Cole Smead - Smead Capital Management, Inc. Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Cole Smead - Smead Capital Management, Inc. continues to apply a disciplined value-oriented framework while carefully trimming several long-held winners. Their Q3’2025 portfolio shows a $5.2B collection of mostly long-duration, cash-generative businesses, with synchronized reductions across real estate, homebuilders, energy, financials, healthcare, and industrials that signal risk management rather than a wholesale strategy shift.

Portfolio Overview: Steady Conviction, Gentle De‑Risking

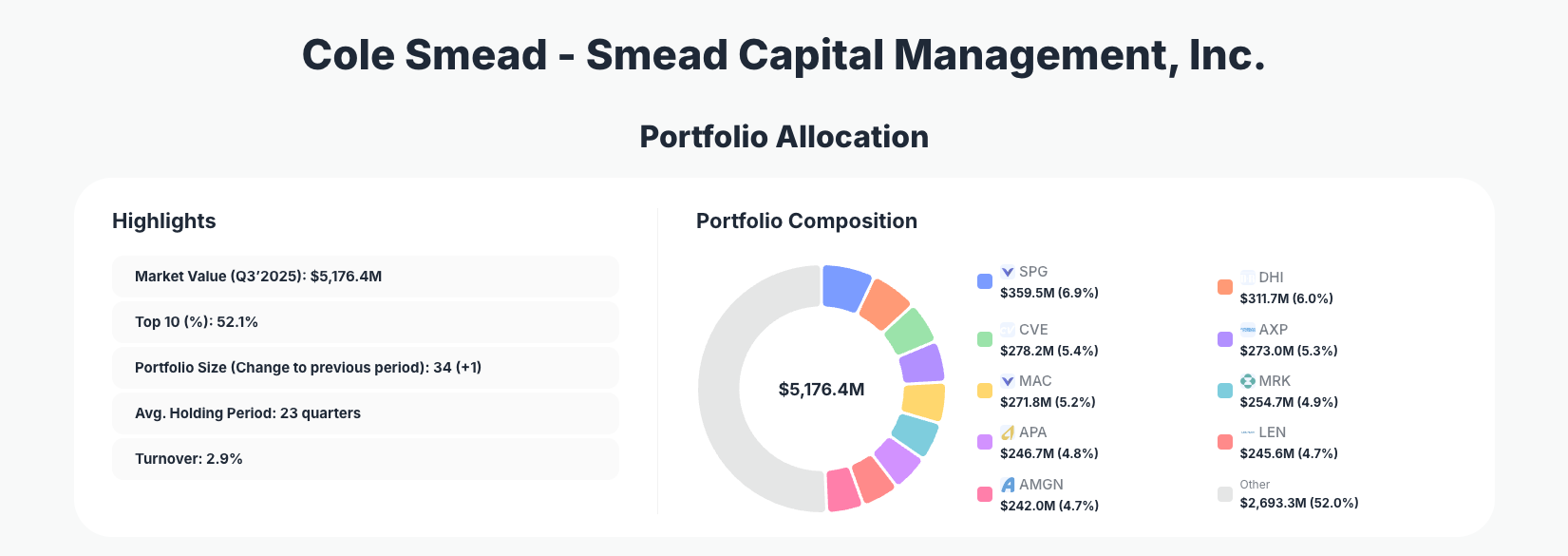

Portfolio Highlights (Q3 2025): - Market Value: $5,176.4M

- Top 10 Holdings: 52.1%

- Portfolio Size: 34 +1

- Average Holding Period: 23 quarters

- Turnover: 2.9%

The latest 13F shows that Smead Capital’s portfolio remains moderately concentrated, with just over half of assets in the top 10 names despite holding 34 positions overall. That balance suggests a barbell between high‑conviction core holdings and a longer tail of smaller ideas, consistent with a firm that wants stock‑picking impact without extreme single‑name risk.

The 23‑quarter average holding period underlines a long-term orientation: positions are typically held for nearly six years, while turnover of only 2.9% confirms that Q3’2025 activity was incremental rather than a dramatic repositioning. Instead of aggressive trading, the team appears to be making measured trims within core winners and cyclical bets, keeping the overall structure of the Q3’2025 portfolio intact.

Finally, the increase to 34 positions +1 indicates selective expansion—likely adding a new idea at the margin—while the broad pattern of small reductions across multiple sectors suggests risk calibration in response to higher valuations or macro uncertainty, not an abandonment of key themes.

