Common Stocks and Uncommon Profits and Other Writings by Philip A. Fisher

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

"Common Stocks and Uncommon Profits and Other Writings" by Philip A. Fisher stands as one of the most influential investment books of the twentieth century. Philip Fisher, a legendary investor and founder of Fisher & Company, built his reputation through a career spanning over seven decades. His success was not just in managing funds but also in shaping the thinking of generations of investors, including Warren Buffett, who credited Fisher’s ideas as a critical influence on his own investment philosophy. Fisher’s focus on qualitative analysis and deep company research marked a departure from the prevailing quantitative-only approaches of his era.

The book was first published in 1958, a period when the stock market was emerging from the shadows of the Great Depression and the Second World War. The postwar economic boom, coupled with growing public participation in equities, provided fertile ground for Fisher’s ideas. Unlike many contemporaries who focused solely on balance sheets and earnings reports, Fisher introduced a new dimension: the importance of management quality, business prospects, and in-depth field research, or what he famously termed the “scuttlebutt” method. This approach revolutionized the way investors approached growth stocks and laid the groundwork for modern qualitative analysis.

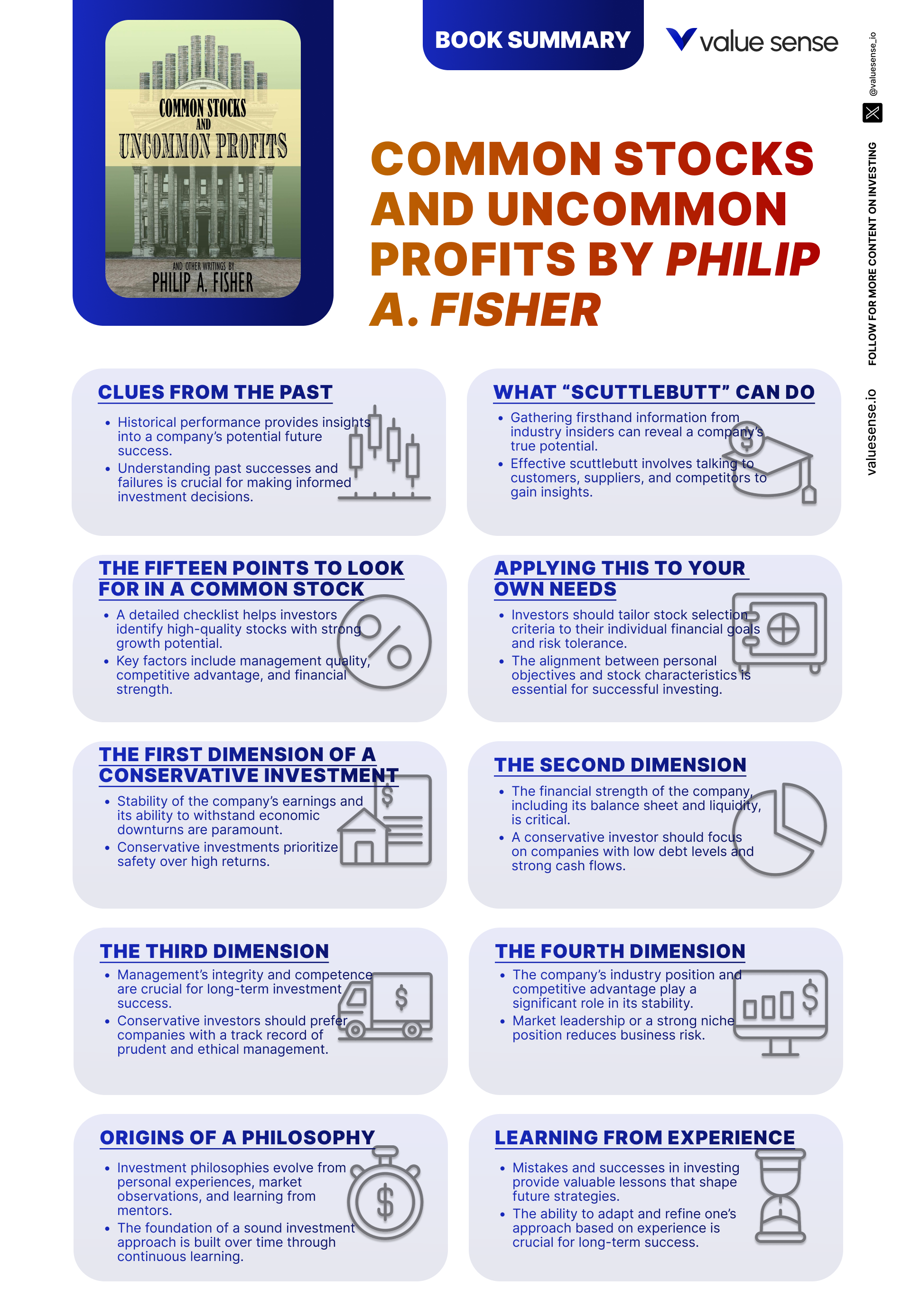

At its core, "Common Stocks and Uncommon Profits" is a treatise on how to identify companies with long-term growth potential. Fisher’s main theme is that extraordinary investment results derive not from short-term speculation but from understanding the true drivers of business success—innovation, management, competitive advantage, and market opportunity. The book’s fifteen-point checklist for evaluating common stocks is a practical, enduring tool that has guided countless investors in their search for quality companies. Fisher’s writings are not limited to a single strategy; they encompass conservative investment approaches, timing, risk management, and the development of a personal investment philosophy.

This book is considered a classic for several reasons: its timeless principles, its influence on value and growth investors alike, and its actionable guidance. It is a must-read for anyone serious about investing—whether you are a novice seeking foundational wisdom or a seasoned professional looking to refine your approach. Fisher’s insistence on thorough research, patience, and independent thinking offers a counterpoint to the herd mentality and short-termism that often dominate the markets.

