Christopher Bloomstran - Semper Augustus Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

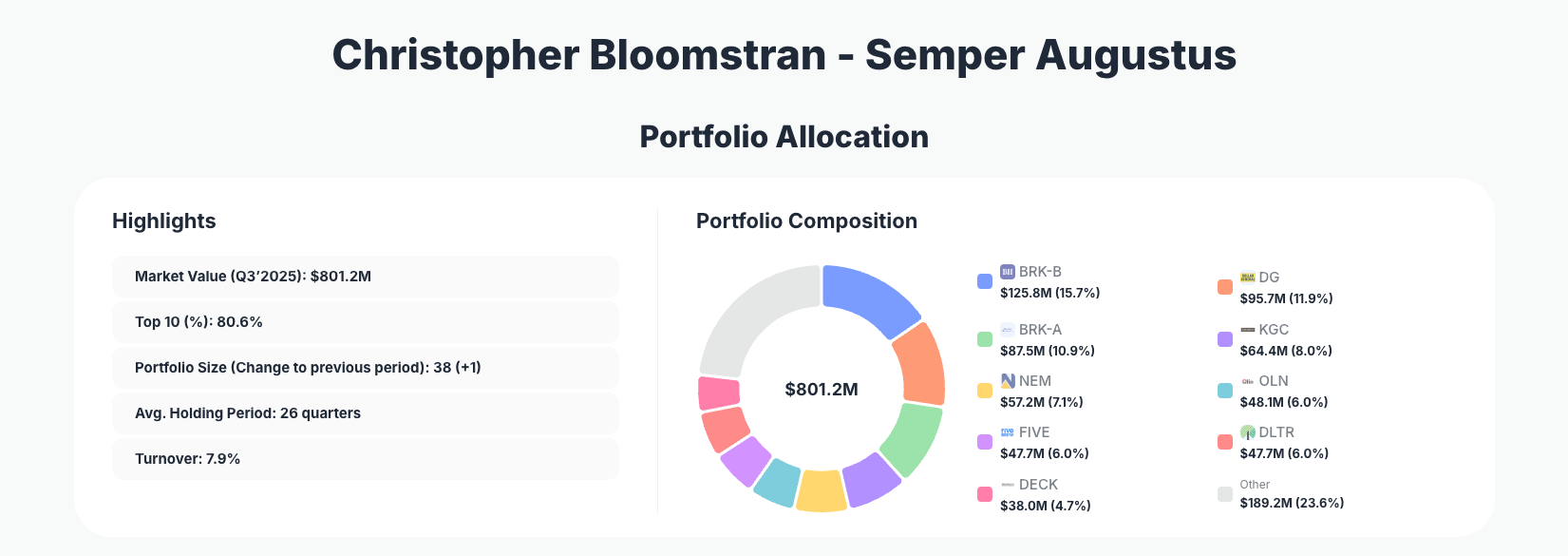

Christopher Bloomstran of Semper Augustus continues to exemplify patient value investing with a keen eye for quality businesses at attractive prices. His $801.2M portfolio in Q3 2025 showcases disciplined tweaks, including significant additions to OLN and DECK, alongside trims in gold miners amid a highly concentrated top tier that dominates over 80% of assets.

Portfolio Overview: Concentration Meets Long-Term Conviction

Portfolio Highlights (Q3 2025): - Market Value: $801.2M - Top 10 Holdings: 80.6% - Portfolio Size: 38 +1 - Average Holding Period: 26 quarters - Turnover: 7.9%

Semper Augustus maintains its hallmark concentration, with the top 10 holdings commanding a staggering 80.6% of the portfolio, underscoring Bloomstran's high-conviction approach to a select group of undervalued names. The low turnover of 7.9% and an average holding period stretching 26 quarters signal a buy-and-hold philosophy rooted in deep fundamental analysis, avoiding the churn that plagues many active managers. This structure allows for meaningful position sizing in businesses where Bloomstran sees wide moats and mispriced intrinsic value.

The addition of one new position brings the total to 38, yet the focus remains razor-sharp on leaders like Berkshire Hathaway and discount retailers, balanced by commodity exposure. Access the full Semper Augustus portfolio details on ValueSense to track these metrics quarter-over-quarter. This setup reflects a strategy resilient to market noise, prioritizing long-term compounding over short-term trades.

Top Holdings: Berkshire Backbone with Strategic Tweaks in Retail and Resources

The portfolio leads with Berkshire Hathaway Inc. (BRK-B) at 15.7%, where Bloomstran added 1.45% to reinforce this core conviction play. Dollar General Corporation (DG) follows closely at 11.9% after a minor reduce of 0.03%, maintaining its role as a resilient discount retailer staple. Gold exposure saw notable action, with Kinross Gold Corporation (KGC) trimmed by 16.10% to 8.0%, signaling caution amid rising prices, while Newmont Corporation (NEM) edged up 0.01% to 7.1%.

