Chris Hohn - TCI Fund Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

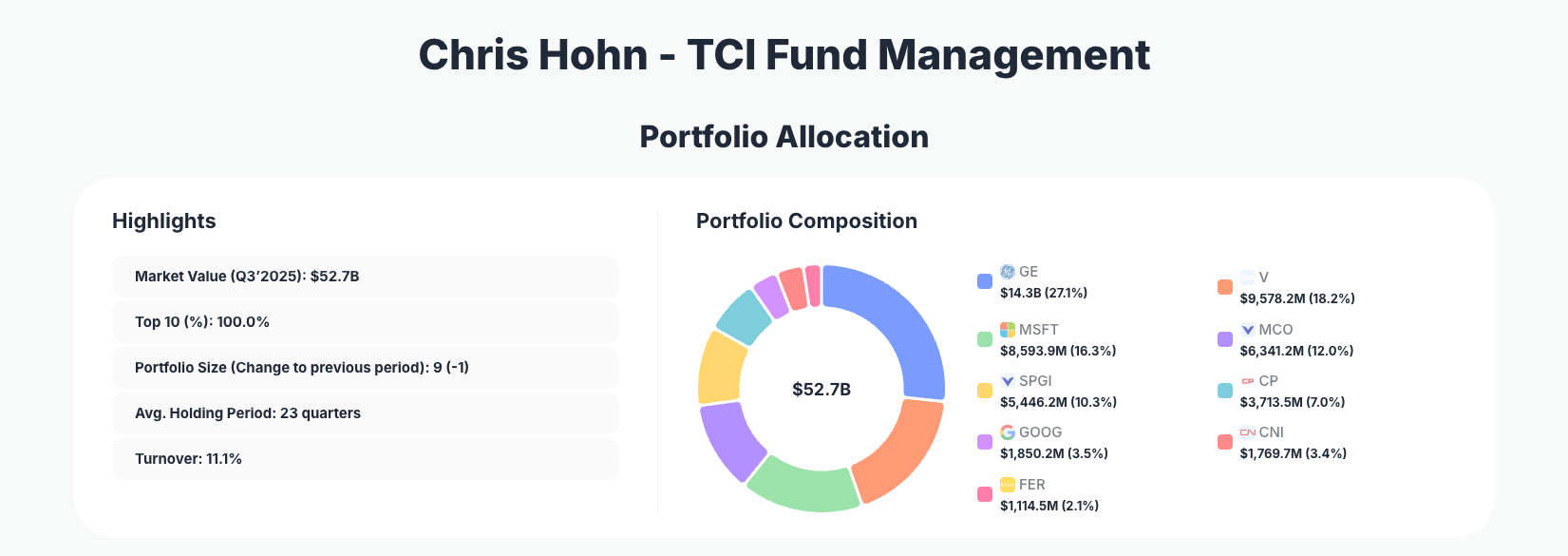

Chris Hohn, the renowned activist investor behind TCI Fund Management, showcases his signature high-conviction style in the latest 13F filing. His $52.7B portfolio for Q3 2025 maintains extreme concentration across just 9 positions, with bold moves like a massive 47.15% addition to Visa signaling confidence in payment networks amid tech sector adjustments.

Portfolio Overview: Extreme Concentration Defines TCI's Edge

Portfolio Highlights (Q3 2025): - Market Value: $52.7B - Top 10 Holdings: 100.0% - Portfolio Size: 9 -1 - Average Holding Period: 23 quarters - Turnover: 11.1%

TCI Fund Management's Q3 2025 portfolio exemplifies Chris Hohn's disciplined approach to concentrated investing, where every position carries massive weight. With the top 10 holdings comprising 100% of the portfolio—despite only 9 total positions—Hohn avoids diversification for its own sake, betting heavily on a handful of high-quality businesses he understands deeply. The reduction to 9 positions from the prior quarter underscores a willingness to exit underperformers, maintaining focus on long-term winners.

This structure reflects TCI's activist roots, where Hohn often pushes for operational improvements in portfolio companies. The impressive average holding period of 23 quarters (over 5.5 years) highlights patience, while the 11.1% turnover indicates measured adjustments rather than reactive trading. Investors tracking this portfolio on ValueSense can see how these metrics signal conviction in durable competitive advantages, from industrial giants to fintech leaders.

Top Holdings: Visa's Massive Build and Strategic Reductions

The TCI portfolio leads with General Electric at 27.1% ("No change"), anchoring the industrial exposure that has long defined Hohn's strategy. A standout move is the aggressive Visa addition of 47.15% to 18.2%, elevating it to a core position worth $9.58B and signaling bullishness on global payments growth. Meanwhile, Microsoft holds steady at 16.3% after a modest "Reduce 5.54%," maintaining significant tech exposure.

