First Eagle Investment Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

First Eagle Investment Management continues to lean into its long-standing philosophy of capital preservation and global value investing, while selectively recalibrating exposure to major technology, healthcare, and commodity-linked names. Its latest Q3’2025 portfolio shows a carefully balanced mix of high‑quality compounders and hard‑asset plays across 404 positions, with notable trims in mega-cap tech like Oracle and Meta Platforms, and meaningful adds to defensive healthcare stalwart Becton, Dickinson and Company and semiconductor bellwether Taiwan Semiconductor Manufacturing Company.

Explore the full First Eagle 13F dashboard:

View First Eagle Investment Management Portfolio on ValueSense

The Big Picture: Quality Value in a Diversified Framework

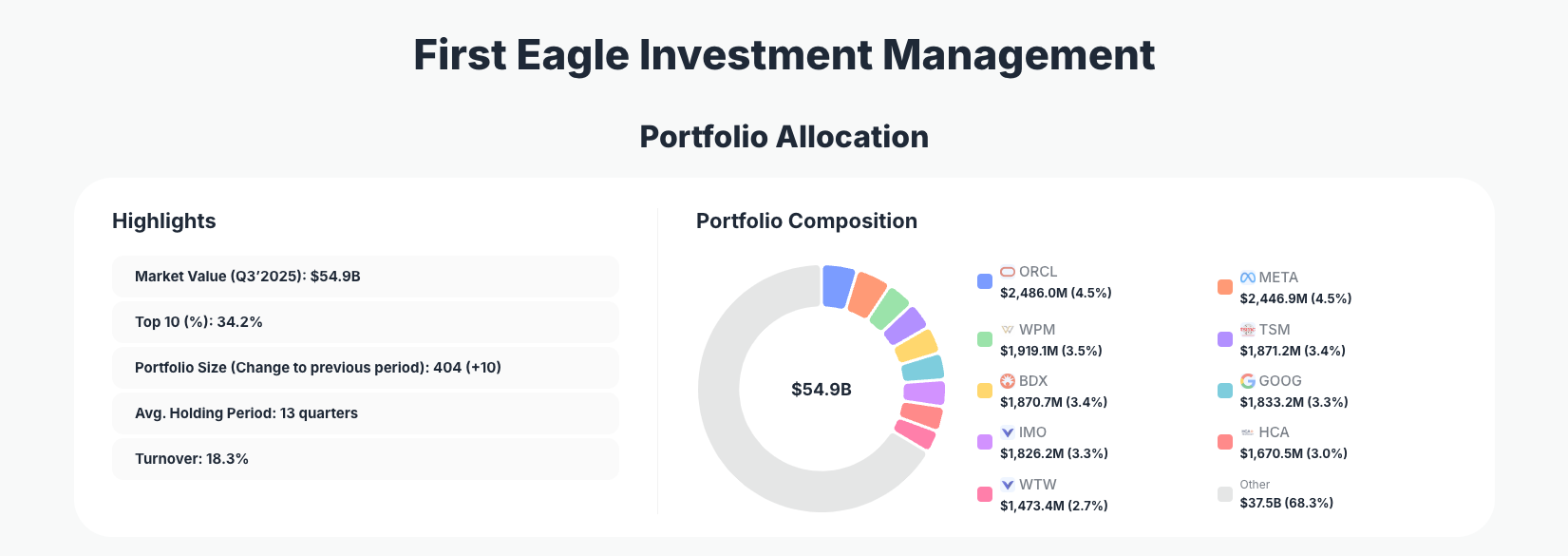

Portfolio Highlights (Q3’2025): - Market Value: $54.9B

- Top 10 Holdings: 34.2%

- Portfolio Size: 404 +10 positions

- Average Holding Period: 13 quarters

- Turnover: 18.3%

First Eagle’s latest $54.9B portfolio remains diversified in terms of position count but relatively focused in capital allocation, with the top 10 holdings representing 34.2% of assets. This combination of breadth (404 positions) and a sizeable top‑bucket suggests a barbell approach: a core of high‑conviction names complemented by a long tail of smaller, often opportunistic or risk‑balancing stakes.

