Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really Mean by Karen Berman, Joe Knight, with John Case

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

“Financial Intelligence: A Manager’s Guide to Knowing What the Numbers Really Mean” by Karen Berman and Joe Knight, with John Case, stands as a foundational text for anyone seeking to demystify the world of financial statements, metrics, and corporate reporting. Karen Berman, who held a Ph.D. in organizational psychology and was a co-founder of the Business Literacy Institute, spent her career teaching managers and executives how to understand the financial side of business. Joe Knight, a seasoned finance and business literacy expert, brings decades of experience in finance, entrepreneurship, and consulting. John Case, a respected business writer, adds further clarity and accessibility. Together, their collaboration has produced a book that bridges the gap between financial professionals and the rest of the business world.

Originally published in 2006, “Financial Intelligence” arrived at a time when corporate scandals such as Enron and WorldCom were still fresh in the public’s mind, and the need for greater transparency and understanding of financial statements was at an all-time high. The book’s relevance has only grown in the years since, as financial literacy has become a crucial skill for managers, entrepreneurs, and investors alike. The authors’ backgrounds in both teaching and real-world finance give the book a practical edge, ensuring it resonates with readers from all industries and levels of experience.

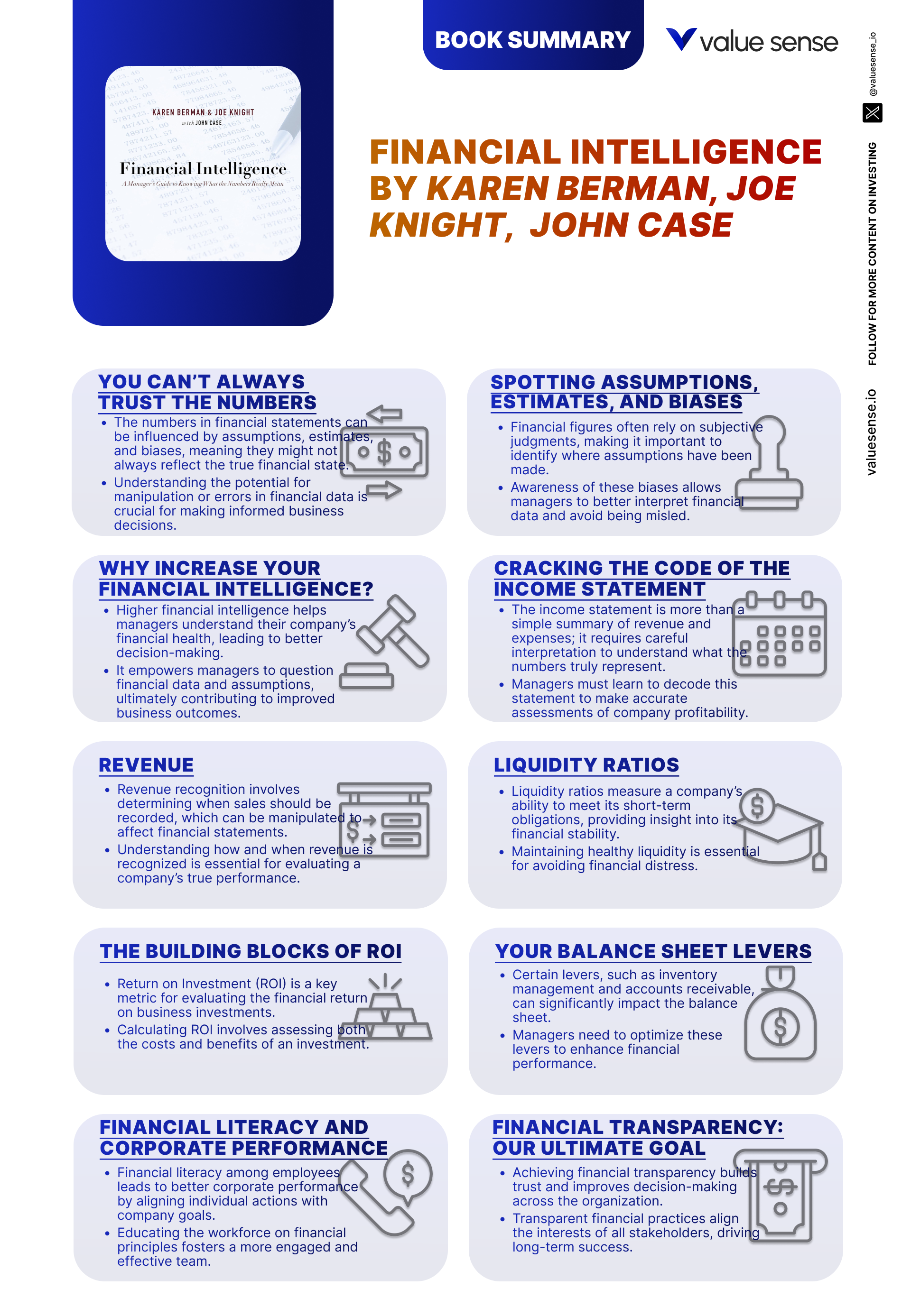

The central theme of the book is that finance is both an art and a science. The authors argue that while numbers may seem objective, financial statements are shaped by assumptions, estimates, and sometimes biases. The book’s core purpose is to equip managers and non-financial professionals with the tools and mindset needed to interpret financial data critically, ask the right questions, and make better business decisions. By focusing on the underlying principles and “stories” behind the numbers, the book empowers readers to see beyond the surface and truly understand what drives financial performance.

