10 Best Compounding Quality Stocks: Elite Growth Companies - Value Sense 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Mathematical Power of Compounding Quality

Compounding quality stocks represent the pinnacle of business excellence - companies that consistently reinvest capital at high returns while maintaining exceptional operational metrics across profitability, growth, and financial strength. These elite businesses create sustainable competitive advantages that enable decades of wealth creation through the mathematical power of compound returns.

Elite Quality Selection Criteria:

- ROIC ≥15%: Exceptional capital efficiency demonstrating sustainable competitive advantages

- Net Income Margin ≥10%: Superior profitability indicating pricing power and operational excellence

- Revenue Growth (YoY) ≥7%: Consistent expansion demonstrating market opportunity capture

- Net Debt to FCF ≤3x: Conservative financial structure ensuring operational flexibility

- Earnings Quality (FCF to Net Income) ≥80%: High-quality earnings with strong cash conversion

- EPS Growth (YoY) ≥10%: Accelerating profitability per share creating shareholder value

Top 10 Compounding Quality Stocks - Ranked by Quality Rating

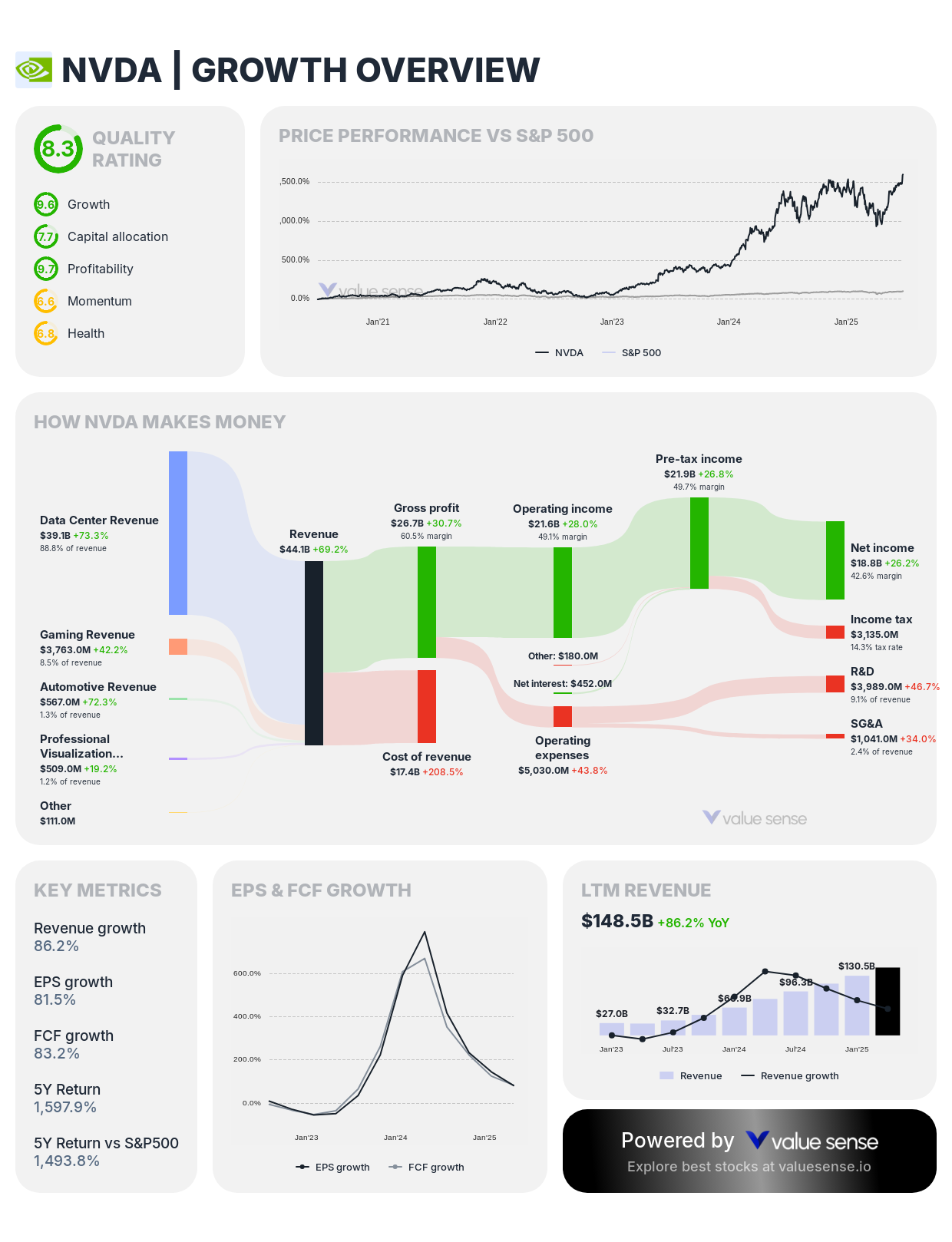

1. NVIDIA Corporation (NVDA) - 8.3 Quality Rating ⭐

- Quality Rating: 8.3 (Exceptional)

- Intrinsic Value: 59.9% overvalued

- 1-Year Return: 22.7%

- Revenue: $148.5B

- Free Cash Flow: $72.1B

- Revenue Growth: 86.2%

- FCF Margin: 48.5%

Investment Thesis: NVIDIA achieves the highest quality rating (8.3) while demonstrating extraordinary operational metrics that exemplify compounding excellence. The AI computing leader's 86.2% revenue growth and 48.5% FCF margin showcase exceptional capital efficiency and market opportunity capture that creates sustainable competitive advantages.

Why It's a Compounding Champion: NVIDIA's dominance in AI accelerators creates a platform business model with exceptional returns on invested capital, pricing power through technological leadership, and expanding addressable markets across data centers, gaming, automotive, and edge computing. The company's CUDA ecosystem generates switching costs that protect market position while enabling premium pricing.

