9 Best DCF Undervalued Stocks: Discounted Cash Flow Analysis - Value Sense

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Precision of Discounted Cash Flow Analysis

Discounted Cash Flow (DCF) analysis represents the most fundamental approach to intrinsic value calculation, estimating a company's worth based on the present value of its expected future cash flows. This methodology provides investors with a systematic framework for determining whether current market prices reflect the underlying economic value of a business.

DCF analysis offers several distinct advantages over other valuation methods: it focuses on actual cash generation rather than accounting metrics, incorporates the time value of money through discount rates, and provides forward-looking assessments based on business fundamentals rather than market sentiment. The approach particularly excels at identifying companies where market prices diverge significantly from underlying cash flow generation potential.

Mathematical Foundation of DCF Analysis:

The core DCF formula calculates intrinsic value as:

Enterprise Value=∑t=1nFCFt(1+WACC)t+Terminal Value(1+WACC)nEnterprise Value=t=1∑n(1+WACC)tFCFt+(1+WACC)nTerminal Value

Where:

- FCF = Free Cash Flow for period t

- WACC = Weighted Average Cost of Capital

- n = Number of projection years

Terminal Value is typically calculated using the perpetuity growth model:

Terminal Value=FCFfinal×(1+g)WACC−gTerminal Value=WACC−gFCFfinal×(1+g)

Where g represents the perpetual growth rate.

DCF Undervalued Selection Criteria:

- Trading below DCF intrinsic value (0% or more undervalued)

- Strong free cash flow generation supporting DCF calculations

- Predictable business models enabling reliable cash flow projections

- Quality fundamentals across multiple valuation methodologies for confirmation

Top 9 DCF Undervalued Stocks - Ranked by DCF Undervaluation

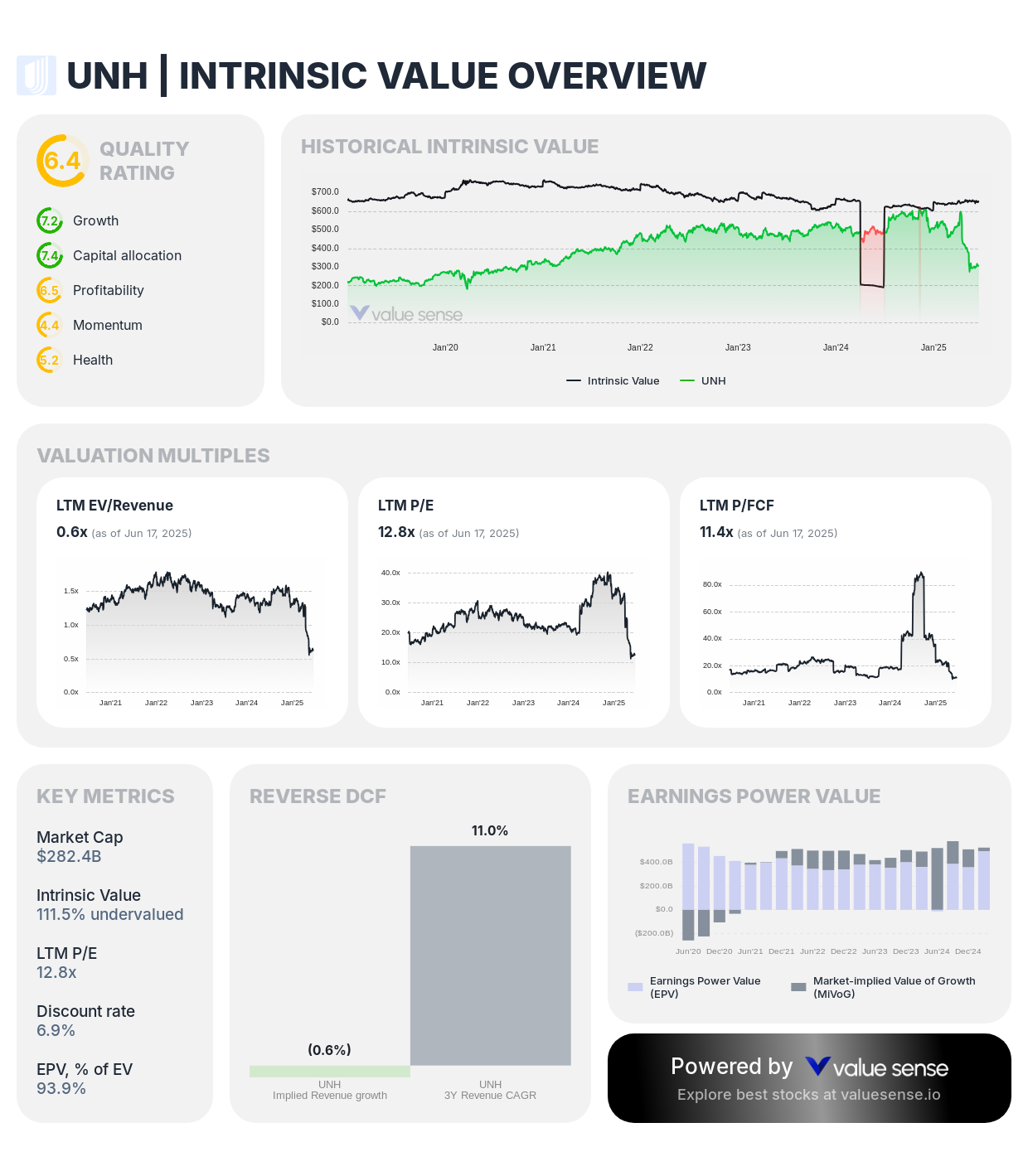

1. UnitedHealth Group Incorporated (UNH) - 236.0% DCF Undervalued ⭐

- DCF Value: 236.0% undervalued

- Intrinsic Value: 111.5% undervalued

- Relative Value: 13.3% overvalued

- Ben Graham Revised Fair Value: 565.9% undervalued

- Peter Lynch Fair Value: 289.1% undervalued

- Earnings Power Value: 93.9% of Enterprise Value

Investment Thesis: UnitedHealth Group demonstrates extraordinary DCF undervaluation at 236.0% below intrinsic value, supported by the highest Earnings Power Value (93.9%) in our analysis and exceptional undervaluation across all fundamental methodologies. The healthcare leader's integrated business model combining insurance operations with Optum health services creates predictable, growing cash flows that DCF analysis recognizes as substantially undervalued by current market pricing.

DCF Analysis Strengths: UnitedHealth's diversified healthcare operations provide exceptional cash flow predictability ideal for DCF modeling. The company's insurance business generates consistent premiums and claims patterns, while Optum's health services create recurring revenue streams with visible growth trajectories. The combination provides DCF analysts with reliable inputs for long-term cash flow projections.

Cash Flow Catalysts:

- Aging population demographics driving sustained healthcare demand growth

- Optum health services expansion creating higher-margin recurring revenue

- Technology investments improving operational efficiency and patient outcomes

- Integrated care delivery model enhancing competitive positioning and cost management

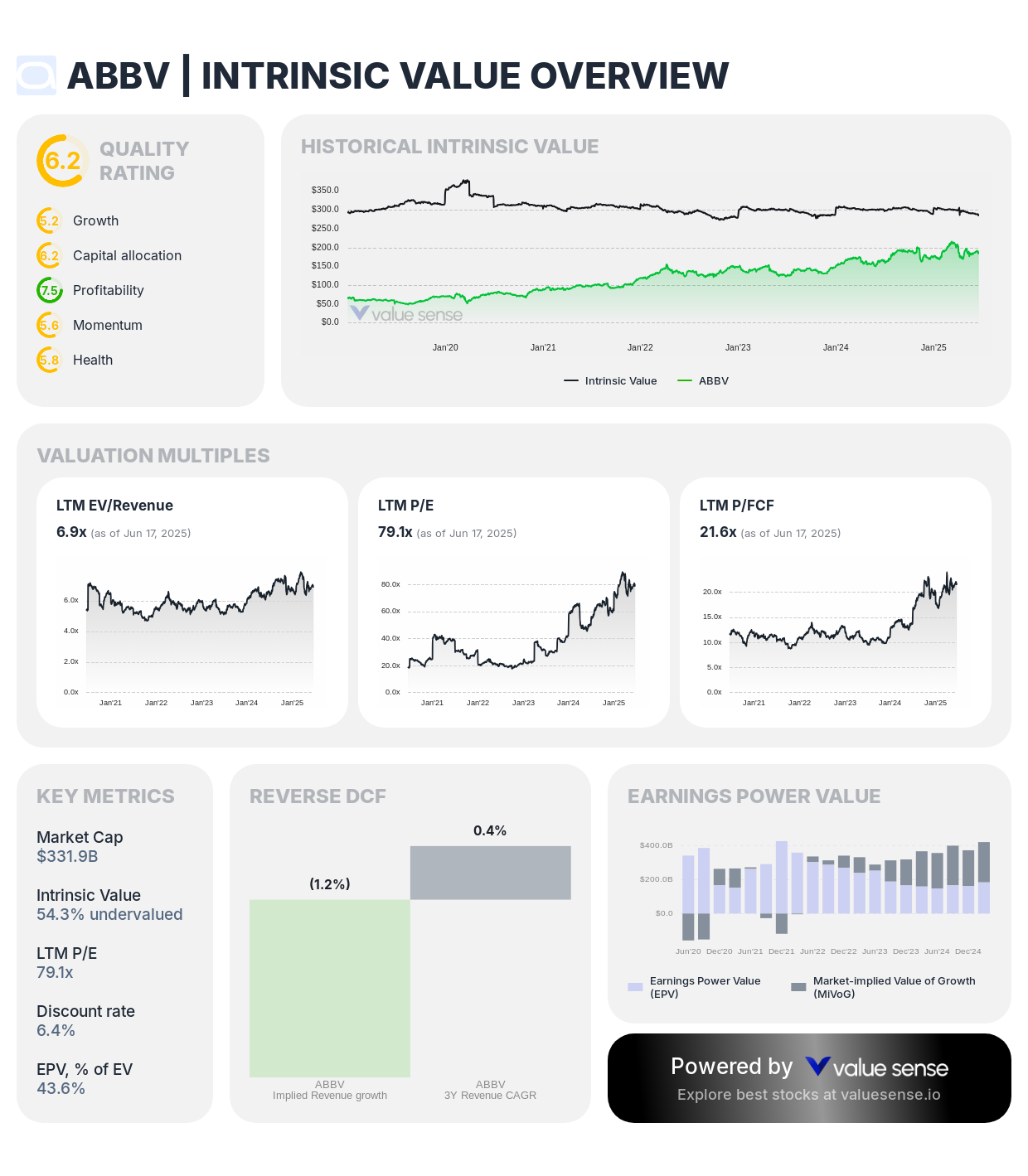

2. AbbVie Inc. (ABBV) - 133.0% DCF Undervalued

- DCF Value: 133.0% undervalued

- Intrinsic Value: 54.3% undervalued

- Relative Value: 24.6% overvalued

- Ben Graham Revised Fair Value: 686.8% undervalued

- Peter Lynch Fair Value: 81.0% undervalued

- Earnings Power Value: 43.6% of Enterprise Value

Investment Thesis: AbbVie demonstrates exceptional DCF undervaluation at 133.0% below intrinsic value, supported by undervaluation across multiple methodologies including our primary intrinsic value model (54.3% undervalued) and extraordinary Graham value recognition (686.8% undervalued). The pharmaceutical giant's diversified portfolio beyond Humira and robust pipeline create substantial future cash flows that DCF analysis effectively captures.

DCF Analysis Strengths: AbbVie's predictable pharmaceutical cash flows and established market positions make it ideal for DCF analysis. The company's consistent R&D investment, regulatory-protected revenue streams, and growing international presence provide the cash flow visibility necessary for reliable DCF calculations. The significant undervaluation suggests market pessimism about post-Humira prospects that DCF analysis indicates may be overdone.

Cash Flow Catalysts:

- Diversified pharmaceutical portfolio reducing single-product dependency risks

- Late-stage pipeline with multiple potential blockbuster treatments

- International expansion opportunities in emerging healthcare markets

- Strategic acquisitions enhancing therapeutic capabilities and market reach

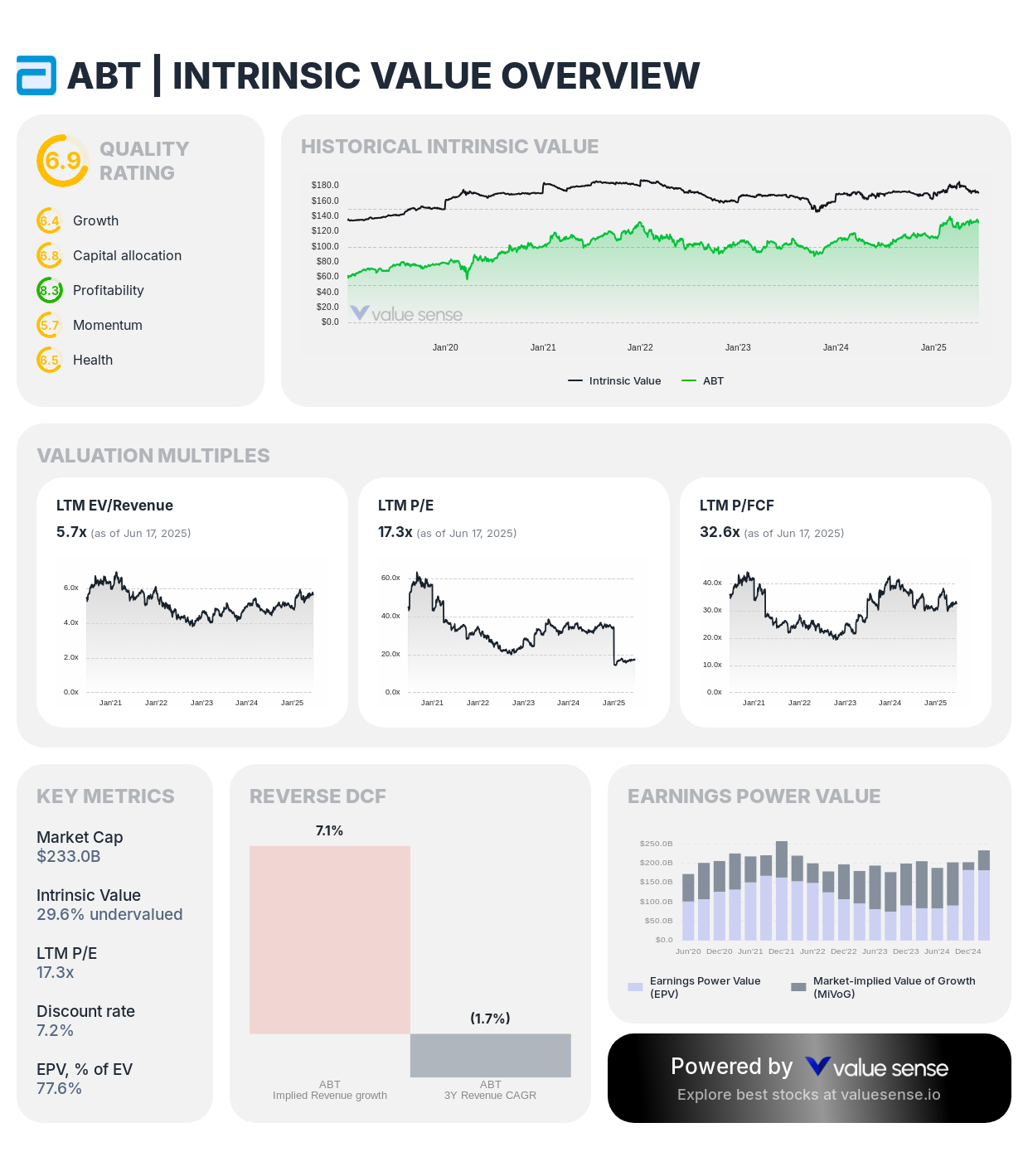

3. Abbott Laboratories (ABT) - 59.0% DCF Undervalued

- DCF Value: 59.0% undervalued

- Intrinsic Value: 29.6% undervalued

- Relative Value: 0.1% undervalued

- Ben Graham Revised Fair Value: 233.5% undervalued

- Peter Lynch Fair Value: 172.2% undervalued

- Earnings Power Value: 77.6% of Enterprise Value

Investment Thesis: Abbott demonstrates strong DCF undervaluation at 59.0%, with exceptional undervaluation according to Graham (233.5%) and Peter Lynch (172.2%) methodologies. The diversified healthcare company's leadership in medical devices, diagnostics, and nutrition creates multiple cash flow streams that DCF analysis indicates are significantly undervalued by current market pricing.

DCF Analysis Strengths: Abbott's diversified healthcare operations provide DCF analysts with multiple predictable cash flow streams across medical devices, diagnostics, pharmaceuticals, and nutrition. The company's global market leadership positions and innovative product pipeline support reliable long-term cash flow projections essential for accurate DCF modeling.

Cash Flow Catalysts:

- FreeStyle Libre continuous glucose monitoring system global expansion

- Medical device innovation in structural heart and electrophysiology

- Emerging market penetration across healthcare product categories

- Operational efficiency improvements and manufacturing optimization

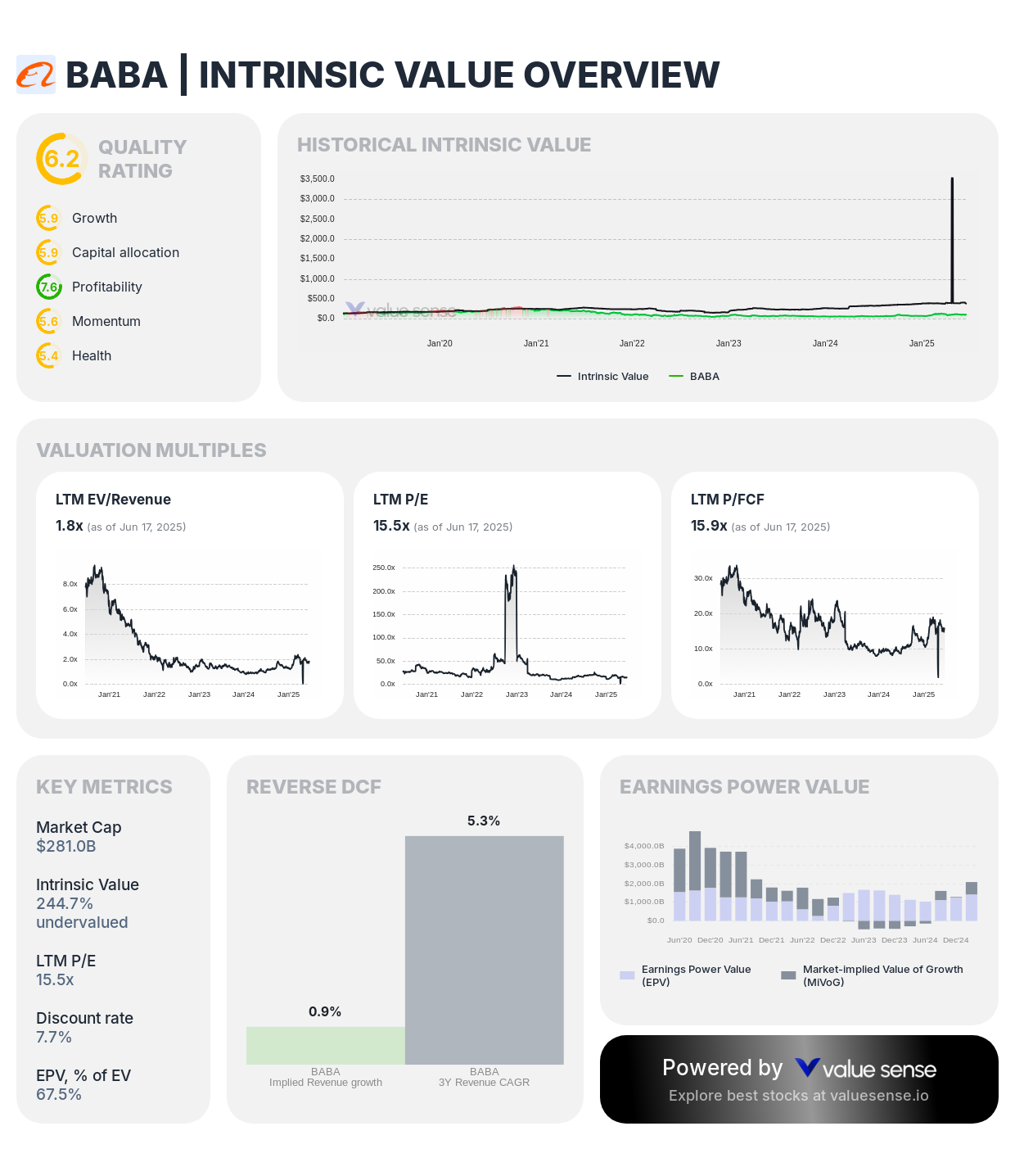

4. Alibaba Group Holding Limited (BABA) - 43.0% DCF Undervalued

- DCF Value: 43.0% undervalued

- Intrinsic Value: 244.7% undervalued

- Relative Value: 445.9% undervalued

- Ben Graham Revised Fair Value: 76.0% overvalued

- Peter Lynch Fair Value: 50.9% undervalued

- Earnings Power Value: 67.5% of Enterprise Value

Investment Thesis: Alibaba presents compelling DCF undervaluation at 43.0%, with even more substantial undervaluation according to our intrinsic value (244.7%) and relative value (445.9%) methodologies. The Chinese e-commerce leader's dominant market position and diversified business model spanning commerce, cloud computing, and digital payments create substantial future cash flow potential that DCF analysis effectively captures despite regulatory uncertainties.

DCF Analysis Strengths: Alibaba's platform-based business model generates highly predictable cash flows through transaction fees, advertising revenue, and cloud services. The company's dominant market position in Chinese e-commerce and expanding international presence provide DCF analysts with clear visibility into future cash generation potential across multiple business segments.

Cash Flow Catalysts:

- Recovery in Chinese consumer spending boosting core commerce operations

- Alibaba Cloud expansion in artificial intelligence and international markets

- International e-commerce growth through strategic partnerships and acquisitions

- Digital payment and fintech services providing additional high-margin revenue streams

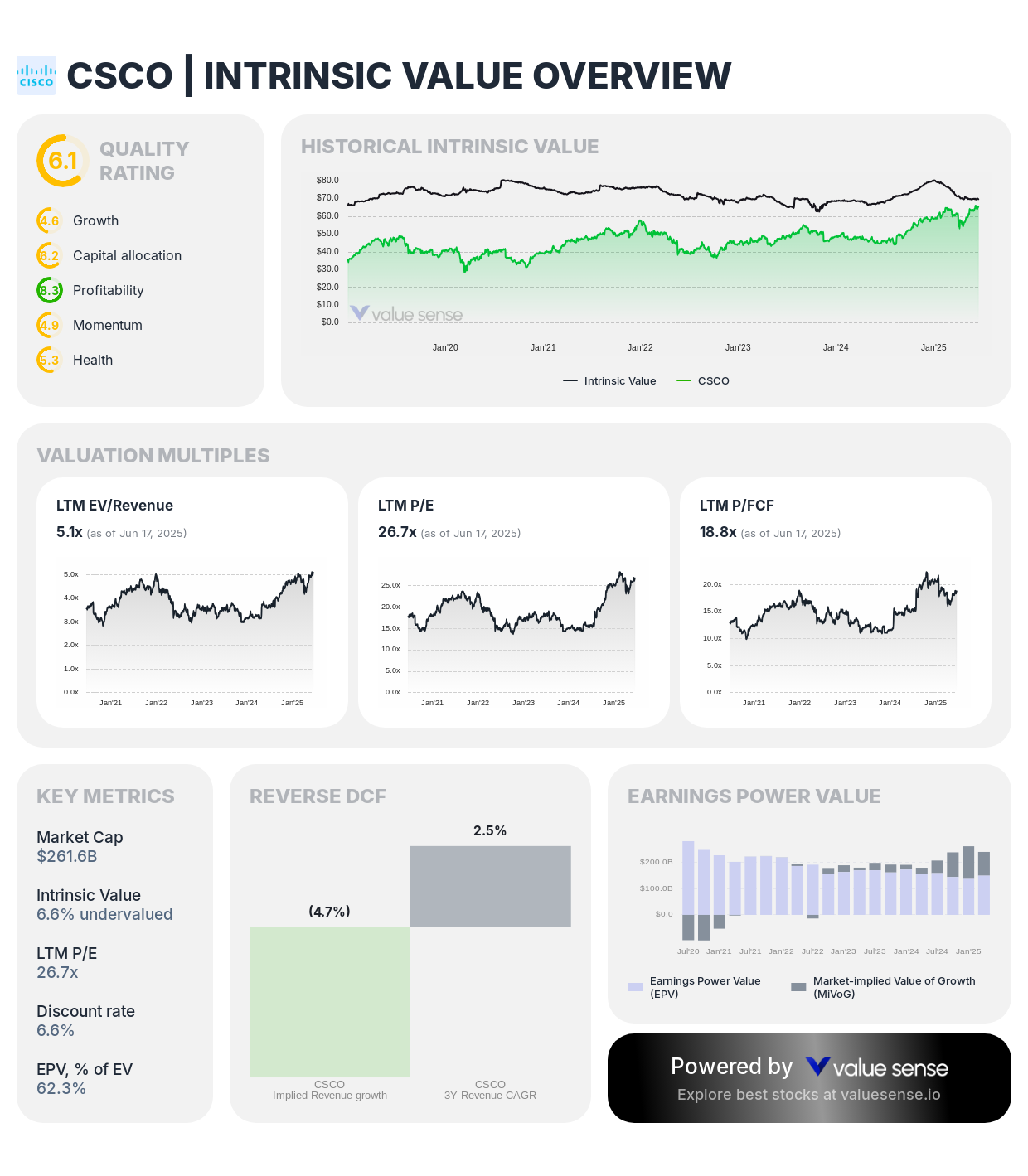

5. Cisco Systems, Inc. (CSCO) - 39.0% DCF Undervalued

- DCF Value: 39.0% undervalued

- Intrinsic Value: 8.6% undervalued

- Relative Value: 26.2% overvalued

- Ben Graham Revised Fair Value: 70.8% undervalued

- Peter Lynch Fair Value: 3.3% undervalued

- Earnings Power Value: 62.3% of Enterprise Value

Investment Thesis: Cisco shows solid DCF undervaluation at 39.0%, supported by strong Earnings Power Value (62.3%) and substantial Graham methodology recognition (70.8% undervalued). The networking technology leader's transformation toward software and services creates more predictable recurring revenue streams that DCF analysis recognizes as undervalued despite modest growth expectations.

