8 Best Fair Value Stocks Trading Near Intrinsic Worth - Value Sense 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Value of Fair Value Investing

Fair value stocks represent companies trading within reasonable proximity to their calculated intrinsic worth, typically within a 10% range above or below fundamental value. These opportunities offer investors the chance to own quality businesses without paying significant premiums or waiting for extreme undervaluation to correct, providing balanced risk-reward profiles ideal for core portfolio holdings.

Unlike deep value investing that seeks heavily discounted stocks or growth investing that accepts premium valuations for rapid expansion, fair value investing emphasizes business quality over valuation extremes. This approach focuses on companies with sustainable competitive advantages, predictable cash flows, and strong management teams that create long-term shareholder value through operational excellence rather than valuation arbitrage.

Fair Value Selection Criteria:

- Trading within 10% above or below calculated intrinsic value

- Strong business fundamentals supporting current valuations

- Quality competitive positioning and sustainable business models

- Consistent performance across multiple valuation methodologies

Top 8 Fair Value Stocks - Ranked by Proximity to Intrinsic Value

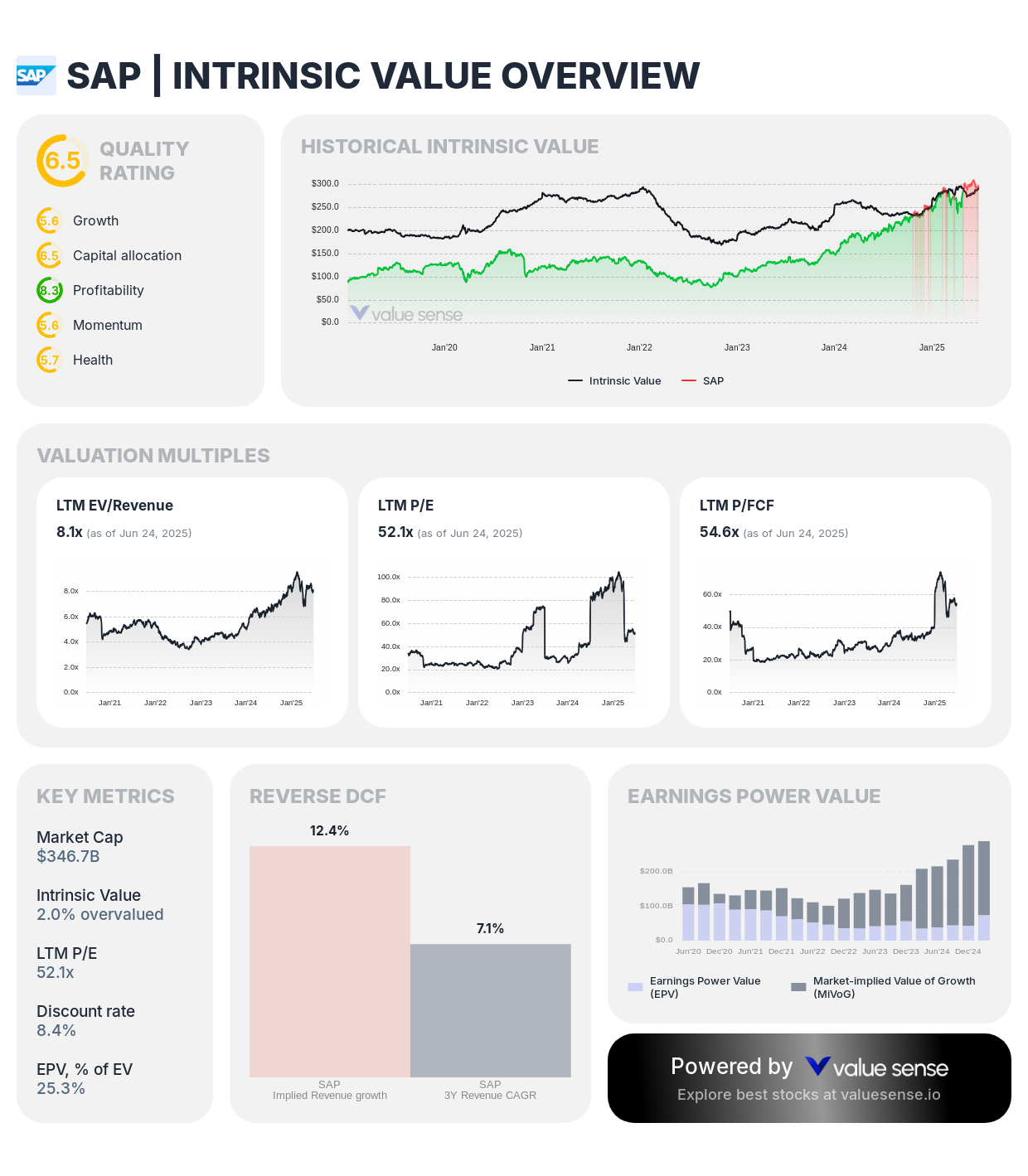

1. SAP SE (SAP) - 2.0% Overvalued ⭐

- Market Cap: $346.7B

- Enterprise Value: $331.6B

- Intrinsic Value: 2.0% overvalued

- DCF Value: 29.0% overvalued

- Relative Value: 25.0% undervalued

- Ben Graham Revised Fair Value: 120.7% undervalued

- Peter Lynch Fair Value: 33.1% undervalued

Investment Thesis: SAP represents the closest approximation to perfect fair value in our analysis, trading just 2.0% above intrinsic worth while demonstrating substantial undervaluation across Graham (120.7%) and Peter Lynch (33.1%) methodologies. As Europe's enterprise resource planning software leader, SAP combines market leadership with successful cloud transformation, creating sustainable competitive advantages that justify current market valuations.

Why It's Fairly Valued: Current pricing accurately reflects SAP's dominant position in mission-critical enterprise software, successful cloud migration strategy, and predictable recurring revenue streams. The market appropriately balances the company's defensive characteristics against modest growth expectations in mature enterprise software markets, creating an ideal fair value opportunity.