What makes "Common Stocks and Uncommon Profits" unique is its blend of practical advice and philosophical depth. Fisher’s ability to distill complex ideas into accessible frameworks, combined with his firsthand anecdotes and decades of market experience, sets this book apart from other investment literature. His emphasis on qualitative factors—such as management integrity, company culture, and industry positioning—remains highly relevant in today’s rapidly changing business landscape. For readers seeking an enduring guide to stock selection, risk management, and personal investment growth, Fisher’s work is an indispensable resource.

Key Themes and Concepts

Philip Fisher’s "Common Stocks and Uncommon Profits" is woven together by a handful of powerful themes that transcend market cycles and economic eras. At the heart of the book is the conviction that successful investing is not just about numbers, but about understanding the qualitative drivers of business performance. Fisher’s work is a masterclass in marrying rigorous research with practical wisdom, offering investors a holistic framework for making sound decisions.

Throughout the book, Fisher returns to several core concepts: the necessity of deep research, the importance of timing, the avoidance of common mistakes, the art of identifying growth stocks, the evolution of a personal investment philosophy, and the value of conservative strategies. Each theme is illustrated with real-world examples, actionable checklists, and philosophical insights that equip readers to navigate both bull and bear markets. The following key themes form the backbone of Fisher’s approach and are as relevant today as when the book was first published.

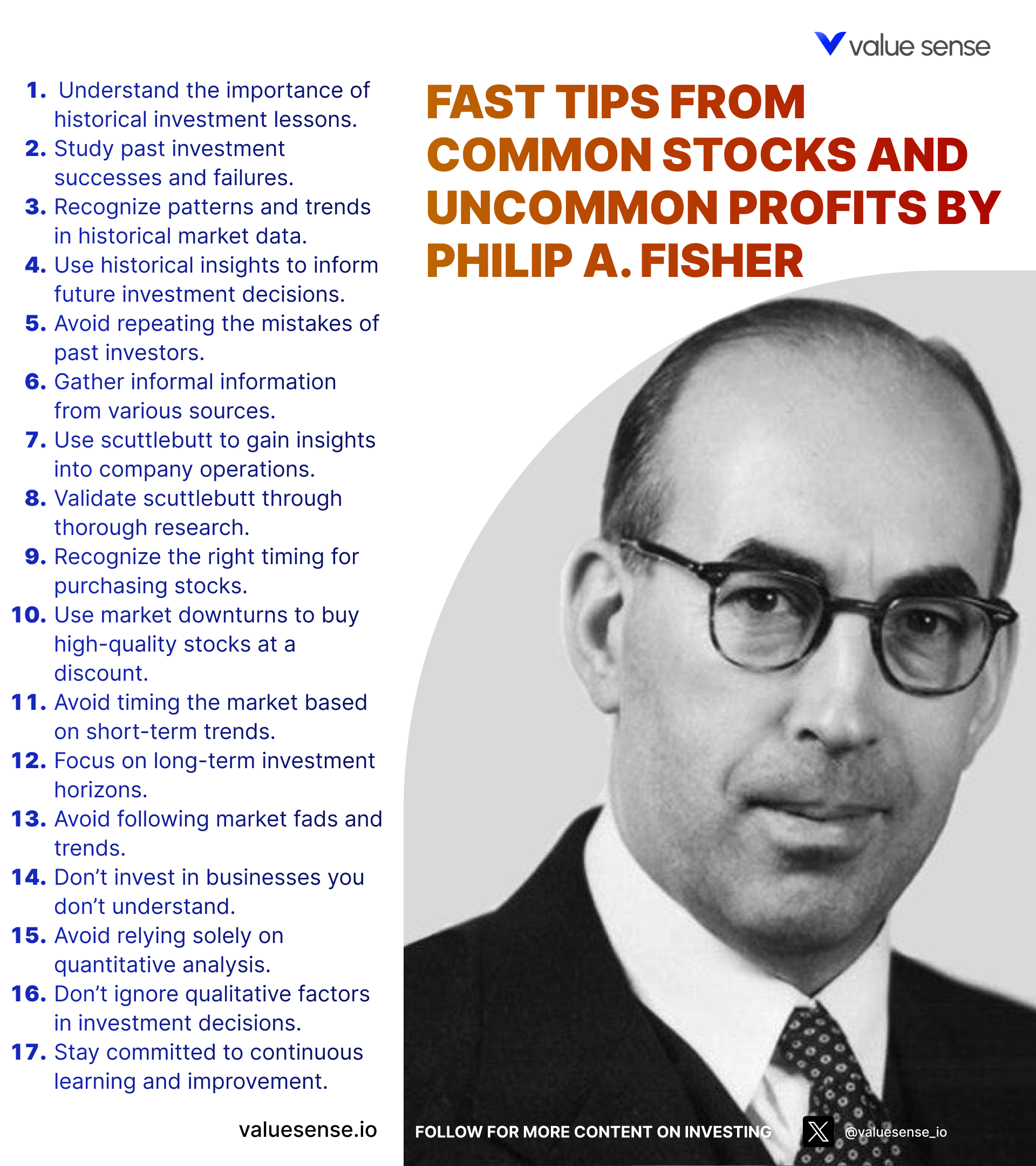

- Investment Research and Analysis: Fisher’s emphasis on research is foundational to his philosophy. The book advocates going beyond financial statements to seek out qualitative information through what Fisher calls the “scuttlebutt” method—gathering insights from suppliers, customers, competitors, and industry experts. This approach enables investors to form a nuanced view of a company’s prospects, management, and competitive positioning. For example, Fisher describes how talking to a company’s customers can reveal product reputation and market share trends that are invisible in quarterly reports. This theme teaches investors that diligent research—both quantitative and qualitative—is the cornerstone of superior investment decisions, helping to uncover hidden risks and opportunities.

