Hamilton - Helmer Strategy Capital Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

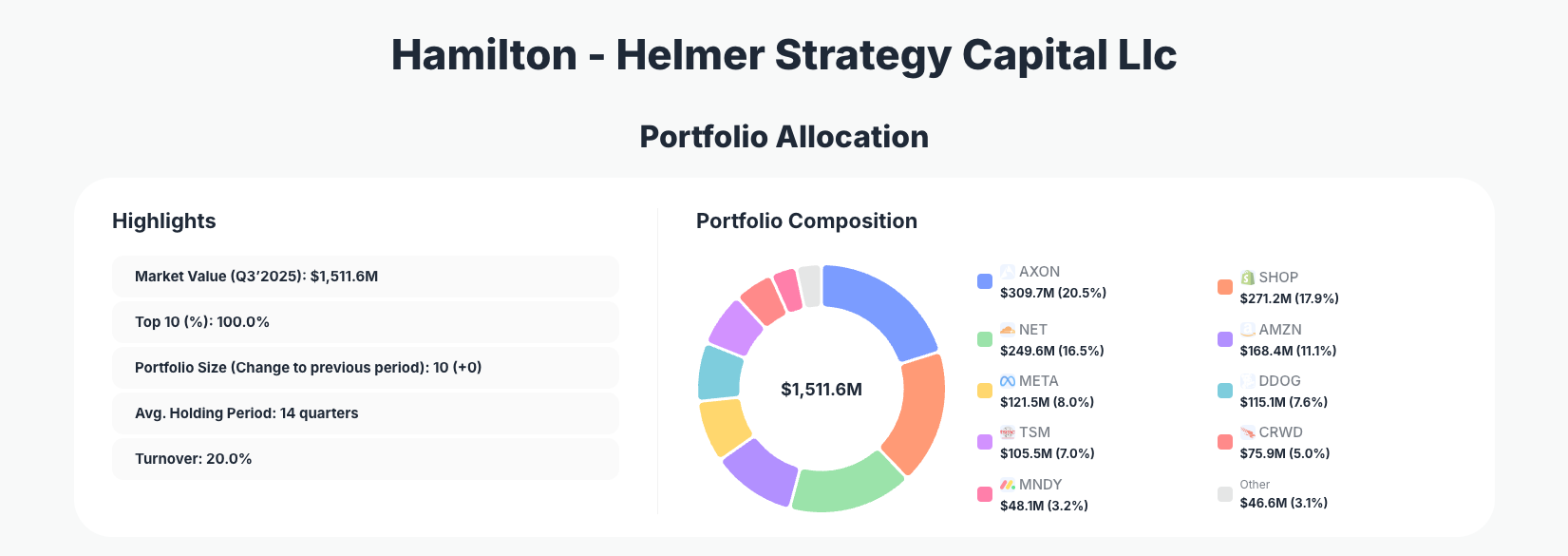

Hamilton - Helmer Strategy Capital Llc enters Q3’2025 with a tightly focused, $1.51B equity book that showcases a refined mix of high-growth, high-moat compounders and selective risk trimming. Their Q3’2025 portfolio remains highly concentrated in software, cloud infrastructure, and platform businesses, highlighted by sizable positions in names like Axon Enterprise, Inc. (AXON), Shopify Inc. (SHOP), and Cloudflare, Inc. (NET), alongside calibrated reductions in prior winners such as Amazon.com, Inc. (AMZN) and CrowdStrike Holdings, Inc. (CRWD).

View Hamilton – Helmer Strategy Capital’s full Q3 2025 portfolio on ValueSense →

Portfolio Overview: A Concentrated Bet on Structural Winners

Portfolio Highlights (Q3 2025): - Market Value: $1,511.6M

- Top 10 Holdings: 100.0%

- Portfolio Size: 10 +0

- Average Holding Period: 14 quarters

- Turnover: 20.0%

Hamilton - Helmer Strategy Capital runs an ultra-concentrated 10-stock book, with the entire equity exposure sitting in the top 10 positions. Their Q3’2025 portfolio reflects a deliberate “few big bets” philosophy rather than a diversified benchmark-hugging approach. A 14-quarter average holding period underscores their preference for multi-year compounding over short-term trading.

Despite this long-term orientation, a 20.0% turnover indicates meaningful tactical adjustments at the margin. Within a fully invested 10-position portfolio, a fifth of capital rotating each year suggests active risk management—paring back where risk/reward looks less compelling, while leaning into new or strengthening convictions within the same structural themes captured in the Strategy Capital portfolio.

Sector-wise, the fund is clearly skewed toward technology, cloud, and digital infrastructure—from SaaS platforms and cybersecurity to global e‑commerce and semiconductor manufacturing. This expresses a view that network effects, recurring revenue, and data-driven moats will remain the dominant drivers of equity value creation over the coming decade, even as individual positions are fine-tuned within the Strategy Capital holdings.

