11 Best High Free Cash Flow Stocks Over $2B - Value Sense Analysis 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Free cash flow represents the ultimate measure of a company's financial health and value creation capability. Companies generating substantial free cash flow possess the financial flexibility to fund growth initiatives, return capital to shareholders, acquire competitors, or weather economic downturns without compromising their competitive position.

Our analysis focuses on companies generating over $2 billion in free cash flow annually, representing the most financially robust businesses in the market. These cash generation powerhouses demonstrate proven business models, operational efficiency, and the ability to convert revenue into actual cash available for strategic deployment.

High Free Cash Flow Selection Criteria:

- Annual free cash flow generation exceeding $2 billion

- Strong free cash flow margins indicating operational efficiency

- Sustainable business models supporting consistent cash generation

- Strategic positioning for continued growth and market leadership

Top 11 High Free Cash Flow Stocks - Complete Analysis

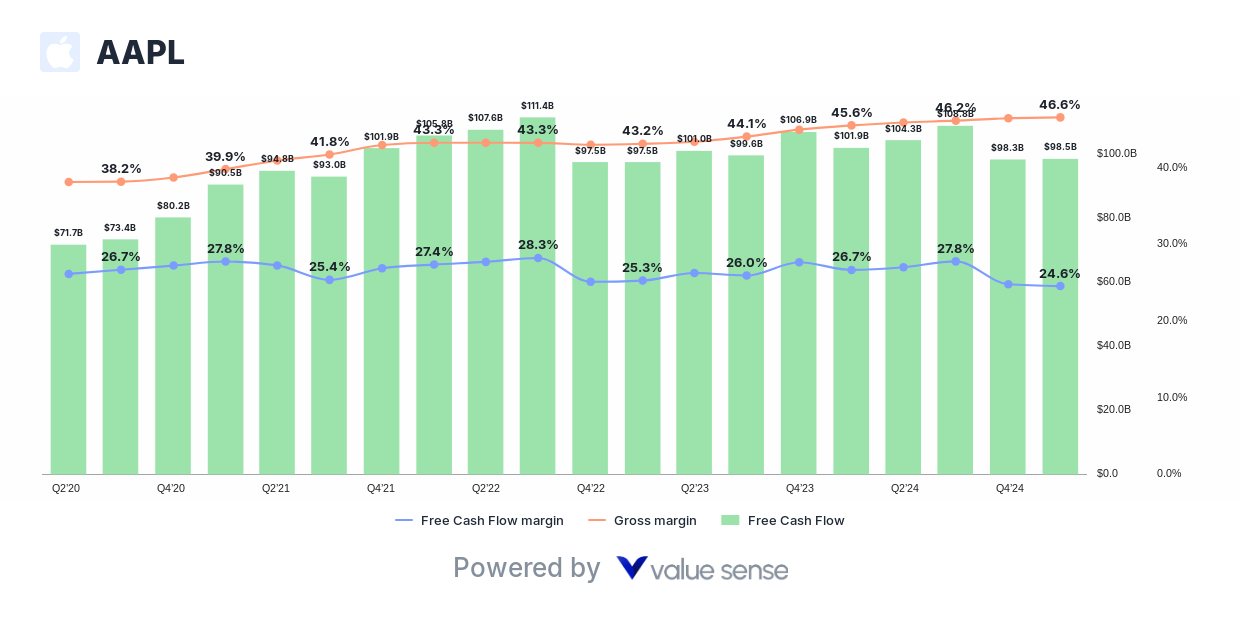

1. Apple Inc. (AAPL) - $98.5B Free Cash Flow

Sector: Technology | Revenue: $400.4B | Revenue Growth: 4.9%

Cash Generation Metrics:

- Free Cash Flow: $98.5B

- FCF Margin: 24.6%

- Gross Margin: 46.6%

Investment Thesis: Apple stands as the undisputed leader in free cash flow generation with an extraordinary $98.5B annually, representing nearly 25% of its massive revenue base. The company's integrated ecosystem of hardware, software, and services creates unparalleled customer loyalty and pricing power, enabling consistent cash generation across economic cycles.

Cash Flow Sustainability: Apple's free cash flow benefits from recurring revenue streams through the App Store, iCloud, and other services, providing stability beyond hardware sales cycles. The company's capital-light business model and premium pricing strategy ensure continued robust cash generation even during market challenges.

Strategic Cash Deployment: Apple's massive cash generation enables substantial shareholder returns through dividends and share repurchases, strategic acquisitions to enhance ecosystem capabilities, and continued R&D investment in emerging technologies like artificial intelligence and augmented reality.

