10 Best Graham Number Stocks: Benjamin Graham's Value Method for 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Timeless Power of Benjamin Graham's Value Investing Method

Benjamin Graham, widely regarded as the father of value investing, developed systematic approaches to identify undervalued securities through rigorous fundamental analysis. His revised fair value methodology combines earnings power with book value to establish conservative intrinsic worth estimates, providing investors with a disciplined framework for identifying companies trading below their fundamental value.

The Graham Number represents one of the most enduring valuation tools in investing, calculated using the formula:

Graham Number=22.5×EPS×Book Value per ShareGraham Number=22.5×EPS×Book Value per Share

This methodology emphasizes companies with both strong earnings power and substantial tangible assets, providing a conservative approach to intrinsic value estimation that prioritizes downside protection over speculative growth projections.

Graham Number Selection Criteria:

- Trading below Ben Graham's revised fair value (undervalued based on Graham methodology)

- Strong earnings consistency and book value supporting intrinsic value calculations

- Quality business fundamentals with sustainable competitive positions

- Multiple valuation approaches providing additional confirmation of undervaluation

Top 10 Graham Number Stocks - Ranked by Graham Undervaluation

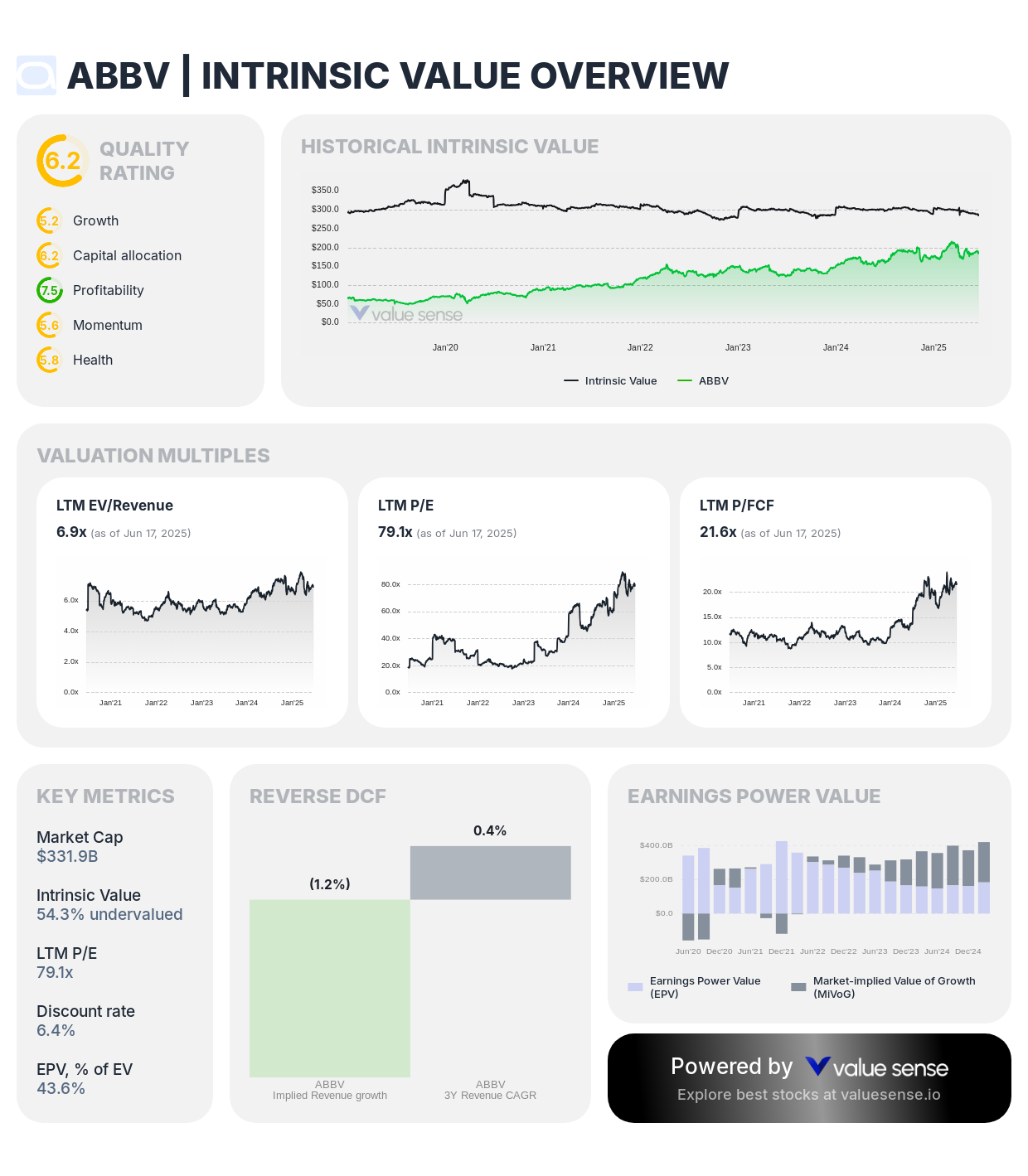

1. AbbVie Inc. (ABBV) - 686.8% Undervalued by Graham Method ⭐

Sector: Pharmaceuticals | Enterprise Value: $396.6B

Complete Valuation Analysis:

- Ben Graham Revised Fair Value: 686.8% undervalued

- Intrinsic Value: 54.3% undervalued

- DCF Value: 133.0% undervalued

- Relative Value: 24.6% overvalued

- Peter Lynch Fair Value: 81.0% undervalued

- Earnings Power Value: 43.6% of Enterprise Value

Investment Thesis: AbbVie represents the most compelling Graham Number opportunity with an extraordinary 686.8% undervaluation according to Ben Graham's revised fair value methodology. Despite facing patent cliff challenges with Humira, AbbVie has successfully diversified its pharmaceutical portfolio with breakthrough treatments in immunology, oncology, and neuroscience. The company's robust pipeline and exceptional free cash flow generation create substantial intrinsic value that Graham's conservative methodology effectively captures.

Graham Method Analysis: Graham's emphasis on earnings consistency and tangible assets aligns perfectly with AbbVie's pharmaceutical operations. The company demonstrates the predictable cash flows and substantial R&D assets that Graham valued, while its diversified portfolio reduces single-product dependency risks that concerned conservative value investors.

Value Catalysts:

- Diversified pharmaceutical portfolio with multiple growth drivers beyond Humira

