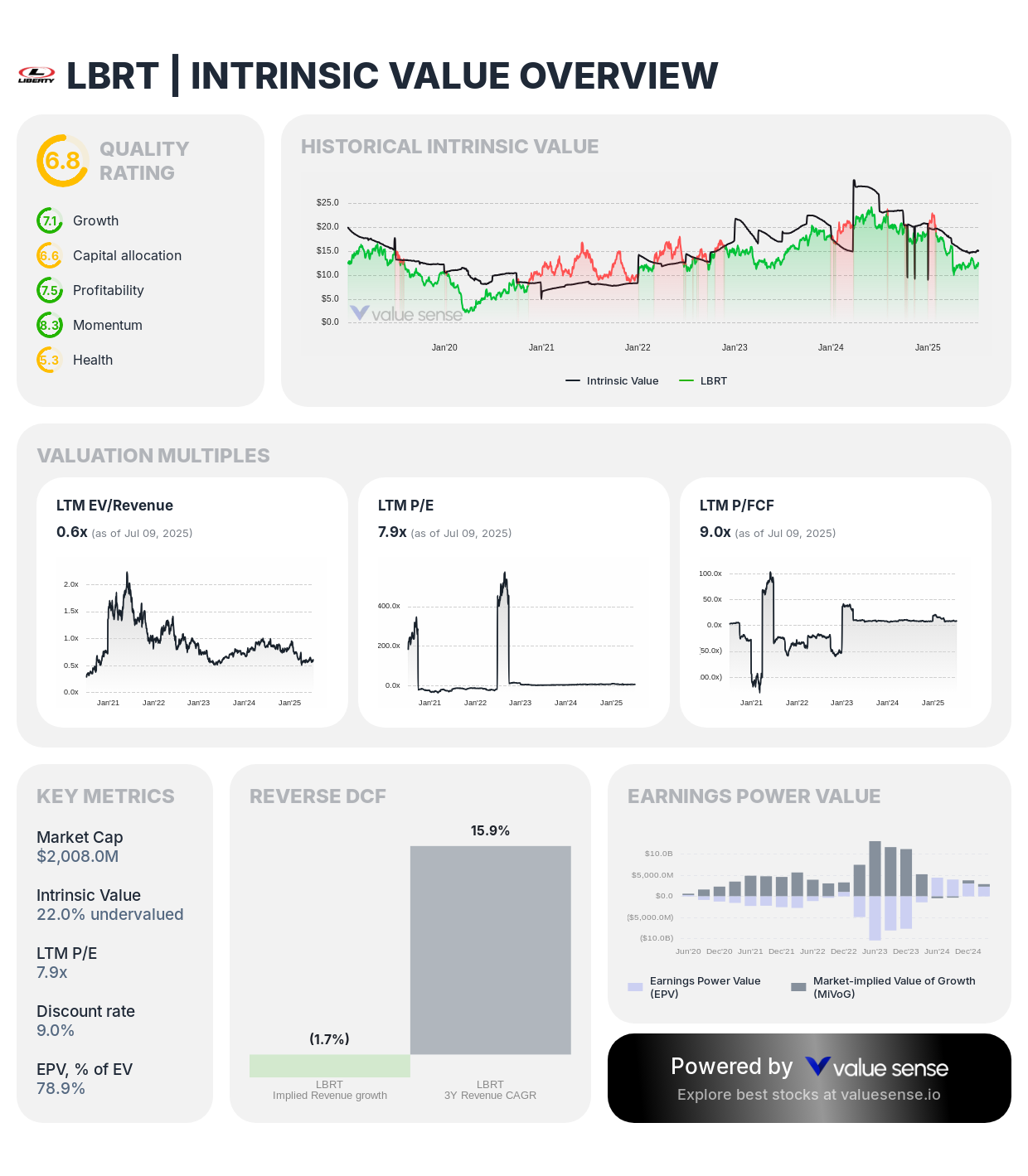

5. Liberty Energy Inc. (LBRT) - Energy Services Specialist

Liberty Energy Inc. provides specialized oilfield services with strong market positioning and attractive valuation metrics in the energy services sector.