- Timing in Investment: Timing, according to Fisher, is not about predicting short-term market moves but about understanding when conditions are optimal for buying or selling. The book delves into the psychology of market cycles, the indicators of value, and the importance of patience. Fisher warns against chasing hot stocks or reacting impulsively to market swings. Instead, he advocates for buying when a company’s long-term prospects are underappreciated and selling only when the original investment thesis no longer holds. This theme is illustrated with historical examples of market euphoria and panic, encouraging investors to remain disciplined and unemotional.

- Avoiding Common Mistakes: Fisher dedicates significant attention to the pitfalls that ensnare even experienced investors. He outlines common errors such as over-diversification, neglecting research, and succumbing to market fads. Through his “Five Don’ts for Investors,” Fisher provides a practical checklist for sidestepping traps that can erode capital and confidence. For instance, he cautions against buying stocks based solely on tips or short-term trends, urging instead a focus on long-term fundamentals. This theme is a vital reminder that risk management and self-awareness are as important as stock selection.

- Growth Stock Identification: One of Fisher’s most enduring contributions is his systematic approach to identifying growth stocks. He provides a fifteen-point checklist that covers everything from research and development capabilities to sales organization and profit margins. Fisher’s criteria go beyond mere earnings growth, emphasizing sustainable competitive advantages and visionary management. He illustrates how companies like Texas Instruments and Motorola, which he famously invested in, exhibited these qualities long before they became household names. This theme empowers investors to look for the underlying drivers of durable growth rather than chasing short-term performance.

- Developing a Personal Investment Philosophy: Fisher believes that every investor must develop a philosophy tailored to their own goals, temperament, and experiences. He shares his own journey, describing how his philosophy evolved through successes, failures, and changing market conditions. Fisher encourages readers to reflect on their own beliefs and to adapt as they gain experience. This theme highlights the importance of introspection, lifelong learning, and the willingness to challenge one’s assumptions—a process that leads to more resilient and effective investment strategies.

- Conservative Investment Strategies: While Fisher is often associated with growth investing, he also advocates for conservative principles such as risk management, diversification, and long-term thinking. He discusses the dimensions of conservative investments, including financial strength, management integrity, and business stability. Fisher’s advice helps investors balance the pursuit of growth with the need for capital preservation, making his approach accessible to both aggressive and risk-averse investors. This theme is especially relevant in volatile markets, where the temptation to take undue risks can be strong.

- Role of Management and Corporate Culture: Fisher is one of the first investment writers to stress the critical importance of management quality and corporate culture. He argues that visionary, ethical, and capable management teams are often the decisive factor in a company’s long-term success. Through interviews, field research, and close observation, Fisher demonstrates how to assess management’s track record, integrity, and alignment with shareholder interests. This theme encourages investors to look beyond the numbers and to consider the people driving the business forward.

Book Structure: Major Sections

Part 1: Foundations of Investment Philosophy

This section, encompassing chapters 1 through 4, lays the groundwork for Fisher’s entire investment approach. Here, Fisher introduces the importance of learning from history, the necessity of thorough research, and the foundational principles that underpin smart investing. The unifying theme is that successful investing begins with understanding both the lessons of the past and the nuances of individual companies, rather than relying on market speculation or superficial analysis.

Fisher opens with an exploration of historical market cycles, emphasizing how past booms and busts offer critical clues for future investment decisions. He introduces the “scuttlebutt” method, which involves gathering information from a wide range of industry participants to build a comprehensive picture of a company’s prospects. The section also addresses the need for investors to tailor their strategies to their own circumstances, risk tolerances, and financial goals. Fisher’s early chapters are rich with anecdotes and practical advice, encouraging readers to look beyond headline numbers and to seek out the qualitative factors that drive long-term value.

Practically, investors can apply these insights by developing a disciplined research process that combines financial analysis with fieldwork. Fisher’s methods encourage investors to talk to customers, suppliers, and competitors to uncover insights that are not available in public filings. By internalizing the lessons of history and committing to thorough research, investors can avoid common pitfalls and identify companies with genuine long-term potential.

In today’s environment, where information is abundant but often superficial, Fisher’s emphasis on deep, independent research is more relevant than ever. The proliferation of data and the velocity of news cycles can encourage reactive decision-making. Fisher’s foundational principles remind investors to slow down, dig deeper, and build a robust understanding before committing capital. This approach is timeless and continues to differentiate successful investors from the crowd.

Part 2: Timing and Strategy in Investing

Chapters 5 through 7 are grouped under the theme of timing and strategic decision-making in the investment process. Fisher explores the art and science of knowing when to buy, when to sell, and how to incorporate dividends into a broader investment strategy. The unifying thread is that timing is less about predicting short-term price movements and more about recognizing when the fundamental case for a stock is strongest or weakest.

Fisher provides detailed criteria for identifying opportune moments to enter or exit positions, such as changes in industry trends, shifts in management, or significant improvements in a company’s competitive position. He also discusses the psychological traps that can lead to poor timing decisions, such as fear of missing out or the reluctance to cut losses. The role of dividends is examined within the context of total return, with Fisher cautioning against overemphasizing yield at the expense of growth potential. This section includes real-world examples and historical data to illustrate how disciplined timing can enhance returns and reduce risk.

For investors, the key takeaway is to base timing decisions on fundamental analysis rather than market sentiment or technical signals. Fisher’s advice is to buy when a company’s prospects are undervalued and to sell only when the original thesis is invalidated. By focusing on business fundamentals and maintaining a long-term perspective, investors can avoid the pitfalls of short-termism and market noise.

With today’s markets characterized by high volatility and rapid information flow, Fisher’s strategic approach to timing remains highly applicable. The temptation to trade frequently or to react to every headline is ever-present. Fisher’s guidance encourages patience, discipline, and a steadfast focus on the factors that truly drive long-term returns.

