Francois Rochon - Giverny Capital Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

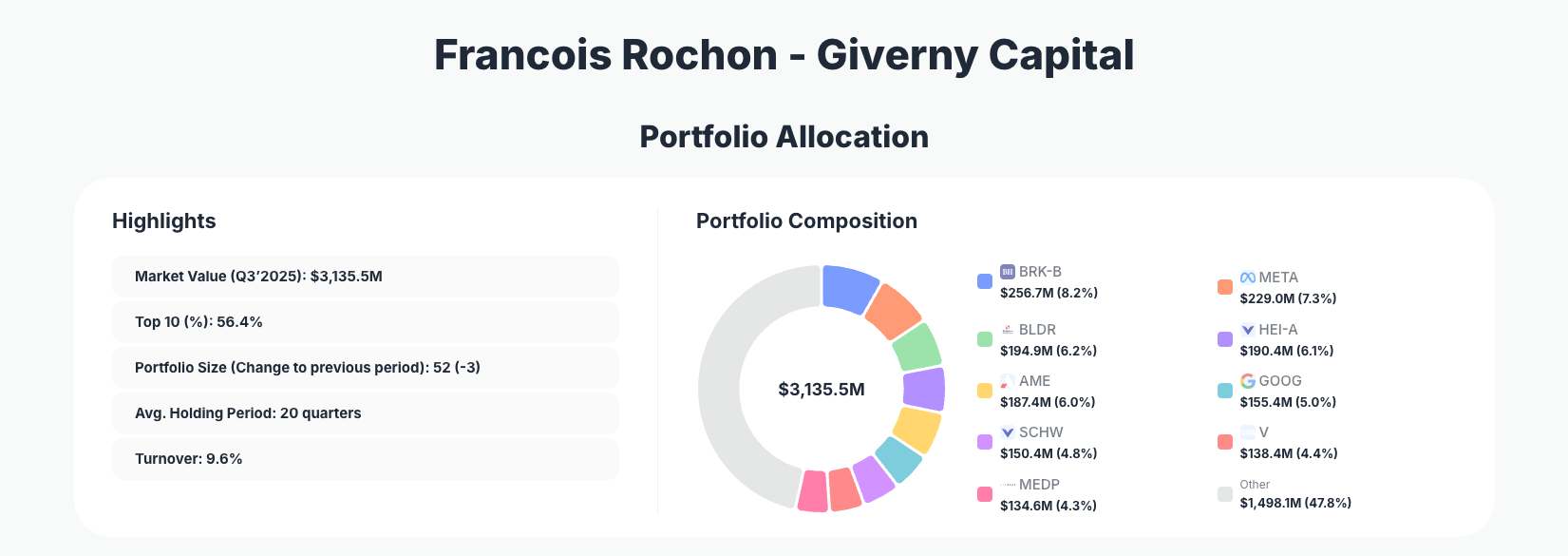

Francois Rochon - Giverny Capital continues to exemplify patient, quality-focused investing through disciplined portfolio adjustments. His Q3 2025 $3.1B portfolio shows low turnover with strategic trims in mega-cap tech and selective adds in financials and industrials, maintaining a focus on long-term compounders across 52 positions.

Portfolio Snapshot: Concentrated Quality with Proven Longevity

Portfolio Highlights (Q3’2025): - Market Value: $3,135.5M - Top 10 Holdings: 56.4% - Portfolio Size: 52 -3 - Average Holding Period: 20 quarters - Turnover: 9.6%

Giverny Capital's portfolio demonstrates Rochon's signature approach: heavy concentration in the top 10 at 56.4%, signaling high conviction in a select group of exceptional businesses. The reduction to 52 positions from the prior quarter reflects ongoing pruning of lower-conviction names, aligning with his philosophy of owning only the highest-quality compounders over multi-year horizons. With an average holding period of 20 quarters—over five years—this underscores a buy-and-hold strategy that prioritizes enduring competitive advantages over short-term trading.

Low turnover of 9.6% further highlights discipline, as Rochon makes measured adjustments rather than reactive shifts. The portfolio's balance across technology, industrials, financials, and healthcare avoids over-reliance on any single sector, providing resilience in volatile markets. Tracking these metrics via Giverny Capital's portfolio page reveals consistent execution of this patient strategy, even as market values fluctuate.

This structure positions Giverny for compounded returns through quality businesses capable of navigating economic cycles, with top holdings driving over half the portfolio's performance.

Core Positions: Trims in Tech Giants, Adds in Financial Resilience

The $3.1B portfolio leads with Berkshire Hathaway Inc. (BRK-B) at 8.2% $256.7M, trimmed by 0.22% to refine exposure to this ultimate conglomerate play. Meta Platforms, Inc. (META) follows at 7.3% $229.0M, reduced 2.22% amid tech sector rotations, while Builders FirstSource, Inc. (BLDR) holds 6.2% $194.9M after a minor 0.25% cut.