Key Financial Metrics:

- Quality Rating: 6.6 (Moderate) - Solid operational performance in services sector

- Intrinsic Value: 22.0% undervalued - Meaningful discount to fair value

- 1-Year Return: (36.6%) - Significant recent weakness creates opportunity

- Revenue: $4,219.5M - Substantial revenue from energy services

- Free Cash Flow: $222.1M - Positive cash generation capabilities

- Revenue Growth: (7.4%) - Cyclical revenue patterns typical of services sector

- FCF Margin: 5.3% - Reasonable profitability metrics

The company's specialized hydraulic fracturing and completion services provide essential capabilities for North American oil and gas production. Strong operational efficiency and market positioning create opportunities for improved profitability as energy markets stabilize and production activities increase across key basins.

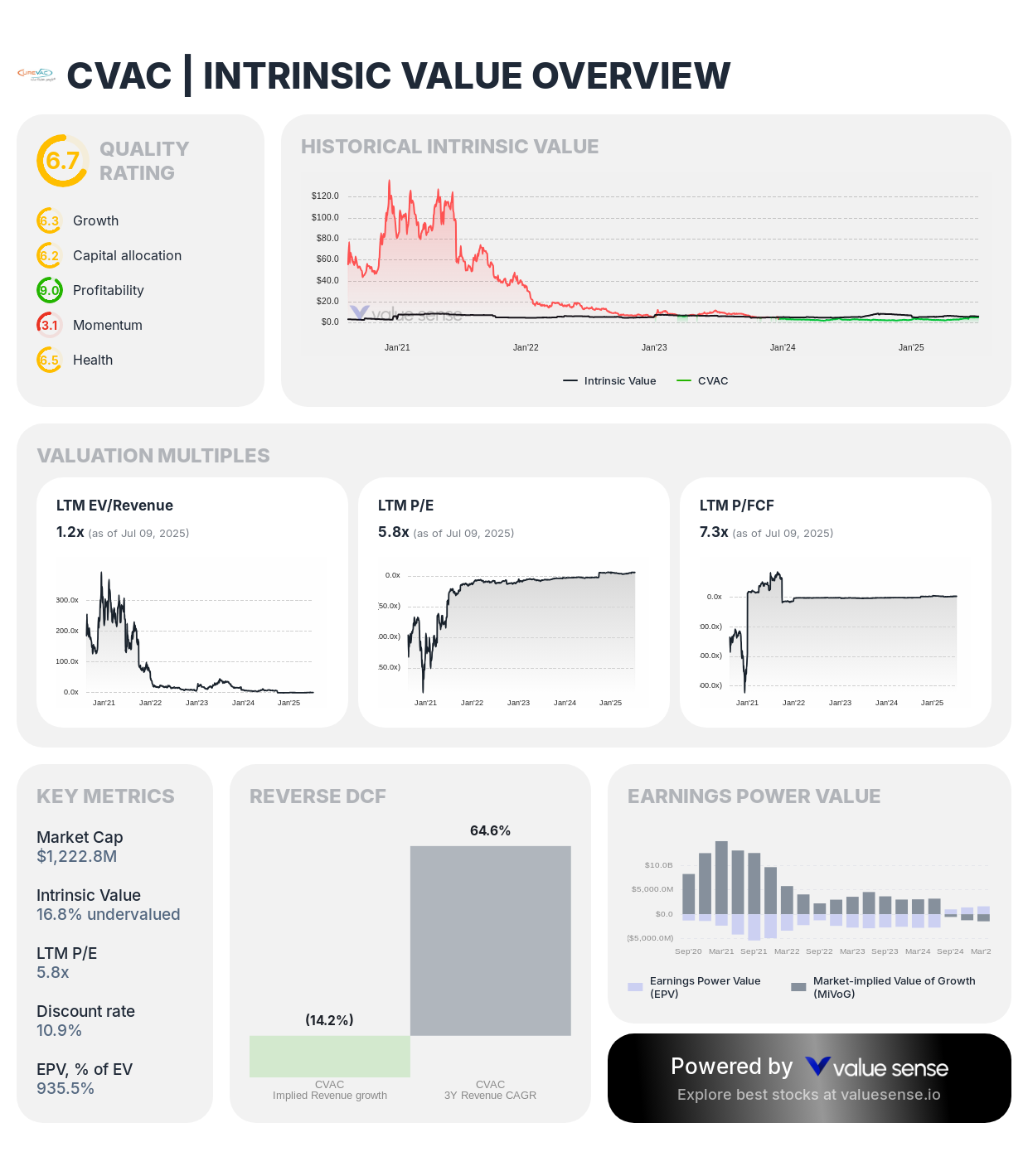

6. CureVac N.V. (CVAC) - Biotechnology Innovation

CureVac N.V. represents a biotechnology opportunity focused on mRNA technology development with significant potential for breakthrough innovations and commercial success.

Key Financial Metrics:

- Quality Rating: 6.7 (Moderate) - Solid biotechnology operations and pipeline

- Intrinsic Value: 16.8% undervalued - Modest but meaningful discount

- 1-Year Return: 79.7% - Exceptional recent performance indicates growing recognition

- Revenue: €523.7M - Growing biotechnology revenue base

- Free Cash Flow: €143.5M - Positive cash generation supporting development

- Revenue Growth: 796.4% - Extraordinary growth trajectory

- FCF Margin: 27.4% - Strong profitability metrics

CureVac's focus on mRNA technology development positions it well for growth in the expanding biotechnology sector. The company's partnerships and pipeline development create multiple opportunities for value creation through successful drug development and commercialization. The exceptional revenue growth and positive cash generation demonstrate the commercial viability of its technology platform.

