Fooled by Randomness by Nassim Nicholas Taleb

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

“Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets” by Nassim Nicholas Taleb is a seminal work that has profoundly influenced the way investors, traders, and thinkers approach uncertainty, probability, and success. Taleb, a former derivatives trader and risk analyst, is renowned for his deep insights into the unpredictable nature of markets and the cognitive biases that shape human decision-making. With a PhD in Management Science and a background in mathematics, philosophy, and finance, Taleb brings a unique multidisciplinary perspective to the world of investing. He is also the author of the acclaimed “Incerto” series, which includes “The Black Swan” and “Antifragile,” further cementing his reputation as a thought leader in risk and uncertainty.

First published in 2001, “Fooled by Randomness” emerged in an era when financial markets were reeling from the dot-com bubble burst. The book’s historical context is crucial—Taleb’s critique of overconfidence, misattribution of skill, and the dangers of ignoring randomness resonated with a generation of investors who had witnessed both spectacular booms and catastrophic busts. The book’s central theme is that randomness and luck play a far greater role in outcomes—especially in finance—than most people are willing to acknowledge. Taleb’s provocative thesis challenges the conventional wisdom that success is primarily a function of skill, intelligence, or hard work, arguing instead that luck and randomness often masquerade as talent.

What sets “Fooled by Randomness” apart from other investment books is its philosophical depth and its relentless focus on the limitations of human cognition. Taleb masterfully blends storytelling, mathematical reasoning, and philosophical inquiry to expose the illusions that pervade financial markets and everyday life. Rather than offering a formula for success, the book teaches readers how to think probabilistically, question narratives, and embrace uncertainty. It is a clarion call for humility in the face of complexity.

This book is considered a classic for several reasons. First, it introduced mainstream investors to concepts like survivorship bias, cognitive illusions, and the problem of induction—ideas that are now foundational in behavioral finance and risk management. Second, Taleb’s writing is both accessible and intellectually rigorous, making complex ideas palatable to a broad audience. “Fooled by Randomness” is not just for professional investors; it is essential reading for anyone who wants to understand the hidden forces that shape outcomes in business, sports, science, and life itself.

Readers who will benefit most from this book include value investors seeking to avoid common pitfalls, traders aiming to improve their risk assessment, and anyone interested in decision-making under uncertainty. If you have ever wondered why some people succeed spectacularly while others fail—despite similar efforts and intelligence—this book will challenge your assumptions and sharpen your critical thinking skills. Its uniqueness lies in its blend of real-world anecdotes, philosophical musings, and actionable wisdom, making it a must-read for anyone serious about navigating the unpredictable world of investing.

Key Themes and Concepts

At its core, “Fooled by Randomness” is a meditation on the omnipresence of chance in our lives and the myriad ways humans fail to recognize it. Taleb weaves together psychology, philosophy, and finance to reveal how our minds are wired to see patterns where none exist, attribute causality to randomness, and construct narratives around luck. Throughout the book, readers are confronted with uncomfortable truths about the limits of knowledge, the dangers of overconfidence, and the importance of humility in decision-making.

Several interlocking themes run through the book, each reinforcing Taleb’s central message: that much of what we attribute to skill, intelligence, or planning is in fact the product of randomness. By understanding these themes, investors can better guard against cognitive traps, improve their risk management, and make more rational decisions in uncertain environments.