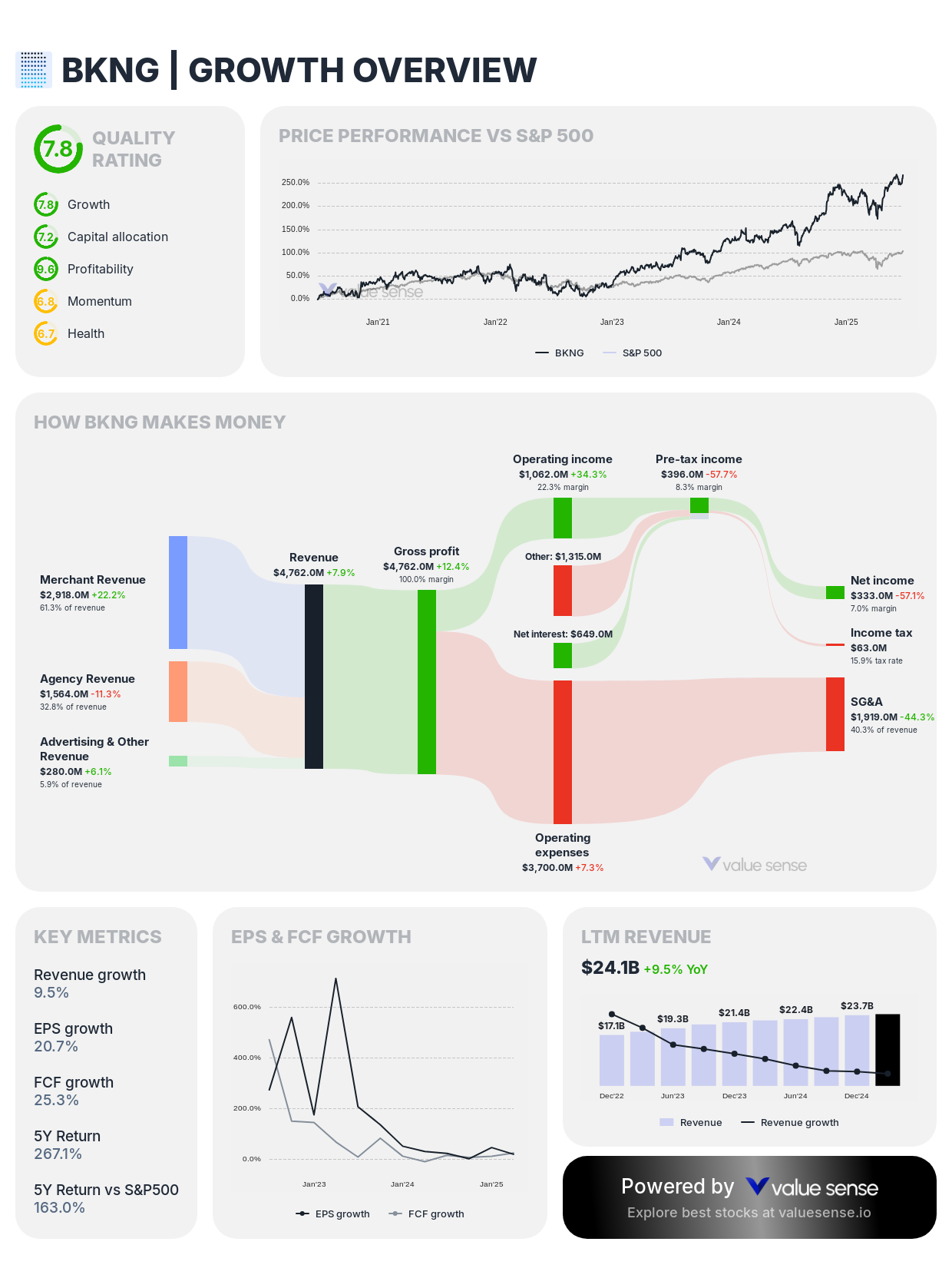

2. Booking Holdings Inc. (BKNG) - 7.8 Quality Rating

- Quality Rating: 7.8 (Exceptional)

- Intrinsic Value: 45.7% overvalued

- 1-Year Return: 41.4%

- Revenue: $24.1B

- Free Cash Flow: $8,482.0M

- Revenue Growth: 9.5%

- FCF Margin: 35.2%

Investment Thesis: Booking Holdings demonstrates exceptional quality with 7.8 rating, combining the world's largest online travel platform with exceptional capital efficiency and cash generation. The company's asset-light business model and network effects create sustainable competitive advantages ideal for long-term compounding.

Why It's a Compounding Champion: Booking's dominant market position in online travel creates network effects between travelers and accommodations, generating exceptional returns on invested capital while maintaining pricing power. The platform business model enables geographic expansion and service diversification with minimal capital requirements.

