Crack the Code: Howard Marks’ Investment Principles for Maximum Returns

Welcome to our blog

At Value Sense we provide tools & insights on undervalued companies.

Learn more here.

Howard Marks, billionaire investor, shares his decades of experience and proven investment philosophies you can adapt to make huge profits.

Key Lessons:

- Profits Are Made in Mispriced Assets

2. The Importance of Second-Level Thinking

3. Intrinsic Value as the Foundation for Strong Returns

4. Risk Management

5. Identifying Prime Investment Opportunities

6. Understanding Market Psychology

7. Anticipating Unpredictable Events

Profits Are Made in Mispriced Assets

Opportunities to outperform the market are limited, so successful investing demands sharp insight. To make huge profits, investors must focus on acquiring mispriced assets.

While this may seem simple, such mispricings are quite rare because investors are actively gathering and analyzing information about various assets. As a result, assets tend to remain close to their intrinsic value. When an asset is fairly priced—which is often the case—it's challenging to profit from it.

Mispricings do happen, however. For instance, in January 2000, Yahoo was valued at $237 per share, but by April, it had dropped to $11 per share. Clearly, the price was incorrect at some point during that time.

Overall, mispricings create significant opportunities for profits and losses. However, identifying them can be quite challenging. If your aim is to achieve above-average returns, your approach must be distinct and superior to that of others.

The Importance of Second-Level Thinking.

First-level thinkers might simply say, “It’s a good company, let’s buy.” In contrast, second-level thinkers dig deeper, reasoning: “It’s a good company, but everyone believes that, so the stock is likely overvalued; therefore, let’s sell.”

This method is effective because it recognizes that all investors collectively shape the market.

Second-level thinking considers the actions and opinions of other investors to gain an edge over the market rather than merely following it.

By acknowledging the broader market sentiment, second-level thinkers can identify opportunities that others overlook, ultimately leading to better investment decisions. It’s not just about what you know; it’s about understanding how others think and react in the market, allowing you to position yourself advantageously.

