Gregg J. Powers - Private Capital Management, Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Gregg J. Powers of Private Capital Management, Llc showcases disciplined portfolio management in his latest 13F filing. His $1.12B portfolio reflects a balanced approach across 168 positions, with notable expansions in high-conviction small-cap names like QuinStreet (QNST) and PowerFleet (AIOT), signaling confidence in overlooked growth opportunities despite trims in legacy holdings.

Portfolio Snapshot: Diversified Discipline with Selective Conviction

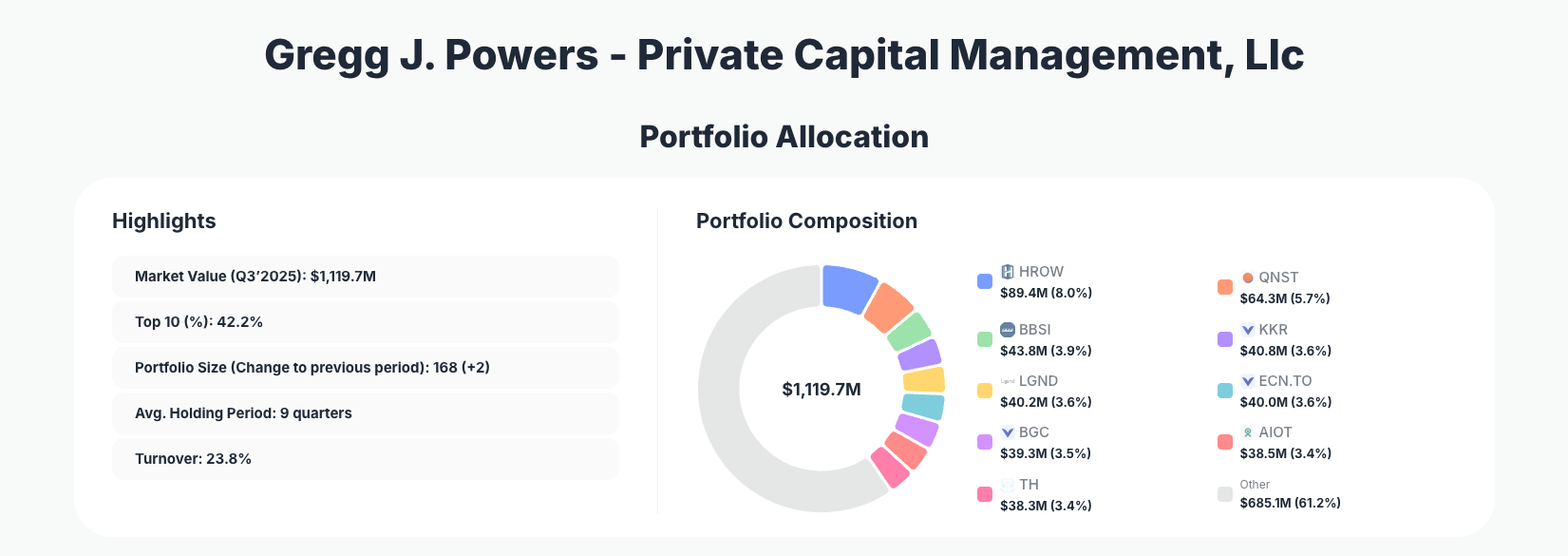

Portfolio Highlights (Q3’2025): - Market Value: $1,119.7M - Top 10 Holdings: 42.2% - Portfolio Size: 168 +2 - Average Holding Period: 9 quarters - Turnover: 23.8%

The Private Capital Management portfolio demonstrates a sophisticated balance between diversification and conviction, holding 168 positions while concentrating 42.2% of assets in just the top 10. This structure allows Gregg J. Powers to maintain broad exposure to small and mid-cap opportunities while deploying meaningful capital into his highest-confidence ideas. The addition of two new positions brings the total to 168, underscoring ongoing opportunity hunting in a volatile market.

With an average holding period of 9 quarters and 23.8% turnover, Powers exhibits patience typical of value-oriented managers who prioritize long-term business fundamentals over short-term market noise. The relatively modest top-10 concentration—compared to ultra-focused peers—suggests a risk-aware strategy that mitigates single-stock blowups across a sprawling portfolio. Tracking changes via the Q3 2025 portfolio reveals active rebalancing, with significant adds and reduces signaling adaptive conviction in evolving market dynamics.

This approach aligns with Powers' track record at Private Capital Management, where diversification serves as a buffer while selective position sizing drives alpha. Investors following his moves can glean insights into undervalued sectors through tools like ValueSense's superinvestor tracker.

Top Positions Breakdown: Healthcare Leaders Meet Explosive New Bets

The portfolio's core remains anchored by healthcare standout Harrow Health (HROW) at 8.0%, though Powers trimmed this position by 4.61%, potentially taking profits after strong performance. A dramatic shift appears in QuinStreet (QNST), which exploded with a 4,515.84% add to reach 5.7% of the portfolio $64.3M, highlighting aggressive conviction in this performance marketing play amid digital advertising tailwinds.

Further trims include Barrett Business Services (BBSI) reduced by 13.97% to 3.9% $43.8M, KKR & Co. (KKR) down 0.76% at 3.6% $40.8M, and Ligand Pharmaceuticals (LGND) cut 0.91% to 3.6% $40.2M. Powers also modestly reduced ECN Capital Corporation by 0.18% to 3.6% $40.0M, while adding slightly to BGC Group (BGC) up 0.28% at 3.5% $39.3M.

