How to Download Complete Stock Financial Data in Seconds (Not Hours)

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Every Monday morning, the same ritual plays out across investment firms worldwide: analysts opening dozens of browser tabs, navigating to quarterly reports, and copying financial data line by line into Excel spreadsheets.

At ValueSense, we decided this ritual needed to die.

We built our platform around a simple premise: What if downloading comprehensive stock data took seconds instead of hours? What if you could get complete financial statements, DCF models, and peer analysis with a single click?

Here's how we made it happen - and why it's changing how financial professionals work.

The Problem We Set Out to Solve

When we surveyed 500+ financial analysts about their biggest workflow frustrations, the answers were unanimous:

- 87% spend 10+ hours per week just getting data into usable format

- "Downloading clean financial data" ranked as the #1 pain point

- Manual data entry errors cause analysis delays in 72% of cases

The core issue wasn't access to data—it was access to usable data. Most platforms give you raw numbers buried in PDFs or basic CSV exports that require hours of cleanup before analysis can begin.

We knew there had to be a better way.

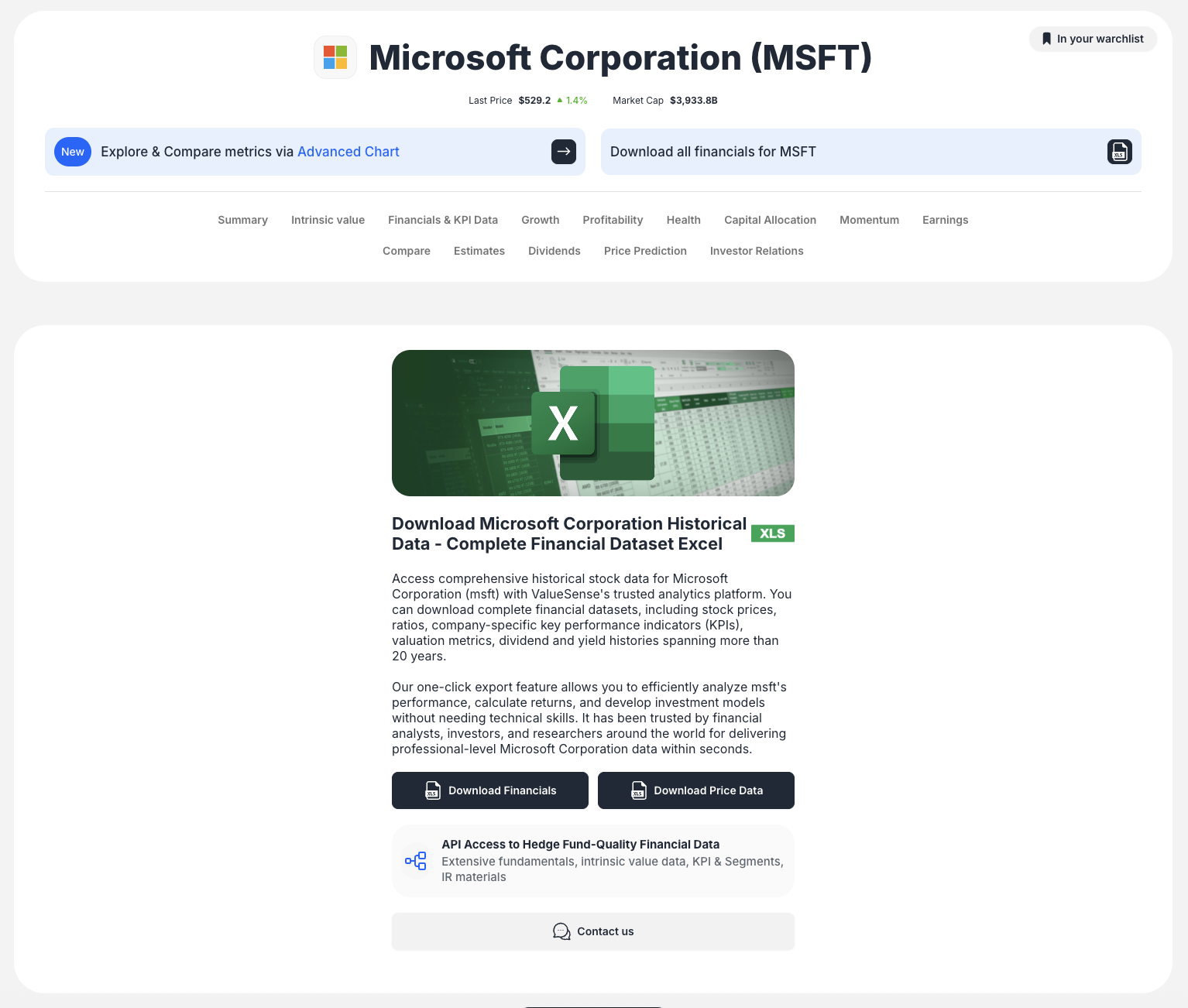

Our Solution: True One-Click Financial Downloads

Instead of forcing analysts to hunt through quarterly reports or wrestle with messy exports, ValueSense delivers complete, analysis-ready datasets with a single download.