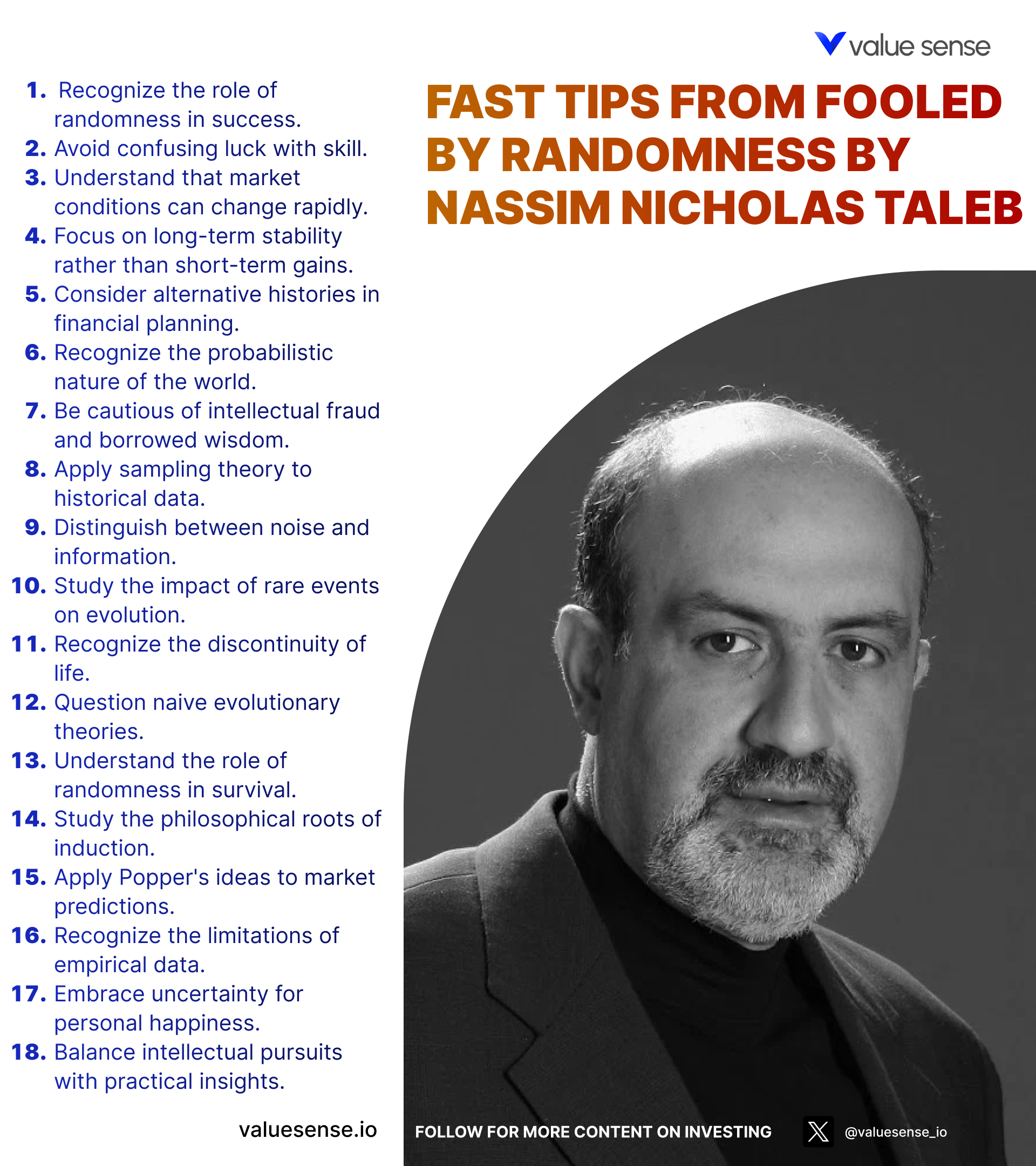

- Randomness vs. Skill: Taleb’s most provocative theme is the confusion between randomness and skill. In financial markets, outcomes are often attributed to talent or intelligence, but Taleb demonstrates with vivid examples that luck plays a far greater role than most realize. He uses stories of traders who succeed spectacularly—only to fail later when luck turns—to illustrate how randomness can elevate individuals temporarily. The book urges investors to distinguish between genuine skill and mere good fortune, advocating for a probabilistic mindset that questions apparent patterns and successes. Recognizing the difference is crucial for avoiding overconfidence and making sound investment decisions.

- Survivorship Bias: Survivorship bias is a recurring concept in the book, highlighting how our perception of success is skewed by only observing the “winners.” Taleb explains that we rarely see the countless unsuccessful traders or investors who have disappeared, leading us to overestimate the prevalence of skill and underappreciate the role of luck. This bias distorts historical analysis and can lead to flawed investment strategies. By being aware of survivorship bias, investors can avoid chasing strategies that appear successful only because the failures have been filtered out of the narrative.

- Cognitive Biases: Human psychology is riddled with biases that make us “probability blind.” Taleb explores how cognitive illusions—such as the tendency to see patterns in random data, overestimate our predictive abilities, and fall prey to the gambler’s fallacy—undermine rational decision-making. The book draws on examples from behavioral finance and psychology, urging readers to cultivate self-awareness and skepticism about their own judgments. For investors, understanding these biases is essential for avoiding costly mistakes and improving risk assessment.

- Philosophical Skepticism: Taleb draws heavily on philosophical traditions of skepticism, particularly the problem of induction. He argues that our knowledge is always provisional and that certainty is an illusion. The book encourages readers to adopt a skeptical, questioning attitude toward predictions and models, recognizing the inherent uncertainty in all forecasts. This philosophical stance is not just academic; it has practical implications for how investors approach markets, risk, and decision-making under uncertainty.

- Stoicism and Personal Elegance: In the face of randomness and uncertainty, Taleb advocates for a stoic approach—embracing humility, self-control, and personal elegance. Rather than being rattled by unpredictable outcomes, stoicism teaches investors to focus on what they can control, accept the limits of their knowledge, and maintain composure in volatile markets. This theme is especially relevant in periods of market turmoil, where emotional discipline can make the difference between success and failure.

- Alternative Histories: The concept of alternative histories is central to Taleb’s critique of conventional success narratives. He argues that every outcome is just one realization among many possible ones and that we should judge decisions by considering alternative scenarios, not just observed results. This probabilistic thinking challenges the tendency to “explain” success or failure after the fact and encourages investors to think in terms of expected value, not just outcomes. In practice, this means evaluating strategies based on a range of possible futures, not just past performance.

- Nonlinearities in Life: Life and markets are nonlinear, meaning small changes can have outsized effects and rare events can dominate outcomes. Taleb emphasizes that traditional models often fail to account for these nonlinearities, leading to underestimation of risk and overconfidence in predictions. By understanding the nonlinear nature of markets, investors can better prepare for “fat tail” events and avoid being blindsided by extreme outcomes.