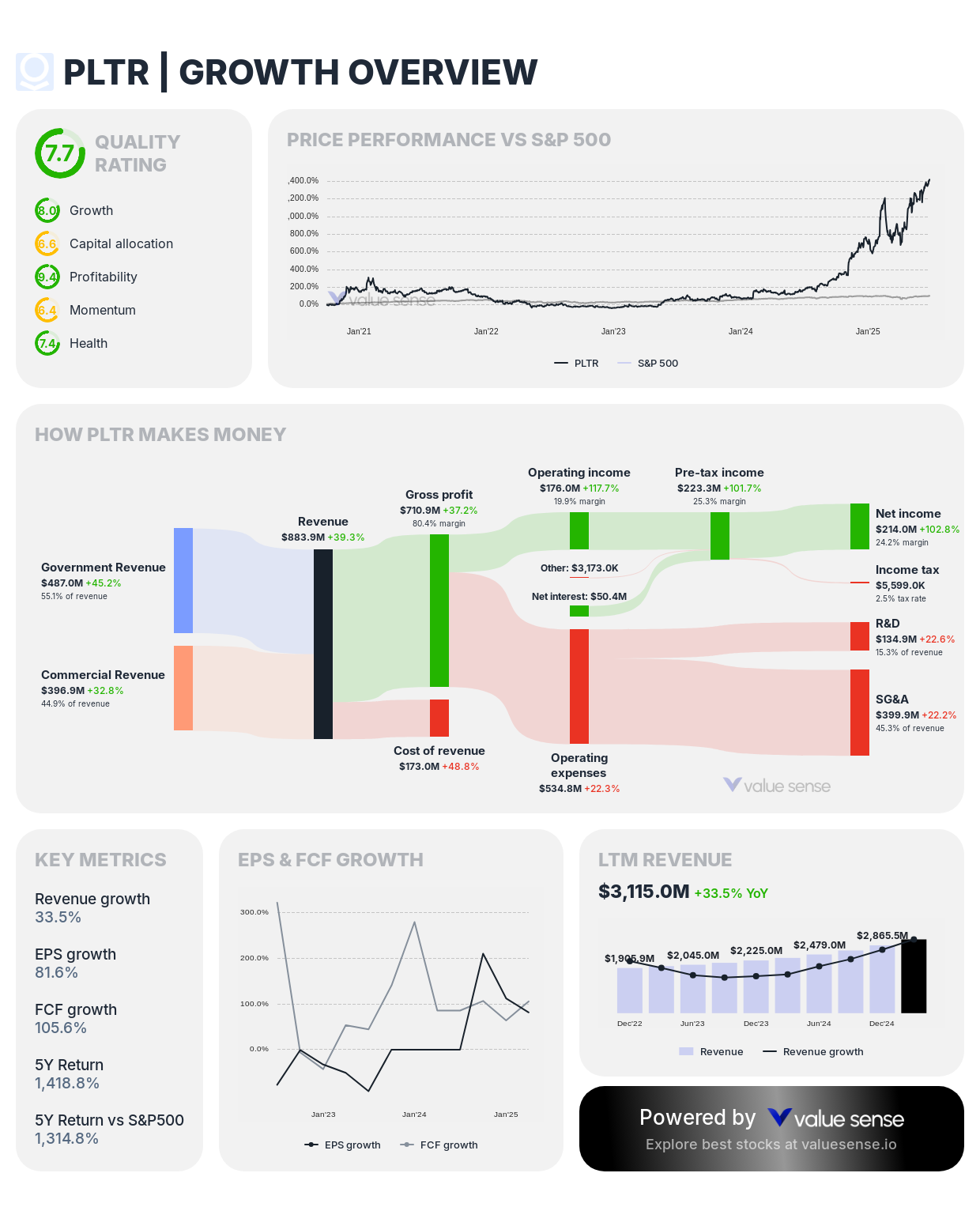

3. Palantir Technologies Inc. (PLTR) - 7.7 Quality Rating

- Quality Rating: 7.7 (Exceptional)

- Intrinsic Value: 87.0% overvalued

- 1-Year Return: 498.7%

- Revenue: $3,115.0M

- Free Cash Flow: $1,318.4M

- Revenue Growth: 33.5%

- FCF Margin: 42.3%

Investment Thesis: Palantir achieves exceptional 7.7 quality rating with extraordinary 498.7% one-year return, demonstrating the data analytics company's exceptional growth potential and operational leverage. The company's specialized software platforms create high switching costs and recurring revenue streams ideal for compounding returns.

Why It's a Compounding Champion: Palantir's mission-critical data analytics platforms become deeply integrated into client operations, creating substantial switching costs and expanding usage over time. The company's specialized expertise in complex data problems generates pricing power while enabling geographic and vertical market expansion.

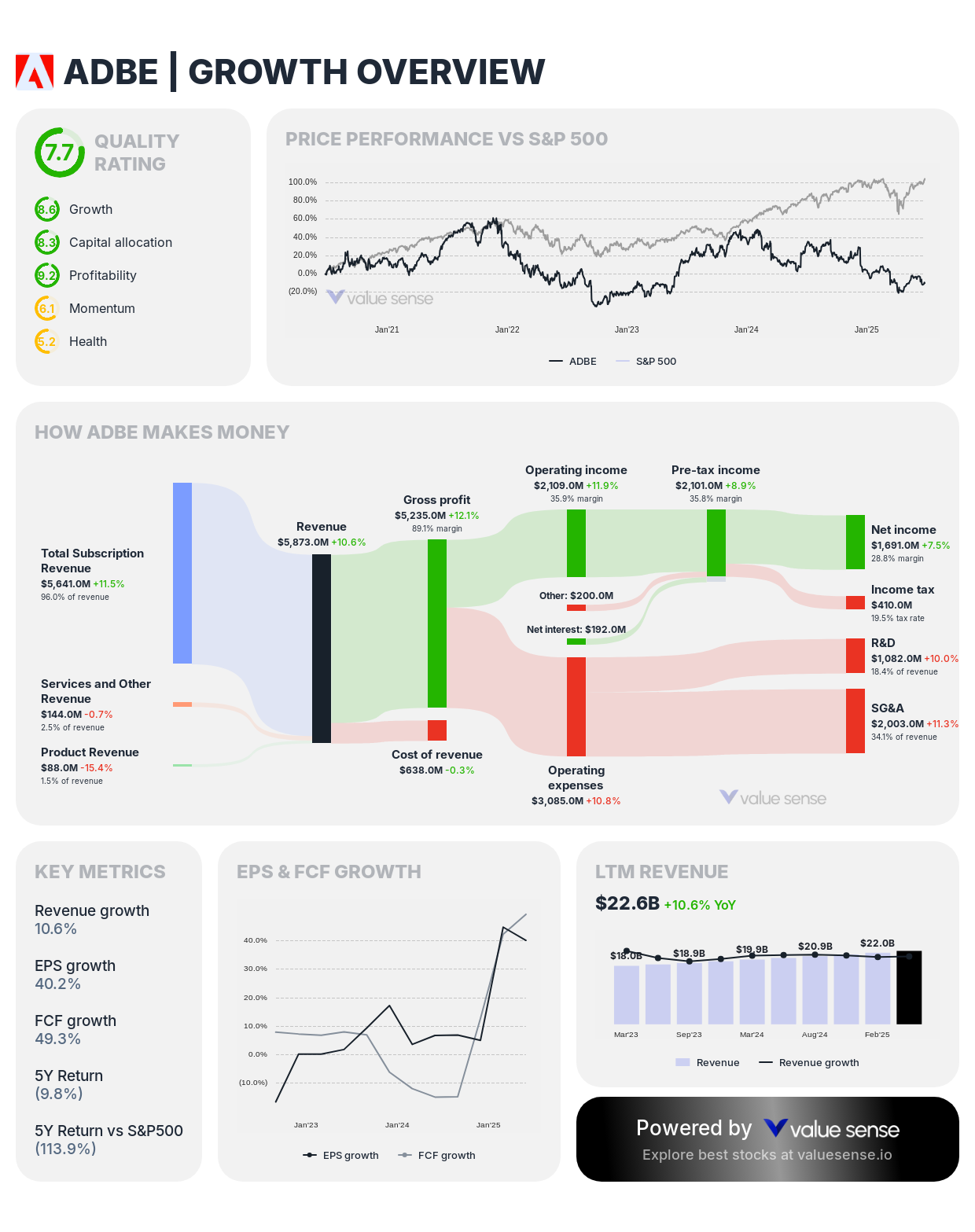

4. Adobe Inc. (ADBE) - 7.7 Quality Rating

- Quality Rating: 7.7 (Exceptional)