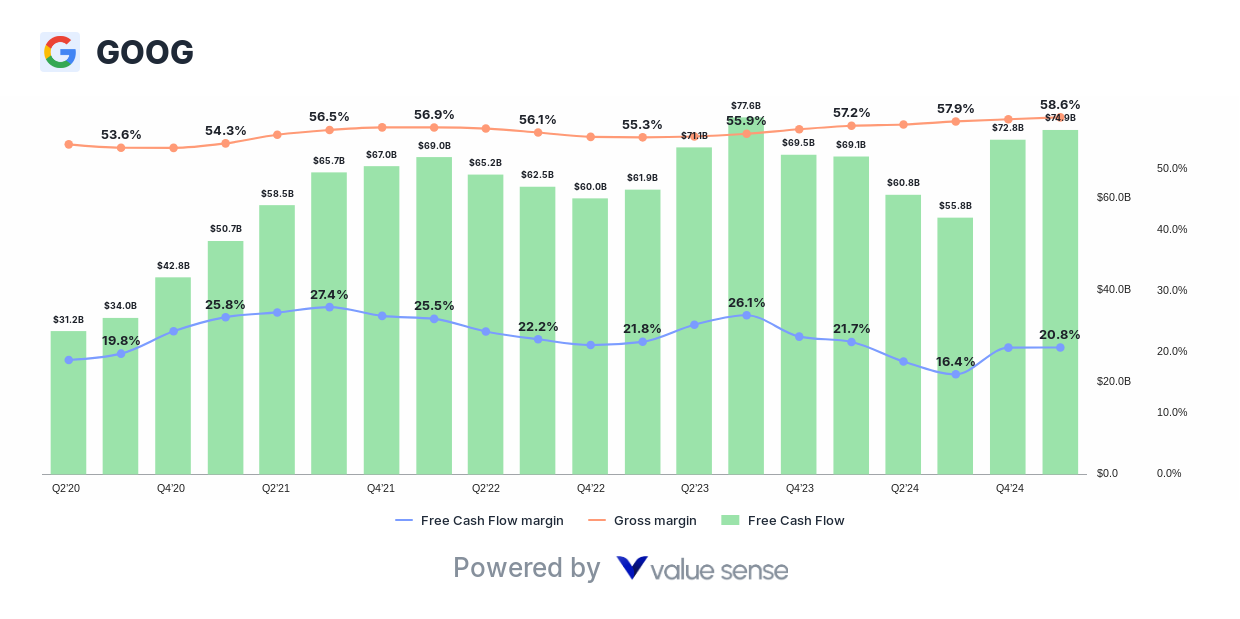

2. Alphabet Inc. (GOOG) - $74.9B Free Cash Flow

Sector: Internet Services | Revenue: $359.6B | Revenue Growth: 13.1%

Cash Generation Metrics:

- Free Cash Flow: $74.9B

- FCF Margin: 20.8%

- Gross Margin: 58.6%

Investment Thesis: Alphabet generates $74.9B in free cash flow through its dominant search advertising platform and expanding cloud services. The company's asset-light business model and market-leading positions in digital advertising create predictable cash flows with substantial growth potential.

Cash Flow Sustainability: Google's search monopoly and YouTube's growing advertising revenue provide stable cash generation, while Google Cloud's rapid expansion offers additional growth drivers. The company's data advantages and AI capabilities strengthen its competitive moat and cash generation potential.

Strategic Cash Deployment: Alphabet's free cash flow supports massive R&D investments in artificial intelligence, autonomous vehicles, and other emerging technologies, while maintaining substantial cash reserves for strategic acquisitions and shareholder returns.

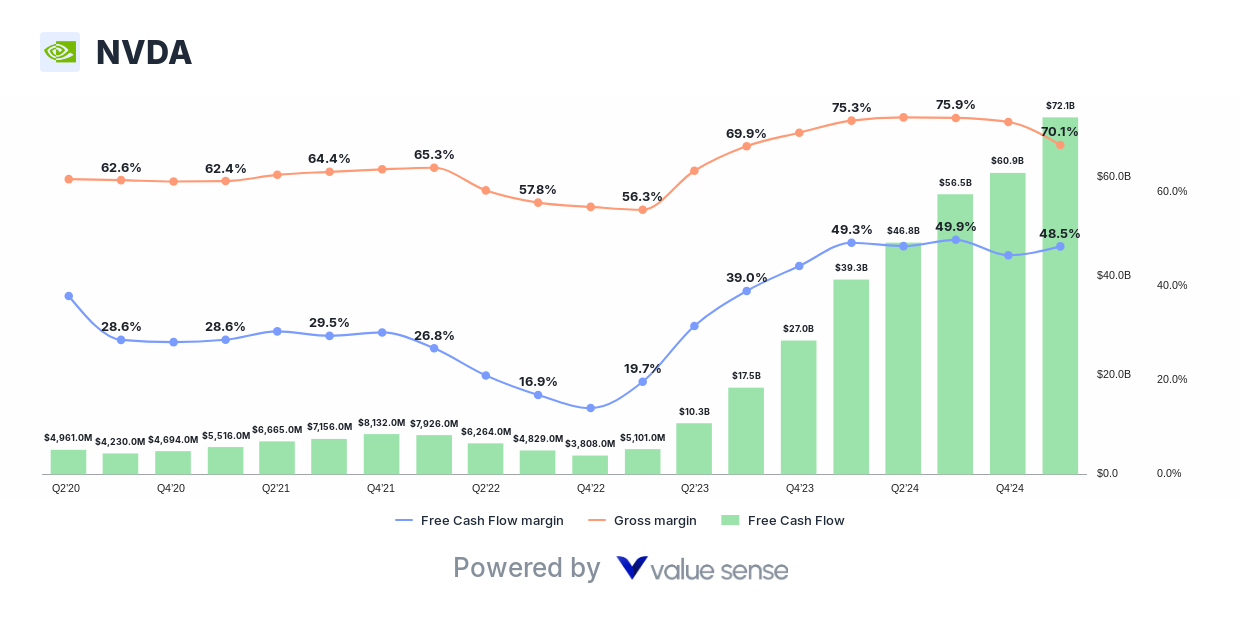

3. NVIDIA Corporation (NVDA) - $72.1B Free Cash Flow

Sector: Semiconductors | Revenue: $148.5B | Revenue Growth: 86.2%

Cash Generation Metrics:

- Free Cash Flow: $72.1B

- FCF Margin: 48.5%

- Gross Margin: 70.1%

Investment Thesis: NVIDIA demonstrates exceptional cash generation with $72.1B in free cash flow and an industry-leading 48.5% FCF margin, reflecting its dominant position in AI computing and graphics processing. The company's technological leadership and platform approach create substantial barriers to entry and pricing power.

