Electricity - the unexpected beneficiary of AI boom

This article was written by guest author Hidden Value Gems

In today’s post, I will provide more details about the growing electricity demand and required investments. Next week, I will share a few names that could be the biggest beneficiaries of this long-term trend.

Reason 1: Grids are simply too old

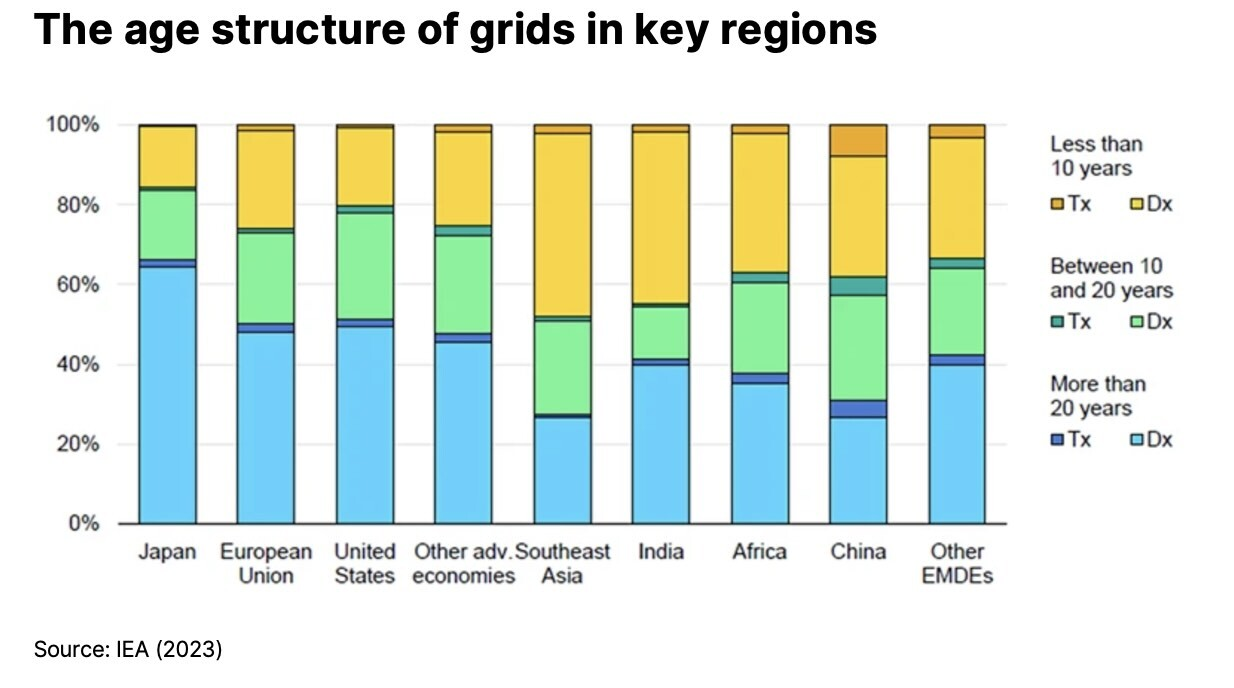

The average age of grid networks in the US and Europe is about 40 and 30 years, respectively.