DCF Analysis Strengths: Cisco's evolution toward subscription-based software and services provides DCF analysts with increasingly predictable recurring revenue streams. The company's essential role in networking infrastructure and cybersecurity creates stable, growing cash flows that support reliable DCF modeling despite technology sector volatility.

Cash Flow Catalysts:

- Software subscription model transition improving revenue predictability and margins

- Cybersecurity services expansion addressing growing enterprise security needs

- 5G infrastructure deployment driving increased networking equipment demand

- Artificial intelligence integration across networking and security products

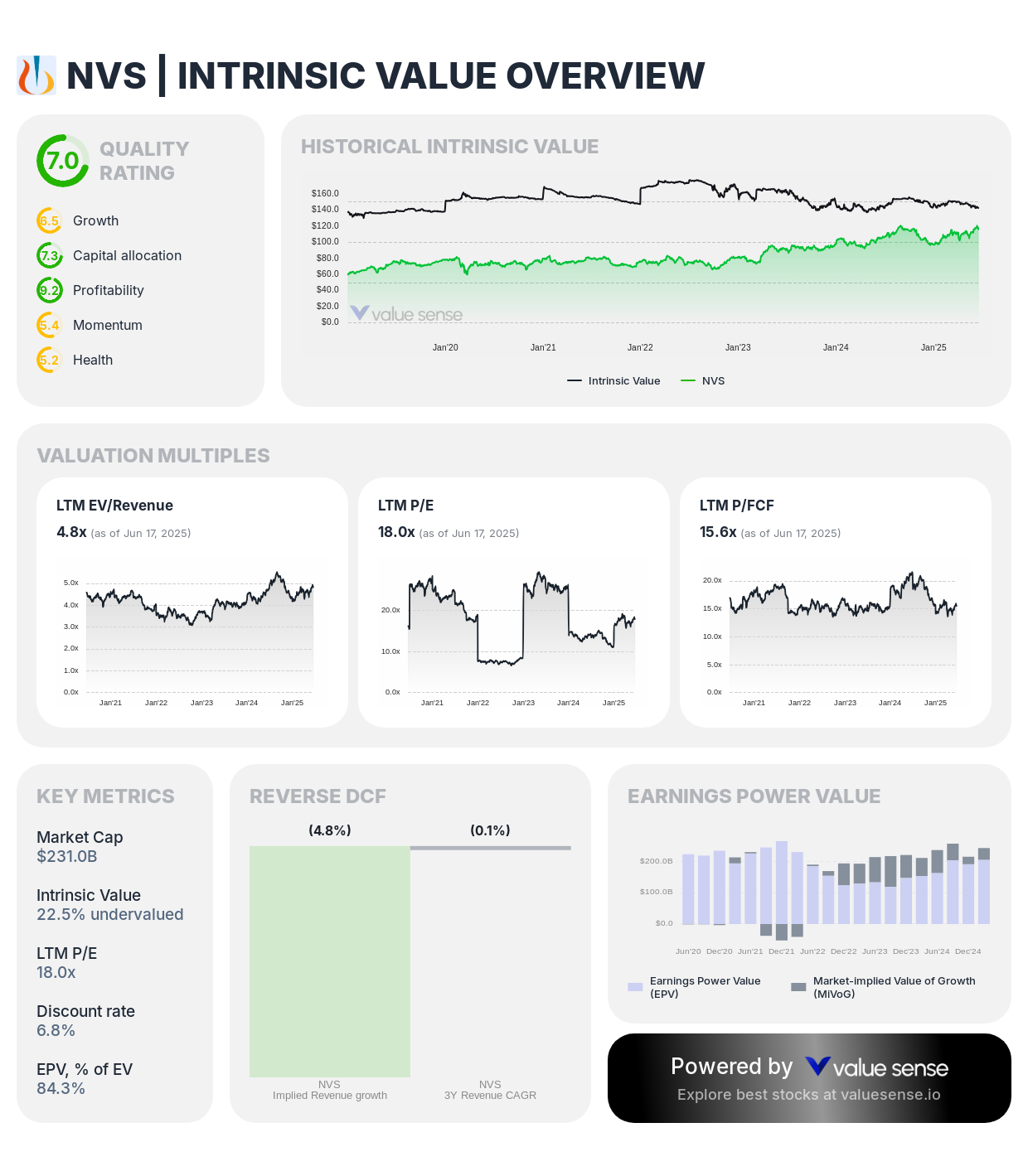

6. Novartis AG (NVS) - 38.0% DCF Undervalued

- DCF Value: 38.0% undervalued

- Intrinsic Value: 22.5% undervalued

- Relative Value: 6.7% undervalued

- Ben Graham Revised Fair Value: 120.1% undervalued

- Peter Lynch Fair Value: 32.3% undervalued

- Earnings Power Value: 84.3% of Enterprise Value

Investment Thesis: Novartis demonstrates consistent DCF undervaluation at 38.0%, supported by undervaluation across all methodologies and exceptional Earnings Power Value of 84.3%. The Swiss pharmaceutical company's focused portfolio strategy and innovative drug pipeline create predictable cash flows that DCF analysis indicates are undervalued by current market pricing.

DCF Analysis Strengths: Novartis benefits from the pharmaceutical industry's inherent cash flow predictability through patent protection, regulatory barriers, and essential healthcare demand. The company's strategic portfolio optimization and focus on innovative medicines provide DCF analysts with clear visibility into future cash generation from established products and pipeline development.

Cash Flow Catalysts:

- Innovative drug pipeline with multiple potential blockbuster treatments

- Strategic portfolio focus on high-growth therapeutic areas

- Emerging market expansion opportunities in underserved healthcare markets

- Operational efficiency improvements enhancing profit margins and cash generation