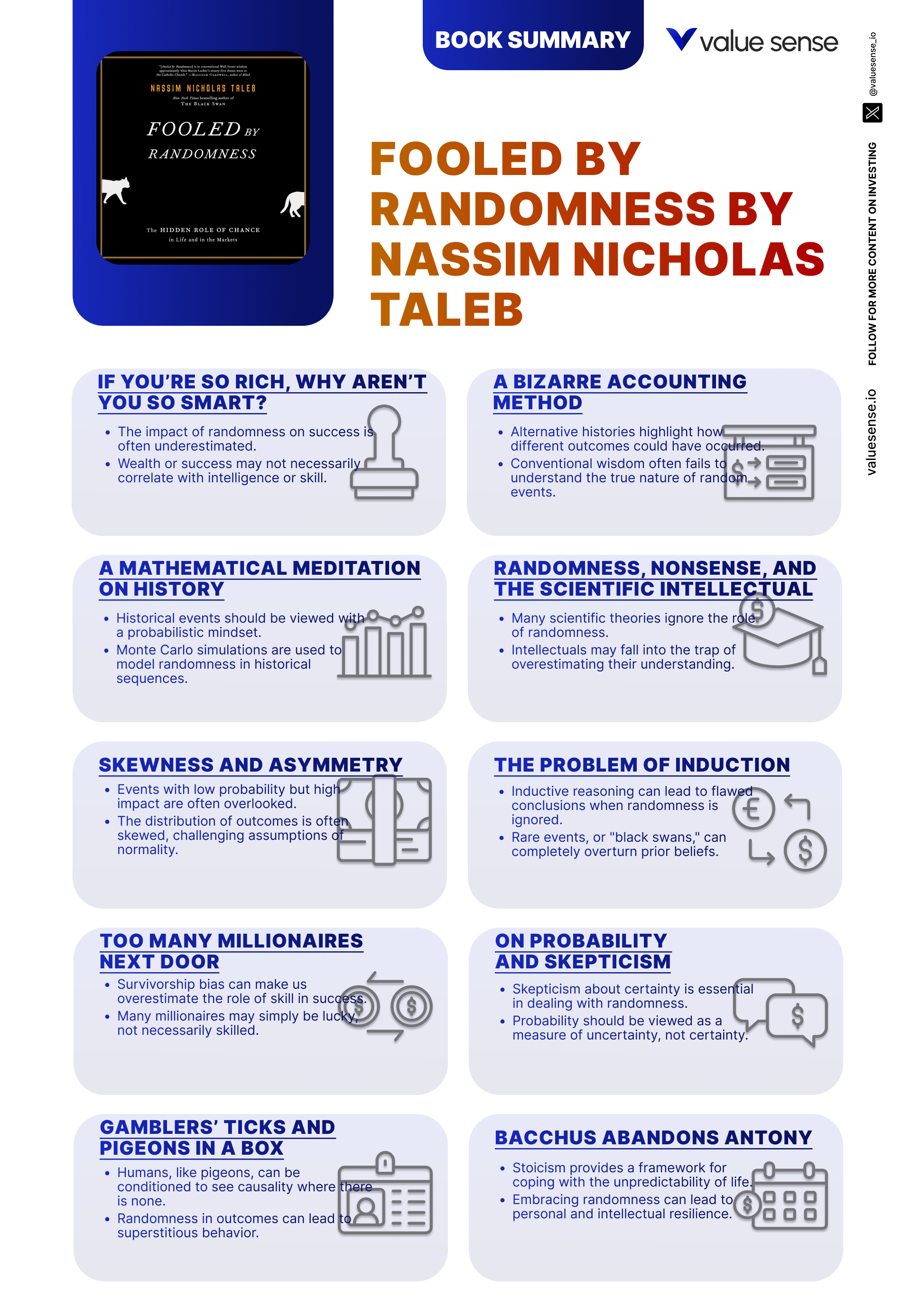

Book Structure: Major Sections

Part 1: Understanding Randomness and Its Impact

This opening thematic section, encompassing Chapters 1 through 3, lays the groundwork for the entire book by introducing readers to the pervasive role of randomness in life and markets. Taleb uses these chapters to challenge the common assumption that outcomes are a direct result of skill or intelligence. He presents financial markets as complex systems where chance events, rather than pure merit, often determine winners and losers. The metaphor of Monte Carlo simulations is introduced to illustrate how a single history is just one of many possible outcomes, each shaped by random events.

Key concepts from these chapters include the idea that randomness can elevate individuals in social hierarchies, making it difficult to distinguish between luck and skill. Taleb provides vivid examples of traders and business leaders who rose to prominence due to favorable random events rather than unique ability. He introduces the concept of alternative histories, encouraging readers to consider how different decisions or chance events could have led to entirely different outcomes. The chapters also challenge the tendency to explain success post hoc, emphasizing the importance of probabilistic thinking in evaluating performance.

For investors, the practical application of these insights is profound. By recognizing the influence of randomness, investors can avoid overconfidence, resist the temptation to chase recent winners, and focus on process over outcome. This mindset encourages a disciplined approach to risk management, where strategies are evaluated based on their robustness across a range of scenarios rather than just past performance. Embracing probabilistic thinking helps investors prepare for uncertainty and avoid costly mistakes driven by narrative fallacies.

In today’s data-driven investment landscape, the lessons from these chapters remain highly relevant. The rise of algorithmic trading, machine learning, and big data has only increased the temptation to see patterns in noise. Understanding randomness is crucial for interpreting backtests, performance metrics, and the claims of market “geniuses.” By internalizing Taleb’s insights, modern investors can build more resilient portfolios and avoid being fooled by randomness in an age of information overload.

Part 2: Cognitive Biases and Misinterpretations

Chapters 4 through 6 collectively explore the psychological and cognitive traps that lead individuals to misinterpret randomness as skill. Taleb delves into the ways human brains are hardwired to seek patterns, construct narratives, and draw causal links—even when none exist. This section is a deep dive into behavioral finance, examining how evolutionary pressures have left us ill-equipped to navigate probabilistic environments like financial markets.

Among the key concepts discussed are the survival of the least fit, where randomness can result in the persistence of unfit individuals or strategies, and the role of skewness and asymmetry in distorting our interpretation of data. Taleb highlights the problem of induction, a philosophical dilemma that questions the validity of reasoning from past observations to future outcomes. He uses real-world examples to illustrate how these biases can lead to catastrophic errors in judgment, such as overestimating the predictive power of historical data or falling prey to the gambler’s fallacy.

For practical investors, this section underscores the importance of self-awareness and skepticism. By understanding cognitive biases, investors can implement safeguards—such as checklists, pre-mortems, and systematic decision rules—to reduce the impact of irrational impulses. Taleb’s critique of induction warns against overreliance on backtested models or historical trends, advocating instead for strategies that are robust to a wide range of possible futures.

In the context of modern investing, where information is abundant and narratives proliferate, these lessons are more important than ever. The proliferation of financial news, social media, and algorithmic trading systems has amplified the risk of cognitive traps. Investors who internalize Taleb’s warnings can better navigate the noise, avoid herd behavior, and maintain discipline in volatile markets.

Part 3: Survivorship Bias and Market Dynamics

This thematic section, covering Chapters 7 through 9, examines how survivorship bias distorts our understanding of success and the dynamics of financial markets. Taleb explains that we tend to focus on the visible “winners”—the successful traders, funds, or companies—while ignoring the countless failures that have disappeared from view. This selective memory leads to an overestimation of skill and an underappreciation of luck in determining outcomes.

The chapters dissect how market dynamics are often misinterpreted due to cognitive biases, with investors attributing outperformance to skill rather than luck. Taleb uses examples of “too many millionaires next door” to illustrate how a few lucky individuals can create the illusion of repeatable success. He warns that strategies that appear to work in hindsight may simply be the result of random chance, and that the true distribution of outcomes is far wider than commonly assumed.

For investors, the practical takeaway is to be wary of performance chasing and to scrutinize the track records of funds, managers, or strategies. Taleb advocates for a focus on process, risk management, and the avoidance of strategies that rely on rare, lucky outcomes. Understanding survivorship bias encourages investors to seek evidence of robustness and repeatability, rather than being seduced by stories of spectacular success.

In the era of social media and financial influencers, survivorship bias is perhaps more dangerous than ever. The visibility of successful traders and “finfluencers” can create unrealistic expectations and drive speculative bubbles. By applying Taleb’s insights, modern investors can maintain perspective, avoid the pitfalls of hero worship, and construct portfolios that are resilient to the vagaries of chance.

