Intrinsic Value with the Free Discount Rate Calculator from Value Sense

Welcome to Value Sense Blog

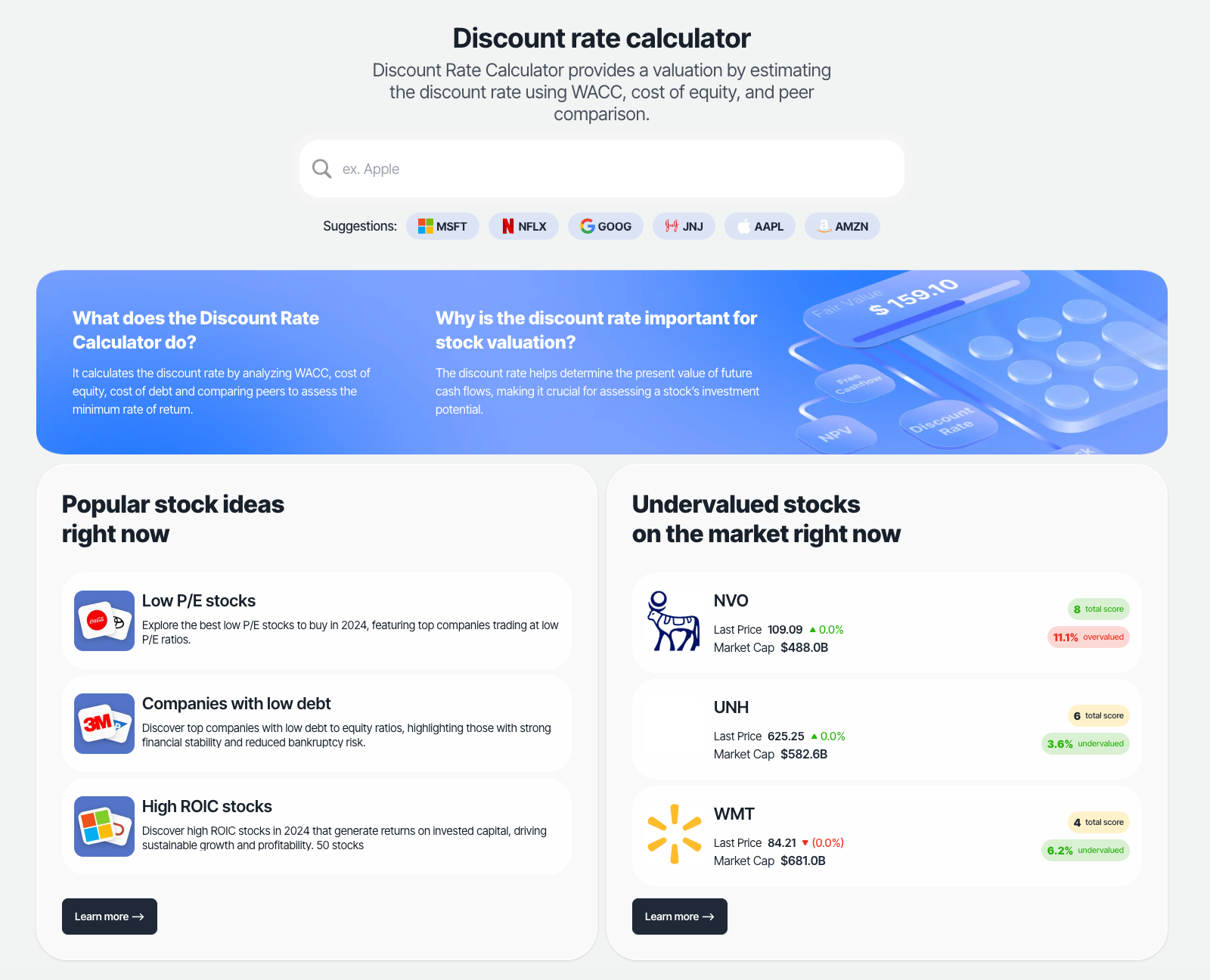

At Value Sense we help investors instantly find top-performing stocks and undervalued companies, saving time on research. You can explore our intrinsic value tools at valuesense.io and learn more about our latest stock ideas.

