David Katz - Matrix Asset Advisors Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

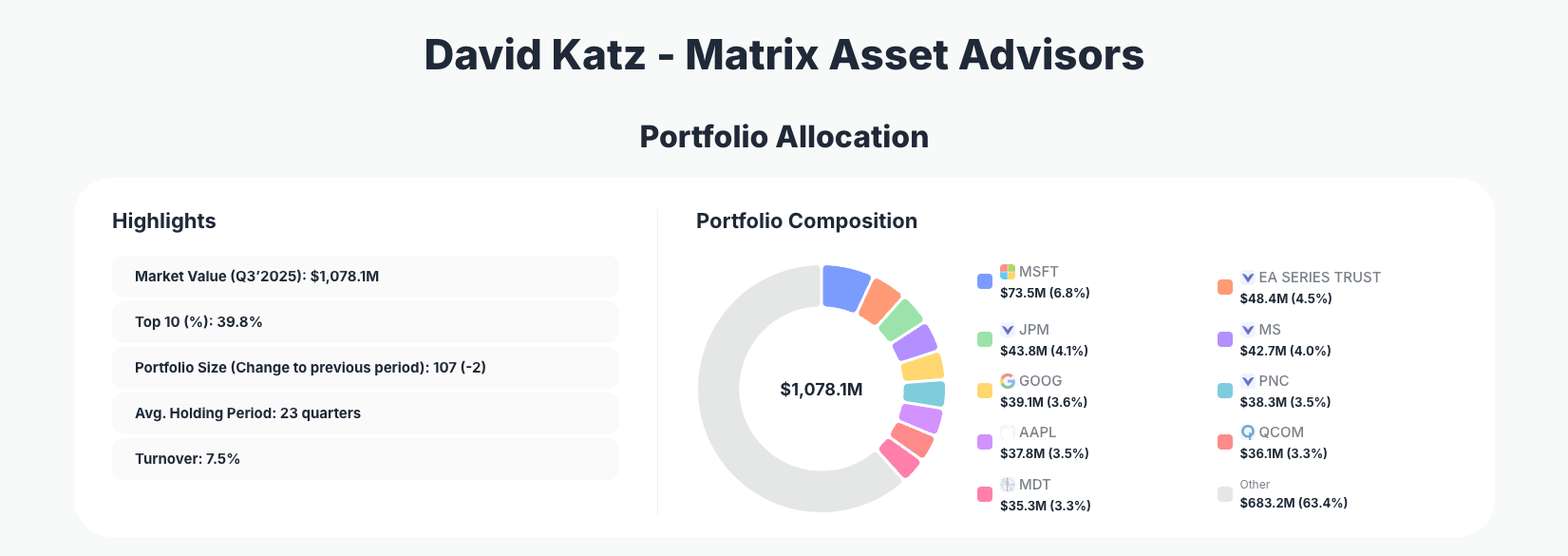

David Katz of Matrix Asset Advisors demonstrates disciplined portfolio management through measured adjustments in his latest 13F filing. His $1.08B portfolio maintains a broad yet focused approach across 107 positions, with low turnover signaling confidence in core holdings amid market volatility.

Portfolio Snapshot: Diversified Discipline with Long-Term Conviction

Portfolio Highlights (Q3 2025): - Market Value: $1,078.1M - Top 10 Holdings: 39.8% - Portfolio Size: 107 -2 - Average Holding Period: 23 quarters - Turnover: 7.5%

Matrix Asset Advisors' Q3 2025 portfolio exemplifies a balanced strategy, with the top 10 holdings representing less than 40% of the total value despite managing over $1 billion. This diversification across 107 positions—down by two from the prior quarter—contrasts with more concentrated superinvestor approaches, suggesting Katz prioritizes risk mitigation while maintaining meaningful stakes in high-quality names. The impressively low 7.5% turnover rate underscores a buy-and-hold philosophy, reinforced by an average holding period of 23 quarters, or nearly six years.

This structure allows for tactical adjustments without disrupting long-term conviction. Recent changes, primarily small adds and reduces in the top tier, indicate fine-tuning rather than wholesale shifts, positioning the portfolio to navigate economic uncertainty. Investors tracking Katz via ValueSense's superinvestor tools can appreciate how this measured approach has sustained performance through varying market cycles.

The portfolio's scale at $1,078.1M reflects institutional-grade execution, with subtle moves like adds in financials and healthcare signaling opportunistic value hunting. This contrasts with high-turnover strategies, highlighting Katz's edge in patience and selectivity.

Top Holdings Breakdown: Tech Giants Meet Financial Stability and Healthcare Bets

The portfolio's upper echelon features active management, starting with Microsoft Corporation (MSFT) at 6.8% after a minor Reduce 0.14%, holding 141,930 shares worth $73.5M. EA SERIES TRUST (_) follows at 4.5% with an Add 0.44% to 414,268 shares valued at $48.4M, showing conviction in this ETF-like exposure. Financial heavyweights dominate next, as JPMorgan Chase & Co. (JPM) sits at 4.1% following a Reduce 0.29% (138,783 shares, $43.8M), while Morgan Stanley (MS) holds 4.0% after Reduce 0.40% (268,428 shares, $42.7M).