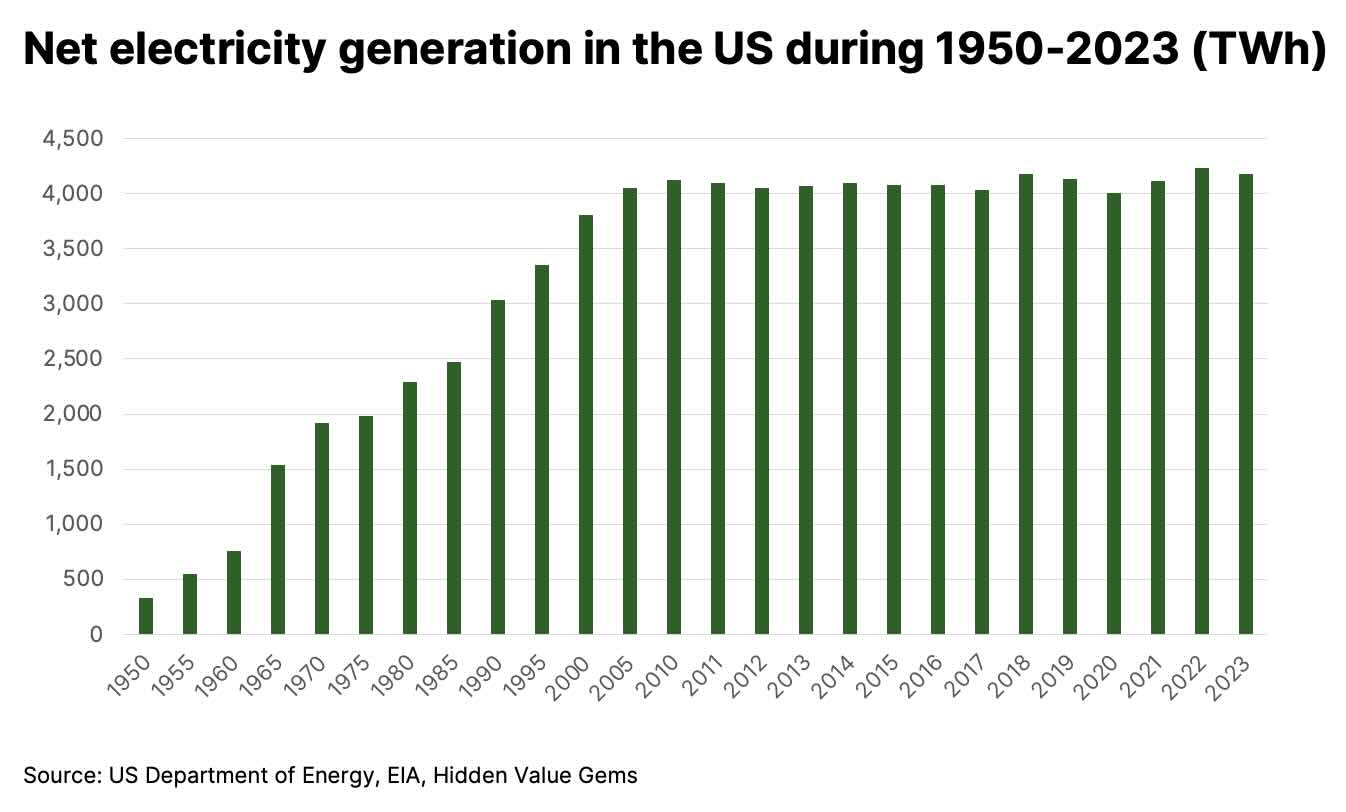

The US grid saw the last major upgrades during the 1960s-70s, more than 50 years ago, when the country expanded its electricity use due to the mass adoption of central air conditioning. Following that major upgrade, electricity demand has slowed down.

Over the past 20 years, US electricity consumption has barely increased (by less than 0.5% annually). In the next six years (2024-2030), electricity demand is expected to grow at 2.4% annually. While the difference is just a couple of percentage points, the implications are much more profound.Here is what the US Energy Department said about it in 2023:

“Much of the U.S. electric grid was built in the 1960s and 1970s. While the system has been improved with automation and some emerging technologies, our ageing infrastructure is struggling to meet our modern electricity needs, such as renewable energy resources and growing building and transportation electrification.”

According to the DOE, “70% of transmission lines are over 25 years old and approaching the end of their typical 50–80-year lifecycle. Large power transformers, which are crucial for managing the majority of electricity flow, have an average age of over 40 years.”

The European grid is a little younger but still 30 years old, on average.

Reason 2: The rise of renewables

The change in the power mix is another critical factor. Even if total energy demand remained flat, the rise of electrification and renewables requires more powerful transmission lines and a more sophisticated grid.

