George Soros - Soros Fund Management Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

George Soros - Soros Fund Management Llc continues to showcase its legendary macro-driven trading style through aggressive position adjustments in the latest 13F filing. The firm's $7B portfolio reflects a dynamic approach with sky-high turnover, trimming 23 positions while building bold new stakes in tech giants and growth plays amid market volatility.

Portfolio Snapshot: High Turnover in a Sprawling Empire

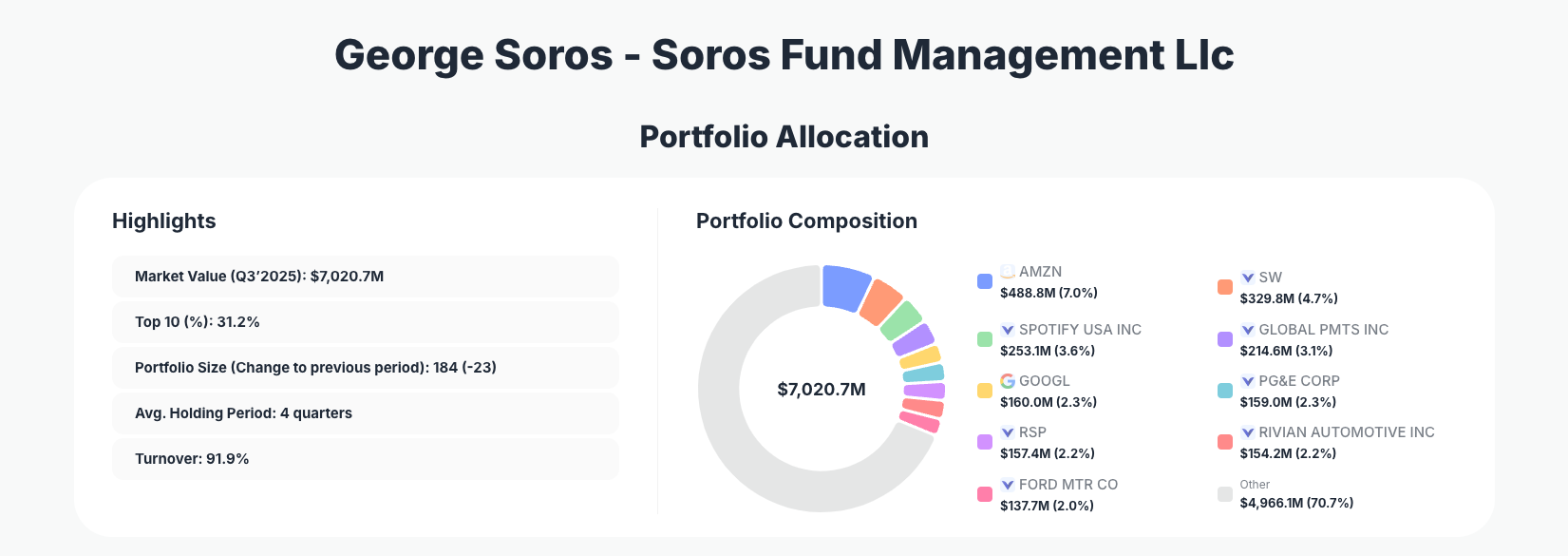

Portfolio Highlights (Q3’2025): - Market Value: $7,020.7M - Top 10 Holdings: 31.2% - Portfolio Size: 184 -23 - Average Holding Period: 4 quarters - Turnover: 91.9%

Soros Fund Management's Q3 2025 portfolio stands out for its massive scale and extreme activity, with 184 positions signaling broad diversification rather than the concentrated bets typical of many superinvestors. The 91.9% turnover rate underscores a high-velocity strategy, where the fund rapidly rotates capital based on macroeconomic shifts—a hallmark of George Soros' reflexive theory of markets, where perceptions drive prices in unpredictable cycles. Despite the sprawling size, the top 10 holdings command just 31.2%, indicating a balanced risk approach across numerous ideas while amplifying conviction plays.

This portfolio structure reveals Soros Fund's adaptability in uncertain times, reducing exposure in 23 names while initiating or expanding others with dramatic moves like 2,341% additions. The average holding period of 4 quarters suggests tactical patience rather than day-trading, allowing positions to play out amid global events. Tracking these shifts via Soros' portfolio page on ValueSense highlights how the fund navigates inflation, tech rallies, and sector rotations.

Top Positions Breakdown: Massive Adds in Tech and ETFs Signal Bullish Momentum

The portfolio's recent changes paint a picture of aggressive growth-oriented bets, starting with powerhouse Amazon.com, Inc. (AMZN) at 7.0% after an eye-popping Add 1,384.12%, positioning it as the #2 holding with $488.8M in value. Smurfit Westrock Plc (SW) follows at 4.7% $329.8M, a modest Add 3.56% tweak to the packaging giant. Streaming leader SPOTIFY USA INC climbed to 3.6% $253.1M via Add 29.68%, while GLOBAL PMTS INC hit 3.1% $214.6M with Add 17.08%, reflecting bets on payments infrastructure.

