David Rolfe - Wedgewood Partners Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

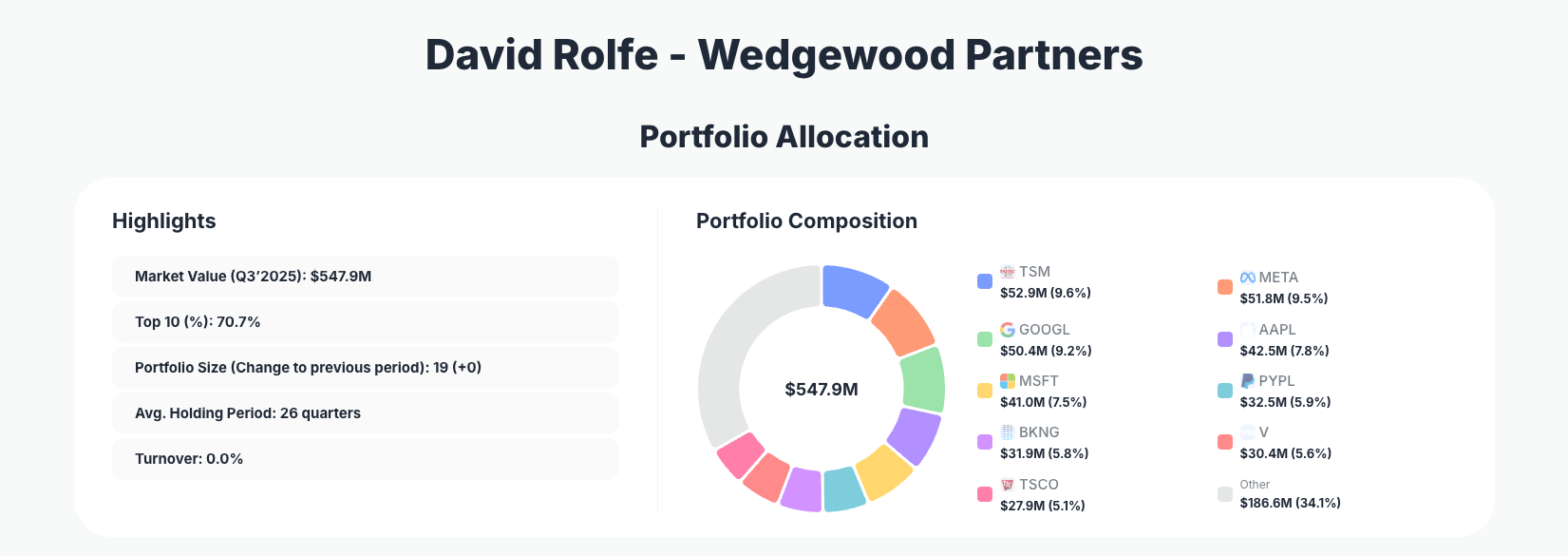

David Rolfe of Wedgewood Partners continues to showcase his disciplined growth-at-a-reasonable-price strategy through active position management. His $547.9M portfolio in Q3 2025 features notable adjustments across tech heavyweights, with nine adds averaging over 3% and a single reduction in a key semiconductor name, all while maintaining ultra-low turnover in a 19-position book.

Portfolio Overview: Concentration with Precision Tweaks

Portfolio Highlights (Q3’2025): - Market Value: $547.9M - Top 10 Holdings: 70.7% - Portfolio Size: 19 +0 - Average Holding Period: 26 quarters - Turnover: 0.0%

Wedgewood Partners' portfolio exemplifies focused conviction investing, where the top 10 holdings command over 70% of assets despite a total of 19 positions. This concentration underscores Rolfe's philosophy of betting big on high-quality growth businesses he understands deeply, avoiding dilution across too many names. The zero turnover rate paired with a 26-quarter average holding period signals patience, with changes limited to fine-tuning rather than wholesale shifts.

Recent moves reveal tactical agility amid market volatility: heavy additions to mega-cap tech leaders like META and MSFT, balanced by a trim in TSM. At just 0.0% turnover, the Q3 2025 portfolio prioritizes long-term compounding over frequent trading, a hallmark of Rolfe's approach that has delivered strong historical returns for patient investors.

This structure—concentrated yet stable—positions Wedgewood to capture upside in resilient tech while managing risk through proven winners. Tracking these metrics on the superinvestor page highlights how Rolfe adapts without abandoning core principles.

Top Holdings: Tech Dominance with Bold Additions

The Wedgewood Partners portfolio leads with Taiwan Semiconductor Manufacturing Company Limited (TSM) at 9.6% $52.9M, though Rolfe reduced this stake by 4.16%—likely taking profits after strong performance in the chip sector. Doubling down on social media and AI, Meta Platforms, Inc. (META) rose to 9.5% $51.8M via a 3.31% add, signaling confidence in its advertising moat and metaverse pivot.

Alphabet Inc. (GOOGL) at 9.2% $50.4M saw a 2.95% increase, reinforcing exposure to search and cloud dominance. Apple Inc. (AAPL) (7.8%, $42.5M) got a 3.11% boost, maintaining ecosystem stickiness as a core bet. Microsoft Corporation (MSFT) climbed to 7.5% $41.0M with a 3.40% add, betting on Azure and AI synergies.

