Google and Intel Q4 2024 Earnings: A Tale of Two Tech Giants

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

The tech world witnessed two vastly different narratives unfold as Google (GOOG) and Intel (INTC) reported their Q4 2024 earnings. While both companies exceeded analyst expectations, the market's reaction—and the underlying business performance—couldn't be more different.

Google: Premium Quality at Premium Prices

Earnings Highlights That Impressed Wall Street

Google delivered exceptional Q4 results that reinforce its position as a dominant tech player:

- EPS: $2.81 (beat expectations of $2.11)

- Revenue: $90.2 billion (beat $89.1 billion consensus)

- Google Cloud Revenue: Up 28% to $12.3 billion

- Operating Margin: Expanded to 34%

- Net Income: Surged 46% YoY

- Capital Allocation: Announced $77 billion share repurchase program

The company's shares initially jumped 7% in after-hours trading before settling at a 3% gain, reflecting investors' confidence in Google's continued growth trajectory.

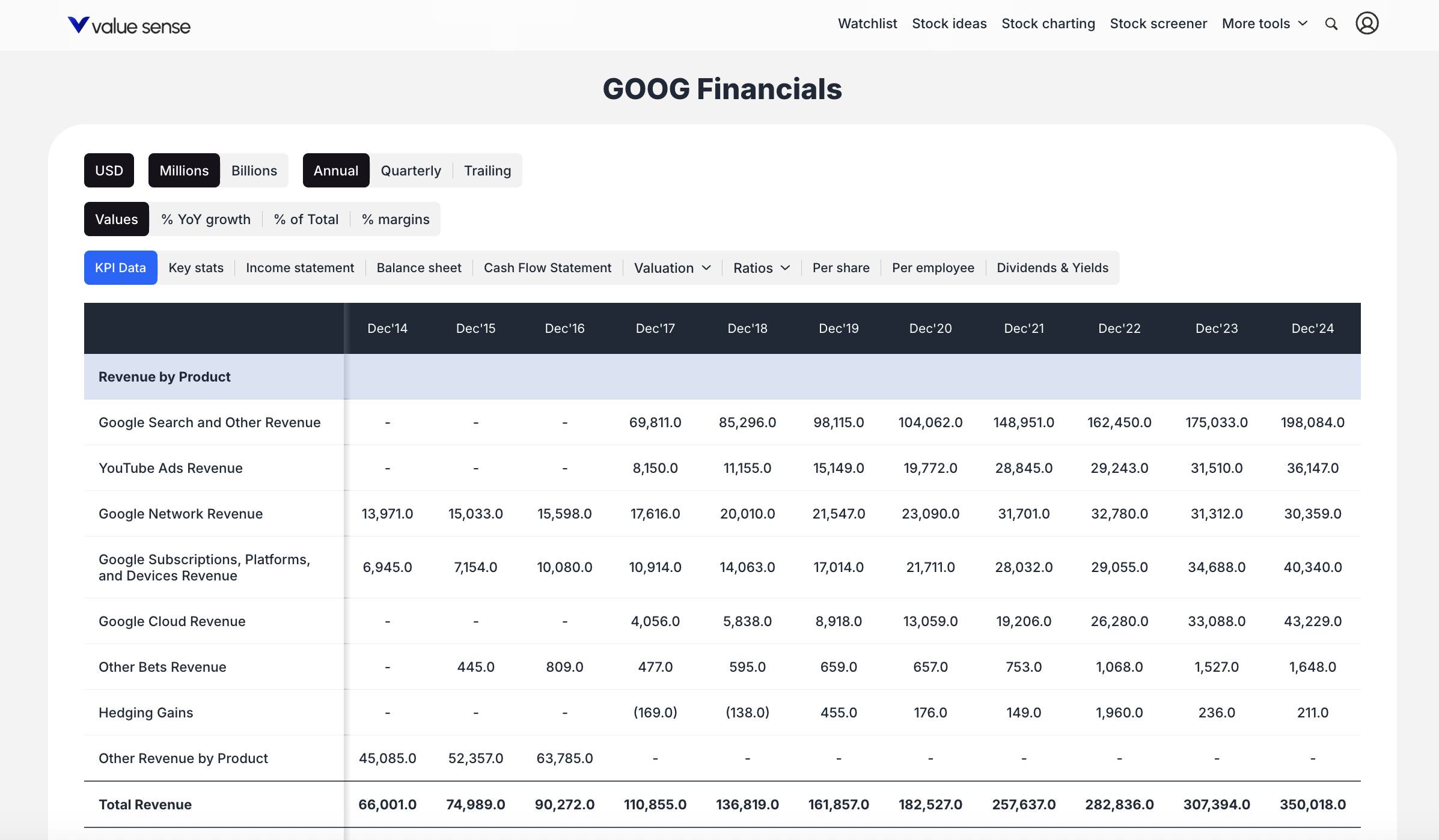

Financial Performance Deep Dive

Google's financial health remains robust, with several key metrics highlighting its competitive advantages:

Revenue Breakdown (Q4 2024):

- Google Search and Other Revenue: $43.2B (up from $40.3B in Q4 2023)

- YouTube Ads Revenue: $9.9B (up from $8.6B in Q4 2023)

- Google Cloud Revenue: $11.4B (up from $9.2B in Q4 2023)

- Total Revenue: $90.2B (up from $86.3B in Q4 2023)