Tech exposure continues with Alphabet Inc. (GOOG) at 3.6%, trimmed by Reduce 1.68% to 160,604 shares $39.1M, alongside steadier names like The PNC Financial Services Group, Inc. (PNC) at 3.5% via Add 0.08% (190,412 shares, $38.3M). Apple Inc. (AAPL) maintains 3.5% with a tiny Reduce 0.02% (148,549 shares, $37.8M), while bold moves shine in QUALCOMM Incorporated (QCOM) at 3.3% after a significant Add 4.48% (217,037 shares, $36.1M). Healthcare enters via Medtronic plc (MDT) at 3.3% with Add 0.39% (370,609 shares, $35.3M), and US BANCORP DEL (_) at 3.2% following Add 0.26% (715,764 shares, $34.6M).

These adjustments blend tech stalwarts with financial resilience and selective growth in semiconductors and medtech, reflecting a portfolio that trims winners modestly while building undervalued opportunities.

What the Portfolio Reveals About Katz's Strategy

Matrix Asset Advisors' moves signal a quality-focused, sector-agnostic approach emphasizing resilient businesses with strong balance sheets.

- Quality over speculative growth: Reductions in mega-caps like MSFT, GOOG, and AAPL suggest profit-taking on valuations, paired with adds in steady earners like PNC and MDT.

- Sector focus on cyclicals with moats: Heavy financials (JPM, MS, PNC) indicate banking sector optimism, complemented by tech (MSFT, GOOG, QCOM) and healthcare (MDT).

- Risk management through diversification: 107 holdings and 39.8% top-10 concentration balance conviction with broad exposure, minimizing single-stock risk.

- Low-turnover patience: 7.5% turnover and 23-quarter holds prioritize compounding over trading.

This reveals a defensive yet opportunistic stance, favoring dividend payers and cash generators amid potential rate shifts.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Microsoft Corporation (MSFT) | $73.5M | 6.8% | Reduce 0.14% |

| EA SERIES TRUST (_) | $48.4M | 4.5% | Add 0.44% |

| JPMorgan Chase & Co. (JPM) | $43.8M | 4.1% | Reduce 0.29% |

| Morgan Stanley (MS) | $42.7M | 4.0% | Reduce 0.40% |

| Alphabet Inc. (GOOG) | $39.1M | 3.6% | Reduce 1.68% |

| The PNC Financial Services Group, Inc. (PNC) | $38.3M | 3.5% | Add 0.08% |

| Apple Inc. (AAPL) | $37.8M | 3.5% | Reduce 0.02% |

| QUALCOMM Incorporated (QCOM) | $36.1M | 3.3% | Add 4.48% |

| Medtronic plc (MDT) | $35.3M | 3.3% | Add 0.39% |

The table underscores moderate concentration, with no single holding exceeding 7% and the top 10 capturing just 39.8% of the $1,078.1M portfolio. This setup allows impactful positions without over-reliance, as seen in the largest reduce on GOOG 1.68% versus aggressive QCOM build 4.48%. Financials comprise over 11% of the top 10, signaling sector preference.

Such balance supports steady performance, with low turnover enabling Katz to exploit mispricings—like QCOM's add—while trimming extended names. For followers, this highlights the value of monitoring subtle shifts in diversified portfolios via tools like ValueSense.

Investment Lessons from David Katz's Matrix Asset Approach

- Embrace measured diversification: 107 holdings with 39.8% top-10 concentration prove broad exposure can coexist with conviction, reducing volatility without diluting returns.

- Prioritize long holding periods: 23 quarters average shows patience compounds winners; avoid chasing short-term noise.

- Fine-tune with precision: Small adds/reduces (e.g., QCOM +4.48%, GOOG -1.68%) demonstrate position sizing as an ongoing discipline, not revolution.

- Favor quality moats in cycles: Bets on financials (JPM, PNC) and tech (MSFT, QCOM) target durable cash flows over hype.

- Low turnover builds edge: 7.5% rate minimizes taxes and fees, letting intrinsic value drive decisions.

Looking Ahead: What Comes Next?

With positions trimmed in tech giants and built in financials/semiconductors, Katz appears positioned for a softening rate environment favoring banks and cyclicals. The portfolio's two-position reduction hints at cash deployment opportunities in undervalued industrials or consumer staples if markets correct. Low 7.5% turnover suggests limited near-term fireworks, but adds like QCOM and MDT point to AI/healthcare tailwinds.

Market conditions—potential Fed cuts and election uncertainty—align with financial overweight, setting up for dividend yields and buybacks. Track via Matrix Asset's ValueSense page for Q4 signals.

FAQ about David Katz - Matrix Asset Advisors Portfolio

Q: What are the most significant changes in David Katz's Q3 2025 portfolio?

A: Key moves include a notable Add 4.48% to QCOM 3.3%, Reduce 1.68% in GOOG 3.6%, and smaller tweaks like Add 0.44% to EA SERIES TRUST and Reduce 0.14% in MSFT. These reflect tactical profit-taking and opportunity capture.

Q: Why does Matrix Asset Advisors maintain such a large number of positions?

A: The 107 holdings (39.8% top-10 concentration) balance risk across quality names, enabling low 7.5% turnover and 23-quarter holds. This diversified strategy suits navigating volatility while capturing sector rotations.

Q: What sectors does Katz favor in this portfolio?

A: Financials (JPM, MS, PNC ~11.6% of top 10), tech (MSFT, GOOG, AAPL, QCOM), and healthcare (MDT) dominate, signaling bets on resilient moats amid economic shifts.

Q: How can I track David Katz's Matrix Asset Advisors portfolio?

A: Follow quarterly 13F filings on the SEC site (45-day lag post-quarter-end) or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/matrix-asset for visualizations, change alerts, and historical data.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!