- Intrinsic Value: 39.8% undervalued

- 1-Year Return: (27.2%)

- Revenue: $22.6B

- Free Cash Flow: $9,437.0M

- Revenue Growth: 10.6%

- FCF Margin: 41.8%

Investment Thesis: Adobe demonstrates exceptional 7.7 quality rating with attractive 39.8% undervaluation, representing one of the few elite quality companies trading below intrinsic value. The creative software leader's subscription model and market dominance create exceptional compounding characteristics.

Why It's a Compounding Champion: Adobe's creative software ecosystem creates substantial switching costs and network effects, enabling consistent pricing power and market share expansion. The company's subscription model generates predictable recurring revenue while artificial intelligence integration enhances competitive positioning.

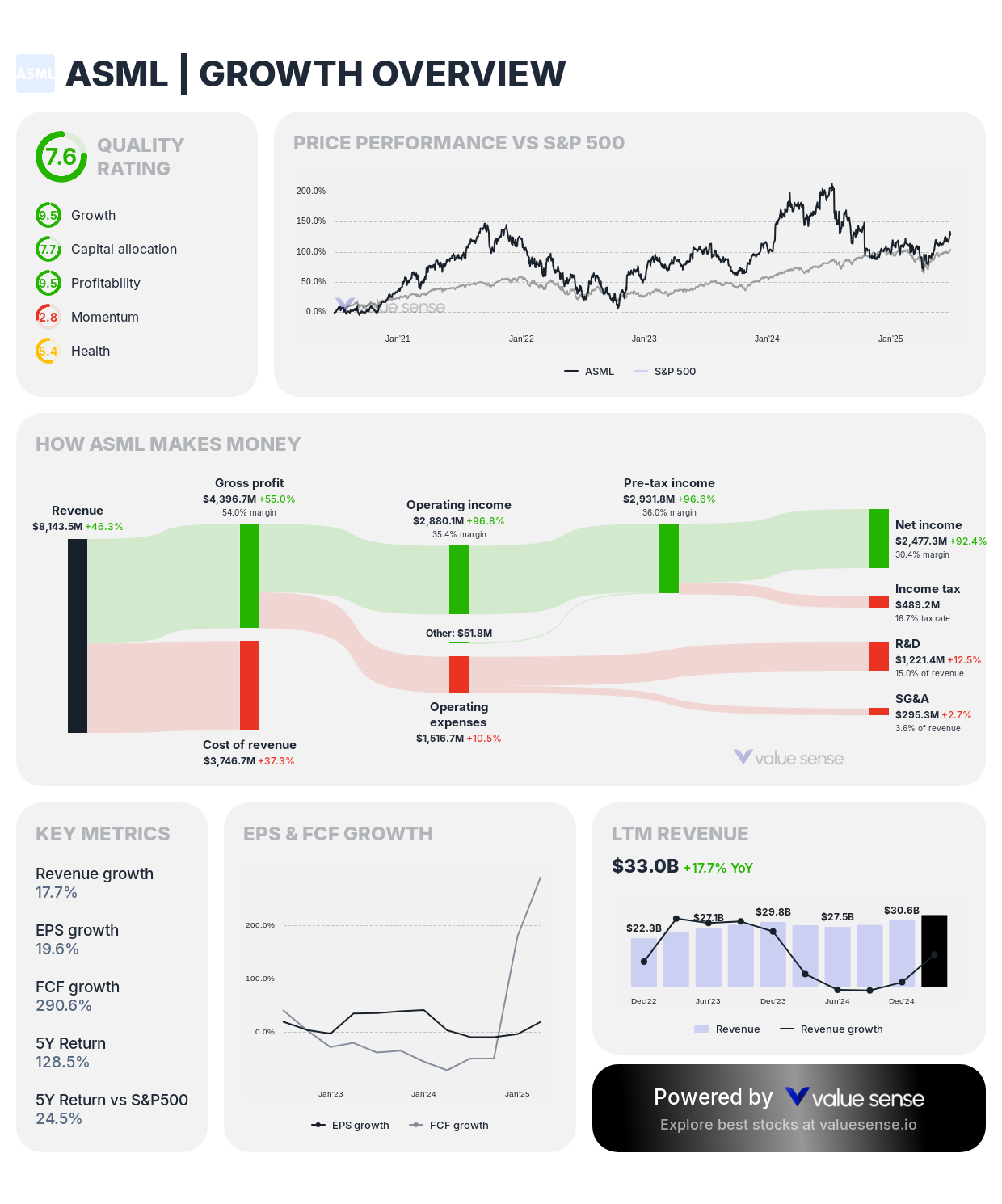

5. ASML Holding N.V. (ASML) - 7.6 Quality Rating

- Quality Rating: 7.6 (Exceptional)

- Intrinsic Value: 3.2% overvalued

- 1-Year Return: (21.1%)

- Revenue: €30.7B

- Free Cash Flow: €9,285.2M

- Revenue Growth: 17.7%

- FCF Margin: 30.2%

Investment Thesis: ASML achieves exceptional 7.6 quality rating while trading closest to fair value (3.2% overvalued), making it the most attractively valued elite quality company in our analysis. The semiconductor equipment leader's monopolistic position in EUV lithography creates unmatched competitive advantages.

Why It's a Compounding Champion: ASML's monopoly in extreme ultraviolet lithography technology creates irreplaceable competitive advantages with no viable competitors. The company's essential role in advanced semiconductor manufacturing ensures sustained demand visibility while enabling premium pricing and high-return capital allocation.