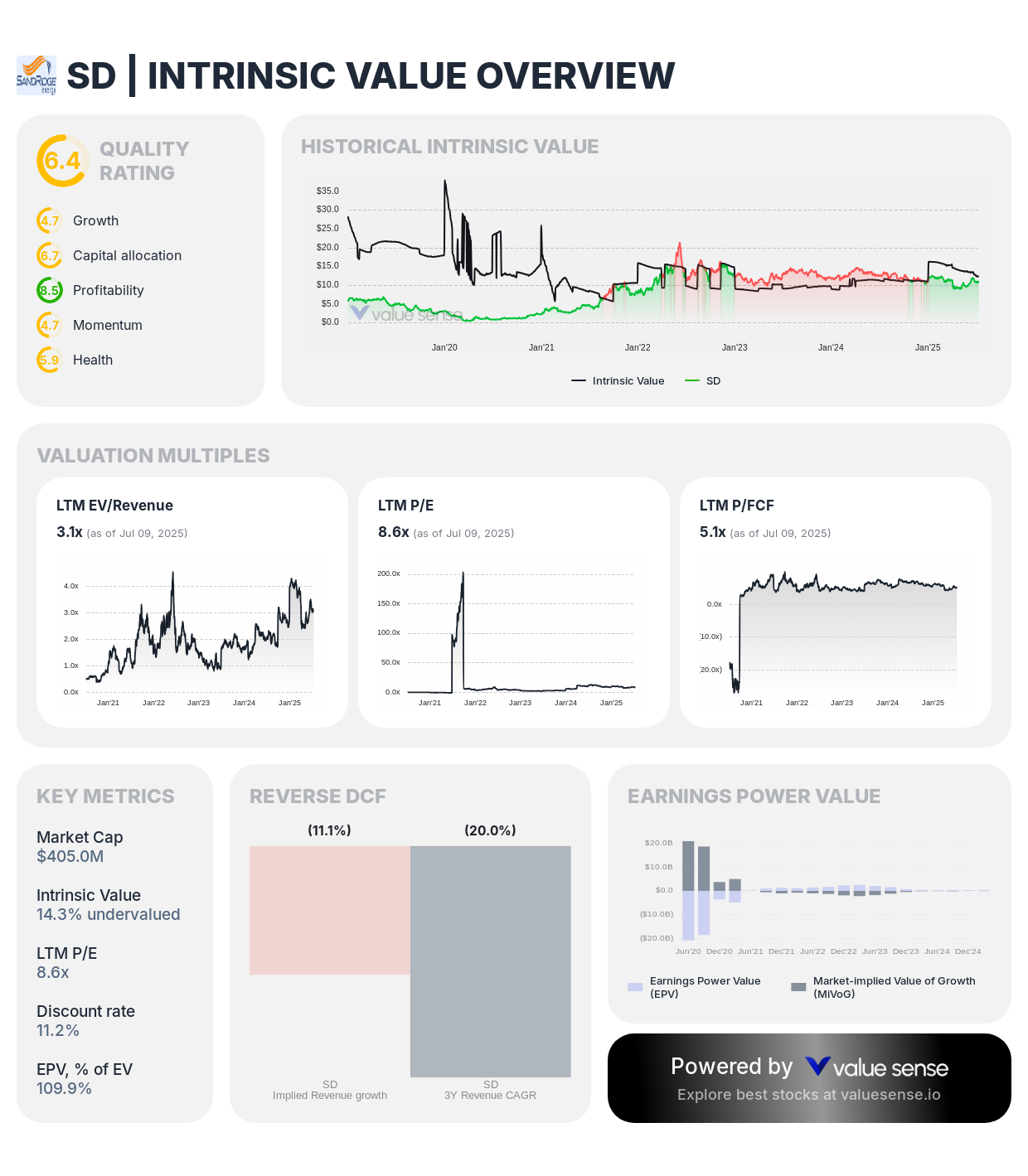

7. SandRidge Energy, Inc. (SD) - Focused Energy Producer

SandRidge Energy, Inc. offers investors exposure to domestic oil and gas production with exceptional operational efficiency and attractive valuation characteristics.

Key Financial Metrics:

- Quality Rating: 6.4 (Moderate) - Solid operational performance in energy sector

- Intrinsic Value: 14.3% undervalued - Modest but meaningful discount

- 1-Year Return: (12.9%) - Recent weakness creates opportunity

- Revenue: $98.6M - Focused energy production operations

- Free Cash Flow: $79.7M - Strong cash generation relative to size

- Revenue Growth: (27.4%) - Declining revenue requires monitoring

- FCF Margin: 80.8% - Exceptional profitability metrics

SandRidge's focus on high-quality domestic oil and gas assets provides exposure to North American energy production with outstanding cash generation characteristics. The company's disciplined approach to capital allocation and operational efficiency creates attractive returns on invested capital, though investors should monitor the revenue decline trend and understand the company's strategic direction.

