Daniel Loeb - Third Point Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

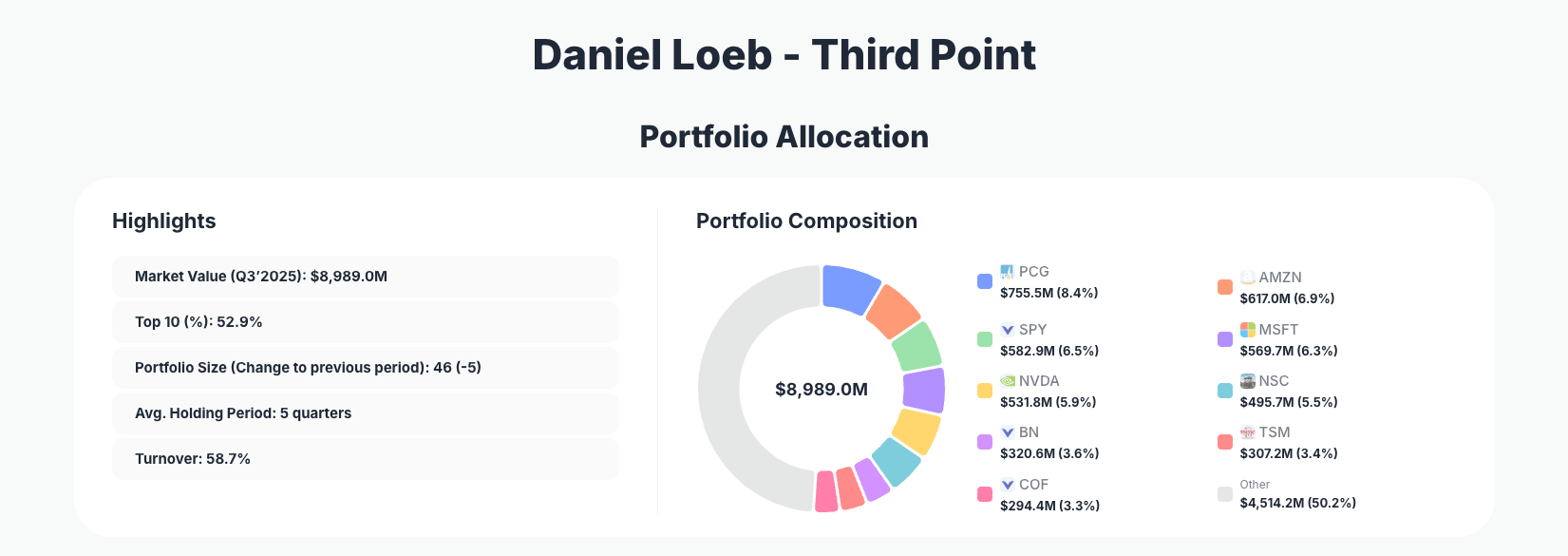

Daniel Loeb continues to run an event-driven, opportunistic playbook at Third Point, and his latest Q3’2025 13F shows a blend of high-conviction tech, restructuring plays, and tactical ETF exposure. His Third Point Q3 2025 portfolio now totals $8,989.0M in U.S. long equity positions, with a little over half of assets concentrated in the top 10 holdings—highlighting a willingness to size up best ideas while still turning over more than half the book in a typical year.

Portfolio Overview: Event-Driven Concentration with a Tech Tilt

Portfolio Highlights (Q3’2025):

- Market Value: $8,989.0M

- Top 10 Holdings: 52.9% of reported equity assets

- Portfolio Size: 46 positions (net -5 vs. prior quarter)

- Average Holding Period: 5 quarters

- Turnover: 58.7%

The Q3’2025 Third Point portfolio is moderately concentrated, with the top 10 names controlling 52.9% of assets while the fund still holds 46 positions overall. That mix reflects Daniel Loeb’s style: core high-conviction stakes—like PG&E and a cluster of mega-cap tech—surrounded by smaller, often more tactical positions that can be rotated as the event-driven opportunity set evolves.

