George Soros - Soros Fund Management LLC Q2 2025 Portfolio Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

George Soros - Soros Fund Management LLC Q2 2025 Portfolio Analysis

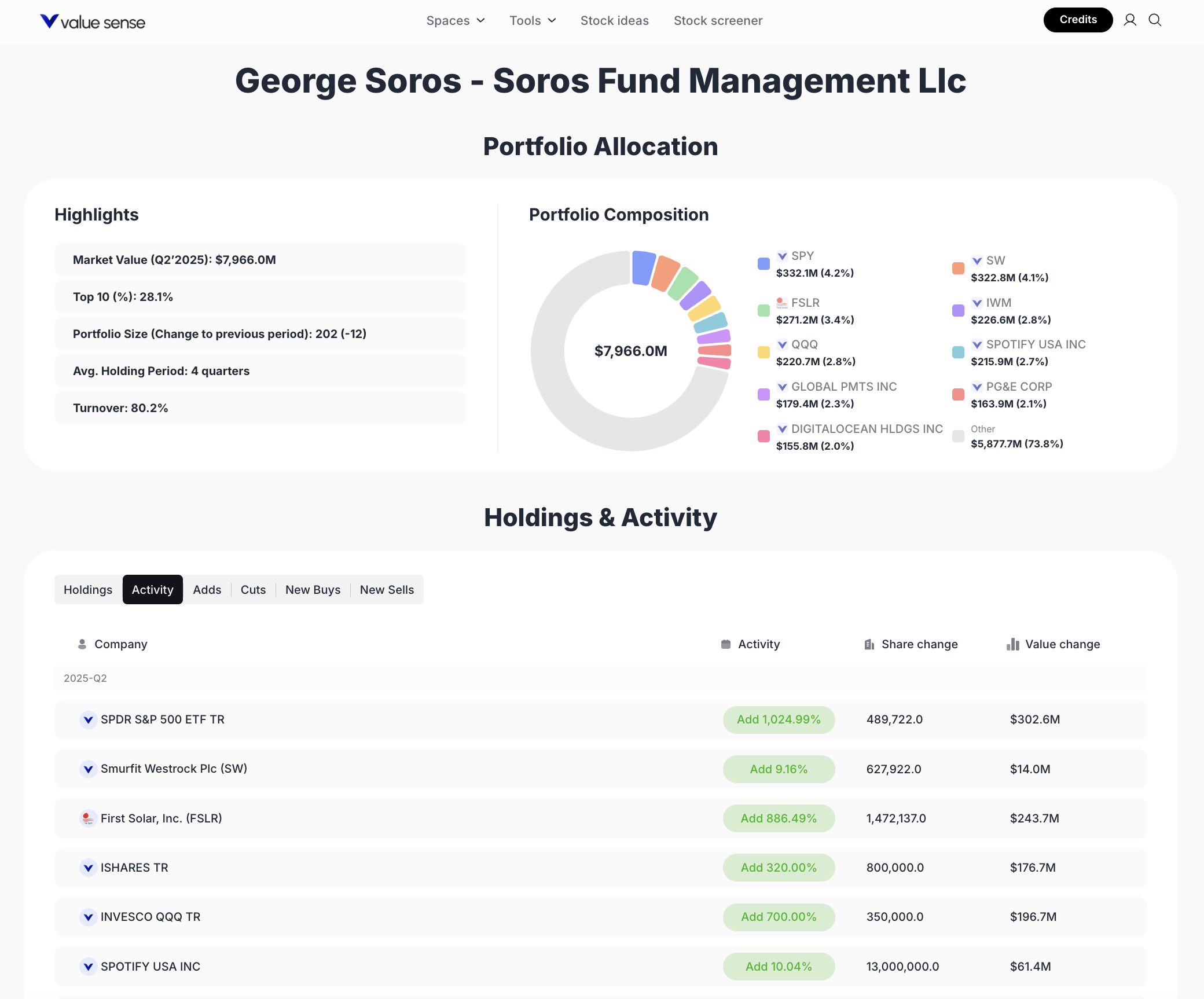

The Q2 2025 market landscape has been characterized by significant institutional repositioning, with Soros Fund Management LLC demonstrating notable portfolio adjustments. George Soros's fund has exhibited a turnover rate of 80.2% this quarter, indicating active management and strategic reallocations across various sectors. Our analysis focuses on the most significant holdings based on market value, percentage changes, and strategic importance within the fund's overall investment thesis.