Here's what we mean by "complete":

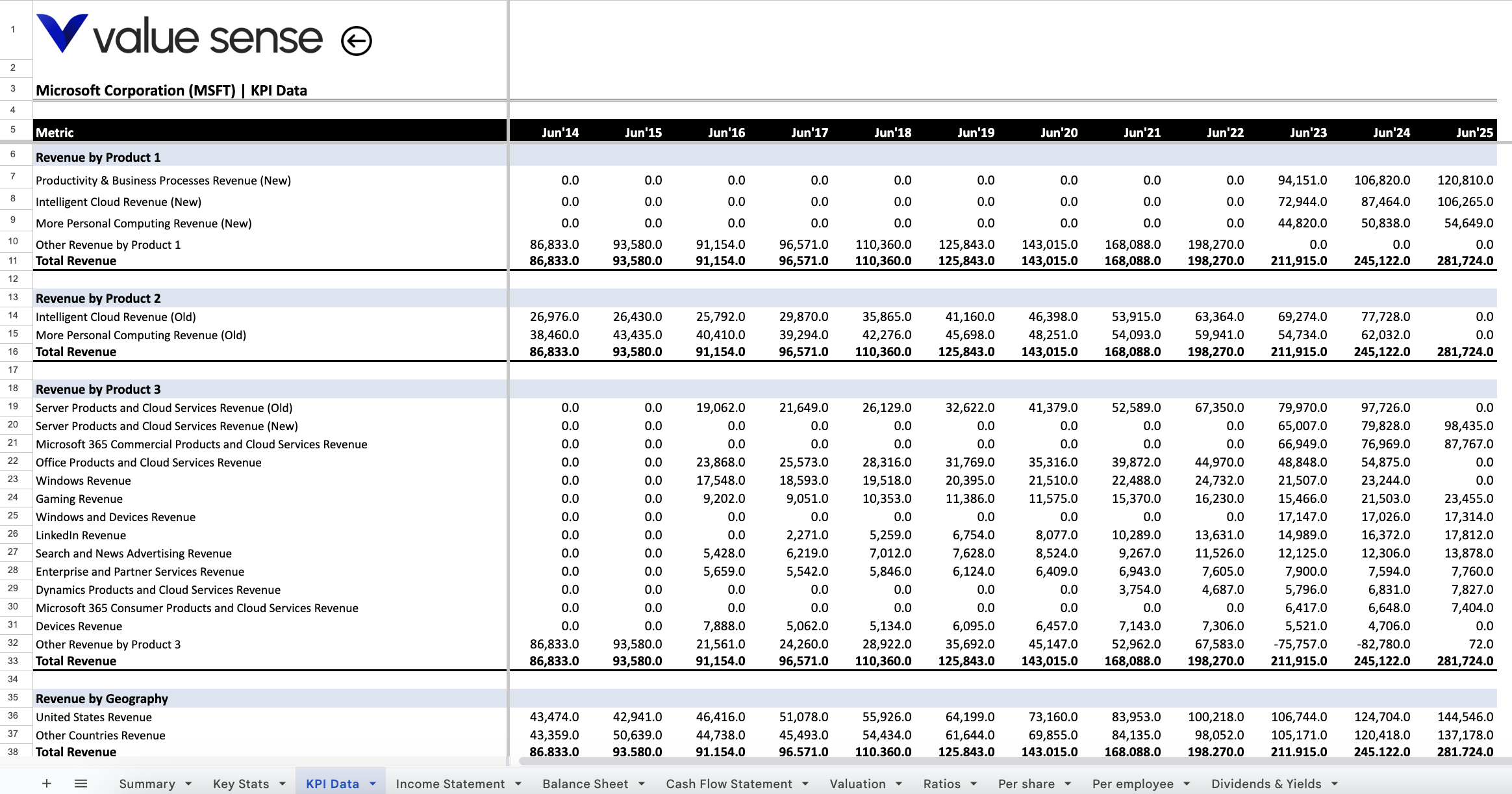

Full Financial Statement Packages

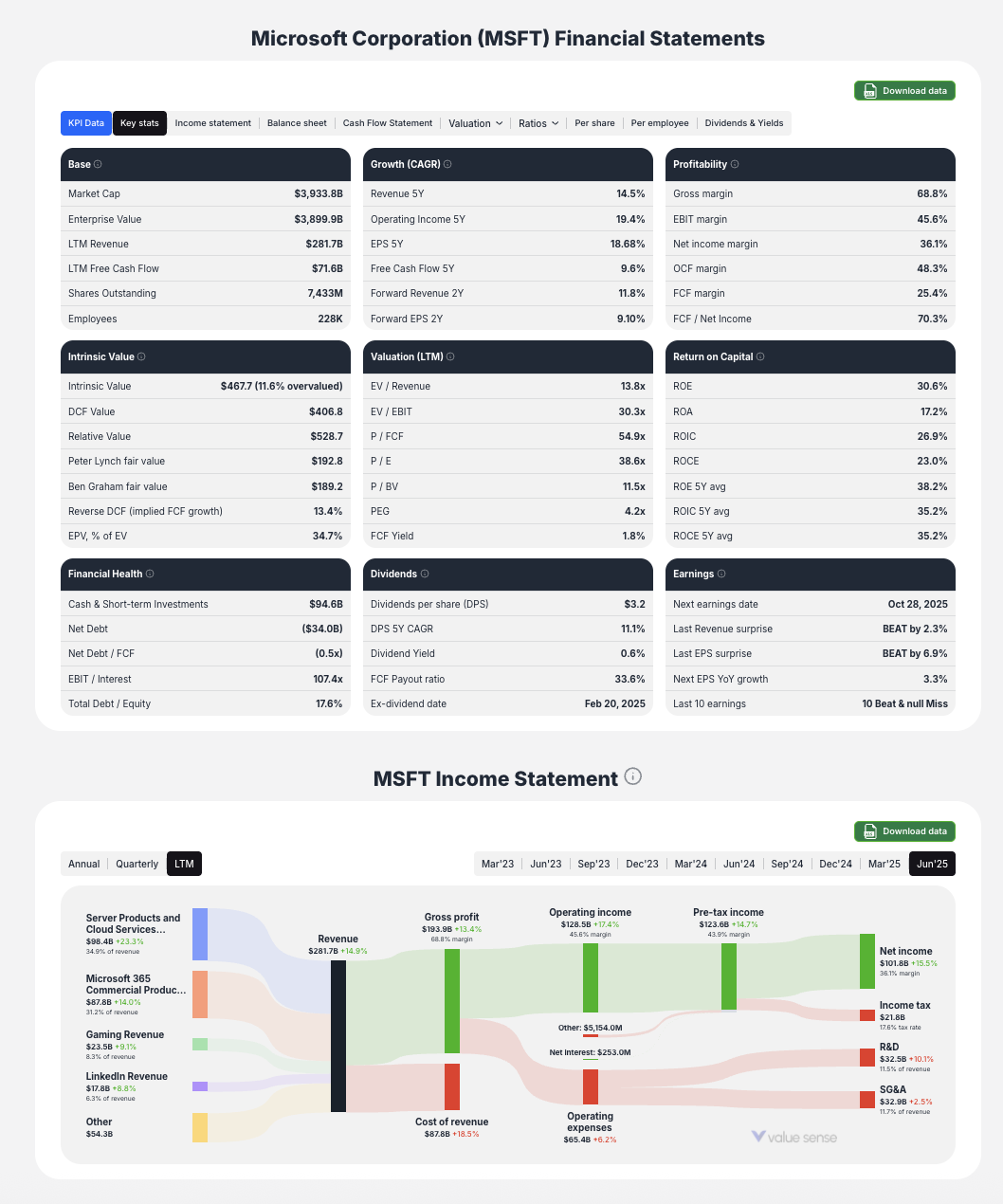

When you download Microsoft's financial data from ValueSense, you get:

- 10 years of income statements with revenue breakdowns by segment

- Complete balance sheet history with debt structure and working capital details

- Cash flow statements with free cash flow calculations already built in

- Key ratios and multiples pre-calculated across all time periods

Everything formatted consistently in professional Excel templates that work immediately with your existing models.

