Greenhaven Associates Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Greenhaven Associates, the value-focused firm founded by legendary investor Edgar Wachenheim III, continues to lean into deeply cyclical U.S. equities while pruning and reallocating around its highest-conviction ideas. The firm’s Q3’2025 portfolio shows a tightly concentrated bet on autos, homebuilders, and select industrial and electronics distributors, with measured trims to long‑held winners and a notable new push into Avantor.

The Big Picture: Concentrated Value in Cyclical Leaders

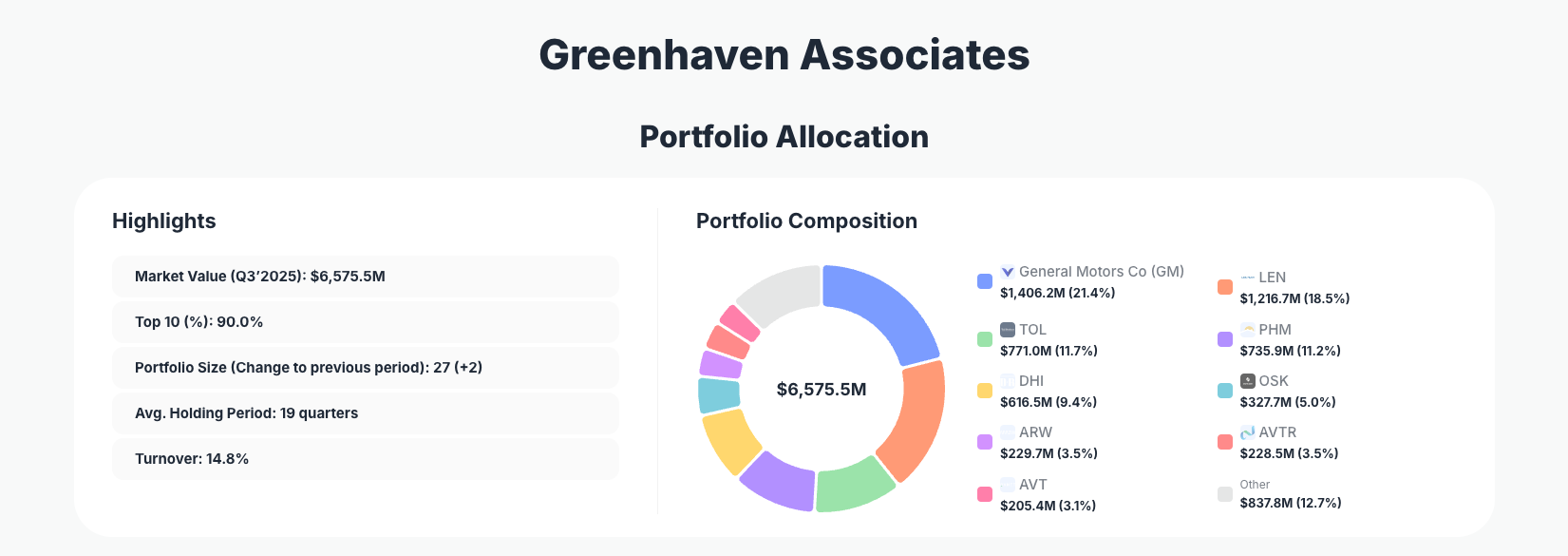

Portfolio Highlights (Q3 2025): - Market Value: $6,575.5M

- Top 10 Holdings: 90.0%

- Portfolio Size: 27 +2

- Average Holding Period: 19 quarters

- Turnover: 14.8%

Greenhaven’s Q3’2025 portfolio remains highly concentrated, with 90.0% of capital in the top 10 positions, despite holding 27 stocks overall. This concentration underscores the firm’s conviction-driven approach: a small number of ideas—primarily in autos, homebuilders, and industrials—drive the vast majority of exposure and future performance.

With an average holding period of 19 quarters, Greenhaven is clearly not trading around headlines. Instead, the portfolio reflects a long-term, fundamentals-first philosophy where positions are sized aggressively when valuation and business quality align. The modest 14.8% turnover suggests incremental adjustments rather than wholesale strategic shifts, even as the firm adds two net new positions this quarter.

The sector mix visible in the Greenhaven Associates portfolio emphasizes economically sensitive businesses—autos via General Motors Co and auto parts via Lear Corporation, alongside a sizable cluster of U.S. homebuilders and construction-linked names. This positioning suggests Greenhaven sees attractive risk/reward in cyclical value at this stage of the economic and rate cycle, while trimming selectively to manage position risk.

Top Holdings Overview: Autos, Homebuilders & Specialty Industrials

The Q3’2025 13F shows 10 positions with notable changes, all of which sit within the top dozen holdings and together represent the core of Greenhaven’s strategy.

The portfolio is led by a massive stake in General Motors Co, sized at 21.4% of assets. Greenhaven Reduce 2.49% in GM, taking some profits or risk off the table while still keeping it as the single largest disclosed position by weight among the reported ranks. This trim reflects disciplined risk management more than a loss of conviction; GM remains a central thesis driver for the entire book.

