Glenn Greenberg - Brave Warrior Advisors Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Glenn Greenberg of Brave Warrior Advisors continues to exemplify disciplined value investing with a focus on high-quality businesses trading at attractive valuations. His $4.3B Q3 2025 portfolio showcases active management, including a bold new position in Elevance Health (ELV) and significant reductions in names like Ryanair (RYAAY), signaling tactical adjustments in a concentrated strategy.

Portfolio Overview: Concentration with Calculated Precision

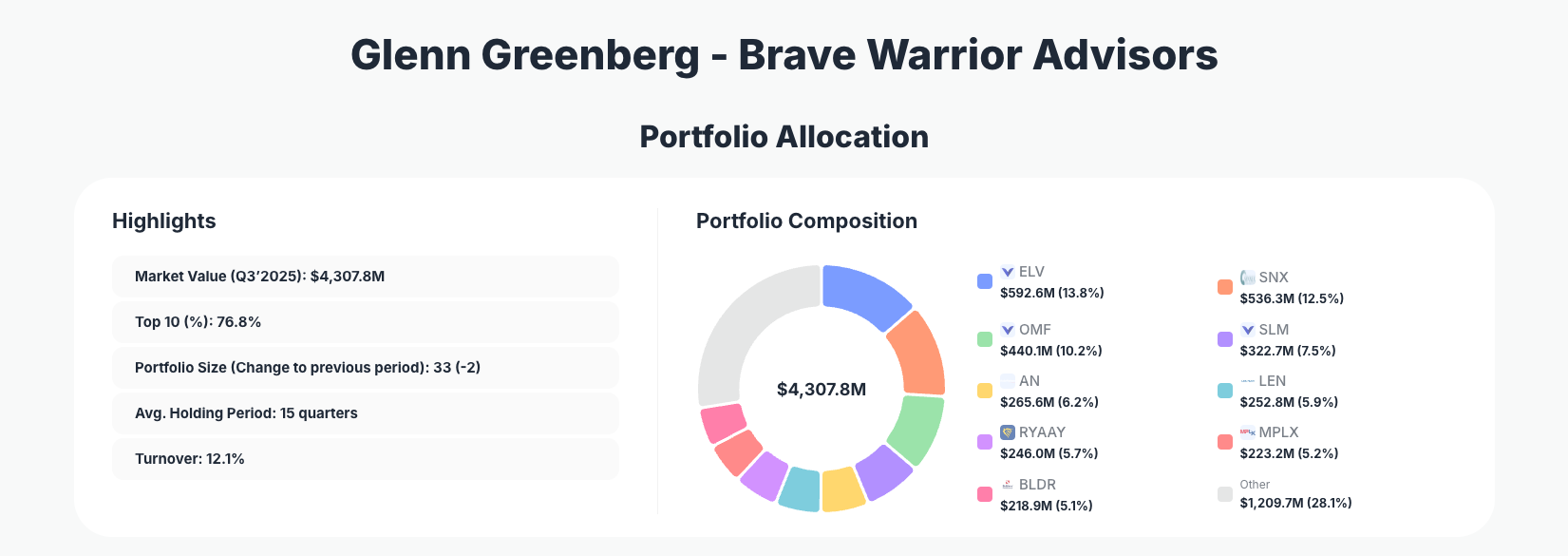

Portfolio Highlights (Q3 2025): - Market Value: $4,307.8M - Top 10 Holdings: 76.8% - Portfolio Size: 33 -2 - Average Holding Period: 15 quarters - Turnover: 12.1%

The Brave Warrior Advisors portfolio maintains its hallmark concentration, with the top 10 holdings commanding 76.8% of the $4.3 billion total. This structure underscores Greenberg's conviction-driven approach, where a select group of positions drives the bulk of performance while the remaining 23 positions provide diversification. The slight reduction in portfolio size to 33 holdings -2 suggests ongoing pruning of lower-conviction names, aligning with a long-term horizon evidenced by the 15-quarter average holding period.

Turnover at 12.1% reflects measured activity—neither stagnant nor overly reactive—allowing Greenberg to capitalize on opportunities without abandoning core principles. This balance is particularly notable in a volatile market, where the firm's focus on resilient sectors like healthcare and financial services positions it for steady compounding. Investors tracking via ValueSense's superinvestor page can see how this concentration has historically delivered superior risk-adjusted returns.

Overall, the portfolio's evolution in Q3 2025 highlights Greenberg's ability to blend patience with opportunism, trimming overvalued positions while initiating bets on undervalued leaders.

Top Holdings: Healthcare Bets and Tactical Reductions Dominate

The Brave Warrior portfolio leads with a fresh Elevance Health (ELV) "Buy" at 13.8% $592.6M, signaling strong conviction in healthcare's defensive qualities. TD SYNNEX (SNX) follows at 12.5% $536.3M after a "Reduce 13.09%" move, potentially locking in gains in the IT distribution space. OneMain Holdings (OMF) holds 10.2% $440.1M with a minor "Reduce 0.96%", maintaining exposure to consumer finance.