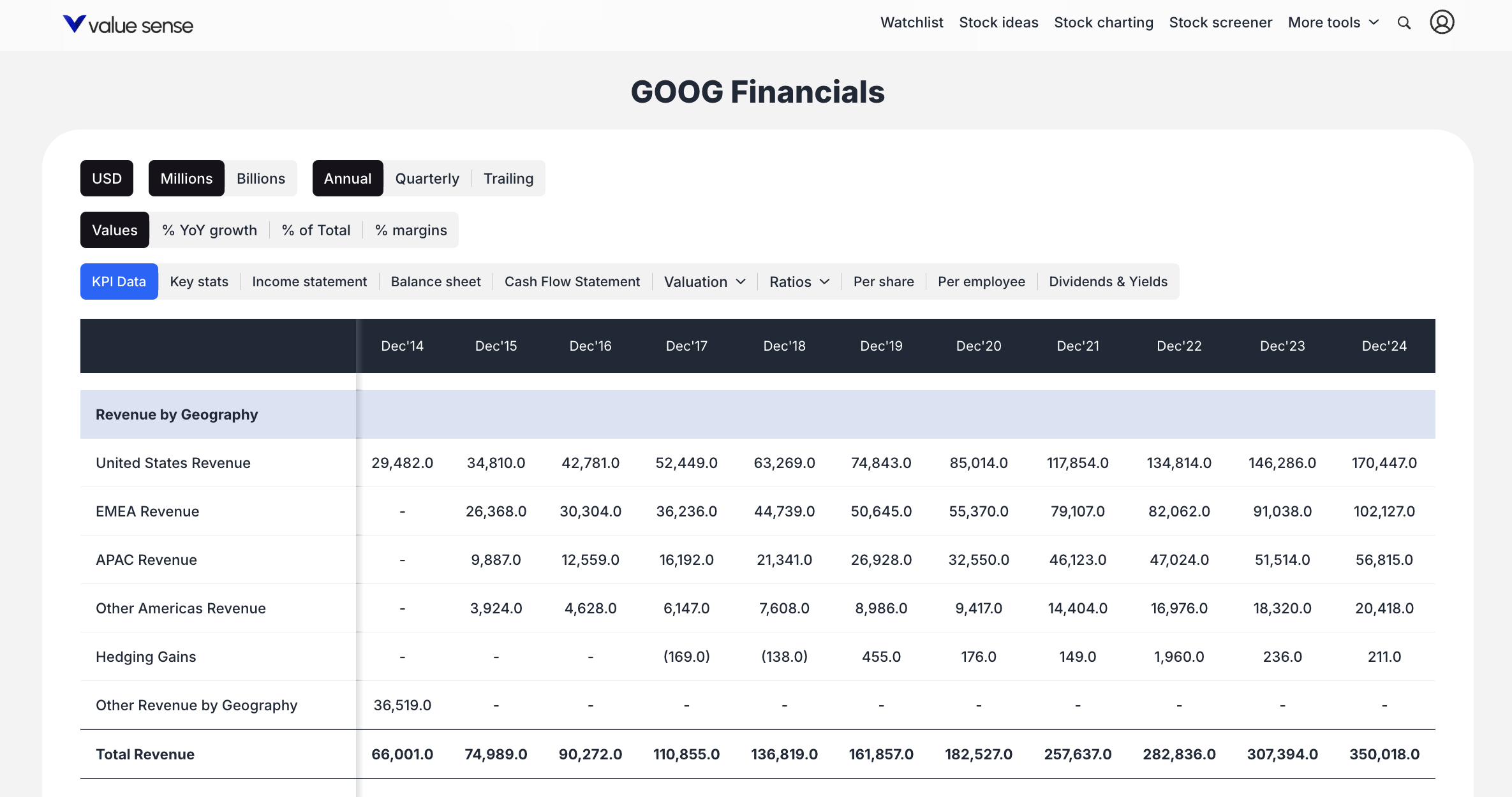

Geographic Performance:

- United States: $42.8B (47% of total revenue)

- EMEA: $30.3B (34% of total revenue)

- APAC: $12.6B (14% of total revenue)

- Other Americas: $4.6B (5% of total revenue)