The fund's approach this quarter reflects a balanced strategy between growth opportunities and defensive positioning, with particular emphasis on ETF diversification and selective individual stock picks across technology, renewable energy, and materials sectors.

Featured Stock Analysis

Stock #1: SPDR S&P 500 ETF Trust (SPY)

Quick Stats Table

• Market Value: $332.1M

• Portfolio %: 4.2%

• Share Change: +489,722

• Value Change: +$302.6M

• Activity: Add 1,024.99%

• Sector: Broad Market ETF

Investment Thesis

SPY represents the fund's largest holding and most significant addition this quarter. The massive 1,024% increase in position size signals Soros Fund Management's strategic pivot toward broad market exposure. This substantial allocation serves as a core portfolio anchor, providing diversified exposure to the U.S. equity market while hedging against sector-specific volatility.

The ETF's role as a defensive positioning tool becomes evident when considering the current macroeconomic uncertainty. By dramatically increasing exposure to SPY, the fund maintains participation in market upside while reducing concentration risk from individual stock picks.

Key Catalysts

• Broad U.S. market recovery potential

• Defensive positioning amid volatility

• Liquidity and low tracking error

• Economic resilience indicators

Risk Factors

• Market-wide downturns impact all holdings

• Limited outperformance versus individual stock picks

• Sensitivity to macroeconomic shocks

• Interest rate sensitivity

Stock #2: Smurfit WestRock Plc (SW)

Quick Stats Table

• Market Value: $322.8M

• Portfolio %: 4.1%

• Share Change: +627,922

• Value Change: +$14.0M

• Activity: Add 9.16%

• Sector: Packaging/Materials

Investment Thesis

Smurfit WestRock represents the fund's second-largest holding, reflecting confidence in the packaging sector's defensive characteristics and steady cash flow generation. The company benefits from resilient demand in consumer goods and the continuing growth of e-commerce, which drives packaging requirements.

The moderate increase of 9.16% suggests a measured approach to building this position, likely viewing the company as a stable, dividend-yielding asset with exposure to sustainable packaging trends. The relatively small value change (+$14M) indicates this was more of a portfolio rebalancing move rather than a major strategic shift.

