Earnings Power Value (EPV): overview, formula and calculator

Welcome to Value Sense Blog

At Value Sense we help investors instantly find top-performing stocks and undervalued companies, saving time on research. You can explore our intrinsic value tools at valuesense.io and learn more about our latest stock ideas.

Earnings Power Value (EPV) is a conservative approach to valuing a company, developed by Columbia University professor Bruce Greenwald. EPV prioritizes a company’s current earnings potential, making it a favorite among value investors who want to avoid overpaying based on optimistic growth assumptions. This method provides a solid baseline for intrinsic value by focusing solely on a company's present earning capacity, offering a powerful way to assess whether a stock is undervalued.

In EPV, the core question is simple: "What is this company worth if it maintains its current level of earnings indefinitely?" EPV aligns with Benjamin Graham’s principle of valuing companies based on current performance rather than speculative future projections.

1. What is Earnings Power Value (EPV)?

Earnings Power Value (EPV) is a valuation method that focuses on estimating a company's intrinsic value based on its current earnings power, assuming these earnings continue indefinitely. Developed by Bruce Greenwald, EPV omits growth projections, offering a reliable and conservative valuation metric that resonates strongly with value investors.

How EPV Aligns with Value Investing Principles

EPV avoids speculative assumptions, aligning closely with value investing principles by focusing on what a company can consistently generate today. This helps investors sidestep overvaluing stocks based on optimistic growth expectations, staying grounded in realistic, present-day earnings.

2. Key Components of EPV Calculation

To calculate EPV accurately, several key financial components must be assessed:

- Adjusted Earnings: Normalized, sustainable earnings after taxes and necessary capital expenditures.

- Cost of Capital: Often represented by Weighted Average Cost of Capital (WACC), though some investors prefer an individualized required rate of return.

- Maintenance Capital Expenditures (CapEx): Capital spending needed to sustain current operations without growth.

These components allow investors to gauge intrinsic value without projecting growth, which can be particularly beneficial for mature, stable businesses.

3. Step-by-Step Guide to Calculating EPV

Step 1: Estimate Adjusted EBIT Margin

Calculate the average EBIT margin over five years to smooth out variations and reflect a more stable measure of earnings before interest and taxes.

Step 2: Determine Normalized EBIT

Apply the adjusted EBIT margin to current sales. This yields normalized EBIT, a consistent figure that reflects sustainable, pre-tax operational income.

Step 3: Calculate Normalized NOPAT (Net Operating Profit After Tax)

Adjust EBIT for taxes, giving the net operating income the business can generate post-tax.

Step 4: Account for Maintenance CapEx and Depreciation

Subtract maintenance CapEx from NOPAT and add back any excess depreciation, arriving at Adjusted Earnings that are suitable for the EPV formula.

Step 5: Divide Adjusted Earnings by Cost of Capital

EPV is determined by dividing Adjusted Earnings by the Cost of Capital. The formula is straightforward:

EPV = Adjusted Earnings / Cost of Capital

4. The Power of EPV in Value Investing

EPV’s conservative approach ensures that an investor isn’t paying for anticipated growth, reducing the risk of overvaluation. For investors focused on mature, stable companies, EPV offers a floor for intrinsic value, providing a cushion against market fluctuations. It’s particularly valuable for sectors where earnings are predictable and consistent, such as utilities, consumer staples, and certain manufacturing businesses.

EPV as a "Financial Safety Net"

Much like a safety net for a trapeze artist, EPV provides investors with a reliable base valuation, helping them navigate volatile market conditions with a realistic outlook on a stock's potential.

5. EPV vs. Other Valuation Methods

| Valuation Method | Focus | Pros | Cons |

|---|---|---|---|

| Earnings Power Value (EPV) | Current earnings power | Conservative, less speculative | Ignores growth potential |

| Discounted Cash Flow (DCF) | Future cash flows | Accounts for growth, comprehensive | Depends on future projections |

| Price-to-Earnings (P/E) | Earnings relative to price | Simple, widely used | Can mislead for high-growth stocks |

| Price-to-Book (P/B) | Asset value | Useful for asset-heavy companies | May not reflect intangible assets |

While each method offers unique insights, EPV stands out for its grounding in current, sustainable earnings. It’s an excellent complement to DCF and other growth-based methods.

