Dennis Hong - ShawSpring Partners Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

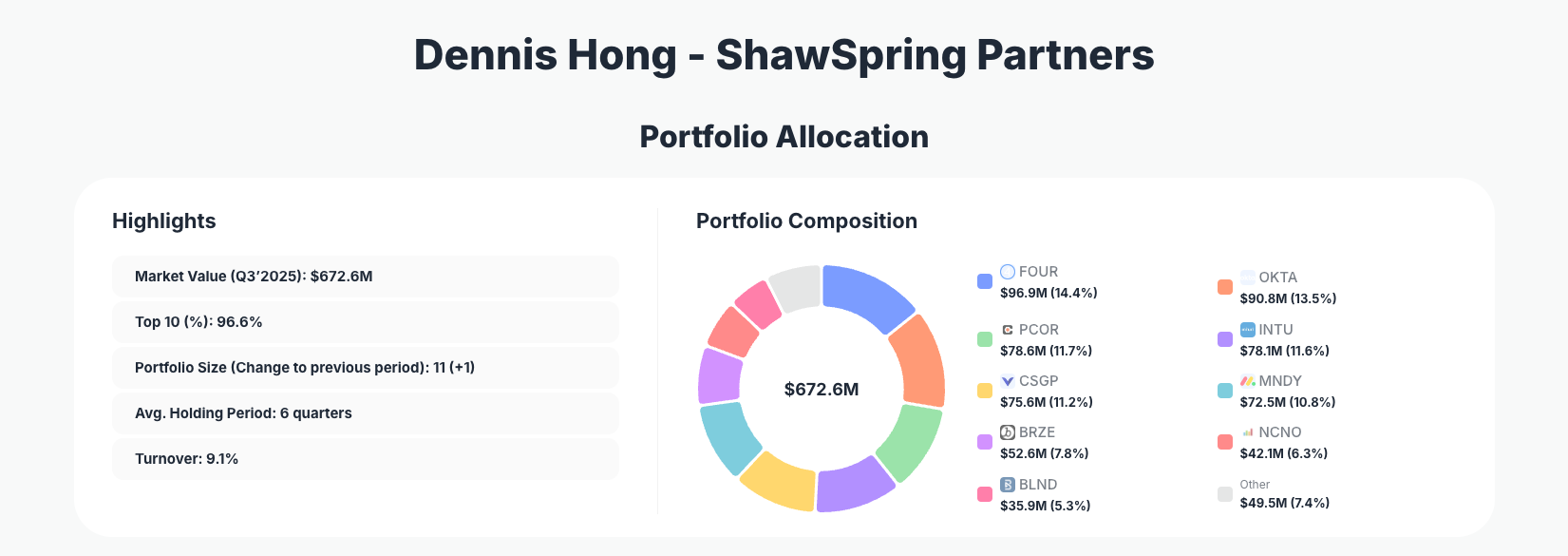

Dennis Hong of ShawSpring Partners showcases his signature focus on high-quality software businesses with the latest $672.6M portfolio from Q3 2025 13F filings. This quarter's moves reveal active portfolio management, including significant additions to payment processors and collaboration tools alongside substantial reductions in several core software holdings, all while maintaining extreme concentration across just 11 positions.

Portfolio Overview: Extreme Concentration in Software Winners

Portfolio Highlights (Q3 2025): - Market Value: $672.6M - Top 10 Holdings: 96.6% - Portfolio Size: 11 +1 - Average Holding Period: 6 quarters - Turnover: 9.1%

ShawSpring Partners' Q3 2025 portfolio exemplifies ultra-concentrated investing, with the top 10 holdings commanding a staggering 96.6% of the entire $672.6M portfolio. This level of focus underscores Dennis Hong's conviction-driven approach, where capital is deployed heavily into a select group of software companies rather than spread across dozens of positions. The addition of one new holding brings the total to 11, signaling measured expansion without diluting focus.

Low turnover of 9.1% combined with a 6-quarter average holding period highlights a buy-and-hold philosophy tempered by tactical adjustments. Significant adds like FOUR and MNDY suggest Hong sees accelerating growth potential in payments and work management software, while deep cuts in names like NCNO and CSGP indicate profit-taking or reduced conviction amid market rotations. Overall, the portfolio remains a high-conviction bet on SaaS durability.

This structure positions ShawSpring to capture outsized returns from software leaders, with minimal diversification risk—a classic hallmark of managers who deeply understand their holdings.

Top Holdings: Payments Surge Meets Software Trims

The portfolio leads with aggressive moves in fintech and collaboration software. Shift4 Payments, Inc. (FOUR) tops the list at 14.4% after a massive Add 60.70%, with $96.9M invested across 1,251,374 shares, signaling strong belief in payment processing growth. Okta, Inc. (OKTA) follows closely at 13.5% $90.8M, bolstered by a modest Add 3.79% to 990,486 shares, reinforcing identity management as a core theme.

On the trim side, Procore Technologies, Inc. (PCOR) holds 11.7% $78.6M after Reduce 30.97% to 1,077,913 shares, while Intuit Inc. (INTU) sits at 11.6% $78.1M following Reduce 17.62% to 114,369 shares—both reflecting rebalancing in established SaaS giants. CoStar Group, Inc. (CSGP) weighs in at 11.2% $75.6M after a sharp Reduce 33.92% to 896,034 shares, potentially freeing capital for higher-upside bets.