Investment Highlights:

- Dominant market position in enterprise resource planning software with exceptional customer retention

- Successful cloud transformation expanding addressable markets and improving margins

- Mission-critical software applications creating high switching costs and pricing power

- Consistent cash generation supporting dividend payments and strategic investments

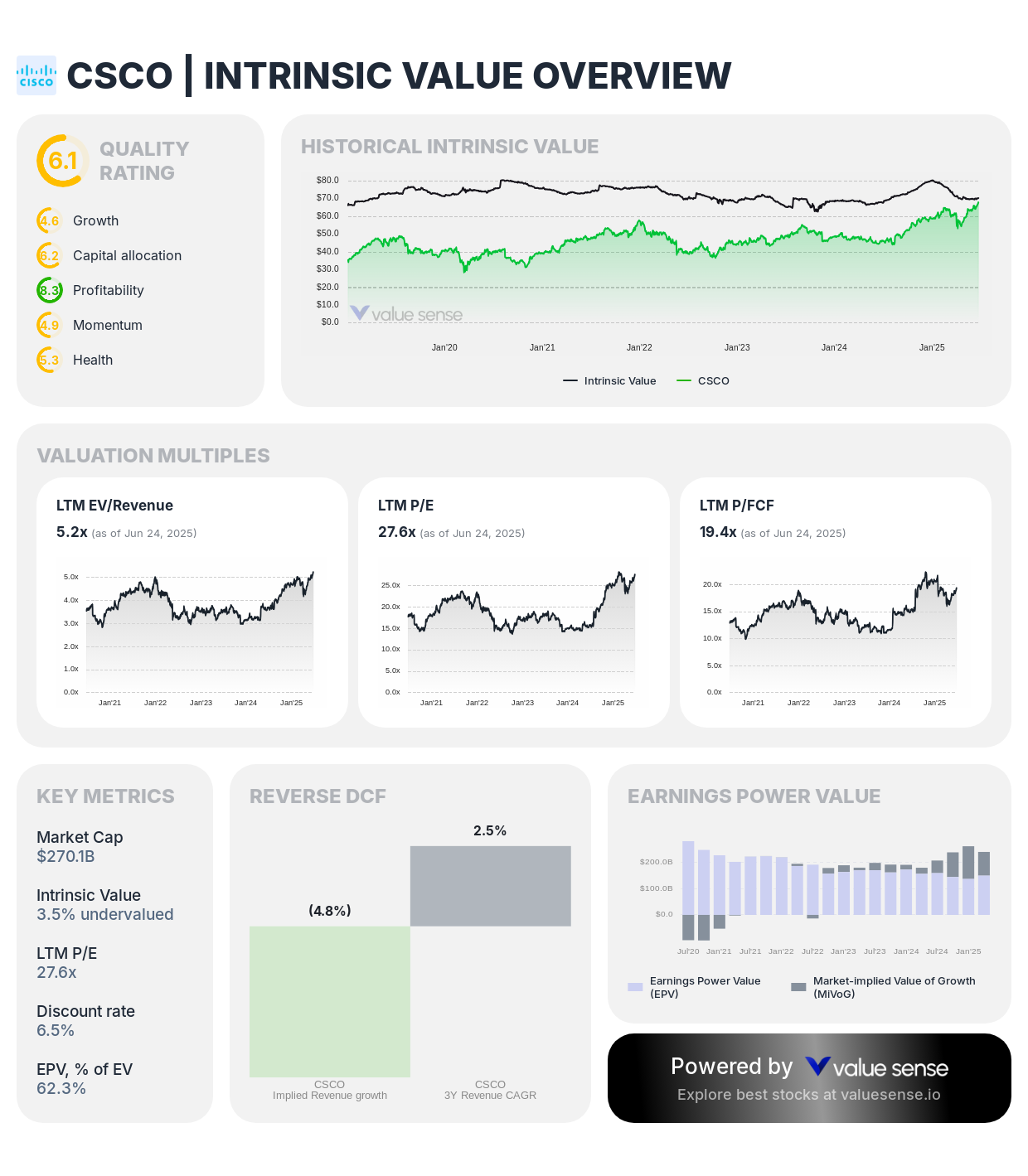

2. Cisco Systems, Inc. (CSCO) - 3.5% Undervalued

- Market Cap: $270.1B

- Enterprise Value: $291.2B

- Intrinsic Value: 3.5% undervalued

- DCF Value: 35.0% undervalued

- Relative Value: 27.8% overvalued

- Ben Graham Revised Fair Value: 64.4% undervalued

- Peter Lynch Fair Value: 0.3% overvalued

Investment Thesis: Cisco demonstrates excellent fair value characteristics trading just 3.5% below intrinsic worth, with substantial DCF undervaluation (35.0%) balanced by relative value overvaluation. The networking technology leader's transformation toward software and services creates more predictable revenue streams while maintaining essential infrastructure positioning that supports current valuations.

Why It's Fairly Valued: The market accurately prices Cisco's transition from hardware-focused to software and services business model, recognizing both the stability of recurring revenue streams and modest growth expectations in mature networking markets. Current pricing reflects realistic expectations for the company's strategic transformation and market leadership position.

Investment Highlights:

- Market leadership in networking infrastructure with high switching costs and customer loyalty

- Successful transition to software and subscription-based revenue models improving predictability

- Essential role in cybersecurity and 5G infrastructure supporting long-term demand

- Strong balance sheet and consistent dividend payments providing defensive characteristics