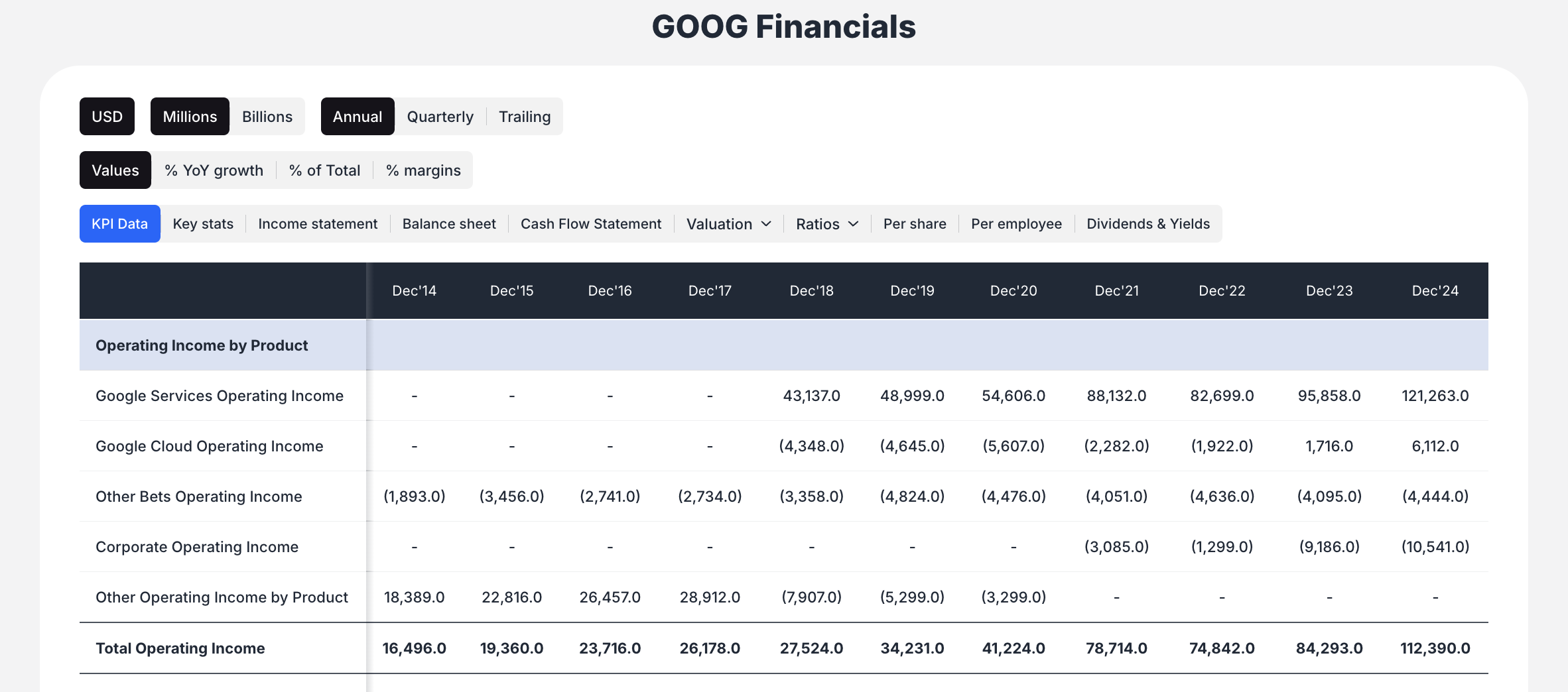

Operating Income by Segment:

- Google Services: $28.9B

- Google Cloud: $1.9B (significant improvement from losses in 2023)

- Total Operating Income: $27.5B (operating margin of 30.5%)

Valuation Analysis: Is Google Stock Overvalued?

Despite its impressive performance, Google's valuation raises important questions for investors:

- Current P/E Ratio: 28x (5-year average)

- Price to Free Cash Flow: 31x (5-year metric)

- Analyst Projections: EPS expected to grow from $9.21 to $17 over 4 years

- DCF Analysis: Suggests fair value around $200 per share

- Traffic Acquisition Costs: $13.5B (14% of revenue, remained stable YoY)

- Paid Clicks Change: +5.0% (showing solid search engagement)

- Cost-per-Click Change: +7.0% (improving ad monetization)

- Impressions Change: +11.0% (expanding ad inventory)

- Cost-per-Impression Change: +10.0% (strong ad pricing power)

Based on discounted cash flow model, investors buying at current levels might expect approximately 12% annualized returns—assuming middle-case growth scenarios materialize.

Intel: Deep Value or Value Trap?

Earnings Results Amid Turnaround Efforts

Intel's Q4 results tell a different story despite beating expectations:

- EPS: $0.13 (beat $0.01 estimate)

- Revenue: $12.67 billion (beat $12.3 billion estimate)

- Stock Reaction: Down 7% after-hours

- Q2 2025 Guidance: Revenue $11.2-12.4 billion, expecting GAAP loss of $0.32/share

The Turnaround Challenge

Intel faces significant headwinds as it attempts to reverse years of decline:

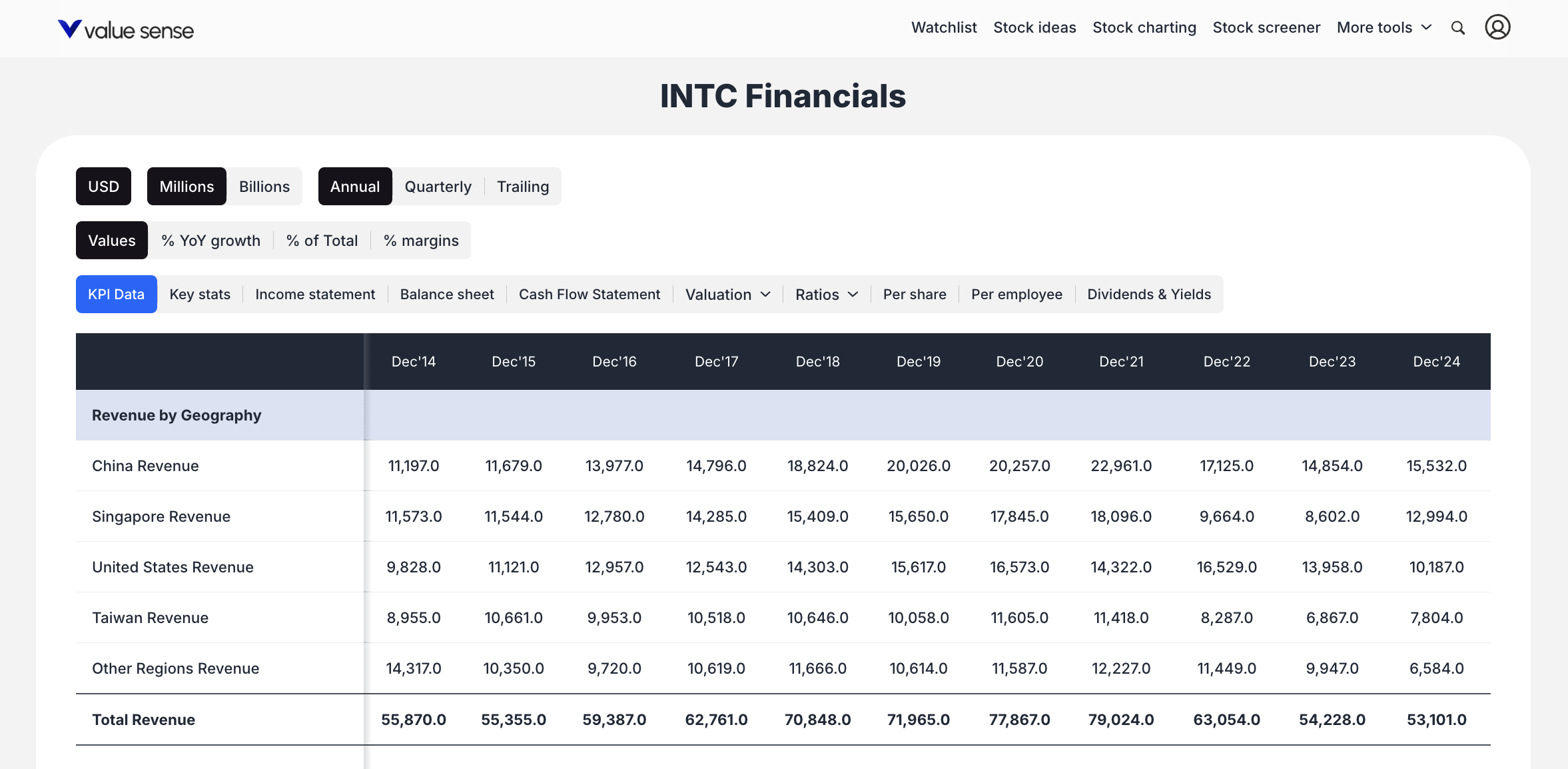

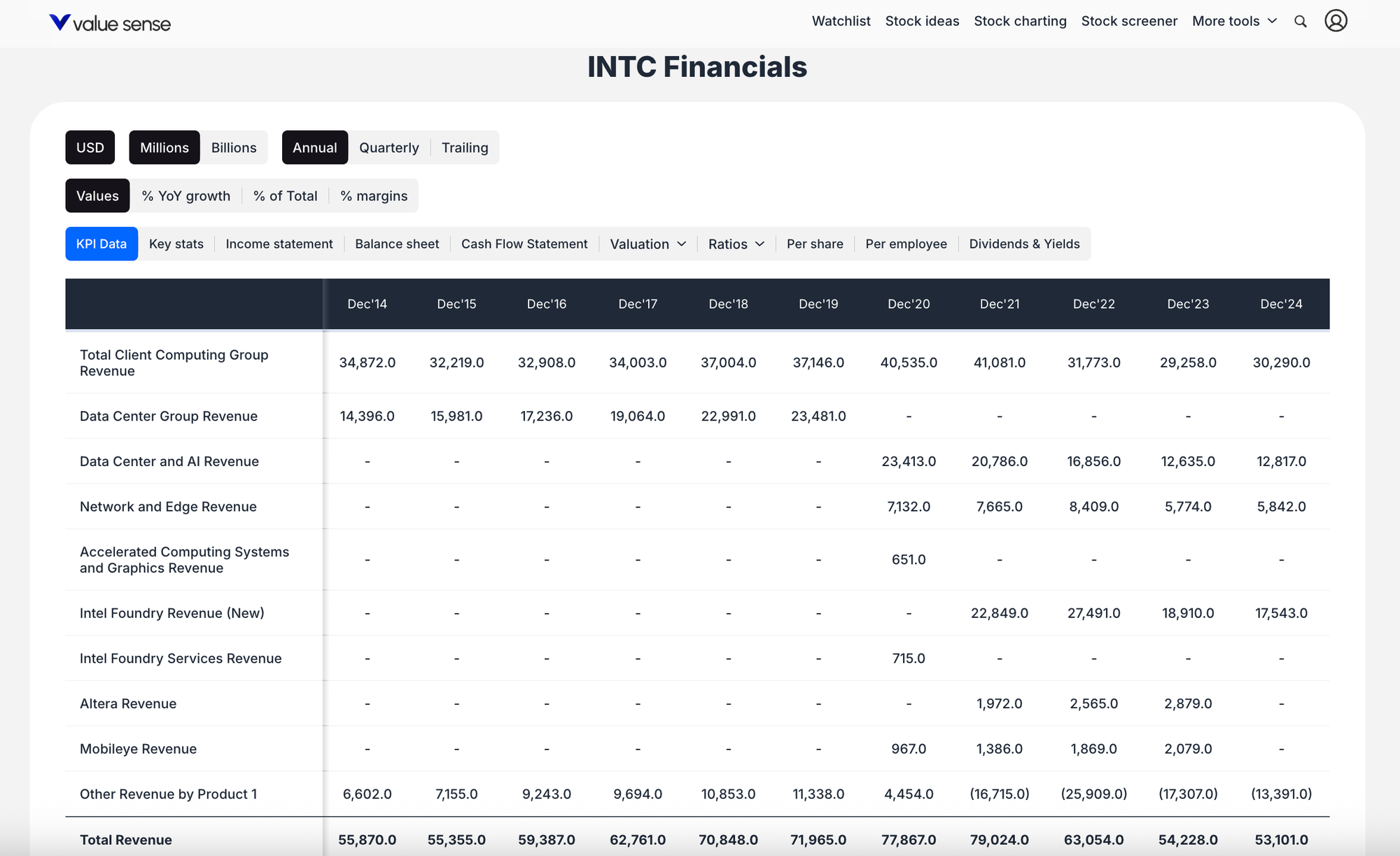

Revenue Trajectory (Annual):

- Peak: $79.0B in 2021

- Current: $53.1B in 2024

- Q4 2024: $12.7B (compared to $14.0B in Q4 2023)

Geographic Revenue Breakdown (Q4 2024):

- China: $4.0B (31% of quarterly revenue)

- Singapore: $3.5B (28% of quarterly revenue)

- United States: $3.2B (25% of quarterly revenue)

- Taiwan: $1.1B (9% of quarterly revenue)

Product Segment Performance:

- Client Computing Group (CCG): $7.3B (down from $8.9B YoY)

- Data Center and AI: $3.4B (down from $4.0B YoY)

- Network and Edge: $1.4B (down from $1.5B YoY)

- Intel Foundry: $4.5B (new reporting segment)

Investment Thesis: High Risk, High Potential Reward

Despite challenges, Intel presents an intriguing opportunity for value investors:

- Acquisition Potential: Trading below levels that make buyout attractive

- Brand Value: Intel remains a recognized name in processing

- Foundry Assets: Valuable intellectual property and manufacturing capabilities

- Intrinsic value: Conservative estimates suggest $19-50 range (middle case $32)

Google vs Intel: Which Stock to Buy?