“Financial Intelligence” is considered a classic because it breaks down complex financial concepts into clear, accessible language without sacrificing depth or rigor. Unlike many finance books that cater solely to accountants or MBAs, Berman and Knight’s work is tailored for the broader business community—managers, team leaders, entrepreneurs, and anyone who needs to make decisions based on financial data. The book’s practical approach, real-world examples, and focus on the “why” behind the numbers set it apart from more technical or theoretical finance texts.

Anyone who is responsible for a budget, manages a team, or aspires to a leadership role will find immense value in this book. It is especially useful for investors who want to dig deeper into company reports, business owners aiming to improve profitability, or professionals seeking to enhance their financial acumen. What makes “Financial Intelligence” unique is its insistence that true understanding comes not from memorizing formulas, but from appreciating the judgment, context, and sometimes creativity involved in financial reporting. The book’s blend of practical tools, cautionary tales, and actionable insights ensures it remains a vital resource for anyone looking to master the language of business.

Key Themes and Concepts

“Financial Intelligence” is structured around several interlocking themes that run throughout the book, each designed to build the reader’s capacity to interpret, question, and leverage financial information. At its core, the book is about developing a skeptical, analytical mindset—recognizing that numbers alone rarely tell the whole story. The authors emphasize that every financial statement is shaped by choices, estimates, and sometimes even strategic manipulation. By exploring themes such as revenue recognition, the distinction between cash flow and profit, and the role of financial literacy, the book provides a comprehensive roadmap for making smarter business and investment decisions.

These themes are not isolated; rather, they weave through multiple chapters and sections, reinforcing the idea that financial intelligence is holistic. Whether you’re analyzing an income statement, a balance sheet, or a set of ratios, the same core questions apply: What assumptions underlie these numbers? What might be hidden or distorted? How do these figures connect to real business activity? The book’s practical orientation ensures that each theme is illustrated with real-world examples, actionable advice, and cautionary tales from business history.

Below, we explore the seven key themes that define “Financial Intelligence,” each with detailed explanations and practical implications for investors and managers.

- Financial Intelligence: This foundational theme is about cultivating the ability to read, interpret, and question financial statements with a critical eye. The authors stress that true financial intelligence involves understanding not just what the numbers say, but how they’re constructed. For example, two companies in the same industry may report very different profits due to differing accounting policies or assumptions. The book encourages readers to dig deeper—asking questions about depreciation methods, inventory valuation, or the timing of expense recognition. For investors, this means not taking reported earnings at face value, but probing for the assumptions and estimates that shape them. Financial intelligence is the bedrock skill that enables all other forms of analysis.

- Revenue Recognition: Revenue is the lifeblood of any business, but recognizing it is often more complex than it appears. The book devotes significant attention to the rules and gray areas of revenue recognition, illustrating how companies can (legally or otherwise) shift the timing of revenue to smooth earnings or meet targets. For instance, a software company might recognize revenue upfront for a multi-year contract, while another might defer it over time. These choices have a direct impact on reported profits and can be used to manipulate perceptions of growth and stability. Investors must understand how and when companies recognize revenue to accurately assess financial health and avoid falling for “creative accounting.”

- Cash Flow vs. Profit: One of the book’s central lessons is that profit and cash flow are not the same thing. A company can show healthy profits on paper while running out of cash—a scenario that has led to the downfall of many businesses. The authors explain the mechanics of cash flow statements, the importance of working capital management, and the dangers of focusing solely on the income statement. For investors and managers, this theme underscores the need to analyze both profitability and liquidity, ensuring that a company’s operations are sustainable in the real world, not just on paper.

- Financial Ratios and Analysis: Ratios are the tools that translate raw financial data into actionable insights. The book covers key categories such as profitability, leverage, liquidity, and efficiency ratios, showing how each can be used to evaluate performance, compare companies, and spot red flags. For example, a declining gross margin might signal rising input costs or pricing pressure, while a high debt-to-equity ratio could indicate financial risk. The authors emphasize that ratios are most meaningful when analyzed in context—across time, versus peers, and in light of industry norms. For investors, mastering financial ratios is essential for screening opportunities and managing risk.

- Return on Investment (ROI): ROI is the ultimate test of whether a business decision creates value. The book unpacks the components of ROI, explains how it’s calculated, and highlights the assumptions that can distort it. For instance, the choice of depreciation method or the allocation of overhead costs can dramatically affect ROI calculations. The authors encourage readers to look beyond headline figures, scrutinizing the inputs and considering alternative scenarios. For managers and investors alike, understanding ROI is crucial for capital allocation, project evaluation, and long-term value creation.