Intrinsic Value

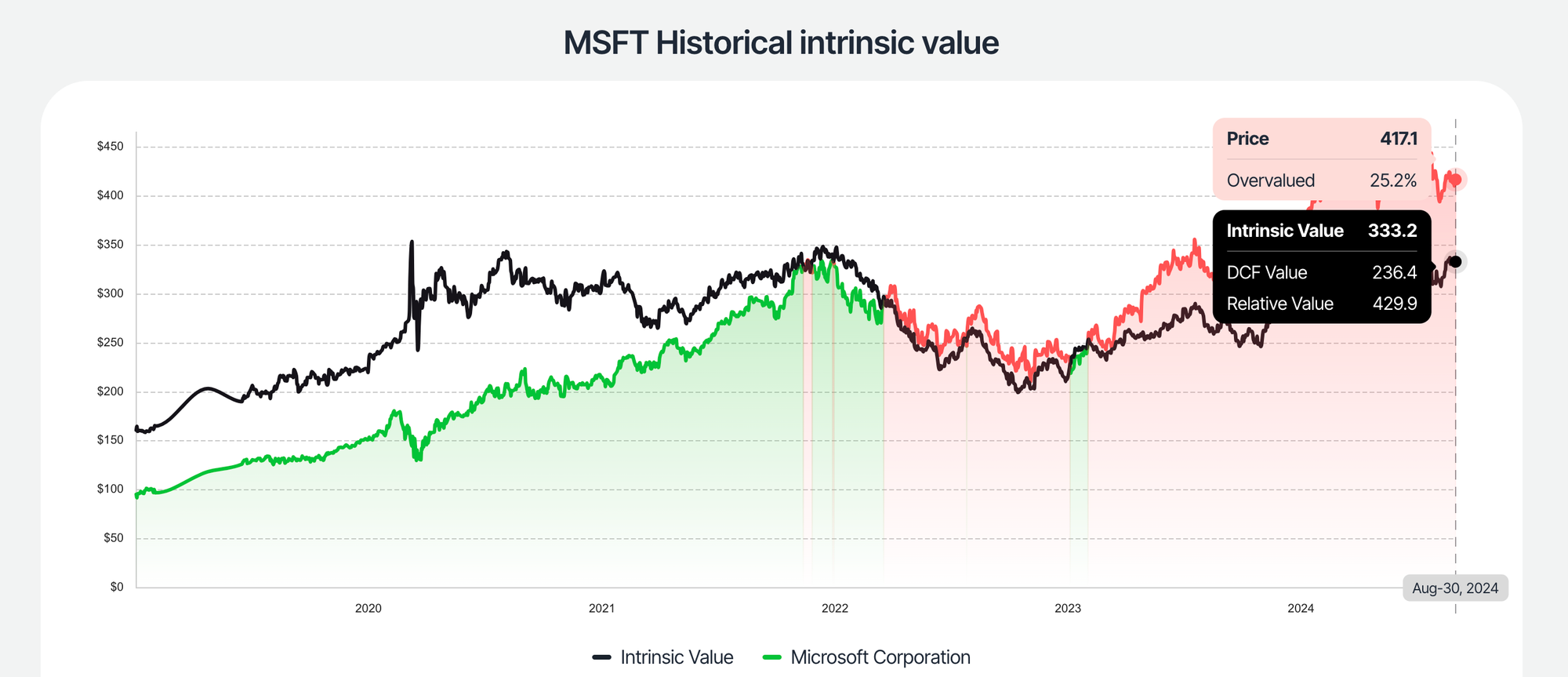

Estimating intrinsic value accurately is a solid foundation for successful investing. This involves a thorough analysis of a company’s fundamentals.

How do you determine intrinsic value?

It is assessed based on several key fundamentals, including:

• Profits

• Debt repayment ability

• Potential for future earnings

Creating an accurate estimate of intrinsic value is essential for successful investing, as it enables you to identify and purchase assets that are undervalued.

Despite its importance, many investors overlook intrinsic value. For instance, if someone offered to sell you their car, you would first check its market value before making a purchase, right? The same principle applies to investing in assets.

To simplify this process, we created a free tool that accurately calculates a stock's intrinsic value.

Managing Risk

Managing risk is a vital part of investing. Since investing is inherently tied to the future, and we can’t predict it with certainty, risk is something we just can’t avoid.

Investment risk is always around, often hiding in plain sight. This is especially true when prices are high, as they’re more likely to drop.

That’s why understanding an asset’s intrinsic value is so important. In the long run, prices tend to revert to their intrinsic value, which serves as a grounding point for assessing potential investments.

You should learn to balance risk and reward. This means not only recognizing when an asset is overpriced but also being aware of the broader market conditions that could influence price movements. A thorough risk assessment allows you to make informed decisions and stay resilient, especially during volatile times.

Identifying Prime Investment Opportunities

One of the most powerful strategies in investing is to look for opportunities where others are unwilling to tread. Often, the best assets are found in areas that make most investors uncomfortable.

While it might feel uneasy at first, aim to seek out underpriced assets that are perceived to be much worse than they actually are. When nobody owns something, its demand is likely to increase. Even if an asset transitions from being viewed as “tolerated,” it can still yield strong returns for you.

The willingness to explore these overlooked opportunities can set you apart from the crowd. It requires a blend of courage and careful research, but the potential rewards are significant. By focusing on the intrinsic value and future potential of these assets, you can position yourself for success in ways many investors miss.

Understanding Market Psychology

Market forecasts are often unreliable. Just think back to how few predictions accurately anticipated the global credit crisis and economic meltdown in 2008.

It’s vital to avoid psychological traps that can distort your judgment. Many major investment mistakes arise from emotional factors, including:

• Greed

• Fear

• Envy

• Ego

Greed, in particular, is the most powerful force. It can easily overpower our natural aversion to risk, leading to poor decision-making.

Anticipating Unpredictable Events

Investment outcomes often rest on unpredictable events. That’s why it’s important to have a strategy that considers this reality.

A solid approach strikes a balance between offensive and defensive tactics:

• Offensive: This means being willing to take on higher risks in the pursuit of greater rewards.

• Defensive: This focuses on protecting your investments and minimizing losses.

By blending these strategies, you can navigate market uncertainties more confidently. Embracing both sides allows you to pursue opportunities while also safeguarding your capital.

Remember, investing demands a thorough grasp of the fundamentals that influence stock prices. Simply following the crowd can expose you to significant risks and losses.

To succeed, you must identify undervalued assets.

Each month we prepare detailed lists of undervalued companies. Our insights combine fundamental analysis with quality metrics to highlight potential undervaluation based on intrinsic value. You can check them down below: