David Abrams - Abrams Capital Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

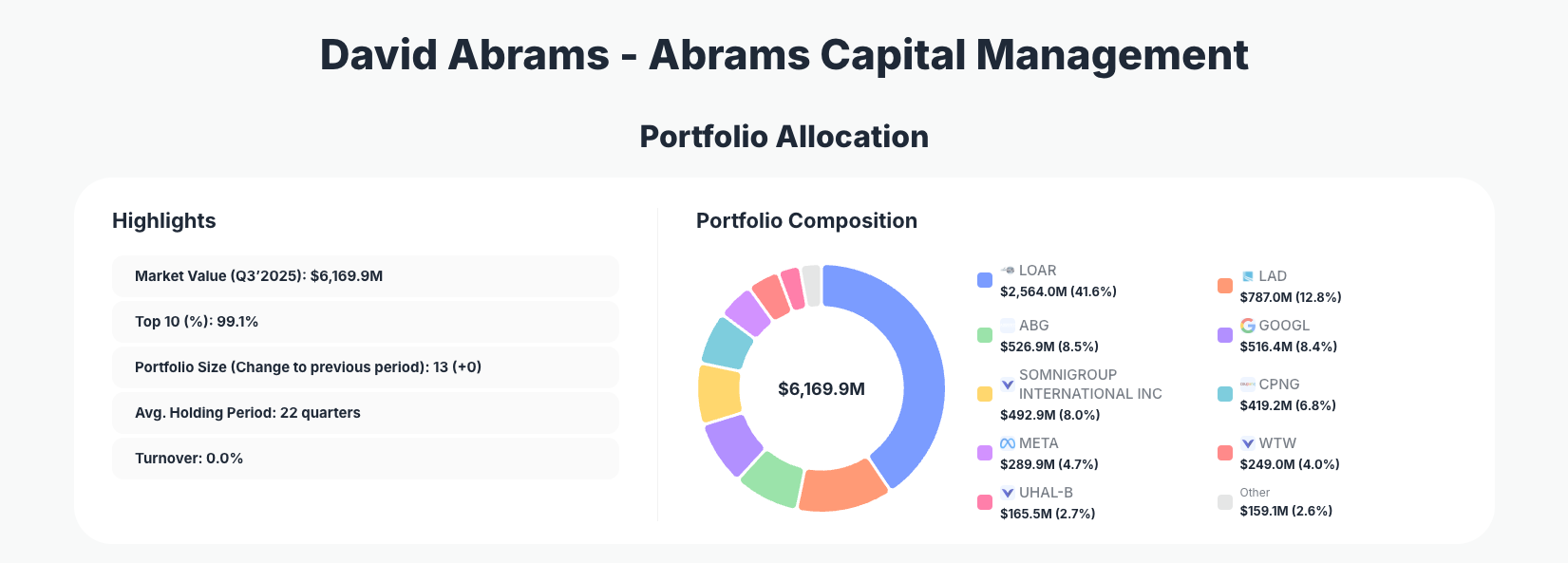

David Abrams - Abrams Capital Management continues to exemplify patient, high-conviction value investing. His Q3’2025 portfolio shows a remarkably stable $6.17B collection of just 13 positions, dominated by a handful of core holdings and only incremental additions to select names—underscoring a strategy built on long holding periods and disciplined concentration.

Portfolio Overview: Concentration as a Competitive Edge

Portfolio Highlights (Q3 2025): - Market Value: $6,169.9M

- Top 10 Holdings: 99.1%

- Portfolio Size: 13 +0

- Average Holding Period: 22 quarters

- Turnover: 0.0%

The Abrams Capital portfolio is an extreme example of concentration: 99.1% of assets are invested in the top 10 positions, with only 13 holdings in total. That structure signals deep conviction in a small set of ideas rather than broad diversification for its own sake.

Zero reported turnover in Q3’2025 reinforces that Abrams Capital’s portfolio is managed with a genuine long-term mindset. With an average holding period of 22 quarters (5.5 years), the firm is clearly willing to sit through volatility when it believes the underlying thesis and valuation remain intact.

Another notable aspect of the Q3’2025 portfolio is the dominance of a few sizable positions, led by Loar Holdings Inc. and a cluster of sizable bets in auto retail, big tech, e-commerce, and specialized business services. The mix suggests a value-oriented approach that still embraces scalable, asset-light or structurally advantaged franchises where upside can compound over many years.