Google's Investment Case

Pros:

- Market-leading positions in search and cloud

- Consistent growth and profitability

- Strong moat and competitive advantages

- Healthy balance sheet

Cons:

- Premium valuation limits upside

- Regulatory risks

- Competition in cloud and AI

Intel's Investment Case

Pros:

- Deep discount to historical valuations

- Turnaround potential

- Strong brand and IP portfolio

- Acquisition target possibility

Cons:

- Execution risk high

- Competitive pressures intense

- Turnaround timeline uncertain

- Continued market share losses

Investment Strategy Recommendations

For Growth Investors

Google offers quality and certainty at a fair price. The company's dominant market positions and consistent growth justify premium valuations for those seeking stability with moderate upside potential.

For Value Investors

Intel presents a classic deep value opportunity. Patient investors willing to endure volatility might find significant upside if the turnaround succeeds—but must accept the risk of further deterioration.

Portfolio Positioning

- Risk-Averse Investors: Google provides steady growth with lower volatility

- Risk-Tolerant Investors: Intel offers potential multi-bagger returns with higher uncertainty

- Balanced Approach: Consider both positions sized according to risk tolerance

Conclusion

The Q4 2024 earnings reports from Google and Intel highlight the diverging paths of two tech giants. Google continues to execute flawlessly, commanding premium valuations for premium performance. Intel struggles to regain its footing, offering potential value for those willing to bet on a successful turnaround.

Your investment decision should align with your risk tolerance, time horizon, and investment philosophy. Neither choice is inherently right or wrong—they simply represent different approaches to capturing returns in the technology sector.

This analysis is based on data compiled by Value Sense as of April 2025. Investors should conduct thorough due diligence before making investment decisions.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Rule of 40 Analysis: High-Performance Tech Stocks

📖 S&P 500 Fair Value Heatmap

📖 9 Undervalued Low Debt Stocks to Buy - 2025

FAQ: Google vs Intel: Q4 Earnings

Q: What were Google's Q4 2024 earnings highlights?

Google reported EPS of $2.81 (beat $2.11 expected) and revenue of $90.2 billion (beat $89.1 billion expected). The company saw strong growth in Google Cloud (+28%), expanded operating margins to 34%, and announced a $77 billion share buyback program.

Q: How did Intel perform in Q4 2024?

Intel beat expectations with EPS of $0.13 (vs $0.01 expected) and revenue of $12.67 billion (vs $12.3 billion expected). However, the stock fell 7% after-hours as the company continues to navigate its turnaround strategy.

Q: Is Google stock overvalued at current prices?

With a P/E ratio of 28x and price-to-FCF of 31x, Google trades at a premium to market averages. DCF analysis suggests fair value around $200, indicating the stock is fairly valued but offers limited margin of safety.

Q: What's the investment thesis for Intel stock?

Intel represents a turnaround play with significant upside potential if successful. Trading below $20 (down from $60+ highs), conservative DCF analysis suggests a value range of $19-50, offering potential multi-bagger returns but with high execution risk.

Q: Which stock is better for long-term investors?

It depends on your risk tolerance. Google offers quality and stability with moderate upside potential, while Intel presents higher risk but potentially higher rewards if the turnaround succeeds.

Q: How has Intel's revenue declined over recent years?

Intel's revenue has fallen from a peak of $79 billion in 2021 to $53.1 billion in 2024, with Q4 2024 revenue at $12.7 billion (down from $14.0 billion in Q4 2023).

Q: What's driving Google's growth?

Google's growth is primarily driven by its cloud business (+28% YoY), continued strength in search and YouTube advertising, and improving monetization metrics (cost-per-click up 7%, impressions up 11%).

Q: Are there acquisition possibilities for Intel?

At current prices below $20, Intel becomes an attractive acquisition target due to its valuable brand, foundry assets, and intellectual property portfolio. Several tech companies have the cash reserves to consider such a move.

Q: What are the main risks for Google investors?

Key risks include regulatory scrutiny, competition in AI and cloud computing, and the premium valuation leaving limited room for error or multiple expansion.

Q: When might Intel's turnaround show results?

Management guidance suggests normalization by 2027, making this a multi-year turnaround play. Investors should expect continued volatility and potential losses in the near term.