Glenn Welling - Engaged Capital Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

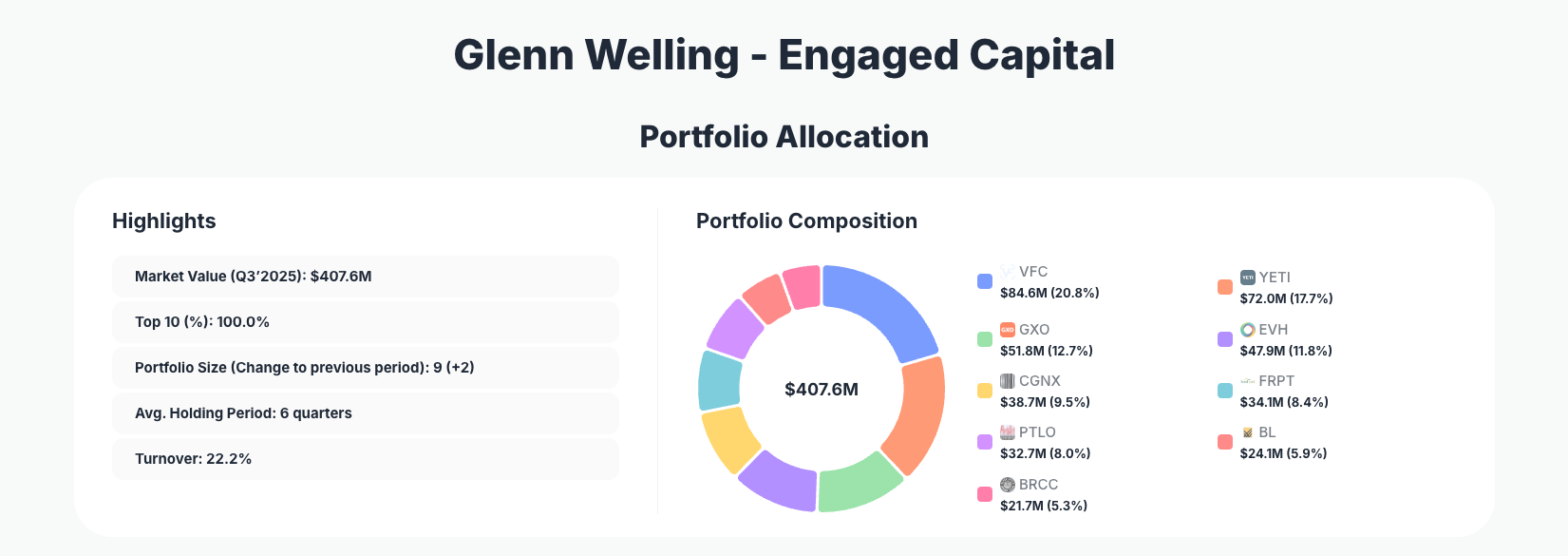

Glenn Welling of Engaged Capital continues to execute his activist investment strategy with precision, targeting undervalued companies ripe for operational improvements. His $407.6M portfolio in Q3 2025 shows dynamic activity across consumer goods, logistics, and healthcare, with notable additions in VFC and a new stake in CGNX, signaling confidence in turnaround stories amid market volatility.

Portfolio Overview: Activist Precision in a Compact Powerhouse

Portfolio Highlights (Q3’2025): - Market Value: $407.6M - Top 10 Holdings: 100.0% - Portfolio Size: 9 +2 - Average Holding Period: 6 quarters - Turnover: 22.2%

Engaged Capital's Q3 2025 portfolio exemplifies the firm's hallmark ultra-concentrated approach, with the top 10 holdings comprising the entire portfolio at 100.0%. This structure underscores Glenn Welling's activist philosophy: deep engagement with a handful of high-conviction ideas rather than broad diversification. The addition of two new positions brings the total to nine, reflecting selective expansion while maintaining focus on businesses where the firm can influence outcomes.

Turnover of 22.2% indicates measured activity, balancing new opportunities like machine vision leader CGNX with trims in positions such as BL. The average holding period of 6 quarters suggests patience in activist campaigns, allowing time for value-unlocking initiatives to materialize. Investors tracking this portfolio via 13F filings will appreciate how Engaged Capital prioritizes quality over quantity in a volatile market.

This setup positions the fund to capitalize on mispriced assets in consumer discretionary and industrials, sectors often overlooked by growth-focused peers. With no dilution from smaller bets, every move carries significant weight.

Top Holdings: Doubling Down on Consumer Resurgence and New Tech Bets

The Engaged Capital portfolio leads with V.F. Corporation (VFC) at 20.8%, where the firm added 8.21% to its stake, betting on a rebound for the apparel giant behind brands like The North Face. Close behind is YETI Holdings (YETI) at 17.7% after a modest Add 0.33%, maintaining exposure to premium coolers and outdoor gear amid lifestyle spending trends.