Adds continue with monday.com Ltd. (MNDY) at 10.8% ($72.5M, Add 33.07% to 374,221 shares), highlighting work OS momentum. Reductions persist in Braze, Inc. (BRZE) (7.8%, $52.6M, Reduce 26.65% to 1,848,244 shares) and nCino, Inc. (NCNO) (6.3%, $42.1M, Reduce 46.20% to 1,553,659 shares), the latter seeing the deepest cut. Blend Labs, Inc. (BLND) rounds out the top 10 at 5.3% ($35.9M, Add 10.43% to 9,840,605 shares), with digital lending exposure.

Beyond the top 10, Vertex, Inc. (VERX) enters at 4.0% $26.8M via Add 51.79% to 1,081,446 shares, extending the software focus into tax compliance tech. These shifts blend opportunistic scaling in payments and productivity tools with disciplined pruning across the board.

What the Portfolio Reveals

Dennis Hong's Q3 moves paint a picture of a manager navigating software sector volatility with precision: - Heavy SaaS and Fintech Tilt: Nearly every holding operates in software, from payments (FOUR) to identity (OKTA) and construction tech (PCOR), betting on recurring revenue resilience. - Active Risk Management: Deep reductions (e.g., 46% in NCNO, 34% in CSGP) amid adds show dynamic position sizing to optimize for growth inflection points. - Growth Over Value: Emphasis on high-growth names like MNDY and BLND prioritizes scalable software models, with U.S.-centric exposure dominating. - Low Turnover Discipline: 9.1% turnover balances conviction (6-quarter holds) with adaptability, avoiding knee-jerk reactions.

This reveals a strategy favoring quality compounders in enterprise software, even as broader tech faces headwinds.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Shift4 Payments, Inc. (FOUR) | $96.9M | 14.4% | Add 60.70% |

| Okta, Inc. (OKTA) | $90.8M | 13.5% | Add 3.79% |

| Procore Technologies, Inc. (PCOR) | $78.6M | 11.7% | Reduce 30.97% |

| Intuit Inc. (INTU) | $78.1M | 11.6% | Reduce 17.62% |

| CoStar Group, Inc. (CSGP) | $75.6M | 11.2% | Reduce 33.92% |

| monday.com Ltd. (MNDY) | $72.5M | 10.8% | Add 33.07% |

| Braze, Inc. (BRZE) | $52.6M | 7.8% | Reduce 26.65% |

| nCino, Inc. (NCNO) | $42.1M | 6.3% | Reduce 46.20% |

| Blend Labs, Inc. (BLND) | $35.9M | 5.3% | Add 10.43% |

This table underscores ShawSpring's extreme concentration, with the top position (FOUR) at 14.4% and the top five exceeding 62% of the portfolio. The mix of bold adds (e.g., 60.70% in FOUR) and trims (e.g., 46.20% in NCNO) demonstrates nuanced capital allocation, reallocating from maturing holdings to emerging leaders. Such focus amplifies returns potential but demands deep conviction, as any single misstep carries outsized impact.

Investment Lessons from Dennis Hong's ShawSpring Approach

- Concentrate Ruthlessly in Your Circle of Competence: 96.6% in top 10 software bets shows confidence in deeply researched SaaS businesses over broad diversification.

- Trim Winners to Fuel New Convictions: Reductions in INTU and CSGP freed capital for adds like MNDY, balancing growth capture with portfolio evolution.

- Prioritize Recurring Revenue Scalability: Focus on payments, identity, and productivity tools highlights bets on high-moat, subscription-driven models.

- Maintain Holding Discipline: 6-quarter average tenure proves patience pays, avoiding churn despite 9.1% turnover.

- Scale Aggressively on Inflection Points: 60.70% add to FOUR exemplifies doubling down when growth accelerates.

Looking Ahead: What Comes Next?

With portfolio size expanding to 11 +1 and low 9.1% turnover, ShawSpring appears positioned for selective deployment into additional software disruptors, potentially in fintech adjacencies or AI-enhanced workflows. The heavy adds to FOUR and MNDY suggest momentum in payments and no-code platforms could drive near-term performance amid economic uncertainty. Trims in overweights like NCNO create dry powder for opportunistic buys if valuations correct. In a high-interest-rate environment favoring cash-generative SaaS, current positioning sets up well for 2026 upside, assuming execution in core holdings.

FAQ about Dennis Hong ShawSpring Partners Portfolio

Q: What are the biggest changes in ShawSpring's Q3 2025 portfolio?

A: Key moves include a massive 60.70% add to Shift4 Payments (FOUR) (now 14.4%), 33.07% add to monday.com (MNDY), and deep reductions like 46.20% in nCino (NCNO) and 33.92% in CoStar (CSGP), reflecting active rebalancing.

Q: Why does ShawSpring maintain such high portfolio concentration?

A: At 96.6% in top 10 holdings across 11 positions, the strategy leverages deep research into software leaders, accepting higher volatility for potential outsized returns from high-conviction bets like OKTA and INTU.

Q: What sectors dominate Dennis Hong's holdings?

A: Enterprise software overwhelmingly leads, spanning payments (FOUR), identity (OKTA), construction (PCOR), tax (VERX), and productivity (MNDY).

Q: How can I track and follow ShawSpring Partners' portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/shawspring for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!