David Tepper - Appaloosa Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

David Tepper, the legendary hedge fund manager behind Appaloosa Management, showcases his opportunistic style in the latest 13F filing. His $7.4B Q3 2025 portfolio reflects active rotation with significant adds in AI leaders like NVDA and industrial plays like WHR, while trimming megacaps such as BABA and AMZN.

Portfolio Snapshot: Opportunistic Concentration with High Turnover

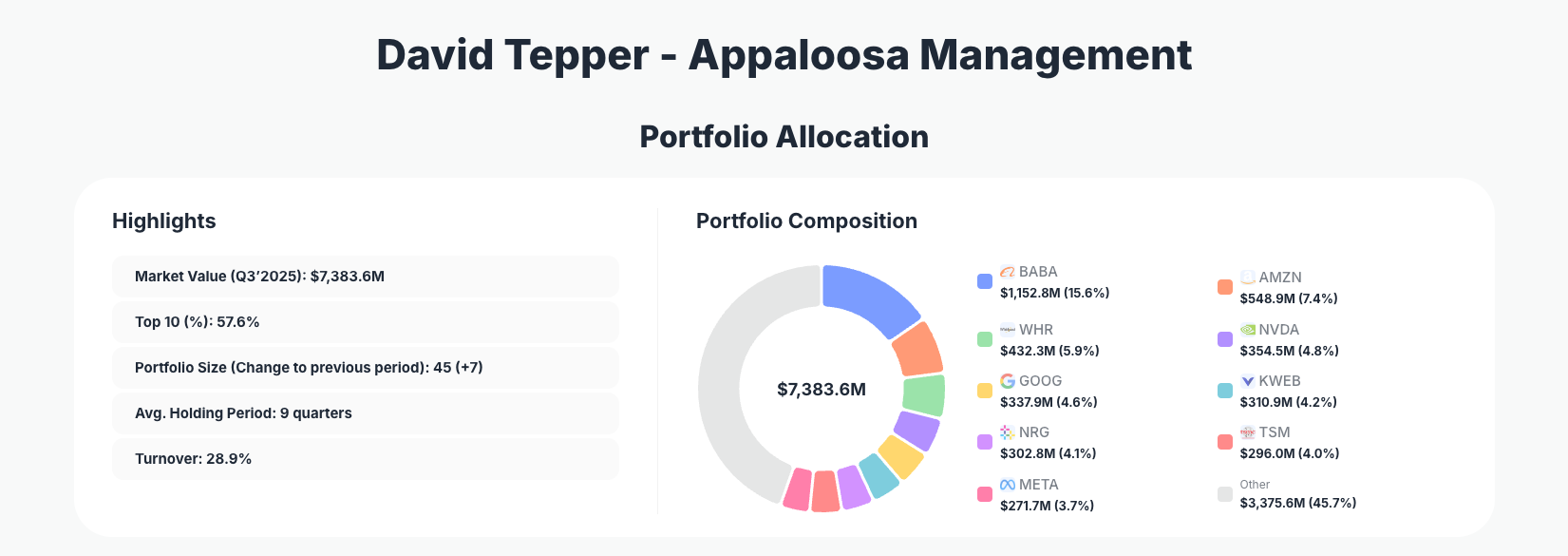

Portfolio Highlights (Q3’2025): - Market Value: $7,383.6M - Top 10 Holdings: 57.6% - Portfolio Size: 45 +7 - Average Holding Period: 9 quarters - Turnover: 28.9%

Appaloosa Management's portfolio maintains a focused top tier, with the top 10 holdings commanding 57.6% of the $7.4 billion total, underscoring Tepper's conviction-driven approach despite a broader 45-position lineup that expanded by 7 new names. This concentration signals high confidence in select ideas, balanced by diversification across 45 holdings to manage risk in volatile markets. The 28.9% turnover rate indicates nimble position adjustments, far above passive benchmarks, reflecting Tepper's macro-savvy trading style honed from his distressed debt roots.

The average holding period of 9 quarters suggests a medium-term horizon, allowing winners like tech giants to compound while exiting laggards promptly. Portfolio growth to 45 positions +7 hints at opportunity hunting amid market dispersion, yet the top-heavy structure—over half in 10 names—amplifies Tepper's best ideas. Track these dynamics live on Appaloosa's ValueSense superinvestor page, where quarter-over-quarter visualizations reveal the full evolution.

This setup positions Appaloosa for asymmetric upside: concentrated bets drive returns when correct, while the expanded tail provides hedges and satellite plays. With turnover at 28.9%, Tepper isn't afraid to pivot, a hallmark of his ability to navigate economic shifts from inflation to AI booms.

Top Positions Breakdown: AI Adds, China Trim, and Surprise Industrials

David Tepper's biggest moves spotlight a mix of trims in high-flyers and aggressive builds in emerging themes. Leading the pack is Alibaba Group Holding Limited (BABA) at 15.6% $1,152.8M, though reduced by 8.73%—a tactical pullback from China's battered giant amid regulatory headwinds. Amazon.com, Inc. (AMZN) follows at 7.4% ($548.9M, Reduce 7.41%), signaling profit-taking in e-commerce dominance as valuations stretched.

Bold adds steal the show: Whirlpool Corporation (WHR) exploded with a staggering Add 1,966.95% to 5.9% $432.3M, betting big on consumer durables recovery or restructuring potential. AI powerhouse NVIDIA Corporation (NVDA) saw an Add 8.57% to 4.8% $354.5M, doubling down on chip demand. Alphabet Inc. (GOOG) dipped to 4.6% ($337.9M, Reduce 7.50%), trimming ad/search exposure.