Other changes include small increases like Moody's ("Add 0.46%" to 12.0%) and S&P Global ("Add 0.89%" to 10.3%), reinforcing a theme of financial data dominance. On the trim side, Canadian Pacific Railway saw a "Reduce 5.61%" to 7.0%, while Alphabet faced a sharp "Reduce 41.41%" to 3.5% and Canadian National Railway a "Reduce 18.36%" to 3.4%, suggesting a pivot away from certain transport and tech names. Stable holdings like Ferrovial at 2.1% ("No change") round out the portfolio, providing infrastructure balance.

What the Portfolio Reveals About TCI's Strategy

Chris Hohn's moves in Q3 2025 reveal a strategy prioritizing quality compounders with strong moats over speculative growth. The heavy tilt toward financial services—Visa, Moody's, S&P Global—highlights bets on oligopolistic businesses with pricing power and network effects, resilient in economic cycles.

Sector focus spans industrials (GE), technology (MSFT, GOOG), and transportation/railways (CP, CNI), but reductions in rails indicate risk management around cyclical exposure. Geographic concentration favors U.S. giants with global reach, plus select international plays like Ferrovial (Spain) and Canadian rails. No overt dividend strategy emerges, as TCI emphasizes capital appreciation through activist influence and long holds.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| General Electric Company | $14.3B | 27.1% | No change |

| Visa Inc. | $9,578.2M | 18.2% | Add 47.15% |

| Microsoft Corporation | $8,593.9M | 16.3% | Reduce 5.54% |

| Moody's Corporation | $6,341.2M | 12.0% | Add 0.46% |

| S&P GLOBAL INC | $5,446.2M | 10.3% | Add 0.89% |

| Canadian Pacific Railway Limited | $3,713.5M | 7.0% | Reduce 5.61% |

| Alphabet Inc. | $1,850.2M | 3.5% | Reduce 41.41% |

| Canadian National Railway Company | $1,769.7M | 3.4% | Reduce 18.36% |

| Ferrovial SE | $1,114.5M | 2.1% | No change |

This table underscores TCI's ultra-concentrated bet on just nine names, with the top five alone commanding 83.9% of the $52.7B portfolio. The massive Visa build amid Alphabet's sharp cut illustrates dynamic position sizing—doubling down on perceived undervaluation while pruning laggards. Such extreme focus amplifies returns from winners like GE (unchanged anchor) but demands precise conviction, as seen in the low turnover and long average hold.

Investment Lessons from Chris Hohn's TCI Approach

- Concentrate ruthlessly in moats you can influence: TCI's 100% top-10 allocation shows Hohn bets big only on businesses with durable advantages, often using activism to unlock value.

- Long holding periods reward patience: 23 quarters average tenure proves time in quality trumps frequent trading, allowing compounds like financial data firms to mature.

- Active position management over buy-and-hold: Bold adds (Visa +47%) and cuts (Alphabet -41%) demonstrate constant reassessment, trimming cyclicals like rails while scaling winners.

- Quality trumps sectors: Diverse mix from industrials to fintech prioritizes cash-generative leaders, not chasing hot trends.

- Size matters for impact: Multi-billion stakes enable board influence, a TCI hallmark absent in diversified portfolios.

Looking Ahead: What Comes Next?

With portfolio size shrinking to 9 positions and turnover at 11.1%, TCI appears positioned for selective deployment rather than broad hunting. The Visa surge suggests appetite for fintech resilience, potentially eyeing more payment or data plays if valuations dip. Reductions in Alphabet and rails hint at caution on Big Tech valuations and industrial cycles, freeing capital for opportunistic buys.

Current holdings set up well for 2026: GE's turnaround, Microsoft's AI tailwinds, and financials' stability provide offense in growth markets. Amid potential rate cuts, watch for infrastructure/international bets like Ferrovial to expand. ValueSense users can monitor the TCI portfolio for fresh 13F insights.

FAQ about Chris Hohn TCI Fund Portfolio

Q: What drove TCI's biggest Q3 2025 changes?

A: The standout was a 47.15% addition to Visa (to 18.2%), boosting payments exposure, paired with sharp reductions like Alphabet -41.41% and rails, reflecting a shift toward financial quality over tech breadth.

Q: Why is TCI's portfolio so concentrated?

A: At 100% in top 10 (just 9 holdings), Hohn prioritizes high-conviction bets on moats like GE 27.1% and Visa, using size for activist impact—far from diversified indexing.

Q: What sectors dominate TCI's strategy?

A: Financial data (Moody's, S&P Global) and industrials (GE) lead, with tech (MSFT) and transport trimmed, betting on resilient cash cows.

Q: How can I track and follow Chris Hohn's TCI Fund?

A: Monitor quarterly 13F filings on the SEC (45-day lag post-quarter-end) via ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/tci-fund for real-time analysis, visualizations, and change alerts.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!