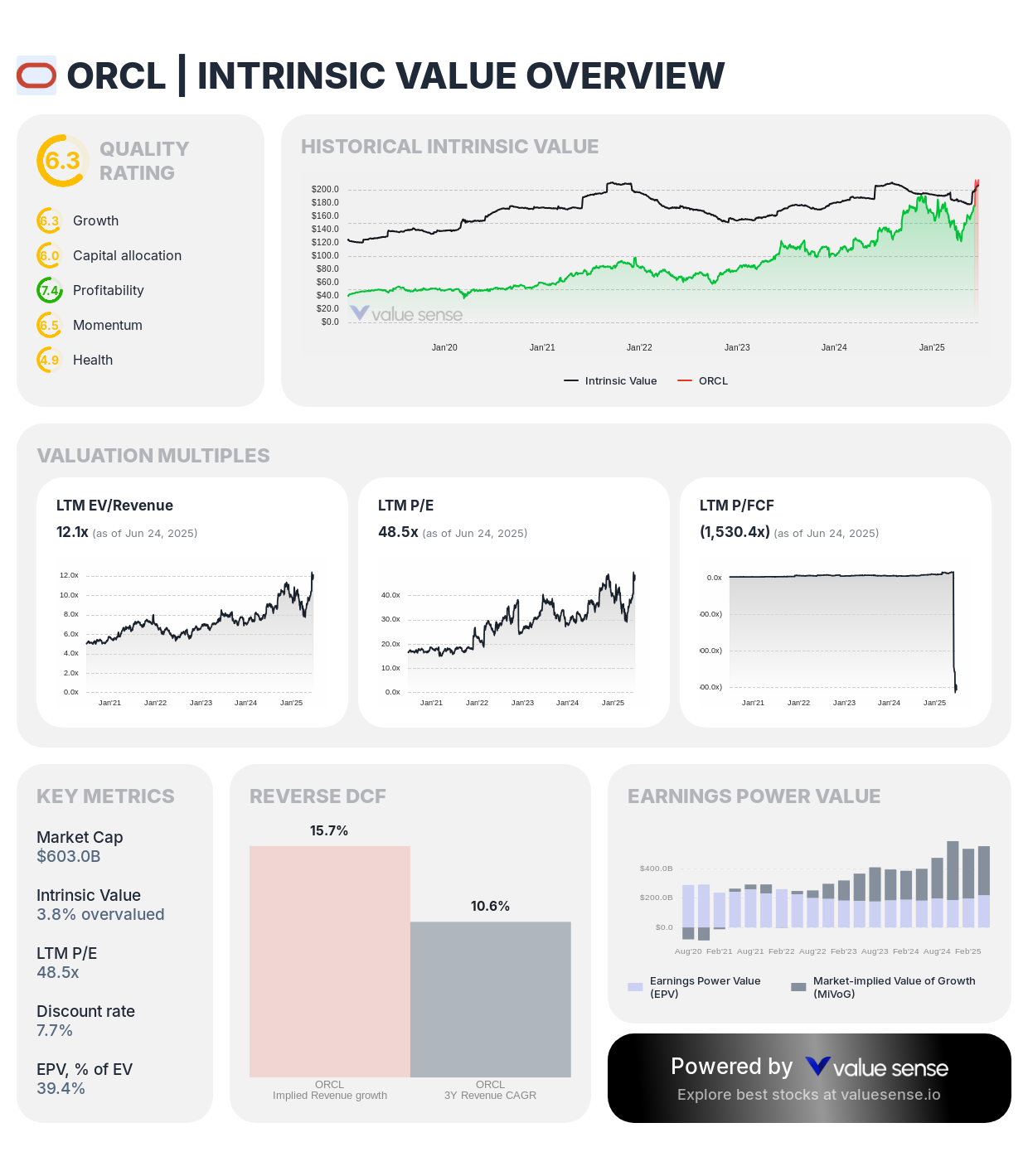

3. Oracle Corporation (ORCL) - 3.8% Overvalued

- Market Cap: $603.0B

- Enterprise Value: $695.9B

- Intrinsic Value: 3.8% overvalued

- DCF Value: 17.0% overvalued

- Relative Value: 9.5% undervalued

- Ben Graham Revised Fair Value: 66.9% overvalued

- Peter Lynch Fair Value: 27.1% overvalued

Investment Thesis: Oracle demonstrates solid fair value characteristics with modest 3.8% overvaluation, reflecting market recognition of the database leader's transformation to cloud computing and autonomous database systems. The company's dominant position in enterprise databases and expanding cloud infrastructure create sustainable competitive advantages that support current premium valuations.

Why It's Fairly Valued: The market appropriately prices Oracle's database monopoly and cloud transformation progress, recognizing both the stability of database licensing revenue and growth potential from autonomous cloud services. Current pricing reflects realistic expectations for the company's competitive positioning against major cloud providers while maintaining its enterprise software leadership.

Investment Highlights:

- Database market leadership with exceptional customer loyalty and switching costs

- Autonomous database technology providing competitive advantages in cloud computing

- Consistent cash generation supporting substantial shareholder returns through dividends and buybacks

- Strategic positioning in enterprise applications and cloud infrastructure markets