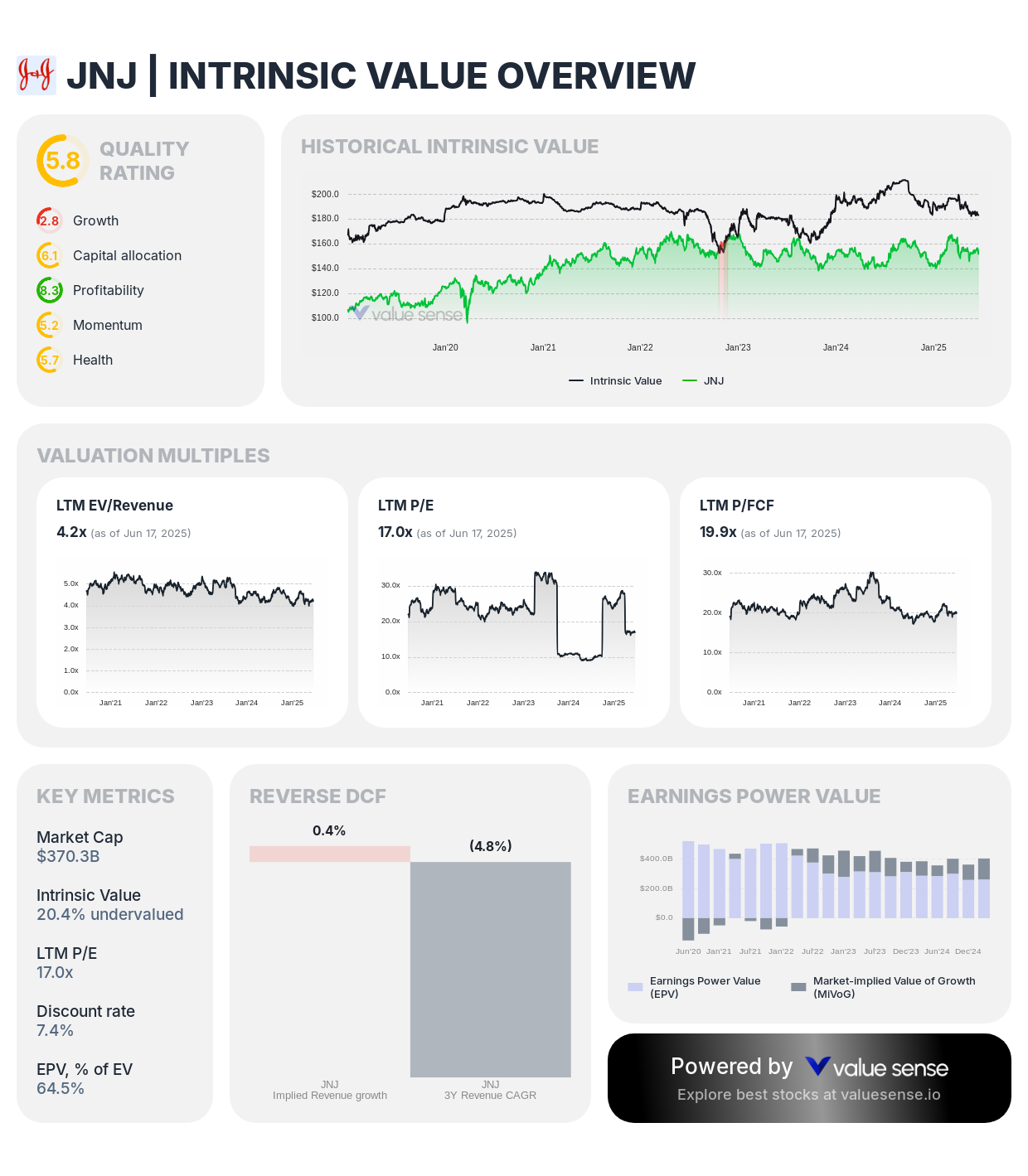

7. Johnson & Johnson (JNJ) - 28.0% DCF Undervalued

- DCF Value: 28.0% undervalued

- Intrinsic Value: 20.4% undervalued

- Relative Value: 13.2% undervalued

- Ben Graham Revised Fair Value: 123.6% undervalued

- Peter Lynch Fair Value: 141.4% undervalued

- Earnings Power Value: 64.5% of Enterprise Value

Investment Thesis: Johnson & Johnson demonstrates consistent DCF undervaluation at 28.0%, with undervaluation across all methodologies including exceptional Graham (123.6%) and Peter Lynch (141.4%) recognition. The healthcare giant's diversified operations and Dividend Aristocrat status create predictable cash flows that DCF analysis indicates are undervalued despite recent business challenges.

DCF Analysis Strengths: J&J's diversified healthcare portfolio across pharmaceuticals, medical devices, and consumer products provides DCF analysts with multiple stable cash flow streams. The company's strong balance sheet, consistent dividend history, and innovative pipeline support reliable long-term cash flow projections essential for DCF modeling.

Cash Flow Catalysts:

- Pharmaceutical pipeline focused on high-growth therapeutic areas including oncology