- Financial Literacy: The book closes with a passionate argument for the importance of financial literacy at all levels of an organization. The authors present compelling evidence that employees who understand the financial implications of their actions make better decisions, drive profitability, and contribute to a culture of transparency. For investors, this theme highlights the value of assessing not just a company’s numbers, but its culture—companies that invest in financial education for their teams are often better run and more resilient.

- The Art and Science of Finance: Throughout the book, Berman and Knight return to the idea that finance is as much about judgment as it is about numbers. Every financial statement is shaped by choices—about accounting policies, estimates, and even ethics. The book provides numerous examples of how companies can “massage” results within the bounds of GAAP, and why understanding these nuances is essential for anyone relying on financial reports. This theme serves as a reminder that skepticism, curiosity, and a willingness to dig deeper are the hallmarks of true financial intelligence.

Book Structure: Major Sections

Part 1: The Art of Finance

This opening section (Chapters 1-4) establishes the core philosophy of the book: finance is not just a matter of crunching numbers, but an art shaped by judgment, estimates, and sometimes bias. The authors introduce the concept of “financial intelligence,” emphasizing that even the most precise-looking statements are built on a foundation of assumptions and choices. Through engaging anecdotes and practical examples, Berman and Knight encourage readers to approach financial data with a healthy dose of skepticism and curiosity.

Key concepts from these chapters include the recognition that financial statements are inherently subjective, and that managers must learn to read between the lines. The authors illustrate how companies can legally “massage” results—through choices in depreciation, inventory valuation, or revenue timing. For example, two firms might report very different profits simply because they use different accounting methods. The section underscores the need for managers and investors to question the numbers, understand the underlying assumptions, and appreciate the limitations of financial reports.

For investors, this section’s lessons are foundational: always look beyond the headline figures, and never assume that reported numbers are purely objective. By developing financial intelligence, readers learn to spot red flags, ask probing questions, and make better-informed decisions. The practical takeaway is that understanding the “art” behind the numbers is just as important as mastering the formulas themselves.

In today’s era of complex financial engineering and ever-evolving accounting standards, the principles introduced here are more relevant than ever. As companies adopt new technologies and business models, the subjective elements of finance—judgment, estimation, and even creative presentation—remain at the heart of financial reporting. This section sets the stage for a deeper exploration of how to interpret and leverage financial data in a world where the numbers are rarely as simple as they seem.

Part 2: Understanding the Income Statement

Chapters 5-9 comprise a deep dive into the income statement, the financial report most familiar to managers and investors. The section unpacks how profit is calculated, the importance of the matching principle, and the complexities of revenue and expense recognition. The authors demystify terms like gross margin, operating income, and net profit, illustrating how each is influenced by accounting choices and business realities.

Key concepts include the idea that profit is always an estimate, shaped by assumptions about timing, recognition, and allocation of costs. The section highlights the critical issue of revenue recognition—when and how companies record sales—and the potential for manipulation. For instance, aggressive recognition can inflate short-term profits at the expense of long-term sustainability. The authors use real-world examples to show how expense timing, accruals, and provisions can all distort the true picture of profitability.

For investors and managers, the practical application is clear: dissect the income statement with an eye for the underlying assumptions. Pay attention to changes in revenue recognition policies, spikes in non-recurring expenses, or shifts in the allocation of overhead. These signals can reveal much about a company’s true performance and the sustainability of its earnings.

With the rise of subscription models, SaaS companies, and complex revenue arrangements, the lessons from this section are increasingly vital. Modern financial statements often mask as much as they reveal, making it essential for analysts to understand the mechanics and potential pitfalls of profit reporting. This section provides the tools needed to navigate these challenges with confidence.

Part 3: The Balance Sheet and Cash Flow

This section (Chapters 10-14) shifts focus to the balance sheet and cash flow statement—two reports that provide a snapshot of a company’s financial health and operational sustainability. The authors explain the structure of the balance sheet, detailing the roles of assets, liabilities, and equity, and emphasize the importance of understanding what these figures truly represent.

Key points include the recognition that balance sheet items are often based on estimates—such as the value of inventory, accounts receivable, or goodwill. The section also draws a clear distinction between profit and cash flow, showing how companies can appear profitable while struggling to pay their bills. The authors highlight the importance of working capital management, the dangers of over-reliance on debt, and the need to analyze cash flow to assess liquidity and solvency.

For investors, this section provides critical insights into evaluating a company’s stability and risk profile. By analyzing trends in working capital, debt levels, and cash generation, readers can spot warning signs of financial distress or uncover hidden strengths. The practical takeaway is to always supplement income statement analysis with a careful review of the balance sheet and cash flow statement.

In an age where companies are increasingly asset-light and reliant on intangible assets, understanding the nuances of the balance sheet is more important than ever. The lessons from this section are directly applicable to modern business models, where traditional measures of value and risk must be reconsidered in light of new realities.

Part 4: Financial Ratios and Analysis

Chapters 20-24 focus on the use of financial ratios as tools for performance analysis, benchmarking, and decision-making. The authors introduce key ratio categories—profitability, leverage, liquidity, and efficiency—and demonstrate how each provides a different lens for evaluating a company’s health and prospects.