Fintech and consumer plays round out the action: PayPal Holdings, Inc. (PYPL) (5.9%, $32.5M) added 4.04%, eyeing recovery potential; Booking Holdings Inc. (BKNG) (5.8%, $31.9M) gained 4.33% on travel rebound; Visa Inc. (V) (5.6%, $30.4M) increased 4.11% for payment network durability; and Tractor Supply Company (TSCO) (5.1%, $27.9M) rose 3.63% as a rural lifestyle outlier. Beyond the top 10, Motorola Solutions, Inc. (MSI) at 4.8% $26.3M received a 3.54% add, diversifying into mission-critical communications.

These 11 positions with changes dominate the narrative, blending Big Tech stability with selective growth names, all hyperlinked for deeper dives on ValueSense ticker pages.

What the Portfolio Reveals

David Rolfe's Q3 moves paint a clear picture of quality growth bias in a high-valuation environment: - Tech Sector Focus: Over 60% implied in top holdings, emphasizing AI enablers like semiconductors (TSM), cloud (MSFT), and platforms (META, GOOGL). - Payments and Consumer Resilience: Adds to PYPL, V, BKNG, and TSCO highlight durable moats in fintech and niche retail. - Risk Management via Trims: The TSM reduction tempers semiconductor cyclicality while amplifying U.S.-centric tech. - Long-Horizon Conviction: 26-quarter holds and 0.0% turnover favor compounding over speculation.

Geographic tilt leans U.S. mega-caps with selective international like Taiwan, avoiding broad diversification for focused bets.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $52.9M | 9.6% | Reduce 4.16% |

| Meta Platforms, Inc. (META) | $51.8M | 9.5% | Add 3.31% |

| Alphabet Inc. (GOOGL) | $50.4M | 9.2% | Add 2.95% |

| Apple Inc. (AAPL) | $42.5M | 7.8% | Add 3.11% |

| Microsoft Corporation (MSFT) | $41.0M | 7.5% | Add 3.40% |

| PayPal Holdings, Inc. (PYPL) | $32.5M | 5.9% | Add 4.04% |

| Booking Holdings Inc. (BKNG) | $31.9M | 5.8% | Add 4.33% |

| Visa Inc. (V) | $30.4M | 5.6% | Add 4.11% |

| Tractor Supply Company (TSCO) | $27.9M | 5.1% | Add 3.63% |

This table captures Wedgewood's hallmark concentration, with the top 10 devouring 70.7% of the $547.9M portfolio. The single reduction in TSM contrasts nine precise adds, averaging ~3.5% increases that boost conviction without overhauling the core book. Such positioning amplifies returns from winners like META and MSFT while the 19 total holdings provide modest diversification.

The low turnover 0.0% amid changes reflects Rolfe's skill in incremental optimization, ensuring the portfolio remains a high-octane vehicle for quality growth.

Investment Lessons from David Rolfe's Wedgewood Approach

- Concentrate on Exceptional Growth at Reasonable Prices: 70.7% in top 10 demands deep moat analysis—emulate by sizing bets around businesses with durable advantages like network effects in V or ecosystems in AAPL.

- Patience Pays: Long Holding Periods Trump Trading: 26 quarters average teaches holding through volatility, as seen in zero turnover despite active tweaks.

- Trim Winners, Add to Proven Recoveries: Reducing TSM while adding to PYPL shows profit-taking and contrarian value in beaten-down names.

- Tech-Centric but Diversified Enough: Balance mega-caps with niche plays like TSCO to mitigate sector risks.

- Active Management in Concentrated Portfolios: Even low-turnover books need vigilant rebalancing, as Rolfe's nine adds demonstrate.

Looking Ahead: What Comes Next?

With portfolio size stable at 19 +0 and zero turnover, Wedgewood appears fully invested, but the TSM trim may free modest cash for opportunistic deploys. Expect continued emphasis on AI-adjacent tech like MSFT and META, plus fintech rebounds in PYPL. In a 2026 market facing rate uncertainty and AI hype, Rolfe's quality focus positions for resilience—watch for further adds in consumer cyclicals like BKNG if travel sustains. Track updates on the Wedgewood superinvestor page.

FAQ about David Rolfe's Wedgewood Partners Portfolio

Q: What drove Wedgewood's heavy adding in Q3 2025?

A: Rolfe added to nine positions averaging 3.5%, including META +3.31%, MSFT +3.40%, and PYPL +4.04%, while trimming TSM by 4.16%—likely optimizing for AI growth and fintech recovery amid low overall turnover.

Q: Why is Wedgewood's portfolio so concentrated?

A: Top 10 holdings represent 70.7% across 19 positions, reflecting Rolfe's high-conviction style favoring quality growth stocks with strong moats over broad diversification, enabling outsized returns from winners like tech giants.

Q: What sectors dominate David Rolfe's strategy?

A: Technology leads (e.g., TSM, AAPL), with fintech (V, PYPL) and consumer (TSCO, BKNG) providing balance.

Q: How can I track and follow David Rolfe's Wedgewood Partners portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/wedgewood for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!