Davis Selected Advisers Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

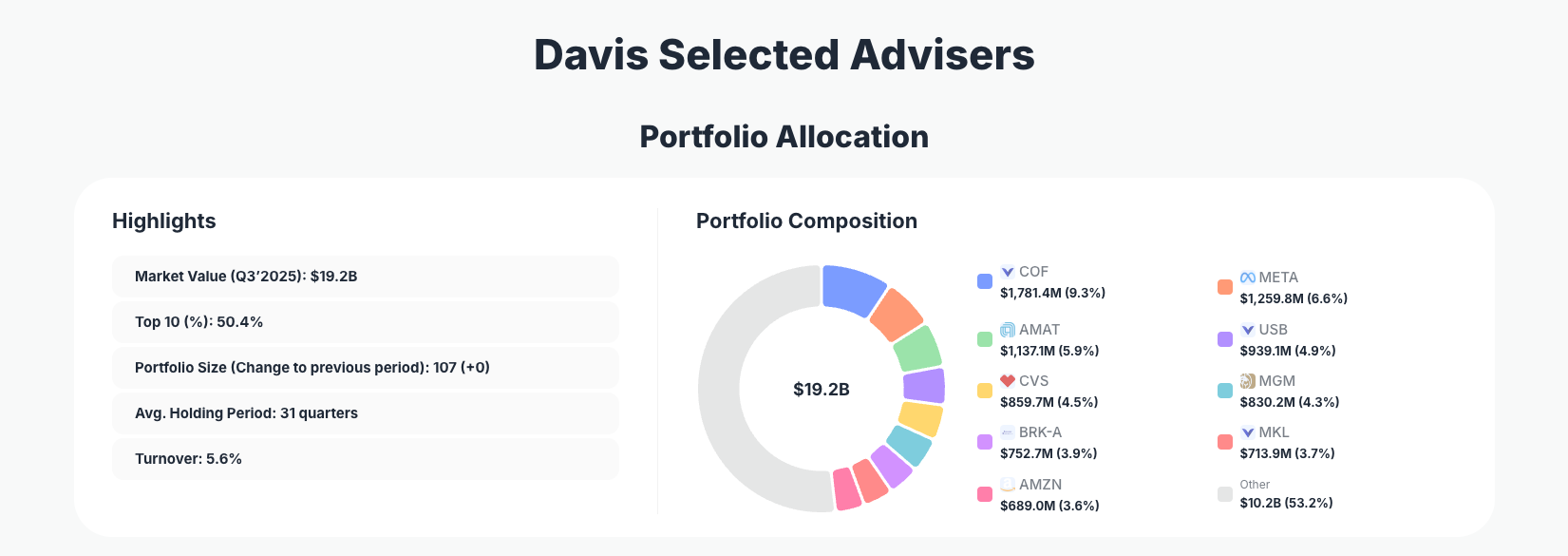

Davis Selected Advisers, the legendary value-oriented firm tracing its roots to Shelby Davis's multi-decade compounding legacy, signals bold conviction in their latest moves. Their $19.2B Q3 2025 portfolio showcases aggressive "Buy" actions across nearly every top position, blending financials, tech giants, and select cyclicals in a diversified yet conviction-driven strategy that underscores their patient, long-term approach.

Portfolio Snapshot: Balanced Diversification Meets High Conviction

Portfolio Highlights (Q3 2025): - Market Value: $19.2B - Top 10 Holdings: 50.4% - Portfolio Size: 107 +0 - Average Holding Period: 31 quarters - Turnover: 5.6%

Davis Selected Advisers maintains a remarkably stable portfolio with 107 positions, reflecting their disciplined value investing philosophy rooted in founder Shelby Davis's emphasis on generational wealth compounding. The low turnover of 5.6% and an impressive average holding period of 31 quarters (over 7.5 years) highlight a buy-and-hold strategy that prioritizes durable businesses over short-term trading. This quarter's data reveals no net change in position count, underscoring consistency amid market volatility.

The top 10 holdings command 50.4% of the portfolio, a moderate concentration level that balances risk while allowing high-conviction bets to drive returns. This structure differs from ultra-concentrated peers, aligning with Davis's approach of spreading exposure across quality names while sizing up winners. Access the full Davis Selected Advisers portfolio breakdown on ValueSense for historical trends and performance metrics.

Notably, the aggressive "Buy" actions in top holdings suggest portfolio managers see compelling valuations in a high-valuation market, potentially positioning for economic cycles favoring financials and tech infrastructure.

Top Positions Breakdown: Financials Lead with Tech and Cyclicals in Tow

The portfolio's upper echelon features decisive "Buy" moves, starting with Capital One Financial (COF) at 9.3% following a new "Buy," signaling strong faith in consumer lending recovery. Meta Platforms (META) follows at 6.6% with another "Buy," betting on advertising resilience and AI-driven growth. Applied Materials (AMAT) (5.9%, "Buy") adds semiconductor equipment exposure, while U.S. Bancorp (_) (4.9%, "Buy") bolsters regional banking conviction.