Key Catalysts

• E-commerce growth driving packaging demand

• Sustainability initiatives in packaging

• Global supply chain normalization

• Steady dividend yield potential

Risk Factors

• Commodity price fluctuations affecting costs

• Cyclical demand in industrial markets

• Currency and geopolitical risks

• Environmental regulation compliance costs

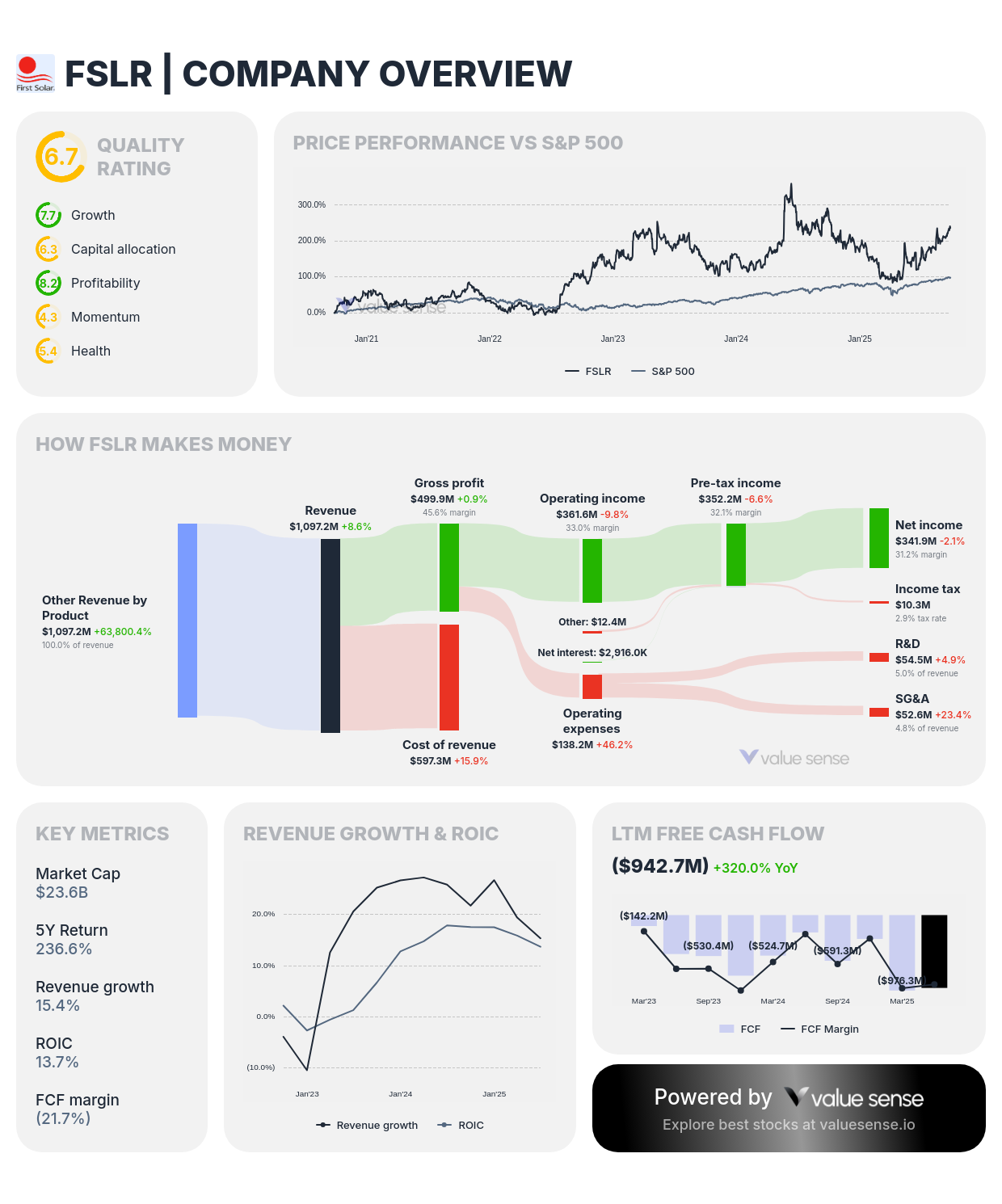

Stock #3: First Solar, Inc. (FSLR)

Quick Stats Table

• Market Value: $271.2M

• Portfolio %: 3.4%

• Share Change: +1,472,137

• Value Change: +$243.7M

• Activity: Add 886.49%

• Sector: Renewable Energy

Investment Thesis

First Solar represents one of the most dramatic position changes in the portfolio, with an 886% increase in shares. This massive addition signals strong conviction in the renewable energy sector's long-term growth prospects and First Solar's competitive positioning within the solar manufacturing industry.

The company's technology leadership in thin-film solar panels and robust project pipeline position it to capitalize on the global energy transition. Government incentives and policy support for renewable energy create a favorable regulatory environment for continued growth.