Cash Flow Sustainability: NVIDIA's free cash flow benefits from its CUDA software ecosystem, creating switching costs and recurring revenue streams. The company's leadership in AI infrastructure and data center computing positions it for sustained cash generation as artificial intelligence adoption accelerates globally.

Strategic Cash Deployment: NVIDIA's substantial cash generation supports continued R&D investment in next-generation computing architectures, strategic acquisitions to expand platform capabilities, and increasing shareholder returns through dividends and share repurchases.

4. Microsoft Corporation (MSFT) - $69.4B Free Cash Flow

Sector: Software | Revenue: $270.0B | Revenue Growth: 14.1%

Cash Generation Metrics:

- Free Cash Flow: $69.4B

- FCF Margin: 25.7%

- Gross Margin: 69.1%

Investment Thesis: Microsoft generates $69.4B in free cash flow through its diversified software and cloud services portfolio. The company's transformation to subscription-based services creates predictable recurring revenue streams and exceptional cash generation capabilities.

Cash Flow Sustainability: Microsoft's Office 365, Azure cloud platform, and Windows ecosystem provide stable cash flows with growth potential. The company's enterprise focus and mission-critical software create high switching costs and reliable cash generation across economic cycles.

Strategic Cash Deployment: Microsoft's substantial free cash flow enables continued cloud infrastructure investment, strategic acquisitions to expand capabilities, and consistent shareholder returns through dividends and share repurchases.

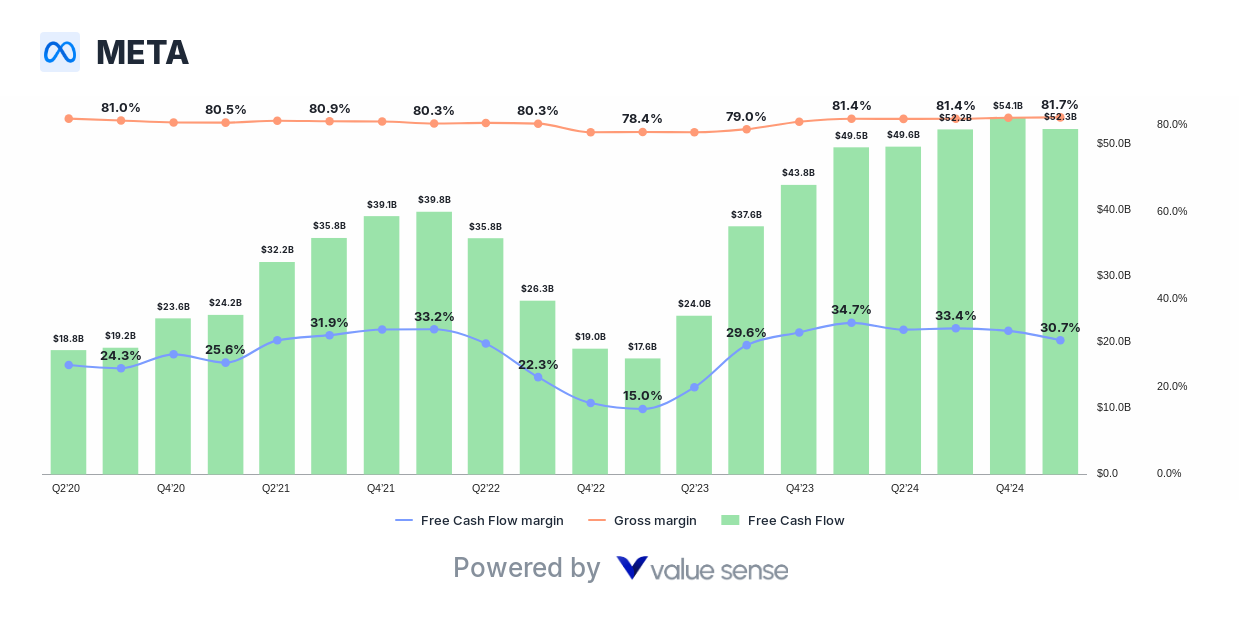

5. Meta Platforms, Inc. (META) - $52.3B Free Cash Flow

Sector: Social Media | Revenue: $170.4B | Revenue Growth: 19.4%

Cash Generation Metrics:

- Free Cash Flow: $52.3B

- FCF Margin: 30.7%

- Gross Margin: 81.7%

Investment Thesis: Meta generates $52.3B in free cash flow through its dominant social media platforms and growing digital advertising business. The company's exceptional gross margins and scale create substantial cash generation capabilities despite significant metaverse investments.