Part 3: Guidelines for Investors

This section, covering chapters 8 through 10, offers a practical roadmap for investors through a series of “do’s and don’ts.” Fisher distills decades of experience into actionable guidelines that help investors navigate common challenges and seize opportunities in the stock market. The central theme is that success in investing is as much about avoiding mistakes as it is about making the right choices.

Fisher identifies frequent pitfalls, such as following the crowd, neglecting research, or over-diversifying. He contrasts these with positive behaviors, like conducting thorough due diligence, focusing on a select group of high-quality companies, and maintaining a long-term orientation. The section includes his famous “Five Don’ts for Investors,” which serve as a checklist for risk management and portfolio protection. Fisher also shares his personal techniques for finding growth stocks, emphasizing the importance of creativity, persistence, and open-mindedness.

Investors can use these guidelines to audit their own processes and to develop habits that reduce the likelihood of costly errors. By internalizing Fisher’s “do’s and don’ts,” investors can build more robust portfolios and improve their decision-making under uncertainty. The practical advice in this section is immediately applicable, regardless of market conditions or investment style.

In the modern era, where investors are bombarded with information and tempted by a plethora of investment products, Fisher’s guidelines offer a grounding influence. His emphasis on independent thinking, disciplined research, and risk management is as valuable today as it was in the 1950s, helping investors to navigate complexity and avoid the traps that ensnare the unwary.

Part 4: Conservative Investment Approaches

Chapters 11 through 13 focus on the dimensions of conservative investing, outlining strategies that prioritize capital preservation, risk management, and long-term stability. The unifying theme is that even growth-oriented investors must incorporate conservative principles to safeguard their portfolios against unforeseen events and market downturns.

Fisher discusses the characteristics of conservative investments, including strong balance sheets, stable cash flows, and prudent management. He emphasizes the importance of understanding a company’s risk profile and of diversifying across industries and business models. The section also addresses the psychological benefits of conservative investing, such as peace of mind and the ability to withstand market volatility without panic selling. Fisher provides examples of companies that exemplify these qualities, illustrating how conservative strategies can coexist with the pursuit of growth.

For investors, the practical application is to balance ambition with caution. Fisher’s advice is to seek out companies that combine growth potential with financial strength and operational resilience. By integrating conservative principles into their investment process, investors can reduce downside risk and improve the consistency of returns over time.

In a world where risk-taking is often glorified, Fisher’s focus on conservative strategies is a valuable counterweight. The lessons in this section are particularly relevant during periods of market stress or economic uncertainty, reminding investors that preservation of capital is the foundation upon which long-term wealth is built.

Part 5: Developing a Personal Investment Philosophy

The final thematic section, spanning chapters 14 through 16, explores the evolution of a personal investment philosophy. Fisher draws on his own experiences to illustrate how beliefs, strategies, and attitudes toward risk mature over time. The central theme is that effective investing is a deeply personal endeavor, shaped by individual goals, experiences, and market observations.

Fisher recounts the formative events that influenced his thinking, such as early successes and failures, interactions with mentors, and the impact of major economic events. He discusses the process of refining one’s philosophy in response to changing circumstances and new information. This section encourages readers to engage in continuous learning, self-reflection, and adaptation. Fisher’s narrative is both instructive and inspiring, offering a roadmap for lifelong growth as an investor.

Investors can apply these insights by regularly reviewing their own philosophies, learning from both successes and mistakes, and remaining open to new ideas. Fisher’s message is that there is no one-size-fits-all approach; each investor must find the path that aligns with their unique temperament and objectives.

In the age of algorithmic trading and passive investing, Fisher’s call for a personal, reflective approach to investing is more important than ever. His emphasis on philosophy, learning, and adaptability provides a foundation for navigating the complexities of modern markets and building a resilient investment practice.