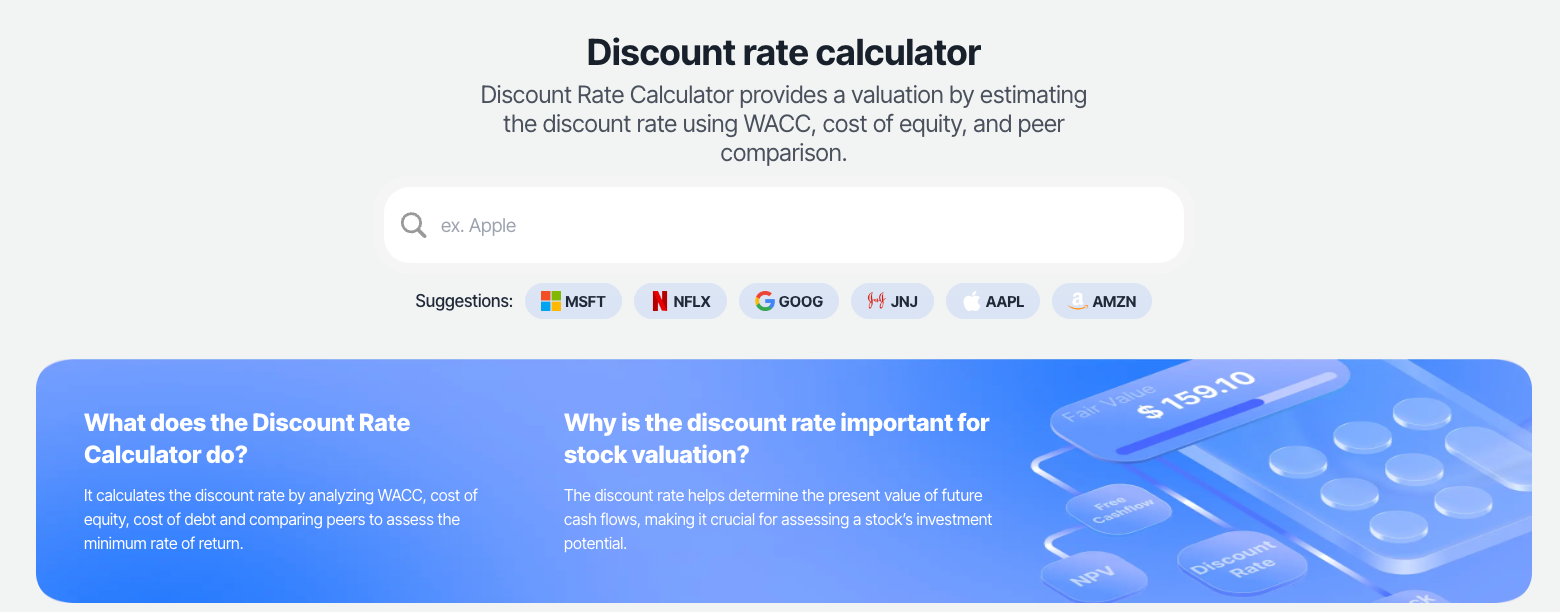

The Discount Rate Calculator: A Key Tool for Accurate Valuation

The Discount Rate Calculator is an essential tool for investors and financial analysts aiming to assess the present value of future cash flows in company valuation. By calculating an appropriate discount rate, this tool helps determine the rate at which projected future earnings or cash flows should be adjusted to reflect the time value of money and the risk associated with the investment. This rate is critical to obtaining a realistic valuation of an asset, project, or business, particularly when using methods like the Discounted Cash Flow (DCF) analysis.

Unlike simple growth assumptions, the discount rate considers risk factors tied to the company’s financial health, market volatility, and the overall economic climate, making it a key factor in valuing companies based on their intrinsic performance rather than market sentiment.