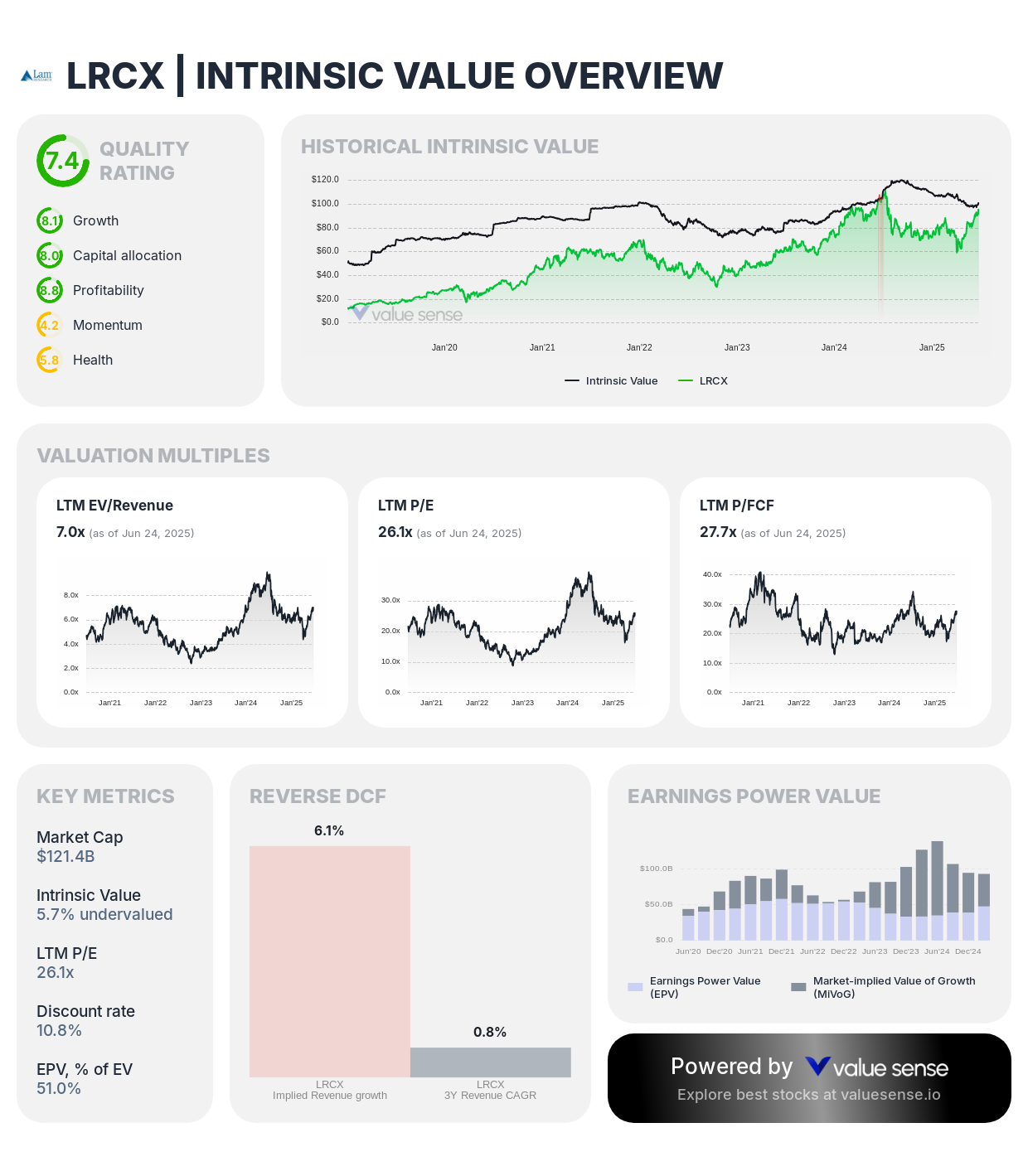

4. Lam Research Corporation (LRCX) - 5.7% Undervalued

- Market Cap: $121.4B

- Enterprise Value: $120.4B

- Intrinsic Value: 5.7% undervalued

- DCF Value: 4.0% overvalued

- Relative Value: 15.4% undervalued

- Ben Graham Revised Fair Value: 16.2% undervalued

- Peter Lynch Fair Value: 37.5% overvalued

Investment Thesis: Lam Research trades at excellent fair value with modest 5.7% undervaluation, reflecting market recognition of the semiconductor equipment company's essential role in advanced chip manufacturing. As a leading provider of wafer fabrication equipment and services, Lam Research benefits from long-term semiconductor industry growth while maintaining technological leadership in critical manufacturing processes.

Why It's Fairly Valued: Current pricing appropriately reflects Lam Research's cyclical semiconductor exposure balanced against its technological leadership and essential role in advanced chip production. The market recognizes both the company's growth potential from AI and data center demand alongside normal semiconductor industry volatility, creating a balanced valuation opportunity.

Investment Highlights:

- Essential equipment provider for advanced semiconductor manufacturing with high barriers to entry

- Technological leadership in critical wafer fabrication processes supporting premium pricing

- Long-term growth drivers from AI, data center, and 5G infrastructure expansion

- Strong customer relationships with leading semiconductor manufacturers providing demand visibility