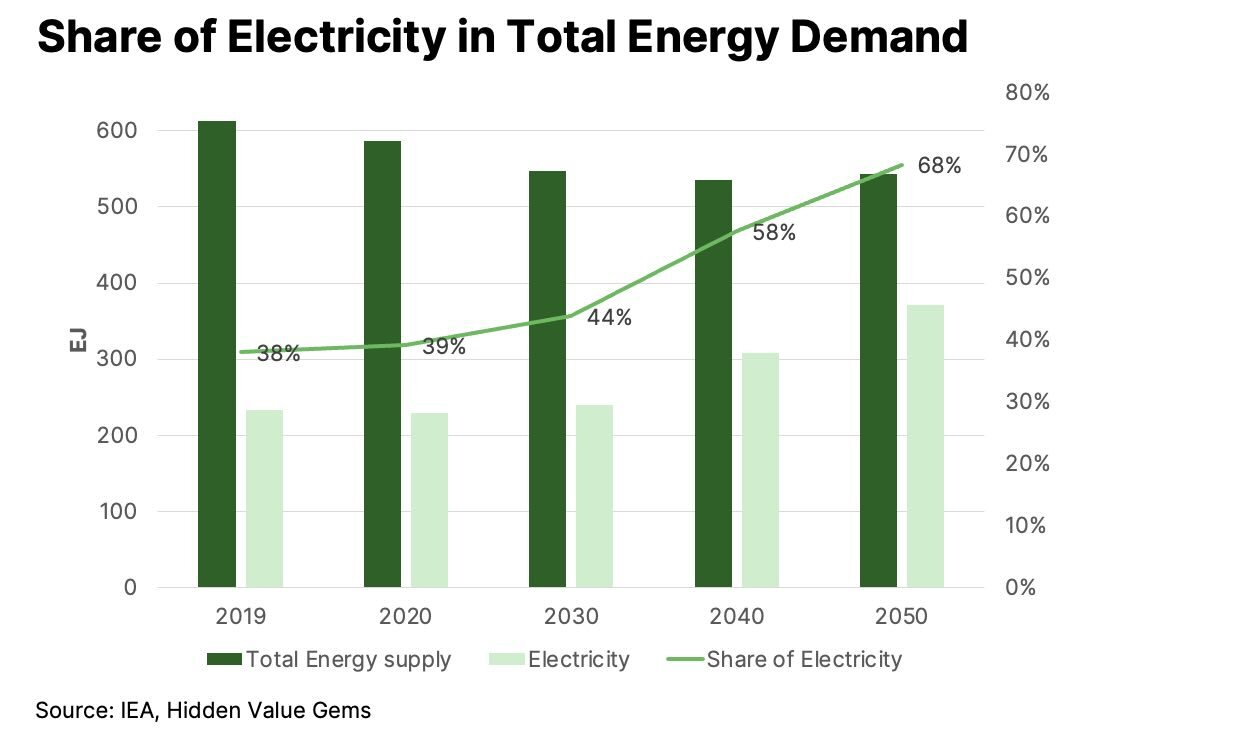

According to the IEA, electricity accounted for 39% of the total energy supply in 2020. For the world to reach net zero emissions by 2050, the share of electricity has to rise to 68%.

In other words, even if there were zero change in the overall energy demand, electricity generation would need to rise by 74% by 2050 and renewables even more than that (by 7.5x!).

In addition, the mix of electricity generation is also rapidly shifting towards renewables. Renewables would need to contribute 77% of all electricity produced, compared to just 17% in 2020, for the world to reach Net zero emissions by 2050.

Even if these targets remain a blue-sky scenario, the direction and magnitude of change are clear.

With the rise of renewables comes the shift in power generation geography. There is a growing need to connect new centres of electricity production (wind and solar) with the existing grid. Moreover, the equipment requirements are higher for renewables than for traditional sources due to the higher variability of power generation.

Another issue is the system imbalances with excess electricity often produced during mid-day (solar) or at night (wind). Negative electricity prices are becoming more common. In South Australia, for example, prices have been negative for about 20% of the time since 2023.

These anomalies call for rapid improvement in system flexibility, which would store energy and transmit it to the under-supplied regions to balance the system. IEA estimates that investments in system flexibility would need to quadruple if the world were to reach net zero emissions by 2050.

The European Commission has estimated that €1 trillion will be needed for energy transition investments, which includes upgrading the grid. For reference, historical total investments in the EU power sector have averaged €100bn a year.

Reason 3: Electricity demand is accelerating

One critical solution for reducing CO2 emissions is not only changing how electricity is generated but also using electricity to replace fossil fuels in other areas of life, such as transportation (electric vehicles, trains), cooking, industrial processes, heating, and so on.

According to the IEA estimates, to achieve Net Zero emissions by 2050, the world has to reduce total energy consumption by 21% in 2019-2050 (-0.8% CAGR). However, as electrification rises from 19% of final energy consumption in 2019 to 49% in 2050, total electricity generation will grow by 2.6x (from 26,922 TWh in 2019 to 71,164 TWh in 2050). This translates into 3.3% annual growth during a 31-year period.

This is higher than 2.8% historical growth in the past 10 years.

Moreover, there are strong reasons to believe that IEA estimates are too conservative.

Firstly, total energy demand is unlikely to decline, as the IEA envisions. The famous Jevons paradox has shown that improving efficiency leads to more resource utilisation, contrary to conventional wisdom.

Secondly, almost one billion people still lack access to electricity, and 2.6 billion people do not have access to clean cooking solutions.

Thirdly, there is a growing middle class in Emerging Markets. Various studies have shown a strong correlation between energy consumption and a country's prosperity level. A typical threshold is about $5k GDP per capita, at which point energy consumption rises much faster than income.

So, even if the population does not grow, more lower-income people move into average income brackets, this will have a disproportionate impact on electricity consumption.

Finally, the AI boom and the rise of data centres can boost demand to dramatically higher levels.

How much power does AI need?

The range of energy demand coming from computers is wide. One estimate made before 2020 suggested that the total energy expenditure for computing could already exceed global energy demand by 2040! This estimate was made based on the assumption that the current mainstream systems require 10^-14 J of energy per one bit transition (referred to as the ‘benchmark’ scenario on the chart below).

Note that this estimate was made in 2015 when the core processor was the CPU, not GPU or other microchips capable of performing simple calculations in parallel that are required for Large Language Models (LLMs), which form the basis of AI programmes.

