Duan Yongping - H&H International Investment Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

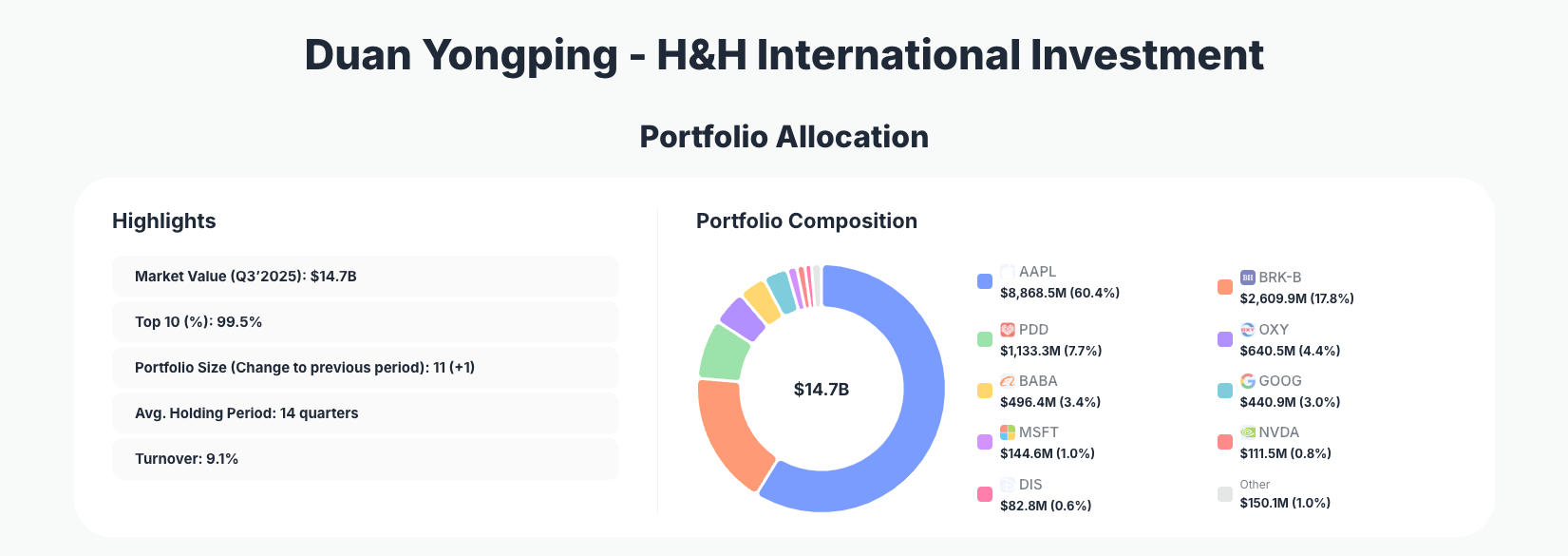

Duan Yongping - H&H International Investment continues to run one of the most concentrated portfolios in the ValueSense universe. Their Q3’2025 portfolio shows $14.7B spread across just 11 positions, dominated by a massive stake in Apple Inc. and a rapidly growing allocation to Berkshire Hathaway (BRK‑B), complemented by targeted trims in Chinese tech and high-flying U.S. semiconductors.

The Big Picture: High-Conviction Concentration at H&H International

Portfolio Highlights (Q3 2025): - Market Value: $14.7B

- Top 10 Holdings: 99.5%

- Portfolio Size: 11 +1

- Average Holding Period: 14 quarters

- Turnover: 9.1%

The latest 13F for H&H International reveals an ultra-concentrated structure, with 99.5% of equity capital in the top 10 names and just 11 positions overall in the H&H International portfolio. This is classic superinvestor behavior: a few big bets, held for years, where conviction is high and incremental activity is focused on sizing and risk control rather than constant stock picking.

At the core of the strategy is a single dominant position in AAPL, representing 60.4% of the portfolio, supported by a 17.8% allocation to BRK‑B and 7.7% in PDD. Together, these three positions account for over 85% of the reported equity value, underscoring how tightly focused the H&H International portfolio remains around a handful of global franchises and Chinese platforms.

Despite that concentration, turnover of 9.1% this quarter shows that Duan is not static: there are meaningful trims in Chinese internet and AI leaders, a major add to Berkshire, and a new position in European semiconductor equipment, suggesting active portfolio refining inside a long-term, low‑churn framework. The 14‑quarter average holding period reinforces that this is still a multi‑year, business‑owner mindset rather than a trading strategy.

Core Positions and Recent Moves: Tech Platforms, Berkshire, and Select Trims

The portfolio is anchored by Apple Inc. (AAPL) at 60.4% of assets, even after a modest “Reduce 0.82%” move. With $8,868.5M across 34,829,107 shares, this remains the defining bet in H&H International’s 13F, and the tiny trim looks more like risk calibration than a fundamental change of heart.