- Robust late-stage pipeline in high-growth therapeutic areas

- Strategic acquisitions enhancing competitive positioning and market reach

- Strong free cash flow generation supporting dividend sustainability and growth

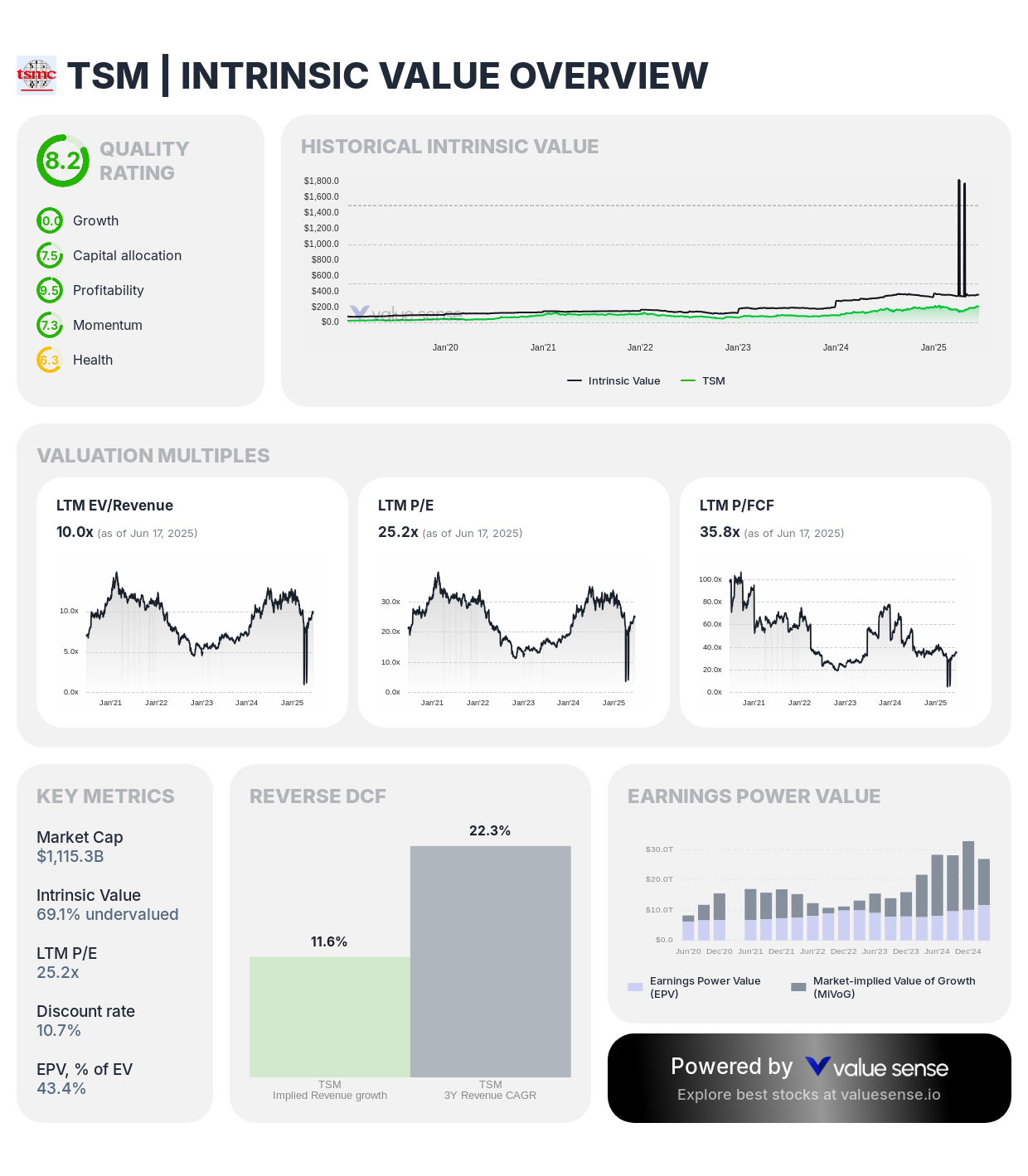

2. Taiwan Semiconductor Manufacturing Company (TSM) - 632.4% Undervalued by Graham Method

Sector: Semiconductors | Enterprise Value: $1,057.4B

- Ben Graham Revised Fair Value: 632.4% undervalued

- Intrinsic Value: 69.1% undervalued

- DCF Value: 20.0% overvalued

- Relative Value: 158.4% undervalued

- Peter Lynch Fair Value: 521.5% undervalued

- Earnings Power Value: 43.4% of Enterprise Value

Investment Thesis: TSMC's 632.4% Graham undervaluation reflects the market's failure to appreciate the extraordinary earnings power and asset base of the world's leading semiconductor foundry. The company's technological leadership in advanced process nodes and essential role in global technology supply chains create substantial competitive moats that Graham's methodology effectively recognizes through its focus on tangible assets and consistent earnings.

Graham Method Analysis: Graham valued companies with irreplaceable competitive positions and substantial capital investments, both characteristics TSMC demonstrates through its semiconductor manufacturing leadership. The company's massive fabrication facilities and technological advantages create the tangible asset base Graham emphasized in his value calculations.

Value Catalysts:

- Dominant position in advanced semiconductor manufacturing with limited global competition

- Essential supplier relationships with technology leaders ensuring demand visibility

- Massive capital investments creating substantial barriers to entry

- Artificial intelligence and data center growth driving premium pricing and capacity utilization

