Dalal Street LLC Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

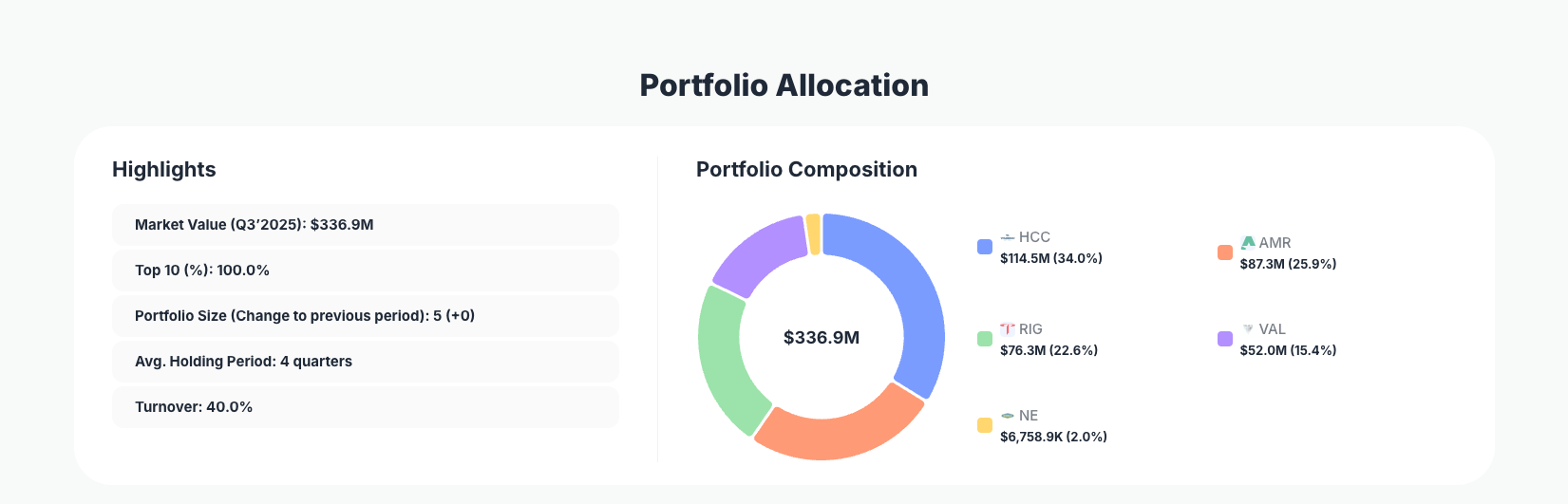

Dalal Street LLC maintains its signature discipline in ultra-concentrated investing with a lean $336.9M portfolio across only 5 positions in Q3 2025. This approach underscores the firm's high-conviction strategy, where every holding carries significant weight, reflecting careful selection of businesses with strong competitive advantages and long-term potential.

Portfolio Overview: The Power of Extreme Focus

Portfolio Highlights (Q3’2025): - Market Value: $336.9M - Top 10 Holdings: 100.0% - Portfolio Size: 5 +0 - Average Holding Period: 4 quarters - Turnover: 40.0%

Dalal Street LLC's Q3 2025 portfolio exemplifies extreme concentration, with the top 10 holdings—essentially the entire portfolio—accounting for 100.0% of assets. This is not diversification by numbers but conviction in a handful of ideas, a hallmark of managers who prioritize deep research over broad exposure. The portfolio size of just 5 positions (+0 changes in count) signals stability, avoiding the churn that plagues many funds.

The 40.0% turnover rate indicates meaningful activity quarter-over-quarter, suggesting Dalal Street actively refines its bets without abandoning its core thesis. With an average holding period of 4 quarters, the firm balances patience with adaptability, holding winners longer while trimming underperformers. This portfolio structure appeals to investors seeking to emulate focused strategies in volatile markets, where spreading bets too thin often dilutes returns.

Such concentration demands exceptional stock-picking skill, as there's little margin for error. Dalal Street's approach aligns with legendary value investors who argue that true edges come from understanding a few businesses intimately rather than superficial knowledge of many. Tracking this via ValueSense reveals how these metrics evolve, offering retail investors a window into professional-grade discipline.

Top Holdings Analysis: A Lean, High-Conviction Lineup

With only 5 positions comprising the entire portfolio and no specific holdings-with-changes or top 10 details disclosed in the latest 13F data, Dalal Street LLC's Q3 2025 structure highlights its unwavering commitment to selectivity. The absence of reported adjustments across these core bets reinforces a "buy and monitor" philosophy, where positions are sized for impact and held through market noise.