A 58.7% turnover and an average 5-quarter holding period show that Loeb is far from a buy-and-forget investor. Instead, the Q3 moves—especially outsized additions to Microsoft, heavier exposure via the broad-market SPDR S&P 500 ETF, and active trimming of cyclicals and semis like Taiwan Semiconductor—underline a dynamic, macro-aware approach.

The reduction in total positions from 51 to 46 suggests subtle tightening of the idea roster. By pruning the tail and leaning into a mix of AI leaders, U.S. infrastructure plays, and select financials, the current Third Point book emphasizes scalable themes (AI, digital platforms) and idiosyncratic catalysts (regulated utilities, rail operators) over broad, unfocused diversification.

Top Holdings Analysis: Tech Leaders, Infrastructure, and Select Financials

The Q3’2025 portfolio’s most active changes are clustered within a set of 10 core names, with several additional top holdings rounding out the picture.

At the top of the change list, PG&E Corporation remains a cornerstone at 8.4% of assets, even after Daniel Loeb modestly reduced the stake by 1.96%. Investors can track this key restructuring and regulatory story via PG&E (PCG), where Third Point still holds 50,100,000 shares worth $755.5M.

On the growth side, mega-cap tech and platform businesses feature prominently. Amazon.com (AMZN) sits at 6.9% of the portfolio, with Loeb adding 3.69% during the quarter to 2,810,000 shares valued at $617.0M. Similarly, Microsoft (MSFT) is a standout: Third Point increased the position by 175.00% to 1,100,000 shares, now worth $569.7M and accounting for 6.3% of the portfolio—one of the fund’s clearest AI and cloud infrastructure bets.

To complement these single-name exposures, Loeb significantly ramped up broad-market beta via SPDR S&P 500 ETF TR, boosting the position by 75.00% to 875,000 shares for a $582.9M stake representing 6.5% of the book. While the ticker is reported as “_” on the 13F, it reflects a deliberate decision to use the S&P 500 ETF as a flexible, liquid tool for macro positioning and risk balancing.

AI hardware remains another core theme. NVIDIA (NVDA) is a 5.9% position, where Third Point added 1.79% to reach 2,850,000 shares valued at $531.8M. This incremental increase—on top of an already large base—signals ongoing conviction in NVIDIA’s role at the center of AI compute and data-center capex.

Beyond tech, Loeb initiated a new buy in U.S. rail infrastructure through Norfolk Southern (NSC), establishing a 5.5% position worth $495.7M across 1,650,000 shares. The simple “Buy” action in the filing suggests this is a fresh, high-conviction idea, likely tied to operational improvement and potential corporate governance catalysts—classic Third Point territory.

In alternatives and asset management, Brookfield Corporation (BN) stands at 3.6% of the portfolio with no change during the quarter, totaling 4,675,000 shares worth $320.6M. The unchanged allocation indicates steady confidence in Brookfield’s diversified real assets, infrastructure, and capital-light fee streams.

The fund did, however, trim exposure to key cyclical and rate-sensitive names. Taiwan Semiconductor (TSM) was reduced by 23.08% to 1,100,000 shares, now a 3.4% position worth $307.2M. Similarly, Capital One Financial (COF) was reduced by 23.23% to 1,385,000 shares, representing 3.3% and $294.4M. Both cuts suggest some profit-taking and risk management around semiconductors and consumer credit.

Among medium-sized, but fast-growing positions, Flutter Entertainment (FLUT) was added to by 4.67%. Third Point now holds 1,120,000 shares valued at $284.5M, a 3.2% allocation, reflecting continued confidence in the global online betting and iGaming trend. Likewise, Casey’s General Stores (CASY)—a U.S. convenience-store and fuel retailer—saw a sizable 38.89% addition to 500,000 shares worth $282.7M, now at 3.1% of the portfolio, indicating growing conviction in a defensive, cash-generative consumer compounder.