Part 4: Human Psychology and Randomness

Chapters 10 through 12 focus on the psychological limitations that make humans particularly vulnerable to randomness. Taleb explores how nonlinearities in life—where small changes can have massive effects—interact with our cognitive shortcomings. He argues that humans are “probability blind,” consistently underestimating the likelihood of rare events and overestimating their ability to predict outcomes.

The section delves into gambler’s fallacies, the illusion of control, and the tendency to misinterpret random sequences as meaningful patterns. Taleb provides examples from both financial markets and everyday life, illustrating how even experienced professionals can fall prey to these illusions. He discusses how the human mind struggles to grasp nonlinearity, leading to poor risk assessment and overconfidence in forecasts.

Investors can apply these lessons by developing strategies that account for fat tails and extreme outcomes, rather than relying on normal distributions and linear models. Taleb’s critique of human psychology suggests that systematic, rules-based approaches may be more effective than intuition-driven decisions. Emphasizing humility and skepticism can help investors avoid overtrading, excessive risk-taking, and costly errors.

With the increasing complexity of financial products and the prevalence of algorithmic trading, the psychological pitfalls described in this section are more relevant than ever. Modern investors must contend with cognitive overload, information asymmetry, and the temptation to overreact to short-term noise. By internalizing Taleb’s warnings, they can build more robust decision-making frameworks and avoid being blindsided by the unexpected.

Part 5: Philosophical and Practical Implications

The final thematic section, encompassing Chapters 13 and 14, brings the philosophical and practical threads of the book together. Taleb discusses the importance of skepticism as a tool for understanding probability, drawing on the traditions of ancient philosophy to advocate for humility and introspection. He introduces the concept of stoicism and personal elegance as a way to navigate the uncertainties of life and markets.

Key concepts include the illusion of certainty, the necessity of philosophical inquiry, and the value of embracing randomness rather than fighting it. Taleb argues that true wisdom lies in recognizing the limits of knowledge and maintaining composure in the face of unpredictable events. He offers practical advice for living with uncertainty, emphasizing the importance of process, discipline, and acceptance of outcomes beyond our control.

For investors, this section serves as a reminder that technical skill and analytical prowess are not enough; psychological resilience and philosophical grounding are equally important. Taleb’s advocacy of stoicism provides a framework for managing emotions, maintaining perspective, and avoiding the destructive behaviors that can arise in turbulent markets. His call for introspection encourages investors to continually question their assumptions and refine their approach.

In a world characterized by rapid change, technological disruption, and increasing uncertainty, the philosophical lessons of “Fooled by Randomness” are more valuable than ever. Modern investors who cultivate skepticism, humility, and stoic discipline will be better equipped to navigate the inevitable ups and downs of markets and life.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: If You're So Rich, Why Aren't You So Smart?

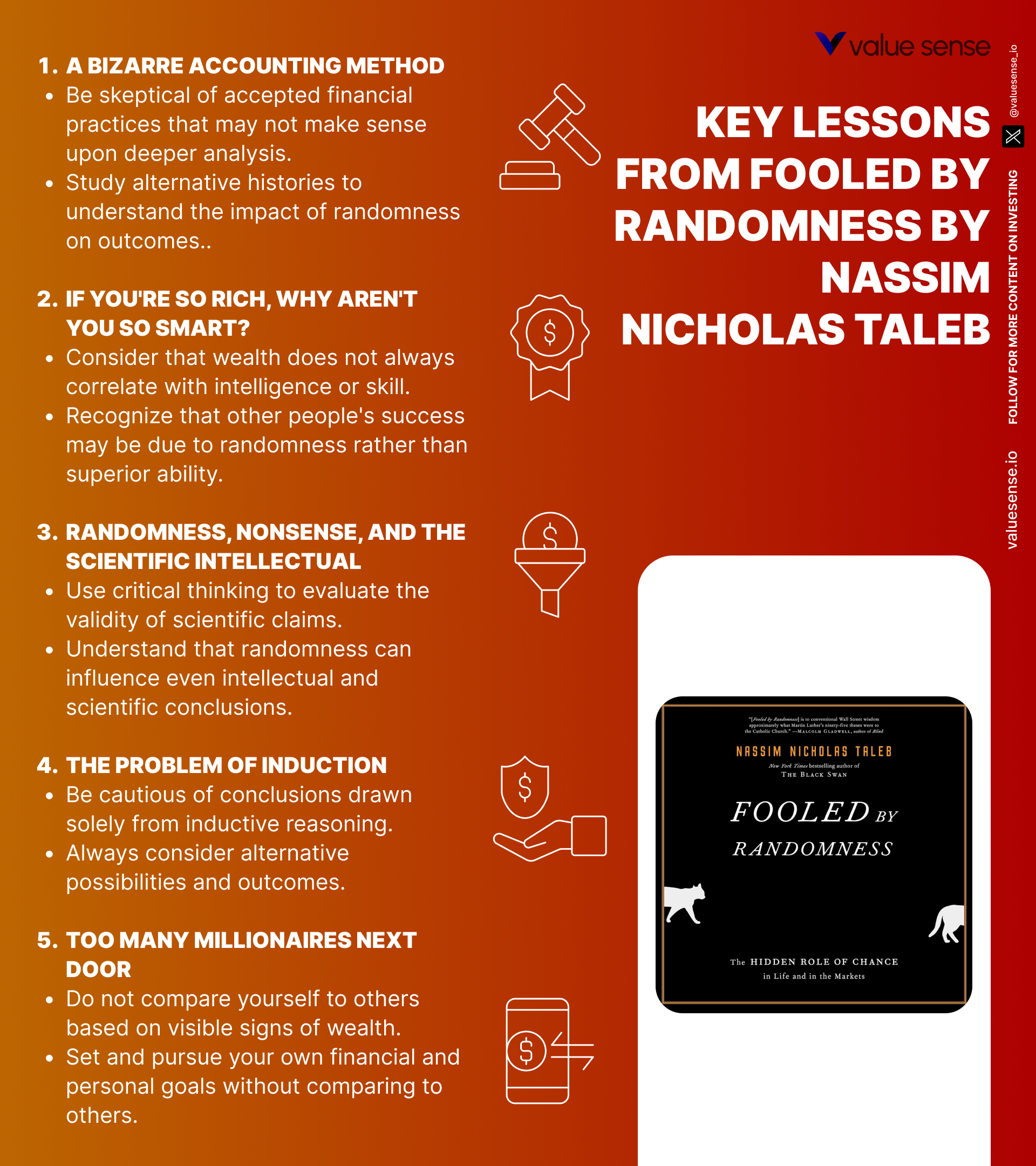

This opening chapter is critically important because it sets the tone for the entire book and introduces Taleb’s fundamental argument: that wealth and success are often mistaken for intelligence and skill, when in fact they may be largely the result of randomness. Taleb challenges the conventional wisdom that equates financial success with superior intellect or insight, using the world of trading as his primary example. He describes how social hierarchies and reputations are frequently built on a foundation of luck rather than genuine ability, and he urges readers to question the narratives that surround successful individuals. By deconstructing the myth of the “smart” rich person, Taleb lays the groundwork for a more skeptical and probabilistic approach to evaluating success.

