Data-Driven Value Investing: Why Fundamentals Still Matter in 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

In an era dominated by momentum trading and speculative investments, fundamental analysis continues to identify compelling investment opportunities that algorithmic screening can uncover. Our recent market analysis demonstrates that systematic value investing approaches, enhanced by modern data analytics, are producing significant alpha generation opportunities.

Market Leadership Through Diversified Revenue Streams

Microsoft Corporation (NASDAQ: MSFT) exemplifies how diversified technology companies are achieving sustainable growth across multiple business segments. Our analysis of Microsoft's quarterly revenue data reveals strong performance across three key divisions:

- Productivity & Business Processes: Demonstrating resilience in enterprise software adoption

- Intelligent Cloud: Capitalizing on accelerated digital transformation trends

- More Personal Computing: Maintaining market position despite competitive pressures

The company's trajectory toward a $4 trillion market capitalization reflects fundamental strength rather than speculative momentum, supported by robust recurring revenue streams and expanding market presence.

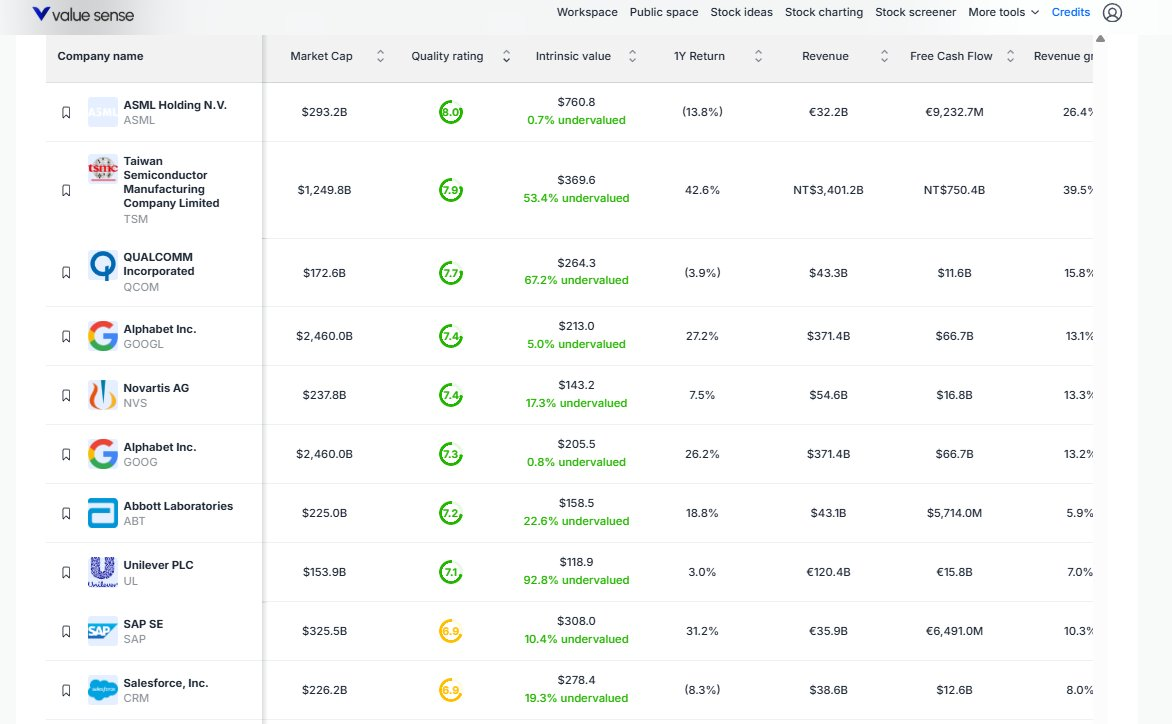

Quantitative Screening Results: High-Quality Undervalued Securities

Our proprietary screening methodology has identified several securities trading below calculated intrinsic values while maintaining strong quality metrics:

Quality Value Opportunities

- ASML Holding N.V. (NASDAQ: ASML) - Semiconductor manufacturing equipment leader

- Taiwan Semiconductor (NYSE: TSM) - Global foundry market leader

- QUALCOMM Incorporated (NASDAQ: QCOM) - Wireless technology and 5G infrastructure

- Alphabet Inc. (NASDAQ: GOOGL) - Search market dominance with AI integration potential

- Novartis AG (NYSE: NVS) - Pharmaceutical innovation and pipeline strength

- Abbott Laboratories (NYSE: ABT) - Medical devices and diagnostics leadership

- Unilever PLC (NYSE: UL) - Consumer goods market stability

- SAP SE (NYSE: SAP) - Enterprise resource planning software

- Salesforce, Inc. (NYSE: CRM) - Customer relationship management platform leader