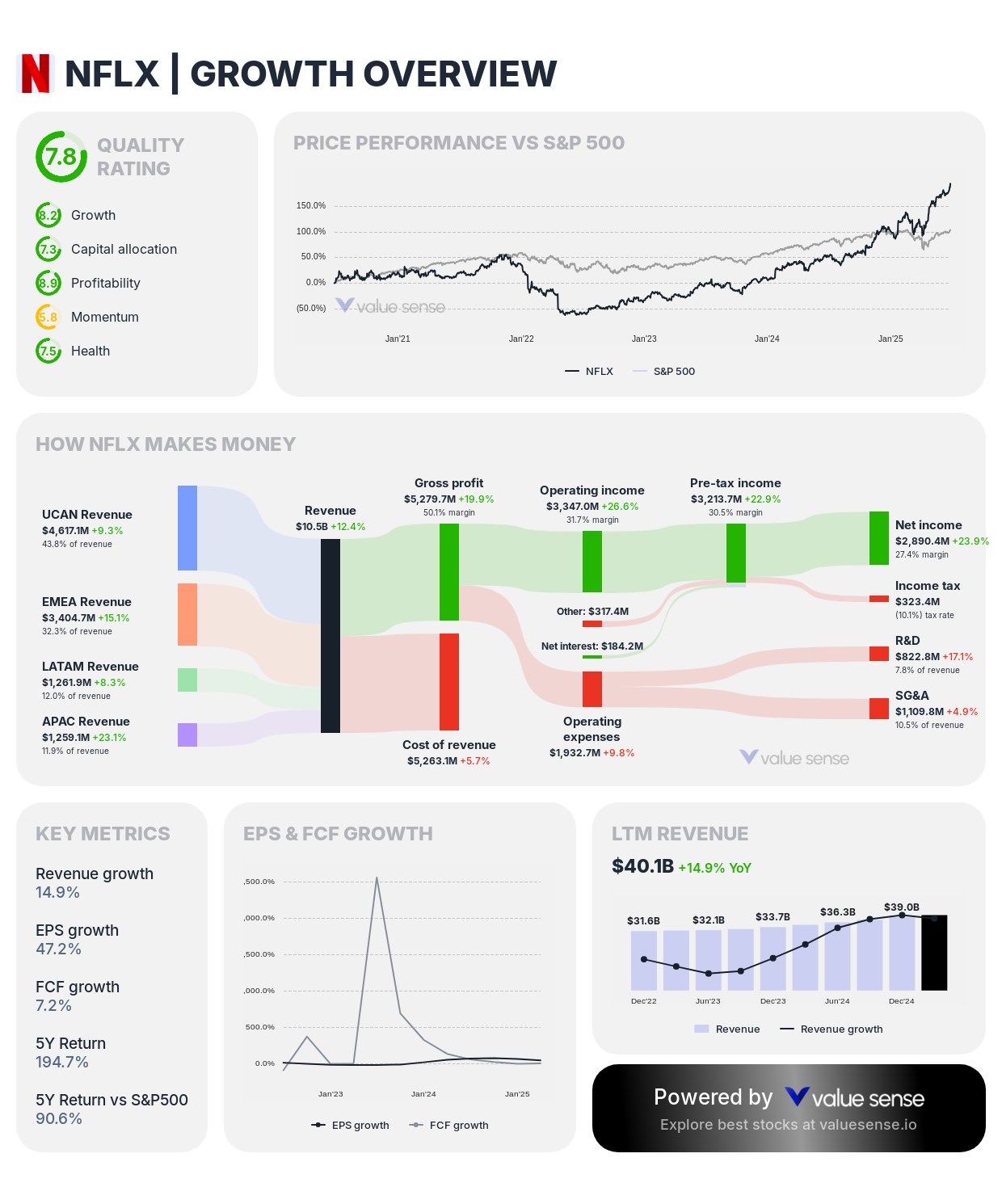

6. Netflix, Inc. (NFLX) - 7.5 Quality Rating

- Quality Rating: 7.5 (Exceptional)

- Intrinsic Value: 35.8% overvalued

- 1-Year Return: 92.8%

- Revenue: $40.1B

- Free Cash Flow: $7,445.9M

- Revenue Growth: 14.9%

- FCF Margin: 18.5%

Investment Thesis: Netflix demonstrates exceptional quality with 7.5 rating and strong 92.8% one-year return, reflecting the streaming leader's successful transition to profitability focus while maintaining global subscriber growth. The company's content strategy and operational leverage create sustainable competitive advantages.

Why It's a Compounding Champion: Netflix's global streaming platform benefits from content scale economies, subscriber network effects, and international expansion opportunities that enable sustained high-return capital allocation. The company's data advantages in content creation and recommendation systems strengthen competitive positioning over time.