Throughout the chapter, Taleb provides vivid anecdotes from his own career as a trader, as well as examples from history and contemporary finance. He recounts stories of colleagues who achieved spectacular gains through risky bets, only to lose everything when luck turned against them. The chapter is peppered with memorable quotes, such as, “It is more random than we think; it is more random than we can think.” Taleb also introduces the idea of “alternative histories”—the notion that for every successful trader, there are countless others who made similar bets but failed, their stories lost to history. He uses statistical data and simulations to show that even a random strategy can produce apparent “winners” in the short term, further undermining the link between wealth and intelligence.

Investors can apply the lessons of this chapter by adopting a more skeptical and humble attitude toward success—both their own and others’. Instead of attributing outperformance solely to skill, they should consider the role of chance and evaluate strategies based on their risk-adjusted returns and robustness across different scenarios. Taleb’s emphasis on process over outcome encourages investors to focus on sound decision-making frameworks rather than chasing recent winners. By recognizing the influence of randomness, investors can avoid overconfidence and the temptation to emulate the “smart money” without understanding the underlying risks.

Historically, financial markets have been littered with examples of individuals and funds that achieved meteoric success, only to flame out spectacularly. The collapse of Long-Term Capital Management in 1998, for instance, highlighted how even Nobel laureates can be brought down by unforeseen random events. In the modern era, the proliferation of social media and the cult of celebrity traders have made it even easier to conflate luck with skill. Taleb’s insights remain as relevant today as ever, serving as a cautionary tale for anyone tempted to attribute success solely to intelligence or expertise.

Chapter 2: A Bizarre Accounting Method

This chapter is essential for its introduction of alternative histories and the probabilistic view of the world. Taleb argues that evaluating decisions based solely on observed outcomes is a flawed approach, as it ignores the many possible paths that could have unfolded. By considering alternative histories—what might have happened if circumstances had been different—investors can gain a deeper understanding of risk and avoid the pitfalls of hindsight bias. The chapter challenges the tendency to explain success or failure after the fact, urging readers to adopt a more nuanced and probabilistic perspective.

Taleb illustrates his points with examples from both finance and everyday life. He discusses how traders and investors often judge their decisions based on the outcomes they experienced, rather than the quality of the decision-making process. The chapter includes references to Monte Carlo simulations, which generate multiple possible scenarios to illustrate the range of potential outcomes. Taleb also draws on philosophical ideas, such as the “many worlds” interpretation, to underscore the importance of considering alternative possibilities. He uses data and anecdotes to show how seemingly “smart” decisions can lead to failure, while risky or foolish bets can sometimes yield success purely by chance.

For investors, the practical application of this chapter is to judge decisions by the process and the range of possible outcomes, rather than just the observed result. This means evaluating strategies based on expected value, risk-adjusted returns, and robustness across different scenarios. Taleb’s probabilistic thinking encourages investors to use tools like scenario analysis, stress testing, and Monte Carlo simulations to assess the full spectrum of risks and rewards. By focusing on process over outcome, investors can avoid the trap of hindsight bias and build more resilient portfolios.

The concept of alternative histories has become increasingly important in the age of big data and algorithmic trading. Backtesting and performance analysis often suffer from selection bias and overfitting, leading to strategies that appear successful in historical data but fail in live markets. By embracing Taleb’s probabilistic approach, modern investors can better navigate the complexities of markets and avoid being misled by random outcomes.

Chapter 5: Survival of the Least Fit—Can Evolution Be Fooled by Randomness?

This chapter is crucial because it examines how randomness can mislead evolutionary interpretations and result in the survival of the least fit. Taleb challenges the traditional Darwinian view that only the fittest survive, arguing that in complex, probabilistic systems, chance can allow unfit individuals or strategies to persist and even flourish. The chapter draws parallels between biological evolution and financial markets, highlighting the dangers of attributing success solely to fitness or skill. Taleb’s analysis has profound implications for how investors interpret market outcomes and the persistence of seemingly successful strategies.

Taleb supports his arguments with examples from both biology and finance. He discusses how random mutations and environmental changes can result in the survival of organisms that are not necessarily the fittest, but simply the luckiest. In financial markets, he points to funds and traders who achieve success through risky strategies that happen to pay off in the short term, despite being fundamentally unsound. The chapter includes references to statistical distributions, survivorship bias, and the dangers of drawing causal inferences from random outcomes. Taleb uses data and simulations to show how randomness can produce apparent “winners” who are actually no more skilled than their less successful peers.

Investors can apply the lessons of this chapter by being skeptical of strategies or funds that have achieved success through highly leveraged or risky bets. Taleb’s critique of the survival of the least fit encourages investors to focus on robustness, risk management, and the avoidance of strategies that rely on rare, lucky outcomes. By recognizing the role of chance in survival, investors can avoid being seduced by performance alone and instead seek evidence of repeatability and sound process.

The concept of survival of the least fit is especially relevant in today’s financial landscape, where high-frequency trading, leverage, and complex derivatives have created new opportunities for random success. The collapse of hedge funds and the frequent blow-ups of “star” managers serve as reminders that luck can be mistaken for skill. Taleb’s insights provide a valuable framework for distinguishing between genuine skill and the fleeting success of the merely lucky.

Chapter 6: Skewness and Asymmetry

This chapter is important because it introduces the concepts of skewness and asymmetry in interpreting data—critical ideas for understanding risk and rare events. Taleb argues that financial markets and life are characterized by distributions that are not symmetrical; instead, rare events (so-called “black swans”) can have outsized impacts that traditional models fail to capture. The chapter challenges the use of normal distributions and linear thinking in risk management, urging readers to account for “fat tails” and the possibility of extreme outcomes.