Cash Flow Sustainability: Meta's Facebook, Instagram, and WhatsApp platforms provide stable advertising revenue with growth potential in emerging markets. The company's data advantages and user engagement create competitive moats supporting cash generation.

Strategic Cash Deployment: Meta's substantial free cash flow supports massive investment in metaverse technologies, AI capabilities, and infrastructure expansion while maintaining significant shareholder returns through dividends and share repurchases.

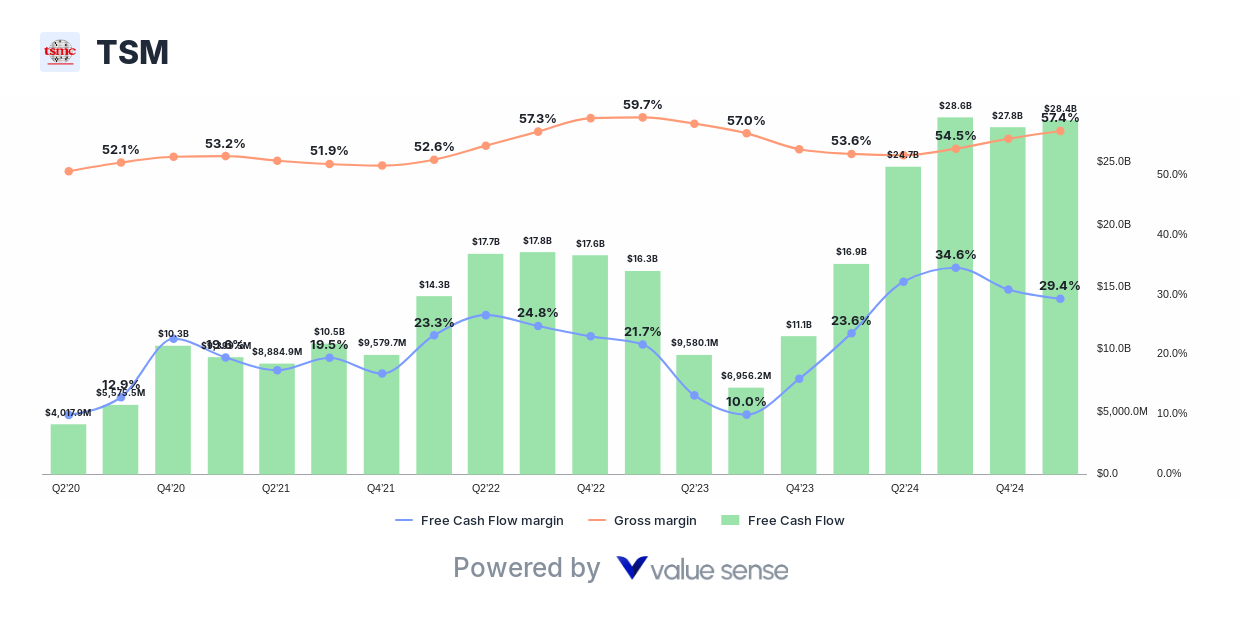

6. Taiwan Semiconductor Manufacturing Company (TSM) - $28.8B Free Cash Flow

Sector: Semiconductors | Revenue: $97.5B USD | Revenue Growth: 39.9%

Cash Generation Metrics:

- Free Cash Flow: NT$922.4B (~$28.8B USD)

- FCF Margin: 29.4%

- Gross Margin: 57.4%

Investment Thesis: TSMC generates approximately $28.8B in free cash flow through its dominant position as the world's largest contract semiconductor manufacturer. The company's technological leadership in advanced process nodes creates substantial competitive advantages and pricing power.

Cash Flow Sustainability: TSMC's free cash flow benefits from long-term customer relationships with technology leaders like Apple and NVIDIA, providing visibility into future demand. The company's continuous technology advancement and capacity expansion support sustained cash generation growth.

Strategic Cash Deployment: TSMC's cash generation supports massive capital expenditures for advanced manufacturing capacity, R&D investment in next-generation process technologies, and modest dividend payments to shareholders.