Key Catalysts

• Global decarbonization mandates

• U.S. Inflation Reduction Act benefits

• Technological improvements in solar efficiency

• International renewable energy expansion

Risk Factors

• Policy uncertainty and subsidy changes

• Competition from low-cost manufacturers

• Supply chain and material cost volatility

• Grid infrastructure limitations

Stock #4: iShares Trust ETF

Quick Stats Table

• Share Change: +800,000

• Value Change: +$176.7M

• Activity: Add 320.00%

• Sector: ETF

Investment Thesis

The iShares Trust ETF addition represents another significant ETF allocation, contributing to the fund's diversification strategy. The 320% increase in shares and $176.7M value change highlight tactical positioning to capture specific sector trends or provide hedging for concentrated positions elsewhere in the portfolio.

This ETF likely provides exposure to specific factors or sectors that complement the fund's broader investment theme, supporting risk-adjusted returns through additional diversification layers.

Key Catalysts

• Sector rotation opportunities

• Factor-based investment exposure

• Portfolio risk mitigation

• Tactical allocation flexibility

Risk Factors

• Tracking error versus benchmark

• Sector concentration risks

• Management fee drag

• Liquidity constraints in underlying assets

Stock #5: Invesco QQQ Trust (QQQ)

Quick Stats Table

• Market Value: $220.7M

• Portfolio %: 2.8%

• Share Change: +350,000

• Value Change: +$196.7M

• Activity: Add 700.00%

• Sector: Technology ETF

Investment Thesis

QQQ provides concentrated exposure to leading technology companies through the Nasdaq-100 index. The 700% increase in position size demonstrates strong conviction in technology sector recovery and the continued importance of innovation-driven growth companies.

This allocation positions the fund to benefit from secular trends in artificial intelligence, cloud computing, and digital transformation. The ETF's liquidity and established track record make it an efficient vehicle for gaining technology exposure.