This section emphasizes the importance of context: ratios are most meaningful when compared across time, against peers, or relative to industry norms. For example, a high current ratio may signal strong liquidity, but could also indicate excessive idle assets. The authors provide practical guidance on interpreting ratios, avoiding common pitfalls, and using ratio analysis to inform strategic decisions.

For investors and managers, mastering ratio analysis is essential for screening opportunities, managing risk, and identifying trends. The section encourages readers to look beyond single metrics, integrating multiple ratios for a more comprehensive view of performance.

With the proliferation of financial data and analytics tools, ratio analysis has become both more accessible and more complex. This section’s lessons are directly relevant to modern investors, who must navigate a sea of metrics and benchmarks to uncover true value and risk.

Part 5: Return on Investment and Working Capital

The final major section (Chapters 26-30) explores the concepts of return on investment (ROI) and working capital management—two pillars of financial decision-making. The authors break down the components of ROI, explain how it’s calculated, and discuss the assumptions that can influence the results. They also delve into the management of working capital, showing how decisions about inventory, receivables, and payables directly impact liquidity and profitability.

Key concepts include the importance of understanding the drivers of ROI, the pitfalls of over-optimistic assumptions, and the role of working capital in sustaining operations. The section provides practical frameworks for evaluating investment opportunities, managing cash cycles, and optimizing capital allocation.

For investors and business leaders, these chapters offer actionable strategies for maximizing returns and minimizing risk. By focusing on both the efficiency of capital use and the sustainability of operations, readers are equipped to make smarter investment and management decisions.

In today’s fast-paced business environment, where capital is scarce and competition fierce, the principles of ROI and working capital management are as relevant as ever. This section’s insights provide a timeless guide for anyone seeking to drive value and ensure long-term success.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: You Can’t Always Trust the Numbers

This opening chapter is critically important because it sets the tone for the entire book, challenging the common misconception that financial statements are purely objective and trustworthy. Berman and Knight explain that every number in a financial report is the result of choices, estimates, and sometimes even strategic manipulation. The main concept is that financial statements, while governed by rules, are shaped by human judgment and can be misleading if taken at face value. The authors urge readers to develop a healthy skepticism and to always question the assumptions behind the numbers.

One striking example from the chapter involves the infamous Enron scandal, where executives exploited accounting loopholes to hide debt and inflate profits. The authors also reference less dramatic, but common, practices such as changing depreciation methods or inventory valuation to smooth earnings. Quotes like “Numbers are only as reliable as the people and systems that produce them” drive home the point that financial data is never completely neutral. The chapter provides data on how widespread these practices are, citing surveys showing that a significant percentage of companies admit to “earnings management.”

Investors and managers can apply these lessons by always digging deeper into financial reports. Instead of accepting headline figures, they should review footnotes, question sudden changes in accounting policies, and compare reported results to industry benchmarks. The chapter recommends specific steps such as checking for consistency in reporting, looking for unexplained fluctuations, and understanding the incentives of management. These habits help uncover potential red flags and ensure more informed decision-making.

In the real world, countless companies have suffered from misplaced trust in financial statements. The chapter references historical cases such as WorldCom and more recent examples like Toshiba, illustrating that the risks are ongoing. The lesson is timeless: skepticism and critical thinking are essential tools for anyone relying on financial data, whether as an investor, manager, or analyst.

Chapter 5: Profit Is an Estimate

This chapter is a cornerstone of the book, explaining why profit—perhaps the most watched financial metric—is always an estimate rather than a fixed fact. The authors delve into the mechanics of the matching principle, which dictates that revenues and expenses must be recognized in the same period, and highlight how this principle depends on significant judgment and assumptions. The main concept is that profit can be manipulated by changing when and how revenues and expenses are recognized, making it crucial for readers to understand the underlying estimates.

The chapter provides detailed examples of how companies can shift profits between periods by accelerating or delaying expenses, or by recognizing revenue early or late. For instance, a manufacturer might delay maintenance expenses to boost current-year profits or recognize revenue from a long-term contract upfront. The authors quote a CFO who says, “Profit is what you want it to be, at least within the bounds of GAAP.” The chapter also includes data on how reported profits can differ dramatically from cash flow, reinforcing the need for caution.

For practical application, the authors advise readers to scrutinize the assumptions behind profit figures. This includes reviewing the timing of major expenses, checking for large accruals or provisions, and comparing profit trends to cash flow. Investors should be wary of companies with consistently rising profits but stagnant or declining cash flow, as this may indicate aggressive accounting. The chapter also recommends using alternative metrics, such as EBITDA or free cash flow, to cross-check reported earnings.

Historically, profit manipulation has played a role in many financial scandals, from Sunbeam’s “channel stuffing” to more recent cases in the tech sector. The chapter’s lessons are directly relevant to modern investors, who must navigate increasingly complex business models and revenue streams. Understanding that profit is an estimate, not a certainty, is essential for avoiding costly mistakes.