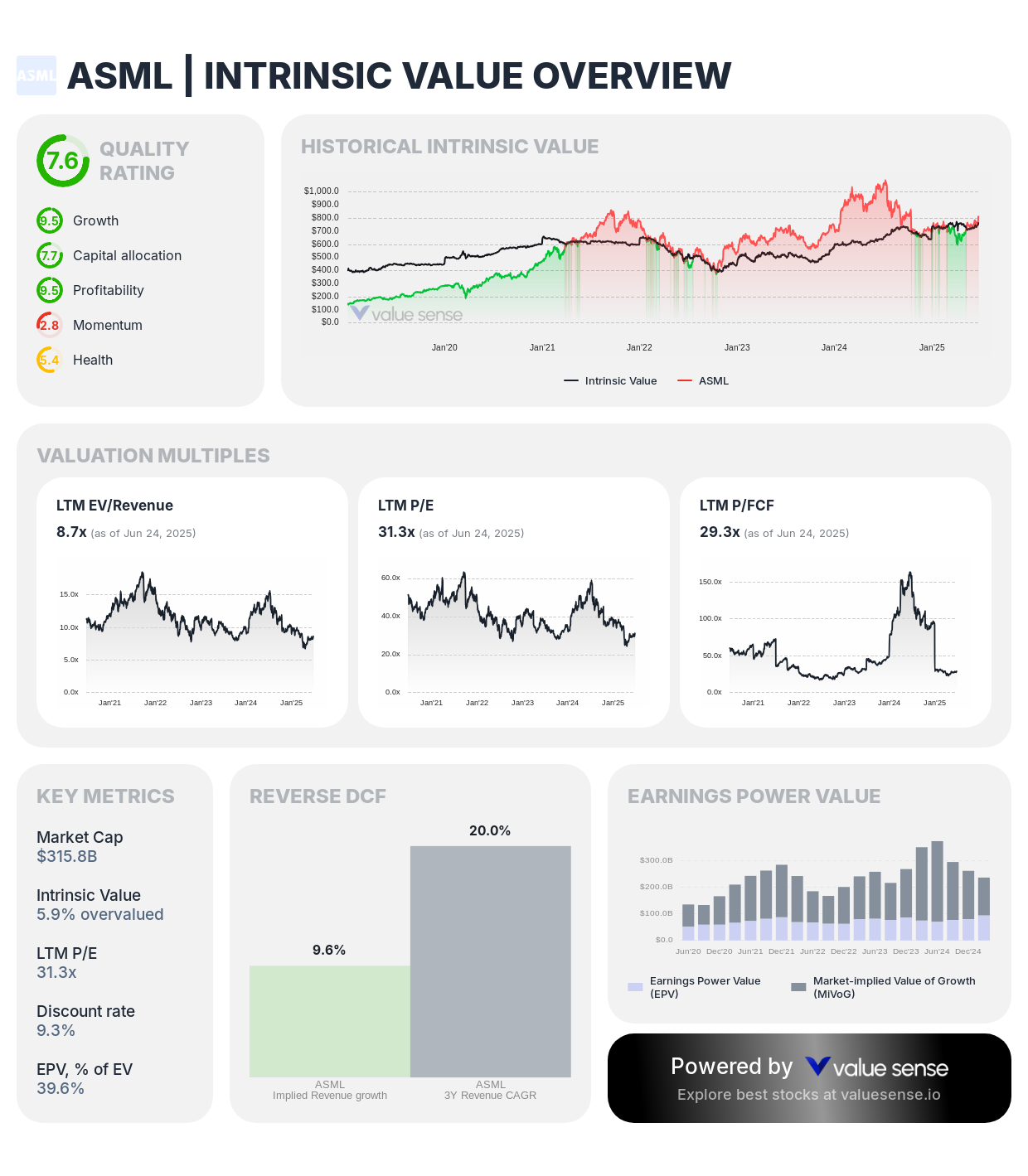

5. ASML Holding N.V. (ASML) - 5.9% Overvalued

- Market Cap: $315.8B

- Enterprise Value: $309.5B

- Intrinsic Value: 5.9% overvalued

- DCF Value: 14.0% overvalued

- Relative Value: 2.2% undervalued

- Ben Graham Revised Fair Value: 12.0% overvalued

- Peter Lynch Fair Value: 18.0% overvalued

Investment Thesis: ASML trades at reasonable fair value with modest 5.9% overvaluation, reflecting market recognition of the semiconductor equipment company's monopolistic position in extreme ultraviolet (EUV) lithography systems. The company's irreplaceable technology and essential role in advanced chip manufacturing justify current premium valuations despite modest overvaluation.

Why It's Fairly Valued: Current pricing appropriately reflects ASML's technological monopoly in EUV lithography, essential role in advanced semiconductor manufacturing, and long-term growth prospects from AI and high-performance computing. The market balances the company's exceptional competitive positioning against cyclical semiconductor industry dynamics.

Investment Highlights:

- Monopolistic position in EUV lithography technology with no viable competitors

- Essential role in advanced semiconductor manufacturing supporting long-term demand visibility

- High barriers to entry through technological complexity and substantial R&D requirements

- Strong customer relationships with leading semiconductor manufacturers providing predictable revenue