Further changes include KRANESHARES TRUST (_) surging Add 85.00% to 4.2% $310.9M, likely China-themed ETF exposure. NRG Energy, Inc. (NRG) at 4.1% ($302.8M, Reduce 5.56%) and Taiwan Semiconductor Manufacturing Company Limited (TSM) at 4.0% ($296.0M, Add 3.41%) highlight energy and semis bets. Meta Platforms, Inc. (META) trimmed to 3.7% ($271.7M, Reduce 7.50%), while Vistra Corp. (VST) dropped sharply Reduce 30.83% to 3.3% $243.9M, possibly rotating out of power utilities.

These shifts—from megacap trims to AI/industrial adds—paint a portfolio adapting to 2025's tech rally and value rotations, with 10+ changes underscoring Tepper's hands-on management.

What the Portfolio Reveals: Macro Bets on AI, China Resilience, and Cyclical Rebound

Tepper's Q3 moves reveal a strategist eyeing AI tailwinds, selective China exposure, and cyclical turnarounds amid U.S. market froth.

- Tech and AI Focus: Adds in NVDA and TSM signal conviction in semiconductors fueling the AI boom, while trims in META, GOOG, and AMZN suggest valuation discipline after rallies.

- China Opportunism: Retaining a hefty 15.6% in BABA despite the reduce, plus KRANESHARES TRUST ramp-up, bets on undervalued recovery in emerging markets.

- Cyclical and Energy Plays: Massive WHR build and NRG/VST adjustments point to housing/appliance rebound and energy transition opportunities.

- Risk Management: 28.9% turnover and portfolio expansion to 45 positions balance concentration risks, with 9-quarter avg hold favoring quality over speculation.

- Geographic Tilt: Heavy Asia (BABA, TSM) and U.S. tech/energy mix hedges global slowdowns.

This thematic pivot—from pure growth to value-infused cyclicals—mirrors Tepper's distressed expertise, positioning for rate cuts and AI capex.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Alibaba Group Holding Limited | $1,152.8M | 15.6% | Reduce 8.73% |

| Amazon.com, Inc. | $548.9M | 7.4% | Reduce 7.41% |

| Whirlpool Corporation | $432.3M | 5.9% | Add 1,966.95% |

| NVIDIA Corporation | $354.5M | 4.8% | Add 8.57% |

| Alphabet Inc. | $337.9M | 4.6% | Reduce 7.50% |

| KRANESHARES TRUST | $310.9M | 4.2% | Add 85.00% |

| NRG Energy, Inc. | $302.8M | 4.1% | Reduce 5.56% |

| Taiwan Semiconductor Manufacturing Company Limited | $296.0M | 4.0% | Add 3.41% |

| Meta Platforms, Inc. | $271.7M | 3.7% | Reduce 7.50% |

The table underscores Appaloosa's classic hedge fund concentration: top 10 at 57.6%, led by BABA's outsized 15.6% stake despite the trim, providing China leverage. Explosive adds like WHR 1,966.95% and NVDA highlight conviction in turnarounds and AI, while uniform ~7% reduces across Big Tech (AMZN, GOOG, META) enforce portfolio hygiene.

This 57.6% top-10 weighting amplifies returns from hits like NVDA but demands precise timing—Tepper's 28.9% turnover proves he delivers, blending size with agility across a $7.4B book.

Investment Lessons from David Tepper's Opportunistic Approach

David Tepper's Q3 portfolio exemplifies principles from his distressed-to-growth evolution:

- Size Matters in Conviction Bets: The massive WHR add 1,966.95% shows scaling into perceived mispricings when macro aligns.

- Trim Winners Relentlessly: Consistent 7-8% reduces in BABA, AMZN, and peers prevent overexposure post-rallies.

- Macro Drives Position Sizing: AI adds (NVDA, TSM) and China tilts reflect reading global cycles better than most.

- Diversify Without Diluting: 45 positions with 57.6% top-10 concentration balances bold calls and hedges.

- Turnover as a Tool: 28.9% rate keeps the portfolio fresh, honoring the 9-quarter avg hold for compounding.

Looking Ahead: What Comes Next?

Appaloosa's positioning sets up for 2026 volatility: heavy AI/semicon exposure via NVDA/TSM thrives on capex cycles, while BABA and KRANESHARES TRUST offer cheap China rebound if stimulus hits. Energy trims (VST) free cash for cyclicals like WHR amid housing hopes.

With portfolio_size at 45 +7 and high turnover, expect new satellite bets in undervalued sectors. No explicit cash figure, but trims suggest dry powder for dips. In a high-rate/AI world, Tepper's mix favors growth-at-reasonable-prices, watch for energy/AI expansions.

FAQ about David Tepper's Appaloosa Portfolio

Q: What are the most significant changes in Tepper's Q3 2025 13F filing?

A: Key moves include a massive Add 1,966.95% to WHR 5.9%, Add 8.57% to NVDA 4.8%, and Add 85% to KRANESHARES TRUST 4.2%, offset by reduces like 8.73% in BABA (still 15.6%) and 30.83% in VST.

Q: Why does Appaloosa maintain such high concentration in its top 10 holdings?

A: At 57.6%, the top 10 reflect Tepper's high-conviction style—big bets on understood themes like AI and China pay off handsomely, balanced by 35 positions for risk control and 28.9% turnover for adaptability.

Q: What does Tepper's sector mix reveal about his market outlook?

A: Heavy tech/AI (NVDA, TSM), China (BABA), and cyclicals (WHR, NRG) signal bets on AI persistence, EM recovery, and U.S. industrial rebound.

Q: How can I track and follow David Tepper's Appaloosa portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/appaloosa for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!