Chapter 7: Revenue: The Issue Is Recognition

Revenue recognition is one of the most critical and complex issues in accounting, and this chapter provides an in-depth exploration of why it matters so much. The authors explain that the timing and method of recognizing revenue can have a huge impact on reported profits and can be manipulated to meet targets or smooth earnings. The chapter’s main concept is that understanding a company’s revenue recognition policies is essential for assessing its true financial performance.

The chapter offers specific examples, such as software companies recognizing multi-year contracts upfront versus spreading them over the contract period. It also discusses notorious cases where improper revenue recognition led to financial scandals, such as Lucent Technologies and Xerox. Quotes from auditors and regulators emphasize the challenges in enforcing consistent standards. The authors provide data showing how changes in revenue recognition rules (such as ASC 606) have affected reported revenue across industries.

Investors and managers can apply these lessons by carefully reviewing a company’s revenue recognition policies, especially when there are significant changes or unusual spikes in revenue. The chapter suggests looking for red flags such as large one-time sales, aggressive booking of future revenue, or significant differences between reported revenue and cash receipts. Understanding these nuances can help investors avoid companies that are “managing” earnings rather than building sustainable businesses.

In the real world, revenue recognition remains a frequent source of restatements and regulatory action. The chapter’s lessons are particularly relevant in industries with complex contracts or long sales cycles, such as technology, construction, and healthcare. By mastering the intricacies of revenue recognition, investors can better assess the quality and sustainability of reported growth.

Chapter 10: Understanding Balance Sheet Basics

This chapter is vital because it provides the foundation for analyzing a company’s financial position. The authors break down the structure of the balance sheet, explaining the roles of assets, liabilities, and equity, and how these elements interact to provide a snapshot of financial health. The main concept is that the balance sheet is not just a static report, but a dynamic reflection of a company’s resources and obligations, shaped by estimates and assumptions.

The chapter uses concrete examples to illustrate how asset values can be influenced by depreciation methods, impairment tests, and market conditions. For instance, inventory may be valued using FIFO or LIFO, leading to significant differences in reported figures. The authors quote financial executives who stress the importance of understanding what’s “behind the numbers,” and provide data on how changes in asset valuation can impact equity and solvency ratios.

For practical application, the chapter recommends that readers analyze trends in key balance sheet items, look for significant changes in asset or liability composition, and review footnotes for information on valuation methods. Investors should pay attention to off-balance-sheet items and contingent liabilities, which can materially affect a company’s risk profile. The chapter also suggests using ratios such as debt-to-equity and current ratio to assess financial stability.

In today’s business environment, where intangible assets and complex financing arrangements are increasingly common, understanding the balance sheet is more important than ever. The chapter’s lessons apply to both traditional manufacturing firms and modern tech companies, providing a universal framework for assessing financial health.

Chapter 15: Cash Is a Reality Check

This chapter drives home the critical distinction between profit and cash flow, emphasizing that cash is the ultimate “reality check” for any business. The authors explain that many companies have failed despite reporting healthy profits, simply because they ran out of cash. The main concept is that cash flow analysis is essential for understanding a company’s ability to meet its obligations and sustain operations.

The chapter provides detailed examples of companies that appeared profitable on paper but faced liquidity crises due to poor cash management. The authors quote business leaders who say, “Profit is an opinion; cash is a fact,” and provide data on the frequency of cash flow problems in otherwise successful firms. The chapter also explains the structure of the cash flow statement and the importance of monitoring operating, investing, and financing activities.

For practical application, the authors advise readers to regularly review cash flow statements, pay attention to trends in working capital, and monitor the timing of cash receipts and payments. Investors should be cautious of companies with large positive profits but negative operating cash flow, as this may indicate aggressive accounting or unsustainable business practices. The chapter also recommends stress-testing cash flow under different scenarios to assess resilience.

In the real world, cash flow analysis is a cornerstone of credit assessment, investment analysis, and risk management. The chapter’s lessons are directly relevant to modern businesses, especially those with complex supply chains or rapid growth. Understanding the difference between profit and cash is essential for avoiding liquidity traps and ensuring long-term success.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 20: The Power of Ratios

This chapter is a linchpin for anyone seeking to analyze company performance, as it introduces the use of financial ratios as powerful tools for benchmarking and decision-making. The authors explain that ratios distill complex financial data into actionable insights, allowing managers and investors to assess profitability, leverage, liquidity, and efficiency. The main concept is that ratio analysis provides context and comparability, helping to identify strengths, weaknesses, and trends.

The chapter provides a comprehensive overview of key ratios, including gross margin, return on assets, current ratio, and debt-to-equity. The authors use real-world examples to show how these ratios can signal opportunities or red flags, such as declining margins or rising leverage. Quotes from experienced analysts emphasize the importance of context, noting that “ratios are only meaningful when compared to something else.” The chapter includes data on industry benchmarks and historical trends, illustrating how ratio analysis can reveal shifts in performance.

For practical application, the chapter recommends that readers calculate and track key ratios over time, compare them to industry peers, and use them to inform strategic decisions. Investors should look for consistent improvement or deterioration in ratios, and be wary of companies with outlier metrics that are not explained by business fundamentals. The chapter also suggests integrating ratio analysis with qualitative research for a more complete picture.