Top Holdings Snapshot: Core Bets and Selective Additions

The most meaningful changes this quarter came from two existing holdings where Abrams increased exposure:

The firm added modestly to Lithia Motors, Inc. (LAD), which now sits at 12.8% of the portfolio with $787.0M invested and an “Add 1.88%” action. This move strengthens an already large position and underscores ongoing conviction in Lithia’s scale, dealership footprint, and consolidation runway within auto retail.

Similarly, Asbury Automotive Group, Inc. (ABG) was increased by “Add 2.23%” to 8.5% of the portfolio, worth $526.9M. Grouping LAD and ABG together highlights Abrams’ strong thematic belief in scaled dealership operators as structurally advantaged players in a cyclical industry.

The single largest position is Loar Holdings Inc. (ticker reported as LOAR) at 41.6% of the portfolio and $2,564.0M in value, marked as “No change.” This enormous allocation—over two-fifths of the entire portfolio—illustrates how concentrated Abrams Capital’s holdings can become when the team has high confidence in the underlying business and its long-term runway.

Big tech exposure comes through Alphabet Inc. (GOOGL), representing 8.4% of the portfolio with $516.4M and “No change.” Maintaining this substantial stake despite market volatility suggests Abrams views Google’s core search and cloud franchises as durable, cash-generative assets rather than short-term trading vehicles.

SOMNIGROUP INTERNATIONAL INC (ticker reported as “_”) accounts for 8.0% of the portfolio at $492.9M with “No change,” indicating another large, stable position where conviction remains high. Likewise, Coupang, Inc. (CPNG) contributes 6.8% and $419.2M to the portfolio, also with “No change,” reflecting a willingness to own a leading e-commerce platform with long-term growth potential.

Mega-cap social platform exposure appears via Meta Platforms, Inc. (META) at 4.7% and $289.9M, again with “No change.” This suggests Abrams is comfortable holding a mature digital advertising and social network franchise alongside more traditional value names.

The portfolio also includes sizeable allocations to WILLIS TOWERS WATSON PLC LTD (4.0%, $249.0M, “No change”) and U HAUL HOLDING COMPANY (2.7%, $165.5M, “No change”), rounding out a collection of concentrated bets in established, often cash-generative businesses. Together, these positions demonstrate how the firm blends high-growth platforms, entrenched service providers, and capital-efficient compounders within a tight set of ideas.

Overall, while only two positions—LAD and ABG—saw incremental additions this quarter, the sheer size of existing holdings speaks louder than activity. Stability, not trading, is the defining feature of this 13F snapshot.

What the Portfolio Reveals About Abrams Capital’s Strategy

Several strategic themes emerge from the Q3’2025 positioning:

- Extreme conviction and concentration

With 99.1% of capital in the top 10 names and a 41.6% weight in Loar Holdings Inc., Abrams is clearly comfortable running a non-diversified, conviction-driven book. This approach leans on deep due diligence and a willingness to let winners grow into dominant allocations. - Blend of value, quality, and scale

Positions such as Lithia Motors, Asbury, and U HAUL HOLDING COMPANY point to a classic value lens focused on cash flows and asset backing, while holdings in Alphabet, Coupang, and Meta add exposure to scalable, network-effect businesses. - Long-duration ownership mindset

An average holding period of 22 quarters and 0.0% turnover confirm that this 13F is not about quarter-to-quarter timing. Instead, Abrams appears to underwrite multi-year or even decade-long theses and tolerates short-term price swings. - Risk managed through understanding, not diversification

Rather than owning dozens of small positions, the Abrams Capital portfolio manages risk by owning businesses the team understands deeply and by size-weighting positions according to conviction and downside analysis.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Loar Holdings Inc. | $2,564.0M | 41.6% | No change |

| Lithia Motors, Inc. (LAD) | $787.0M | 12.8% | Add 1.88% |

| Asbury Automotive Group, Inc. (ABG) | $526.9M | 8.5% | Add 2.23% |

| Alphabet Inc. (GOOGL) | $516.4M | 8.4% | No change |

| SOMNIGROUP INTERNATIONAL INC | $492.9M | 8.0% | No change |

| Coupang, Inc. (CPNG) | $419.2M | 6.8% | No change |

| Meta Platforms, Inc. (META) | $289.9M | 4.7% | No change |

| WILLIS TOWERS WATSON PLC LTD | $249.0M | 4.0% | No change |

| U HAUL HOLDING COMPANY | $165.5M | 2.7% | No change |

The table highlights just how top-heavy the Abrams Capital portfolio truly is. Loar Holdings Inc. alone accounts for more than the combined weight of the next three positions, creating a “barbell” where one dominant stake is complemented by a cluster of sizable yet comparatively smaller bets.