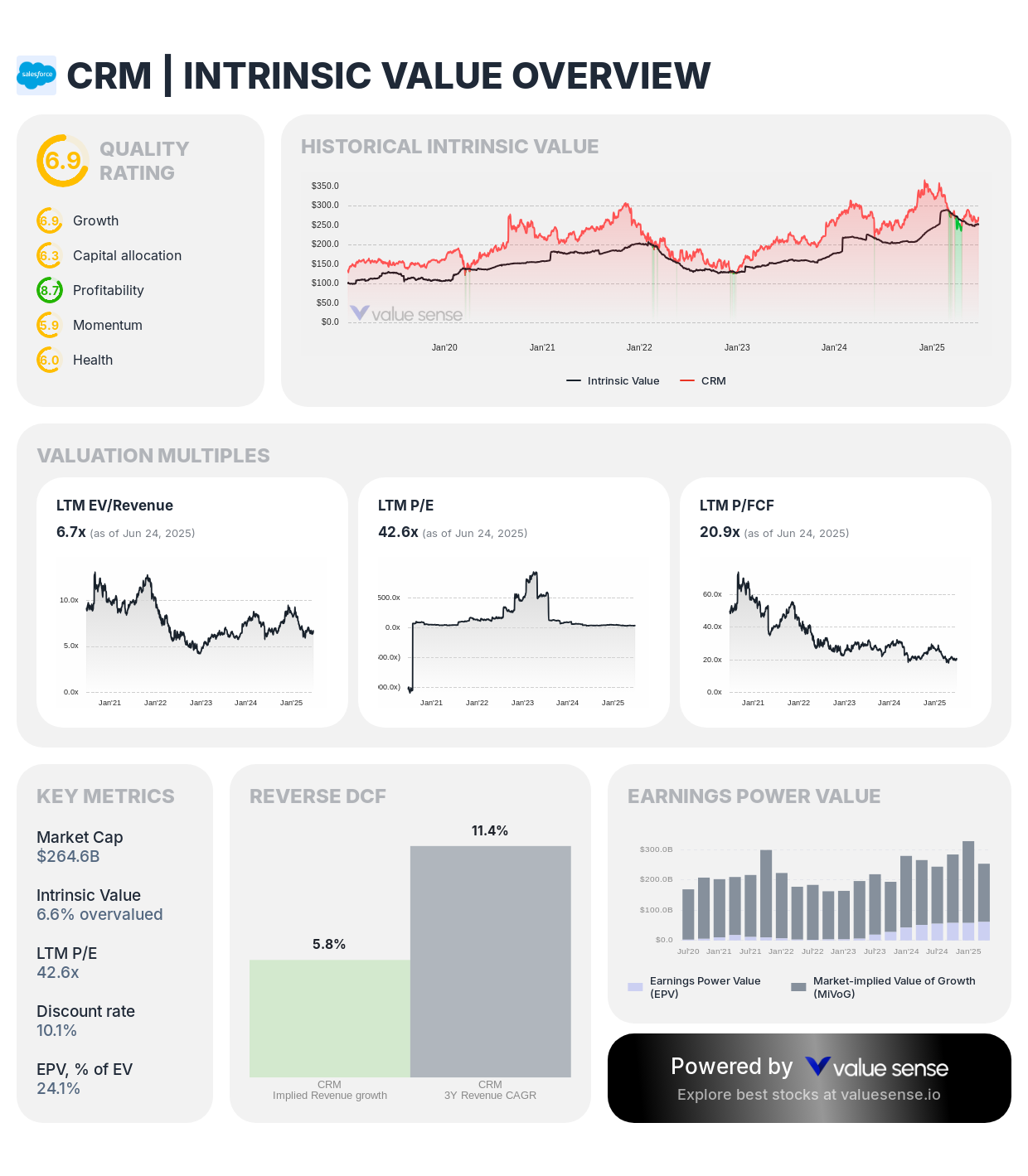

6. Salesforce, Inc. (CRM) - 6.6% Overvalued

- Market Cap: $264.6B

- Enterprise Value: $258.6B

- Intrinsic Value: 6.6% overvalued

- DCF Value: 67.0% overvalued

- Relative Value: 53.8% undervalued

- Ben Graham Revised Fair Value: 63.9% undervalued

- Peter Lynch Fair Value: 5.8% overvalued

Investment Thesis: Salesforce demonstrates reasonable fair value with 6.6% overvaluation, supported by substantial undervaluation in relative value (53.8%) and Graham methodologies (63.9%). The customer relationship management leader's platform approach and subscription revenue model create predictable cash flows that support current market valuations despite modest premium to intrinsic worth.

Why It's Fairly Valued: The market appropriately prices Salesforce's leadership in cloud-based CRM software, recognizing both the company's growth potential and increasing competition in enterprise software markets. Current pricing reflects realistic expectations for subscription revenue growth and platform expansion opportunities while accounting for competitive pressures.

Investment Highlights:

- Market leadership in customer relationship management software with strong network effects

- Platform-based business model creating ecosystem advantages and customer stickiness

- Consistent subscription revenue growth providing predictable cash flows

- Strategic acquisitions expanding addressable markets and competitive positioning

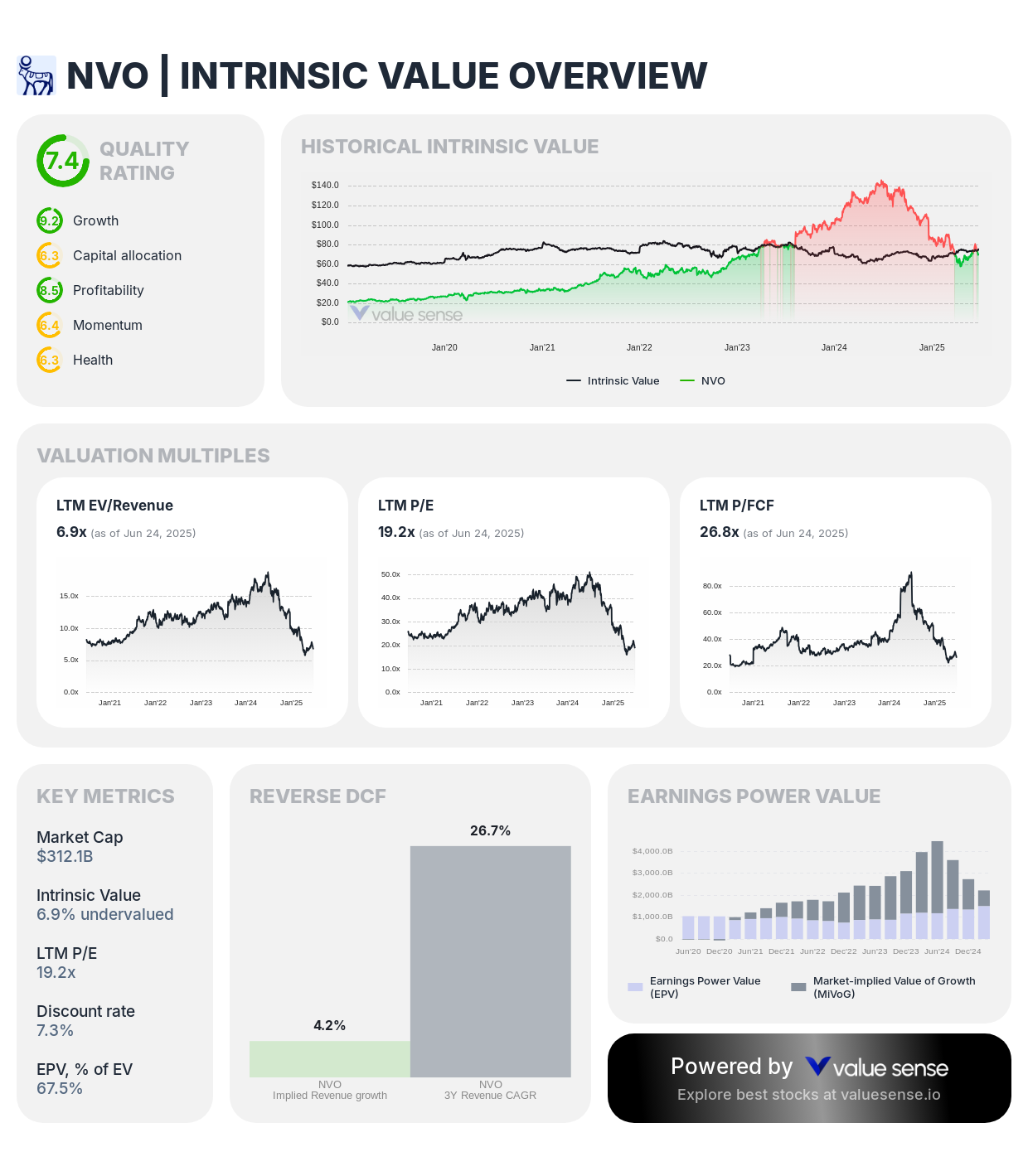

7. Novo Nordisk A/S (NVO) - 6.9% Undervalued

- Market Cap: $312.1B

- Enterprise Value: $324.1B

- Intrinsic Value: 6.9% undervalued

- DCF Value: 18.0% undervalued

- Relative Value: 4.3% overvalued

- Ben Graham Revised Fair Value: 22.3% undervalued

- Peter Lynch Fair Value: 34.3% undervalued

Investment Thesis: Novo Nordisk represents an attractive fair value opportunity trading 6.9% below intrinsic worth while demonstrating consistent undervaluation across multiple methodologies. As the world's leading diabetes care company with breakthrough obesity treatments, Novo Nordisk combines defensive healthcare characteristics with substantial growth opportunities in rapidly expanding therapeutic markets.