HEICO CORP NEW stands at 6.1% $190.4M with an "Add 0.00%", signaling steady conviction in this aerospace and defense niche leader, complemented by AMETEK, Inc. (AME) at 6.0% $187.4M, boosted by 0.03%. Alphabet Inc. (GOOG) weighs in at 5.0% $155.4M, trimmed 2.37% as Rochon dials back big tech.

Recent activity shows adds in steadier names: The Charles Schwab Corporation (SCHW) at 4.8% ($150.4M, Add 0.53%), Visa Inc. (V) at 4.4% ($138.4M, Add 1.05%), and Medpace Holdings, Inc. (MEDP) at 4.3% ($134.6M, Add 0.02%). Beyond the top 10, The Progressive Corporation (PGR) gained 2.60% to 4.2% $131.8M, highlighting insurance sector appeal. These moves blend tech trims with financial and industrial reinforcements, covering 11 key changes while emphasizing quality moats.

Strategic Signals: Quality Compounders in a High-Interest World

Giverny's Q3 adjustments reveal a strategy tilted toward resilient quality over speculative growth. Key themes include:

- Quality moats prioritized: Holdings like BRK-B, V, and SCHW emphasize durable competitive edges, with adds signaling bets on fee-generating financials amid elevated rates.

- Tech discipline: Significant trims in META 2.22% and GOOG 2.37% suggest profit-taking after rallies, balancing growth exposure.

- Industrial and healthcare balance: Positions in AME, BLDR, and MEDP provide cyclical resilience and innovation plays.

- Risk via diversification: 52 positions with 56.4% in top 10 manage concentration risk while allowing conviction bets.

- Long-term horizon: 20-quarter average hold supports ignoring noise for compounding.

This approach favors businesses with strong free cash flow and management alignment, ideal for uncertain macro conditions.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Berkshire Hathaway Inc. (BRK-B) | $256.7M | 8.2% | Reduce 0.22% |

| Meta Platforms, Inc. | $229.0M | 7.3% | Reduce 2.22% |

| Builders FirstSource, Inc. | $194.9M | 6.2% | Reduce 0.25% |

| HEICO CORP NEW | $190.4M | 6.1% | Add 0.00% |

| AMETEK, Inc. | $187.4M | 6.0% | Add 0.03% |

| Alphabet Inc. | $155.4M | 5.0% | Reduce 2.37% |

| The Charles Schwab Corporation | $150.4M | 4.8% | Add 0.53% |

| Visa Inc. | $138.4M | 4.4% | Add 1.05% |

| Medpace Holdings, Inc. | $134.6M | 4.3% | Add 0.02% |

The table underscores Giverny's focused conviction, with the top 10 commanding 56.4% of the $3,135.5M portfolio—led by BRK-B and tech names despite trims. Minor adjustments like Visa's 1.05% add and Schwab's 0.53% boost show tactical refinement without disrupting core themes. This concentration amplifies returns from winners like industrials and financials while the three-position trim to 52 enhances efficiency.

Investment Lessons from Francois Rochon’s Giverny Capital Approach

Rochon's Q3 filing distills timeless principles for long-term investors:

- Prioritize exceptional compounders: Bet heavily on businesses like BRK-B and V with wide moats and capable management.

- Patience through long holds: 20-quarter average tenure proves holding beats trading, as seen in low 9.6% turnover.

- Trim winners selectively: Reductions in META and GOOG lock in gains without abandoning quality.

- Balance conviction with diversification: 56.4% top 10 concentration paired with 52 positions manages risk.

- Focus on quality over valuation alone: Adds in financials like PGR emphasize resilience in any rate environment.

Looking Ahead: What Comes Next?

Giverny's positioning sets up well for 2026, with low turnover suggesting dry powder for opportunistic buys amid potential rate cuts. Trims in overvalued tech free capital for undervalued industrials or healthcare like MEDP. The portfolio's quality tilt—financials up via V and SCHW—positions it for economic softening, while BRK-B's diversification hedges volatility. Monitor Giverny Capital's portfolio for new positions in resilient sectors as markets digest Fed policy.

FAQ about Francois Rochon - Giverny Capital Portfolio

Q: What are the most significant changes in Giverny Capital's Q3 2025 13F filing?

A: Key moves include trims in META (Reduce 2.22%) and GOOG (Reduce 2.37%), with adds in PGR (Add 2.60%), V (Add 1.05%), and SCHW (Add 0.53%), reflecting a shift toward financial stability.

Q: Why does Giverny Capital maintain such high concentration in its top 10 holdings?

A: At 56.4%, the top 10 focus amplifies returns from high-conviction quality names like BRK-B, balanced by 42 positions for risk control, aligning with Rochon's compounder strategy.

Q: What sectors dominate Giverny Capital's portfolio strategy?

A: Technology (META, GOOG), industrials (AME, BLDR), financials (V, PGR), and healthcare (MEDP) lead, emphasizing moats over cyclical bets.

Q: How can I track and follow Francois Rochon's Giverny Capital portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/giverny-capital for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!