Dodge & Cox Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

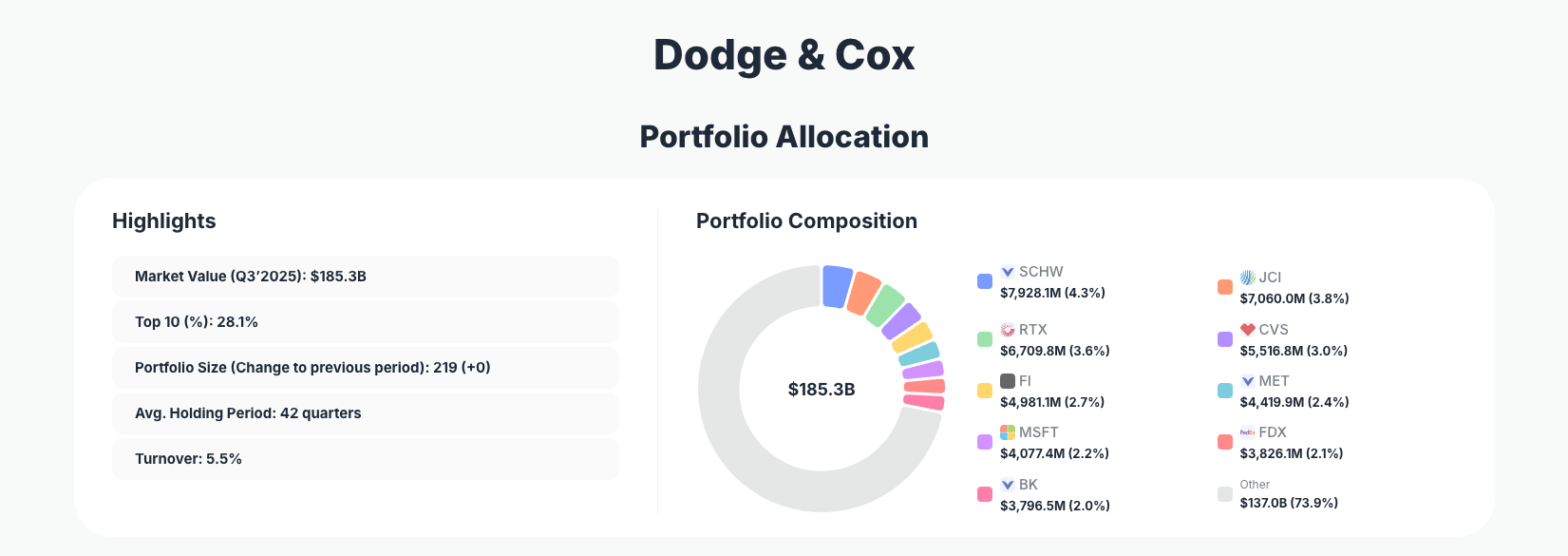

Dodge & Cox, one of the oldest and most respected value-oriented asset managers in the United States, continues to showcase its hallmark blend of patience and disciplined security selection. The firm’s Q3’2025 portfolio filing reveals a massive $185.3B equity book with modest 5.5% turnover, where incremental trims to long‑time winners sit alongside sizable additions to select financials and business services leaders.

The Big Picture: Diversified Value with Long Holding Periods

Portfolio Highlights (Q3’2025): - Market Value: $185.3B

- Top 10 Holdings: 28.1%

- Portfolio Size: 219 +0 positions

- Average Holding Period: 42 quarters

- Turnover: 5.5%

The scale and structure of Dodge & Cox’s portfolio show a classic institutional value shop running a broad yet conviction‑weighted book. With 219 positions and the top 10 at only 28.1%, the firm is far more diversified than ultra‑concentrated hedge funds, yet still expresses clear preference through multi‑billion‑dollar stakes in core names.

An average holding period of 42 quarters—more than 10 years—underscores the team’s commitment to long-term, fundamentals‑driven investing. Rather than rapid rotation, the Q3’2025 13F indicates measured adjustments: small reductions in several large positions, and targeted increases where the risk‑reward has become especially compelling. The modest 5.5% turnover further confirms that most of the equity portfolio remains anchored in long-standing ideas, with changes focused at the margin.

The combination of a large asset base, long holding periods, and relatively low top‑10 concentration suggests a strategy geared toward robust diversification across sectors, while still building up sizeable allocations where valuations, balance sheets, and management quality align with Dodge & Cox’s intrinsic value discipline.

Core Holdings and Key Moves: Financials, Industrials, and Quality Compounders

The Q3’2025 13F shows meaningful but controlled activity across several major positions. The portfolio continues to lean into financials, insurance, and business services, while maintaining exposure to high‑quality technology and industrial names.

One of the most significant positions is The Charles Schwab Corporation, with The Charles Schwab Corporation representing 4.3% of the portfolio at $7,928.1M, though Dodge & Cox chose to Reduce 1.56% of its stake. This trim aligns with a pattern of incremental profit‑taking in winners, rather than a wholesale shift away from the business model.