Logistics play GXO Logistics (GXO) holds 12.7% with an aggressive Add 9.08%, highlighting supply chain optimization potential. Healthcare services firm Evolent Health (EVH) at 11.8% saw a Reduce 3.25%, possibly taking profits after prior gains. A bold new Buy in Cognex (CGNX) commands 9.5%, introducing industrial automation via machine vision technology.

Pet food innovator Freshpet (FRPT) remains steady at 8.4% with No change, anchoring the consumer staples exposure. Portillo's (PTLO) at 8.0% got an Add 4.91%, reinforcing fast-casual dining conviction. Significant trims hit BlackLine (BL) at 5.9% (Reduce 25.57%), while BRC Inc. (BRCC) rounded out changes with Add 2.96% at 5.3%, tapping into the coffee and lifestyle brand space. These moves blend established activists targets with fresh entries, showcasing Welling's adaptability.

What the Portfolio Reveals

Glenn Welling's Q3 positioning reveals a strategic tilt toward consumer discretionary turnarounds and industrial efficiency plays, sectors primed for activist intervention.

- Consumer Focus: Heavy weighting in VFC, YETI, PTLO, and BRCC (over 50% combined) signals bets on brand revitalization amid shifting spending habits.

- Logistics and Tech Efficiency: Additions in GXO and CGNX emphasize supply chain and automation themes, areas ripe for cost-cutting activism.

- Healthcare Discipline: Trim in EVH shows risk management, balancing growth with valuation discipline.

- Risk Management: 100% concentration in 9 names with 22.2% turnover demonstrates high conviction paired with active monitoring, avoiding overexposure.

This mix prioritizes U.S.-centric small-to-mid cap opportunities where engagement can drive outsized returns.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| V.F. Corporation (VFC) | $84.6M | 20.8% | Add 8.21% |

| YETI Holdings, Inc. (YETI) | $72.0M | 17.7% | Add 0.33% |

| GXO Logistics, Inc. (GXO) | $51.8M | 12.7% | Add 9.08% |

| Evolent Health, Inc. (EVH) | $47.9M | 11.8% | Reduce 3.25% |

| Cognex Corporation (CGNX) | $38.7M | 9.5% | Buy |

| Freshpet, Inc. (FRPT) | $34.1M | 8.4% | No change |

| Portillo's Inc. (PTLO) | $32.7M | 8.0% | Add 4.91% |

| BlackLine, Inc. (BL) | $24.1M | 5.9% | Reduce 25.57% |

| BRC Inc. (BRCC) | $21.7M | 5.3% | Add 2.96% |

This table illustrates Engaged Capital's extreme concentration, with the top holding VFC at over 20% and the top five exceeding 72%. Additions dominate changes (six out of nine), reflecting proactive deployment into perceived bargains like GXO and the CGNX initiation. Trims in BL (down 25.57%) suggest profit-taking or shifting priorities. Overall, this structure amplifies activist impact but demands precise stock-picking.

Investment Lessons from Glenn Welling's Activist Approach

- Concentrate on Engagable Businesses: Welling's 100% top-10 allocation teaches that true edge comes from deep involvement in fixable companies like VFC, not passive indexing.

- Active Position Sizing: Additions like 9.08% in GXO show constant reassessment, scaling into winners while trimming laggards such as BL.

- Patience in Turnarounds: A 6-quarter average hold supports giving management time post-engagement, as seen in steady FRPT.

- Diversify Within Conviction: Nine positions span consumer, logistics, and tech, mitigating sector risk without diluting focus.

- Exploit Small-Cap Inefficiencies: New buys like CGNX highlight opportunities where activists can unlock value ignored by large funds.

Looking Ahead: What Comes Next?

Engaged Capital's fully invested stance (100% in top holdings) leaves little cash for immediate deployment, but the +2 position growth and 22.2% turnover suggest ongoing opportunism. Expect further activism in consumer brands if economic softening creates entry points, building on VFC and PTLO. Tech efficiency plays like CGNX position the portfolio for AI-driven industrial gains.

In a 2026 market potentially marked by rate cuts and consumer recovery, these holdings could benefit from multiple expansion. Watch for Q4 13F for signs of consolidation or new campaigns—track updates on ValueSense.

FAQ about Glenn Welling Engaged Capital Portfolio

Q: What are the biggest changes in Engaged Capital's Q3 2025 13F filing?

A: Key moves include Add 9.08% to GXO, a new Buy in CGNX, and significant Reduce 25.57% in BL, alongside additions in VFC and PTLO.

Q: Why does Engaged Capital maintain 100% concentration in just 9 positions?

A: This reflects Glenn Welling's activist strategy, focusing capital on high-conviction ideas where engagement can drive change, maximizing impact over diversification.

Q: What sectors dominate Glenn Welling's portfolio?

A: Consumer discretionary (VFC, YETI, PTLO, BRCC), logistics (GXO), tech (CGNX, BL), healthcare (EVH), and pet food (FRPT), blending turnaround and growth themes.

Q: How can I track Engaged Capital's portfolio like a pro?

A: Follow quarterly 13F filings on the SEC site, but use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/engaged-capital for real-time analysis, visualizations, and change alerts—note the 45-day reporting lag.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!