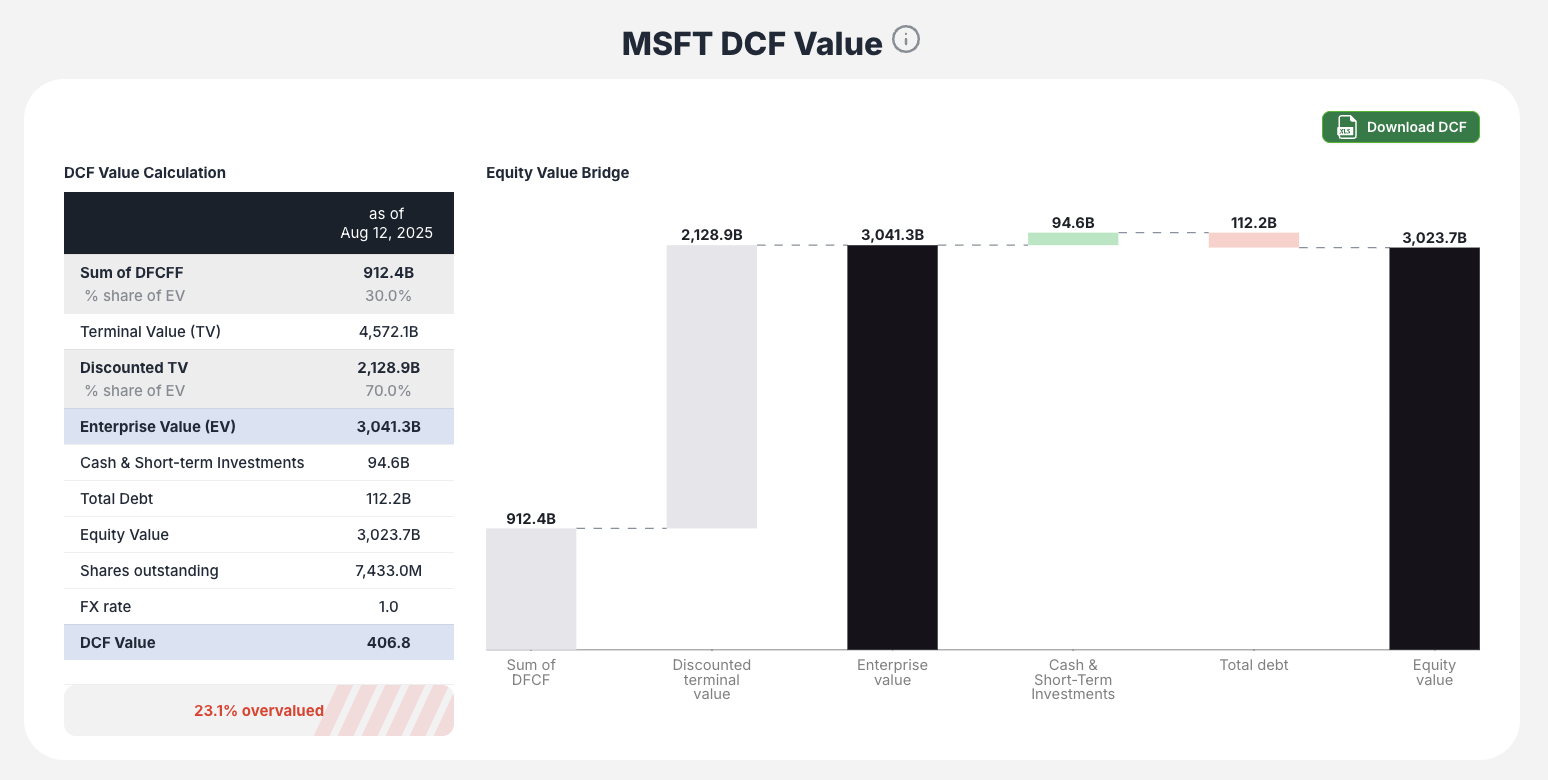

Professional DCF Model Templates

Instead of building discounted cash flow models from scratch, you can download:

- Fully integrated 3-statement models with historical data already populated

- 5-year projection frameworks with customizable assumption inputs

- Sensitivity analysis tables testing growth and discount rate scenarios

- Monte Carlo simulation structures ready for advanced modeling

These aren't basic templates—they're institutional-quality models that would take 6+ hours to build manually.

