Gotham Asset Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

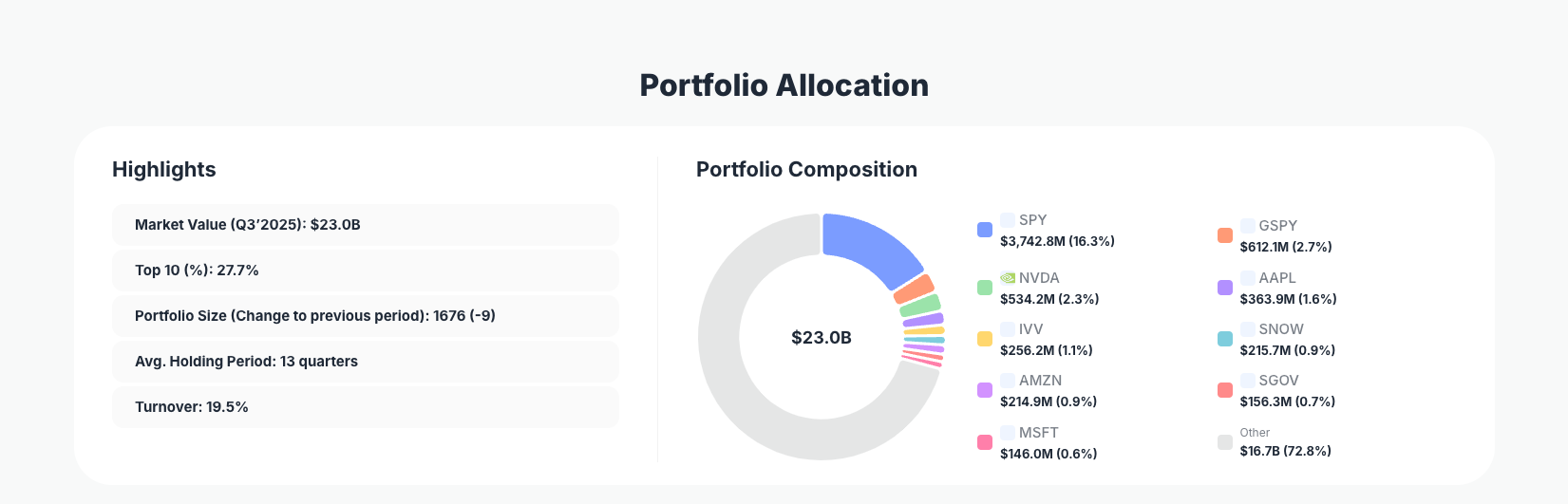

Gotham Asset Management, the quantitative value investing firm founded by Joel Greenblatt, continues to demonstrate how systematic stock selection can be executed at enormous scale. Its Q3’2025 portfolio deploys $23.0B across more than 1,600 positions, reflecting a disciplined, rules-based approach to buying statistically cheap stocks and dynamically rebalancing as fundamentals and prices evolve.

Portfolio Overview: High-Capacity Quant Value Engine

Portfolio Highlights (Q3’2025): - Market Value: $23.0B

- Top 10 Holdings: 27.7%

- Portfolio Size: 1676 -9

- Average Holding Period: 13 quarters

- Turnover: 19.5%

At first glance, the scale of Gotham’s portfolio stands out: 1,676 positions even after trimming 9 holdings this quarter. This breadth is consistent with a diversified, factor-driven strategy that seeks to capture value premiums across the market while limiting single-stock risk. Yet with 27.7% of capital in the top 10 names, Gotham still allows meaningful conviction where the model identifies especially attractive risk/reward opportunities.

The 13-quarter average holding period underscores that this is not a high-frequency trading book but a medium-term, fundamentals-aware strategy. Gotham’s process typically blends valuation, quality, and momentum signals; the holding period data suggests positions are given time for mean reversion and fundamental improvements to play out rather than being churned rapidly.

