Guy Spier - Aquamarine Capital Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

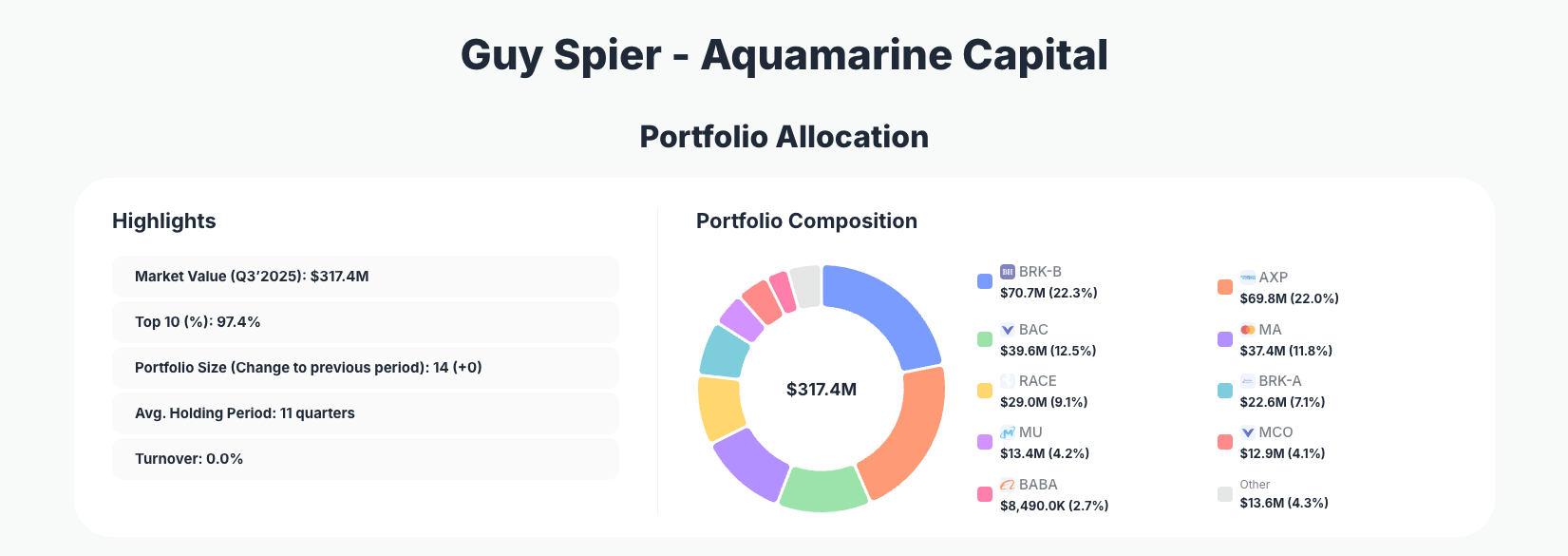

Guy Spier - Aquamarine Capital continues to showcase a classic long-term value investing discipline, letting winners compound while making only surgical tweaks at the margin. Their Q3’2025 portfolio remains tightly focused, with $317.4M allocated across just 14 positions, dominated by financial and payment franchises, and only two meaningful trades this quarter: a sharp reduction in Micron Technology and a notable add to niche commodity play Core Natural Resources.

Portfolio Overview: A Quiet Quarter for a Deeply Concentrated Fund

Portfolio Highlights (Q3’2025): - Market Value: $317.4M

- Top 10 Holdings: 97.4% of the portfolio

- Portfolio Size: 14 +0 positions

- Average Holding Period: 11 quarters

- Turnover: 0.0%

Aquamarine’s latest Q3’2025 portfolio is a textbook example of concentration and patience. With 97.4% of capital in the top 10 names and only 14 holdings overall, Spier is clearly willing to back a small set of businesses he understands deeply rather than diversify for its own sake.

The 11-quarter average holding period underscores a genuine buy‑and‑hold mentality rather than a trading mindset. A reported 0.0% turnover this quarter means virtually no fresh capital was moved between names; instead, the existing structure of Aquamarine’s portfolio has been left to compound. For investors studying superinvestors for signals, this kind of stability can be as informative as aggressive activity.

Another defining feature of Aquamarine’s portfolio is its tilt toward financial compounding machines—payment networks, financials, and data/ratings—balanced by a handful of high‑quality cyclicals and selective exposure to technology and natural resources. The minimal number of trades this quarter suggests conviction in the core thesis across these holdings, with adjustments focused on risk/return calibration rather than strategy shifts.

Core Holdings & Key Positions: Financial Franchises and Select Tech

The Q3’2025 portfolio is anchored by a handful of large, high‑conviction positions, complemented by a few smaller names where Spier is still building or trimming exposure.