Momentum builds with PowerFleet (AIOT) increased 9.06% to 3.4% $38.5M and Target Hospitality (TH) trimmed 7.02% at 3.4% $38.3M. Extending beyond the top 10, Secure Waste Infrastructure Corp saw a 0.40% reduction to 3.4% $37.5M, rounding out active changes in this diverse mix of healthcare, services, financials, and industrials.

What the Portfolio Reveals About Powers' Strategy

Gregg J. Powers' Q3 moves paint a picture of opportunistic value hunting in small caps, blending healthcare stability with growth in tech-enabled services:

- Healthcare tilt with discipline: Dominant exposure to HROW and LGND reflects faith in specialized pharma and biotech, but trims suggest profit-taking amid valuation stretches.

- Aggressive small-cap adds: Massive builds in QNST and AIOT indicate bets on under-the-radar performers in digital marketing and IoT, prioritizing scalable growth over mega-caps.

- Risk management via diversification: 168 holdings and 42.2% top-10 concentration balance conviction with broad exposure, reducing volatility in niche bets.

- Turnover signals adaptability: 23.8% rate shows willingness to rotate capital, trimming laggards like BBSI while amplifying winners.

This strategy favors quality micro/mid-caps with improving fundamentals, navigating uncertainty through position-specific conviction.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Harrow Health, Inc. (HROW) | $89.4M | 8.0% | Reduce 4.61% |

| QuinStreet, Inc. (QNST) | $64.3M | 5.7% | Add 4,515.84% |

| Barrett Business Services, Inc. (BBSI) | $43.8M | 3.9% | Reduce 13.97% |

| KKR & Co. Inc. (KKR) | $40.8M | 3.6% | Reduce 0.76% |

| Ligand Pharmaceuticals Incorporated (LGND) | $40.2M | 3.6% | Reduce 0.91% |

| ECN Capital Corporation (_) | $40.0M | 3.6% | Reduce 0.18% |

| BGC Group, Inc (BGC) | $39.3M | 3.5% | Add 0.28% |

| PowerFleet, Inc. (AIOT) | $38.5M | 3.4% | Add 9.06% |

| Target Hospitality Corp. (TH) | $38.3M | 3.4% | Reduce 7.02% |

The top 10 command 42.2% of the $1,119.7M portfolio, with no single position exceeding 8.0%, illustrating Powers' preference for controlled conviction over extreme bets. Notable is the blend of aggressive expansions—like QNST's outsized add—and prudent trims in BBSI and HROW, suggesting dynamic capital allocation based on relative value.

This concentration level supports alpha generation without excessive risk, as the remaining 158 positions provide ballast. The changes highlight a portfolio in motion, rewarding scalable growers while de-risking mature holdings.

Investment Lessons from Gregg J. Powers' Approach

Gregg J. Powers' Q3 2025 portfolio exemplifies timeless principles tailored to small-cap value investing:

- Hunt undervalued small caps relentlessly: Massive adds like QNST 4,515.84% show the payoff of spotting overlooked growth before the crowd.

- Trim winners to fund conviction: Reducing top holdings like HROW by 4.61% demonstrates discipline in reallocating to higher-upside ideas.

- Diversify thoughtfully: 168 positions with 42.2% in top 10 balance broad exposure and focused bets, mitigating small-cap volatility.

- Patience pays in holding periods: 9-quarter average tenure underscores buying businesses, not trading headlines.

- Monitor turnover actively: 23.8% rate reveals constant vigilance, exiting underperformers like BBSI -13.97% to fuel new opportunities.

These lessons empower retail investors to emulate Powers' adaptive, research-driven style.

Looking Ahead: What Comes Next?

Powers' positioning sets up well for a small-cap resurgence, with fresh capital from trims like BBSI and TH available for deployment. The +2 positions signal ongoing expansion, potentially into healthcare or tech services amid economic uncertainty. Expansions in AIOT and QNST position the portfolio for AI/IoT and digital ad tailwinds.

In a high-interest-rate environment, Powers' focus on cash-generative small caps could shine if rate cuts unlock growth. Track the Private Capital portfolio for Q4 signals on whether healthcare trims deepen or new bets emerge in cyclicals.

FAQ about Gregg J. Powers Portfolio

Q: What are the most significant changes in Gregg J. Powers' Q3 2025 portfolio?

A: Key moves include a massive 4,515.84% add to QuinStreet (QNST) at 5.7%, 9.06% increase in PowerFleet (AIOT), and trims like 13.97% in BBSI and 4.61% in Harrow Health (HROW), reflecting profit-taking and rotation to growth.

Q: Why does Powers maintain such a large number of positions with moderate top-10 concentration?

A: The 168 holdings and 42.2% top-10 allocation balance diversification against conviction, allowing broad small-cap exposure while sizing up high-confidence bets like QNST, reducing risk in volatile micro-caps.

Q: What sectors dominate Powers' small-cap strategy?

A: Healthcare leads with HROW and LGND, complemented by services (QNST, AIOT), financials (KKR), and industrials, targeting undervalued niches.

Q: How can I track Gregg J. Powers' Private Capital Management portfolio?

A: Follow quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/private-capital for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!