Industrial and building‑technology exposure remains important through Johnson Controls International plc, at 3.8% of the portfolio and $7,060.0M in value, where the firm opted to Reduce 4.05%. Similarly, in aerospace and defense, RTX Corporation sits at 3.6% and $6,709.8M, with a Reduce 3.96% action, signaling a cautious risk‑management stance after strong performance or valuation reratings.

Healthcare and retail pharmacy exposure continues via CVS Health Corporation, which accounts for 3.0% of the portfolio and $5,516.8M in capital. Here, Dodge & Cox executed only a Reduce 0.15%, effectively holding the line on a core position while modestly managing size.

On the buying side, the standout move is in payments and fintech infrastructure: Fiserv, Inc. now makes up 2.7% of the portfolio with $4,981.1M invested after a sizable Add 30.00%. This aggressive addition suggests high conviction in Fiserv’s recurring revenue model, embedded banking relationships, and long runway in digital payments.

Insurance also remains a core theme. MetLife, Inc. stands at 2.4% of the portfolio and $4,419.9M in value, with Dodge & Cox choosing to Add 0.90%—a small but telling expression of ongoing confidence in the insurer’s earnings and capital return profile.

In technology, the firm maintains a large position in Microsoft Corporation at 2.2% of the portfolio and $4,077.4M, but executed a Reduce 3.32% move. This likely reflects valuation discipline more than a negative view on fundamentals, as Microsoft remains one of the highest‑quality franchises globally.

Transportation and logistics feature via FedEx Corporation, which now represents 2.1% of the portfolio with $3,826.1M after Dodge & Cox chose to Add 12.03%. This meaningful increase suggests the firm sees attractive upside in FedEx’s margin expansion and global trade exposure.

Banking exposure is rounded out by The Bank of New York Mellon Corporation, at 2.0% of the portfolio and $3,796.5M, where a Reduce 7.38% move points to careful size control amid rate and regulatory uncertainty. Rounding out the key changes list is energy exposure through Occidental Petroleum Corporation, also at 2.0% of the portfolio and $3,774.5M, where Dodge & Cox opted to Reduce 0.46%, a very modest trim that keeps the position essentially intact.

Across these 10–11 highlighted names, the pattern is clear: measured trims in large, long‑held positions where valuations have risen, and selectively aggressive adds in names like Fiserv and FedEx where the firm sees a compelling blend of quality, cyclicality, and discounted intrinsic value.

What the Portfolio Reveals About Dodge & Cox’s Strategy

Several strategic themes emerge from the Q3’2025 moves in Dodge & Cox’s portfolio:

- Quality at a Discount, Not Growth at Any Price

The focus on companies like SCHW, MSFT, FI, and FDX reflects a bias toward durable franchises with strong cash flows. The trims to Microsoft and RTX, paired with additions to Fiserv and FedEx, suggest a constant rebalancing between quality and valuation. - Heavy Tilt Toward Financials and Insurance

Large allocations to The Charles Schwab Corporation, MetLife, Inc., and The Bank of New York Mellon Corporation indicate a conviction that well‑capitalized financials remain undervalued relative to their earnings power and capital return potential. - Global but U.S.-Centric Exposure

While Johnson Controls International plc is domiciled in Ireland and other holdings have global operations, the bulk of major positions are U.S.-listed blue chips, consistent with Dodge & Cox’s history of focusing on U.S. and developed‑market large caps. - Income and Capital Return Matter

Many core holdings—such as MetLife, BNY Mellon, CVS, and Occidental Petroleum Corporation—are established dividend payers and active repurchasers of their own shares, which aligns with a value strategy that prizes shareholder yield. - Risk Management Through Gradualism

Actions like Reduce 1.56% in SCHW, Reduce 0.15% in CVS, and Reduce 0.46% in OXY highlight Dodge & Cox’s preference for incremental rather than binary decisions. Position sizing is fine‑tuned in response to prices, fundamentals, and portfolio‑level risk.

Collectively, the Q3’2025 data reinforces Dodge & Cox’s reputation: long-term, valuation‑driven, with a bias toward financially strong, cash‑generative businesses, and a steady hand through market volatility.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| The Charles Schwab Corporation | $7,928.1M | 4.3% | Reduce 1.56% |

| Johnson Controls International plc | $7,060.0M | 3.8% | Reduce 4.05% |

| RTX Corporation | $6,709.8M | 3.6% | Reduce 3.96% |

| CVS Health Corporation | $5,516.8M | 3.0% | Reduce 0.15% |

| Fiserv, Inc. | $4,981.1M | 2.7% | Add 30.00% |

| MetLife, Inc. | $4,419.9M | 2.4% | Add 0.90% |

| Microsoft Corporation | $4,077.4M | 2.2% | Reduce 3.32% |

| FedEx Corporation | $3,826.1M | 2.1% | Add 12.03% |

| The Bank of New York Mellon Corporation | $3,796.5M | 2.0% | Reduce 7.38% |

These top positions together represent a meaningful slice of the 28.1% allocated to the top ten holdings, yet no single name dominates the book. The largest disclosed position here, The Charles Schwab Corporation at 4.3%, indicates that Dodge & Cox prefers diversified conviction instead of “all‑in” bets.