The second pillar is Berkshire Hathaway Inc. (BRK‑B), now 17.8% of the portfolio at $2,609.9M, following a sizable “Add 53.53%” to 5,191,300 shares. This is one of the most notable moves in Q3’2025, increasing exposure to a diversified collection of operating businesses and public equities via Berkshire’s balance sheet.

Among Chinese and Asia‑centric platforms, PDD Holdings Inc. (PDD) stands at 7.7% of the portfolio $1,133.3M, but the position was “Reduce 1.02%”, a small trim that likely reflects risk management after a strong run rather than an outright thesis reversal. Alibaba Group Holding Limited (BABA), by contrast, saw a more material “Reduce 25.86%”, leaving it at 3.4% of assets $496.4M. This sharp cut suggests a more cautious stance toward Alibaba specifically versus the broader Chinese ecommerce opportunity.

On the U.S. mega‑cap tech side, Alphabet Inc. (GOOG) now accounts for 3.0% of the portfolio $440.9M after a “Reduce 6.93%” adjustment, signaling some profit‑taking in a high‑quality compounder while still maintaining a significant position. Microsoft Corporation (MSFT) sits at 1.0% $144.6M with “No change”, showing ongoing confidence in the business without any attempt to aggressively resize it this quarter.

In energy, Occidental Petroleum Corporation (OXY) represents 4.4% of the portfolio $640.5M with “No change” in Q3’2025. This stable allocation indicates that OXY continues to play a strategic role—likely as an inflation‑ and commodity‑linked hedge—within the concentrated book.

AI and semiconductor exposure is being actively tuned. NVIDIA Corporation (NVDA) now accounts for 0.8% $111.5M following a substantial “Reduce 38.04%”, a clear signal of de‑risking in one of the market’s most volatile high‑flyers while still retaining upside participation. At the same time, H&H International initiated or expanded its European semiconductor equipment bet via ASML Holding N.V. (ASML), which enters the book at 0.5% $77.4M as a “Buy” with 80,000 shares—diversifying AI‑related exposure into critical infrastructure for chip manufacturing.

Rounding out the top names, The Walt Disney Company (DIS) holds 0.6% of the portfolio $82.8M with “No change”, suggesting a patient stance on the company’s ongoing turnaround and streaming re‑positioning rather than a trade around quarterly headlines.

Across these 10–11 key positions, the Q3’2025 13F paints a picture of a tech‑ and platform‑heavy portfolio anchored by Apple and Berkshire, with nuanced trims in Chinese internet and U.S. AI leaders offset by a notable ramp‑up in Berkshire and a new high‑quality semiconductor infrastructure play via ASML.

What the Portfolio Reveals About Duan Yongping’s Current Strategy

Several strategic themes stand out from the Q3’2025 H&H International filing:

- Concentration in a few world‑class franchises

With 99.5% of capital in the top 10 names and 60.4% in AAPL alone, Duan is clearly willing to let winners dominate the H&H International portfolio when business quality and long‑term prospects justify it. - Quality and resilience over pure growth

Additions to BRK‑B and the steady weighting in MSFT and OXY indicate a tilt toward diversified, cash‑generative compounders that can perform across cycles, rather than chasing the most speculative growth narratives. - Selective de‑risking in high‑beta names

The sizable “Reduce 38.04%” in NVDA and “Reduce 25.86%” in BABA highlight careful risk trimming where volatility and geopolitical or regulatory risks are more pronounced, while still preserving upside through retained stakes. - Balanced global exposure

The portfolio combines U.S. tech and financial‑like exposure (AAPL, BRK‑B, GOOG, MSFT, NVDA) with Chinese platforms (PDD, BABA) and European semiconductor infrastructure (ASML), reflecting conviction in global champions rather than a narrow regional bet. - Option‑like smaller positions for upside and diversification

Sub‑1% holdings in NVDA, ASML, and DIS serve as smaller, high‑optionality stakes that can be scaled over time or trimmed opportunistically, without jeopardizing the core thesis driven by Apple and Berkshire.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Apple Inc. (AAPL) | $8,868.5M | 60.4% | Reduce 0.82% |

| Berkshire Hathaway Inc. (BRK-B) | $2,609.9M | 17.8% | Add 53.53% |

| PDD Holdings Inc. (PDD) | $1,133.3M | 7.7% | Reduce 1.02% |

| Occidental Petroleum Corporation (OXY) | $640.5M | 4.4% | No change |

| Alibaba Group Holding Limited (BABA) | $496.4M | 3.4% | Reduce 25.86% |

| Alphabet Inc. (GOOG) | $440.9M | 3.0% | Reduce 6.93% |

| Microsoft Corporation (MSFT) | $144.6M | 1.0% | No change |

| NVIDIA Corporation (NVDA) | $111.5M | 0.8% | Reduce 38.04% |

| The Walt Disney Company (DIS) | $82.8M | 0.6% | No change |

This table underscores just how top‑heavy the Q3’2025 H&H International portfolio is. The top two positions—AAPL and BRK‑B—alone command over 78% of reported assets, while PDD lifts the top three to roughly 86%. Below that, position sizes drop quickly into the low‑single‑digit range, highlighting a clear separation between core, high‑conviction holdings and secondary, yet still meaningful, satellites.