Understanding the Discount Rate

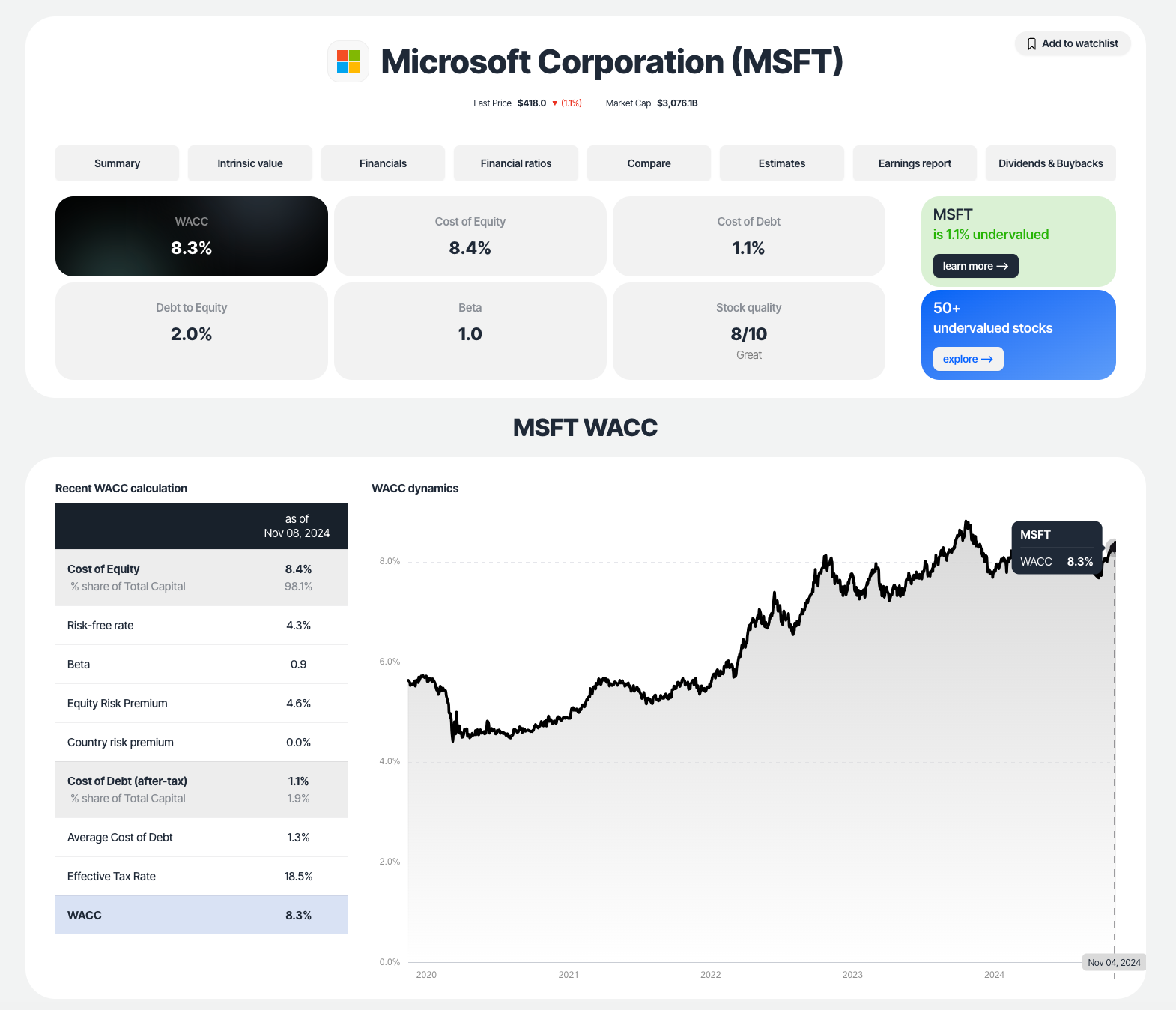

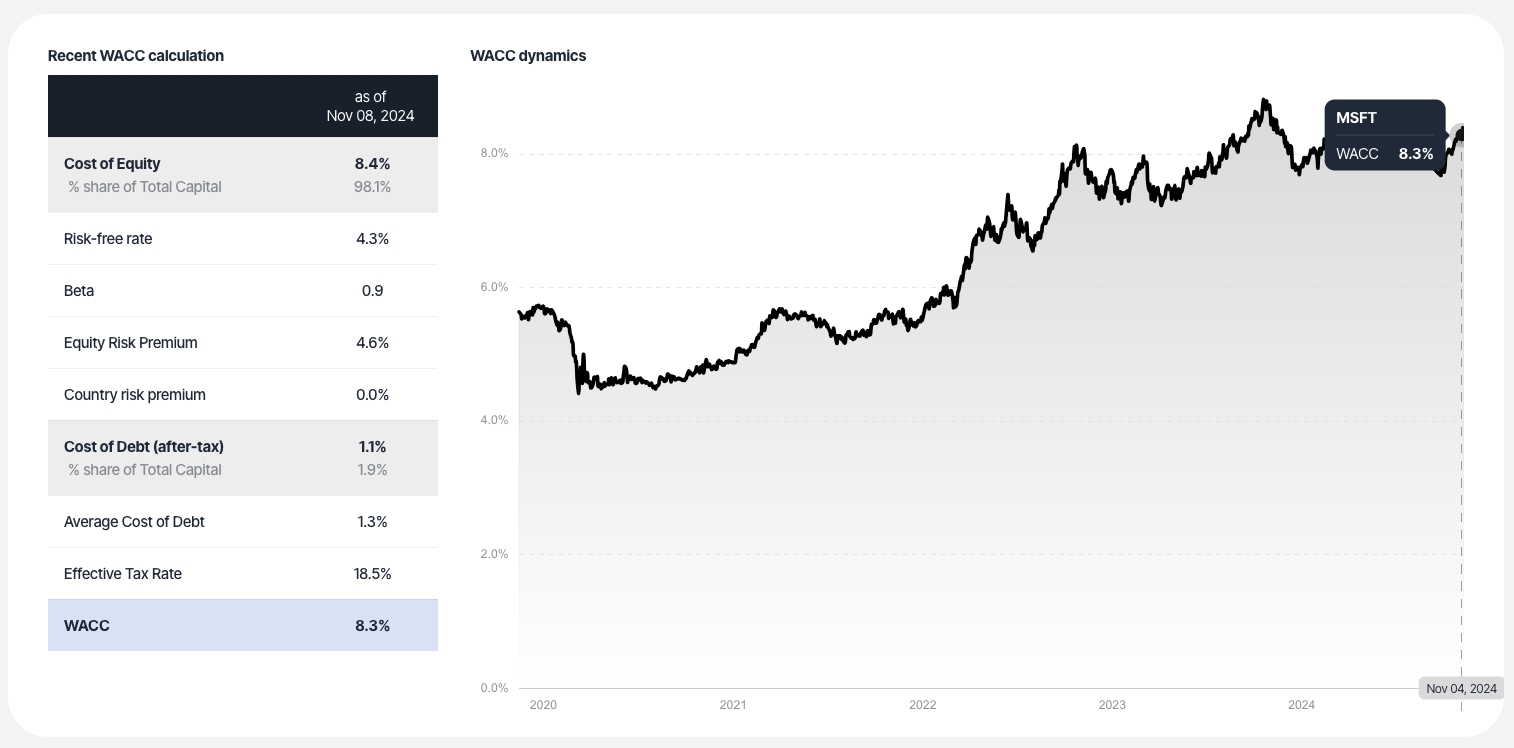

The discount rate represents the return required by investors to commit capital, factoring in the risk and opportunity cost of investing in a particular asset. Often calculated as the Weighted Average Cost of Capital (WACC), the discount rate incorporates both debt and equity financing costs to provide a balanced view of a company's cost of capital. This rate ensures that future earnings are appropriately converted into present value terms, thus providing a realistic assessment of what the company is worth today.

Key Components in the Discount Rate Calculation

- Cost of Equity: Reflecting the return required by shareholders, the cost of equity is often derived using models like the Capital Asset Pricing Model (CAPM), which accounts for risk-free returns, beta (market risk), and the equity risk premium.

- Cost of Debt: The after-tax cost of debt reflects the interest rate that the company pays on its liabilities, adjusted for the tax benefits associated with interest payments.

- Capital Structure: The mix of debt and equity financing, represented as WACC, determines the weight of each component in calculating an average required return, adjusted for risk.

- Risk Premiums: Additional adjustments may include country or industry risk premiums, which account for external factors affecting the risk and return of an investment.

Why Use the Discount Rate Calculator?

The Discount Rate Calculator simplifies these complex calculations, allowing investors to quickly determine a suitable discount rate for any given business. By providing a clear picture of what rate to apply to future cash flows, this tool enables investors to:

- Estimate True Business Value: By using a risk-adjusted discount rate, investors obtain a reliable measure of a company’s value based on its future earning potential.

- Improve DCF Accuracy: Since the discount rate significantly impacts DCF valuations, calculating it precisely is crucial for accurate results.

- Assess Investment Risk: The calculator reflects the risk level of an investment, allowing investors to make well-informed comparisons between different assets or companies.

How to Calculate Discount Rate?

With the Value Sense Discount Rate Calculator, you can instantly compute an accurate discount rate for any stock or business. By simply entering details like expected returns, debt levels, and equity costs, the tool automates the calculation, outputting a WACC-based discount rate tailored to the specific company or project.

Maximize Your Investment Potential with Value Sense’s Free Tools

In addition to our Discount Rate Calculator, we offer an array of free intrinsic value calculators to support investors in making the best possible financial decisions. These include:

- reverse DCF calculator

- earnings growth model

- Peter Lynch charts

- discount rate calculator

- margin of safety calculator

- intrinsic value calculator

And much more.

Explore Our Stock Selection Lists

For investors looking to explore undervalued stocks, our analytics team offers exclusive lists of top stock picks:

Ready to Get Started?

Join over 3,500 value investors worldwide who are using Value Sense tools to uncover investment opportunities. Visit valuesense.io today to start calculating with our Discount Rate Calculator and other powerful valuation tools – all completely free!