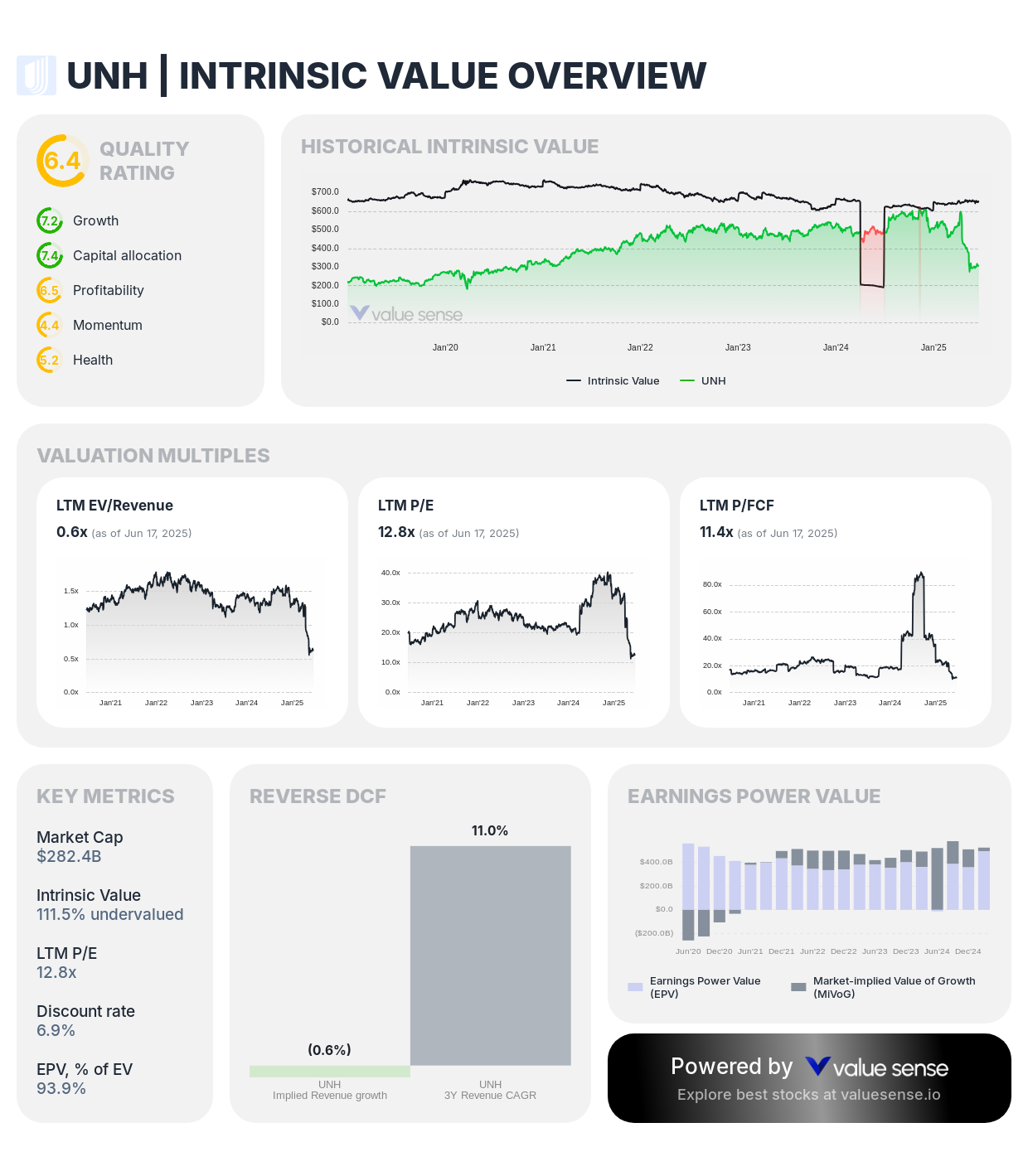

3. UnitedHealth Group Incorporated (UNH) - 565.9% Undervalued by Graham Method

Sector: Healthcare | Enterprise Value: $258.1B

- Ben Graham Revised Fair Value: 565.9% undervalued

- Intrinsic Value: 111.5% undervalued

- DCF Value: 236.0% undervalued

- Relative Value: 13.3% overvalued

- Peter Lynch Fair Value: 289.1% undervalued

- Earnings Power Value: 93.9% of Enterprise Value

Investment Thesis: UnitedHealth Group demonstrates exceptional undervaluation at 565.9% below Graham's revised fair value, supported by the highest Earnings Power Value (93.9%) in our analysis. As America's largest health insurer with rapidly growing Optum health services, UnitedHealth combines defensive healthcare characteristics with substantial growth opportunities through demographic trends and integrated care delivery.

Graham Method Analysis: Graham's methodology captures UnitedHealth's exceptional earnings consistency and substantial tangible assets through its diversified healthcare operations. The company's predictable insurance cash flows and growing healthcare services create the earnings stability Graham sought in defensive value investments.

Value Catalysts:

- Aging population demographics driving sustained healthcare demand growth

- Integrated care delivery model improving operational efficiency and patient outcomes

- Optum health services expansion creating higher-margin revenue streams

- Technology investments enhancing competitive positioning and cost management

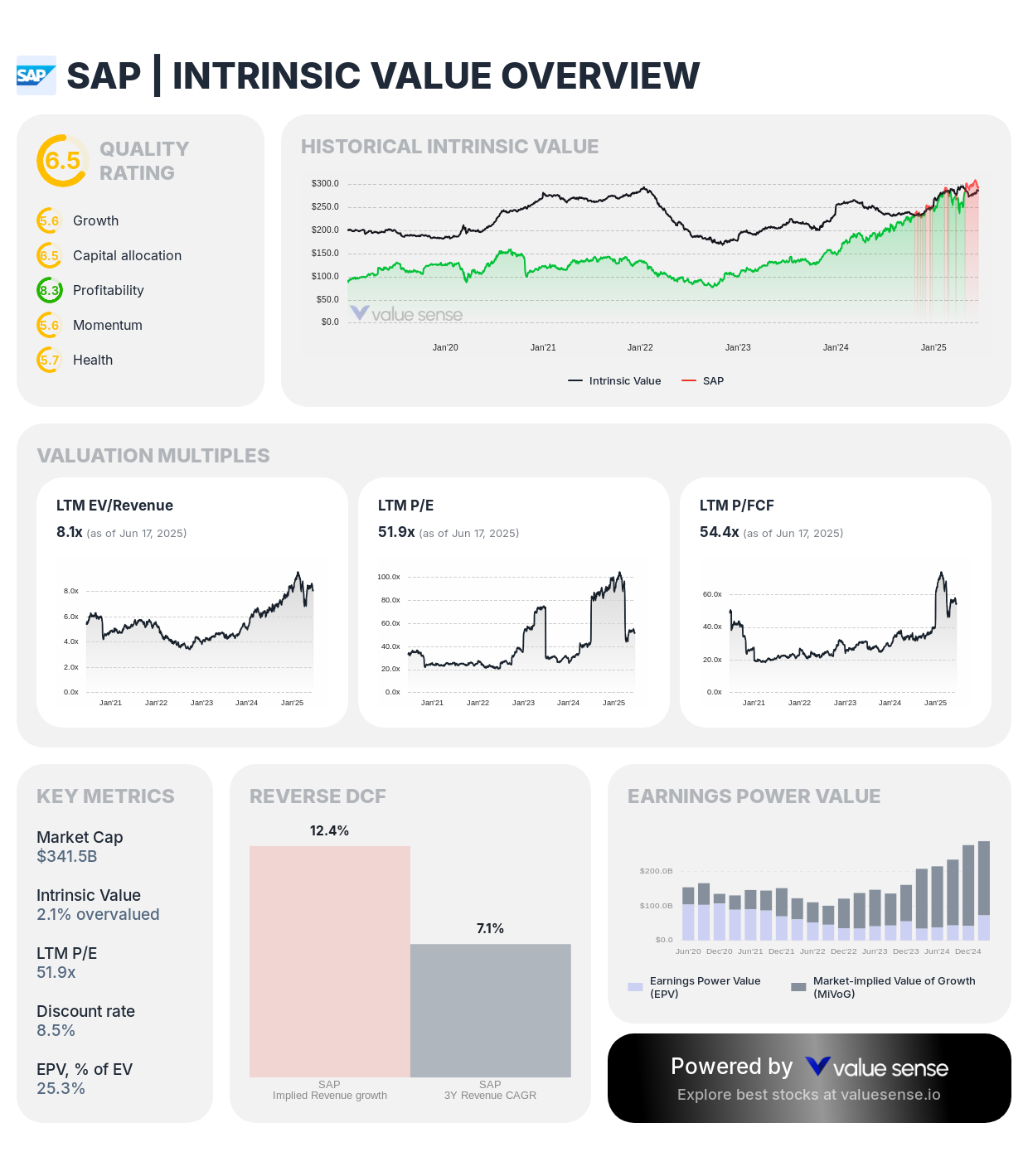

4. SAP SE (SAP) - 124.1% Undervalued by Graham Method

Sector: Enterprise Software | Enterprise Value: $326.6B

- Ben Graham Revised Fair Value: 124.1% undervalued

- Intrinsic Value: 2.1% overvalued

- DCF Value: 29.0% overvalued

- Relative Value: 24.7% undervalued

- Peter Lynch Fair Value: 33.6% undervalued

- Earnings Power Value: 25.3% of Enterprise Value

Investment Thesis: SAP's 124.1% Graham undervaluation reflects the market's underappreciation of the enterprise software leader's earnings consistency and competitive positioning. The company's mission-critical business applications and high customer switching costs create predictable revenue streams that Graham's methodology effectively captures despite the asset-light nature of software businesses.

Graham Method Analysis: While Graham traditionally favored asset-heavy industries, SAP's exceptional earnings consistency and competitive moat through enterprise software dominance align with Graham's emphasis on sustainable competitive advantages. The company's recurring revenue model provides the earnings predictability Graham valued in his investment framework.