Special Consideration Stocks - Higher Risk Profiles

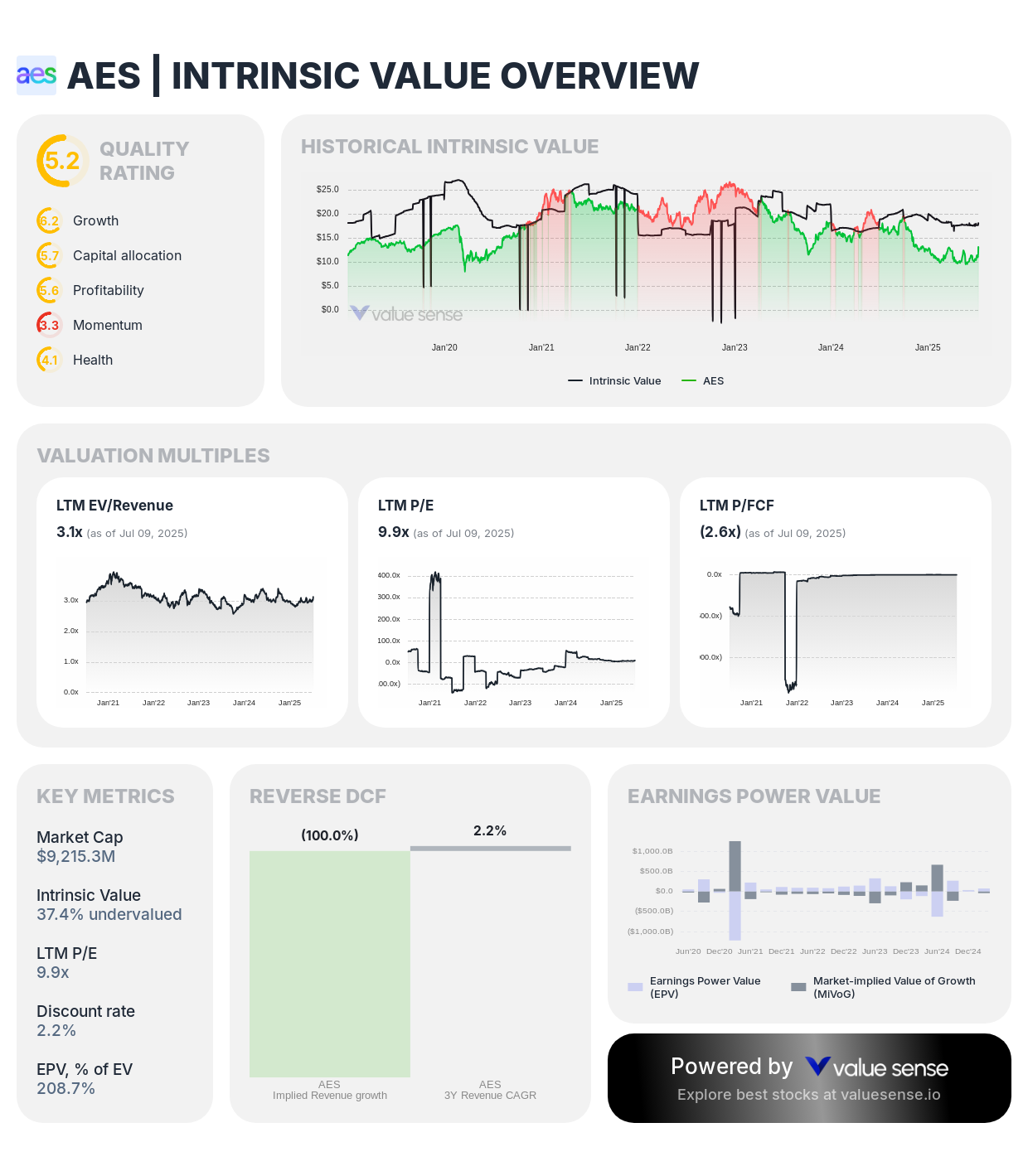

The AES Corporation (AES) - Turnaround Opportunity

Important Risk Warning: AES Corporation presents significant undervaluation but currently faces operational challenges that require careful evaluation.

Key Financial Metrics:

- Quality Rating: 6.4 (Moderate) - Moderate quality rating reflects operational challenges

- Intrinsic Value: 37.4% undervalued - Deep discount to intrinsic value

- 1-Year Return: (22.2%) - Recent weakness reflects operational concerns

- Revenue: $12.1B - Substantial revenue base in global utilities

- Free Cash Flow: ($3,488.0M) - Warning: Negative free cash flow

- Revenue Growth: (3.2%) - Declining revenue trends

- FCF Margin: (28.8%) - Negative margins reflect investment cycle

AES Corporation's significant undervaluation comes with substantial risks due to negative free cash flow and declining revenue. The company's global utilities operations and renewable energy investments may create long-term value, but investors should thoroughly understand the capital investment cycle and cash flow timeline before considering this opportunity.