Top Holdings: Cloud Platforms, Cybersecurity, and Selective Trimming

The Q3’2025 filing shows 10–11 key names with notable activity across nearly the entire book. The portfolio is anchored by Axon, Shopify, and Cloudflare, with a second tier of large positions in mega-cap platforms and infrastructure players.

The largest position remains Axon Enterprise, Inc. (AXON) at 20.5% of the portfolio, where Strategy Capital made only a minor “Reduce 0.25%” adjustment. At this size, Axon is a core conviction position, and the tiny trim looks more like position sizing discipline than any change in thesis.

Close behind, Shopify Inc. (SHOP) sits at 17.9% of capital and was a clear “Buy” during the quarter. This makes Shopify a central pillar of the Hamilton – Helmer strategy: a scaled e‑commerce enablement platform with long runway, and one of the few positions being actively increased in the latest Strategy Capital 13F.

Cloudflare, Inc. (NET) represents 16.5% of the portfolio, slightly adjusted with a “Reduce 0.26%” move. Similar fractional trims occur in Datadog, Inc. (DDOG) at 7.6%, Taiwan Semiconductor Manufacturing Company Limited (TSM) at 7.0%, and monday.com Ltd. (MNDY) at 3.2%, each labeled “Reduce 0.26%”. These micro-adjustments across several holdings suggest an incremental rebalancing program—potentially harvesting gains or keeping single-stock risk within strict bounds while maintaining strong conviction.

The fund’s exposure to global platform leaders is expressed via Amazon.com, Inc. (AMZN) at 11.1% and Meta Platforms, Inc. (META) at 8.0%. However, the moves here are more pronounced: Amazon was marked “Reduce 7.26%”, a significant step down, while Meta saw a lighter “Reduce 0.22%”. That combination implies a relative preference for Meta’s risk/reward versus Amazon at current levels, without exiting either franchise.

Cybersecurity exposure is held through CrowdStrike Holdings, Inc. (CRWD), still 5.0% of the portfolio despite an eye‑catching “Reduce 81.75%” action. This is the most aggressive single change in the filing—likely reflecting either valuation concerns, risk control after strong performance, or a shift toward other security or infrastructure names while keeping a residual stake.

Complementing these software and platform leaders is an EV and AI‑levered exposure via Tesla, Inc. (TSLA), at 3.1% of the portfolio and tagged “Reduce 34.25%”. Tesla remains meaningful, but the one‑third cut shows Strategy Capital dialing back volatility and single‑name risk in what is historically a high-beta position.

Across these 10–11 highlighted holdings, the pattern is clear: one notable Buy (Shopify), one very large reduction (CrowdStrike), a sizable trim in Tesla and Amazon, and a series of minimal fractional reductions across core cloud and SaaS names, while Axon remains the single largest anchor with only a microscopic trim.

What the Portfolio Reveals About Strategy

This quarter’s moves in the Hamilton – Helmer Strategy Capital Llc portfolio highlight several consistent strategic themes:

- Compounding Quality Over Broad Diversification

A 10‑stock book with 100% in the top 10 and a 14‑quarter holding period shows a deliberate choice to own a small set of high-conviction compounders rather than broad market exposure. - Tech & Cloud as Structural Growth Engines

Heavy weights in SHOP, NET, DDOG, MNDY, CRWD, and TSM suggest a strong belief that cloud, SaaS observability, cybersecurity, and semiconductors remain secular winners over a full cycle. - Risk Management via Incremental Trims

Repeated “Reduce 0.2X%” adjustments across several holdings show a preference for gradual, rules-based sizing discipline rather than abrupt portfolio turnover, aligning with a 20% annual turnover in an otherwise long-hold strategy. - Selective De-Risking of High-Beta Names

The sharp reductions in CRWD (‑81.75%) and TSLA (‑34.25%), and the more meaningful trim in AMZN (‑7.26%), point to a measured de-risking from some of the most volatile or richly valued holdings, while keeping exposure to their underlying themes. - Global, Not Just U.S., Orientation

With Shopify (Canada), TSMC (Taiwan), and monday.com (Israel) all meaningful allocations, Strategy Capital is clearly comfortable with global champions listed in U.S. markets rather than a purely domestic bias.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Axon Enterprise, Inc. (AXON) | $309.7M | 20.5% | Reduce 0.25% |

| Shopify Inc. (SHOP) | $271.2M | 17.9% | Buy |

| Cloudflare, Inc. (NET) | $249.6M | 16.5% | Reduce 0.26% |

| Amazon.com, Inc. (AMZN) | $168.4M | 11.1% | Reduce 7.26% |

| Meta Platforms, Inc. (META) | $121.5M | 8.0% | Reduce 0.22% |

| Datadog, Inc. (DDOG) | $115.1M | 7.6% | Reduce 0.26% |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $105.5M | 7.0% | Reduce 0.26% |

| CrowdStrike Holdings, Inc. (CRWD) | $75.9M | 5.0% | Reduce 81.75% |

| monday.com Ltd. (MNDY) | $48.1M | 3.2% | Reduce 0.26% |

The top three positions—Axon, Shopify, and Cloudflare—alone account for 54.9% of total equity exposure, illustrating just how much of the fund’s outcome is driven by a handful of core ideas. Meanwhile, the next tier (Amazon, Meta, Datadog, and TSM) pushes concentration even further, so that the top seven stocks represent more than 80% of the portfolio.