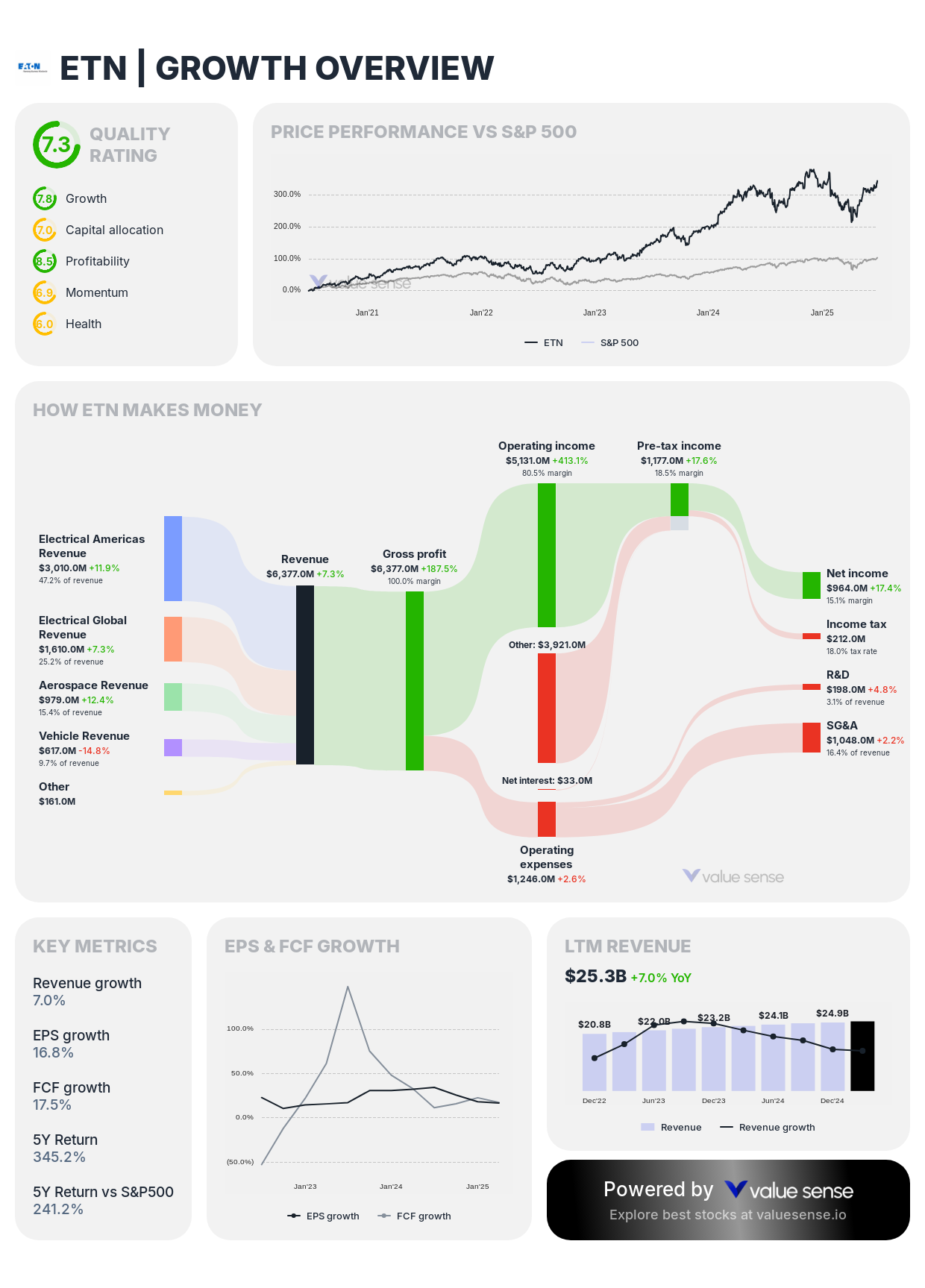

7. Eaton Corporation plc (ETN) - 7.3 Quality Rating

- Quality Rating: 7.3 (Exceptional)

- Intrinsic Value: 47.3% overvalued

- 1-Year Return: 11.5%

- Revenue: $25.3B

- Free Cash Flow: $3,465.0M

- Revenue Growth: 7.0%

- FCF Margin: 13.7%

Investment Thesis: Eaton demonstrates strong 7.3 quality rating, reflecting the industrial technology company's leadership in electrical systems and components across multiple end markets. The company's diversified portfolio and technology focus create sustainable competitive advantages.

Why It's a Compounding Champion: Eaton's essential electrical infrastructure products and energy-efficient solutions benefit from global electrification trends and infrastructure modernization. The company's technology leadership and operational excellence enable sustained high-return capital allocation across economic cycles.

8. QUALCOMM Incorporated (QCOM) - 7.1 Quality Rating

- Quality Rating: 7.1 (Exceptional)

- Intrinsic Value: 68.8% undervalued

- 1-Year Return: (18.6%)

- Revenue: $42.3B

- Free Cash Flow: $11.7B

- Revenue Growth: 16.1%

- FCF Margin: 27.7%

Investment Thesis: QUALCOMM achieves strong 7.1 quality rating with substantial 68.8% undervaluation, making it the most attractively valued quality company in our selection. The semiconductor leader's dominance in mobile technology and expanding markets create exceptional value potential.

Why It's a Compounding Champion: QUALCOMM's extensive intellectual property portfolio and leadership in 5G technology create sustainable competitive advantages with high-margin licensing revenue. The company's expansion beyond smartphones into automotive, IoT, and edge computing provides multiple growth vectors for capital allocation.

