10 high dividend yield stocks for 2025

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Almost every investor seeks consistent income through their investments. For individual investors, this often means focusing on stocks with high dividend yields, while income-focused portfolios aim to maximize regular cash distributions.

To help identify stocks offering strong dividend performance, we applied several targeted criteria:

- High Dividend Yield: Companies with dividend yields exceeding 4%, indicating robust income potential.

- Dividend Stability: Only companies with a consistent history of dividend payments for at least 5 consecutive years.

- Financial Strength: Stocks with a payout ratio under 75%, ensuring sustainable dividend distributions.

The following five stocks meet all these criteria. While past performance doesn't guarantee future returns, these companies stand out with reliable income streams and financial stability, making them promising options for dividend-focused investors.

10 high dividend yield stocks for 2025

Here’s the new list of Value Sense’s top high dividend yield picks to buy for Q1 2025. These companies continue to demonstrate strong financial positions and strategic initiatives that support their status as high-dividend yield stocks, making them attractive options for income-focused investors.

- BHP Group - BHP

- Pfizer - PFE

- Verizon - VZ

- Unilever - UL

- TotalEnergies - TTE

- AT&T - T

- UPS - UPS

- Gilead Sciences - GILD

- Shell - SHEL

- Bristol-Myers Squibb Co - BMY

Here are essential metrics and insights on each stock, as of Nov. 19, 2024, according to our analysts.

1/ BHP Group

With a robust 5.33% yield, BHP continues to benefit from strong commodity prices. The company recently announced record iron ore production, supporting its ability to maintain high dividend payments.

- Dividend Yield: 5.33% as of November 19, 2024.

- Annual Dividend per Share: $2.148244, paid semi-annually.

- Dividend Payout Ratio: 93.7% for the fiscal year ending June 30, 2024.

2/ Pfizer

Offering an impressive 6.76% yield, Pfizer's recent acquisition of Seagen strengthens its oncology portfolio, potentially securing future dividend sustainability despite patent expirations.

- Dividend Yield: 6.76% as of November 18, 2024.

- Annual Dividend per Share: $1.68, paid quarterly.

- Dividend Payout Ratio: 433.67% for the fiscal year ending December 31, 2023.

3/ Verizon

Verizon's 6.41% yield remains attractive. The company's ongoing 5G network expansion and recent subscriber growth in Q3 2024 underscore its capacity to maintain high dividends.

- Dividend Yield: 6.41% as of November 18, 2024.

- Annual Dividend per Share: $2.71, paid quarterly.

- Dividend Payout Ratio: 95.54% for the fiscal year ending December 31, 2023.

4/ Unilever

While offering a more modest 3.27% yield, Unilever's recent focus on high-growth categories and emerging markets supports its consistent dividend policy.

- Dividend Yield: 3.27% as of November 19, 2024.

- Annual Dividend per Share: £1.4845, paid quarterly.

- Dividend Payout Ratio: 66.35% for the fiscal year ending December 31, 2023.

5/ TotalEnergies

With a solid 5.45% yield, TotalEnergies' recent increase in LNG production and renewable energy investments bolster its dividend sustainability.

- Dividend Yield: 5.45% as of November 19, 2024.

- Annual Dividend per Share: €3.16, paid quarterly.

- Dividend Payout Ratio: 37.61% for the fiscal year ending December 31, 2023.

6/ AT&T

AT&T's 4.83% yield remains appealing. The company's recent subscriber growth and 5G network improvements support its ability to maintain attractive dividends.

- Dividend Yield: 4.83% as of November 18, 2024.

- Annual Dividend per Share: $1.11, paid quarterly.

- Dividend Payout Ratio: 56.16% for the fiscal year ending December 31, 2023.

7/ UPS

UPS offers a 4.82% yield. Its recent operational efficiency improvements and strategic focus on high-margin sectors reinforce its dividend-paying capacity.

- Dividend Yield: 4.82% as of November 18, 2024.

- Annual Dividend per Share: $6.52, paid quarterly.

- Dividend Payout Ratio: 82.98% for the fiscal year ending December 31, 2023.

8/ Gilead Sciences

With a 3.48% yield, Gilead's recent advancements in HIV treatments and oncology pipeline strengthen its position as a reliable dividend payer.