Within this structure, changes to a single name can meaningfully shift risk. The drastic reduction in CRWD from its prior level to a still‑meaningful 5.0% shows how Strategy Capital can rapidly lower exposure to a theme while continuing to participate. In contrast, micro‑trims of 0.2–0.3% across multiple holdings look like fine-tuning of weights rather than changes in conviction, suggesting that the manager’s core views on Axon, Cloudflare, Datadog, TSM, Meta, and monday.com remain intact.

Investment Lessons from Hamilton – Helmer Strategy Capital

Several practical lessons emerge from studying the Hamilton - Helmer Strategy Capital Llc portfolio:

- Concentrate When You Know Your Edge

Running 10 positions with 100% of capital in the top 10 underscores a belief that depth of understanding beats breadth of coverage. For individual investors, this suggests focusing on a manageable watchlist of businesses you can truly follow. - Hold for Years, Adjust by Inches

A 14‑quarter average holding period combined with multiple sub‑1% trims demonstrates that time in the market plus small, ongoing calibrations can be more effective than constant trading. - Use Position Sizing as a Risk Lever

Strategy Capital’s sharp cuts in CRWD and TSLA, versus microscopic trims in AXON or NET, show that risk can be managed primarily through size rather than binary “in or out” decisions. - Anchor on Structural Trends, Not Quarterly Noise

The portfolio is built around durable themes—cloud, cybersecurity, digital commerce, semiconductors, and mission‑critical software—rather than tactical trades. Long‑term theses guide the structure; quarterly moves just fine‑tune exposures. - Let Winners Dominate, but Don’t Let Them Run Wild

Allowing Axon, Shopify, and Cloudflare to represent more than half of the portfolio illustrates letting winners grow, while minor trims and periodic rebalancing keep concentration from becoming uncontrolled.

Looking Ahead: What Comes Next?

Using this Q3’2025 13F snapshot, several forward-looking implications stand out:

- Room to Add if Volatility Strikes

By trimming high-beta names like CRWD and TSLA, Strategy Capital may be creating flexibility to re‑deploy into drawdowns across cloud, cyber, or AI beneficiaries without meaningfully changing the core roster. - Potential Re‑Rotation Within Tech

The only outright “Buy” tag is in SHOP, suggesting that commerce infrastructure and merchant tooling may be an area where the manager sees relatively superior upside versus other growth names they already own. - Steady Commitment to Cloud & Platforms

The continued presence of NET, DDOG, MNDY, and TSM at substantial weights indicates no sign of a pivot away from infrastructure‑like software and semiconductor names, even amid macro uncertainty. - Watch for New Entrants in Adjacent Themes

With a 20% turnover and the willingness to re‑size aggressively, future quarters could reveal new positions in adjacent or enabling technologies (AI tooling, data platforms, edge computing), complementing the existing architecture of the Strategy Capital portfolio.

FAQ about Hamilton – Helmer Strategy Capital Portfolio

Q: What were the biggest changes in Hamilton – Helmer Strategy Capital’s Q3 2025 portfolio?

The most significant moves were an 81.75% reduction in CrowdStrike (CRWD), a 34.25% reduction in Tesla (TSLA), and a 7.26% reduction in Amazon (AMZN), alongside a Buy in Shopify (SHOP). Smaller trims affected several other holdings.

Q: How concentrated is the Hamilton – Helmer Strategy Capital Llc portfolio?

It holds 10 positions with 100% of capital in the top 10, and over half of the portfolio is in Axon, Shopify, and Cloudflare alone—an extremely high-conviction, concentrated strategy.

Q: What is their typical holding period and turnover?

The average holding period is 14 quarters (over three years), with 20.0% turnover, implying that Strategy Capital usually holds businesses for years but still makes meaningful annual adjustments.

Q: Which sectors and themes does the portfolio emphasize?

The portfolio is heavily weighted toward technology, cloud infrastructure, SaaS, cybersecurity, digital commerce, and semiconductors, via names like NET, DDOG, CRWD, SHOP, and TSM.

Q: How can I track Hamilton – Helmer Strategy Capital’s portfolio going forward?

You can follow their quarterly changes through 13F filings and use ValueSense’s superinvestor tracker at the Strategy Capital portfolio page for updated holdings, position changes, visuals, and historical data. Remember that 13F filings are reported with a 45‑day lag, so positions may have shifted after the reporting date.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!