In the age of big data and automated analytics, ratio analysis remains a fundamental skill. The chapter’s lessons are directly applicable to modern investing, where the ability to quickly screen and assess companies is essential. Mastering ratio analysis enables investors and managers to cut through the noise and focus on what really matters.

Chapter 26: The Building Blocks of ROI

This chapter is essential because it demystifies the concept of return on investment (ROI), which is central to evaluating business decisions and investments. The authors break down the components of ROI, explain how it’s calculated, and highlight the assumptions and choices that can influence the results. The main concept is that understanding the drivers of ROI is crucial for making informed decisions about capital allocation and project evaluation.

The chapter provides detailed examples of how different depreciation methods, cost allocations, and revenue projections can affect ROI calculations. The authors quote executives who stress the importance of scrutinizing the inputs and considering alternative scenarios. The chapter also includes data on typical ROI benchmarks by industry, helping readers set realistic expectations and identify outliers.

For practical application, the chapter recommends that readers break down ROI calculations into their component parts, test different assumptions, and consider both short-term and long-term impacts. Investors should be cautious of projects with high projected ROI but unrealistic assumptions, and should always compare ROI to the cost of capital. The chapter also suggests using sensitivity analysis to assess the robustness of ROI estimates.

In the real world, ROI analysis is a cornerstone of investment decision-making, from evaluating new product launches to assessing mergers and acquisitions. The chapter’s lessons are directly relevant to modern managers and investors, who must navigate a landscape of competing opportunities and limited resources. Understanding the building blocks of ROI is essential for maximizing value and avoiding costly mistakes.

Chapter 31: Financial Literacy and Corporate Performance

This chapter serves as the capstone of the book, making a compelling case for the importance of financial literacy at all levels of an organization. The authors argue that employees who understand the financial implications of their actions are more engaged, make better decisions, and drive improved performance. The main concept is that financial intelligence is not just for finance professionals, but is a critical skill for everyone in the business.

The chapter provides examples of companies that have invested in financial education for their teams and seen measurable improvements in profitability, efficiency, and employee satisfaction. The authors quote CEOs who credit financial literacy programs with transforming their organizations. The chapter also includes data from surveys showing that financially literate employees are more likely to identify cost savings, suggest process improvements, and contribute to strategic goals.

For practical application, the chapter recommends that organizations invest in ongoing financial training, encourage open discussion of financial results, and provide tools for employees to track the impact of their actions. Investors can use these insights to assess corporate culture and management quality, looking for companies that prioritize transparency and education. The chapter also suggests incorporating financial literacy metrics into performance reviews and incentives.

In today’s knowledge-driven economy, where collaboration and agility are key, financial literacy is a powerful competitive advantage. The chapter’s lessons apply to organizations of all sizes and industries, reinforcing the idea that financial intelligence is everyone’s business. Companies that foster a culture of financial literacy are better positioned to adapt, innovate, and thrive in an ever-changing marketplace.

