10 High-Quality Stocks With High FCF Yield

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Looking to fortify your investment strategy with robust, long-term performers? Many investors believe it’s nearly impossible to find quality companies that offer both double-digit Free Cash Flow (FCF) yield and over 15% annualized returns, but that assumption often leads to missing out on top-tier market opportunities.

These under-the-radar picks combine steady financial performance, significant profitability, and consistent growth, making them prime candidates for portfolio diversification.

Here are 10 High-Quality Firms that prove high FCF yield and strong returns can indeed go hand in hand.

PDD Holdings Inc. $PDD

Quality: 7.7

FCF yield: 12.4%

Price performance CAGR 5y: 21.8%

Harmony Gold Mining $HMY

Quality: 7.9

FCF yield: 10.0%

Price performance CAGR 5y: 23.5%

Crocs $CROX

Quality: 7.4

FCF yield: 15.9%

Price performance CAGR 5y: 19.2%

Matson $MATX

Quality: 7.2

FCF yield: 10.8%

Price performance CAGR 5y: 30.1%

Sylvamo $SLVM

Quality: 7.0

FCF yield: 21.32%

Price performance CAGR 5y: 49.5%

Protagonist Therapeutics $PTGX

Quality: 7.2

FCF yield: 10.1%

Price performance CAGR 5y: 38.2%

ZIM Integrated Shipping Services $ZIM

Quality: 7.9

FCF yield: 46.4%

Price performance CAGR 5y: 65.1%

International Seaways $INSW

Quality: 7.1

FCF yield: 18.3%

Price performance CAGR 5y: 16.7%

Golden Ocean Group $GOGL

Quality: 7.0

FCF yield: 17.2%

Price performance CAGR 5y: 23.5%

Star Bulk Carriers $SBLK

Quality: 7.2

FCF yield: 24.6%

Price performance CAGR 5y: 19.1%

Dorchester Minerals $DMLP

Quality: 7.0

FCF yield: 10.9%

Price performance CAGR 5y: 22.8%

Dorian LPG $LPG

Quality: 7.2

FCF yield: 23.9%

Price performance CAGR 5y: 27.7%

Global Ship Lease $

Quality: 7.8

FCF yield: 26.4%

Price performance CAGR 5y: 26.9%

The Screening criteria for High-Quality Firms With Double-Digit FCF Yield and Over 15% Annualized Returns:

Quality > 7

FCF yield > 10%

Price performance 5Y CAGR > 15%

You can check out the companies from the thread on the Value Sense platform. It's absolutely free.

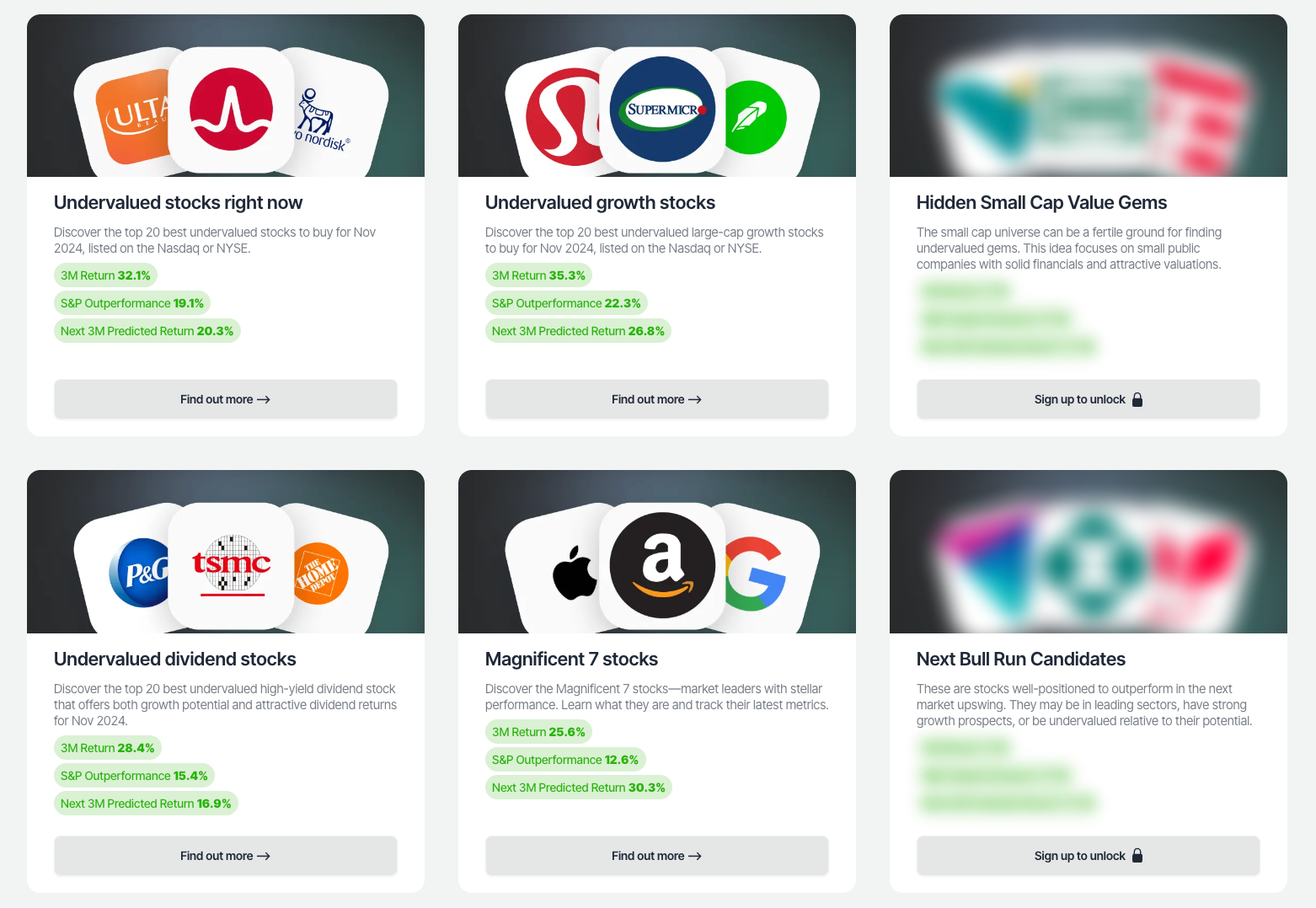

For investors seeking opportunities, our analytics team provides comprehensive lists of undervalued companies where the intrinsic value suggests potential undervaluation, combining fundamental analysis with quality metrics:

Ready to start?

Join 3,500+ value investors worldwide

FAQ

What makes these companies stand out as strong investment opportunities?

These companies offer a combination of high Free Cash Flow (FCF) yield and strong annualized price performance, making them attractive for investors looking for both profitability and growth.

Why is Free Cash Flow (FCF) yield important when evaluating stocks?

FCF yield measures how much cash a company generates relative to its market value, indicating financial stability and the potential for shareholder returns through dividends, buybacks, or reinvestment.

Which company on the list has the highest FCF yield?

ZIM Integrated Shipping Services ($ZIM) has the highest FCF yield at 46.4%, making it a standout for cash flow generation.

What sector do most of these companies belong to?

Many of these companies are from capital-intensive industries like shipping, mining, and energy, which typically generate high cash flows and can offer strong returns in favorable market conditions.

How does historical price performance influence future investment decisions?

A strong 5-year CAGR (Compound Annual Growth Rate) suggests consistent growth and resilience, making these companies more attractive for long-term investors seeking capital appreciation.