Deep Dive: Essential Chapters

Chapter 1: Clues from the Past

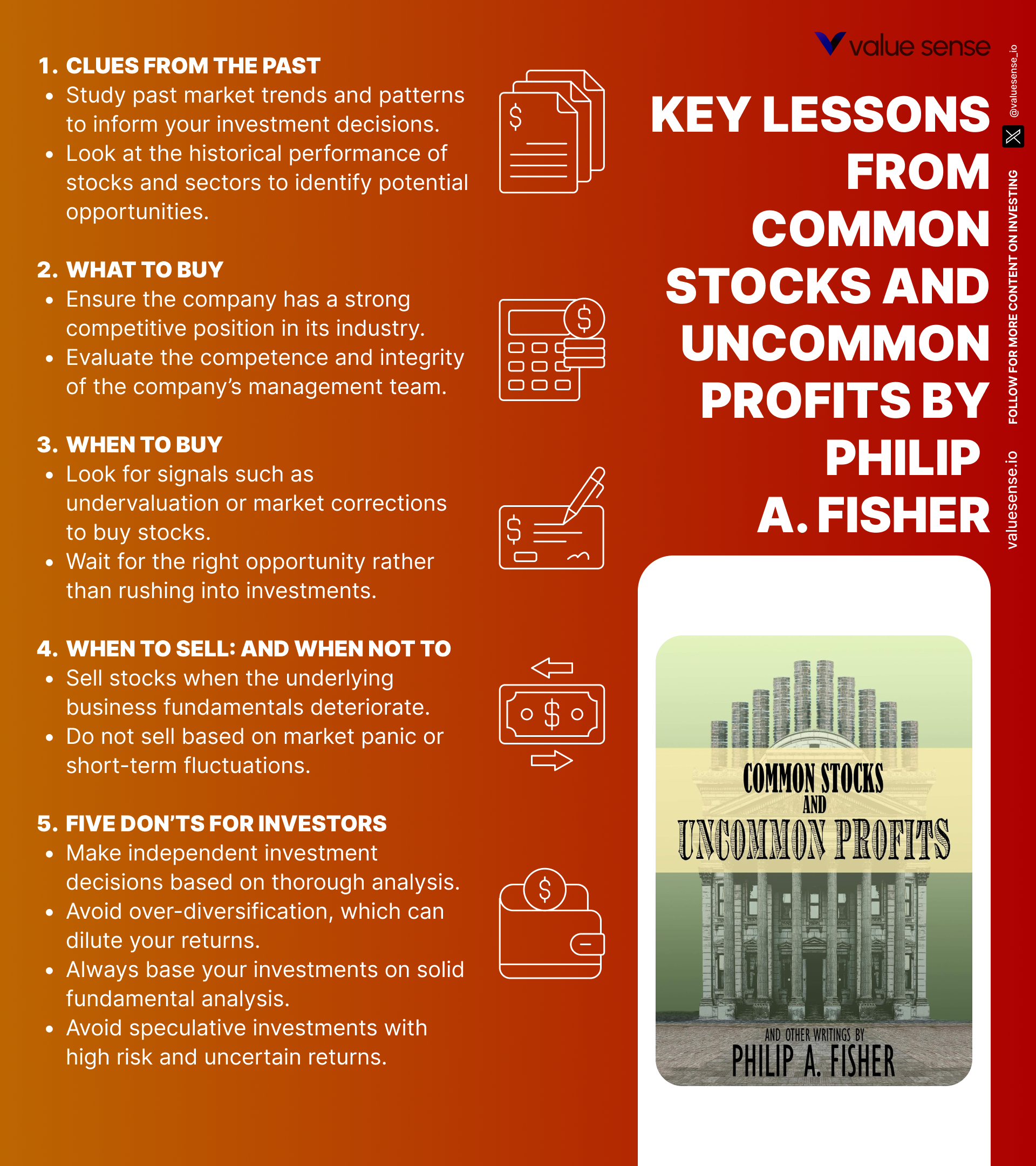

This opening chapter is foundational because it establishes the importance of learning from history in investment decision-making. Fisher argues that the patterns of past market cycles, investor psychology, and business developments provide invaluable lessons for today’s investors. He emphasizes that while history does not repeat exactly, it often rhymes, and those who ignore it are doomed to repeat the mistakes of previous generations. The chapter sets the tone for the book by advocating for a disciplined, research-driven approach grounded in historical awareness.

Fisher provides vivid examples of past market manias and crashes, such as the speculative excesses of the 1920s and the subsequent Great Depression. He analyzes how investor behavior, driven by greed and fear, led to predictable booms and busts. The chapter is rich with data on historical price-to-earnings ratios, dividend yields, and market sentiment, illustrating how these metrics have fluctuated over time. Fisher quotes industry veterans and draws on his own decades of experience to highlight the cyclical nature of markets and the dangers of extrapolating recent trends indefinitely.

Investors can apply the lessons of this chapter by incorporating historical analysis into their research process. This means studying past market cycles, understanding the drivers of previous bubbles and crashes, and using this knowledge to inform expectations about future returns and risks. Fisher advises investors to remain humble, recognizing that markets are shaped by human psychology as much as by economic fundamentals. By learning from the past, investors can avoid the pitfalls of overconfidence and herd behavior.

The relevance of this chapter is undiminished in today’s markets, where new technologies and financial innovations often lead to speculative excesses. The dot-com bubble, the 2008 financial crisis, and the recent surge in meme stocks all echo the patterns Fisher describes. By grounding their strategies in historical context, modern investors can better navigate volatility and position themselves for long-term success.

Chapter 2: What 'Scuttlebutt' Can Do

This chapter is critically important because it introduces the “scuttlebutt” method, one of Fisher’s most original and influential contributions to investment research. The scuttlebutt approach involves gathering information from a company’s ecosystem—suppliers, customers, competitors, and employees—to gain insights that are not available in public filings or analyst reports. Fisher argues that this qualitative research is essential for understanding the true strengths and weaknesses of a business.

Fisher shares anecdotes of how he uncovered valuable information through informal conversations and fieldwork. For example, he describes visiting factories, talking to salespeople, and interviewing industry experts to assess a company’s reputation, product quality, and customer loyalty. He provides specific questions to ask, such as “How does this company’s product compare to its competitors?” and “What is management’s track record for innovation?” The chapter includes quotes from business leaders who stress the importance of reputation and relationships in driving long-term success.

Investors can apply the scuttlebutt method by developing a network of industry contacts and conducting primary research beyond financial statements. This might involve attending trade shows, reading industry publications, or reaching out to customers and suppliers. Fisher encourages investors to be curious, persistent, and skeptical, always seeking to verify information from multiple sources. The scuttlebutt approach helps investors identify qualitative factors—such as management integrity and competitive advantage—that are often the key to sustained growth.

In the age of big data and digital information, the scuttlebutt method remains highly relevant. While technology has made it easier to access quantitative data, qualitative insights are still best gathered through direct interaction and observation. Modern investors can use social media, online reviews, and professional networks to supplement traditional research, but the core principle of seeking out diverse perspectives is unchanged. Fisher’s scuttlebutt method is a timeless tool for gaining an edge in stock selection.

Chapter 3: What to Buy: The Fifteen Points to Look for in a Common Stock

This chapter is a cornerstone of Fisher’s philosophy, presenting his famous fifteen-point checklist for evaluating potential stock investments. The checklist covers a wide range of criteria, from the company’s research and development capabilities to the quality of its sales organization and the integrity of its management. Fisher argues that these qualitative factors are often more important than short-term financial metrics in determining a company’s long-term potential.

Fisher provides detailed explanations and examples for each of the fifteen points. For instance, he discusses the importance of a company’s ability to innovate, citing examples of firms that maintained a technological edge through sustained investment in R&D. He also emphasizes the need for strong profit margins, efficient cost control, and a clear strategy for growth. Fisher includes anecdotes of companies that failed to meet these criteria and suffered as a result, reinforcing the importance of a comprehensive evaluation process.