Value Catalysts:

- Enterprise resource planning software leadership with exceptional customer retention

- Cloud transformation expanding addressable markets and recurring revenue opportunities

- Artificial intelligence integration enhancing product capabilities and customer value

- High switching costs creating sustainable competitive advantages and pricing power

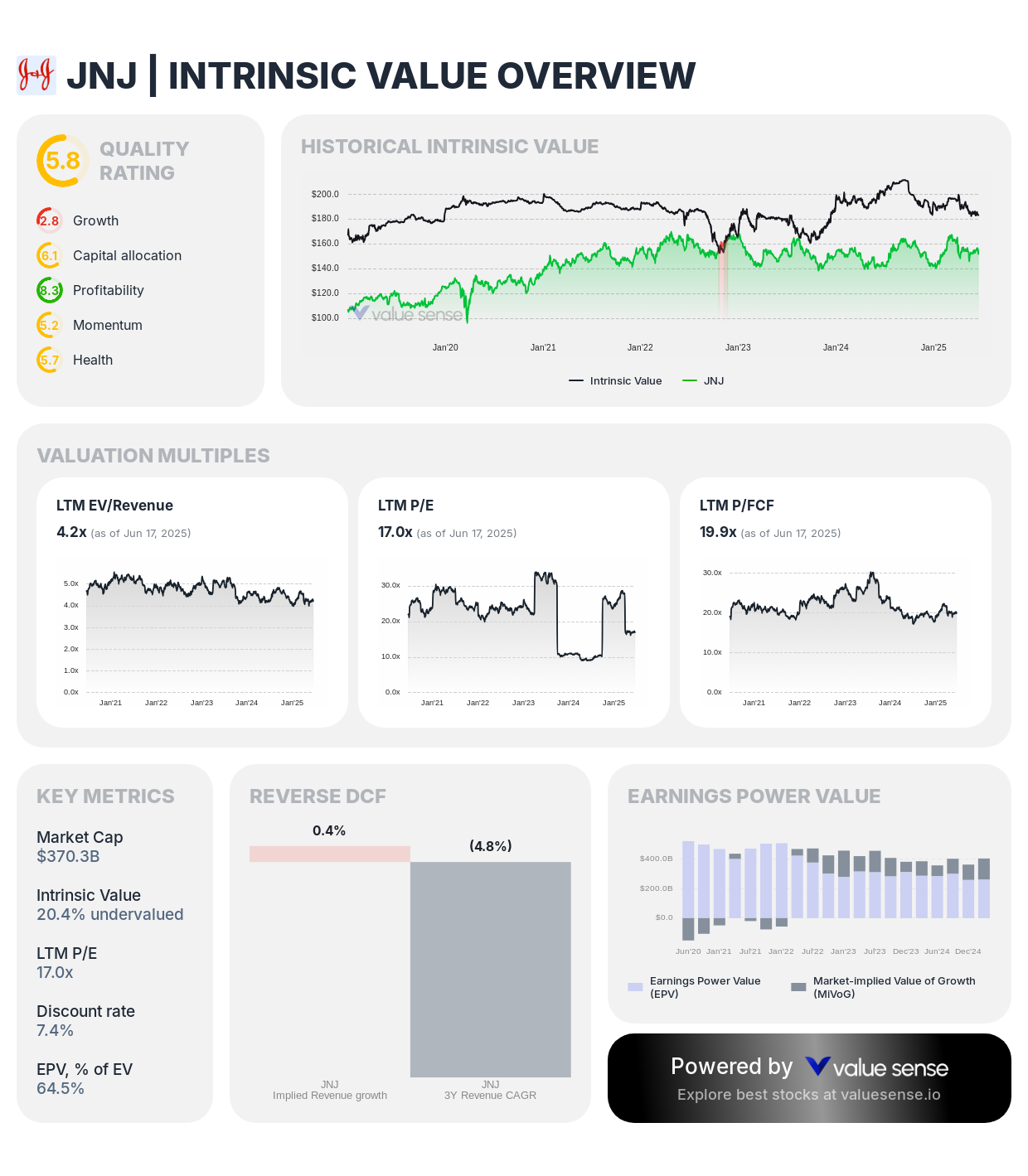

5. Johnson & Johnson (JNJ) - 123.6% Undervalued by Graham Method

Sector: Healthcare | Enterprise Value: $345.4B

- Ben Graham Revised Fair Value: 123.6% undervalued

- Intrinsic Value: 20.4% undervalued

- DCF Value: 28.0% undervalued

- Relative Value: 13.2% undervalued

- Peter Lynch Fair Value: 141.4% undervalued

- Earnings Power Value: 64.5% of Enterprise Value

Investment Thesis: Johnson & Johnson's 123.6% Graham undervaluation, combined with undervaluation across all other methodologies, represents a rare consensus value opportunity. The healthcare giant's diversified operations across pharmaceuticals, medical devices, and consumer health create the stable earnings and defensive characteristics Graham emphasized in his investment philosophy.

Graham Method Analysis: J&J exemplifies Graham's ideal investment with consistent earnings, strong balance sheet, and defensive business model. The company's Dividend Aristocrat status and 64.5% Earnings Power Value demonstrate the financial strength and shareholder-friendly policies Graham sought in quality value investments.

Value Catalysts:

- Diversified healthcare portfolio providing stability across economic cycles

- Pharmaceutical pipeline focused on high-growth therapeutic areas including oncology