Key Catalysts

• AI and machine learning adoption

• Cloud computing expansion

• Digital transformation acceleration

• Strong earnings momentum in tech leaders

Risk Factors

• High valuation multiples in technology

• Interest rate sensitivity

• Regulatory scrutiny of big tech

• Market concentration in top holdings

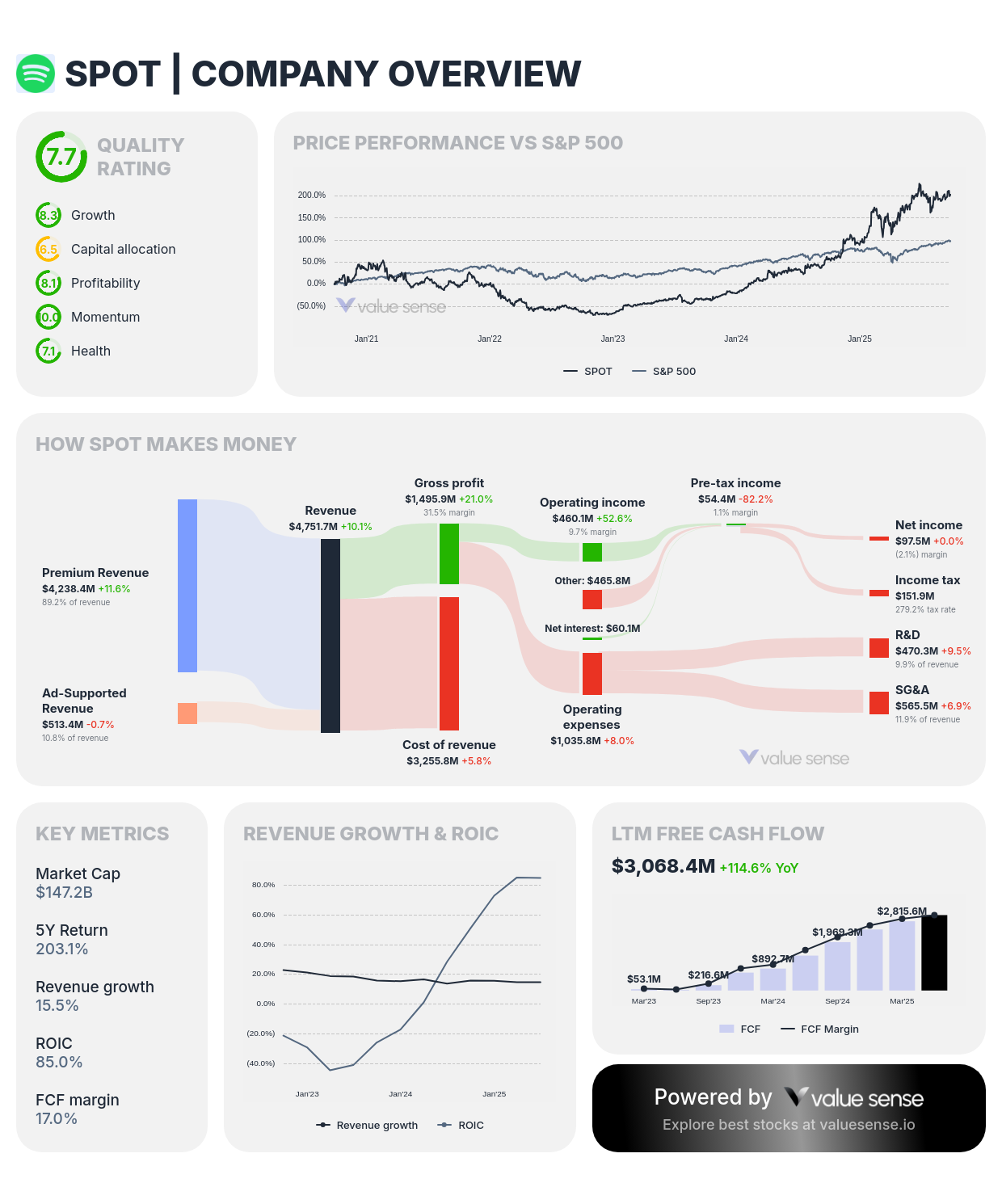

Stock #6: Spotify Technology S.A.

Quick Stats Table

• Market Value: $215.0M

• Portfolio %: 2.7%

• Share Change: +13,000,000

• Value Change: +$61.4M

• Activity: Add 10.04%

• Sector: Media/Streaming

Investment Thesis

Spotify represents the fund's bet on the continued growth of digital media consumption and the streaming economy. The modest 10% increase suggests measured optimism about the company's ability to monetize its large user base and expand into new content verticals.

The company's data analytics capabilities and global reach position it well for continued growth in paid subscriptions and advertising revenue. Strategic initiatives in podcasting and audio content diversification support long-term growth prospects.

Key Catalysts

• Paid subscriber growth acceleration

• Advertising revenue expansion

• Podcast and audio content monetization

• International market penetration

Risk Factors

• Intense competition from tech giants

• Content licensing cost inflation

• Currency exposure in international markets

• Regulatory challenges in key markets

Stock #7: iShares Russell 2000 ETF (IWM)

Quick Stats Table

• Market Value: $226.6M

• Portfolio %: 2.8%

• Sector: Small Cap ETF

Investment Thesis

IWM provides exposure to U.S. small-cap stocks, adding another diversification layer to the portfolio. Small-cap exposure can outperform during economic recovery periods and provides access to companies with higher growth potential but also higher volatility.

The inclusion of IWM balances the large-cap and mega-cap exposure from other ETF holdings, creating a more comprehensive approach to U.S. equity market participation.