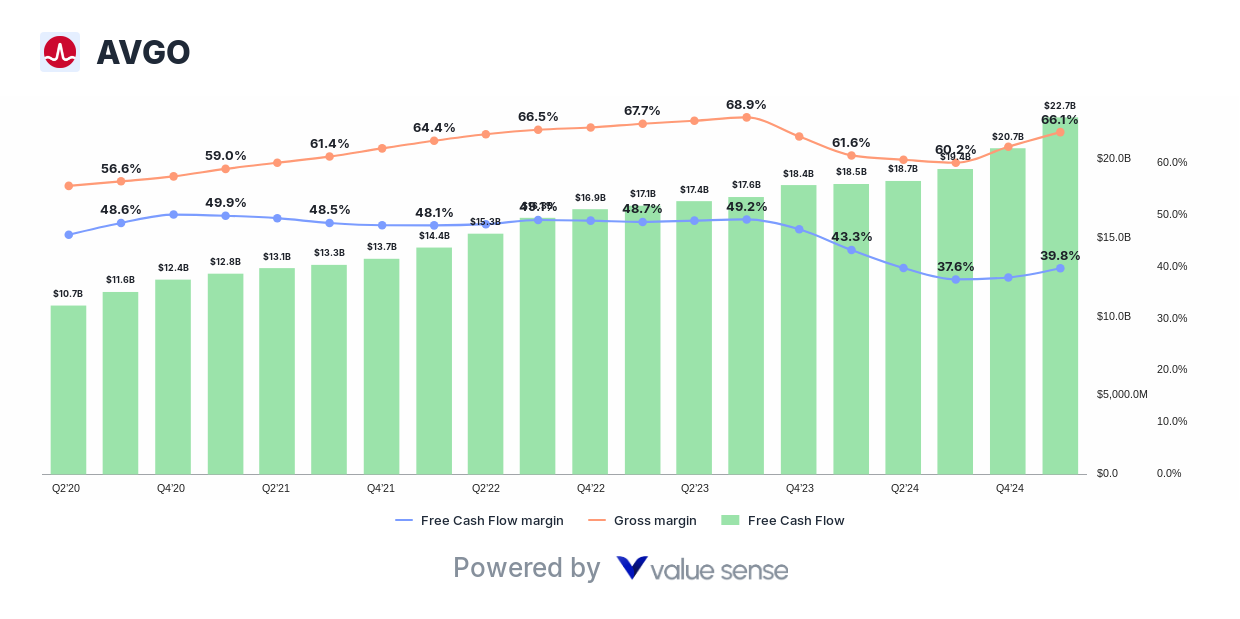

7. Broadcom Inc. (AVGO) - $22.7B Free Cash Flow

Sector: Semiconductors | Revenue: $57.0B | Revenue Growth: 33.9%

Cash Generation Metrics:

- Free Cash Flow: $22.7B

- FCF Margin: 39.8%

- Gross Margin: 66.1%

Investment Thesis: Broadcom generates $22.7B in free cash flow through its diversified semiconductor and infrastructure software portfolio. The company's focus on mission-critical applications and strategic acquisitions create substantial cash generation capabilities.

Cash Flow Sustainability: Broadcom's free cash flow benefits from essential semiconductor components for wireless communications and enterprise software with high switching costs. The company's acquisition strategy successfully expands addressable markets and cash generation potential.

Strategic Cash Deployment: Broadcom's substantial cash generation supports strategic acquisitions, debt reduction, and substantial dividend payments to shareholders, maintaining a disciplined capital allocation approach.

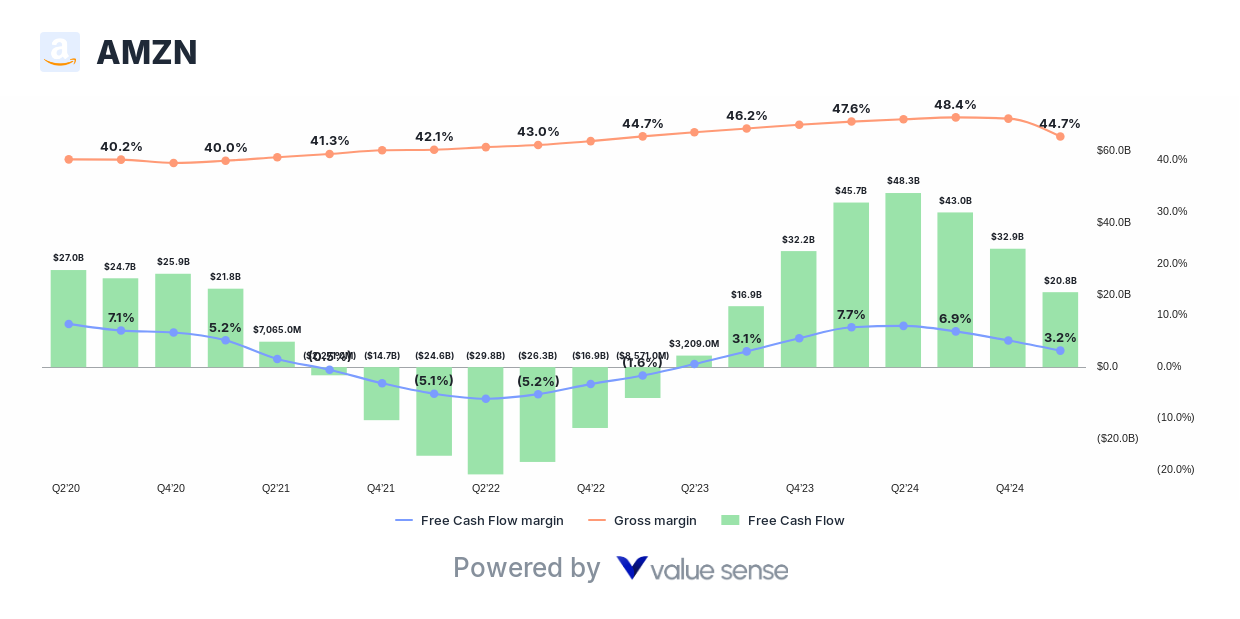

8. Amazon.com, Inc. (AMZN) - $20.8B Free Cash Flow

Sector: E-commerce/Cloud | Revenue: $650.3B | Revenue Growth: 10.1%

Cash Generation Metrics:

- Free Cash Flow: $20.8B

- FCF Margin: 3.2%

- Gross Margin: 44.7%

Investment Thesis: Amazon generates $20.8B in free cash flow despite its massive scale and continued growth investments. The company's diversified business model spanning e-commerce, cloud computing, and advertising creates multiple cash generation streams.