Housing is the second major pillar. Lennar Corporation accounts for 18.5% of the portfolio after an Add 1.68% move, signaling increased confidence in U.S. homebuilder earnings power and the longer‑term housing supply/demand imbalance. Greenhaven complements this with sizeable but slightly trimmed stakes in Toll Brothers, Inc. (11.7%, Reduce 0.37%), PulteGroup, Inc. (11.2%, Reduce 0.19%), and D.R. Horton, Inc. (9.4%, Reduce 1.18%). Together, these four builders form an unusually concentrated exposure to U.S. residential construction, with slight trims suggesting valuation management rather than a strategic exit.

Beyond housing, Greenhaven continues to emphasize industrial and specialty manufacturing. Oshkosh Corporation sits at 5.0% of the portfolio with a Reduce 1.09% action, indicating a modest de‑risking while maintaining meaningful exposure to defense, specialty vehicles, and infrastructure-related demand. In electronics distribution, Arrow Electronics, Inc. at 3.5% (Reduce 0.75%) and Avnet, Inc. at 3.1% (Reduce 0.86%) show similar behavior: incremental trims to mature winners while still keeping them firmly inside the top 10.

One of the most notable moves this quarter is Greenhaven’s commitment to Avantor, Inc.. The position now represents 3.5% of the portfolio with a clear Buy label and 18,311,570 shares. This signals a willingness to allocate fresh capital into life sciences tools and lab consumables, diversifying somewhat away from pure cyclicals into a structurally growing niche with recurring revenue characteristics.

Rounding out the key changes, Lear Corporation—a major auto seating and electronics supplier—accounts for 2.7% of assets after a more material Reduce 2.49% move. Given Lear’s tight linkage to global auto production cycles and margins, Greenhaven appears to be rebalancing its auto complex around its highest-conviction name, GM, while trimming peripheral but still core holdings.

Collectively, these 10–11 names—GM, LEN, TOL, PHM, DHI, OSK, ARW, AVTR, AVT, and LEA—form the backbone of the Greenhaven Associates portfolio, with each action (Add, Reduce, or Buy) reflecting nuanced adjustments rather than wholesale thematic pivots.

What the Portfolio Reveals About Greenhaven’s Current Strategy

Greenhaven’s Q3’2025 positioning provides several clear signals about how the firm views markets, risk, and opportunity:

- Cyclical value at the core

Heavy allocations to GM and the homebuilder basket (LEN, TOL, PHM, DHI) show a clear willingness to embrace earnings volatility when valuations appear depressed relative to normalized earnings power. Greenhaven is not chasing momentum; it is leaning into sectors often avoided near macro uncertainty. - Selective trimming, not broad de‑risking

Most of the quarter’s moves are small Reduce actions (2.49%, 1.18%, 1.09%, 0.86%, 0.75%, 0.37%, 0.19%), indicating position fine‑tuning rather than an exit from key themes. This suggests that Greenhaven still believes the primary upside remains intact but is managing single‑stock and sector concentration risk. - Incremental diversification into structural growth

The Buy in Avantor stands out as a measured step toward more stable, recurring-revenue businesses in life sciences and lab supplies. It diversifies cash flow profiles while maintaining a value overlay, as AVTR has historically traded at a discount when sentiment toward life sciences tools cools. - U.S.-centric, fundamentals‑driven exposure

Every highlighted holding is a U.S.-listed company, reflecting Greenhaven’s comfort operating within U.S. markets, accounting standards, and regulatory regimes. The focus remains on bottom‑up, fundamental valuation rather than macro calls or geographic bets. - Dividends as a secondary benefit

Many of these holdings—autos, builders, industrials, distributors—pay dividends, but yield does not appear to be the primary driver. Instead, dividends complement a thesis grounded in earnings power and multiple re‑rating from depressed levels.

Portfolio Concentration Analysis

Using the reported top 10 holdings:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| General Motors Co (GM) | $1,406.2M | 21.4% | Reduce 2.49% |

| Lennar Corporation (LEN) | $1,216.7M | 18.5% | Add 1.68% |

| Toll Brothers, Inc. (TOL) | $771.0M | 11.7% | Reduce 0.37% |

| PulteGroup, Inc. (PHM) | $735.9M | 11.2% | Reduce 0.19% |

| D.R. Horton, Inc. (DHI) | $616.5M | 9.4% | Reduce 1.18% |

| Oshkosh Corporation (OSK) | $327.7M | 5.0% | Reduce 1.09% |

| Arrow Electronics, Inc. (ARW) | $229.7M | 3.5% | Reduce 0.75% |

| Avantor, Inc. (AVTR) | $228.5M | 3.5% | Buy |

| Avnet, Inc. (AVT) | $205.4M | 3.1% | Reduce 0.86% |

These nine disclosed top positions alone account for approximately 87.3% of the portfolio, consistent with the reported 90.0% allocation in the top 10 holdings. GM and LEN together make up nearly 40% of assets, highlighting Greenhaven’s willingness to let a handful of their best ideas dominate risk and return.

