Francis Chou - Chou Associates Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

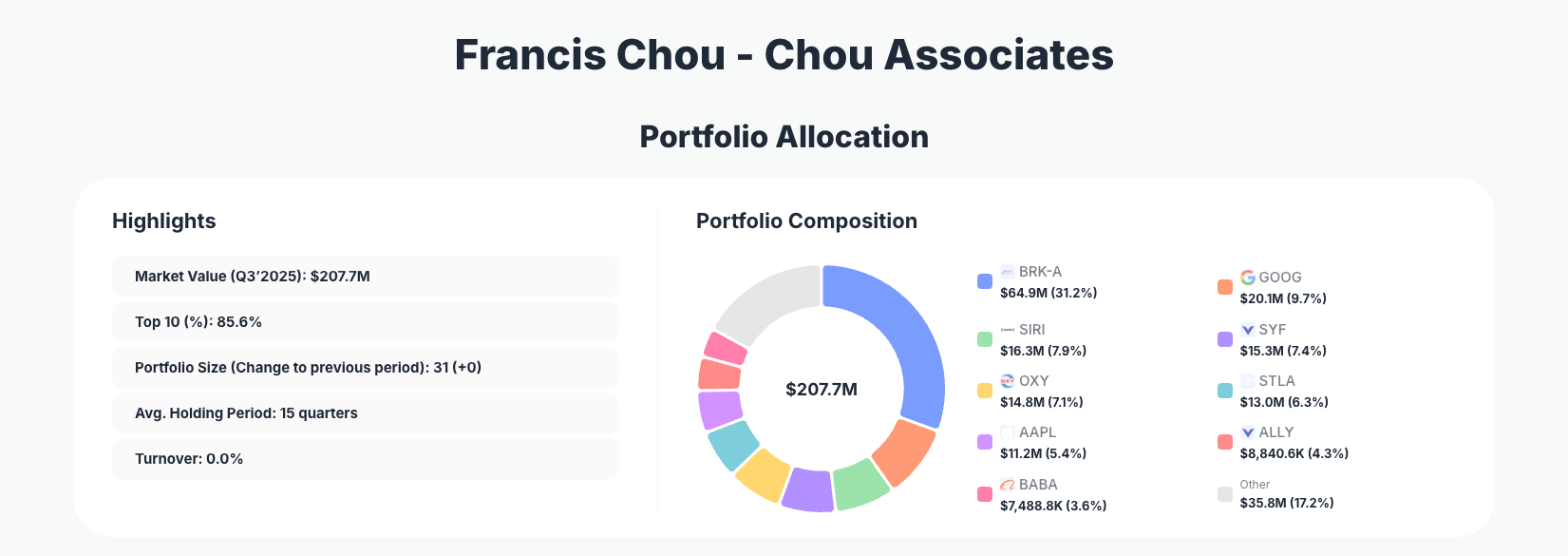

Francis Chou - Chou Associates continues to exemplify patient, deep-value investing discipline. Their Q3’2025 portfolio stands at $207.7M in disclosed 13F equity holdings, with virtually no turnover 0.0% and only one meaningful adjustment: a bold “Add 101.47%” move in automaker Stellantis N.V., signaling increased conviction while the rest of the book remains deliberately stable.

Portfolio Overview: A Patient, High-Conviction Value Book

Portfolio Highlights (Q3’2025): - Market Value: $207.7M

- Top 10 Holdings: 85.6%

- Portfolio Size: 31 +0

- Average Holding Period: 15 quarters

- Turnover: 0.0%

The Chou Associates portfolio is highly concentrated, with 85.6% of capital in the top 10 positions despite holding 31 names overall. This structure underscores a classic value approach: a handful of core, high-conviction ideas surrounded by smaller satellite positions that have limited impact on overall performance.

An average holding period of 15 quarters (nearly four years) combined with 0.0% turnover this quarter reinforces that Chou Associates’ portfolio is managed with long-duration conviction, not short-term trading. Most positions were left untouched, and the fund chose to act decisively only where the margin of safety likely widened—most notably in autos via Stellantis.

This discipline is particularly evident in the fund’s core anchor position and several large, unchanged holdings. The manager is clearly willing to let theses play out over years, letting intrinsic value compound rather than trying to time quarterly sentiment swings—an approach that aligns closely with ValueSense’s focus on intrinsic value and long-term business quality.

Top Holdings Overview: Blue-Chip Compounding Meets Opportunistic Autos

The Q3’2025 snapshot of the Chou Associates portfolio shows a distinctive blend of quality compounders, financials, energy, and deep-value cyclicals, with only one significant position change this quarter.