Investors can apply this chapter by using Fisher’s checklist as a framework for due diligence. Before investing in a company, investors should systematically assess each of the fifteen points, seeking evidence of sustainable competitive advantages and high-quality management. Fisher advises against investing in companies that fall short on multiple criteria, regardless of how attractive their financials may appear. The checklist serves as a filter, helping investors focus on businesses with the greatest potential for long-term success.

The fifteen-point framework remains widely used by professional and individual investors alike. In today’s complex markets, where companies often operate in rapidly changing industries, Fisher’s emphasis on qualitative analysis is more important than ever. The checklist provides a structured approach to evaluating companies, helping investors avoid the pitfalls of superficial analysis and short-term thinking.

Chapter 5: When to Buy

This chapter is essential because it addresses the critical question of timing in stock purchases. Fisher argues that even the best companies can be poor investments if bought at the wrong time, and conversely, that patient investors can achieve superior returns by waiting for the right entry point. The chapter explores the factors that signal optimal buying opportunities and warns against the dangers of impulsive or emotional decision-making.

Fisher provides historical examples of companies whose stocks were undervalued due to temporary setbacks, market pessimism, or misunderstood business models. He discusses the importance of monitoring economic conditions, industry trends, and company-specific developments to identify periods of maximum opportunity. Fisher also examines common psychological traps, such as the fear of missing out or the tendency to chase rising stocks. The chapter includes data on historical price movements and valuation multiples to illustrate how patient investors can benefit from market inefficiencies.

Investors can apply the lessons of this chapter by developing a disciplined approach to timing. This involves setting clear criteria for entry, such as target valuation ranges, business milestones, or industry catalysts. Fisher advises investors to resist the urge to buy simply because others are doing so, and to wait for moments when the market underestimates a company’s potential. By focusing on long-term fundamentals and avoiding short-term noise, investors can improve their chances of buying at attractive prices.

The principles outlined in this chapter are especially relevant in volatile markets, where prices can swing wildly in response to news and sentiment. Modern investors can use tools such as watchlists, limit orders, and staged buying to implement Fisher’s timing strategies. The core message—that patience and discipline are essential for successful investing—remains as true today as it was in Fisher’s time.

Chapter 6: When to Sell: And When Not To

This chapter tackles the often-neglected topic of selling, which Fisher believes is as important as buying in achieving superior investment results. He emphasizes that many investors undermine their returns by selling too soon or holding on to losing positions for too long. The chapter provides a framework for making rational selling decisions based on changes in a company’s fundamentals, rather than on short-term price movements or emotional reactions.

Fisher shares examples of companies whose long-term prospects deteriorated due to shifts in industry dynamics, management missteps, or competitive threats. He outlines specific indicators that signal it may be time to sell, such as declining profit margins, loss of market share, or evidence of unethical behavior by management. Fisher also warns against selling simply because a stock has appreciated, arguing that great companies can continue to compound value for years. The chapter includes quotes from successful investors who attribute their success to holding onto winners and cutting losers decisively.

Investors can apply these lessons by establishing clear sell criteria before making an investment. This might include regular reviews of company performance, monitoring for red flags, and maintaining the discipline to act when the original investment thesis is invalidated. Fisher advises investors to avoid knee-jerk reactions to market volatility and to focus on the underlying business. By adopting a structured approach to selling, investors can maximize returns and minimize regret.

In the current environment, where markets are increasingly driven by short-term sentiment, Fisher’s advice on selling is particularly valuable. The ability to hold onto high-quality companies through periods of volatility, while exiting positions that no longer meet one’s criteria, is a hallmark of successful investors. Fisher’s framework provides a rational, evidence-based approach to one of the most challenging aspects of portfolio management.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 8: Five Don’ts for Investors

This chapter is a critical guide to risk management, outlining five common mistakes that can derail an investor’s success. Fisher’s “Five Don’ts for Investors” serve as a checklist for avoiding behaviors that lead to poor outcomes, such as over-trading, following the crowd, or neglecting research. The chapter is grounded in decades of observation and is filled with practical advice for safeguarding capital.

Fisher details each of the five don’ts with examples from his own experience and from well-known market failures. For instance, he warns against the temptation to buy stocks based on tips or rumors, citing cases where such investments led to significant losses. He also cautions against over-diversification, arguing that spreading capital too thinly can dilute returns and make it harder to monitor individual positions. The chapter includes anecdotes of investors who suffered from lack of discipline, as well as those who prospered by adhering to Fisher’s guidelines.

Investors can apply these lessons by conducting regular audits of their own behavior and portfolio. Fisher recommends setting clear rules for position sizing, information gathering, and decision-making. By internalizing the five don’ts, investors can reduce the likelihood of costly errors and build more resilient portfolios. Fisher’s advice is to focus on a select group of high-quality companies, to do thorough research, and to avoid being swayed by market sentiment.

The relevance of this chapter is heightened in today’s markets, where social media and rapid information flow can amplify herd behavior and speculation. Fisher’s timeless warnings serve as a reminder that sound investing is as much about avoiding mistakes as it is about making the right picks. The five don’ts are a practical tool for investors seeking to navigate complexity with discipline and confidence.

Chapter 10: How I Go about Finding a Growth Stock

This chapter offers a window into Fisher’s personal methodology for identifying growth stocks, making it one of the most practical and actionable sections of the book. Fisher shares the techniques he uses to uncover companies with the potential for sustained expansion, emphasizing creativity, persistence, and a willingness to look beyond the obvious. The chapter is a blueprint for investors seeking to build a portfolio of high-potential businesses.

Fisher describes the process of idea generation, which begins with broad industry analysis and narrows down to specific companies. He discusses the importance of reading trade journals, attending industry conferences, and building relationships with insiders. Fisher provides examples of how he discovered companies like Texas Instruments and Motorola by following industry trends and seeking out emerging technologies. The chapter is rich with anecdotes and practical tips, such as the value of asking open-ended questions and looking for companies that are “doing something different.”