The distribution also reveals sector balance: major stakes across brokerage/banking (SCHW, BK), insurance (MET), healthcare/retail (CVS), industrials/aerospace (JCI, RTX, FDX), technology (MSFT), and payments/fintech (FI). This mix supports a multi‑sector value approach that reduces idiosyncratic risk while still offering upside from stock‑specific catalysts.

Investment Lessons from Dodge & Cox’s Long-Term Value Approach

Dodge & Cox’s Q3’2025 positioning offers several actionable takeaways for individual investors:

- Hold for Years, Not Quarters

An average holding period of 42 quarters shows the power of compounding when you let high‑quality businesses execute over time instead of reacting to every market headline. - Use Valuation to Guide Trims and Adds

Incremental moves such as Reduce 3.32% in Microsoft Corporation and Add 30.00% in Fiserv, Inc. demonstrate a disciplined approach: trim when valuations stretch, and size up when quality meets attractive pricing. - Diversify Across Strong Franchises

With 219 positions and no single stock above the mid‑single‑digit range, Dodge & Cox shows that you can express conviction without undue concentration risk. - Favor Cash-Generative, Shareholder‑Friendly Companies

Many of the highlighted names combine solid free cash flow with dividends and buybacks, a hallmark of value investing focused on total shareholder return. - Adjust, Don’t Overreact

Small reductions such as Reduce 0.15% in CVS Health Corporation or Reduce 0.46% in Occidental Petroleum Corporation illustrate that risk management often means nudging portfolio weights, not wholesale exits.

Looking Ahead: What Comes Next for Dodge & Cox’s Portfolio?

While 13F data is inherently backward‑looking, the Q3’2025 positioning of Dodge & Cox’s portfolio hints at how the firm is thinking about the future:

- The continued overweight to financials and insurance suggests Dodge & Cox still sees room for earnings normalization and capital return in these sectors as interest rate uncertainty stabilizes.

- Aggressive buying in Fiserv and increased exposure to FedEx imply confidence in secular growth in digital payments and global trade/logistics recovery, even if short‑term volatility persists.

- Maintaining and only slightly trimming positions like Microsoft, CVS, RTX, and Schwab signals belief in their long‑term competitive advantages, even at richer valuations.

- Modest reductions in energy (Occidental Petroleum) and selective trims in rate‑sensitive financials like BNY Mellon indicate prudent risk control amid shifting macro conditions.

For investors watching this strategy, the key will be to monitor whether Dodge & Cox continues adding to financial infrastructure and payment names or begins rotating more aggressively into other cyclical or defensive areas in future quarters.

FAQ about Dodge & Cox’s Portfolio

Q: What were the most notable changes in Dodge & Cox’s Q3’2025 portfolio?

The most notable changes include a 30.00% increase in Fiserv, Inc., a 12.03% increase in FedEx Corporation, and meaningful trims such as Reduce 7.38% in The Bank of New York Mellon Corporation, along with smaller reductions in The Charles Schwab Corporation, Johnson Controls International plc, RTX Corporation, CVS Health Corporation, Microsoft Corporation, and Occidental Petroleum Corporation.

Q: How concentrated is Dodge & Cox’s portfolio?

The firm runs a $185.3B equity book across 219 positions, with the top 10 holdings accounting for 28.1% of assets. This indicates a diversified but conviction‑weighted portfolio where no single holding dominates overall risk.

Q: Does Dodge & Cox frequently trade its holdings?

No. The average holding period of 42 quarters and 5.5% turnover in Q3’2025 show that Dodge & Cox is a low‑turnover, long‑term investor, making incremental changes rather than frequent trading.

Q: Which sectors appear most important to Dodge & Cox right now?

Based on the largest and most actively adjusted positions, financials, insurance, industrials, healthcare, technology, and energy are key sectors. Holdings such as SCHW, MET, JCI, RTX, CVS, MSFT, FI, FDX, BK, and OXY illustrate this sector mix.

Q: How can I track Dodge & Cox’s portfolio over time?

You can follow Dodge & Cox’s holdings through quarterly 13F filings, which U.S. institutional managers must submit within 45 days of each quarter’s end. Because of this reporting lag, positions may have changed by the time they’re public, so using platforms like ValueSense’s Dodge & Cox superinvestor page helps you visualize changes, analyze historical trends, and compare position sizes and turnover across quarters.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!