Why It's Fairly Valued: The market accurately recognizes Novo Nordisk's exceptional competitive positioning in diabetes care, innovative drug pipeline, and expanding obesity treatment opportunities. Current pricing reflects both the company's strong fundamentals and realistic growth expectations, creating a balanced investment opportunity without significant premium or discount to intrinsic worth.

Investment Highlights:

- Global leadership in diabetes care with expanding patient populations worldwide

- Revolutionary obesity treatments addressing massive addressable markets with premium pricing

- Consistent innovation pipeline maintaining competitive advantages in specialized therapeutic areas

- Predictable cash flows and strong balance sheet supporting dividend growth and strategic investments

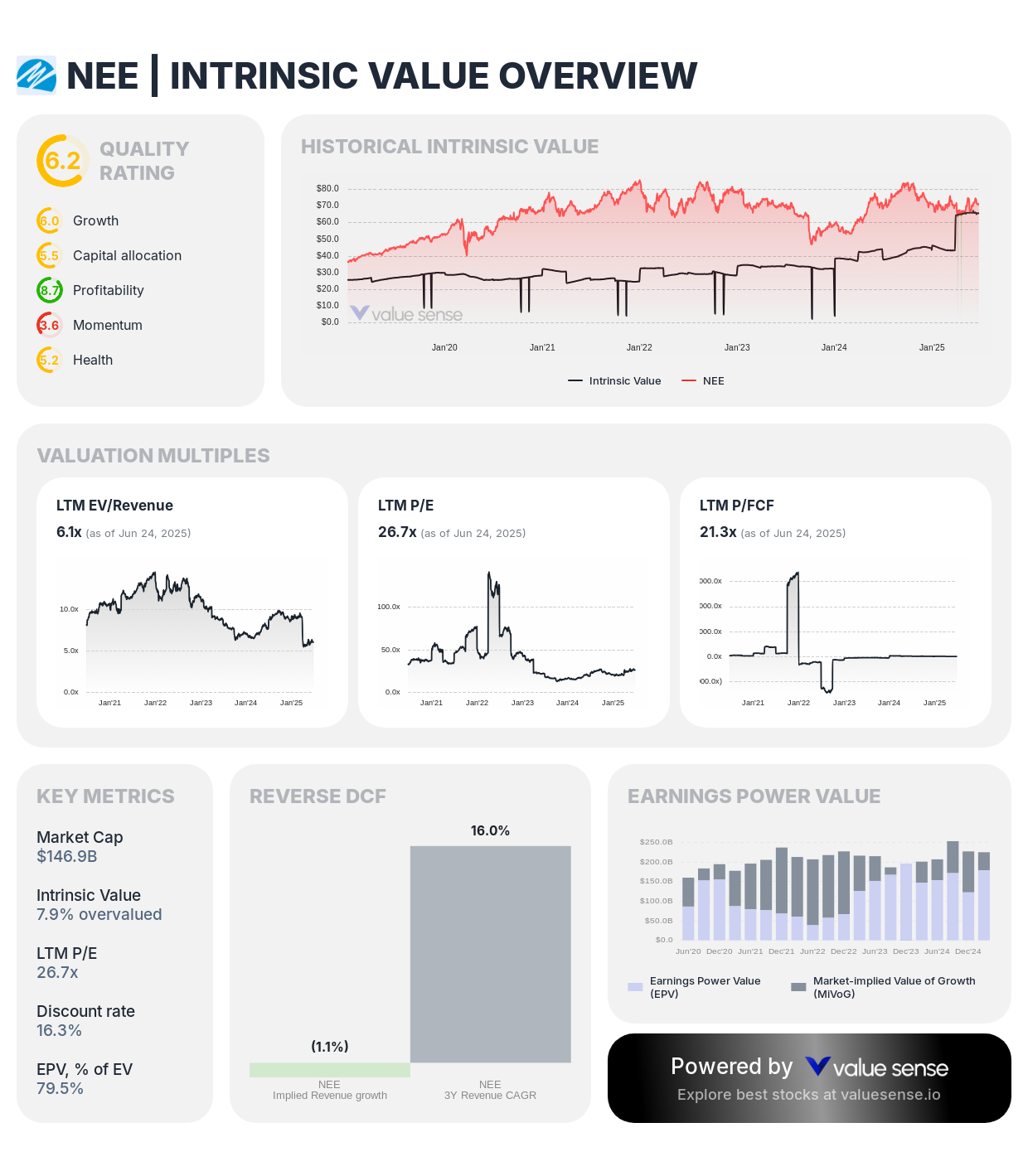

8. NextEra Energy, Inc. (NEE) - 7.9% Overvalued

- Market Cap: $146.9B

- Enterprise Value: $154.3B

- Intrinsic Value: 7.9% overvalued

- Relative Value: 7.9% overvalued

- Ben Graham Revised Fair Value: 135.8% undervalued

- Peter Lynch Fair Value: 40.2% undervalued

Investment Thesis: NextEra Energy trades at reasonable fair value with modest 7.9% overvaluation, balanced by substantial undervaluation in Graham (135.8%) and Peter Lynch (40.2%) methodologies. The utility leader's renewable energy development and regulated operations create predictable cash flows that support current valuations despite premium to intrinsic worth.

Why It's Fairly Valued: Current pricing appropriately reflects NextEra's leadership in renewable energy development, regulated utility operations, and visible growth pipeline through energy transition investments. The market balances the company's defensive characteristics against modest growth expectations in utility markets while recognizing its strategic positioning for the energy transition.