- Medical device innovation in surgical and interventional solutions

- Strategic divestitures focusing resources on core healthcare strengths

- International expansion opportunities in emerging healthcare markets

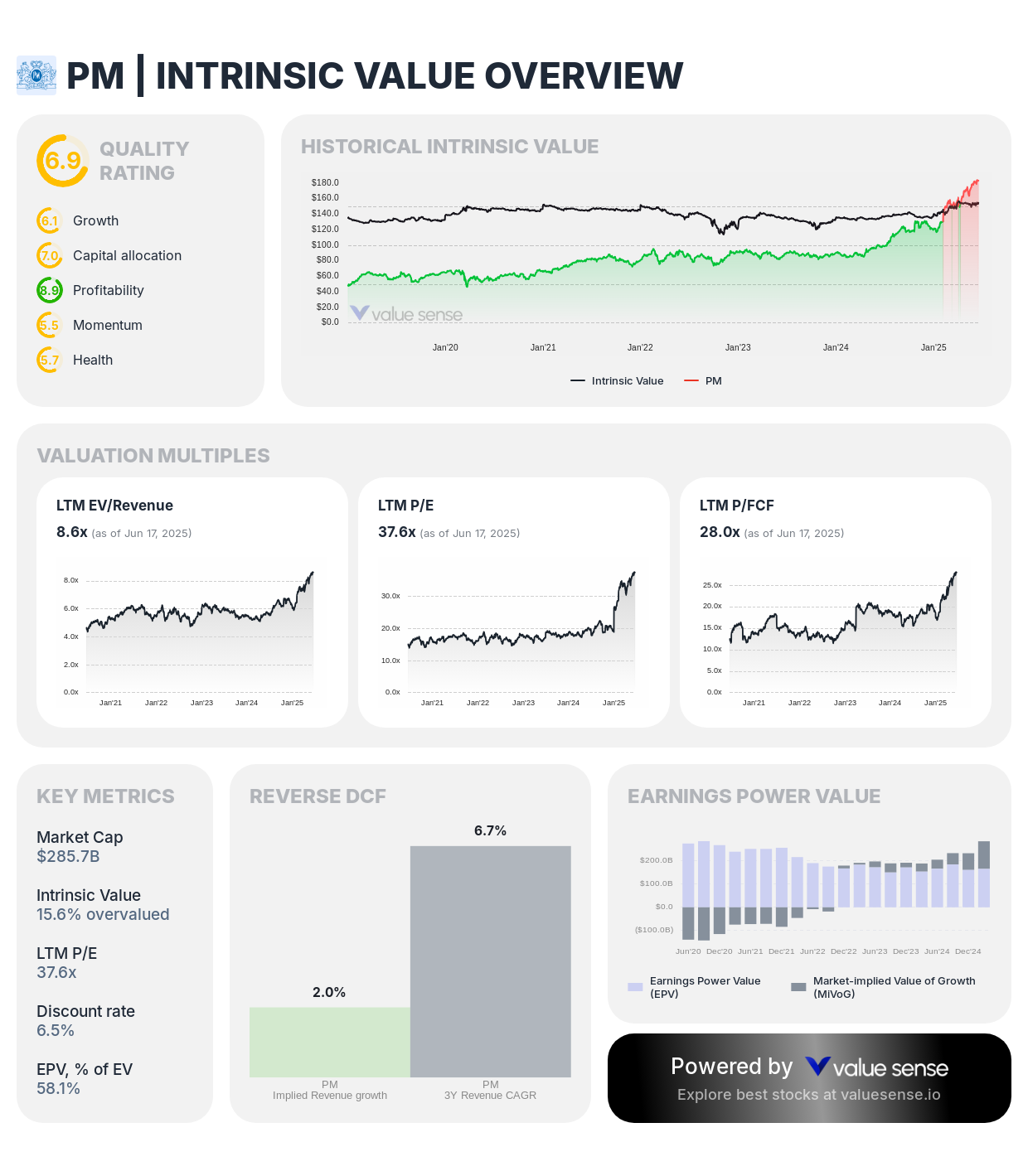

8. Philip Morris International Inc. (PM) - 27.0% DCF Undervalued

- DCF Value: 27.0% undervalued

- Intrinsic Value: 15.6% overvalued

- Relative Value: 58.5% overvalued

- Ben Graham Revised Fair Value: 39.5% undervalued

- Peter Lynch Fair Value: 12.2% overvalued

- Earnings Power Value: 58.1% of Enterprise Value

Investment Thesis: Philip Morris shows moderate DCF undervaluation at 27.0%, supported by Graham methodology recognition (39.5% undervalued) and strong Earnings Power Value (58.1%). The international tobacco company's transformation toward reduced-risk products and consistent cash generation create predictable cash flows that DCF analysis recognizes despite regulatory challenges.

DCF Analysis Strengths: Philip Morris benefits from highly predictable cash flows through its international tobacco operations and strong brand portfolio. The company's reduced-risk product strategy and geographic diversification provide DCF analysts with clear visibility into future cash generation despite regulatory and health-related headwinds in traditional tobacco markets.

Cash Flow Catalysts:

- Reduced-risk product portfolio expansion addressing regulatory and health concerns

- International market leadership with strong brand recognition and pricing power

- Operational efficiency improvements and cost optimization initiatives

- Strategic investments in next-generation tobacco alternatives

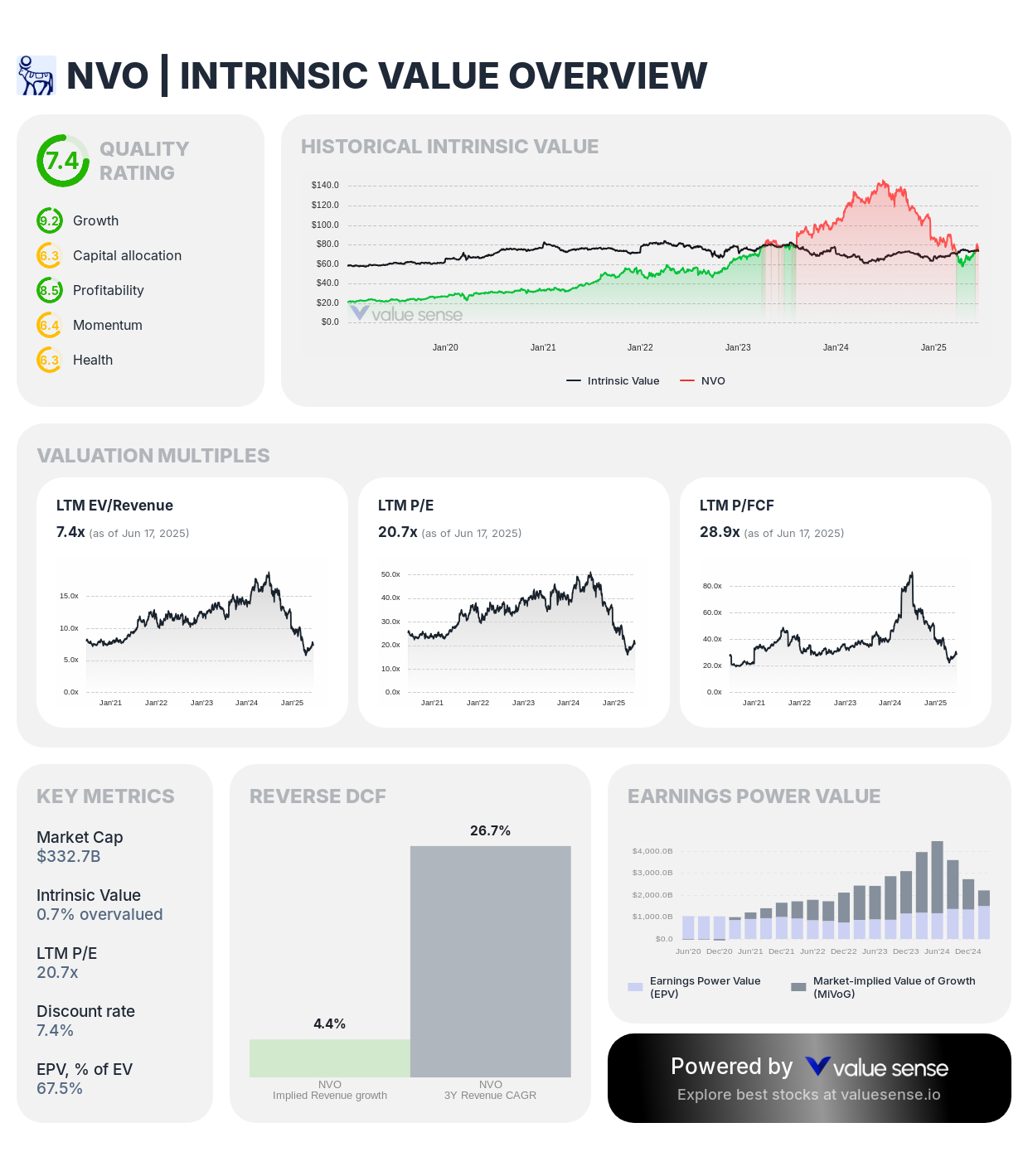

9. Novo Nordisk A/S (NVO) - 9.0% DCF Undervalued

- DCF Value: 9.0% undervalued

- Intrinsic Value: 0.7% overvalued

- Relative Value: 10.7% overvalued

- Ben Graham Revised Fair Value: 16.4% undervalued

- Peter Lynch Fair Value: 23.8% undervalued

- Earnings Power Value: 67.5% of Enterprise Value

Investment Thesis: Novo Nordisk shows modest DCF undervaluation at 9.0%, with exceptional Earnings Power Value (67.5%) demonstrating strong current cash generation capabilities. The Danish pharmaceutical company's leadership in diabetes care and breakthrough obesity treatments create predictable cash flows that DCF analysis recognizes as modestly undervalued despite recent market appreciation.