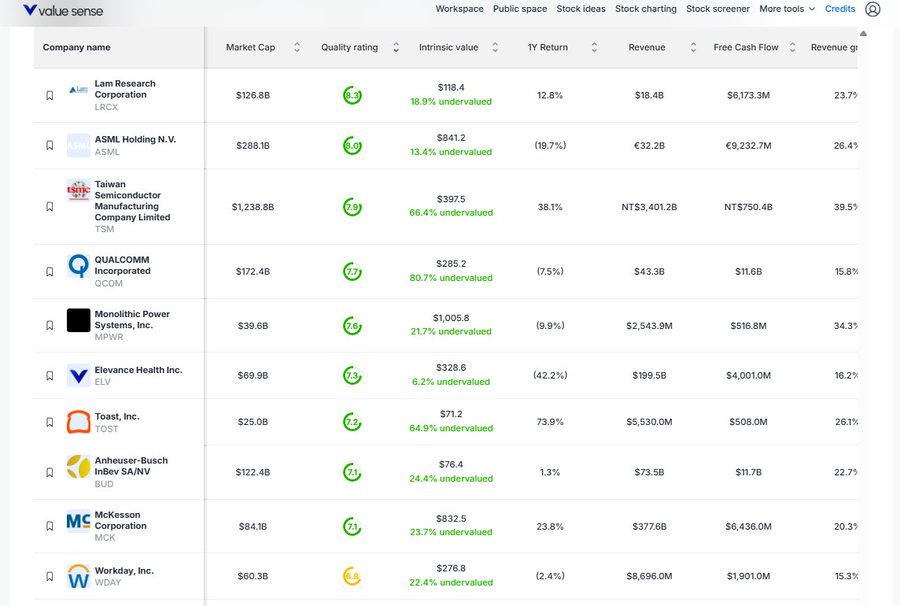

Growth-Value Convergence Opportunities

- Lam Research Corporation (NASDAQ: LRCX) - Semiconductor equipment manufacturing

- Monolithic Power Systems (NASDAQ: MPWR) - Power management solutions

- Elevance Health Inc. (NYSE: ELV) - Healthcare services and managed care

Large-Cap Technology Assessment: Quality Rankings

Our fundamental analysis framework evaluates the "Magnificent Seven" technology stocks based on quality metrics rather than market momentum:

- NVIDIA Corporation (NASDAQ: NVDA) - AI semiconductor leadership and competitive moats

- Meta Platforms Inc. (NASDAQ: META) - Social media network effects and metaverse positioning

- Microsoft Corporation (NASDAQ: MSFT) - Cloud infrastructure and productivity software dominance

- Alphabet Inc. (NASDAQ: GOOGL) - Search market position and emerging AI capabilities

- Apple Inc. (NASDAQ: AAPL) - Premium consumer ecosystem and brand loyalty

- Tesla, Inc. (NASDAQ: TSLA) - Electric vehicle market leadership and energy storage

- Amazon.com Inc. (NASDAQ: AMZN) - E-commerce infrastructure and cloud services

Strategic Investment Implications

Recent market activity demonstrates that systematic value identification remains effective when enhanced with quantitative analytics. Notable developments include:

Institutional Activity: Recent significant position increases by established investment managers in healthcare and technology sectors suggest continued confidence in fundamental analysis approaches.

Valuation Convergence: Our models indicate several securities where current market prices represent substantial discounts to calculated fair value estimates, creating potential alpha generation opportunities.

Research Methodology and Risk Considerations

Our analysis employs multi-factor screening incorporating:

- Discounted cash flow modeling

- Relative valuation metrics

- Quality score assessments

- Financial strength indicators

- Competitive positioning analysis

Important Considerations: All investment analysis should incorporate individual risk tolerance, investment objectives, and comprehensive due diligence. Past performance does not guarantee future results, and all investments carry inherent risks.

Key Takeaways

- Systematic Approach: Quantitative screening continues to identify compelling opportunities

- Quality Focus: Emphasis on sustainable competitive advantages and strong fundamentals

- Diversification Benefits: Opportunities exist across multiple sectors and market capitalizations

- Long-term Perspective: Patient capital deployment based on fundamental analysis rather than market timing

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Leopold Aschenbrenner's AI Revolution Portfolio

📖 How to Download Complete Stock Financial Data in Seconds

📖 11 Best Multibagger Stocks with Heavy Moats