The second‑largest position is Berkshire Hathaway Inc. (BRK-B) at 22.3% of the portfolio, unchanged this quarter, with 140,600 shares worth $70.7M. Aquamarine also holds 30 shares of Berkshire Hathaway Inc. (BRK-A), a 7.1% position valued at $22.6M, also marked as “No change.” Together, the two Berkshire share classes represent nearly 30% of the total portfolio—an enormous vote of confidence in Warren Buffett’s conglomerate and its underlying collection of cash‑generating businesses.

Close behind, American Express Company sits at 22.0% of the portfolio, with 210,000 shares valued at $69.8M and “No change” in Q3. This long‑term holding aligns with Aquamarine’s preference for durable brands, strong customer relationships, and recurring fee‑based revenue streams.

The banking exposure is dominated by Bank of America Corporation, a 12.5% position at $39.6M with 767,845 shares and “No change” this quarter. In payments, Mastercard Incorporated accounts for 11.8% of the portfolio (65,750 shares worth $37.4M), again with no reported adjustment. These holdings collectively underline a consistent focus on financial infrastructure and payment rails as long‑term compounding engines.

On the consumer and luxury side, Ferrari N.V. represents 9.1% of the portfolio, with 60,000 shares worth $29.0M and “No change” in Q3. Ferrari’s presence among the top positions highlights Aquamarine’s willingness to own elite brands with pricing power, even when headline valuation multiples may appear elevated.

Within the smaller top‑10 positions, Moody's Corporation accounts for 4.1% of capital (27,000 shares valued at $12.9M, “No change”), while Alibaba Group Holding Limited represents 2.7%, with 47,500 shares worth $8.49M and no activity this quarter. Moody’s extends the financial infrastructure theme into credit ratings and data, while Alibaba provides exposure to Chinese e‑commerce and cloud computing at scale.

The main area of active change this quarter is technology hardware and memory. Micron Technology, Inc.—already a top‑10 holding at 4.2% of the portfolio—was significantly trimmed. Aquamarine now holds 80,000 shares worth $13.4M after a “Reduce 60.00%” action. The size of this cut suggests a deliberate de‑risking or profit‑taking move in a cyclical, capital‑intensive segment, while still retaining exposure for potential upside.

At the smaller‑cap end of the book, Core Natural Resources, Inc. stands out as the only meaningful add this quarter. The position, ranked 15th by size, totals 10,740 shares worth $897.0K (0.3% of the portfolio) following an “Add 32.59%” move. While still a modest allocation, the scale of the percentage increase hints at Spier’s growing conviction in this commodities‑linked name and a desire to scale into the opportunity gradually.

Together, these 10–11 key holdings paint a clear picture: extremely concentrated bets on financial and payment infrastructure, buttressed by select positions in premium brands, selectively trimmed tech cyclicals like Micron, and an expanding but still small allocation to Core Natural Resources.

What the Portfolio Reveals About Aquamarine’s Strategy

Aquamarine’s Q3’2025 13F filing reveals several strategic themes:

- Concentration in durable franchises

Nearly all capital is deployed into businesses with entrenched competitive advantages—payment networks, major banks, credit rating agencies, and Berkshire’s diversified ecosystem. These franchises typically benefit from network effects, high switching costs, and regulatory or brand moats. - Financial infrastructure at the core

Heavy allocations to American Express, Mastercard, Bank of America, and Moody’s show a clear preference for the “picks and shovels” of global finance—businesses that sit on top of transaction flows or critical risk information rather than chasing more speculative growth. - Selective cyclicality and tech exposure

The significant trim in Micron indicates respect for cyclicality and capital intensity in memory and semiconductor markets, while still maintaining a 4.2% stake for upside participation. - Gradual scaling into smaller ideas

The 32.59% increase in Core Natural Resources, despite its small 0.3% weight, suggests a “toe‑in‑the‑water” approach to newer or more volatile ideas: start small, increase slowly as conviction and evidence build. - Risk management via low turnover

With 0.0% turnover, Aquamarine avoids excessive trading costs, tax frictions, and timing errors. Risk is managed through careful initial selection, sizing, and occasional trims (like Micron) rather than constant reshuffling.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Berkshire Hathaway Inc. (BRK-B) | $70.7M | 22.3% | No change |

| American Express Company | $69.8M | 22.0% | No change |

| Bank of America Corporation | $39.6M | 12.5% | No change |

| Mastercard Incorporated | $37.4M | 11.8% | No change |

| Ferrari N.V. | $29.0M | 9.1% | No change |

| Berkshire Hathaway Inc. (BRK-A) | $22.6M | 7.1% | No change |

| Micron Technology, Inc. | $13.4M | 4.2% | Reduce 60.00% |

| Moody's Corporation | $12.9M | 4.1% | No change |

| Alibaba Group Holding Limited | $8,490.0K | 2.7% | No change |

The table shows just how top‑heavy this portfolio is: the top three holdings—Berkshire (BRK-B), American Express, and Bank of America—alone account for over half of total capital. Adding Mastercard and Ferrari brings the concentration even higher, reflecting a deep belief that a small number of exceptional businesses can drive the majority of long‑term returns.

