🗞 Eyes on NVIDIA

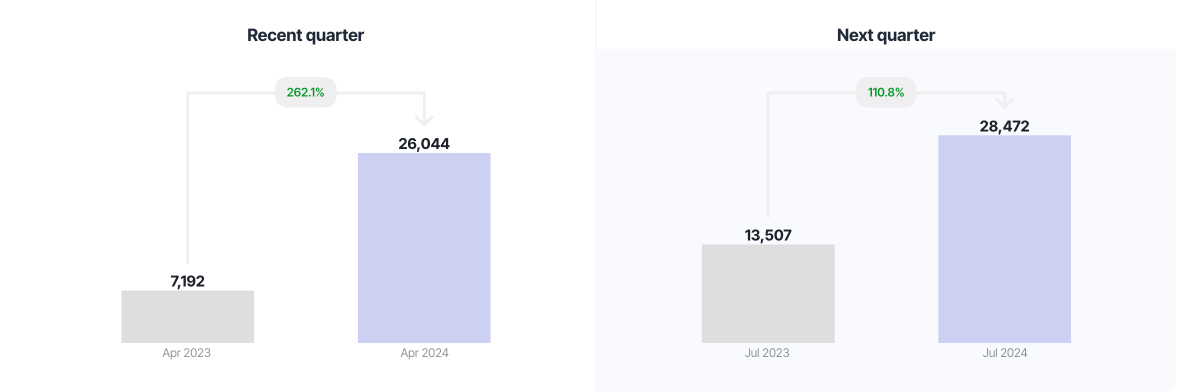

Analysts and investors have high hopes for Nvidia’s second-quarter update, with predictions of $28.7 billion in revenue and $15.9 billion in profit—both more than double last year’s figures. The spotlight will be on its data center business, which accounts for over three-quarters of its total revenue and produces the powerful chips driving generative AI applications like OpenAI’s ChatGPT. Nvidia’s competitive edge has made its stock the ultimate “pick-and-shovel” play in the tech revolution.

No one expects Nvidia to slow down anytime soon, especially with data centre spending on the rise. However, challenges remain: the company faces increasing competition from Intel, AMD, and Arm rumors, and its heavy reliance on the AI chip market could backfire if the industry hits a bump. Given the sky-high expectations, even a hint of bad news on Wednesday could have an outsized impact on the stock price. Just earlier this month, rumours about delays in the rollout of Nvidia’s next-generation Blackwell chips sent its shares tumbling.

This earnings release, and what management says about the company’s outlook, could either validate Nvidia’s impressive $3 trillion valuation or temper the enthusiasm surrounding tech stocks. This comes at a crucial time, with the latest earnings season hinting at a long-awaited profit recovery for companies left out of the AI frenzy. The “Magnificent Seven”—the biggest US tech firms—have driven most of the S&P 500’s earnings growth recently. But excluding those seven, the rest of the index’s profits have actually shrunk year-over-year for the past five quarters. That streak may be ending, though: earnings for those 493 companies are estimated to have grown by 7.4% in the second quarter, compared to the same time last year. Meanwhile, the Magnificent Seven’s earnings are expected to have risen by 35%, a drop from the lofty gains they’ve seen in the past.