Cash Flow Sustainability: Amazon's AWS cloud platform provides high-margin recurring revenue, while Prime membership and advertising businesses offer growing cash generation potential. The company's scale advantages and customer loyalty support sustained cash flow growth.

Strategic Cash Deployment: Amazon's free cash flow supports continued infrastructure investment, international expansion, and emerging technology development while maintaining financial flexibility for strategic opportunities.

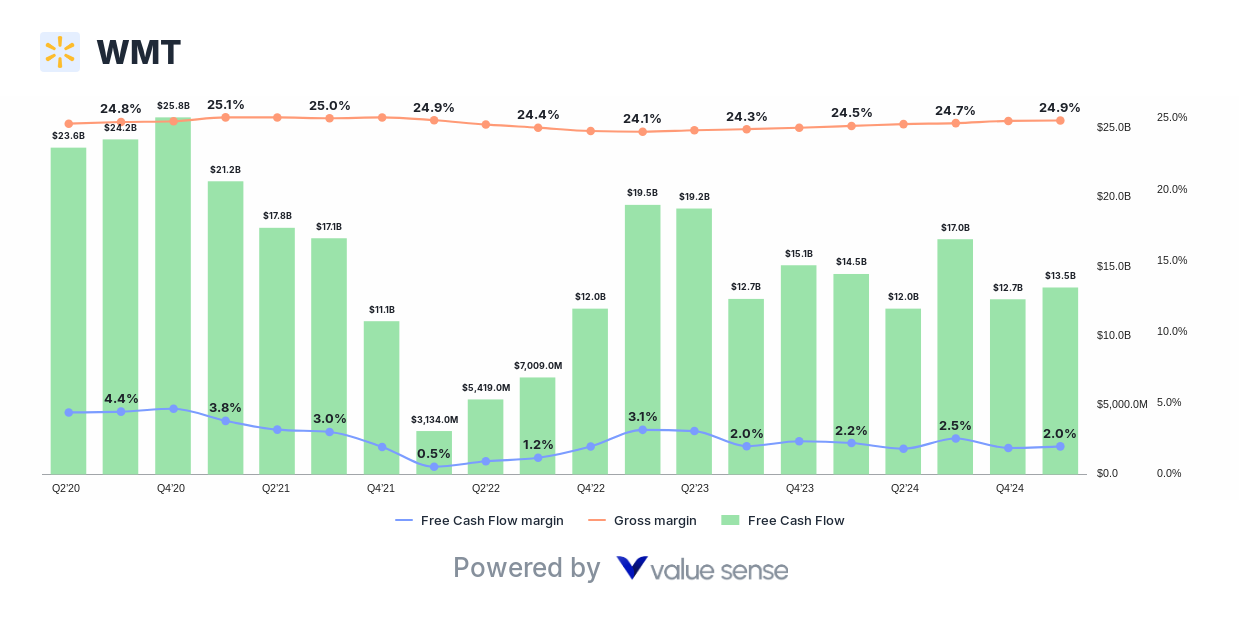

9. Walmart Inc. (WMT) - $13.5B Free Cash Flow

Sector: Retail | Revenue: $685.1B | Revenue Growth: 4.2%

Cash Generation Metrics:

- Free Cash Flow: $13.5B

- FCF Margin: 2.0%

- Gross Margin: 24.9%

Investment Thesis: Walmart generates $13.5B in free cash flow through its massive retail operations and growing e-commerce business. The company's scale advantages and operational efficiency create consistent cash generation despite low margins.

Cash Flow Sustainability: Walmart's essential retail services and supply chain advantages provide stable cash flows across economic cycles. The company's e-commerce growth and international expansion offer additional cash generation opportunities.

Strategic Cash Deployment: Walmart's free cash flow supports continued technology investment, supply chain optimization, and consistent dividend payments while maintaining financial flexibility for strategic initiatives.