Aggressive moves highlight conviction elsewhere: Olin Corporation (OLN) surged with a massive 141.30% add to 6.0%, betting big on chemicals amid industrial demand. Retail names faced trims, including Five Below, Inc. (FIVE) down 4.48% to 6.0% and Dollar Tree, Inc. (DLTR) reduced 0.24% to 6.0%. Deckers Outdoor Corporation (DECK) jumped 78.05% to 4.7%, tapping consumer growth potential. Beyond the top 10, Valero Energy Corporation (VLO) added 0.41% to 4.2% for energy diversification, and Starbucks Corporation (SBUX) saw a slight 0.05% reduce to 2.5%.

Complementing these changes, stable anchors like Berkshire Hathaway Inc. (BRK-A) at 10.9% held "No change," providing a bedrock of quality. This mix of adds in industrials and consumer plays, paired with gold adjustments, illustrates tactical refinement without abandoning value roots.

What the Portfolio Reveals

Bloomstran's Q3 moves reveal a strategy blending unwavering quality with opportunistic value hunting: - Quality over speculation: Heavy Berkshire weighting and stable retailers emphasize durable moats in essential businesses. - Sector focus on cyclicals with tailwinds: Adds in chemicals (OLN) and energy (VLO) suggest bets on industrial recovery, while gold trims (KGC) indicate profit-taking. - Retail resilience: Persistent exposure to DG, FIVE, and DLTR highlights conviction in discount models amid economic uncertainty. - Risk management via diversification: 38 positions temper top-10 dominance, with consumer and commodities balancing the portfolio. - Long-term dividend potential: Holdings like NEM and VLO offer yield in a high-rate environment.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Berkshire Hathaway Inc. (BRK-B) | $125.8M | 15.7% | Add 1.45% |

| Dollar General Corporation (DG) | $95.7M | 11.9% | Reduce 0.03% |

| Berkshire Hathaway Inc. (BRK-A) | $87.5M | 10.9% | No change |

| Kinross Gold Corporation (KGC) | $64.4M | 8.0% | Reduce 16.10% |

| Newmont Corporation (NEM) | $57.2M | 7.1% | Add 0.01% |

| Olin Corporation (OLN) | $48.1M | 6.0% | Add 141.30% |

| Five Below, Inc. (FIVE) | $47.7M | 6.0% | Reduce 4.48% |

| Dollar Tree, Inc. (DLTR) | $47.7M | 6.0% | Reduce 0.24% |

| Deckers Outdoor Corporation (DECK) | $38.0M | 4.7% | Add 78.05% |

This table underscores extreme concentration, with Berkshire's dual classes alone at over 26% and the top five exceeding 53%. The 80.6% top-10 weighting amplifies returns from winners like the massive OLN add but demands precise conviction—evident in trims to volatile KGC. Bloomstran's tweaks, like boosting DECK, show active oversight to optimize risk-reward in a 38-stock portfolio.

Investment Lessons from Christopher Bloomstran’s Approach

- Concentrate on what you know deeply: 80.6% in top 10 reflects total commitment to researched names like Berkshire and retailers.

- Patience pays—26-quarter holds: Low 7.9% turnover proves holding through volatility builds wealth.

- Trim winners selectively: Reducing KGC by 16% after gains shows discipline in locking profits.

- Scale into value aggressively: 141% add to OLN demonstrates sizing up when margins of safety improve.

- Balance quality with cyclicals: Berkshire anchors pair with commodities and energy for diversified value exposure.

Looking Ahead: What Comes Next?

With portfolio size up to 38 +1 and low turnover, Semper Augustus appears positioned for selective deployment into undervalued industrials or consumer recoveries. The OLN and DECK adds signal opportunity in cyclical rebounds, while gold trims free capital for energy like VLO amid volatile commodities. In a potentially slowing economy, retail resilience via DG sets up defensively, with Berkshire as an evergreen buffer. Watch for further tweaks as Q4 unfolds, trackable via ValueSense's superinvestor page.

FAQ about Christopher Bloomstran Portfolio

Q: What drove the biggest changes in Semper Augustus Q3 2025?

A: Standouts include a 141.30% add to Olin (OLN) at 6.0% and 78.05% to Deckers (DECK) at 4.7%, signaling bets on chemicals and consumer growth, offset by a 16.10% trim in Kinross Gold (KGC).

Q: Why such high concentration in the top 10 holdings?

A: Bloomstran's 80.6% top-10 allocation prioritizes high-conviction value plays like Berkshire (26.6% combined) where deep analysis justifies outsized bets, minimizing dilution from lesser ideas.

Q: What sectors dominate Semper Augustus' strategy?

A: Financials via Berkshire, discount retail (DG, FIVE), gold miners, and emerging industrials/energy, balancing quality with commodity cycles.

Q: How can I track Christopher Bloomstran’s portfolio?

A: Follow quarterly 13F filings on ValueSense at https://valuesense.io/superinvestors/semper-augustus for real-time analysis, changes, and visuals—note the 45-day lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!