Practical Investment Strategies

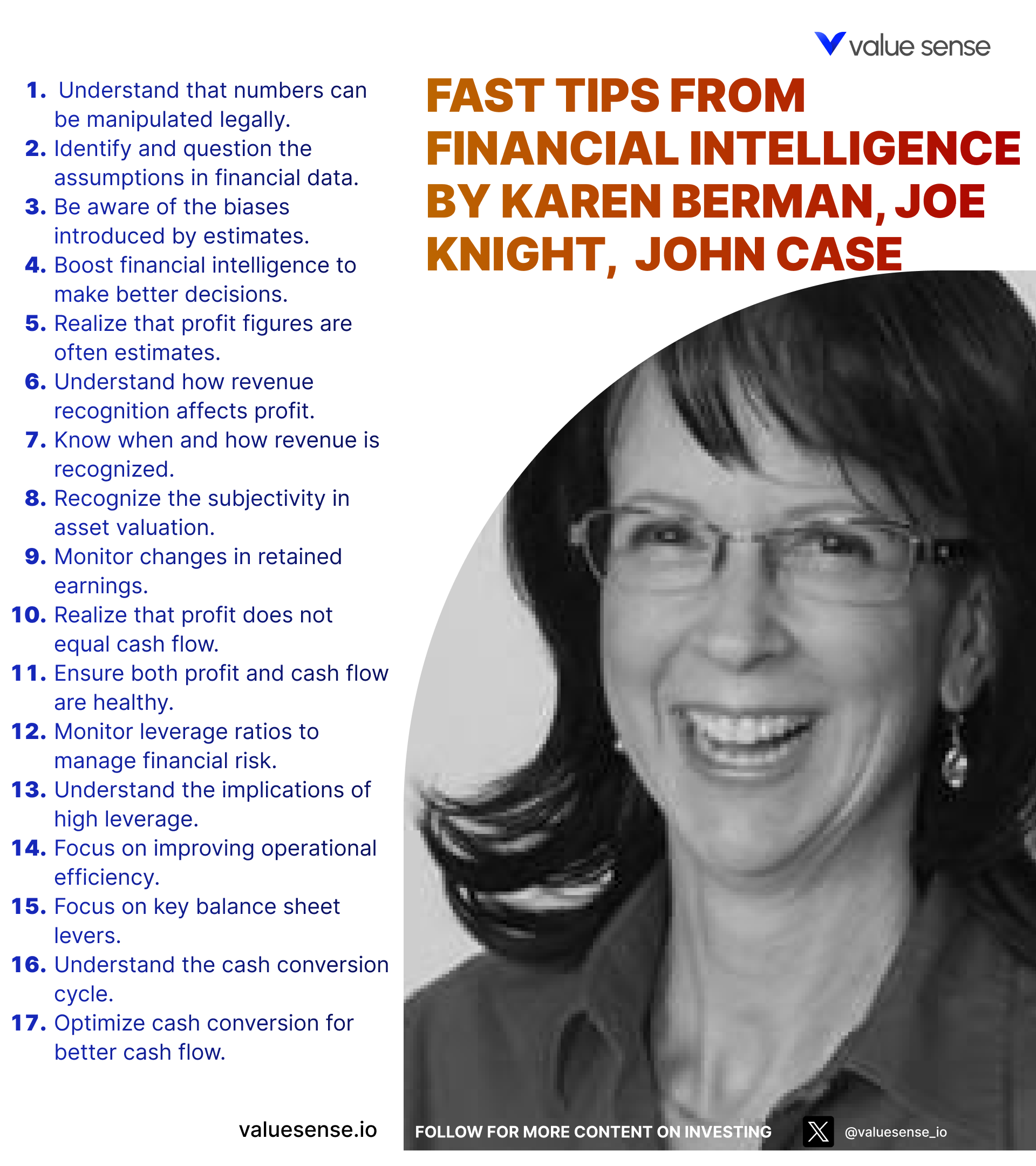

- 1. Analyze the Assumptions Behind the Numbers: Before making any investment decision, dig into the assumptions underlying a company’s financial statements. Review footnotes for changes in accounting policies, check for shifts in revenue recognition, and scrutinize estimates for depreciation, inventory, and provisions. By understanding what’s driving the numbers, you can spot aggressive accounting or unsustainable profit trends. This approach reduces the risk of being misled by headline figures and helps identify companies with transparent, conservative reporting practices.

- 2. Focus on Cash Flow, Not Just Profit: Always examine the cash flow statement alongside the income statement. Look for companies with strong operating cash flow that consistently exceeds net profit, as this indicates quality earnings. Be wary of firms with positive profits but negative cash flow from operations, as this may signal aggressive accounting or liquidity problems. Use tools like free cash flow yield and cash conversion cycle analysis to assess financial health and sustainability.

- 3. Use Ratio Analysis for Screening and Benchmarking: Calculate key financial ratios—such as return on assets, current ratio, debt-to-equity, and gross margin—to compare companies within the same industry. Track these ratios over time to spot trends or deterioration. For example, a declining gross margin may indicate rising costs or pricing pressure, while a rising debt-to-equity ratio could signal increasing financial risk. Use ratio analysis to create a shortlist of potential investments and to monitor existing holdings for red flags.

- 4. Assess Revenue Quality and Recognition Policies: Go beyond topline growth by evaluating the quality and sustainability of revenue. Review the company’s revenue recognition policies to ensure they align with industry standards and are applied consistently. Look for warning signs such as large one-time sales, aggressive booking of future revenue, or significant differences between reported revenue and cash receipts. Quality revenue is recurring, predictable, and supported by strong customer relationships.

- 5. Evaluate Working Capital Management: Analyze how effectively a company manages its inventory, receivables, and payables. Efficient working capital management frees up cash, reduces borrowing needs, and enhances profitability. Use metrics like days sales outstanding (DSO), days inventory outstanding (DIO), and days payable outstanding (DPO) to benchmark performance. Companies with tight working capital cycles are better positioned to weather downturns and capitalize on growth opportunities.

- 6. Scrutinize ROI Calculations and Capital Allocation: When evaluating investment projects or acquisitions, break down ROI calculations into their component parts. Test different assumptions, such as changes in sales growth, margin, or capital expenditure, to assess sensitivity. Compare projected ROI to the company’s cost of capital and to industry benchmarks. Favor companies with a disciplined, transparent approach to capital allocation and a track record of exceeding ROI targets.

- 7. Prioritize Companies with High Financial Literacy: Assess the quality of management and corporate culture by looking for evidence of financial literacy initiatives. Companies that invest in employee education, encourage open discussion of financial results, and link incentives to financial performance are more likely to make sound decisions and adapt to change. Use annual reports, investor presentations, and management commentary to gauge the organization’s commitment to financial intelligence.

- 8. Monitor for Red Flags and Unusual Patterns: Stay alert for signs of earnings management or financial manipulation. Red flags include sudden changes in accounting policies, unexplained fluctuations in key ratios, or frequent restatements of financial results. Use automated tools and screeners to set alerts for unusual patterns, and supplement quantitative analysis with qualitative research. Early detection of red flags can help avoid costly investment mistakes.