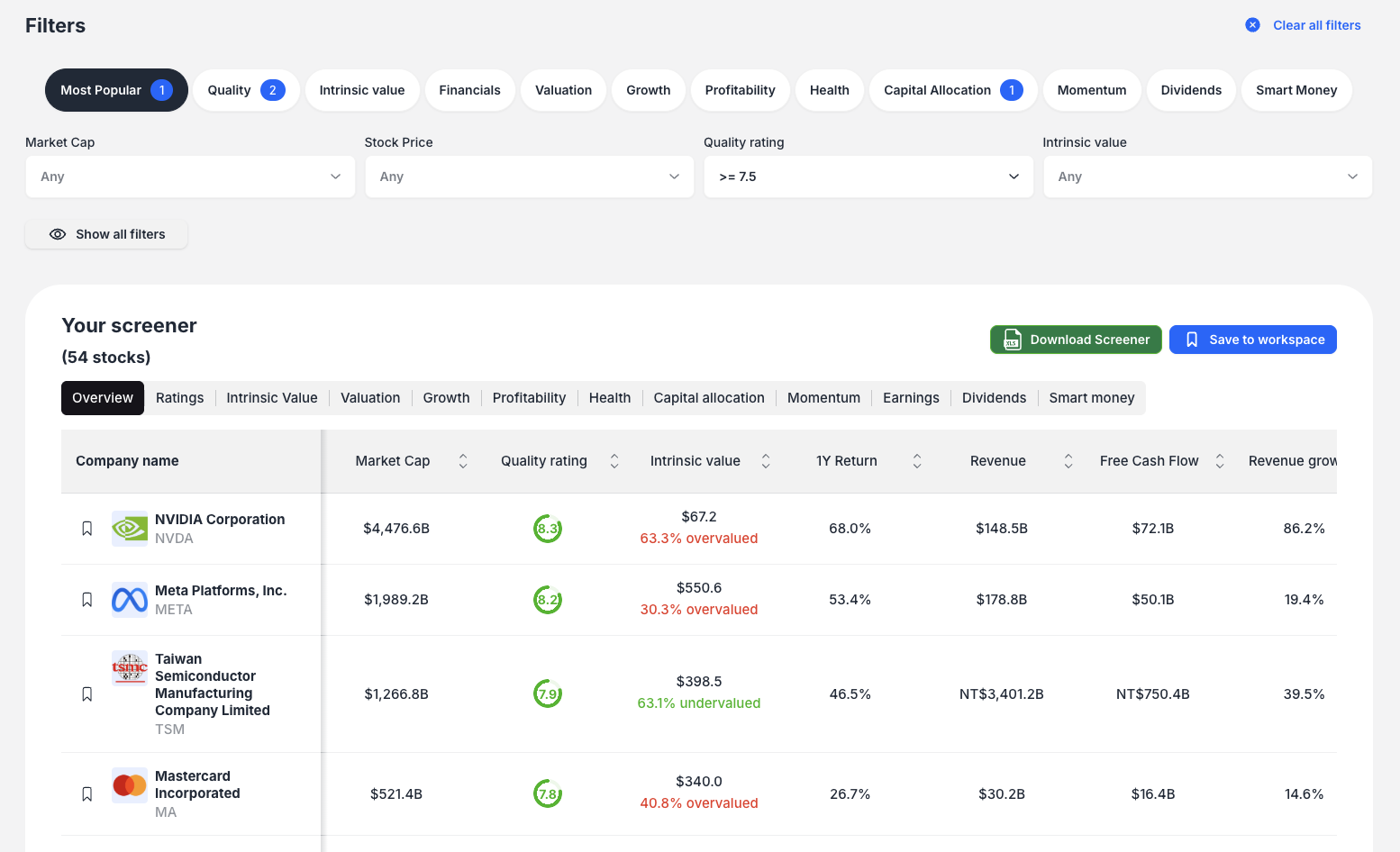

Stock Screener Bulk Exports

Traditional screeners show results on web pages. ValueSense lets you download entire datasets:

- All companies meeting your criteria in a single Excel file

- Comprehensive metrics for peer comparison analysis

- Historical screening results to track performance over time

- Custom calculated fields that preserve your analysis methodology

How We Made Downloads Actually Work

The technical challenge wasn't just aggregating data—it was making that data immediately useful for analysis. Here's how our download system works:

Smart Data Normalization

Every company reports financials slightly differently. Our system:

- Standardizes accounting treatments across companies

- Normalizes time periods and reporting dates

- Reconciles segment classifications and geographic breakdowns

- Ensures consistent currency and unit handling

When you download Microsoft and Apple data, they look like they were prepared by the same analyst using identical methodologies.