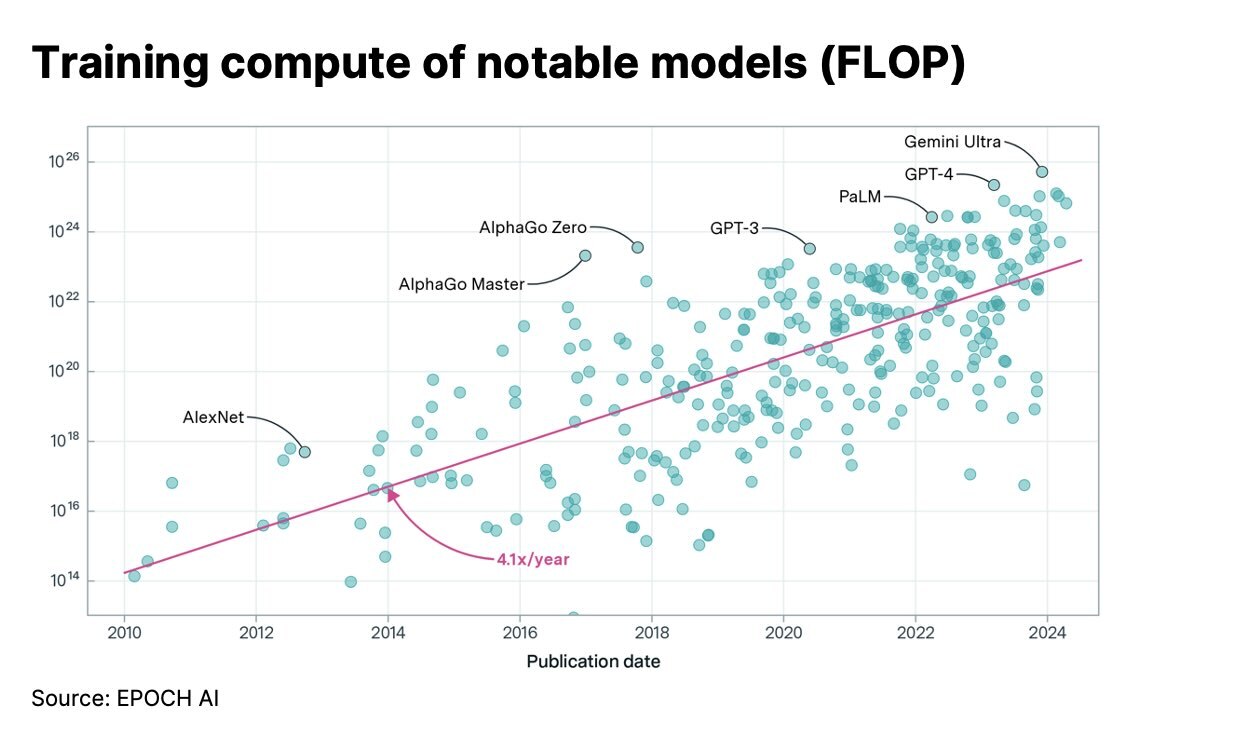

More recent estimates suggest that compute (computational resources) growth has been increasing by a factor of 4-5x a year in recent years.

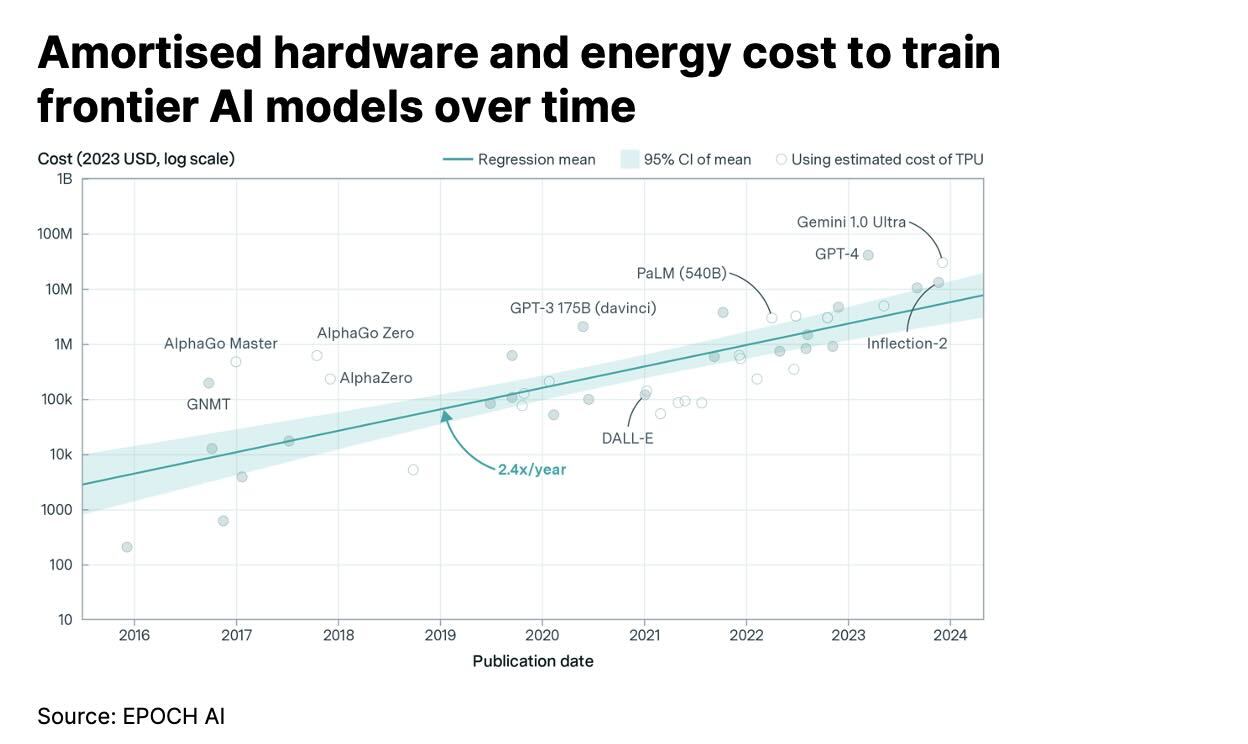

The cost of training AI models has been increasing at a 2.4x rate a year. Electricity has accounted for a relatively small share, 2-6% of the total costs, but the power requirement is substantial in absolute terms. For example, Alphabet’s Gemini Ultra requires 35MW power, while future AI supercomputers may require power measured in Gigawatts. For reference, the current installed capacity of a city like Madrid is just 457 MW, while Berlin’s installed capacity is even less - 272 MW.