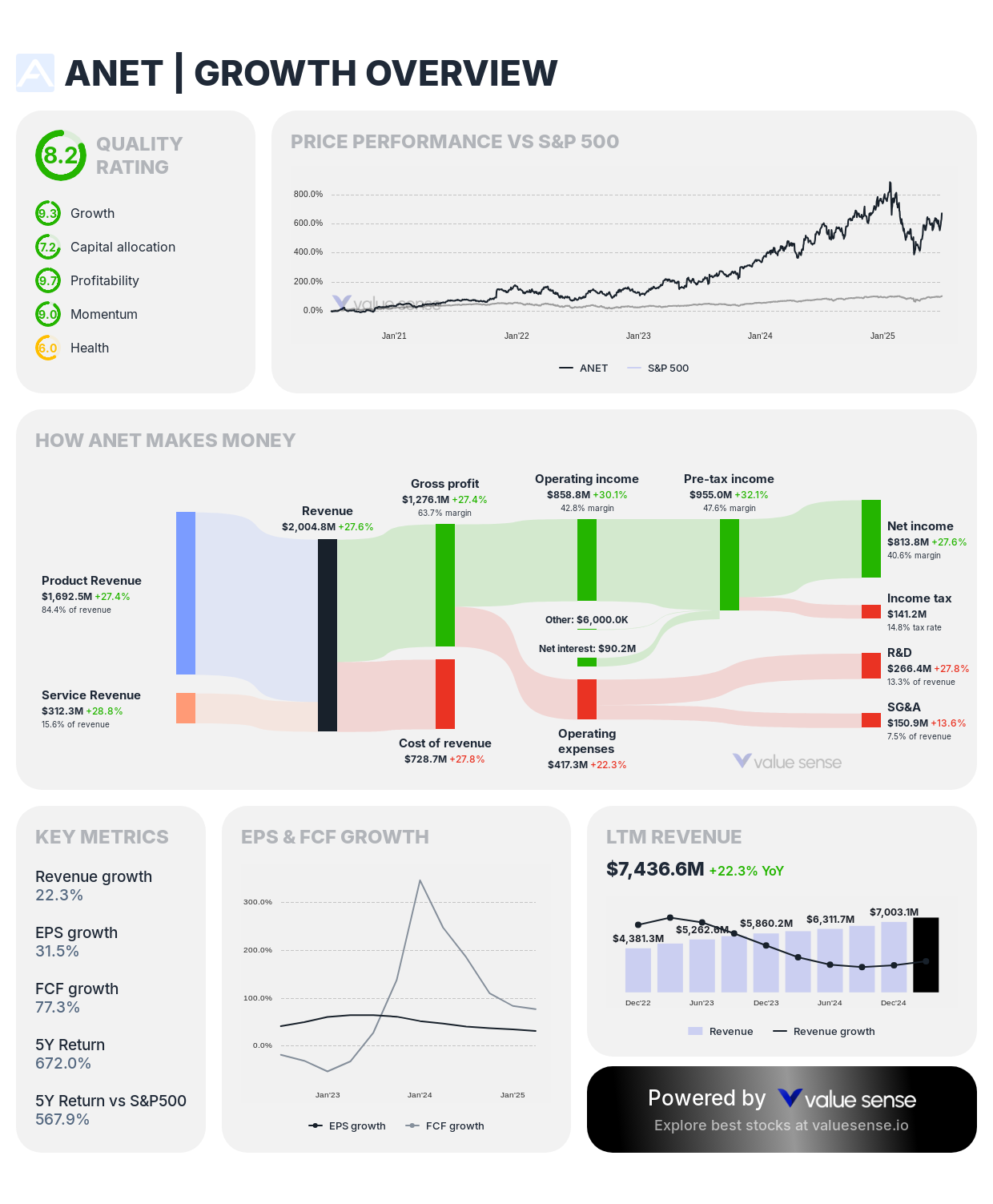

9. Arista Networks, Inc. (ANET) - 6.9 Quality Rating

- Quality Rating: 6.9 (Strong)

- Intrinsic Value: 45.4% overvalued

- 1-Year Return: 21.4%

- Revenue: $7,436.6M

- Free Cash Flow: $3,785.1M

- Revenue Growth: 22.3%

- FCF Margin: 50.9%

Investment Thesis: Arista Networks achieves strong 6.9 quality rating with exceptional 50.9% FCF margin, demonstrating the cloud networking company's superior operational efficiency and competitive positioning. The company's software-driven approach creates sustainable advantages in data center networking.

Why It's a Compounding Champion: Arista's software-defined networking solutions create customer stickiness and recurring revenue opportunities while enabling rapid innovation cycles. The company's focus on cloud data centers positions it for sustained growth from digital transformation and AI infrastructure demand.

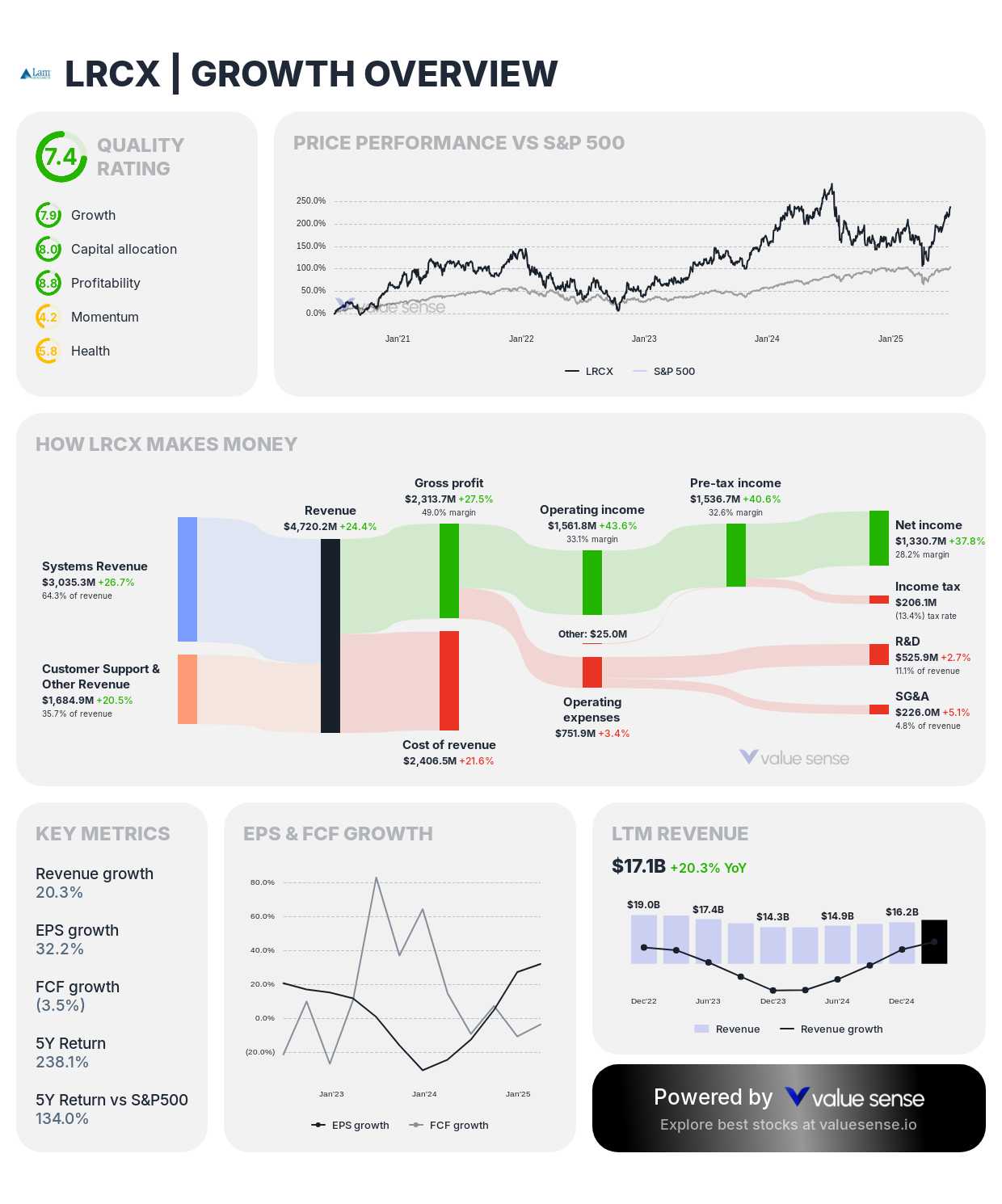

10. Lam Research Corporation (LRCX) - 6.6 Quality Rating

- Quality Rating: 6.6 (Strong)

- Intrinsic Value: 4.2% undervalued

- 1-Year Return: (7.4%)

- Revenue: $17.1B

- Free Cash Flow: $4,380.8M

- Revenue Growth: 20.3%

- FCF Margin: 25.6%

Investment Thesis: Lam Research demonstrates solid 6.6 quality rating with attractive 4.2% undervaluation, reflecting the semiconductor equipment company's essential role in advanced chip manufacturing. The company's technological leadership and customer relationships create sustainable competitive advantages.