DCF Analysis Strengths: Novo Nordisk's specialized focus on diabetes and obesity care provides DCF analysts with clear visibility into future cash flows from established products and expanding treatment populations. The company's market leadership and continuous innovation pipeline support reliable long-term cash flow projections.

Cash Flow Catalysts:

- Global leadership in diabetes care with expanding patient populations

- Revolutionary obesity treatments addressing massive addressable markets

- Continuous innovation in drug delivery systems and treatment effectiveness

- International market expansion with direct sales and strategic partnerships

DCF Investment Strategy for Value Investors

Prioritize Substantial DCF Undervaluation: Focus on companies showing significant DCF undervaluation exceeding 30%, particularly those like UnitedHealth (236.0%), AbbVie (133.0%), and Abbott (59.0%). These represent opportunities where market prices substantially understate the present value of expected future cash flows based on fundamental business analysis.

Confirm with Multiple Valuation Approaches: DCF analysis works best when confirmed by other methodologies. Companies like UnitedHealth and AbbVie show undervaluation across multiple approaches, providing additional confidence in investment decisions. Exercise caution with companies showing DCF undervaluation but significant overvaluation in other methodologies without understanding the underlying reasons.

Assess Cash Flow Predictability: DCF analysis requires reliable cash flow projections, making it particularly suitable for companies with predictable business models like healthcare (UnitedHealth, AbbVie, Novartis) and established technology platforms (Cisco, Alibaba). Prioritize companies with consistent historical cash generation and clear visibility into future performance.

Monitor Earnings Power Value: High Earnings Power Value percentages like UnitedHealth (93.9%) and Novartis (84.3%) provide additional confirmation of DCF undervaluation by demonstrating strong current cash generation relative to enterprise value. This metric helps validate DCF assumptions about sustainable cash flow generation.

Understanding Our DCF Analysis Methodology

Our comprehensive DCF methodology incorporates several sophisticated analytical components:

Free Cash Flow Projections: We project future free cash flows based on detailed analysis of:

- Historical cash flow patterns and growth trends

- Revenue growth expectations incorporating market dynamics

- Operating margin evolution and competitive positioning

- Capital expenditure requirements and working capital changes

Weighted Average Cost of Capital (WACC) Calculation:

WACC=(EV)×Re+(DV)×Rd×(1−T)WACC=(VE)×Re+(VD)×Rd×(1−T)

Where:

- E = Market value of equity

- D = Market value of debt

- V = Total market value (E + D)

- Re = Cost of equity

- Rd = Cost of debt

- T = Corporate tax rate

Terminal Value Estimation: We calculate terminal value using multiple approaches:

- Perpetuity growth model with conservative growth assumptions

- Exit multiple methodology based on industry comparables

- Sensitivity analysis across various terminal value scenarios

Present Value Calculation: All projected cash flows are discounted to present value using company-specific WACC, with additional risk adjustments for business model uncertainty, competitive dynamics, and macroeconomic factors.

Key Takeaways for DCF Value Investors

✅ Exceptional DCF Opportunities: UnitedHealth (236.0%) and AbbVie (133.0%) offer substantial DCF undervaluation with strong fundamentals

✅ Healthcare Sector Strength: Multiple healthcare companies show significant DCF undervaluation with predictable cash flows

✅ Multiple Confirmation: Best opportunities show undervaluation across DCF and other methodologies for added confidence

✅ Cash Flow Quality: High Earnings Power Value companies provide additional validation of DCF undervaluation

✅ Diversified Opportunities: DCF undervaluation spans healthcare, technology, pharmaceuticals, and consumer sectors

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best Graham Number Stocks

📖 11 Best DRIP Stocks for 2025

📖 9 Best Small-Cap Growth Stocks

FAQ About DCF Valuation

What makes DCF analysis particularly effective for identifying undervalued stocks?

DCF analysis focuses on the fundamental economic value of a business by estimating the present value of future cash flows, providing an objective measure independent of market sentiment or comparable company valuations. This approach particularly excels at identifying companies like UnitedHealth (236.0% DCF undervalued) where market prices fail to reflect underlying cash generation potential. DCF analysis cuts through market noise to focus on actual business performance and cash flow sustainability, making it especially valuable during periods of market volatility or sector-specific pessimism.

Why do some companies show DCF undervaluation while other methods indicate overvaluation?

DCF analysis relies on specific assumptions about future growth rates, margins, and discount rates that may differ from other valuation approaches. Philip Morris shows 27.0% DCF undervaluation but overvaluation in other methods because DCF may incorporate more optimistic assumptions about the company's reduced-risk product transition than other methodologies capture. DCF tends to be more forward-looking about business transformation, while other methodologies may focus more heavily on current fundamentals or historical patterns.

How important is Earnings Power Value for validating DCF undervaluation?

Earnings Power Value is crucial for DCF validation because it measures current cash generation relative to enterprise value, providing a baseline for DCF assumptions. Companies with high EPV like UnitedHealth (93.9%) and Novartis (84.3%) demonstrate strong current profitability that supports DCF projections of future cash flows. Low EPV may indicate DCF models are too optimistic about future improvement, while high EPV provides confidence that companies can sustain or grow the cash flows assumed in DCF calculations.

What sectors are best suited for DCF analysis and why?

DCF analysis works best for sectors with predictable cash flows and clear visibility into future performance, making healthcare companies like UnitedHealth, AbbVie, and Novartis ideal candidates. These businesses benefit from regulatory protection, essential demand, and established market positions that support reliable cash flow projections. Technology companies with recurring revenue models like Cisco also work well for DCF analysis, while capital-intensive or cyclical businesses may present greater challenges for accurate long-term cash flow forecasting.

How should investors interpret DCF undervaluation in combination with other valuation metrics?

DCF undervaluation provides the strongest investment signal when confirmed by multiple valuation approaches, as demonstrated by companies like UnitedHealth and AbbVie showing undervaluation across DCF, intrinsic value, and Graham methodologies. When DCF shows undervaluation but other methods indicate overvaluation, investors should carefully examine the underlying assumptions and business fundamentals. The most compelling opportunities typically show consistent undervaluation across multiple approaches, providing greater confidence that market prices genuinely understate intrinsic business value.

Important DCF Methodology Note: DCF analysis requires numerous assumptions about future performance, growth rates, and discount rates that can significantly impact valuation conclusions. Our DCF calculations incorporate conservative assumptions and sensitivity analysis, but investors should understand that actual results may vary from projections. DCF undervaluation provides valuable insight into potential intrinsic value but should be combined with qualitative business analysis and other valuation approaches for comprehensive investment decisions.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. DCF valuations are based on current financial data and forward-looking assumptions that may change with new information. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.