- Medical device innovation in surgical and interventional solutions

- Strong balance sheet supporting strategic acquisitions and dividend growth

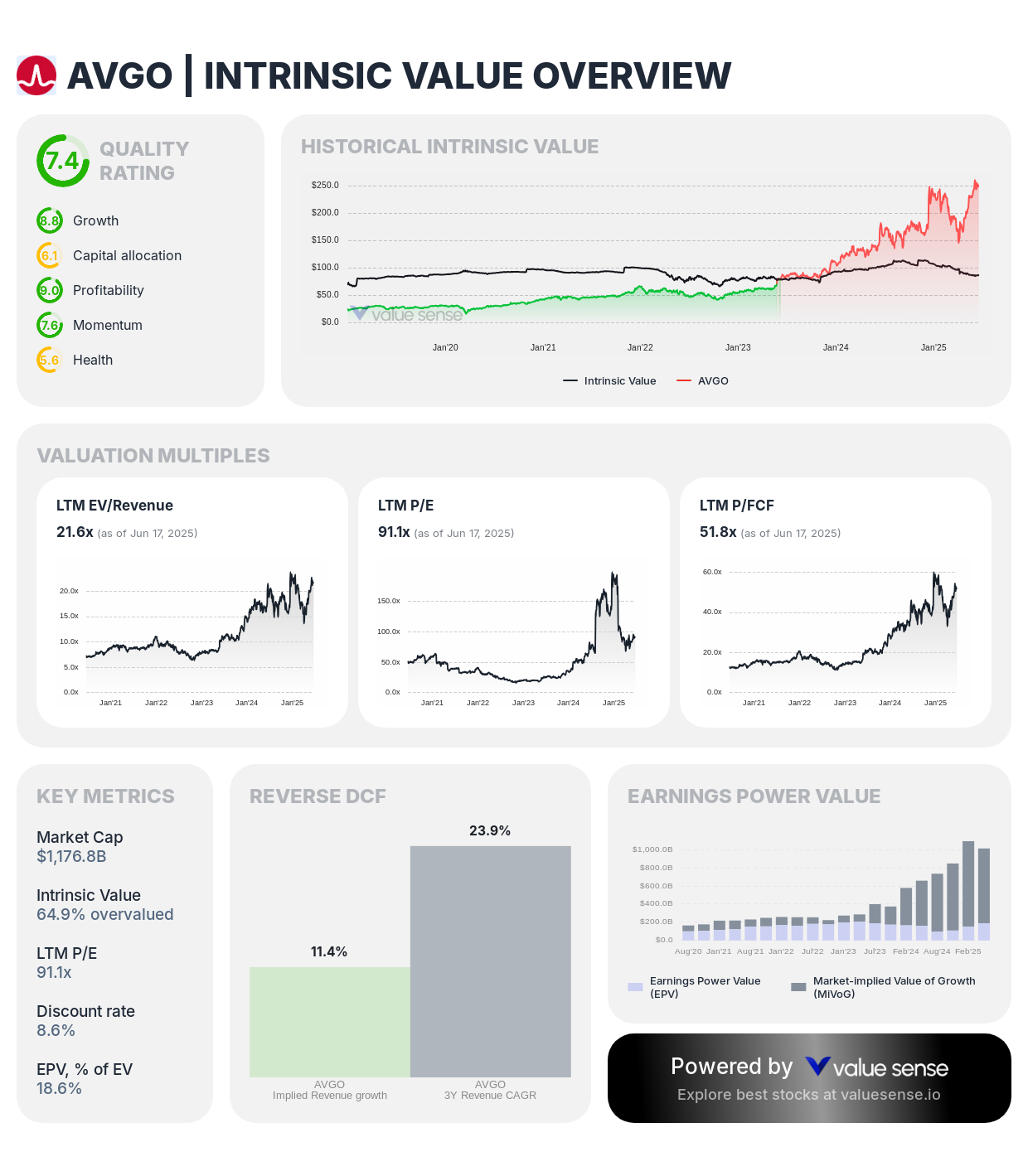

6. Broadcom Inc. (AVGO) - 107.2% Undervalued by Graham Method

Sector: Semiconductors | Enterprise Value: $1,234.6B

- Ben Graham Revised Fair Value: 107.2% undervalued

- Intrinsic Value: 64.9% overvalued

- DCF Value: 78.0% overvalued

- Relative Value: 51.4% overvalued

- Peter Lynch Fair Value: 57.4% undervalued

- Earnings Power Value: 18.6% of Enterprise Value

Investment Thesis: Broadcom presents an interesting contrarian opportunity with 107.2% Graham undervaluation despite premium valuations according to other methodologies. The company's strategic acquisitions and focus on mission-critical semiconductor and software applications create substantial earnings power that Graham's conservative methodology recognizes despite current market premiums.

Graham Method Analysis: Graham's approach captures Broadcom's exceptional cash generation and strategic asset accumulation through acquisitions. The company's focus on essential technology infrastructure aligns with Graham's preference for businesses with sustainable competitive advantages and predictable earnings streams.

Value Catalysts:

- Diversified semiconductor portfolio serving mission-critical technology applications

- Strategic acquisitions expanding addressable markets and customer relationships

- Infrastructure software business providing high-margin recurring revenue

- Essential role in data center and AI infrastructure supporting long-term demand

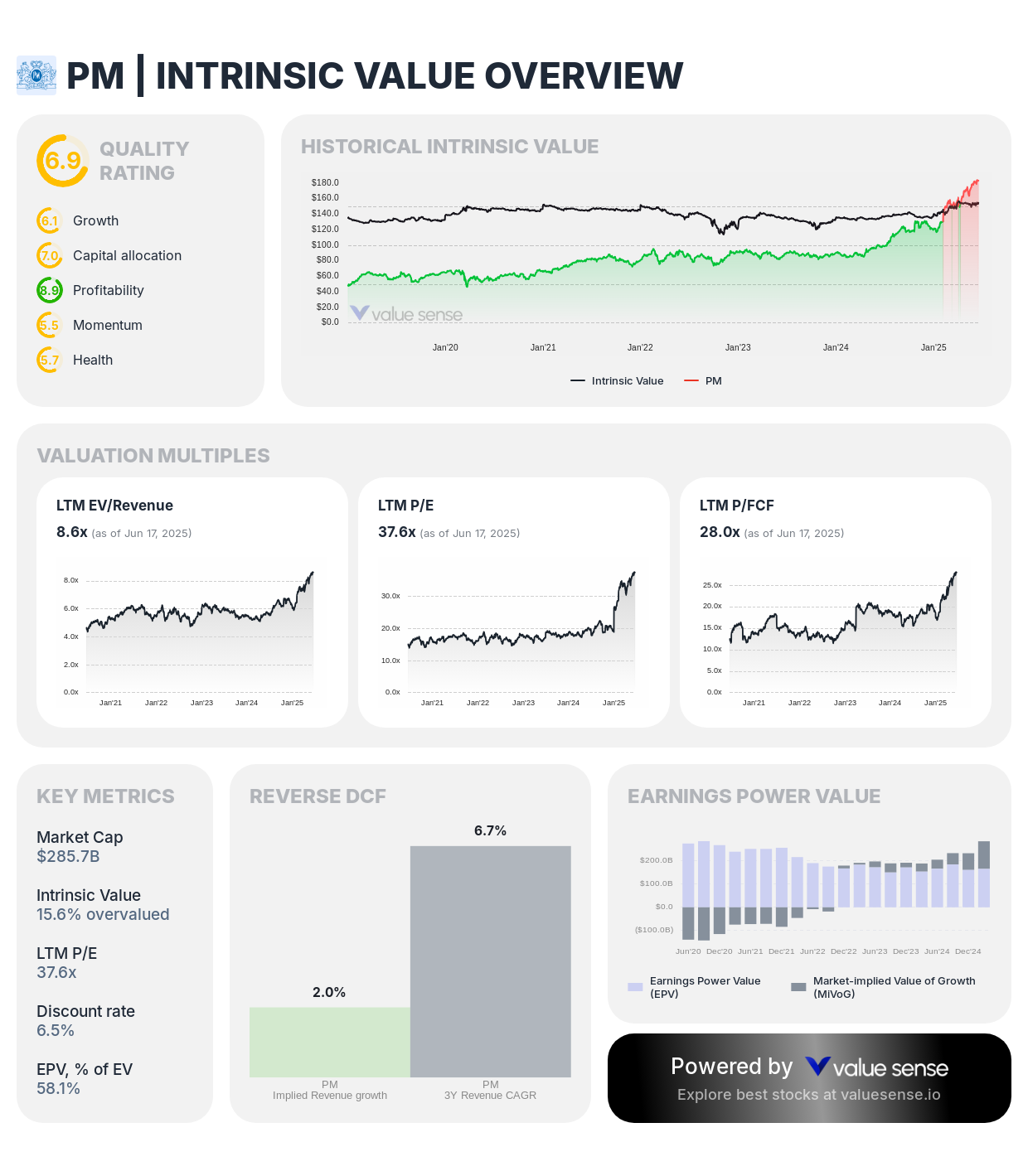

7. Philip Morris International Inc. (PM) - 39.5% Undervalued by Graham Method

Sector: Consumer Staples | Enterprise Value: $330.9B

- Ben Graham Revised Fair Value: 39.5% undervalued

- Intrinsic Value: 15.6% overvalued

- DCF Value: 27.0% overvalued

- Relative Value: 58.5% overvalued

- Peter Lynch Fair Value: 12.2% overvalued

- Earnings Power Value: 58.1% of Enterprise Value

Investment Thesis: Philip Morris demonstrates moderate Graham undervaluation at 39.5% below revised fair value, supported by exceptional Earnings Power Value of 58.1%. The company's transformation toward reduced-risk products and strong international brand portfolio create the consistent earnings and competitive positioning Graham valued in consumer staples investments.