Healthcare and leisure picks round out the momentum, with CVS Health (CVS) at 4.5% ("Buy") tapping pharmacy benefits value, and MGM Resorts (MGM) (4.3%, "Buy") eyeing travel rebound. Iconic names like Berkshire Hathaway (BRK-A) (3.9%, "Buy"), Markel (MKL) (3.7%, "Buy"), and Amazon (AMZN) (3.6%, "Buy") reflect admiration for capital allocators and e-commerce dominance. Extending to changes, Viatris (VTRS) (3.6%, "Buy") emerges as a healthcare wildcard with massive share volume.

These moves paint a picture of opportunistic accumulation in beaten-down sectors, with financials (COF, USB) at ~14%, tech (META, AMAT, AMZN) ~16%, and cyclicals/healthcare filling the rest for broad-based upside.

Strategic Signals: Quality Cyclicals in a Value Wrapper

Davis Selected Advisers' Q3 actions reveal a strategy blending timeless value tenets with tactical sector rotations:

- Financials resurgence: Heavy "Buys" in COF and USB bet on normalizing rates and consumer strength, prioritizing banks with fortress balance sheets.

- Tech pragmatism: Positions in META, AMAT, and AMZN target proven cash cows over speculative AI, favoring infrastructure enablers.

- Healthcare and leisure value: CVS, VTRS, and MGM highlight undervalued recovery plays with defensive traits.

- Insurance affinity: "Buys" in BRK-A and MKL nod to Shelby Davis's insurance roots, seeking float-generating compounders.

- Risk discipline: Low turnover and 107 holdings mitigate volatility while top-10 weighting ensures alpha from convictions.

This mix underscores a risk-managed pivot toward cyclical recovery without abandoning quality moats.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Capital One Financial Corporation | $1,781.4M | 9.3% | Buy |

| Meta Platforms, Inc. | $1,259.8M | 6.6% | Buy |

| Applied Materials, Inc. | $1,137.1M | 5.9% | Buy |

| U.S. Bancorp | $939.1M | 4.9% | Buy |

| CVS Health Corporation | $859.7M | 4.5% | Buy |

| MGM Resorts International | $830.2M | 4.3% | Buy |

| Berkshire Hathaway Inc. (BRK-A) | $752.7M | 3.9% | Buy |

| Markel Corporation | $713.9M | 3.7% | Buy |

| Amazon.com, Inc. | $689.0M | 3.6% | Buy |

The table illustrates a top-10 slice worth nearly $10B, or 50.4% of the portfolio, with uniform "Buy" signals across all positions—an unusual show of synchronized conviction. No single holding exceeds 10%, promoting balance, yet the financials-tech blend (over 25% combined) positions Davis for rate-cut tailwinds and AI capex. This concentration amplifies returns from core theses while the broader 107 holdings provide ballast, exemplifying measured aggression.

Investment Lessons from Davis Selected Advisers

Davis Selected Advisers' playbook offers timeless wisdom for patient investors:

- Patience compounds: A 31-quarter average hold screams conviction—avoid trading noise for multi-year ownership.

- Size with discipline: Top-10 at 50.4% shows bold bets on understood businesses, but diversification to 107 prevents over-reliance.

- Hunt undervalued cyclicals: "Buys" in COF, CVS highlight buying quality during fear.

- Honor insurance moats: Echoing Shelby Davis, BRK-A and MKL prioritize float and capital allocation.

- Low turnover wins: 5.6% churn proves minimal activity maximizes tax efficiency and focus.

Looking Ahead: What Comes Next?

With turnover at 5.6% and steady position count, Davis appears poised for selective deployment into further dips. The aggressive Q3 "Buys" suggest dry powder for financials and tech if valuations correct, especially amid potential 2026 rate cuts boosting COF and USB. Healthcare like VTRS offers defensive ballast, while cyclicals (MGM) gear up for consumer spending revival. Track the full portfolio on ValueSense for Q4 updates.

FAQ about Davis Selected Advisers Portfolio

Q: What do the aggressive "Buy" moves in Q3 2025 reveal about Davis's market view?

The uniform "Buys" across top holdings like COF 9.3% and META 6.6% indicate optimism on financial recovery, tech infrastructure, and undervalued cyclicals, positioning for economic normalization.

Q: Why does Davis maintain 107 positions with 50.4% in the top 10?

This balances high-conviction bets (financials, tech) with broad diversification, reducing risk while amplifying returns from understood leaders—classic Shelby Davis discipline.

Q: How does Davis's insurance heritage influence current holdings?

Roots in Shelby Davis show in "Buys" for BRK-A and MKL, favoring float-generating compounders with superior allocation.

Q: Which sectors stand out in recent changes?

Financials (~14%), tech (~16%), healthcare (CVS, VTRS), and leisure (MGM) dominate "Buys," targeting value in recovery plays.

Q: How can I track Davis Selected Advisers' portfolio?

Monitor quarterly 13F filings (45-day lag post-quarter-end) via SEC EDGAR, or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/davis-selected for real-time analysis, visualizations, and alerts.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!