Various estimates indicate that ChatGPT query leads to 8-10x more energy demand than a traditional Google search.

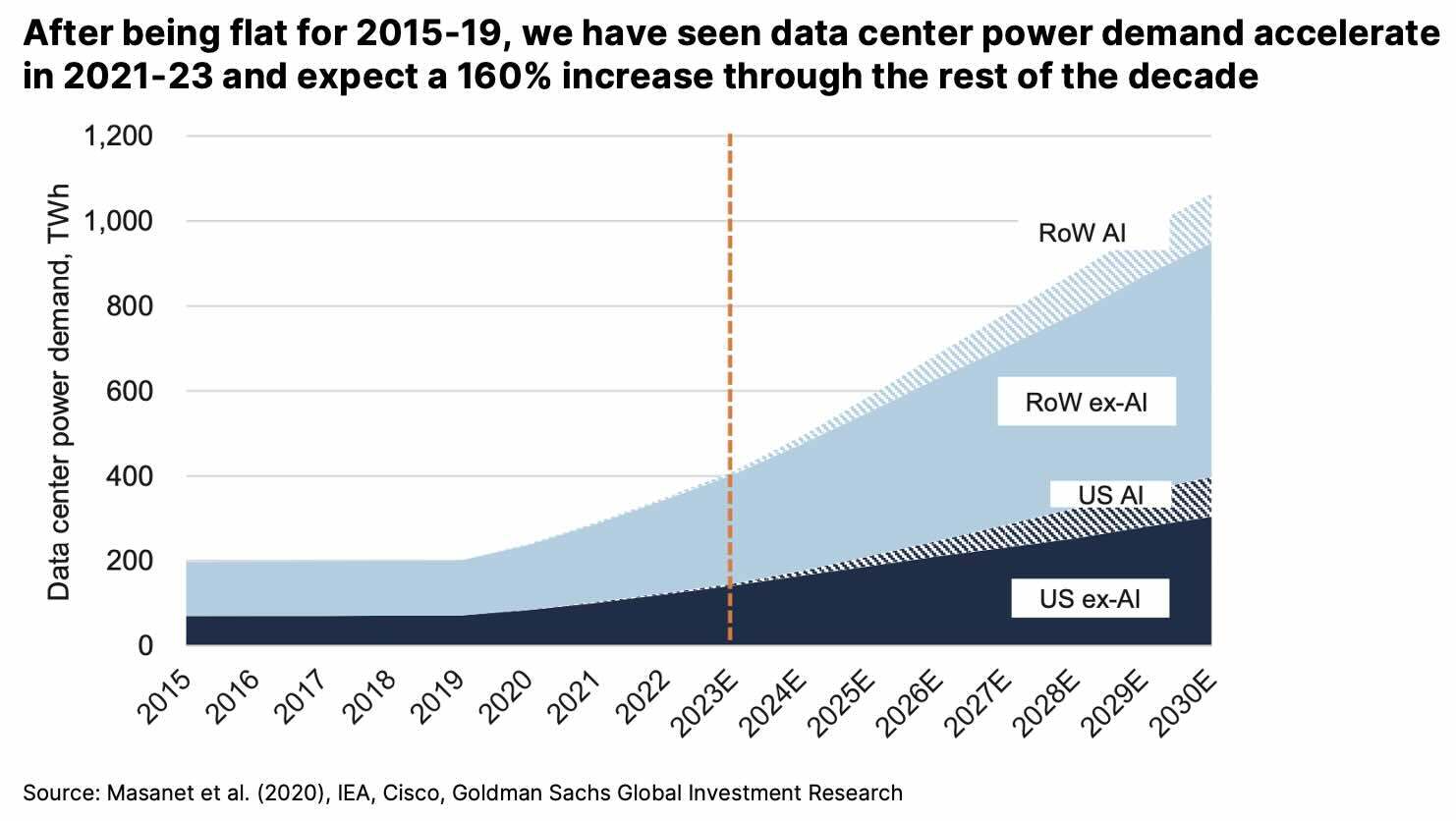

According to the IEA, in 2022, before the latest AI boom took off, electricity demand from data centres, AI, and cryptocurrencies already amounted to 460 TWh, or 2% of global electricity consumption.

Based on estimates by the IEA, Electric Power Research Institute, and other think tanks, this sector could already be consuming 620-1,050 TWh of electricity by 2026 and 1,200-1,400 by 2030.

The incremental growth in power demand during 2022-’26 (160-690 TWh, depending on the scenario) is equivalent to adding at least one Sweden (176 TWh) or most of Germany (507 TWh).

Under certain conditions, US data centres alone could consume over 500 TWh of electricity by 2030.