Top Positions: Selective Trims Across Real Estate, Energy, Homebuilders & Healthcare

The most notable activity this quarter was a series of modest reductions across several of Smead Capital’s larger positions, all in the 6–7% range. These changes were broadly spread across sectors, reinforcing the impression of portfolio-wide trimming rather than a conviction reversal on any single name.

The second-largest disclosed position is SIMON PPTY GROUP INC NEW at 6.9% of the portfolio and $359.5M in value, where Smead implemented a “Reduce 7.11%” action, signaling a controlled scale‑back after strong performance while still keeping the stake substantial. Real estate exposure is further represented by The Macerich Company at 5.2% of the portfolio $271.8M, also tagged as “Reduce 7.11%,” indicating a consistent approach to trimming REIT and retail property exposure rather than exiting the theme.

Within U.S. homebuilders, D.R. Horton, Inc. remains a key position at 6.0% $311.7M, again seeing a “Reduce 7.11%” adjustment. The housing theme continues with Lennar Corporation at 4.7% $245.6M and NVR, Inc. at 4.1% $212.6M. Both were also reduced by roughly 7.11%, showing a coordinated lightening across the homebuilding complex while preserving sizeable exposure to U.S. residential demand.

Energy remains another prominent pillar in Smead Capital’s portfolio. Cenovus Energy Inc. sits at 5.4% $278.2M with a “Reduce 6.62%” move, while APA Corporation holds 4.8% $246.7M and was “Reduce 7.13%.” These nearly parallel trims suggest profit‑taking or risk‑reduction in cyclical commodity names, not a rejection of the energy thesis.

On the financial side, American Express Company represents 5.3% of the portfolio $273.0M and was also “Reduce 7.11%,” implying that the team is gently moderating exposure to consumer and payments while still treating AmEx as a core holding.

Healthcare exposure is anchored by Merck & Co., Inc. at 4.9% $254.7M, with a “Reduce 7.12%” adjustment, and Amgen Inc. at 4.7% $242.0M marked “Reduce 7.11%.” These are still substantial weights; the modest trims appear to be portfolio‑level calibration rather than a change in sentiment on large‑cap pharma.

Rounding out this group of key holdings, the synchronized “Reduce ~7%” actions across SIMON PPTY GROUP INC NEW, D.R. Horton, Cenovus Energy, American Express, Macerich, Merck, APA, Lennar, Amgen, and NVR underscores a methodical, cross‑portfolio trim—freeing up capital and managing position size while keeping the underlying themes intact.

What the Portfolio Reveals About Smead Capital’s Current Strategy

Several themes stand out from the Q3’2025 13F:

- Long‑term, low‑turnover discipline

With an average holding period of 23 quarters and turnover at just 2.9%, Smead Capital is clearly not running a trading book. The strategy relies on deep fundamental research, allowing time for value to be realized rather than reacting to short‑term market noise. - Moderate concentration with diversified pillars

The top 10 holdings represent 52.1% of the portfolio, so conviction is concentrated, but not to an extreme. Real estate, homebuilders, energy, financials, and healthcare all feature prominently, creating multiple independent drivers of return. - Systematic risk management via trims

The near‑uniform “Reduce ~7%” actions across many major positions in the Q3’2025 portfolio point to position-sizing discipline—likely responding to strong price appreciation or changing macro risk, rather than thesis breaks. - Value‑ and cash‑flow orientation

REITs, homebuilders, upstream energy, and established pharma are all sectors where Smead can emphasize free cash flow, dividend potential, and asset backing, consistent with a value‑driven, income‑sensitive philosophy.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| SIMON PPTY GROUP INC NEW | $359.5M | 6.9% | Reduce 7.11% |

| D.R. Horton, Inc. | $311.7M | 6.0% | Reduce 7.11% |

| Cenovus Energy Inc. | $278.2M | 5.4% | Reduce 6.62% |

| American Express Company | $273.0M | 5.3% | Reduce 7.11% |

| The Macerich Company | $271.8M | 5.2% | Reduce 7.11% |

| Merck & Co., Inc. | $254.7M | 4.9% | Reduce 7.12% |

| APA Corporation | $246.7M | 4.8% | Reduce 7.13% |

| Lennar Corporation | $245.6M | 4.7% | Reduce 7.11% |

| Amgen Inc. | $242.0M | 4.7% | Reduce 7.11% |

The top positions cluster tightly between roughly 4.7% and 6.9%, meaning no single name dominates risk, but each has enough weight to meaningfully impact performance. Real estate, homebuilding, energy, payments, and pharma all sit within this top grouping, ensuring that multiple sectors share the performance burden.