Analysis-Ready Formatting

Our downloads aren't just data dumps. They're professionally formatted Excel files with:

- Preserved formulas for easy customization

- Conditional formatting highlighting key metrics

- Dynamic charts that update with your changes

- Executive summary dashboards ready for presentations

Bulk Processing Power

Need to analyze an entire sector? ValueSense can export:

- Complete datasets for 50+ companies in under 2 minutes

- Standardized peer comparison tables with industry benchmarks

- Sector-level screening results with thousands of data points

- Historical performance tracking across multiple time periods

Real Impact: How Our Users Work Differently

Sarah Kim, Senior Analyst at Meridian Capital

"I used to spend Monday mornings building DCF models from scratch. Now I download ValueSense templates and spend that time on scenario analysis instead. My coverage universe doubled because the data prep time disappeared."

Sarah's workflow transformation:

- Before: 8 hours building each DCF model manually

- After: 30 minutes customizing downloaded templates

- Result: Coverage increased from 12 to 25 stocks with better analysis depth

Marcus Rodriguez, VP at Blackstone Portfolio Company

"For acquisition analysis, we needed consistent models across dozens of potential targets. ValueSense's bulk export gave us standardized DCF templates for entire sectors. Deal evaluation went from weeks to days."

Marcus's M&A process:

- Before: Analysts building individual models with inconsistent assumptions

- After: Standardized templates enabling direct peer comparison

- Result: 40% faster deal evaluation with improved decision quality

Emma Chen, Independent Research Analyst

"As a solo practitioner, I couldn't compete with institutional research teams. ValueSense's download capabilities gave me the same quality data and models as Goldman Sachs. My research looks institutional-grade now."

Emma's business transformation:

- Before: 15 hours per research report on data preparation

- After: 2 hours with comprehensive downloads

- Result: Research output increased 300%, subscriber base grew accordingly

What Makes Our Downloads Different

Speed That Actually Matters

- Complete company financial package: Under 30 seconds

- Bulk sector analysis (50+ companies): Under 2 minutes

- Custom DCF model with 10-year history: Instant download

- Stock screener results (1000+ companies): Under 1 minute

Quality You Can Trust

- 99.7% data accuracy verified against original filings

- Same-day updates for earnings releases and material events

- Professional formatting that works with existing workflows

- Institutional-grade models used by top-tier investment firms

Flexibility for Every Workflow

- Multiple export formats: Excel, CSV, PDF summaries

- Customizable templates: Adjust models to your methodology

- Bulk operations: Download entire sectors or screening results

- API access: Integrate with existing systems and workflows

The Competitive Edge This Creates

Teams using ValueSense's download capabilities operate differently than those stuck with manual processes:

Investment Firms:

- Cover 2-3x more companies with existing headcount

- Generate insights faster with immediate data access

- Produce higher-quality research with professional templates

- Win mandates through superior analysis speed and depth

Corporate Development Teams:

- Evaluate acquisition pipelines more systematically

- Create consistent valuation frameworks across opportunities

- Present cleaner analysis to executive teams and boards

- Execute deals faster with streamlined evaluation processes

Independent Analysts:

- Compete directly with institutional research quality

- Scale coverage without proportional time investment

- Focus expertise on insights rather than data preparation

- Build sustainable research businesses with professional output

The Bottom Line: Time is Competitive Advantage

The financial analysis industry is dividing into two camps: firms that embrace modern download capabilities and those that cling to manual processes.

At ValueSense, we see this divide widening every day. Our users consistently outperform peers not because they're better analysts, but because they spend their time analyzing instead of formatting data.

The question isn't whether comprehensive downloads will become the industry standard—it's whether you'll adopt them before your competitors do.

We built ValueSense to give financial professionals their time back. Time to think. Time to analyze. Time to generate the insights that actually matter.

Because in a world where markets move in milliseconds, the firms that win are the ones that can analyze fastest without sacrificing quality.

Ready to transform your financial analysis workflow? Try ValueSense's comprehensive download tools and experience the difference analysis-ready data makes. Download complete financial datasets, professional DCF models, and bulk screening results in seconds.

What you get:

✅ Complete financial statements (10+ year history)

✅ Professional DCF model templates with sensitivity analysis

✅ Bulk stock screener exports for sector analysis

✅ Analysis-ready Excel formatting with preserved formulas

✅ Same-day data updates for earnings and material events

Stop spending hours on data preparation. Start generating insights immediately.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best High Free Cash Flow Stocks

📖 10 Best Undervalued Dividend Stocks

📖 11 Best Multibagger Stocks with Heavy Moats