An average holding period of 13 quarters underscores First Eagle’s patient, long‑term orientation. Rather than rapid trading, the 18.3% turnover indicates a steady but not hyperactive level of rebalancing: big positions like Oracle and Wheaton Precious Metals are adjusted materially when risk/reward shifts, while other names see more incremental “maintenance” moves.

The expansion from 394 to 404 positions +10 shows that the firm is still finding selective new ideas or diversifiers even late in the cycle. Within this broad base, the First Eagle portfolio continues to emphasize durable free‑cash‑flow generators (tech platforms, medical technology, logistics) alongside real‑asset exposure (precious metals, energy), consistent with the firm’s historical focus on downside protection and purchasing power preservation.

Core Holdings and Recent Moves: Tech Platforms, Hard Assets & Healthcare

At the heart of the First Eagle portfolio sit a set of global franchises whose cash flows and competitive advantages can compound across cycles—but Q3’2025 shows that position sizes are anything but static.

The technology sleeve remains significant but is being actively fine‑tuned. Oracle Corporation (ORCL) stands as one of the largest positions at 4.5% of the portfolio, yet First Eagle executed a substantial “Reduce 20.71%” move, taking profits after strong performance and likely mitigating single‑name risk. In contrast, Meta Platforms, Inc. (META) also at 4.5% was only trimmed by “Reduce 0.03%”, effectively signaling that Meta remains a strategic long‑term holding with only nominal size recalibration.

Defensive growth and real‑asset hedges show up prominently. Wheaton Precious Metals Corp. (WPM) accounts for 3.5% of the portfolio and was marked as “Reduce 5.18%”, suggesting modest profit‑taking in a key precious‑metals streaming name while still keeping a large inflation‑hedge exposure. On the energy side, IMPERIAL OIL LTD, at 3.3% of assets and tagged “Reduce 1.69%”, shows a slight de‑risking in fossil‑fuel exposure rather than an outright strategic exit.

Semiconductors and high‑quality hardware remain in favor. Taiwan Semiconductor Manufacturing Company Limited (TSM) is a 3.4% position and was nudged higher with an “Add 0.10%” action—small in percentage but notable given the already large base and TSM’s central role in global chip supply. Similarly, Alphabet Inc. (GOOG), at 3.3%, saw an “Add 0.20%”, indicating a continued constructive view on core search, cloud, and AI monetization prospects.

Healthcare is another key pillar. Becton, Dickinson and Company (BDX) represents 3.4% of the portfolio and was one of the most aggressively increased holdings with an “Add 13.75%” move. This sizable add signals rising conviction in BDX’s durable demand for medical devices and consumables, particularly attractive in uncertain macro environments. By contrast, HCA Healthcare, Inc. (HCA) at 3.0% was marked “Reduce 6.90%”, reflecting a nuanced re‑balancing within healthcare between hospital operators and more defensive med‑tech.

In the financial and business‑services space, WILLIS TOWERS WATSON PLC LTD holds 2.7% of assets and was modestly adjusted with a “Reduce 0.66%”, hinting at incremental risk control rather than a shift in thesis. Meanwhile, transport and logistics exposure comes through C.H. Robinson Worldwide, Inc. (CHRW), a 2.5% position that saw a minor “Reduce 0.19%”—a small trim that still leaves CHRW as a meaningful play on global freight and supply‑chain normalization.

Collectively, these 10–11 names—Oracle, Meta, Wheaton Precious Metals, Taiwan Semiconductor, Becton Dickinson, Alphabet, Imperial Oil, HCA Healthcare, Willis Towers Watson, and C.H. Robinson—anchor more than a quarter of the First Eagle holdings, illustrating the firm’s preference for globally diversified, cash‑rich businesses complemented by real‑asset exposure and essential service providers.