Modern Applications and Relevance

The principles outlined in “Financial Intelligence” are more relevant than ever in today’s fast-evolving business and investment landscape. Since the book’s publication, the complexity of financial reporting has increased, with new accounting standards (such as IFRS 15 and ASC 606), the rise of intangible assets, and the proliferation of subscription and service-based business models. Yet the core message—that numbers are shaped by judgment and context—remains timeless.

Modern investors face a deluge of data, from quarterly reports to alternative data sources and real-time analytics. The ability to interpret, question, and synthesize this information is a critical competitive advantage. The book’s emphasis on financial intelligence equips readers to cut through the noise, focus on what matters, and avoid being misled by superficial metrics. As financial scandals and restatements continue to make headlines, the need for skepticism and analytical rigor is as acute as ever.

Recent examples, such as the collapse of Wirecard or the accounting controversies at Luckin Coffee, underscore the dangers of relying solely on reported numbers. Investors who applied the lessons from “Financial Intelligence”—scrutinizing revenue recognition, cash flow, and management incentives—were better positioned to spot problems early. At the same time, the book’s focus on financial literacy and corporate culture is increasingly relevant in an era where ESG (environmental, social, and governance) factors are central to investment decisions.

To adapt the book’s classic advice to current conditions, investors should leverage modern tools—such as automated screeners, data visualization, and AI-powered analytics—while maintaining the critical mindset advocated by Berman and Knight. The fundamentals of questioning assumptions, understanding context, and integrating qualitative insights with quantitative analysis are as valuable today as ever. By combining timeless principles with modern technology, investors can navigate complexity and uncover opportunities in even the most challenging markets.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Start with Financial Statement Literacy: Begin by reading and dissecting a company’s annual and quarterly reports. Focus on the income statement, balance sheet, and cash flow statement, and make note of key line items and footnotes. Use resources such as online courses, books, or workshops to build foundational knowledge. Allocate at least 2-3 weeks to mastering the basics before moving on to deeper analysis.

- Develop a Critical Analytical Framework: Create a checklist of questions to ask when reviewing financial reports. Include prompts about revenue recognition, expense timing, asset valuation, and off-balance-sheet items. Set a timeline of 1-2 months to practice applying this framework to different companies, refining your approach based on feedback and new insights.

- Construct a Diversified Portfolio with Ratio-Based Screening: Use financial ratios to screen for companies with strong profitability, liquidity, and efficiency. Allocate your portfolio across sectors and industries to minimize risk. Start with a target allocation (e.g., 60% core holdings, 20% growth, 20% value opportunities) and adjust based on ongoing analysis. Rebalance quarterly to maintain alignment with your strategy.

- Implement Ongoing Monitoring and Review: Set a regular schedule (monthly or quarterly) to review portfolio holdings, update financial models, and track changes in key ratios. Use automated alerts and screeners to flag unusual patterns or red flags. Document your findings and decisions to build a track record and improve your analytical process over time.

- Commit to Continuous Learning and Improvement: Stay current with changes in accounting standards, industry trends, and best practices in financial analysis. Participate in webinars, join investment communities, and read widely to expand your knowledge. Use feedback from your investment results to refine your approach, and seek out mentors or peers for additional perspective. Make financial intelligence a lifelong pursuit, not a one-time project.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really Mean

1. Who should read “Financial Intelligence” and what will they gain?

This book is ideal for managers, business owners, investors, and professionals who need to make decisions based on financial data but lack a formal accounting background. Readers will gain a practical understanding of how to interpret financial statements, recognize the assumptions behind the numbers, and apply critical thinking to financial analysis. The book’s accessible style and real-world examples make it valuable for both beginners and experienced professionals seeking to deepen their financial acumen.

2. How does “Financial Intelligence” differ from traditional accounting textbooks?

Unlike traditional textbooks that focus on technical accounting rules and procedures, “Financial Intelligence” emphasizes the art and judgment involved in financial reporting. The book prioritizes practical application, teaching readers how to question assumptions, spot potential manipulation, and connect financial data to real business decisions. Its focus on stories, examples, and actionable insights makes it more engaging and immediately useful than most academic texts.

3. What are the most important financial statements covered in the book?

The book covers the three primary financial statements: the income statement, balance sheet, and cash flow statement. Each is explained in detail, with a focus on how they interrelate and what they reveal about a company’s performance and health. The authors also highlight the importance of footnotes and management discussion sections, which often contain critical information not visible in the headline numbers.

4. How can investors use the lessons from “Financial Intelligence” to improve their results?

Investors can use the book’s lessons to look beyond surface-level metrics and dig into the quality and sustainability of reported earnings. By analyzing assumptions, scrutinizing revenue recognition, and focusing on cash flow, investors can better identify undervalued opportunities and avoid companies with aggressive accounting. The book also advocates for using ratio analysis, benchmarking, and ongoing monitoring to enhance investment decision-making.

5. Is the content of “Financial Intelligence” still relevant in today’s fast-changing markets?

Absolutely. Despite changes in accounting standards and the rise of new business models, the core principles—skepticism, critical analysis, and understanding the context behind the numbers—are more important than ever. The book’s focus on financial literacy, transparency, and the art of finance makes it a timeless resource for navigating both traditional and modern financial challenges.