Investors can apply these techniques by developing their own research routines and networks. Fisher advises casting a wide net in the idea generation phase and then applying rigorous analysis to filter for quality. He encourages investors to be patient, to follow their curiosity, and to remain open to new opportunities. By adopting Fisher’s methods, investors can improve their ability to identify growth stocks before they become widely recognized.

In the modern era, where information is more accessible than ever, Fisher’s approach to finding growth stocks remains highly effective. Investors can use online resources, industry databases, and professional networks to supplement traditional research. The core principle—combining broad exploration with deep analysis—continues to be a source of competitive advantage for successful investors.

Chapter 14: Origins of a Philosophy

This chapter is significant because it explores the formative experiences that shape an investor’s philosophy. Fisher recounts the early influences that guided his approach to investing, including his education, mentors, and initial successes and failures. The chapter provides a candid look at the process of developing a coherent set of beliefs and strategies, emphasizing the role of self-reflection and continuous learning.

Fisher shares stories of his early investments, both successful and unsuccessful, and describes how these experiences informed his views on risk, research, and decision-making. He discusses the impact of major economic events, such as the Great Depression, on his thinking and highlights the importance of adapting to changing circumstances. The chapter includes quotes from Fisher’s mentors and peers, illustrating the value of seeking out diverse perspectives and learning from others.

Investors can apply the lessons of this chapter by taking time to reflect on their own experiences and to identify the beliefs that drive their decisions. Fisher encourages readers to keep a journal, to analyze both successes and failures, and to seek out mentors who can provide guidance and feedback. By engaging in this process of self-examination, investors can develop a philosophy that is both resilient and adaptable.

The relevance of this chapter is universal, as every investor’s journey is shaped by a unique set of experiences and influences. Fisher’s emphasis on philosophy and learning provides a roadmap for personal growth and long-term success. In an industry often dominated by short-term thinking, the cultivation of a thoughtful, well-grounded philosophy is a key differentiator.

Chapter 16: The Philosophy Matures

This chapter builds on the previous one by examining how an investor’s philosophy evolves over time. Fisher discusses the process of refining beliefs and strategies in response to new information, changing market conditions, and personal growth. The chapter is a testament to the importance of flexibility, humility, and lifelong learning in the pursuit of investment excellence.

Fisher provides examples of how his own philosophy changed as he gained experience and as the market environment shifted. He describes the challenges of adapting to new technologies, regulatory changes, and competitive dynamics. The chapter includes anecdotes of both successes and setbacks, illustrating the value of learning from mistakes and being willing to change course when necessary. Fisher quotes other investors who stress the importance of adaptability and open-mindedness.

Investors can apply these lessons by regularly reviewing their own strategies and being willing to adjust in response to new evidence. Fisher advises maintaining a balance between conviction and flexibility, recognizing that no approach is infallible. He encourages investors to seek out feedback, to learn from peers, and to remain curious and open to new ideas. By embracing change, investors can stay ahead of the curve and continue to improve their results over time.

The themes of maturity and adaptation are especially relevant in today’s fast-paced markets, where new technologies and global events can rapidly alter the investment landscape. Fisher’s emphasis on continuous improvement and philosophical evolution provides a blueprint for building a sustainable, long-term investment practice.

Practical Investment Strategies

- Implement the Scuttlebutt Method: Begin by identifying a shortlist of companies in industries you understand. Reach out to suppliers, customers, competitors, and former employees to gather qualitative insights. Ask open-ended questions about product quality, management reputation, and competitive dynamics. Document your findings and look for recurring themes or red flags. Use this information to supplement traditional financial analysis, focusing on companies that demonstrate strong relationships and market positioning.

- Apply the Fifteen-Point Checklist: For every potential investment, systematically evaluate each of Fisher’s fifteen criteria, including research and development strength, sales organization effectiveness, profit margins, and management integrity. Assign a score or qualitative assessment to each point, and avoid companies that fall short on multiple dimensions. Use the checklist as a filter to narrow your focus to businesses with the greatest potential for sustainable growth. Update your analysis regularly as new information becomes available.

- Time Your Purchases Based on Fundamentals: Monitor industry trends, company-specific developments, and macroeconomic indicators to identify periods of undervaluation. Set clear entry criteria, such as target price-to-earnings ratios or business milestones. Be patient and wait for opportunities when high-quality companies are temporarily out of favor due to market volatility or short-term setbacks. Use limit orders and staged buying to build positions gradually, reducing the risk of adverse price movements.

- Establish Clear Sell Criteria: Before investing, define the conditions under which you would sell a stock, such as a deterioration in fundamentals, loss of competitive advantage, or management missteps. Review your holdings regularly and act decisively when your original investment thesis is invalidated. Avoid selling simply because a stock has appreciated; instead, focus on the company’s ongoing ability to compound value. Maintain a disciplined approach to selling, using both quantitative and qualitative signals.

- Focus on a Concentrated Portfolio of High-Quality Companies: Rather than spreading capital across dozens of positions, concentrate your investments in a select group of businesses that meet Fisher’s criteria. This allows for deeper research and better monitoring of each holding. Diversify across industries and business models to manage risk, but avoid over-diversification, which can dilute returns and increase complexity. Regularly review your portfolio to ensure that each position continues to meet your standards.

- Balance Growth with Conservative Principles: Seek out companies with both high growth potential and strong financial foundations. Look for businesses with stable cash flows, prudent management, and resilient business models. Use conservative position sizing and risk management techniques to protect capital during downturns. Prioritize companies that have demonstrated the ability to weather economic cycles and adapt to changing conditions.