6. Practical Example: Calculating EPV for a Hypothetical Company

Let’s assume a company, Steady Industries, with these financials:

- Average EBIT Margin (5 years): 15%

- Current Annual Sales: $1 billion

- Effective Tax Rate: 25%

- Maintenance CapEx: $50 million

- Excess Depreciation: $10 million

- Cost of Capital: 10%

Step-by-Step Calculation

- Estimate Normalized EBIT:Normalized EBIT=1,000,000,000×0.15=150,000,000\text{Normalized EBIT} = 1,000,000,000 \times 0.15 = 150,000,000Normalized EBIT=1,000,000,000×0.15=150,000,000

- Calculate Normalized NOPAT:Normalized NOPAT=150,000,000×(1−0.25)=112,500,000\text{Normalized NOPAT} = 150,000,000 \times (1 - 0.25) = 112,500,000Normalized NOPAT=150,000,000×(1−0.25)=112,500,000

- Adjusted Earnings:Adjusted Earnings=112,500,000−50,000,000+10,000,000=72,500,000\text{Adjusted Earnings} = 112,500,000 - 50,000,000 + 10,000,000 = 72,500,000Adjusted Earnings=112,500,000−50,000,000+10,000,000=72,500,000

- Calculate EPV:EPV=72,500,0000.10=725,000,000\text{EPV} = \frac{72,500,000}{0.10} = 725,000,000EPV=0.1072,500,000=725,000,000

Thus, EPV for Steady Industries is $725 million, providing a baseline for evaluating if the company is over or undervalued based on its current earnings.

7. Advantages of Using EPV

- Conservatism: Reduces speculative growth assumptions.

- Focus on Stability: Ideal for stable companies with consistent earnings.

- Simple Calculation: Relies on current financial data without requiring extensive growth forecasting.

8. Limitations and Considerations of EPV

- Growth Limitation: Ignores future growth potential, which can undervalue high-growth companies.

- Economic Moat Oversight: Doesn’t factor in competitive advantages or intangible assets.

- Industry Cyclicality: Less effective for cyclical businesses due to earnings variability.

9. How EPV Fits into the Modern Investment Landscape

In today’s growth-focused market, EPV serves as a conservative valuation tool, reminding investors of the importance of stable earnings. As markets evolve, EPV’s core principle—valuing companies based on existing, proven earnings—remains crucial for avoiding hype-driven overvaluation.

10. Common Industries for EPV Application

EPV is especially useful in evaluating mature sectors such as utilities, established manufacturing, consumer staples, and financial services, where earnings are typically predictable and consistent.

11. Using EPV with Other Valuation Methods

Combining EPV with methods like DCF, P/E, or qualitative analysis provides a more comprehensive view of a company’s intrinsic value, allowing investors to assess both current stability and growth potential.

12. EPV for Sustainable and Responsible Investing

Because EPV highlights companies that sustain earnings with minimal reinvestment, it aligns well with sustainable investing practices, favoring efficient, responsible businesses.

13. EPV vs. Growth Valuation Methods

For high-growth companies, EPV might underestimate potential value, while methods like DCF that project cash flows better capture future prospects.

14. EPV as a Tool for Long-Term Investors

EPV is ideal for long-term investors seeking steady returns, providing a realistic assessment of a stock’s earning power without speculative growth risks.

15. Final Thoughts on the Usefulness of EPV in Value Investing

Earnings Power Value remains a valuable tool for investors seeking to understand a company’s intrinsic value based on present earnings. By using EPV, investors can ground themselves in a reliable valuation approach that complements other methods, offering a conservative baseline in a volatile market.