The next cluster—TOL, PHM, and DHI—shows a similarly bold stance, with more than 32% of the book in just three homebuilders. Below them, OSK, ARW, AVTR, and AVT round out the remaining top allocations, each between 3–5%, reinforcing that even “smaller” core positions are meaningfully sized.

Despite this concentration, the pattern of small Reductions across most names indicates that Greenhaven is actively managing drawdown risk and single‑name exposure. The introduction and growth of AVTR into a 3.5% stake also shows a deliberate attempt to broaden the portfolio’s economic drivers without diluting overall conviction.

Investment Lessons from Greenhaven Associates’ Approach

Greenhaven’s Q3’2025 13F offers several practical lessons for individual investors studying superinvestor portfolios:

- Concentrate when the odds are in your favor

With 90% of capital in its top 10 holdings, Greenhaven demonstrates that true conviction requires meaningful position size, not a long tail of tiny, inconsequential bets. - Holding periods create the edge

An average holding period of 19 quarters (almost five years) reflects a willingness to sit through volatility as long as the underlying thesis is intact. This long horizon is critical for value strategies in cyclical sectors. - Trim, don’t churn

Most moves—“Reduce 0.19%,” “Reduce 0.37%,” “Reduce 0.75%”—are surgical adjustments rather than full exits. This is a blueprint for risk management via rebalancing, not reactionary trading. - Anchor on intrinsic value, not narratives

Autos, homebuilders, and industrial distributors are rarely in favor simultaneously, yet Greenhaven continues to size them heavily. The common thread is discounted valuations relative to normalized cash flows, not popularity. - Diversify by business model, not just sector label

The Buy in AVTR shows that even within a value framework, investors can mix cyclical exposure (builders, autos) with more stable, recurring-revenue businesses (life sciences tools) to smooth the portfolio’s overall earnings profile.

Looking Ahead: What Comes Next for Greenhaven’s Portfolio?

Based on current positioning, several forward-looking implications emerge for the Greenhaven Associates portfolio:

- Interest rates and housing will be key drivers

With over 30%+ in homebuilders and construction-linked names, any shift in rate expectations, housing starts, or affordability metrics will materially influence portfolio performance. Easing rates or sustained housing undersupply could provide a tailwind. - Autos remain a swing factor

GM’s 21.4% weight means that company-specific execution—on EV strategy, capital allocation, and labor costs—will be pivotal. Greenhaven’s slight Reduce 2.49% suggests some prudence, but GM will likely remain a core pillar unless fundamentals deteriorate sharply. - Scope for further AVTR expansion

Having established Avantor at 3.5% with a Buy stance, Greenhaven has room to scale this up if the thesis plays out and valuations remain attractive. This could mark the beginning of a more balanced mix between cyclical and structural growers. - Dry powder via incremental trims

Small reductions across multiple names may indicate that Greenhaven is building incremental liquidity—either for risk control or to fund future opportunities that emerge from volatility in Q4 and beyond.

For investors tracking this strategy, future 13F filings will reveal whether Greenhaven doubles down on cyclicals, rotates further into defensive growers like AVTR, or selectively takes profits as price converges toward intrinsic value.

FAQ about Greenhaven Associates’ Portfolio

Q: What were the most significant changes in Greenhaven’s Q3’2025 13F filing?

The most notable moves were a Reduce 2.49% in General Motors, an Add 1.68% in Lennar, and a Buy in Avantor. Smaller reductions occurred in Toll Brothers, PulteGroup, D.R. Horton, Oshkosh, Arrow Electronics, Avnet, and Lear.

Q: How concentrated is Greenhaven Associates’ portfolio?

Greenhaven runs a high‑conviction book, with 90.0% of the portfolio in its top 10 positions and only 27 holdings overall. GM alone is 21.4% of assets, while the top two positions (GM and LEN) approach 40% combined.

Q: What is Greenhaven’s typical holding period and turnover?

The average holding period is 19 quarters, underscoring a long‑term, buy‑and‑hold orientation. Turnover is 14.8%, meaning only a modest fraction of the portfolio changes each quarter, in line with a patient value strategy.

Q: Which sectors or themes does Greenhaven favor right now?

The Q3’2025 filing shows an emphasis on autos (GM, LEA), homebuilders (LEN, TOL, PHM, DHI), industrial and specialty manufacturing (OSK), and electronics distribution (ARW, AVT), with growing interest in life sciences tools via AVTR.

Q: How can I track Greenhaven Associates’ portfolio going forward?

You can follow Greenhaven’s holdings through quarterly 13F filings with the SEC. Remember, 13F data is reported with a 45‑day lag after quarter‑end, so positions may have changed since the filing date. For up‑to‑date analysis, visualizations, and historical tracking, use the ValueSense superinvestor page for Greenhaven at Greenhaven Associates’ portfolio.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!