Two offsetting drivers will drive future demand. On the one hand, the amount of data produced will continue to rise far ahead of the GDP. Additional computations will likely boost demand further.

On the other hand, cooling accounts for about 40% of a data centre's current energy demand. There are ongoing efforts to improve cooling efficiency. Liquid cooling is one such option, which is much more energy efficient. If this technology becomes widespread, it could reduce data centre energy demand.

The chip designs could also improve and become more energy efficient.

Nevertheless, the efficiency gains are unlikely sufficient to slow down energy demand growth.

By 2030, the demand will inevitably be significantly higher, even if data centre and chip efficiency improves in the future. Goldman Sachs, for example, estimates that global data centres alone will account for 3-4% of global electricity consumption by 2030, which is more than twice as high as today (1-2%).

These c. two percentage points gain in the share of data centres is more than what countries such as Brazil, Korea, Canada, or Germany consume annually.

There are other consequences of AI-related energy demand. One of them is a shift in geographic mix. Over the past 40 years, most of the energy demand came from emerging markets driven by industrialisation (e.g., China), while developed countries (e.g., the US and Europe) have seen very modest growth as the energy intensity of their GDP gradually declined (supported by the rise of services in the economy).

However, the AI boom is now concentrated in the US and, to a lesser extent, other regions, including Europe, which does not want to be left behind. These regions have relied on grid networks built 30-50 years ago, which have been largely sufficient to accommodate modest changes in energy consumption, but they are not capable of meeting the rapid growth in demand and a shift in sources of power generation (e.g., the rise of renewables).

The need for radical investments into the grid

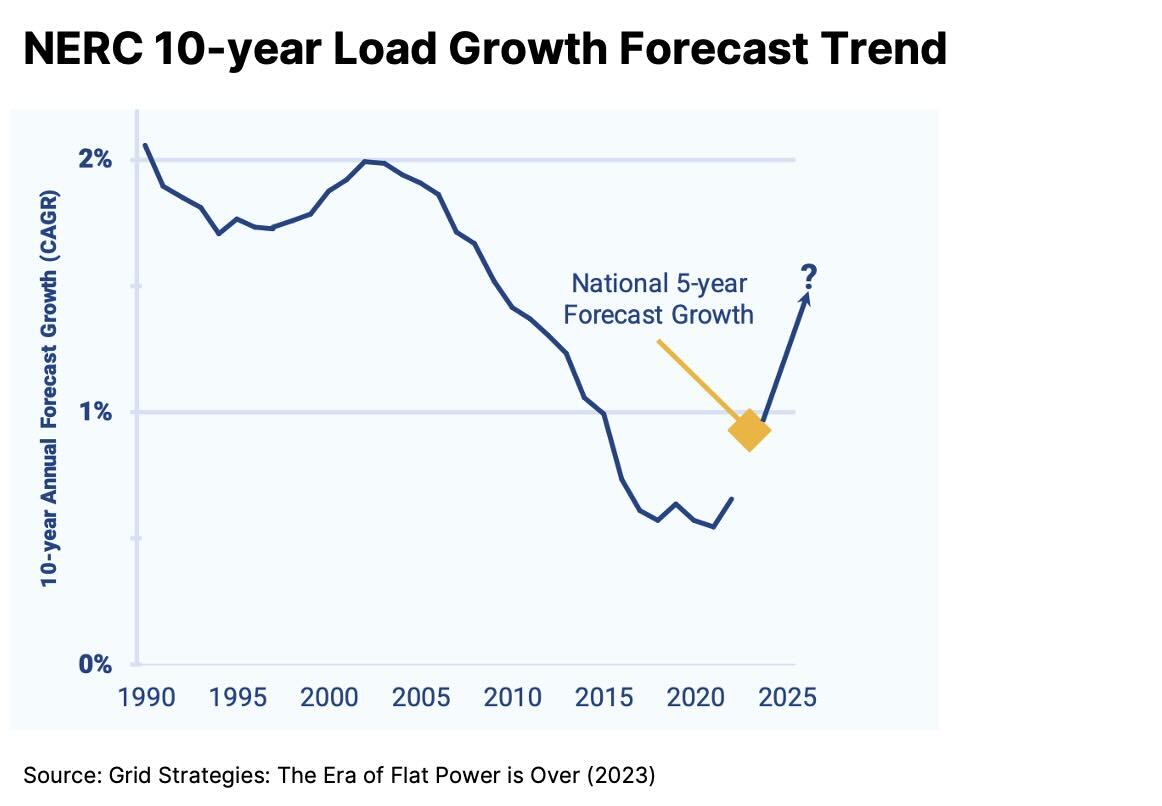

Annual demand in the ‘old’ regions of the world economy has been rapidly slowing down.

As a result, US grid planners at NERC have been forecasting a mere 0.5% annual growth rate. However, peak demand has increased above that rate (already 0.9% in 2023, although likely underestimated).

In just one year, the forecast of cumulative electricity growth over the next five years increased from 2.6% to 4.7%

According to the Electric Power Research Institute, fifteen states accounted for an estimated 80% of the US data centre load in 2023. Such uneven distribution of electricity demand increases the requirements for local power networks.