Beyond the top name, weights fall into a relatively tight band between 2.7% and 12.8%, showing deliberate sizing around a core group of ideas. The only recorded changes—small additions to LAD and ABG—suggest fine-tuning rather than a wholesale shift in strategy, reinforcing the view that Q3’2025 was about staying the course rather than repositioning.

Investment Lessons from David Abrams’ Approach

- Concentrate when conviction is high

A 41.6% position in Loar Holdings Inc. illustrates that when Abrams finds a truly exceptional idea, he is willing to size it aggressively instead of capping exposure arbitrarily. - Hold long enough for the thesis to play out

With a 22-quarter average holding period and 0.0% turnover, the portfolio shows that edge often comes from patience—letting intrinsic value compound rather than trading around market noise. - Mix traditional value with scalable franchises

Owning auto dealers like Lithia Motors and Asbury alongside digital giants like Alphabet, Coupang, and Meta demonstrates that value investing today can include both asset-heavy and asset-light compounders. - Use incremental changes to refine risk-reward

The “Add 1.88%” and “Add 2.23%” moves in LAD and ABG suggest small, deliberate adjustments rather than large, reactive trades—an approach that helps keep decisions anchored in valuation and fundamentals. - Understand businesses deeper than the market narrative

Sustaining large, steady positions through volatility implies that Abrams is guided more by internal estimates of intrinsic value than by headline sentiment, a mindset individual investors can emulate with disciplined research.

Looking Ahead: What Comes Next for Abrams Capital?

Given 0.0% turnover and only incremental additions to existing holdings, the current Abrams Capital portfolio appears positioned for continuity rather than major change. With 13 positions and nearly all capital in the top 10, the firm still has room to introduce new ideas if markets dislocate, but the emphasis is clearly on letting current holdings compound.

Future developments to watch include:

- Whether the already massive Loar Holdings Inc. allocation is trimmed if it continues to outperform, or allowed to grow further.

- Additional scaling into or out of the auto retail theme via LAD and ABG as industry conditions evolve.

- Any new positions that might modestly diversify the book or introduce fresh growth vectors alongside existing tech and e-commerce exposure.

For investors following Abrams’ style, the takeaway is clear: expect gradual, thesis-driven adjustments rather than rapid trading, and use each new 13F to track how conviction evolves over time.

FAQ about David Abrams – Abrams Capital Portfolio

Q: What were the main changes in Abrams Capital’s Q3 2025 portfolio?

A: The only reported changes in Q3’2025 were incremental additions to two existing positions: Lithia Motors, Inc. (LAD) with an “Add 1.88%” action and Asbury Automotive Group, Inc. (ABG) with an “Add 2.23%.” All other top holdings were marked “No change,” and overall turnover was 0.0%.

Q: How concentrated is the Abrams Capital portfolio?

A: Extremely concentrated. There are 13 positions in total, and 99.1% of assets sit in the top 10 holdings, with Loar Holdings Inc. alone representing 41.6% of the portfolio’s reported market value.

Q: What is Abrams Capital’s typical holding period?

A: The average holding period is 22 quarters, or about 5.5 years. This long-duration ownership underscores a value-driven philosophy focused on intrinsic value growth rather than short-term price moves.

Q: Which sectors or themes stand out in the current holdings?

A: Key themes include auto retail via Lithia Motors and Asbury, digital platforms and advertising via Alphabet and Meta, and e-commerce through Coupang, complemented by specialized service and infrastructure-type holdings such as WILLIS TOWERS WATSON PLC LTD and U HAUL HOLDING COMPANY.

Q: How can I track David Abrams’ latest portfolio moves?

A: Abrams Capital’s long equity positions are disclosed quarterly in 13F filings, which are typically released up to 45 days after each quarter-end. You can track these filings and see historical holdings, changes, and visualizations using ValueSense’s superinvestor tracker for Abrams Capital at https://valuesense.io/superinvestors/abrams-capital.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!