Graham Method Analysis: Graham appreciated companies with strong brand assets and pricing power, characteristics Philip Morris demonstrates through its global tobacco portfolio. The company's consistent cash generation and market leadership create earnings stability despite regulatory challenges in traditional tobacco markets.

Value Catalysts:

- Leadership in reduced-risk tobacco products addressing regulatory and health concerns

- Strong international brand portfolio with pricing power and market share

- Substantial free cash flow generation supporting dividend payments and strategic investments

- Geographic diversification reducing dependence on any single regulatory environment

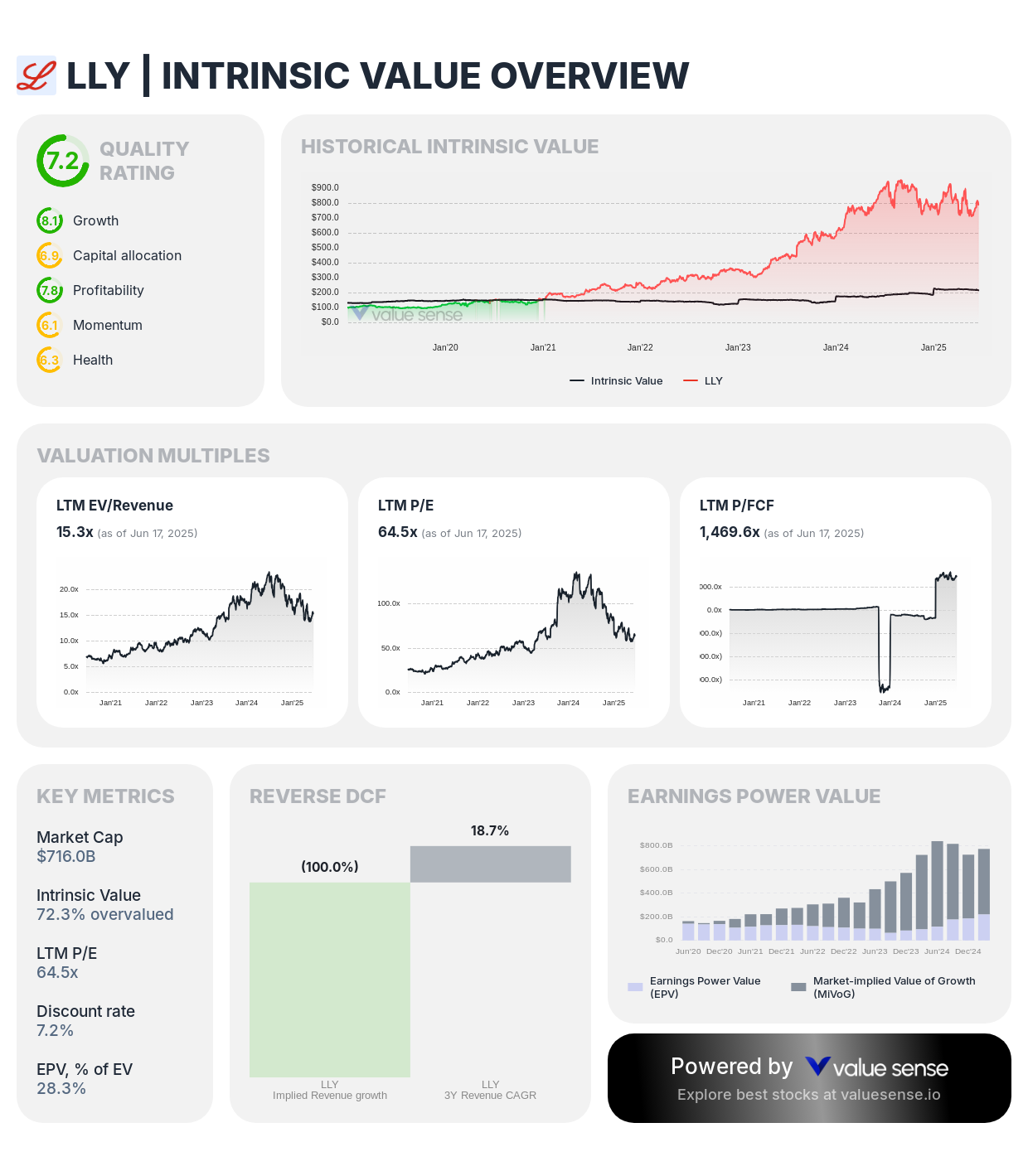

8. Eli Lilly and Company (LLY) - 35.5% Undervalued by Graham Method

Sector: Pharmaceuticals | Enterprise Value: $751.3B

- Ben Graham Revised Fair Value: 35.5% undervalued

- Intrinsic Value: 72.3% overvalued

- DCF Value: 78.0% overvalued

- Relative Value: 66.7% overvalued

- Peter Lynch Fair Value: 10.0% overvalued

- Earnings Power Value: 28.3% of Enterprise Value

Investment Thesis: Eli Lilly presents a contrarian Graham opportunity with 35.5% undervaluation according to revised fair value methodology despite significant premiums in other approaches. The pharmaceutical company's breakthrough treatments in diabetes and obesity create substantial earnings potential that Graham's conservative approach recognizes despite current market enthusiasm.

Graham Method Analysis: Graham's methodology focuses on current earnings power rather than speculative future growth, providing a more conservative valuation for Lilly's innovative pharmaceutical portfolio. The company's established market positions and pipeline assets create tangible value that Graham's approach effectively captures.

Value Catalysts:

- Leadership in diabetes care with expanding treatment options and patient populations