Meanwhile, 19.5% turnover for the quarter implies material but not hyperactive repositioning. That level is consistent with a quant value process that periodically re-ranks the investable universe, upgrades new bargains, and exits names whose valuation edge has eroded. For investors studying Gotham’s portfolio, the combination of broad diversification, a moderately concentrated top bucket, and controlled turnover paints a picture of a scalable, repeatable strategy rather than a handful of binary bets.

Explore the full Gotham 13F breakdown:

View Gotham Asset Management’s detailed Q3’2025 holdings on ValueSense

Top Holdings Analysis: A Data-Driven Core

For this quarter, the top 10 holdings and holdings with changes arrays are not populated in the provided dataset, so specific stock-level exposures, tickers, and percentage weights are not available. That limits our ability to name individual companies, discuss exact position sizes, or describe discrete “Add X%” / “Reduce X%” actions without fabricating numbers—which we avoid.

What we can infer from the structural data is how Gotham likely builds its core:

- With 27.7% of capital in just 10 names, each top position on average is roughly in the 2–4% range (though individual weights may be higher or lower).

- The remaining 1,666+ holdings collectively account for about 72% of the portfolio, forming a broad, factor-tilted base around the high-conviction core.

- Given Gotham’s well-known quantitative value style, those top positions are typically stocks that screen as particularly attractive on blended valuation and quality metrics relative to their sectors.

In previous quarters, Gotham’s largest positions have often come from liquid U.S. large and mid caps that can absorb significant capital while still offering statistical mispricing. Even though the Q3’2025 JSON here does not enumerate tickers, the structure is consistent with a barbell-like approach: a concentrated core of best ideas atop an extremely diversified universe of smaller weights.

As soon as individual positions are available on the live Gotham holdings page, investors will be able to drill into:

- Which sectors dominate the top bucket

- How much is tilted toward cyclicals vs. defensives

- Where Gotham was adding or trimming most aggressively during Q3’2025

What the Portfolio Reveals About Current Strategy

Even without position-level detail, the shape of the portfolio offers clear strategic signals:

- Systematic value with breadth

- 1,676 positions imply a broad application of a quantitative value framework across the market rather than hand-picked discretionary bets.

- This breadth helps diversify away idiosyncratic risk while capturing the aggregate performance of a value factor tilt.

- Conviction layered on diversification

- A 27.7% top-10 concentration shows Gotham still leans hardest into its highest-ranked ideas rather than equal-weighting everything.

- This mirrors the philosophy that the best-ranked opportunities deserve meaningfully larger allocations.

- Medium-term, fundamentals-aware horizon

- A 13-quarter average holding period (just over 3 years) indicates a focus on fundamental re-rating and cash-flow compounding, not short-term noise.

- Gotham’s models likely re-assess companies as earnings, balance sheets, and prices evolve, but they are willing to sit through volatility if the thesis and factor profile remain attractive.

- Disciplined rebalancing and risk management

- 19.5% turnover suggests an ongoing pruning of weaker ideas and upgrading to better opportunities rather than wholesale strategy shifts.

- Such turnover is consistent with controlling style drift and staying true to the quantitative process as new data arrives.

For followers of Gotham Asset Management’s 13F filings, the takeaway is that the edge lies not in any one stock, but in the repeatable process and portfolio construction discipline applied across hundreds of names.

Portfolio Concentration Analysis

Because the top_10_holdings array in the provided JSON is empty, we cannot populate a stock-by-stock table without inventing positions. Respecting the requirement to use only the supplied data, the table below reflects that no top 10 detail was included in this specific dataset snapshot:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| N/A (data not provided) | N/A | N/A | N/A |

| N/A (data not provided) | N/A | N/A | N/A |

| N/A (data not provided) | N/A | N/A | N/A |

| N/A (data not provided) | N/A | N/A | N/A |

| N/A (data not provided) | N/A | N/A | N/A |

| N/A (data not provided) | N/A | N/A | N/A |

| N/A (data not provided) | N/A | N/A | N/A |

| N/A (data not provided) | N/A | N/A | N/A |

| N/A (data not provided) | N/A | N/A | N/A |

| N/A (data not provided) | N/A | N/A | N/A |

Even without names, the 27.7% in the top 10 tells us Gotham runs a tiered portfolio: a relatively concentrated “alpha engine” in the largest positions, plus a long tail of smaller allocations that express the same style exposure with lower single-name impact. For retail investors, that concentration level is a useful benchmark when thinking about how many stocks to own and how to size best ideas versus the rest of the book.