What the Portfolio Reveals About First Eagle’s Current Strategy

Several themes emerge from First Eagle’s Q3’2025 positioning and trades:

- Quality over speculative growth

The emphasis on companies like Alphabet, TSMC, Becton Dickinson, and Wheaton Precious Metals underlines a preference for robust balance sheets, entrenched competitive moats, and recurring cash flows rather than highly levered or story‑driven growth equities. - Sector balance between growth, defense, and hard assets

The mix of mega‑cap tech platforms (ORCL, META, GOOG), defensive healthcare (BDX, HCA), energy (Imperial Oil), and precious‑metal streaming (WPM) suggests a portfolio engineered to participate in upside while maintaining ballast against inflation and macro shocks. - Global and multi‑currency exposure

Holdings such as TSMC, Wheaton Precious Metals, and Imperial Oil show First Eagle’s traditional comfort with non‑U.S. franchises and foreign‑currency cash flows, a natural fit with its capital‑preservation and real‑asset heritage. - Dividend and cash‑return awareness

Many of these names—Oracle, Wheaton, Imperial Oil, Willis Towers Watson—have consistent dividend or buyback programs. While the 13F does not show yields, the selection pattern supports a bias toward total‑return stories where shareholder distributions complement capital appreciation. - Risk management through trims vs. wholesale exits

The pattern of “Reduce 5–20%” (e.g., Oracle, Wheaton, HCA, Imperial Oil) rather than outright sells indicates an active risk‑management framework: the team de‑risks by taking profits and right‑sizing positions instead of abandoning long‑term winners at the first sign of volatility.

Portfolio Concentration Analysis

Using the reported top holdings:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Oracle Corporation (ORCL) | $2,486.0M | 4.5% | Reduce 20.71% |

| Meta Platforms, Inc. (META) | $2,446.9M | 4.5% | Reduce 0.03% |

| Wheaton Precious Metals Corp. (WPM) | $1,919.1M | 3.5% | Reduce 5.18% |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $1,871.2M | 3.4% | Add 0.10% |

| Becton, Dickinson and Company (BDX) | $1,870.7M | 3.4% | Add 13.75% |

| Alphabet Inc. (GOOG) | $1,833.2M | 3.3% | Add 0.20% |

| IMPERIAL OIL LTD | $1,826.2M | 3.3% | Reduce 1.69% |

| HCA Healthcare, Inc. (HCA) | $1,670.5M | 3.0% | Reduce 6.90% |

| WILLIS TOWERS WATSON PLC LTD | $1,473.4M | 2.7% | Reduce 0.66% |

These nine disclosed top positions alone account for roughly 31.6% of the overall portfolio, very close to the reported 34.2% for the full top‑10 bucket. That level of concentration—roughly one‑third of capital in under a dozen stocks—demonstrates high conviction while still avoiding the ultra‑concentrated style of some hedge funds.

The table also shows that First Eagle is not shy about making meaningful size adjustments within its core book. The 20.71% reduction in Oracle and 13.75% add to Becton Dickinson stand out as deliberate capital‑allocation decisions, rebalancing across sectors (tech to healthcare) without compromising the overall quality tilt. Incremental adds to TSM and Alphabet, alongside small trims in Imperial Oil and Willis Towers Watson, further refine the risk profile without changing the strategic pillars of the portfolio.