The only top‑10 name with a reported change is Micron, with a “Reduce 60.00%” action. This stands out as a clear risk‑management decision in an otherwise static set of holdings. The trim lowers exposure to a cyclical semiconductor player while keeping intact the structural bets on financial and consumer franchises.

Investment Lessons from Guy Spier’s Aquamarine Strategy

Investors studying Guy Spier – Aquamarine Capital can draw several practical lessons from the Q3’2025 13F:

- Concentrate when conviction is high

With 97.4% of capital in the top 10 holdings and nearly 30% across the two Berkshire share classes, Aquamarine shows that meaningful outperformance often requires being meaningfully different from the index. - Let time do the heavy lifting

An 11‑quarter average holding period and 0.0% turnover reflect a philosophy where most of the work is done upfront—underwriting business quality and valuation—then allowing compounding and management execution to play out over years. - Favor enduring economic moats

Heavy allocations to payment networks, banks, credit ratings, and a unique luxury brand like Ferrari underscore the importance of durable competitive advantages: network effects, brand power, regulatory barriers, and scale. - Use trims, not churn, to manage risk

The 60% reduction in Micron shows that risk can be managed by adjusting position sizes rather than abandoning ideas wholesale or constantly rotating into new names. - Scale into new or volatile ideas carefully

Increasing Core Natural Resources by 32.59% while keeping it at just 0.3% of the portfolio demonstrates a staged approach to building exposure, especially in more cyclical or commodity‑linked areas.

Looking Ahead: What Comes Next for Aquamarine Capital?

Given the 0.0% turnover and stable roster of holdings, Aquamarine appears content with its current positioning and focused on long‑term compounding rather than near‑term market rotations. The portfolio is heavily levered to:

- Continued strength in financial infrastructure through American Express, Mastercard, Bank of America, and Moody’s.

- Compounding within Berkshire Hathaway’s ecosystem, via both BRK-B and BRK-A.

- Premium brand and pricing power dynamics in Ferrari.

- Selective upside from tech cyclicals and resources through Micron and Core Natural Resources.

Future 13F filings will show whether the Micron trim was a one‑off recalibration or part of a broader effort to reduce exposure to cyclical tech. The incremental add to CNR also bears watching, as it may evolve into a more meaningful position if Aquamarine’s thesis continues to play out.

Investors tracking Aquamarine’s portfolio should view current holdings as a reflection of long‑term conviction rather than a short‑term market call. Any future changes are likely to be incremental and thesis‑driven, not reactionary.

FAQ about Guy Spier – Aquamarine Capital Portfolio

Q: What were the most significant changes in Aquamarine’s Q3’2025 portfolio?

The main adjustments were a “Reduce 60.00%” action in Micron Technology, which now stands at 4.2% of the portfolio, and an “Add 32.59%” increase to Core Natural Resources, now 0.3% of assets. All major core positions such as Berkshire (BRK-B), American Express, Bank of America, and Mastercard were reported as “No change.”

Q: How concentrated is the Guy Spier – Aquamarine Capital portfolio?

Extremely concentrated: 97.4% of capital is invested in the top 10 positions, with 14 holdings in total. The largest two holdings—Berkshire (BRK-B) and American Express—alone account for 44.3% of the portfolio.

Q: What is Aquamarine’s average holding period and turnover?

The average holding period is 11 quarters, and reported turnover for Q3’2025 is 0.0%. This reflects a long‑term, low‑churn approach consistent with classic value investing.

Q: Which sectors or themes does Aquamarine emphasize?

The portfolio is heavily tilted toward financial infrastructure and services—payment networks, a major U.S. bank, a leading credit rating agency, and Berkshire’s diversified holdings—supplemented by a luxury consumer brand, selective technology exposure via Micron, and a small but growing natural resources position in Core Natural Resources.

Q: How can I track Guy Spier – Aquamarine Capital’s latest holdings and changes?

You can follow all reported positions, historical moves, and quarterly updates on ValueSense’s superinvestor tracker at Aquamarine’s portfolio. Remember that 13F filings are disclosed with a 45‑day lag after quarter‑end, so the positions shown may differ from real‑time holdings; use ValueSense to monitor trends, concentration, and incremental adjustments over multiple quarters.[2][3][4][5][6][7][8][9]

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!