- Continuously Refine Your Investment Philosophy: Keep a journal of your investment decisions, including the rationale for each buy and sell. Reflect on your successes and failures, and seek feedback from mentors and peers. Regularly review and update your investment philosophy in response to new information and changing market conditions. Embrace lifelong learning and remain open to adapting your approach as you gain experience.

- Leverage Modern Tools for Qualitative Research: Use online resources such as professional networks, industry forums, and social media to gather scuttlebutt-style information. Attend virtual conferences, listen to management calls, and read expert interviews to gain diverse perspectives. Supplement traditional research with alternative data sources, such as customer reviews and employee ratings, to build a more comprehensive view of each company.

Modern Applications and Relevance

Many of Fisher’s core principles are more relevant today than ever. The modern investor faces an environment of information overload, rapid technological change, and global market interconnections. Fisher’s insistence on deep, independent research stands in stark contrast to the surface-level analysis that often dominates financial media. The scuttlebutt method, for example, can now be amplified through digital channels—social media, professional networking platforms, and customer review sites—allowing investors to gather qualitative insights at unprecedented scale and speed.

Since the book’s original publication, the landscape of investing has evolved dramatically. Passive investing, algorithmic trading, and the proliferation of data analytics have transformed the way portfolios are constructed and managed. However, what remains timeless is Fisher’s focus on company fundamentals, management quality, and the importance of a long-term perspective. The cyclical nature of markets, the human tendency toward herd behavior, and the value of independent thinking are as true in the era of meme stocks and cryptocurrencies as they were in the age of industrial giants.

Modern examples abound that reinforce Fisher’s teachings. The rise and fall of high-profile tech companies, the importance of visionary leadership at firms like Apple and Tesla, and the enduring value of conservative risk management during crises like the COVID-19 pandemic all echo the lessons found in "Common Stocks and Uncommon Profits." Investors who applied Fisher’s principles during recent market downturns—focusing on quality, management, and long-term prospects—were often rewarded with superior returns and lower volatility.

To adapt Fisher’s classic advice to current conditions, investors should leverage modern tools for both quantitative and qualitative research. Advanced screening tools, alternative data sources, and global information networks can enhance the scuttlebutt approach. At the same time, the need for skepticism, patience, and discipline has only grown in a world of algorithm-driven trading and instant news. Fisher’s enduring message is that while tools and tactics evolve, the underlying principles of sound investing remain constant.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Start with Industry and Company Selection: Begin by identifying industries you understand or are willing to study in depth. Use financial screens, industry reports, and sector analyses to shortlist companies that show consistent growth, strong financials, and competitive advantages. Allocate several weeks to this initial phase, ensuring a solid foundation for further research.

- Conduct Scuttlebutt and Deep Research: Dedicate the next 1-2 months to qualitative research. Reach out to industry contacts, attend conferences, and use online platforms to gather insights from customers, suppliers, and competitors. Document your findings and compare them against public filings and analyst reports. This step is crucial for uncovering information that is not reflected in financial statements.

- Build a Focused Portfolio with Clear Criteria: Based on your research, select 8-15 companies that meet Fisher’s fifteen-point checklist and demonstrate both growth potential and conservative financial management. Allocate capital based on conviction and risk assessment, typically concentrating more in your highest-conviction ideas while ensuring diversification across industries. Maintain position sizes that reflect your risk tolerance and the quality of the underlying business.

- Establish and Follow a Regular Review Schedule: Set a quarterly or semi-annual schedule to review each holding. Evaluate whether the original investment thesis remains intact, monitor for red flags, and update your analysis with new information. Be prepared to act decisively if a company’s fundamentals deteriorate or if better opportunities arise. Use this review process to maintain discipline and avoid emotional decision-making.

- Pursue Continuous Improvement and Learning: Keep a detailed investment journal, noting the rationale for each decision, the outcomes, and lessons learned. Regularly read industry publications, investment books, and case studies to broaden your perspective. Seek feedback from mentors, join investment communities, and remain open to adapting your philosophy as you gain experience. Embrace mistakes as learning opportunities and strive for incremental improvement over time.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Common Stocks and Uncommon Profits and Other Writings

1. What is the “scuttlebutt” method and how can investors use it today?

The “scuttlebutt” method is Fisher’s approach to gathering qualitative information about a company by talking to its customers, suppliers, competitors, and employees. In today’s world, investors can use online reviews, social media, LinkedIn, and industry forums to supplement traditional field research. The key is to seek out diverse perspectives and to verify information from multiple sources before making investment decisions.

2. How does Fisher’s fifteen-point checklist help in evaluating stocks?

Fisher’s fifteen-point checklist provides a comprehensive framework for assessing a company’s long-term growth potential. It covers areas such as research and development, profit margins, sales organization, and management integrity. By systematically evaluating each point, investors can identify companies with sustainable competitive advantages and avoid those with hidden weaknesses.

3. Is Fisher’s investment philosophy still relevant in the age of passive investing and ETFs?

Yes, Fisher’s philosophy is highly relevant today. While passive investing and ETFs have made it easier to gain broad market exposure, Fisher’s focus on deep research, management quality, and company fundamentals remains essential for those seeking to outperform the market. His principles help investors identify exceptional businesses that can deliver superior long-term returns.

4. What are the most common mistakes Fisher warns investors to avoid?

Fisher cautions against several common mistakes, including over-diversification, following market fads, neglecting research, and making decisions based on tips or rumors. He emphasizes the importance of discipline, independent thinking, and focusing on a select group of high-quality companies. These warnings are designed to help investors protect their capital and avoid unnecessary risks.

5. How can investors develop their own investment philosophy as Fisher recommends?

Investors can develop their own philosophy by reflecting on their goals, risk tolerance, and past experiences. Fisher suggests keeping a journal, learning from both successes and failures, and seeking feedback from mentors and peers. Regularly reviewing and updating one’s philosophy in response to new information and changing market conditions is key to long-term success.