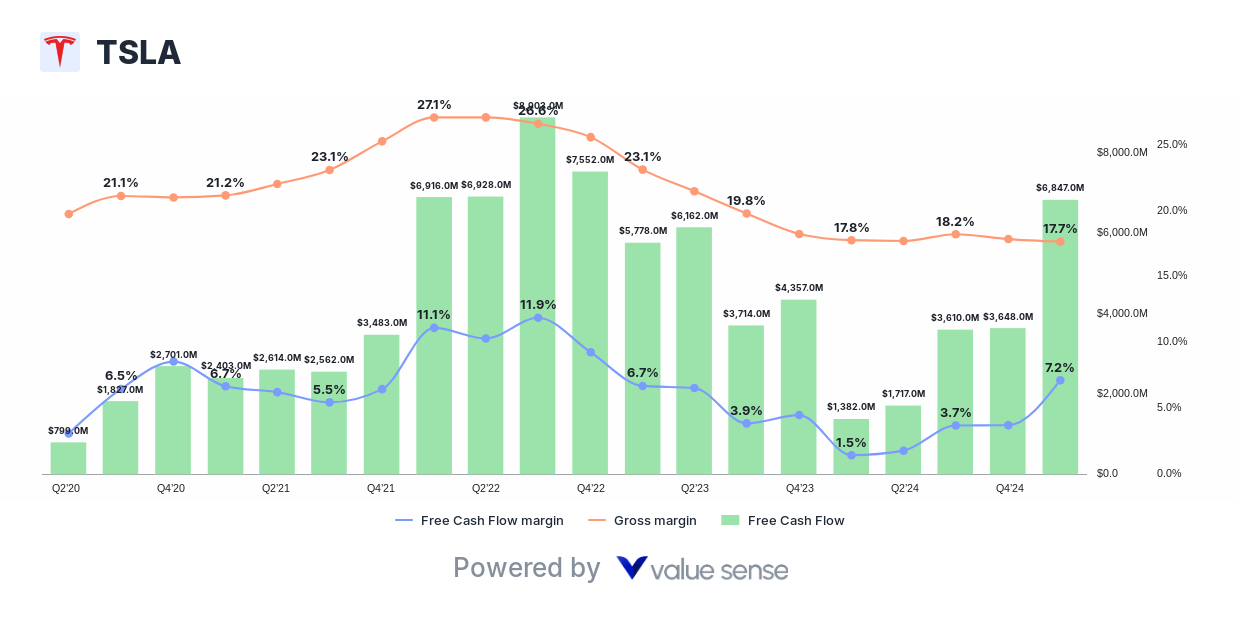

10. Tesla, Inc. (TSLA) - $6.8B Free Cash Flow

Sector: Electric Vehicles | Revenue: $95.7B | Revenue Growth: 1.0%

Cash Generation Metrics:

- Free Cash Flow: $6.8B

- FCF Margin: 7.2%

- Gross Margin: 17.7%

Investment Thesis: Tesla generates $6.8B in free cash flow through its integrated electric vehicle and energy business. The company's manufacturing efficiency improvements and scale expansion support growing cash generation capabilities despite capital-intensive operations.

Cash Flow Sustainability: Tesla's free cash flow benefits from increasing production volumes, operational efficiency gains, and expanding energy storage business. The company's technological leadership and brand strength support sustained cash generation growth.

Strategic Cash Deployment: Tesla's cash generation supports continued manufacturing capacity expansion, R&D investment in autonomous driving and energy technologies, and potential shareholder returns as the business matures.

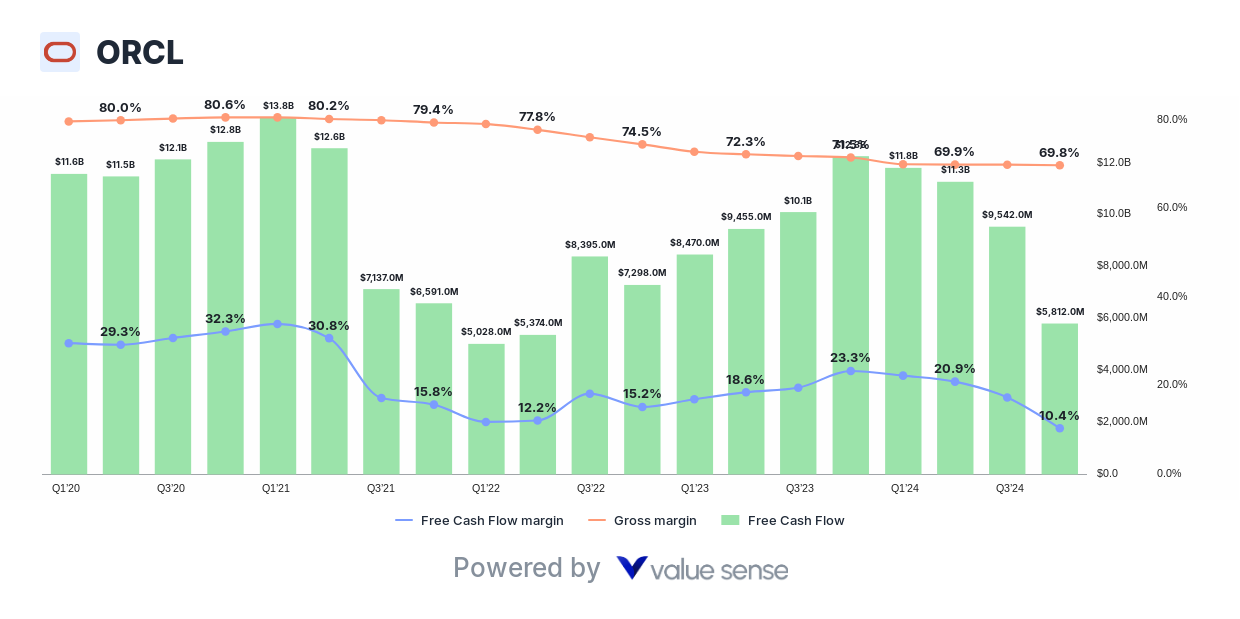

11. Oracle Corporation (ORCL) - $5.8B Free Cash Flow

Sector: Enterprise Software | Revenue: $55.8B | Revenue Growth: 6.2%

Cash Generation Metrics:

- Free Cash Flow: $5.8B

- FCF Margin: 10.4%

- Gross Margin: 69.8%

Investment Thesis: Oracle generates $5.8B in free cash flow through its enterprise database and cloud infrastructure services. The company's mission-critical software and high switching costs create predictable cash generation with growth potential.