- Revolutionary obesity treatments addressing massive addressable markets

- Robust pharmaceutical pipeline with multiple potential blockbuster therapies

- Strong competitive positioning in high-growth therapeutic areas

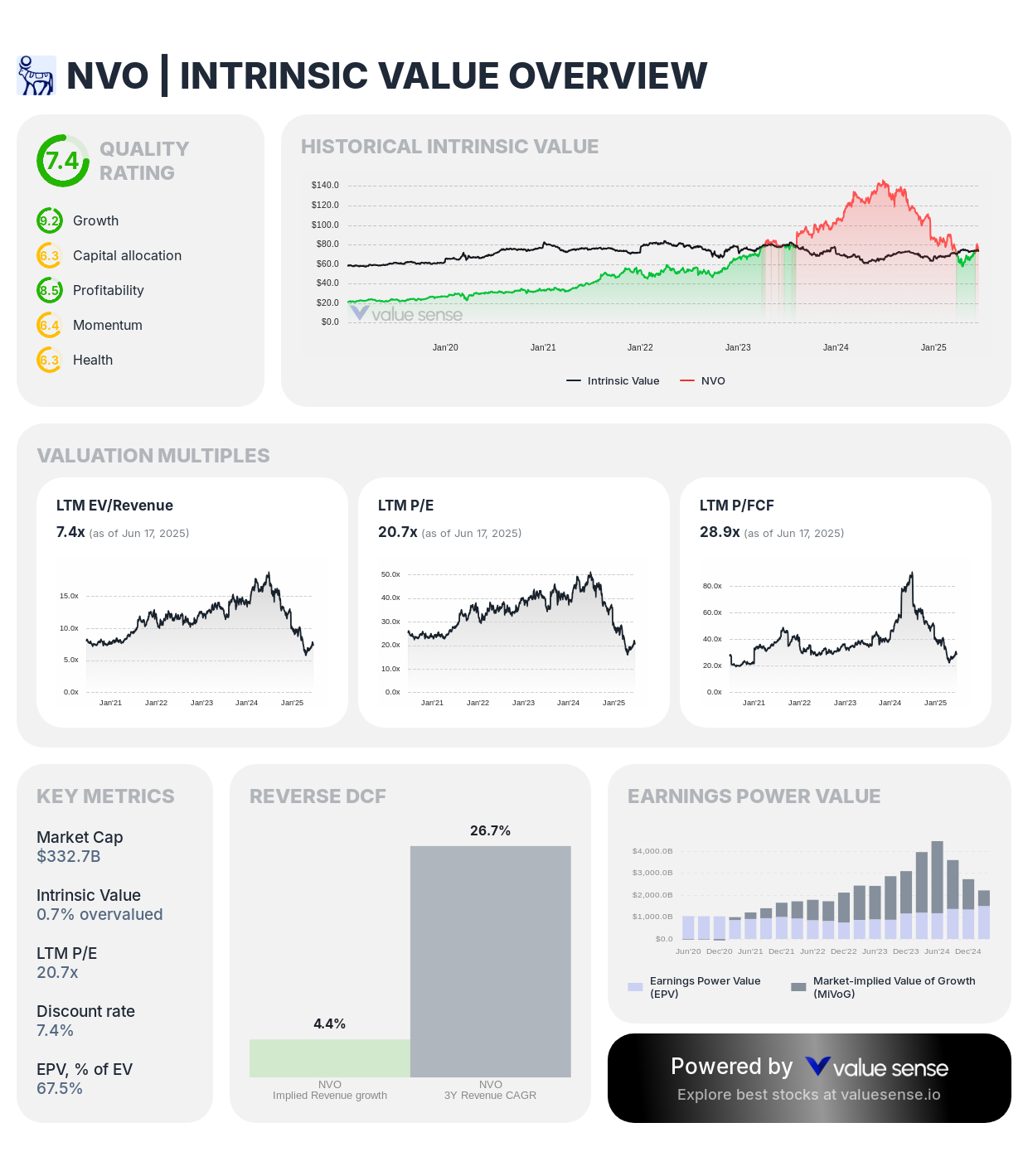

9. Novo Nordisk A/S (NVO) - 16.4% Undervalued by Graham Method

Sector: Pharmaceuticals | Enterprise Value: $344.6B

- Ben Graham Revised Fair Value: 16.4% undervalued

- Intrinsic Value: 0.7% overvalued

- DCF Value: 9.0% undervalued

- Relative Value: 10.7% overvalued

- Peter Lynch Fair Value: 23.8% undervalued

- Earnings Power Value: 67.5% of Enterprise Value

Investment Thesis: Novo Nordisk demonstrates modest Graham undervaluation at 16.4% below revised fair value, supported by exceptional Earnings Power Value of 67.5%. The Danish pharmaceutical company's specialized focus on diabetes and obesity care creates sustainable competitive advantages and predictable earnings that Graham's methodology effectively recognizes.

Graham Method Analysis: Graham valued companies with specialized market positions and consistent earnings, both characteristics Novo Nordisk demonstrates through its diabetes care leadership. The company's focused therapeutic approach and global market dominance create the earnings predictability Graham sought in quality investments.

Value Catalysts:

- Global leadership in diabetes care with expanding patient populations worldwide

- Breakthrough obesity treatments revolutionizing weight management therapy

- Continuous innovation in drug delivery systems and treatment effectiveness

- Strong international expansion opportunities in emerging healthcare markets

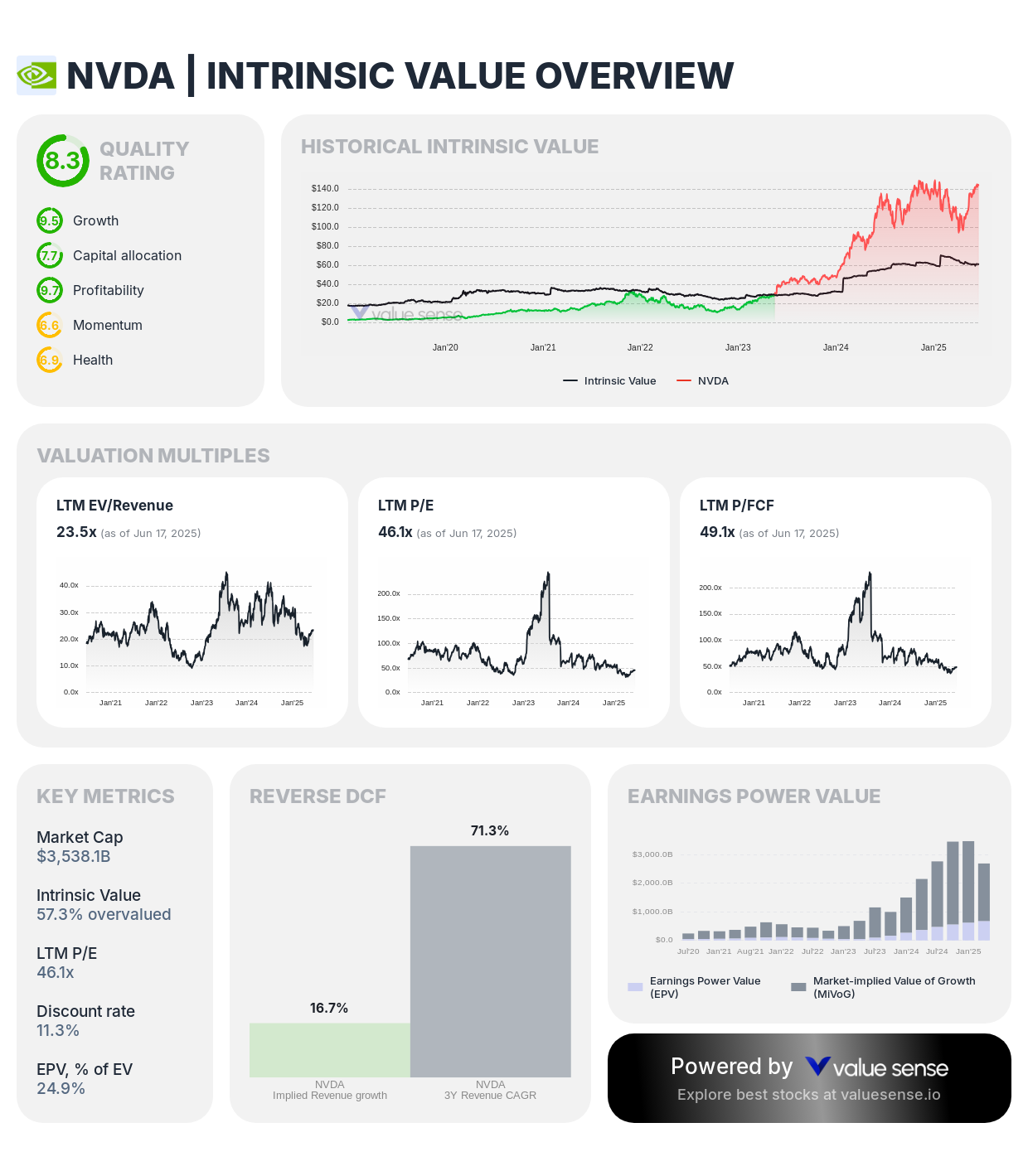

10. NVIDIA Corporation (NVDA) - 11.9% Undervalued by Graham Method

Sector: Semiconductors | Enterprise Value: $3,494.7B

- Ben Graham Revised Fair Value: 11.9% undervalued

- Intrinsic Value: 57.3% overvalued

- DCF Value: 72.0% overvalued

- Relative Value: 42.9% overvalued

- Peter Lynch Fair Value: 14.7% overvalued

- Earnings Power Value: 24.9% of Enterprise Value

Investment Thesis: NVIDIA represents a unique case where Graham's conservative methodology finds modest undervaluation (11.9%) despite significant premiums according to growth-oriented approaches. The AI computing leader's exceptional earnings power and technological assets create intrinsic value that Graham's methodology recognizes, though with limited margin of safety given current market premiums.