The most notable move is in Stellantis N.V., now a 6.3% position, where Chou executed an aggressive “Add 101.47%” increase to 1,394,194 shares valued at $13.0M. This doubling signals a strong view that Stellantis remains undervalued relative to its earnings power and capital return potential, especially given the auto sector’s cyclicality and pessimistic sentiment.

The portfolio continues to be dominated by Berkshire Hathaway Inc. (BRK-A), which represents 31.2% of assets with 86 shares worth $64.9M and “No change” in Q3. This massive allocation reflects deep confidence in Berkshire’s diversified operating businesses, conservative balance sheet, and internal compounding engine.

Tech exposure is led by Alphabet Inc., holding 82,390 shares worth $20.1M and accounting for 9.7% of the portfolio with “No change”. This indicates a willingness to own dominant, cash-rich platforms at what Chou likely views as reasonable valuations relative to long-term cash flows.

Media exposure comes through Sirius XM Holdings Inc., a 7.9% position with 702,462 shares valued at $16.3M, again with “No change” this quarter. The steady weight implies ongoing conviction in Sirius XM’s cash generation and subscriber economics, despite broader questions around legacy audio and streaming competition.

In consumer finance, SYNCHRONY FINANCIAL sits at 7.4% of the portfolio with 215,702 shares worth $15.3M and “No change” in Q3. While the 13F data provides the name as “SYNCHRONY FINANCIAL” with ticker _, the unchanged stake suggests that Chou remains comfortable with the credit profile and earnings power through the cycle.

Energy exposure is anchored by Occidental Petroleum Corporation, a 7.1% position with 313,000 shares valued at $14.8M, also “No change”. This reflects a continued bet on hydrocarbons and the potential for shareholder returns through buybacks and deleveraging in a structurally tighter energy market.

Mega-cap tech is further represented by Apple Inc., at 5.4% of the portfolio with 44,000 shares worth $11.2M and “No change” this quarter. This moderate sizing relative to Berkshire and Alphabet shows a willingness to own high-quality tech, but without over-concentration at prevailing valuations.

In consumer finance again, Ally Financial Inc. accounts for 4.3% of assets, with 225,525 shares valued at $8,840.6K and “No change”. The position size suggests Chou sees attractive risk-reward in specialized lending despite macro concerns around credit normalization.

Rounding out the major positions, Alibaba Group Holding Limited represents 3.6% of the portfolio with 41,900 shares worth $7,488.8K, again with “No change”. This reflects a continued belief in Alibaba’s long-term cash generation potential despite persistent regulatory and sentiment overhangs in Chinese equities.

Combined, these top holdings reveal a portfolio built around dominant franchises (Berkshire, Alphabet, Apple), cash generative media and financials (Sirius XM, Synchrony, Ally), energy (Occidental), and contrarian value in autos and China (Stellantis, Alibaba)—with Stellantis as the sole active bet this quarter via a dramatic position increase.

What the Portfolio Reveals About Chou’s Current Strategy

Several key strategy themes emerge from the Q3’2025 positioning of the Chou Associates portfolio:

- Quality-focused value, not “cheap for a reason”

The top allocations are to durable, cash-rich businesses such as Berkshire Hathaway, Alphabet, and Apple, indicating an emphasis on quality franchises at value prices rather than purely low multiples. - Sector diversification with conviction clusters

Capital is spread across conglomerates, tech, media, financials, energy, and autos, but the largest weights cluster around Berkshire, big tech, and financials, balancing cyclical exposures (energy, autos) with highly resilient earnings streams (Berkshire, Alphabet, Apple). - Geographic breadth with selective emerging market exposure

While most holdings are US or US-listed, the presence of Stellantis (multinational automaker) and Alibaba introduces European and Chinese exposure, suggesting Chou is comfortable going global where valuation and business quality align. - Implicit yield and capital return focus

Although the 13F data does not show dividend yields, names like Stellantis, Occidental, Synchrony, Ally, and Alibaba are often associated with buybacks, dividends, or both, indicating an eye toward shareholder-friendly capital allocation as part of the value thesis. - Risk management via extreme concentration in a few “north stars”

With 31.2% in Berkshire and 85.6% in the top 10, risk is managed less through broad diversification and more through knowing a few businesses deeply, letting them anchor the portfolio across cycles.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Berkshire Hathaway Inc. (BRK-A) | $64.9M | 31.2% | No change |

| Alphabet Inc. (GOOG) | $20.1M | 9.7% | No change |

| Sirius XM Holdings Inc. (SIRI) | $16.3M | 7.9% | No change |

| SYNCHRONY FINANCIAL | $15.3M | 7.4% | No change |

| Occidental Petroleum Corporation (OXY) | $14.8M | 7.1% | No change |

| Stellantis N.V. (STLA) | $13.0M | 6.3% | Add 101.47% |

| Apple Inc. (AAPL) | $11.2M | 5.4% | No change |

| Ally Financial Inc. (ALLY) | $8,840.6K | 4.3% | No change |

| Alibaba Group Holding Limited (BABA) | $7,488.8K | 3.6% | No change |

This table highlights just how top-heavy the Chou Associates portfolio is: Berkshire alone is nearly one-third of assets, and together with Alphabet, Sirius XM, Synchrony, and Occidental, the top five positions account for more than 60% of capital. The remaining positions, including Stellantis, Apple, Ally, and Alibaba, round out an 85.6% top-10 concentration.