These 10–12 names—PG&E, Amazon, SPDR S&P 500, Microsoft, NVIDIA, Norfolk Southern, Brookfield, TSM, Capital One, Flutter, and Casey’s—form the core signal of Daniel Loeb’s Q3’2025 stance: structurally advantaged tech and platforms balanced with special situations, infrastructure upgrades, and selective financials.

What the Portfolio Reveals About Third Point’s Current Strategy

Several clear themes emerge from the Q3’2025 positioning:

- Scaling into dominant tech & AI platforms

Significant additions to Microsoft, NVIDIA, and a larger stake in Amazon show a deliberate tilt toward companies controlling key infrastructure layers in cloud, AI compute, and e-commerce ecosystems. - Blending idiosyncratic catalysts with macro tools

Positions like PG&E and Norfolk Southern offer company-specific catalysts (regulation, governance, operational turnarounds), while the amplified stake in the SPDR S&P 500 ETF gives Third Point a flexible lever to quickly adjust net equity exposure. - Selective de-risking in cyclicals and rate-sensitive sectors

Sharp reductions in Taiwan Semiconductor and Capital One suggest more caution around areas sensitive to global capex cycles and consumer credit quality, even as the fund doubles down on secular compounders. - Concentration with active rotation

With 52.9% of capital in the top 10 names and a turnover near 60%, the strategy is high-conviction but not static. Loeb is willing to move quickly—scaling winning themes, cutting risk where necessary, and introducing new catalysts like Norfolk Southern. - Balanced exposure across sectors and factors

The combination of utilities, tech, financials, infrastructure, and consumer defensives indicates an attempt to blend growth, quality, and event-driven upside, rather than making a single-factor macro bet.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| PG&E Corporation | $755.5M | 8.4% | Reduce 1.96% |

| Amazon.com, Inc. | $617.0M | 6.9% | Add 3.69% |

| SPDR S&P 500 ETF TR | $582.9M | 6.5% | Add 75.00% |

| Microsoft Corporation | $569.7M | 6.3% | Add 175.00% |

| NVIDIA Corporation | $531.8M | 5.9% | Add 1.79% |

| Norfolk Southern Corporation | $495.7M | 5.5% | Buy |

| Brookfield Corporation | $320.6M | 3.6% | No change |

| Taiwan Semiconductor Manufacturing Company Limited | $307.2M | 3.4% | Reduce 23.08% |

| Capital One Financial Corporation | $294.4M | 3.3% | Reduce 23.23% |

The table underscores how tightly the portfolio is anchored around a handful of names. Just three positions—PG&E, Amazon, and the SPDR S&P 500 ETF—collectively account for nearly 22% of the overall book, while the top six reach well over one-third of assets. This level of concentration means each security can meaningfully drive overall performance, especially high-beta tech and AI plays like MSFT and NVDA.

At the same time, Third Point spreads risk across different drivers: regulated utilities (PCG), mega-cap platforms (AMZN, MSFT), AI hardware (NVDA), industrial infrastructure (NSC), asset management (BN), semis (TSM), and consumer credit (COF). The sizable ETF allocation further dampens stock-specific risk while allowing Loeb to maintain market exposure as he rotates among individual opportunities.

Investment Lessons from Daniel Loeb’s Third Point Strategy

- Concentrate where you have an edge

Third Point’s top positions command large slices of the portfolio. When Loeb has a strong thesis—such as on PG&E or Microsoft—he is willing to size them meaningfully rather than spreading capital thinly. - Let themes compound, but adjust sizing aggressively

Q3 shows both aggressive additions (175.00% more MSFT, 75.00% more S&P 500 ETF) and sharp cuts (over 23% reductions in TSM and COF). Position sizing is treated as an active risk-management and return-enhancement lever, not something set once and forgotten. - Blend secular growth with special situations