Investment Highlights:

- Leadership position in renewable energy development with substantial project pipeline

- Regulated utility operations providing predictable cash flows and dividend growth

- Strategic positioning for energy transition with wind and solar expertise

- Strong balance sheet supporting continued infrastructure investment and shareholder returns

Fair Value Investment Strategy for Balanced Portfolios

Emphasize Quality Over Valuation Extremes: Fair value stocks like SAP (2.0% overvalued) and Cisco (3.5% undervalued) offer quality business exposure without waiting for extreme undervaluation or paying significant premiums. These companies provide balanced risk-reward profiles suitable for core portfolio holdings, emphasizing business fundamentals over valuation arbitrage opportunities.

Focus on Business Fundamentals and Competitive Moats: Companies trading near fair value require emphasis on competitive positioning, management quality, and long-term growth prospects rather than valuation correction potential. Prioritize businesses with sustainable competitive advantages like Oracle's database monopoly, ASML's EUV lithography leadership, or Novo Nordisk's diabetes care dominance.

Diversification Across Sectors and Business Models: Fair value opportunities span healthcare (Novo Nordisk), enterprise software (SAP, Oracle, Salesforce), semiconductor equipment (ASML, Lam Research), networking (Cisco), and utilities (NextEra Energy), providing balanced sector exposure without concentration risk. This diversification approach reduces portfolio volatility while maintaining exposure to different economic cycles and growth drivers.

Long-Term Holding Approach for Wealth Creation: Fair value stocks typically require longer investment horizons for wealth creation through business growth rather than valuation expansion. Focus on companies with sustainable competitive advantages that can compound shareholder value over extended periods, as immediate price appreciation may be limited compared to deeply undervalued opportunities.

Understanding Our Fair Value Methodology

Multiple Valuation Convergence Analysis: Our fair value identification requires analyzing convergence across multiple methodologies including intrinsic value, DCF analysis, relative valuation, Ben Graham revised fair value, and Peter Lynch fair value. Companies showing consistent pricing across methodologies demonstrate market efficiency in valuation and reduced risk of significant mispricings.

Quality Assessment Integration: Fair value analysis emphasizes business quality metrics including competitive positioning, financial strength, management effectiveness, and growth sustainability. These factors justify current market pricing and support long-term value creation even when stocks trade near intrinsic worth rather than at significant discounts.

Risk-Adjusted Return Expectations: Fair value stocks typically offer more modest but consistent returns compared to undervalued opportunities, with lower volatility and reduced downside risk. Expected returns align with business fundamentals and operational performance rather than valuation arbitrage, making them suitable for conservative and balanced investment approaches.

Key Takeaways for Fair Value Investors

✅ Closest to Perfect Pricing: SAP (2.0% overvalued) and Cisco (3.5% undervalued) offer excellent entry points at reasonable valuations

✅ Quality Technology Leaders: Oracle, ASML, and Salesforce provide enterprise software and semiconductor equipment leadership

✅ Balanced Portfolio Foundation: Fair value stocks offer stability and consistent returns for core holdings

✅ Sector Diversification: Opportunities span healthcare, technology, semiconductors, enterprise software, and utilities

✅ Long-Term Wealth Building: Focus on business growth rather than valuation expansion for sustainable returns

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 9 Best Undervalued Stocks Under $1

📖 8 Best Undervalued Low-Price Stocks Under $20

📖 10 Best Safe Stocks for Beginners

FAQ About Fair Value Investing

What advantages do fair value stocks offer compared to undervalued opportunities?

Fair value stocks provide several advantages including reduced volatility due to reasonable market pricing, lower risk of value traps since current pricing reflects realistic business fundamentals, and more predictable returns based on business performance rather than valuation correction. Companies like SAP and Cisco offer quality business exposure without the uncertainty of waiting for extreme undervaluation to correct, making them suitable for investors seeking steady wealth accumulation through business growth rather than valuation arbitrage.

How can investors identify quality fair value opportunities in efficient markets?

Quality fair value opportunities typically demonstrate consistent performance across multiple valuation methodologies, strong competitive positioning with sustainable advantages, predictable cash flows supporting current valuations, and clear growth strategies aligned with market expectations. Companies like Oracle and ASML show convergence between market pricing and fundamental analysis, indicating efficient valuation that reflects underlying business quality and growth prospects without significant premiums or discounts.

Should investors be concerned about modest overvaluation in fair value stocks?

Modest overvaluation of 5-8% in quality companies often reflects market recognition of competitive advantages, growth potential, or defensive characteristics that justify premium pricing. Companies like ASML with monopolistic positioning or NextEra with renewable energy leadership may warrant slight premiums due to exceptional business quality. However, investors should monitor whether premiums expand significantly beyond fundamental justification and consider dollar-cost averaging for entry timing.

What role should fair value stocks play in portfolio construction?

Fair value stocks typically serve as core portfolio holdings, providing stability and consistent returns while reducing overall portfolio volatility. These companies offer balanced risk-reward profiles suitable for 40-60% of equity allocations, complemented by undervalued opportunities for growth potential and defensive holdings for stability. The predictable nature of fair value returns makes them ideal for investors with moderate risk tolerance seeking steady wealth accumulation through operational performance.

How do fair value stocks perform during different market cycles?

Fair value stocks generally demonstrate more stable performance during market volatility due to reasonable initial pricing that reduces downside risk during corrections while limiting excessive gains during market euphoria. Companies like Novo Nordisk and Oracle typically outperform during market stress due to defensive characteristics while participating moderately in market advances. This stability makes fair value stocks particularly attractive for investors seeking consistent performance across various economic conditions and market cycles.

Important Note on Fair Value Investing: Fair value stocks offer balanced risk-reward profiles but may provide more modest returns compared to undervalued opportunities. These investments emphasize business quality and long-term growth over valuation arbitrage, requiring patience for wealth creation through operational performance rather than market repricing. Fair value identification depends on accurate fundamental analysis and may change with business performance or market conditions.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Fair value calculations are based on current financial data and assumptions that may change with new information. Market conditions, business performance, and competitive dynamics can affect both intrinsic value calculations and market pricing. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.