The standout is clearly Stellantis with its “Add 101.47%” action—the only top-10 holding with any change. That single move effectively signals Chou’s current highest-conviction incremental idea, while the “No change” status across all other large positions confirms that the existing thesis lineup remains intact and requires no tinkering.

Investment Lessons from Francis Chou’s Value Strategy

Investors studying the Francis Chou – Chou Associates approach can draw several practical lessons from this Q3’2025 13F:

- Concentrate when you truly understand the business

A 31.2% weight in Berkshire Hathaway shows that when conviction is exceptionally high, concentration can be a feature, not a bug, provided risk is grounded in business quality, not price speculation. - Holding periods matter more than quarterly noise

With an average holding period of 15 quarters and 0.0% turnover, Chou demonstrates that letting compounding work often beats constant trading. Ideas are given years, not months, to close the gap between price and intrinsic value. - Act decisively, but infrequently

The “Add 101.47%” to Stellantis is a textbook example: when the thesis strengthens or price declines improve the margin of safety, he moves boldly, while leaving everything else untouched. - Blend quality compounders with contrarian deep value

Pairing mega-cap tech and Berkshire with autos, energy, and Chinese tech shows a balanced value style: own great businesses at fair prices and good businesses at very attractive prices. - Position sizing is a risk-management tool

The portfolio uses size tiers: core anchors (Berkshire), meaningful but smaller core positions (Alphabet, Sirius XM, Synchrony, Occidental), and mid-sized contrarian plays (Stellantis, Alibaba, Ally) to calibrate risk and upside.

Looking Ahead: What Comes Next for Chou Associates?

While 13F filings are backward-looking, the current mix in the Chou Associates portfolio offers useful clues about how Francis Chou may navigate the coming quarters:

- Dry powder via stability, not explicit cash

The 13F does not disclose cash, but 0.0% turnover and no new names suggest Chou is comfortable letting existing positions compound rather than constantly hunting for new ideas. Any additional capital may be funneled into existing high-conviction names like Stellantis if volatility increases. - Potential focus areas for future buys

Given the current lineup, investors might watch for additional activity in autos, energy, and out-of-favor tech/China, especially if macro fears produce further valuation compression in these areas. - Resilience through Berkshire and big tech

With Berkshire, Alphabet, and Apple as substantial holdings, the portfolio is positioned to withstand economic cycles via diversified earnings streams, robust balance sheets, and strong free cash flow generation. - Scope for gradual rotation, not wholesale shifts

The extreme stability in Q3’2025 suggests that any future changes are likely to be incremental position adjustments—similar to the Stellantis move—rather than broad sector rotations or strategy overhauls.

To monitor how these themes evolve, you can follow the latest filings and updates for Chou Associates’ portfolio directly on ValueSense.

FAQ about Francis Chou – Chou Associates Portfolio

Q: What was the most significant portfolio change for Chou Associates in Q3’2025?

The only notable change in Q3’2025 was in Stellantis N.V., where Chou executed an “Add 101.47%” increase to a 6.3% portfolio weight, while all other top-10 holdings were marked as “No change.”

Q: How concentrated is the Francis Chou – Chou Associates portfolio?

The portfolio has 31 positions, but the top 10 comprise 85.6% of total market value, with Berkshire Hathaway alone accounting for 31.2%. This reflects a highly concentrated, high-conviction value strategy.

Q: How active is Chou’s trading strategy quarter to quarter?

For Q3’2025, turnover was reported at 0.0%, and the average holding period is 15 quarters, indicating that Chou trades very infrequently and typically holds positions for multiple years.

Q: Which sectors and themes does Chou Associates emphasize today?

The top holdings point to an emphasis on conglomerates (Berkshire), large-cap tech (Alphabet, Apple), media (Sirius XM), financials (Synchrony, Ally), energy (Occidental), autos (Stellantis), and Chinese e-commerce (Alibaba)—a blend of quality compounders and contrarian value.

Q: How can I track Francis Chou’s latest holdings and 13F filing updates?

You can follow Francis Chou – Chou Associates through quarterly 13F filings, which are typically reported with a 45-day lag after quarter-end. To see structured analysis, historical changes, and visualizations, use the ValueSense superinvestor tracker at Chou Associates’ portfolio page.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!