- Dividend Yield: 3.48% as of November 18, 2024.

- Annual Dividend per Share: $3.08, paid quarterly.

- Dividend Payout Ratio: 66.09% for the fiscal year ending December 31, 2023.

9/ Shell

Shell's 4.10% yield is backed by strong cash flows. The company's recent focus on LNG and renewable energy projects supports its dividend sustainability.

- Dividend Yield: 4.10% as of November 18, 2024.

- Annual Dividend per Share: $1.062286, paid quarterly.

- Dividend Payout Ratio: 44.99% for the fiscal year ending December 31, 2023.

10/ Bristol-Myers Squibb Co

Offering a 4.23% yield, Bristol-Myers Squibb's recent product launches and robust oncology pipeline reinforce its ability to maintain high dividend payments.

- Dividend Yield: 4.23% as of November 18, 2024.

- Annual Dividend per Share: $2.40, paid quarterly.

- Dividend Payout Ratio: 59.56% for the fiscal year ending December 31, 2023.

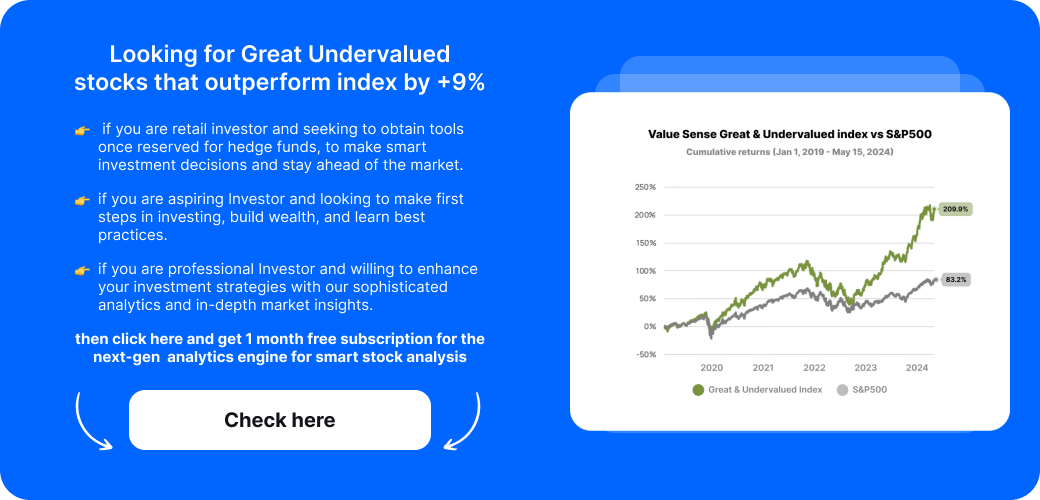

For investors seeking opportunities, our analytics team provides comprehensive lists of undervalued companies where the intrinsic value suggests potential undervaluation, combining fundamental analysis with quality metrics:

Ready to start?

Join 3,500+ value investors worldwide

FAQ about high dividend yield stocks

What is considered a high dividend yield?

Generally, a dividend yield above 4% is considered high. However, it's important to assess the sustainability of the dividend and the company's financial health. For example, BHP Group offers a 5.33% yield, while Pfizer provides an impressive 6.76% yield12.

How often are dividends typically paid?

Most companies pay dividends quarterly, but some may pay monthly or annually. For instance, BHP Group pays semi-annually, while companies like Pfizer, Verizon, and AT&T pay quarterly dividends123.

What is a dividend payout ratio, and why is it important?

The dividend payout ratio is the percentage of earnings a company pays out as dividends. A lower ratio, typically under 75%, suggests more sustainable dividend distributions. For example, TotalEnergies has a healthy payout ratio of 37.61%, indicating strong dividend sustainability5.

Are high dividend yields always a good sign?

Not necessarily. While high yields can be attractive, they may also indicate potential risks. It's crucial to examine the company's financial health, dividend history, and future prospects. For instance, Pfizer's high yield of 6.76% should be considered alongside its recent acquisitions and patent expirations2.

How can investors evaluate the sustainability of a company's dividends?

Investors should consider factors such as the company's financial strength, payout ratio, dividend history, and future growth prospects. For example, Shell's 4.10% yield is supported by strong cash flows and strategic investments in LNG and renewable energy projects.