Loeb pairs long-duration compounding stories—like AMZN, NVDA, and FLUT—with event-driven or restructuring opportunities in names such as PCG and NSC. Retail investors can learn to look for both types of setups rather than only chasing “growth” or only “deep value.” - Use ETFs as strategic tools, not just passive investments

The expanded SPDR S&P 500 ETF allocation shows how a fundamentally driven hedge fund still uses index products to manage exposures, bridge between ideas, or quickly shift net market exposure. Individual investors can similarly deploy ETFs to complement stock-picking. - Maintain flexibility through moderate holding periods

An average holding period of 5 quarters strikes a balance: long enough to let theses play out, but short enough to avoid anchoring on outdated views. For personal portfolios, that suggests regularly revisiting theses as fundamentals and valuations evolve.

Looking Ahead: What Comes Next for Third Point?

Based on the current Q3’2025 positioning, several implications emerge for the road ahead:

- Room to add or hedge via ETFs

With a sizable SPDR S&P 500 ETF stake already in place, Loeb can efficiently scale net long or trim exposure without touching core single-name positions, depending on macro data, rates, and earnings trends. - Potential for further rotation within tech and semis

The combination of adding to MSFT and NVDA while reducing TSM hints at a preference for U.S.-listed software and AI infrastructure platforms over more cyclical or geopolitically exposed chip manufacturing. - Watch for activism and governance angles

Fresh buys like Norfolk Southern and large, enduring stakes like PG&E are classic candidates where Loeb might engage with boards or management teams to unlock value—often through operational improvements, capital allocation changes, or strategic reviews. - Continued emphasis on resilient cash-flow generators

Additions to Casey’s General Stores and steady conviction in Brookfield suggest an awareness of the need for durable, cash-rich businesses that can weather volatility even as the fund leans into growth and AI.

Investors watching the next 13F will want to see whether Third Point continues scaling its AI and platform bets, expands activist campaigns in industrials and utilities, or further reshapes financial and cyclical exposure as macro conditions evolve.

FAQ about Daniel Loeb – Third Point Portfolio

Q: What were the most significant portfolio changes for Third Point in Q3’2025?

A: Key moves included a 175.00% increase in Microsoft, a 75.00% increase in the SPDR S&P 500 ETF exposure, incremental additions to Amazon, NVIDIA, Flutter Entertainment, and Casey’s General Stores, plus notable reductions in Taiwan Semiconductor and Capital One.

Q: How concentrated is Daniel Loeb’s portfolio?

A: As of Q3’2025, about 52.9% of the Third Point portfolio is in the top 10 positions, with 46 total holdings. That means performance is driven primarily by a relatively small group of high-conviction ideas.

Q: What role does activism play in Third Point’s positions?

A: While not every holding is activist, many large stakes—such as in regulated utilities or industrials like PG&E and Norfolk Southern—fit Third Point’s history of engaging management and boards to unlock value through operational improvements, capital allocation changes, or strategic alternatives.

Q: Which sectors and themes does Third Point favor right now?

A: Q3’2025 positioning emphasizes mega-cap tech and AI (AMZN, MSFT, NVDA), infrastructure and utilities (PCG, NSC), financials and asset managers (COF, BN), and consumer & gaming (FLUT, CASY).

Q: How does the 45-day lag in 13F filings affect following Daniel Loeb’s trades?

A: U.S. 13F filings are typically released up to 45 days after quarter-end, so the Q3’2025 report shows positions as of that date, not necessarily real-time holdings. Investors should treat 13F data as a strategic roadmap, not a precise trading signal, and use platforms like ValueSense to track how the Third Point portfolio has evolved over time.

Q: How can I track and follow Third Point’s portfolio going forward?

A: You can monitor Daniel Loeb’s holdings via quarterly 13F filings and by using ValueSense’s superinvestor tracker at Third Point’s portfolio, which provides updated holdings, historical changes, and visualizations of sector and position-level exposure.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!