Why It's a Compounding Champion: Lam Research's essential wafer fabrication equipment and technological expertise create high barriers to entry and customer stickiness. The company's innovation in critical manufacturing processes enables premium pricing while benefiting from long-term semiconductor industry growth.

Compounding Quality Investment Strategy

Prioritize Exceptional Quality with Attractive Valuations: Focus on the rare combination of exceptional quality ratings with reasonable valuations. Adobe (39.8% undervalued, 7.7 quality) and QUALCOMM (68.8% undervalued, 7.1 quality) represent ideal opportunities combining business excellence with attractive entry points.

Embrace Long-Term Holding Periods: Compounding mathematics requires time to create exponential wealth. Plan for 10+ year holding periods to capture the full value creation potential of these exceptional businesses. The difference between 10 and 20-year holding periods can be transformational for wealth building.

Diversify Across Quality Themes: Build a portfolio spanning AI computing (NVIDIA), travel platforms (Booking), data analytics (Palantir), creative software (Adobe), semiconductor equipment (ASML, Lam Research), streaming entertainment (Netflix), industrial technology (Eaton), wireless technology (QUALCOMM), and cloud networking (Arista).

Focus on Capital Efficiency Over Growth Rates: While growth matters, prioritize companies demonstrating exceptional returns on invested capital. A company growing at 15% with 30% ROIC will create more wealth over time than one growing at 25% with 10% ROIC.

Understanding Our Quality Methodology

Capital Efficiency Excellence (ROIC ≥15%): Return on Invested Capital measures management's ability to generate profits from invested capital. Companies exceeding 15% ROIC demonstrate sustainable competitive advantages, pricing power, and operational excellence essential for long-term compounding.

Profitability Leadership (Net Income Margin ≥10%): High profit margins indicate pricing power, operational efficiency, and competitive positioning that enables premium pricing. This profitability provides the cash flow necessary for continued reinvestment at high returns.

Growth Consistency (Revenue Growth ≥7%): Sustained revenue growth demonstrates expanding market opportunities, successful execution, and reinvestment opportunities that fuel continued compounding. This growth must be profitable and sustainable.

Financial Strength (Net Debt to FCF ≤3x): Conservative capital structures ensure operational flexibility during economic uncertainty while reducing financial risk. Strong balance sheets enable companies to invest opportunistically during market downturns.

Earnings Quality (FCF to Net Income ≥80%): High cash conversion ratios validate accounting quality and ensure reported earnings translate into actual cash available for reinvestment, acquisitions, or shareholder returns.

Shareholder Value Creation (EPS Growth ≥10%): Growing earnings per share demonstrates management's ability to increase per-share profitability through operational excellence, strategic capital allocation, and market expansion.

Key Takeaways for Compounding Quality Investors

✅ Elite Quality Leader: NVIDIA (8.3 rating) offers the highest quality with exceptional AI market positioning

✅ Undervalued Opportunities: Adobe (39.8% undervalued) and QUALCOMM (68.8% undervalued) combine quality with attractive valuations

✅ Fair Value Entry: ASML (3.2% overvalued) and Lam Research (4.2% undervalued) offer reasonable entry points

✅ Diversified Excellence: Quality opportunities span technology, entertainment, industrial, and semiconductor sectors

✅ Long-Term Focus: All companies demonstrate the operational excellence necessary for decades of wealth compounding

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 8 Best Fair Value Stocks Trading Near Intrinsic Worth

📖 9 Best Undervalued Stocks Under $1

📖 7 Best Undervalued Cheap Stocks Under $20

FAQ About Compounding Quality Investing

What makes a company qualify as a true compounding quality business?

True compounding quality businesses demonstrate exceptional capital efficiency (ROIC ≥15%), superior profitability (margins ≥10%), consistent growth (≥7%), conservative finances (debt ≤3x FCF), high earnings quality (FCF ≥80% of net income), and accelerating per-share profitability (EPS growth ≥10%). These criteria ensure companies can reinvest capital at high returns while maintaining financial flexibility and generating real cash earnings that compound over time.

Why do most quality companies trade at premium valuations?

Quality companies typically trade at premiums because markets recognize their superior business characteristics, sustainable competitive advantages, and consistent execution track records. Investors willingly pay higher prices for businesses demonstrating predictable cash flows, pricing power, and growth opportunities. However, occasional opportunities like Adobe and QUALCOMM arise from temporary market pessimism, creating attractive entry points for patient investors.

How important is holding period for realizing compounding benefits?

Holding period is crucial because mathematical compound returns accelerate over time. A 20% annual return becomes 6.2x wealth over 10 years but 38.3x over 20 years. Quality companies require extended holding periods to capture full value creation through business growth, market expansion, and operational leverage. Short-term volatility becomes irrelevant when focusing on long-term business fundamentals.

What are the primary risks of investing in premium-valued quality companies?

Premium-valued quality companies face risks including multiple compression if growth slows, increased competition eroding competitive advantages, and higher volatility during market corrections due to elevated expectations. However, superior business quality often justifies premiums through sustained outperformance, making business risk assessment more important than valuation timing for long-term wealth creation.

How should investors balance quality criteria with valuation considerations?

Successful quality investing typically prioritizes business excellence over valuation timing, as superior companies often justify premium pricing through sustained outperformance. Focus on companies meeting all quality criteria while seeking occasional undervaluation opportunities. Consider dollar-cost averaging for premium-valued quality companies, as their superior business characteristics often lead to continued outperformance despite elevated entry valuations.

Important Note on Quality Investing: Compounding quality stocks require exceptional business characteristics and often trade at premium valuations. While these companies offer superior long-term wealth creation potential, they may experience higher volatility during market corrections due to elevated expectations. Success requires patience, long-term perspective, and focus on business fundamentals rather than short-term price movements.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Quality metrics are based on recent financial data and may change with quarterly reporting. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.