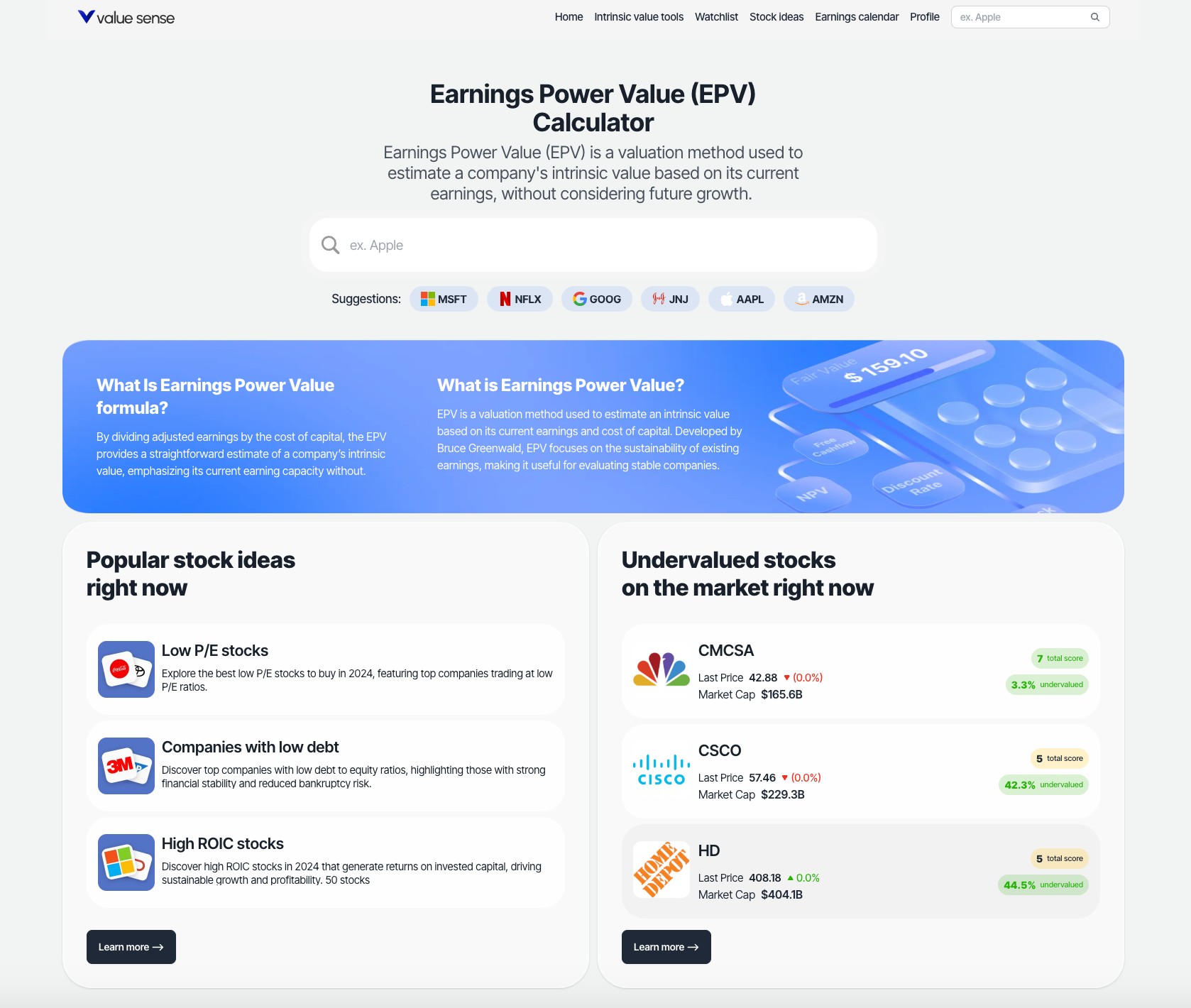

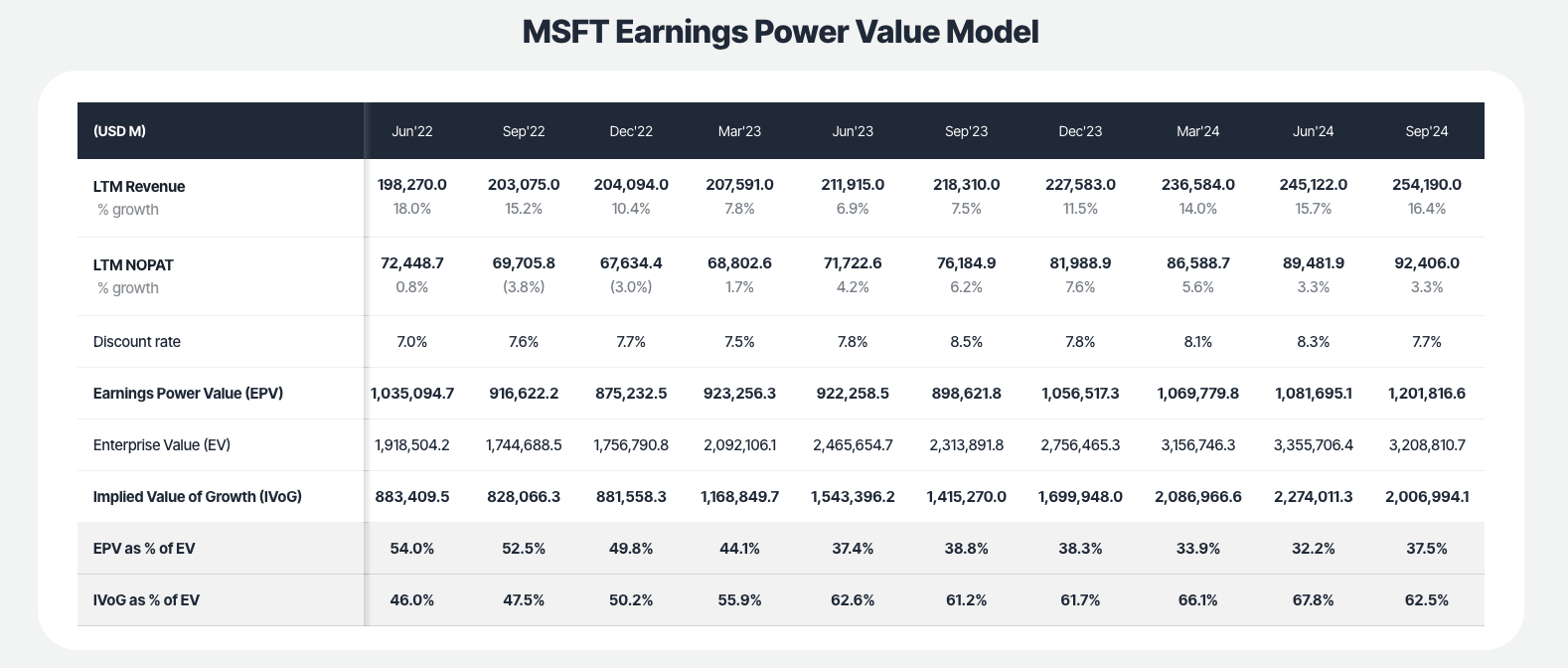

How to calculate EPV online? Any EPV valuation calculators for stocks?

Use Value Sense Free EPV calculator. Select any public company to instantly calculate a fair value and EPV online.

We offer 10+ FREE valuation tools to analyze intrinsic value:

- reverse DCF calculator

- earnings growth model

- Peter Lynch charts

- discount rate calculator

- margin of safety calculator

- intrinsic value calculator

For investors seeking opportunities, our analytics team provides comprehensive lists of undervalued companies where the intrinsic value suggests potential undervaluation, combining fundamental analysis with quality metrics:

Ready to start?

Join 3,500+ value investors worldwide

FAQs

- Is EPV suitable for all companies?

EPV works best for stable, mature companies with predictable earnings, like utilities and consumer staples. It’s less suitable for high-growth firms or startups where future growth plays a large role in value. - How often should EPV be recalculated?

Recalculate EPV annually or when there’s a major change in the company’s financials or business model, as this can affect the accuracy of the earnings power estimate. - Can EPV be used with other valuation methods?

Absolutely. Many investors use EPV alongside methods like DCF and P/E ratios to get a balanced view, combining EPV’s conservatism with other growth-oriented insights. - What limitations does EPV have?

introduceEPV doesn’t account for growth potential or intangible assets and may undervalue companies with strong competitive advantages or high growth trajectories. It’s often used best as a baseline rather than a sole valuation method. - How is EPV different from Discounted Cash Flow (DCF) valuation?

EPV focuses on current, sustainable earnings without accounting for future growth, making it more conservative. DCF, on the other hand, projects future cash flows, which introduce growth assumptions and can be more speculative.