Taleb uses a variety of examples to illustrate skewness and asymmetry, from financial crashes to natural disasters. He explains how most models underestimate the probability and impact of rare events, leading to complacency and inadequate risk controls. The chapter includes references to statistical concepts such as kurtosis and the limitations of standard deviation as a risk measure. Taleb provides quotes and anecdotes from both finance and history to underscore the dangers of ignoring skewness, such as the 1987 stock market crash and other unexpected events that caught investors off guard.

For investors, the practical takeaway is to design portfolios and strategies that are robust to extreme events, rather than relying on historical averages or “normal” expectations. This means incorporating stress testing, scenario analysis, and tail risk hedging into the investment process. Taleb’s emphasis on asymmetry encourages investors to seek opportunities with limited downside and significant upside, while avoiding strategies that are vulnerable to catastrophic losses.

The relevance of skewness and asymmetry has only increased in the modern era, with the proliferation of complex financial products and the growing frequency of market shocks. The 2008 financial crisis, for example, was a stark reminder of the dangers of ignoring fat tails and rare events. By internalizing the lessons of this chapter, investors can better prepare for the unexpected and build more resilient portfolios.

Chapter 7: The Problem of Induction

This chapter is a philosophical cornerstone of the book, addressing the problem of induction and its implications for knowledge, prediction, and risk management. Taleb draws on the work of philosophers like David Hume to argue that reasoning from past observations to future outcomes is inherently flawed. The chapter challenges the reliability of predictions and models, emphasizing the uncertainty and unpredictability of complex systems like financial markets.

Taleb uses historical examples and philosophical arguments to illustrate the limitations of induction. He discusses the famous “black swan” problem, where the observation of only white swans leads to the false conclusion that all swans are white—until a single black swan is observed. The chapter includes quotes from philosophers and references to real-world failures of induction, such as financial crises and technological disruptions. Taleb emphasizes that even long periods of stability can be shattered by unforeseen events, rendering past data an unreliable guide to the future.

For investors, the lesson is to approach forecasts and models with skepticism, recognizing that the future may not resemble the past. Taleb advocates for strategies that are robust to model error and uncertainty, such as diversification, stress testing, and the avoidance of overfitting. By acknowledging the limits of induction, investors can avoid the trap of overconfidence and build portfolios that are better prepared for the unknown.

The problem of induction remains a central challenge in modern finance, where data-driven models and machine learning algorithms are increasingly relied upon for decision-making. The failures of risk models during the 2008 crisis and the limitations of backtesting highlight the dangers of assuming that the future will mirror the past. Taleb’s philosophical skepticism provides a valuable antidote to the hubris of prediction and the allure of certainty.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 8: Too Many Millionaires Next Door

This chapter is a critical exploration of survivorship bias and its impact on our perception of success. Taleb argues that the abundance of “millionaires next door” creates the illusion that success is easily attainable and primarily the result of skill or intelligence. In reality, we only see the winners, while the vast majority of unsuccessful individuals are invisible, leading to a distorted understanding of what it takes to succeed.

Taleb supports his arguments with data and anecdotes, highlighting the statistical improbability of widespread success and the dangers of drawing conclusions from a non-representative sample. He discusses how business books and self-help gurus often focus on the habits of the successful, ignoring the countless others who followed similar paths but failed. The chapter includes references to statistical distributions, the law of large numbers, and the pitfalls of narrative-driven analysis. Taleb’s memorable quotes and real-world examples drive home the point that luck plays a far greater role in success than most people acknowledge.

For investors, the practical lesson is to be wary of strategies or gurus that promise easy riches based on the stories of a few successful individuals. Taleb encourages investors to look beyond the visible winners and consider the broader distribution of outcomes. This means focusing on risk management, diversification, and process, rather than chasing the latest hot strategy or stock. By understanding survivorship bias, investors can avoid being misled by anecdotal evidence and build more realistic expectations for success.

In the age of social media and financial influencers, the dangers of survivorship bias are amplified. The visibility of successful traders and “finfluencers” can create unrealistic benchmarks and drive speculative bubbles. Taleb’s insights are a timely reminder to focus on process, risk, and humility, rather than being seduced by the stories of the few who got lucky.

Chapter 9: It Is Easier to Buy and Sell Than Fry an Egg

This chapter examines the superficiality of financial success and the ease with which it can be misinterpreted as skill. Taleb argues that the ability to buy and sell financial assets is far less demanding than achieving real, sustainable success. He critiques the tendency to conflate activity with achievement, highlighting how the mechanics of trading can create the illusion of expertise where none exists.

Taleb uses examples from his own experience as a trader, as well as historical anecdotes, to illustrate how easy access to markets and the proliferation of trading platforms have democratized speculation but not necessarily increased genuine skill. He discusses the dangers of overtrading, the pitfalls of short-termism, and the tendency to mistake luck for talent. The chapter includes memorable quotes and references to the psychological traps that lead investors to overestimate their abilities.

For investors, the lesson is to focus on substance over form, prioritizing sound investment principles and long-term value creation over frequent trading or speculation. Taleb advocates for a disciplined approach that emphasizes process, patience, and risk management, rather than chasing quick wins or reacting to market noise. By recognizing the superficiality of much financial activity, investors can avoid the traps of overconfidence and excessive risk-taking.

The rise of commission-free trading and the gamification of investing through apps like Robinhood have made Taleb’s warnings more relevant than ever. The ease of buying and selling has led to a surge in retail trading activity, often with little regard for fundamentals or risk. Taleb’s insights serve as a cautionary tale for modern investors, emphasizing the importance of discipline, humility, and a focus on real value.

Chapter 11: Randomness and Our Mind: We Are Probability Blind

This chapter is a deep dive into the cognitive biases that make humans “probability blind” and ill-equipped to deal with randomness. Taleb argues that our brains are hardwired to see patterns, construct narratives, and overestimate our ability to predict outcomes, leading to poor risk assessment and costly mistakes. The chapter draws on research from psychology and behavioral finance to explain why even experienced professionals are vulnerable to these cognitive traps.

Taleb uses a variety of examples to illustrate how probability blindness manifests in real life, from gamblers who misinterpret random streaks as skill to investors who see trends in noise. He discusses the gambler’s fallacy, the illusion of control, and the tendency to overreact to short-term fluctuations. The chapter includes quotes from leading psychologists and references to classic experiments that reveal the limitations of human intuition in probabilistic environments.