According to McKinsey estimates, total annual investments in the energy sector are projected to grow by up to 5% p.a. to reach $1.3-2.4 trillion by 2040.

Transmission and distribution (T&D) network investments are projected to experience the highest growth of 4-8% p.a., reaching between $0.6 trillion and $1.2 trillion by 2040, depending on the scenario.

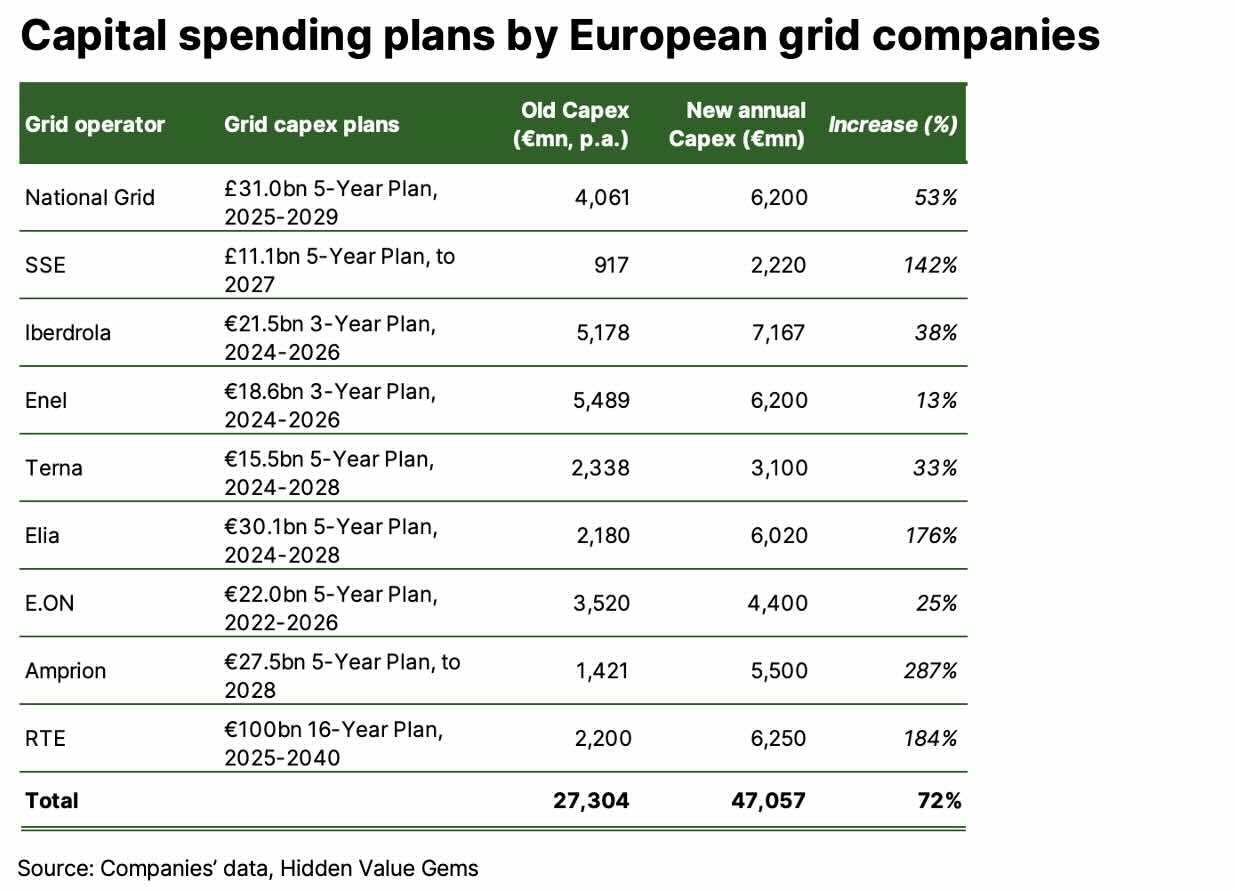

European grid operators have already raised their mid-term investment plans by 72% which adds almost €2 trillion of capex in the next 10 years.

Global investments in the grid are expected to more than double from 2030 relative to the 2016-22 period.

Possible skills gaps and labour shortages

According to the IEA, spending on more efficient appliances, electric and fuel cell vehicles, building retrofits, and energy‐efficient construction would require 16 million workers. This could be a significant challenge due to rising labour shortages and skill gaps, especially in Europe.

The International Labour Organisation notes that the number of vacancies – a measure of (unfilled) demand for labour – remains elevated after peaking in 2022 across numerous advanced economies. Even after the pandemic, many advanced economies continue to experience soaring rates of unfilled vacancies, indicating the persistent nature of the labour shortage issue.

In 2023, the European Labour Authority identified electricians and electrical mechanics as professions with the most severe shortage in over a dozen EU countries, similar to doctors.

As economy lacks critical skills, projects will likely get more expensive.

Reshoring

Another factor contributing to resurging electricity demand is the reshoring and near-shoring industrial policies, which aim to bring more supply chains closer to core markets, reversing the previous outsourcing policy.