Further down, SLM CORP (SLM) rose to 7.5% $322.7M via "Add 10.61%", boosting the student lending play, while AutoNation (AN) at 6.2% $265.6M saw a tiny "Reduce 0.04%". Lennar (LEN) (5.9%, $252.8M) was trimmed "Reduce 7.03%" amid housing market caution, and Ryanair (RYAAY) (5.7%, $246.0M) faced the sharpest cut at "Reduce 24.07%", possibly due to airline sector headwinds. MPLX (MPLX) gained to 5.2% $223.2M with "Add 4.50%", adding midstream energy stability, and Builders FirstSource (BLDR) (5.1%, $218.9M) dipped "Reduce 1.20%". Rounding out changes, Fidelity National Financial (FNF) at 4.9% $211.1M edged up "Add 0.06%", reinforcing title insurance exposure.

These moves paint a picture of selective rotation: building in healthcare and energy while paring cyclical names like airlines and homebuilders, all within a top-heavy structure.

What the Portfolio Reveals

Glenn Greenberg's Q3 adjustments reveal a strategy prioritizing resilient cash generators amid economic uncertainty. Key themes include:

- Quality over growth: New bets like ELV and additions to MPLX emphasize predictable earnings from healthcare and midstream, sectors with strong moats and less sensitivity to growth slowdowns.

- Sector focus: Heavy tilt toward financials (OMF, SLM, FNF) and healthcare, with trims in consumer cyclical (LEN, BLDR) and airlines (RYAAY).

- Geographic concentration: Primarily U.S.-centric with international flavor via RYAAY, but reductions suggest caution on Europe exposure.

- Risk management: Low turnover 12.1% and long holding periods (15 quarters) indicate conviction, balanced by trims in volatile names to manage downside.

- Dividend strategy: Positions like MPLX highlight yield plays for income stability.

This positioning favors durable businesses that can weather inflation or recession, reflecting Greenberg's value discipline.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Elevance Health Inc. (ELV) | $592.6M | 13.8% | Buy |

| TD SYNNEX Corporation (SNX) | $536.3M | 12.5% | Reduce 13.09% |

| OneMain Holdings, Inc. (OMF) | $440.1M | 10.2% | Reduce 0.96% |

| SLM CORP (SLM) | $322.7M | 7.5% | Add 10.61% |

| AutoNation, Inc. (AN) | $265.6M | 6.2% | Reduce 0.04% |

| Lennar Corporation (LEN) | $252.8M | 5.9% | Reduce 7.03% |

| Ryanair Holdings plc (RYAAY) | $246.0M | 5.7% | Reduce 24.07% |

| MPLX LP (MPLX) | $223.2M | 5.2% | Add 4.50% |

| Builders FirstSource, Inc. (BLDR) | $218.9M | 5.1% | Reduce 1.20% |

The table illustrates extreme concentration, with the top three holdings alone exceeding 36% of the portfolio and the top 10 at 76.8%. This setup amplifies returns from winners like the new ELV stake but demands precise selection—evident in the sharp 24% trim to RYAAY, freeing capital for higher-conviction ideas.

Greenberg's trims in six of the top 10 (e.g., SNX -13%, LEN -7%) versus adds in three show disciplined rebalancing, maintaining focus on quality while adapting to valuations. The absence of a #1 holding in the data suggests an even more balanced top tier, reducing single-stock risk in this high-conviction framework.

Investment Lessons from Glenn Greenberg's Brave Warrior Approach

Glenn Greenberg's track record at Brave Warrior Advisors offers timeless principles for value investors:

- Concentrate in what you understand: 76.8% in top 10 reflects deep research into businesses like healthcare (ELV) and financials, avoiding broad diversification.

- Long holding periods drive returns: 15-quarter average underscores patience, letting compounders like MPLX mature.

- Trim winners, add to value: Reductions in RYAAY 24% and adds to SLM 10.6% show profit-taking and opportunistic scaling.

- Position sizing demands vigilance: Minor tweaks like AN -0.04% highlight constant monitoring, even in core holdings.

- Sector rotation with discipline: Shift from cyclicals to defensives mirrors economic cycle awareness without chasing fads.

These lessons emphasize business quality, timing, and conviction over market noise.

Looking Ahead: What Comes Next?

With turnover at 12.1% and two positions trimmed from the portfolio, Brave Warrior likely holds dry powder for deployments in undervalued sectors. The new ELV stake and MPLX add suggest interest in healthcare stability and energy yields, potential areas for further accumulation if valuations dip.

Market conditions—persistent inflation, rate uncertainty—favor Greenberg's defensive tilt, with financials like FNF poised for housing recovery plays. Watch for opportunistic buys in consumer finance or industrials, as the 33-position slate leaves room for 1-2 new convictions. Current positioning sets up for resilient performance in choppy markets, with long holds providing a strong base for 2026 upside.

FAQ about Glenn Greenberg Brave Warrior Advisors Portfolio

Q: What are the most significant changes in Glenn Greenberg's Q3 2025 13F filing?

A: Key moves include a new "Buy" in Elevance Health (ELV) at 13.8%, sharp "Reduce 24.07%" in Ryanair (RYAAY), and "Add 10.61%" to SLM CORP, reflecting rotation toward defensives.

Q: Why does Brave Warrior maintain such high portfolio concentration?

A: Greenberg favors 76.8% in top 10 holdings to maximize returns from high-conviction ideas, backed by deep analysis, while the 15-quarter hold period minimizes trading costs and taxes.

Q: What sectors does Greenberg favor in this portfolio?

A: Healthcare (ELV), financials (OMF, SLM), and energy (MPLX) dominate, with trims in cyclicals like housing and airlines.

Q: How can I track Glenn Greenberg's Brave Warrior portfolio?

A: Follow quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/brave-warrior for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!