For investors, the practical application is to implement systematic, rules-based approaches that mitigate the impact of cognitive biases. Taleb advocates for the use of checklists, pre-mortems, and quantitative models to reduce reliance on intuition and emotion. By acknowledging their own probability blindness, investors can take steps to improve risk assessment, avoid overtrading, and maintain discipline in volatile markets.

The relevance of this chapter has only increased with the rise of algorithmic trading, big data, and information overload. Modern investors are bombarded with data and narratives that can easily trigger cognitive biases. Taleb’s insights provide a valuable framework for cultivating self-awareness, skepticism, and a probabilistic mindset in an increasingly complex financial landscape.

Chapter 13: Carneades Comes to Rome: On Probability and Skepticism

This chapter explores the philosophical implications of probability and the necessity of skepticism in understanding uncertainty. Taleb draws on the teachings of Carneades, an ancient skeptic philosopher, to argue that certainty is often an illusion and that true wisdom lies in questioning assumptions and embracing doubt. The chapter challenges the conventional belief in the predictability of markets and the reliability of models, urging readers to adopt a more skeptical and humble approach to knowledge.

Taleb supports his arguments with historical examples, philosophical quotes, and references to the limitations of scientific and financial models. He discusses how overconfidence and the illusion of certainty have led to catastrophic failures, both in finance and other domains. The chapter includes anecdotes about the dangers of dogmatism and the value of maintaining an open, questioning mind. Taleb’s writing is both provocative and insightful, encouraging readers to rethink their approach to risk and decision-making.

For investors, the lesson is to approach markets, models, and forecasts with skepticism, recognizing the limits of knowledge and the inevitability of error. Taleb advocates for strategies that are robust to uncertainty, such as diversification, stress testing, and the avoidance of overfitting. By embracing skepticism, investors can avoid the traps of overconfidence and build portfolios that are better prepared for the unknown.

The philosophical skepticism championed by Taleb is increasingly relevant in a world where complex models and data-driven algorithms are widely used but often misunderstood. The failures of risk models during financial crises and the unpredictability of markets underscore the importance of humility and doubt. Taleb’s insights provide a valuable framework for navigating uncertainty and avoiding the perils of false certainty.

Chapter 14: Bacchus Abandons Antony

The final chapter brings together the philosophical and practical implications of randomness, concluding with a reflection on stoicism and personal elegance. Taleb argues that in a world dominated by uncertainty, the most effective response is not to seek control or certainty, but to cultivate humility, self-control, and a sense of personal elegance. The chapter draws on the traditions of stoic philosophy, emphasizing the importance of focusing on what we can control and accepting what we cannot.

Taleb uses historical anecdotes, literary references, and personal reflections to illustrate the virtues of stoicism in the face of randomness. He discusses how the pursuit of certainty and control often leads to frustration and disappointment, while acceptance and composure enable us to navigate uncertainty with grace. The chapter includes memorable quotes and practical advice for living with unpredictability, such as “Elegance in the face of randomness is true wisdom.”

For investors, the lesson is to develop psychological resilience and emotional discipline, recognizing that markets and life are inherently unpredictable. Taleb advocates for a focus on process, risk management, and acceptance of outcomes beyond our control. By embracing stoicism, investors can avoid destructive behaviors such as panic selling, revenge trading, or excessive risk-taking during periods of volatility.

In an era of rapid change, technological disruption, and frequent market shocks, the virtues of stoicism and personal elegance are more valuable than ever. Taleb’s concluding insights provide a timeless guide for navigating the uncertainties of investing and life, encouraging readers to cultivate humility, discipline, and perspective in the face of randomness.

Practical Investment Strategies

- Adopt Probabilistic Thinking: Shift your mindset from deterministic to probabilistic. Instead of evaluating investments solely based on outcomes, assess the quality of your decisions by considering the range of possible scenarios. Use tools like scenario analysis and Monte Carlo simulations to visualize alternative futures, and judge your process by how well it prepares you for uncertainty, not just by whether you “won” or “lost” on a particular trade. This approach helps you avoid hindsight bias and makes your strategy more robust to randomness.

- Focus on Process Over Outcome: Develop a systematic, repeatable investment process that emphasizes risk management, diversification, and discipline. Document your decision-making criteria, set predefined entry and exit rules, and conduct regular post-mortems to assess whether your process was followed, regardless of outcome. By focusing on process, you reduce the temptation to chase recent winners or react emotionally to short-term results, which are often driven by chance rather than skill.

- Beware of Survivorship Bias: When evaluating strategies, funds, or gurus, look beyond the visible winners and seek out information about the “graveyard” of failed attempts. Ask for complete track records, not just cherry-picked successes. Use databases and academic studies that account for survivorship bias, and be skeptical of claims that are not supported by rigorous, representative data. This mindset helps you avoid being misled by anecdotal evidence and unrealistic expectations.

- Prepare for Fat Tails and Rare Events: Design your portfolio to be robust to extreme outcomes by incorporating tail risk hedging, stress testing, and scenario analysis. Allocate a portion of your portfolio to assets or strategies that benefit from volatility and rare events (e.g., long volatility, protective puts). Avoid overexposure to strategies that rely on the absence of rare events, such as selling options or leveraged carry trades. This approach ensures you are prepared for the unexpected and reduces the risk of catastrophic losses.

- Implement Systematic Risk Controls: Use quantitative risk management tools such as stop-loss orders, position sizing rules, and maximum drawdown limits. Regularly monitor your risk exposures and rebalance your portfolio to maintain alignment with your risk tolerance and investment objectives. By automating risk controls, you minimize the impact of emotional decision-making and ensure consistent execution of your strategy.

- Embrace Skepticism and Continuous Learning: Approach markets, models, and forecasts with a healthy dose of skepticism. Regularly challenge your assumptions, seek out dissenting opinions, and update your beliefs in light of new evidence. Read widely, study failures as well as successes, and cultivate intellectual humility. This mindset enables you to adapt to changing market conditions and avoid the pitfalls of dogmatism and overconfidence.