Key Catalysts

• U.S. economic recovery benefiting small caps

• Increased M&A activity in small caps

• Interest rate environment favoring growth

• Domestic focus reducing international risks

Risk Factors

• Higher volatility than large-cap indices

• Liquidity constraints in underlying stocks

• Economic sensitivity amplification

• Quality dispersion among holdings

Portfolio Diversification Analysis

Soros Fund Management's Q2 2025 portfolio demonstrates sophisticated diversification across multiple dimensions:

Asset Class Diversification:

• Broad Market ETFs (SPY): 4.2%

• Technology ETFs (QQQ): 2.8%

• Small Cap ETFs (IWM): 2.8%

• Sector-Specific ETFs: Additional exposure

• Individual Stocks: Targeted opportunities

Sector Allocation:

• Broad Market: 4.2%

• Technology: 2.8%

• Renewable Energy: 3.4%

• Materials/Packaging: 4.1%

• Media/Streaming: 2.7%

• Small Cap: 2.8%

This allocation strategy balances growth opportunities with defensive positioning, utilizing ETFs for broad market exposure while making selective individual stock bets in high-conviction sectors.

Risk Management Insights

The fund's 80.2% turnover rate indicates active portfolio management and willingness to adapt positions based on changing market conditions. Key risk management themes include:

- Diversification Through ETFs: Heavy reliance on ETFs reduces single-stock risk while maintaining market participation.

- Sector Balance: Exposure across defensive (materials) and growth (technology, renewable energy) sectors.

- Position Sizing: Largest positions in broad market ETFs provide stability foundation.

- Thematic Investing: Concentrated bets on renewable energy and technology trends.

Market Timing and Entry Strategies

Given the significant position changes this quarter, investors considering similar strategies might employ:

• Staggered Entry: Phased accumulation to manage volatility

• Sector Rotation Monitoring: Tracking institutional flows for timing insights

• ETF Core with Stock Satellites: Using ETFs as foundation with individual stock overlays

• Risk Budget Allocation: Balancing defensive and growth positions based on market conditions

Investment Outlook and Implications

Soros Fund Management's Q2 2025 positioning suggests several market views:

- Constructive on U.S. Markets: Large SPY allocation indicates overall market optimism

- Technology Recovery: Significant QQQ position reflects confidence in tech sector rebound

- Energy Transition: Major First Solar position shows conviction in renewable energy secular trends

- Diversification Premium: Multiple ETF holdings emphasize risk management importance

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Large Cap Stock Picks for 2025

📖 5 Best Telecom Infrastructure Stock Picks for 2025

📖 12 Best Robotics Stock Picks for 2025: In-Depth Analysis & Watchlist

📖 10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

📖 5 Best Stock Picks for October 2025: Top Undervalued Stocks

FAQ

Frequently Asked Questions

Q1: What drives Soros Fund Management's high turnover rate?

A1: The 80.2% turnover reflects active management philosophy, responding to market opportunities and risk management requirements in volatile conditions.

Q2: Why such heavy emphasis on ETFs versus individual stocks?

A2: ETF concentration provides diversification benefits while maintaining market participation, reducing single-stock risk during uncertain market conditions.

Q3: What does the First Solar position indicate about renewable energy?

A3: The 886% increase suggests strong conviction in the energy transition theme and First Solar's competitive positioning in the growing solar market.

Q4: How should retail investors interpret these institutional moves?

A4: These positions offer insight into professional portfolio construction, emphasizing diversification, risk management, and thematic investing approaches.

Q5: What are the key risks in replicating this strategy?

A5: Main risks include market timing challenges, ETF tracking errors, sector concentration, and the need for active management capabilities.

Conclusion

Soros Fund Management's Q2 2025 portfolio reflects a sophisticated approach to market participation, balancing broad market exposure through ETFs with targeted individual stock selections. The strategy emphasizes diversification while maintaining conviction in specific themes like renewable energy and technology recovery.

For investors seeking to understand institutional positioning and portfolio construction principles, this analysis provides valuable insights into professional money management during periods of market uncertainty. The combination of defensive positioning and growth opportunities illustrates timeless investment principles adapted to current market conditions.

For more detailed analysis and investment research tools, visit ValueSense to explore our comprehensive market insights and valuation models.