The striking feature of this table is the near‑identical “Reduce ~7%” tag across every top‑10 name disclosed here. That pattern strongly suggests a systematic resizing of key holdings—likely to keep each position within a desired risk band—while preserving their status as core convictions. For investors studying Smead Capital, this is a textbook example of how to harvest gains without abandoning long-term themes.

Investment Lessons from Cole Smead’s Smead Capital Approach

- Trim, don’t churn

Instead of constantly swapping ideas, Smead Capital makes small, percentage‑based trims in established winners, keeping turnover low while still managing risk and realizing gains. - Let themes, not tickers, drive structure

Grouped exposure to REITs, homebuilders, and energy shows that the portfolio is built around macro and industry theses—then diversified within each theme. - Position sizing is an active decision

The coordinated 6–7% reductions illustrate that sizing is treated as a risk lever, separate from the underlying investment thesis. Even favored holdings get trimmed when they grow too large. - Patience compounds insights

A 23‑quarter average holding period demonstrates that the edge lies in holding through cycles, allowing fundamentals and mean reversion to work, instead of trying to time every move. - Concentration with boundaries

With just over half the capital in the top 10 positions, Smead shows that you can be conviction‑driven without being overexposed to any single stock or sector.

Looking Ahead: What Comes Next for Smead Capital’s Portfolio?

Based on the current positioning, Smead Capital appears to be:

- Building optionality through trims

By shaving 6–7% off multiple large holdings, the firm likely frees up incremental capital for new opportunities or future drawdowns, without changing its core identity. - Prepared for housing and energy volatility

Continued but slightly reduced exposure to D.R. Horton, Lennar, NVR, Cenovus, and APA suggests they still believe in the long-term demand for housing and energy but want room to navigate cyclical swings. - Maintaining ballast in healthcare and financials

Trims in Merck, Amgen, and American Express still leave them as sizable positions, implying these remain defensive, cash‑flow‑rich anchors for the portfolio. - Potentially ready to add a new generation of value ideas

The increase to 34 positions hints that Smead Capital may be seeding fresh ideas at smaller weights, which could grow into future core holdings as conviction builds.

For investors tracking Cole Smead – Smead Capital Management, Inc., monitoring future 13F filings will show whether these Q3’2025 trims were a one‑off rebalance or the start of a broader derisking trend.

FAQ about Cole Smead – Smead Capital Portfolio

Q: Why did Smead Capital trim so many top positions in Q3 2025?

A: The synchronized “Reduce ~7%” actions across SIMON PPTY GROUP INC NEW, D.R. Horton, Cenovus Energy, American Express, Macerich, Merck, APA, Lennar, Amgen, and NVR point to position‑sizing discipline and profit-taking, not a wholesale shift in strategy.

Q: How concentrated is the Smead Capital portfolio?

A: The top 10 holdings make up 52.1% of the portfolio’s market value, while the firm holds 34 positions in total. This reflects moderate concentration: enough to benefit from stock selection, but diversified across sectors and themes.

Q: What does the long average holding period say about Smead Capital’s style?

A: With an average holding period of 23 quarters, Smead Capital clearly follows a long-term, buy‑and‑hold value approach, allowing time for thesis realization rather than relying on frequent trading or market timing.

Q: Which sectors are most influential in Smead Capital’s Q3 2025 holdings?

A: Real estate (SIMON PPTY GROUP INC NEW, Macerich), homebuilders (D.R. Horton, Lennar, NVR), energy (Cenovus, APA), financials (American Express), and healthcare (Merck, Amgen) are the main pillars influencing performance.

Q: How can I track Cole Smead’s holdings and future portfolio changes?

A: Smead Capital’s U.S. equity positions are disclosed in quarterly 13F filings, which are typically released up to 45 days after quarter‑end. You can easily follow these updates, historical changes, and detailed metrics using ValueSense’s superinvestor tracker on Smead Capital’s portfolio page.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!