Investment Lessons from First Eagle’s Global Value Approach

Investors studying the First Eagle Investment Management portfolio Q3 2025 can extract several practical principles:

- Concentrate in what you truly understand

Even within a 404‑stock universe, about one‑third of assets sit in fewer than 10–12 names. This reflects the belief that a handful of deeply researched, high‑quality businesses merit outsized capital, while smaller positions can play supporting or exploratory roles. - Holding period discipline matters

A 13‑quarter average holding period shows that First Eagle allows theses to play out through full cycles, reducing the pressure to time short‑term price swings. Long duration can be an edge when combined with robust fundamental work. - Trim, don’t necessarily exit, long‑term winners

The “Reduce 20.71%” in Oracle and moderate cuts in Wheaton Precious Metals and HCA show a repeatable pattern: scale back risk when valuations or position sizes stretch, while preserving exposure to enduring franchises. - Balance growth with ballast

Pairing platforms like Meta and Alphabet with hard‑asset and defensive names (WPM, Imperial Oil, BDX) helps cushion macro and inflation shocks without abandoning upside. - Think globally but stay quality‑focused

Exposure to non‑U.S. leaders such as TSMC and Wheaton reflects a search for attractive valuations and resilient business models worldwide, rather than a home‑market bias.

Looking Ahead: What Might Come Next for First Eagle’s Portfolio?

Based on current positioning, several forward‑looking implications stand out for the First Eagle stocks landscape:

- Room to re‑deploy into volatility

Recent trims in large positions like Oracle, Wheaton, HCA, and Imperial Oil free up incremental capacity to add back on drawdowns or fund new high‑conviction ideas if markets correct or sector leadership rotates. - Potential continued tilt toward defensive healthcare and infrastructure

The sizeable add to Becton Dickinson and stable weight in HCA (despite a trim) suggest that medical technology, consumables, and essential care infrastructure may remain favored hunting grounds if economic or political uncertainty persists. - Selective tech and semiconductor exposure

Incremental adds to TSMC and Alphabet imply that First Eagle still sees attractive long‑term risk/reward in enabling technologies and AI infrastructure, even if they pare back certain names like Oracle after strong runs. - Ongoing role for real assets and energy

Even with small reductions, the continued prominence of Wheaton Precious Metals and Imperial Oil points to an enduring allocation to commodities and energy as inflation hedges and diversifiers.

For investors watching these moves, tracking future 13F filings will be key to seeing whether Q3’2025’s rebalancing proves to be the start of a bigger sector rotation or simply fine‑tuning around a consistent core philosophy.

FAQ about First Eagle Investment Management Portfolio

Q: What were the most significant changes in First Eagle’s Q3 2025 portfolio?

The most notable adjustments were a “Reduce 20.71%” in Oracle, a sizable “Add 13.75%” in Becton, Dickinson, and moderate reductions in Wheaton Precious Metals, HCA Healthcare, and Imperial Oil, alongside small adds to TSMC and Alphabet.

Q: How concentrated is the First Eagle portfolio?

While First Eagle holds 404 +10 positions, the top 10 account for 34.2% of total market value, with individual top names such as Oracle and Meta each around 4.5%. This reflects a balanced approach: diversified breadth with meaningful conviction in a select group of core holdings.

Q: Does the portfolio reflect a shift in sector strategy?

The Q3’2025 13F suggests refinement rather than a wholesale shift. First Eagle is modestly reducing some tech and energy exposure while increasing defensive healthcare and maintaining significant stakes in quality tech and real assets, preserving its diversified, quality‑value profile.

Q: Which sectors or names seem most critical to First Eagle’s current outlook?

Mega‑cap platforms (META, GOOG, ORCL), key semiconductor infrastructure (TSM), defensive healthcare (BDX, HCA), logistics (CHRW), and real‑asset plays (WPM, Imperial Oil) appear central to the firm’s view on growth, inflation, and global trade.

Q: How can I track First Eagle’s portfolio changes over time?

You can follow First Eagle’s holdings via quarterly 13F filings, which U.S. institutional managers must submit within 45 days of each quarter‑end. Because of this 45‑day reporting lag, positions may have changed since the filing date. Platforms like ValueSense aggregate these filings, visualize changes, and provide historical context—visit the dedicated page at First Eagle Investment Management’s portfolio to monitor new moves.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!