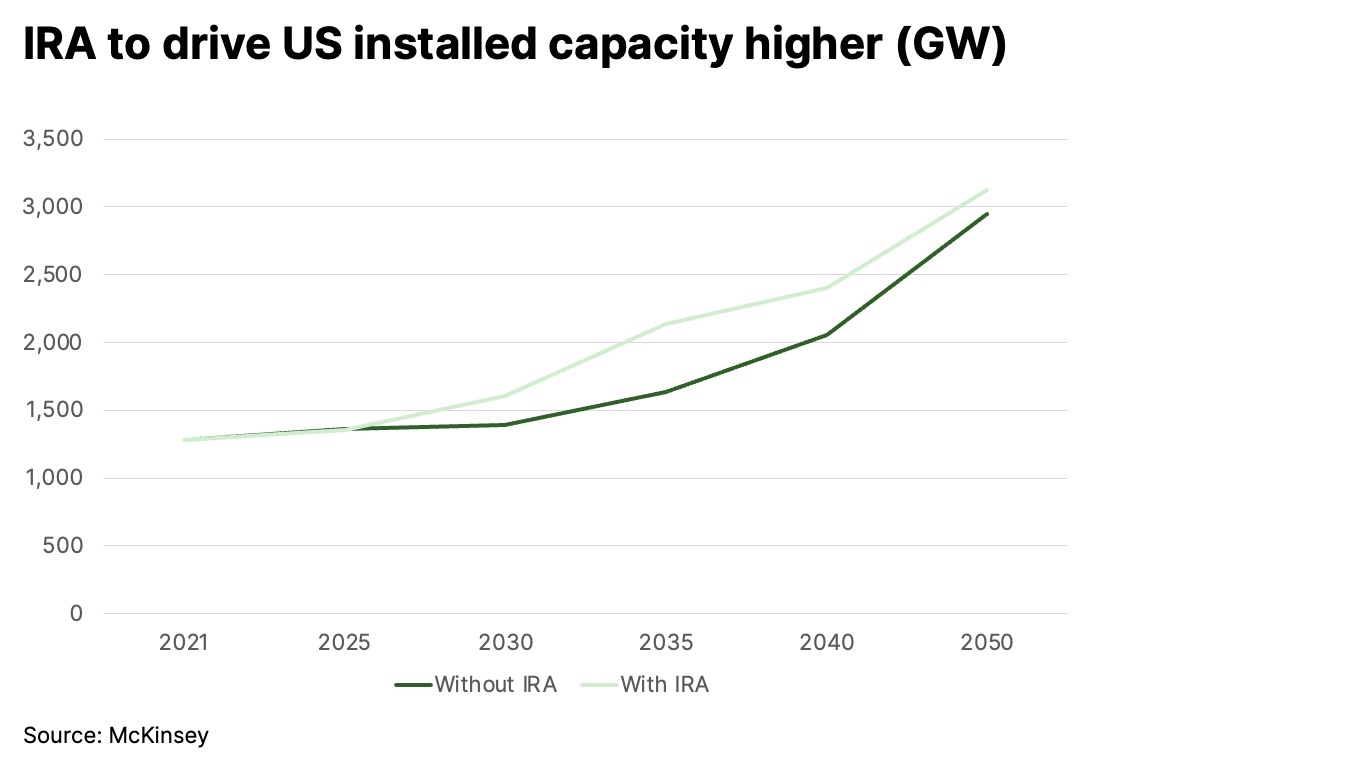

The Inflation Reduction Act (IRA) introduced by the Biden administration incentivises building factories in the US. Based on McKinsey analysis, this alone could drive peak power demand by 30% by 2035.

Europe follows a similar policy, especially in light of higher geopolitical risks and its willingness to reduce its energy dependence on Russia.

Climate change

Recently, the world has observed more extreme weather conditions (hotter summers and colder winters). Globally, research indicates that energy demand due to climate change could increase by 11% to 27% under moderate warming scenarios, with more severe increases projected under vigorous warming conditions.

The U.S. Environmental Protection Agency (EPA) estimates that average electricity demand could increase by 1.5% to 6.5% by 2050 under unmitigated climate change scenarios. The most significant increases are expected in regions like the Northeast and Northwest, where cooling degree days (CDDs) are expected to rise substantially.

Conclusion

The world has entered an inflexion point with transformational changes in electricity consumption. This is driven by global policies aimed at reducing CO2 emissions through the broader use of renewables and the electrification of major processes to replace traditional fossil fuels.

The share of electricity in the total energy supply is set to undergo a staggering increase, nearly doubling from 39% in 2020 to a projected 68% by 2050. Furthermore, renewables could contribute as much as 74% of total electricity generation in 2050, a significant leap from the current level of less than 30%.

Data centres already account for about 2% of total electricity consumption globally, similar to German annual demand. Combined with AI models, the new segment could add up to 1 TWh of electricity demand by 2030, the equivalent of two Germanies.

Meeting these demands will necessitate the development of more robust and intelligent grids, a pressing need given the rapid ageing of the core infrastructure and the evident shortage of skilled labour.

Other long-term trends include climate change and 'reshoring' (industrial policies).

In Part II, we will discuss specific companies that stand to benefit from this rapid growth in electricity demand.