Cash Flow Sustainability: Oracle's database dominance and cloud transformation provide stable cash flows with expanding margins. The company's focus on high-value enterprise applications creates sustainable competitive advantages and cash generation.

Strategic Cash Deployment: Oracle's free cash flow supports cloud infrastructure investment, strategic acquisitions, and substantial shareholder returns through dividends and share repurchases.

Investment Strategy for High Free Cash Flow Companies

Prioritize FCF Margin Excellence: Companies with FCF margins above 25% (NVIDIA at 48.5%, Meta at 30.7%, TSMC at 29.4%, Microsoft at 25.7%) demonstrate exceptional operational efficiency and cash conversion capabilities. These businesses typically maintain sustainable competitive advantages and pricing power.

Diversification Across Business Models: High free cash flow companies span multiple business models from asset-light software (Microsoft, Oracle) to capital-intensive manufacturing (TSMC, Tesla). Diversification across models provides exposure to different growth drivers and economic cycle resilience.

Assess Cash Deployment Strategies: Evaluate how companies deploy their substantial cash generation. Leaders like Apple and Microsoft balance growth investment with shareholder returns, while growth companies like Tesla prioritize capacity expansion and technology development.

Monitor Cash Flow Sustainability: Analyze the recurring nature of cash flows and competitive positioning. Companies with subscription models (Microsoft, Oracle) or network effects (Apple, Meta) typically demonstrate more predictable cash generation than cyclical businesses.

Free Cash Flow Analysis Framework

Quality Assessment (40% Weight):

- Consistency of cash generation across business cycles

- Conversion of earnings to actual cash flows

- Working capital management efficiency

- Capital allocation discipline and strategic focus

Growth Evaluation (35% Weight):

- Revenue growth sustainability and market opportunity

- Free cash flow growth rates and margin expansion potential

- Reinvestment requirements and returns on invested capital

- Competitive positioning and market share trends

Financial Strength (25% Weight):

- Balance sheet quality and debt management

- Cash flow coverage of dividends and capital expenditures

- Financial flexibility for strategic opportunities

- Ability to maintain cash generation during downturns

Key Takeaways for Free Cash Flow Investors

✅ Cash Generation Leaders: Apple ($98.5B), Alphabet ($74.9B), and NVIDIA ($72.1B) demonstrate exceptional cash generation scale

✅ Margin Excellence: NVIDIA (48.5%), Broadcom (39.8%), and Meta (30.7%) show superior cash conversion efficiency

✅ Diversified Opportunities: High FCF companies span technology, retail, automotive, and enterprise software sectors

✅ Strategic Flexibility: Substantial cash generation provides competitive advantages through economic cycles

✅ Shareholder Returns: Strong cash flows enable consistent dividends, share repurchases, and growth investment

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Quality Low-Debt Stocks

📖 10 Best Undervalued Dividend Stocks

📖 11 Best Multibagger Stocks with Heavy Moats

FAQ About High Free Cash Flow Stocks

What makes free cash flow more important than earnings for investment analysis?

Free cash flow represents the actual cash generated by a business after covering operational expenses and necessary capital expenditures, providing a more accurate picture of financial health than accounting earnings. Companies can manipulate earnings through accounting practices, but cash generation reflects real business performance. High FCF companies like Apple ($98.5B) and NVIDIA ($72.1B) demonstrate the ability to convert business operations into actual cash available for strategic deployment, debt reduction, or shareholder returns.

How do free cash flow margins indicate business quality and competitive advantages?

Free cash flow margins reveal operational efficiency and pricing power by showing how much revenue converts to available cash. Companies with FCF margins above 25% like NVIDIA (48.5%) and Meta (30.7%) typically possess strong competitive moats, premium pricing capabilities, and efficient operations. Higher margins indicate businesses can generate substantial cash without proportional increases in capital expenditures, suggesting sustainable competitive advantages and scalable business models.

Should investors focus on absolute free cash flow amounts or FCF margins?

Both metrics provide valuable insights for different investment objectives. Absolute FCF amounts like Apple's $98.5B indicate scale and financial flexibility for major strategic initiatives, while FCF margins reveal operational efficiency and business model quality. Large investors might prioritize absolute amounts for liquidity and impact, while efficiency-focused investors emphasize margins. The ideal combination features both substantial absolute generation and strong margins, as demonstrated by companies like NVIDIA and Microsoft.

How sustainable are high free cash flow levels during economic downturns?

FCF sustainability during downturns depends on business model characteristics and competitive positioning. Companies with recurring revenue streams (Microsoft, Oracle), essential services (Walmart), or strong competitive moats (Apple, Alphabet) typically maintain cash generation better than cyclical businesses. Diversified companies with multiple revenue streams and asset-light models generally demonstrate more resilient cash flows. Investors should analyze historical performance during previous downturns and assess the defensive characteristics of each business model.

What are the best uses of substantial free cash flow for long-term value creation?

Optimal cash deployment balances growth investment, shareholder returns, and strategic flexibility. The most value-creating approaches include reinvestment in high-return growth opportunities, strategic acquisitions that expand competitive moats, consistent dividend payments, and opportunistic share repurchases. Companies like Apple and Microsoft excel at balancing these priorities, while growth companies like Tesla prioritize capacity expansion. The key is maintaining discipline and focusing on investments that strengthen competitive advantages rather than pursuing growth at any cost.