The 53.53% increase in Berkshire is the standout allocation change at the top of the book, while large percentage reductions such as “Reduce 25.86%” in Alibaba and “Reduce 38.04%” in NVIDIA are occurring in positions that were already meaningfully smaller. This pattern suggests Duan is reinforcing his highest‑conviction bedrocks while trimming around the edges in more volatile or uncertain names, tightening the risk profile of an already concentrated strategy.

Investment Lessons from Duan Yongping’s H&H International Approach

Investors studying the Duan Yongping – H&H International 13F can draw several practical lessons:

- Concentrate when conviction and understanding are deep

Allowing Apple to reach 60.4% of the portfolio—and keeping it there with only a 0.82% trim—reflects a willingness to let a dominant, well‑understood franchise drive long‑term results. - Use position sizing as your primary risk lever

The contrast between large adds to BRK‑B and aggressive percentage cuts in smaller stakes like NVDA and BABA shows how adjusting sizes—without constantly changing the stock list—can manage portfolio risk. - Hold through cycles; trade around the edges

An average holding period of 14 quarters indicates that once Duan commits to a name, he is prepared to own it for years, with quarterly actions typically fine‑tuning rather than overhauling the portfolio. - Balance growth and durability

Pairing high‑growth platforms (PDD, NVDA) and AI‑linked infrastructure (ASML) with durable, diversified compounders (BRK‑B, MSFT) can help capture upside while mitigating downside. - Use small, high‑optionality positions thoughtfully

Sub‑1% allocations, such as in ASML and DIS, provide exposure to attractive themes without materially jeopardizing the portfolio if the thesis takes longer to play out or proves wrong.

Looking Ahead: What Might Come Next for H&H International?

Based on the current Q3’2025 positioning, several forward‑looking considerations emerge:

- Room to continue building Berkshire and high‑quality compounders

The large add to BRK‑B suggests Duan may continue using market volatility to increase exposure to diversified, cash‑rich vehicles that can redeploy capital internally across cycles. - Selective expansion in semiconductor infrastructure

The new ASML “Buy” at 0.5% could be the first leg of a larger allocation if valuation and fundamentals remain attractive, particularly as AI‑driven chip demand persists. - Continued risk management in China‑related exposure

The significant reduction in BABA alongside only a light trim in PDD hints that future Chinese allocation may skew toward perceived winners and away from more structurally challenged platforms. - Potential for further trimming in high‑volatility AI names

After cutting NVDA by 38.04%, Duan may continue to adjust AI‑linked exposures as valuations and risk‑reward profiles evolve, potentially reallocating capital to more diversified or infrastructure‑like plays. - Ongoing refinement, not reinvention

With only 9.1% turnover and 14‑quarter average holding periods, future quarters are likely to show incremental adjustments rather than wholesale changes—ideal conditions for investors who want to shadow a disciplined, business‑owner investing style via the H&H International portfolio.

FAQ about Duan Yongping – H&H International Portfolio

Q: What were the most significant changes in H&H International’s Q3’2025 13F filing?

The standout moves were a 53.53% “Add” in Berkshire Hathaway (BRK‑B), a 25.86% “Reduce” in Alibaba (BABA), and a 38.04% “Reduce” in NVIDIA (NVDA), alongside a new “Buy” in ASML at 0.5% of the portfolio.

Q: How concentrated is Duan Yongping’s portfolio?

Extremely concentrated: the top 10 holdings account for 99.5% of reported assets, with Apple alone at 60.4% and Berkshire Hathaway at 17.8%, reflecting a high‑conviction, low‑diversification approach.

Q: How long does H&H International typically hold its positions?

The average holding period is 14 quarters, indicating that Duan generally owns businesses for several years, adjusting position sizes gradually rather than turning over the book frequently.

Q: Which sectors and themes does the portfolio emphasize?

The Q3’2025 13F highlights a focus on U.S. mega‑cap tech and platforms (AAPL, GOOG, MSFT, NVDA), Chinese ecommerce platforms (PDD, BABA), energy (OXY), and semiconductor infrastructure (ASML), along with a smaller stake in media/entertainment (DIS).

Q: How can I track Duan Yongping’s future portfolio moves?

You can follow H&H International’s holdings through quarterly 13F filings, which must be reported within 45 days after each quarter‑end. Platforms like ValueSense aggregate these filings and provide visual breakdowns, historical trends, and change analysis on the dedicated superinvestor page for the H&H International portfolio.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!