- Practice Stoic Discipline: Develop emotional resilience and self-control by focusing on what you can control—your process, risk management, and behavior. Accept that outcomes are often beyond your control and resist the urge to overreact to short-term volatility. Use techniques from stoic philosophy, such as premeditatio malorum (visualizing possible setbacks), to prepare mentally for adverse outcomes. This discipline helps you maintain composure and make rational decisions under pressure.

- Use Alternative Data and Scenario Analysis: Supplement traditional financial analysis with alternative data sources and scenario planning. Evaluate how your investments might perform under a range of adverse conditions, such as market crashes, economic shocks, or geopolitical events. Use data-driven tools to identify hidden risks and test the robustness of your strategy. This approach helps you avoid overreliance on historical trends and prepares you for a wider range of possible futures.

Modern Applications and Relevance

Since its publication, “Fooled by Randomness” has only grown in relevance as financial markets have become more complex, interconnected, and data-driven. The principles Taleb articulates—skepticism, probabilistic thinking, humility, and risk awareness—are even more critical in an era characterized by algorithmic trading, high-frequency strategies, and the proliferation of financial products. The rise of social media and the democratization of investing have amplified the dangers of survivorship bias, narrative fallacies, and the temptation to attribute success to skill rather than luck.

What has changed since the book’s release is the sheer volume and velocity of information. Investors are now bombarded with real-time data, news, and performance metrics, making it easier than ever to see patterns in noise and react emotionally to short-term fluctuations. The gamification of trading through apps like Robinhood has lowered barriers to entry, but also increased the risk of overtrading and speculation based on superficial signals. The lessons of Taleb’s work—particularly the dangers of overconfidence and the importance of risk management—are more urgent in this environment.

At the same time, much of what Taleb describes remains timeless. The fundamental limitations of human cognition, the pervasiveness of randomness, and the illusion of control are as relevant today as they were at the turn of the century. The financial crises of 2008 and the COVID-19 pandemic are stark reminders that rare, extreme events can and do occur, often with devastating consequences for those who are unprepared. Taleb’s emphasis on preparing for fat tails and embracing humility has been vindicated by these events.

Modern examples abound of the principles in action. The collapse of high-profile hedge funds, the volatility of meme stocks, and the unpredictability of cryptocurrencies all illustrate the dangers of mistaking luck for skill and the limitations of models that ignore fat tails. Conversely, investors and funds that have embraced Taleb’s principles—such as robust risk controls, diversification, and scenario analysis—have often weathered storms better than those who relied on static models or narratives.

To adapt Taleb’s classic advice to current conditions, investors should leverage technology not to chase signals or overfit models, but to enhance risk management, automate discipline, and expand their awareness of possible outcomes. By combining the timeless wisdom of “Fooled by Randomness” with modern tools and data, investors can build strategies that are both resilient and adaptive in an unpredictable world.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Develop a Probabilistic Mindset: Begin by training yourself to think in probabilities rather than certainties. Read foundational works on probability, such as Taleb’s “Fooled by Randomness,” and practice scenario analysis for every investment decision. Use Monte Carlo simulations or simple “what-if” exercises to visualize a range of possible outcomes. This mental shift is the foundation for all subsequent steps and should become a daily habit.

- Establish a Disciplined Investment Process: Within the first month, document your investment philosophy, decision criteria, and risk tolerance. Create a checklist for evaluating each opportunity, including factors such as expected value, downside risk, and alternative outcomes. Set predefined rules for entry, exit, and position sizing. Review your process quarterly to ensure it remains aligned with your goals and the realities of the market.

- Construct a Robust Portfolio: Allocate your capital across a diversified set of assets, strategies, or markets. Use risk management tools such as stop-loss orders, maximum position limits, and tail risk hedges. Aim for a balance between growth and safety, with an emphasis on strategies that are robust to rare events and market shocks. Rebalance your portfolio at least semi-annually to maintain your desired risk profile.

- Implement Ongoing Risk Management: Set up a regular review schedule—monthly or quarterly—to assess your risk exposures, performance, and adherence to your process. Use quantitative tools to monitor drawdowns, volatility, and tail risk. Conduct stress tests and scenario analyses to evaluate how your portfolio would perform under adverse conditions. Adjust your allocations proactively in response to changes in market conditions or personal circumstances.

- Pursue Continuous Improvement and Education: Dedicate time each month to reading, reflection, and skill development. Study both successes and failures, and seek feedback from peers or mentors. Stay current with advancements in risk management, behavioral finance, and investment technology. Consider maintaining a journal to track your decisions, thought processes, and lessons learned. Use resources like Value Sense’s research platform, academic journals, and books by leading thinkers to deepen your understanding.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Fooled by Randomness

1. What is the main message of “Fooled by Randomness”?

The central message is that chance and randomness play a much larger role in success and failure—especially in investing—than most people realize. Taleb argues that what is often perceived as skill or intelligence is frequently the product of luck, and that human cognitive biases make us prone to misinterpret these outcomes. The book urges readers to adopt a probabilistic mindset, focus on process over results, and remain humble in the face of uncertainty.

2. How does Taleb suggest investors deal with randomness in the markets?

Taleb recommends that investors embrace probabilistic thinking, prioritize robust risk management, and avoid overreliance on models or past performance. He advocates for diversification, stress testing, and the use of strategies that are resilient to rare, extreme events. Taleb also emphasizes the importance of humility, skepticism, and emotional discipline in navigating unpredictable markets.

3. What is survivorship bias, and why is it important for investors?

Survivorship bias is the tendency to focus on the visible “winners” while ignoring the many failures that are no longer present. In investing, this leads to an overestimation of skill and the effectiveness of certain strategies. Recognizing survivorship bias helps investors avoid being misled by anecdotal success stories and encourages a more realistic assessment of risk and performance.

4. Can the lessons from “Fooled by Randomness” be applied to fields outside of finance?

Absolutely. The principles outlined in the book—such as the dangers of overconfidence, the importance of probabilistic thinking, and the limitations of human cognition—are relevant to business, sports, science, and everyday life. Anyone making decisions under uncertainty can benefit from Taleb’s insights into randomness, risk, and humility.

5. How can investors identify if their success is due to skill or luck?

Taleb suggests evaluating success over long periods and across multiple scenarios, rather than relying on short-term results. Investors should focus on the quality of their decision-making process, use risk-adjusted metrics, and consider alternative histories to judge whether outcomes are repeatable or merely the result of chance. A robust process and humility are key to distinguishing skill from luck.