Graham Method Analysis: While NVIDIA's growth trajectory exceeds Graham's typical investment profile, the company's substantial earnings generation and technological asset base align with Graham's emphasis on tangible competitive advantages. The modest Graham undervaluation suggests even conservative valuation approaches recognize underlying fundamental value.

Value Catalysts:

- Dominant position in artificial intelligence computing with technological leadership

- Essential role in data center infrastructure and high-performance computing

- Platform ecosystem creating competitive moats and recurring revenue opportunities

- Expanding addressable markets through AI adoption across industries

Benjamin Graham Investment Strategy for Modern Markets

Prioritize Substantial Graham Undervaluation: Focus on companies showing significant undervaluation according to Ben Graham's revised fair value methodology, particularly those exceeding 100% undervaluation like AbbVie (686.8%), TSMC (632.4%), and UnitedHealth (565.9%). These represent classic value opportunities where market prices substantially understate intrinsic worth according to Graham's conservative principles.

Confirm with Earnings Power Value: Graham emphasized companies with strong earnings relative to their enterprise value. Prioritize companies with high Earnings Power Value percentages like UnitedHealth (93.9%), Novo Nordisk (67.5%), and Johnson & Johnson (64.5%), as these demonstrate the earnings consistency Graham valued in quality investments.

Balance Conservative and Growth Characteristics: While Graham favored conservative investments, modern markets require balancing traditional value characteristics with growth potential. Companies like TSMC and SAP combine Graham undervaluation with technological leadership, offering both value and growth characteristics for contemporary portfolios.

Exercise Patience for Value Realization: Graham's approach requires patience for market recognition of intrinsic value. These undervalued opportunities may take extended periods to converge toward fair value, but the substantial discounts identified by Graham's methodology provide significant margin of safety for patient investors.

Understanding Graham's Valuation Methodology

Benjamin Graham's revised fair value methodology represents a systematic approach to identifying undervalued securities through conservative fundamental analysis. The approach emphasizes several key principles:

Earnings Consistency Over Growth Speculation: Graham prioritized companies with predictable, sustainable earnings rather than speculative growth projections. This conservative approach helps identify businesses with reliable cash generation capabilities that can weather economic uncertainty.

Tangible Asset Recognition: The methodology incorporates book value and tangible assets, providing downside protection through asset backing. This approach particularly benefits companies with substantial physical assets, intellectual property, or strategic market positions.

Margin of Safety Emphasis: Graham's calculations inherently build in conservative assumptions, creating a margin of safety between calculated intrinsic value and market price. This buffer protects investors from valuation errors and market volatility.

Multiple Validation Approach: Our analysis combines Graham's methodology with other valuation approaches to provide comprehensive assessment. Companies showing undervaluation across multiple methodologies offer additional confidence in investment decisions.

Key Takeaways for Graham Number Investors

✅ Exceptional Value Opportunities: AbbVie (686.8%), TSMC (632.4%), and UnitedHealth (565.9%) offer extraordinary Graham undervaluation

✅ Earnings Power Focus: Companies with high EPV ratios like UnitedHealth (93.9%) and Novo Nordisk (67.5%) demonstrate strong fundamental profitability

✅ Sector Diversification: Opportunities span healthcare, technology, semiconductors, and consumer staples for balanced exposure

✅ Conservative Foundation: Graham methodology provides margin of safety through conservative valuation assumptions

✅ Patient Approach Required: Value realization may require extended time horizons but offers substantial potential returns

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best High Free Cash Flow Stocks

📖 10 Best Undervalued Dividend Stocks

📖 9 Best Small-Cap Growth Stocks

FAQ About Graham Number Investing

What makes Ben Graham's revised fair value different from other valuation methods?

Ben Graham's revised fair value methodology specifically combines earnings per share and book value per share using a systematic mathematical formula, emphasizing both current profitability and tangible asset backing. Unlike DCF analysis which relies on future cash flow projections or relative valuation comparing market multiples, Graham's approach provides a conservative estimate based on current fundamentals. This methodology tends to favor established companies with strong balance sheets and consistent earnings, as demonstrated by UnitedHealth's 565.9% Graham undervaluation versus other valuation approaches showing different results.

Why do some companies show significant Graham undervaluation while appearing overvalued by other methods?

Graham's methodology emphasizes current earnings power and tangible book value, which can create different valuations than forward-looking approaches like DCF analysis. Companies like Eli Lilly show 35.5% Graham undervaluation but 72.3% intrinsic value overvaluation because Graham's method focuses on current financial strength rather than future growth expectations. This divergence often occurs when market prices reflect aggressive growth assumptions that Graham's conservative approach doesn't fully incorporate, creating opportunities for value investors willing to accept more modest growth expectations.

How important is the Earnings Power Value (EPV) percentage for Graham Number stocks?

Earnings Power Value percentage is crucial for Graham Number investing because it measures a company's current earnings relative to its enterprise value, assuming no future growth. High EPV percentages like UnitedHealth's 93.9% or Johnson & Johnson's 64.5% indicate companies generating substantial earnings relative to their total valuation, providing strong fundamental support for Graham's value calculations. This metric aligns perfectly with Graham's emphasis on current earning power over speculative future growth, helping identify companies with sustainable competitive advantages.

What are the limitations of using Graham's methodology in today's technology-driven markets?

Graham's methodology was developed for industrial-age companies and may undervalue asset-light businesses with significant intangible assets like software platforms, data advantages, or network effects. The emphasis on book value can miss companies with valuable intellectual property or brand assets that don't appear on traditional balance sheets. Additionally, the conservative growth assumptions may cause investors to miss opportunities in rapidly evolving industries. However, companies like SAP and NVIDIA showing Graham undervaluation demonstrate that even technology leaders can offer value opportunities when their current earnings power exceeds market recognition.

How should investors balance Graham undervaluation with modern growth considerations?

Successful Graham investing in modern markets requires balancing conservative valuation principles with recognition of legitimate growth opportunities. Prioritize companies showing substantial Graham undervaluation (over 100%) while maintaining competitive advantages and reasonable growth prospects, such as TSMC combining 632.4% Graham undervaluation with semiconductor industry leadership. Consider Graham methodology as providing a conservative baseline while evaluating companies' ability to grow earnings sustainably over time. The ideal approach uses Graham's margin of safety concept while acknowledging that some growth premiums may be justified for companies with strong competitive moats and expanding addressable markets.

Important Note on Graham Methodology: Ben Graham's revised fair value represents a conservative valuation approach emphasizing current fundamentals over future growth projections. Investors should consider multiple valuation methodologies, business quality, competitive positioning, and growth prospects when making investment decisions. The Graham Number provides valuable insight into potential undervaluation but should be combined with qualitative analysis of business fundamentals and industry dynamics.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Graham Number calculations are based on the most recent available financial data and may vary with quarterly reporting. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.