This ultra-compact setup—100% in 5 names—avoids the dilution of broader portfolios, allowing each holding to drive performance. While individual tickers like potential leaders in their sectors aren't itemized here, the overall weighting implies equal or near-equal distribution, typical for funds prioritizing balance within conviction plays. Investors following Dalal Street can infer a focus on resilient, undervalued names that withstand economic shifts, much like the firm's steady portfolio size suggests.

The lack of new buys or sells in the data points to confidence in the current lineup, with turnover reflecting prior-quarter dynamics now settled. This flowing composition sets Dalal Street apart, emphasizing quality over quantity in an era of index hugging.

What the Portfolio Reveals

Dalal Street LLC's portfolio unveils a clear strategy centered on extreme concentration for maximum impact. By limiting to 5 positions, the firm bets heavily on deep moats, likely favoring businesses with durable cash flows and defensible advantages.

Key themes include: - Quality over quantity: 100% top 10 allocation means no filler stocks—every position must earn its keep. - Moderate turnover discipline: 40.0% rate shows willingness to act on new information without excessive trading. - Longer-term orientation: 4-quarter average holding period prioritizes compounding over short-term momentum. - Risk via conviction: Small portfolio size amplifies winners but demands rigorous vetting, embodying high-conviction value investing.

This setup signals caution amid market uncertainty, focusing on stability rather than chasing growth sectors.

Portfolio Concentration Analysis

Since detailed top 10 holdings data is not available in the Q3 2025 filing breakdown, the portfolio's full concentration is captured in its 5-position structure, with top holdings representing 100.0%.

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| (Entire portfolio in 5 positions) | $336.9M | 100.0% | No detailed changes reported |

Dalal Street LLC's table-equivalent reveals total commitment to its picks, with no single position dominating beyond the collective 100% top allocation. This even spread across 5 names minimizes single-stock risk while maximizing focus, a smart risk management play for a $336.9M book.

The +0 portfolio size change underscores continuity, letting compounders breathe amid 40.0% turnover from earlier activity. Such concentration rewards patience, as small portfolios like this often outperform diversified peers when selection is sharp.

Investment Lessons from Dalal Street LLC

Dalal Street LLC's Q3 2025 portfolio demonstrates timeless principles for serious investors: - Embrace extreme concentration: With 100% in 5 positions, true edges shine—dilution is the enemy of superior returns. - Turnover as a tool, not a habit: 40.0% rate shows measured adjustments, preserving the average 4-quarter hold for compounding. - Size for conviction: Portfolio size of 5 +0 proves less is more when you know your circle of competence deeply. - Stability in selection: No net changes signal trust in core holdings, avoiding reactive trading in noisy markets. - Metrics matter: Track top 10 pct 100% and holding periods to gauge a manager's discipline over hype.

Looking Ahead: What Comes Next?

Dalal Street LLC's steady 5-position setup positions it well for opportunistic moves, especially with 40.0% turnover hinting at dry powder or readiness to pivot. In a market potentially facing rate shifts or sector rotations by late 2025, this lean structure allows nimble deployment into undervalued names overlooked by the crowd.

Expect focus on resilient sectors like those with strong balance sheets, as the firm's average hold suggests aversion to fads. Current positioning—100% concentrated—sets up for outsized gains if picks deliver, while the small size facilitates quick scaling into new ideas. ValueSense tracking will flag the next 13F for fresh opportunities.

FAQ about Dalal Street LLC Portfolio

Q: What does the 40.0% turnover indicate for Dalal Street LLC's Q3 2025 strategy?

A: The 40.0% turnover reflects active portfolio management, with adjustments made to optimize the 5 core positions without expanding the lineup, balancing conviction with adaptability.

Q: Why is Dalal Street LLC's portfolio so concentrated at 100.0% top 10 holdings?

A: Extreme concentration in just 5 positions (+0 change) enables high-conviction bets on thoroughly vetted businesses, a strategy that amplifies returns from superior picks while minimizing distraction.

Q: What sectors might Dalal Street LLC favor based on its structure?

A: While specific holdings aren't detailed, the ultra-focused 5-position portfolio likely targets undervalued, moat-heavy sectors like financials, industrials, or consumer staples that align with value principles.

Q: How can I track and follow Dalal Street LLC's portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/dalal-street for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!