NL Industries, Inc. (NL) - Specialty Chemicals Turnaround

Important Risk Warning: NL Industries shows valuation discount but faces operational challenges requiring careful analysis.

Key Financial Metrics:

- Quality Rating: 6.4 (Moderate) - Moderate quality in specialty chemicals sector

- Intrinsic Value: 12.8% undervalued - Modest discount to fair value

- 1-Year Return: 20.3% - Recent positive performance

- Revenue: $148.2M - Focused specialty chemicals operations

- Free Cash Flow: ($30.6M) - Warning: Negative free cash flow

- Revenue Growth: (6.2%) - Declining revenue trends

- FCF Margin: (20.6%) - Negative margins require investigation

NL Industries' specialized focus on titanium dioxide and other specialty chemicals provides exposure to industrial markets with potential for operational improvements. However, the negative free cash flow and declining revenue require thorough analysis of the company's turnaround strategy and market position before investment consideration.

Investment Strategy for Undervalued Cheap Stocks

Quality-First Approach

Our analysis prioritizes companies with strong quality ratings and positive cash generation characteristics. Stocks like Pearson, Baytex, and Permian Resources demonstrate the combination of operational excellence and attractive valuations that creates compelling investment opportunities with favorable risk-adjusted return profiles.

Sector Diversification Benefits

The selection spans multiple sectors including education, energy, utilities, biotechnology, and specialty chemicals, providing natural diversification benefits that help reduce portfolio risk while maintaining exposure to different economic cycles and growth drivers across global markets.

Risk Management Considerations

Investors should carefully distinguish between companies with temporary valuation discounts and those facing structural challenges. Companies showing negative free cash flow (AES, NL) require additional due diligence and may be appropriate only for risk-tolerant investors with thorough understanding of their business models and turnaround prospects.

Geographic Diversification

The international exposure across North American, European, and emerging market companies provides geographic diversification that helps reduce concentration risk while accessing different economic growth patterns and market opportunities.

Sector Analysis and Market Opportunities

Energy Sector Leadership

The significant representation of energy companies reflects current market conditions creating attractive valuations across the sector. Companies like Baytex, Permian Resources, Liberty Energy, and SandRidge Energy offer different approaches to energy sector exposure, from production to services, providing multiple ways to capitalize on potential energy market recovery.

Defensive Characteristics

Utilities like Centrais Elétricas Brasileiras and education companies like Pearson provide defensive characteristics and steady cash flows that can help stabilize portfolio performance during market volatility while offering attractive dividend income potential.

Innovation and Growth

CureVac represents the biotechnology sector's potential for breakthrough innovations and substantial value creation through successful drug development and commercialization, providing growth exposure that complements the value characteristics of other selections.

Conclusion

These undervalued cheap stocks represent compelling opportunities for investors seeking quality companies trading below their intrinsic values across diverse sectors and geographic markets. The combination of strong fundamental characteristics, significant valuation discounts, and operational excellence creates attractive risk-adjusted return potential for patient investors.

Success with these investments requires careful attention to company-specific fundamentals, sector dynamics, and appropriate risk management. While the affordable nature and attractive valuations of these stocks create compelling opportunities, investors should maintain disciplined approaches to position sizing and portfolio construction.

The most attractive opportunities combine strong quality ratings with positive cash generation and reasonable growth prospects, while higher-risk situations require additional analysis and may be suitable only for experienced investors with appropriate risk tolerance and investment time horizons.

For comprehensive analysis, real-time updates, and detailed financial metrics on these and other undervalued opportunities, visit ValueSense.io to access our complete database of quality assessments and valuation models.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Best Undervalued S&P 500 Stocks

📖 11 Best Undervalued Multibagger Stocks

📖 The Magnificent 7 Stocks: Fundamental Quality Rankings & Insights