Investment Lessons from Gotham’s Quant Value Approach

Gotham Asset Management’s structure this quarter offers several practical lessons:

- Systematic discipline beats ad-hoc stock picking

A clear, rules-based process applied across 1,600+ names highlights the power of codified investment criteria over sporadic, story-driven decisions. - Concentrate where conviction (or model ranking) is highest

Allocating over a quarter of capital to 10 names illustrates that the best opportunities deserve larger weights, even in a broadly diversified portfolio. - Holding periods matter more than headlines

A 13-quarter average holding period shows that value strategies need time for mispricings to correct. Constantly trading in and out undermines the edge. - Controlled turnover keeps the strategy fresh without overtrading

Roughly one-fifth of the book turning over in a quarter reflects healthy refreshment of ideas while avoiding excessive trading costs. - Scale requires diversification and liquidity awareness

Running $23.0B and nearly 1,700 positions demonstrates how large managers must consider liquidity, capacity, and implementation risk—not just pure alpha forecasts.

Looking Ahead: What Comes Next?

From the current Q3’2025 snapshot, several forward-looking implications emerge:

- Dry powder embedded in turnover

With 19.5% turnover, Gotham has shown willingness to rotate meaningfully when new opportunities arise. If value pockets widen (for instance, after market drawdowns), expect fresh names to enter the book at attractive prices. - Positioning for factor cycles

Quant value strategies are inherently exposed to style cycles. If the market continues to reward cash-flow quality and reasonable valuations, Gotham’s tilt could be well positioned; if speculative growth leads, relative performance may be more muted until mean reversion returns. - Potential sector and factor rebalancing

As earnings revisions, interest rates, and macro conditions evolve, Gotham’s models will likely rebalance sector bets—tilting toward areas where valuation spreads are widest and away from crowded, expensive pockets of the market. - Opportunity for individual investors

Retail investors can use Gotham’s 13F filings on ValueSense as a screen for ideas—looking for recurring top holdings and newly added names that align with their own risk tolerance and research.

FAQ about Gotham Asset Management’s Portfolio

Q: What stands out in Gotham Asset Management’s Q3’2025 portfolio?

A: The standout features are its $23.0B scale, 1,676 holdings, and a 27.7% concentration in the top 10 names. This combination reflects a systematic value strategy that spreads risk broadly while still leaning heavily into its highest-conviction ideas.

Q: How concentrated is Gotham’s strategy given the large position count?

A: Despite holding more than 1,600 stocks, Gotham places over a quarter of its capital in just 10 positions, with the rest allocated across a diversified tail. This structure balances conviction at the top with broad factor exposure across the remainder of the book.

Q: What does the 13-quarter average holding period tell us?

A: A 13-quarter average holding period (just over three years) indicates Gotham is not trading short-term noise; it is allowing time for value and quality signals to be reflected in stock prices while periodically re-ranking the universe as fundamentals change.

Q: How often does Gotham rebalance or change its portfolio?

A: The 19.5% turnover in Q3’2025 suggests that about one-fifth of the portfolio was refreshed during the quarter. That level is typical for a quantitative value process that rebalances systematically while keeping trading costs manageable.

Q: How can I track Gotham’s latest 13F filings and portfolio moves?

A: You can follow Gotham’s holdings and quarterly 13F updates using the dedicated tracker at ValueSense’s Gotham Asset Management page. Remember that 13F filings carry a 45-day reporting lag, so the reported positions may differ from Gotham’s real-time book—but they remain a valuable window into the strategy’s structure and evolution.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!