Tech exposure deepens with Alphabet Inc. (GOOGL) surging to 2.3% $160.0M on an explosive Add 2,341.11%, matching Soros' affinity for digital leaders. Utility PG&E CORP holds 2.3% $159.0M despite Reduce 4.85%, providing defensive balance. ETF INVESCO EXCHANGE TRADED FD T jumped to 2.2% $157.4M with Add 1,542.54%, while RIVIAN AUTOMOTIVE INC stayed steady at 2.2% $154.2M on No change. Auto play FORD MTR CO expanded to 2.0% $137.7M via Add 603.56%.

Changes extend beyond the top 10, with ISHARES TR at 1.9% $132.7M after Add 115.00% and SPDR S&P 500 ETF TR at 1.8% $125.9M gaining Add 93.30%, bolstering broad market exposure amid individual stock risks.

What the Portfolio Reveals About Soros' Macro Playbook

Soros Fund's Q3 moves highlight a tech and growth tilt with massive adds in AMZN, GOOGL, and Spotify, betting on AI-driven digital economies despite high valuations. The heavy ETF rotations like Invesco and SPDR S&P 500 suggest hedging against single-stock volatility while maintaining upside.

Sector diversity spans consumer (Amazon), industrials (Smurfit Westrock), autos (Ford, Rivian), utilities (PG&E), and payments (Global Pmts), reflecting macro bets on economic recovery and consumer spending. High turnover 91.9% indicates opportunistic trading over buy-and-hold, aligned with Soros' famous currency plays.

Risk management shines through a low top-10 concentration 31.2% across 184 positions, diluting blowup risk while chasing alpha. No overt dividend focus; instead, growth and momentum dominate.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Amazon.com, Inc. | $488.8M | 7.0% | Add 1,384.12% |

| Smurfit Westrock Plc | $329.8M | 4.7% | Add 3.56% |

| SPOTIFY USA INC | $253.1M | 3.6% | Add 29.68% |

| GLOBAL PMTS INC | $214.6M | 3.1% | Add 17.08% |

| Alphabet Inc. | $160.0M | 2.3% | Add 2,341.11% |

| PG&E CORP | $159.0M | 2.3% | Reduce 4.85% |

| INVESCO EXCHANGE TRADED FD T | $157.4M | 2.2% | Add 1,542.54% |

| RIVIAN AUTOMOTIVE INC | $154.2M | 2.2% | No change |

| FORD MTR CO | $137.7M | 2.0% | Add 603.56% |

This table underscores Soros Fund's balanced concentration, with no single position exceeding 7% despite blockbuster adds like Amazon and Alphabet. The mix of massive increases (e.g., 2,341% in GOOGL) alongside trims (PG&E) and stability (Rivian) shows disciplined rebalancing. At 31.2% total weight, the top 10 provide focused firepower without over-reliance, enabling the fund to pivot swiftly in a 184-position portfolio.

Investment Lessons from George Soros' Macro Trading Mastery

- Embrace high turnover for macro shifts: 91.9% turnover teaches that staying nimble captures reflexive market moves, not rigid long-term holds.

- Size positions aggressively on conviction: Explosive adds like 1,384% in AMZN reward bold scaling when macro tailwinds align.

- Diversify broadly to manage risk: 184 positions with low top-10 concentration 31.2% prevent any one bet from sinking the ship.

- Mix growth bets with defensive plays: Tech surges paired with utilities and ETFs balance offense and protection.

- Track average holding periods: 4 quarters allows ideas to breathe while avoiding stagnation in fast markets.

Looking Ahead: What Comes Next?

With 91.9% turnover and a net reduction of 23 positions, Soros Fund appears flush with dry powder for Q4 opportunities, potentially deploying into AI, EVs (building on Rivian/Ford), or cyclicals if macro improves. Current tech-heavy positioning sets up well for continued digital growth, but PG&E trim hints at rotating out of utilities amid rate cut expectations.

Watch for broader ETF expansions if volatility spikes, or new macro trades on global events. In frothy markets, this setup positions the fund to exploit dislocations while the sprawling portfolio hedges downside.

FAQ about George Soros Portfolio

Q: What drove Soros Fund's massive position increases in Q3 2025?

A: The fund piled into tech like AMZN (Add 1,384%) and GOOGL (Add 2,341%), plus ETFs, signaling bullishness on growth and broad indices amid economic uncertainty.

Q: Why is Soros Fund's portfolio so large yet low-concentration?

A: At 184 positions with top 10 at just 31.2%, it reflects a macro hedge fund style—spreading bets across ideas while sizing winners aggressively to capture diverse opportunities without single-point failure.

Q: How does high turnover 91.9% fit Soros' strategy?

A: True to his reflexive investing philosophy, rapid rotations exploit market psychology shifts, trimming laggards like PG&E while building momentum plays.

Q: What sectors stand out in recent changes?

A: Tech/digital (Amazon, Alphabet, Spotify), industrials/packaging (Smurfit Westrock), autos/EVs (Ford, Rivian), and ETFs dominate adds, blending growth with tactical hedges.

Q: How can I track and follow George Soros' portfolio?

A: Monitor quarterly 13F filings on the SEC (with a 45-day lag) or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/soros for real-time analysis, historical changes, and visualizations.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!