High-Growth Stocks With High ROIC

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Almost every investor seeks consistent returns through their investments. For

Many investors think that High Growth and Great Capital Allocation is impossible to expect from one company.

That's why they miss on best opportunities on the market.

Here are 8 High-Growth Stocks With ROIC > 20% and FCF Yield > 3% to prove you wrong.

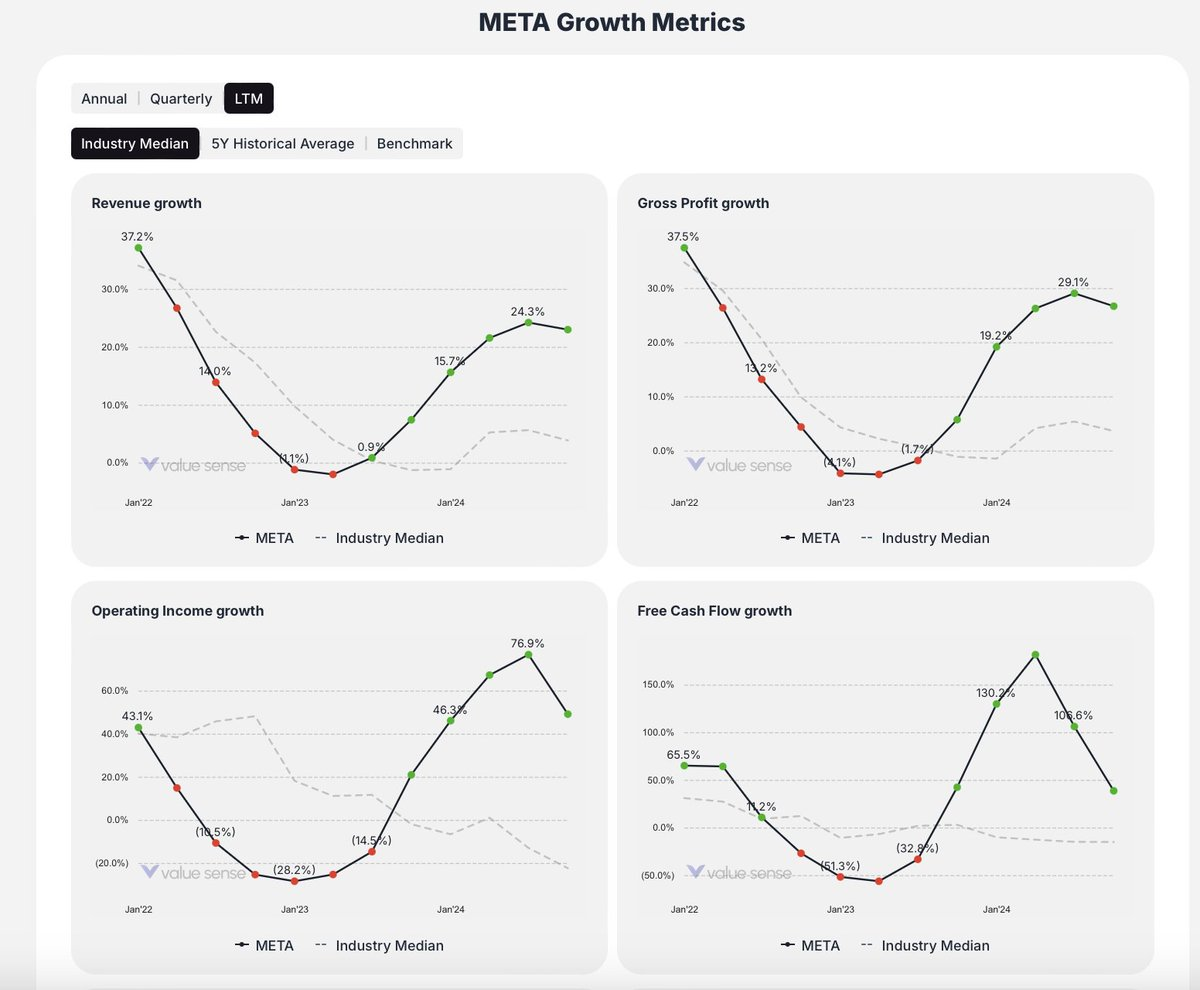

Meta Platforms $META

Growth Rating: 9.5 / 10

ROIC: 36.2%

FCF Yield: 3.4

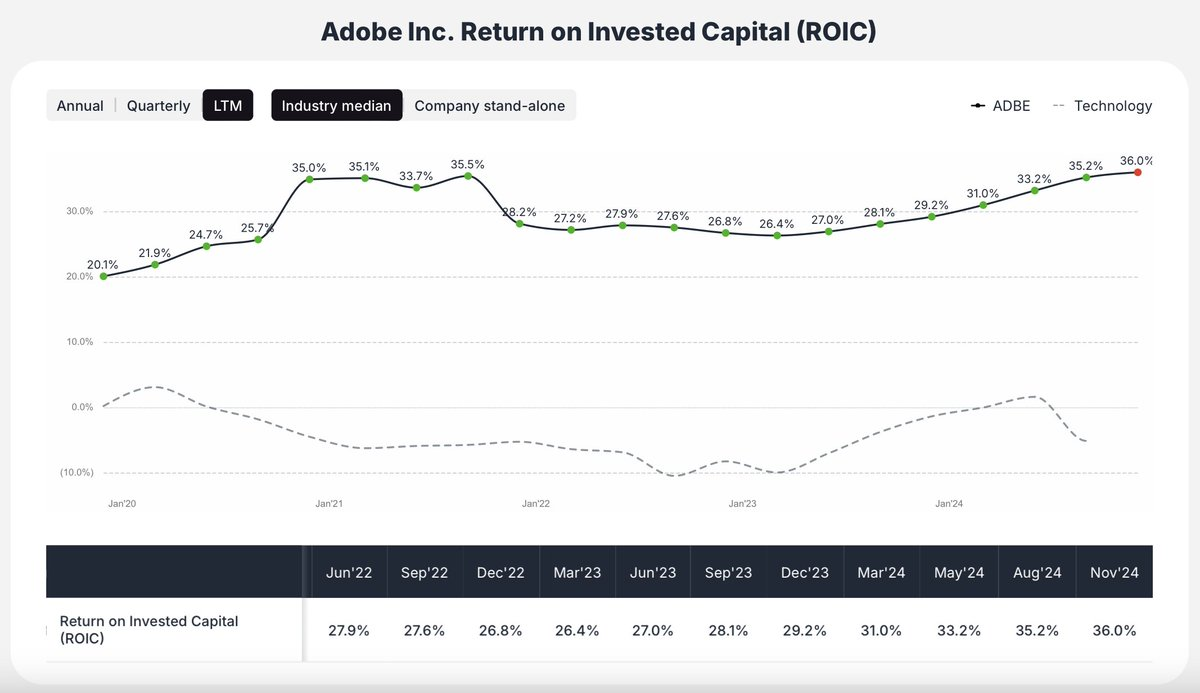

Adobe $ADBE

Growth Rating: 8.0 / 10

ROIC: 36.0%

FCF Yield: 4.4

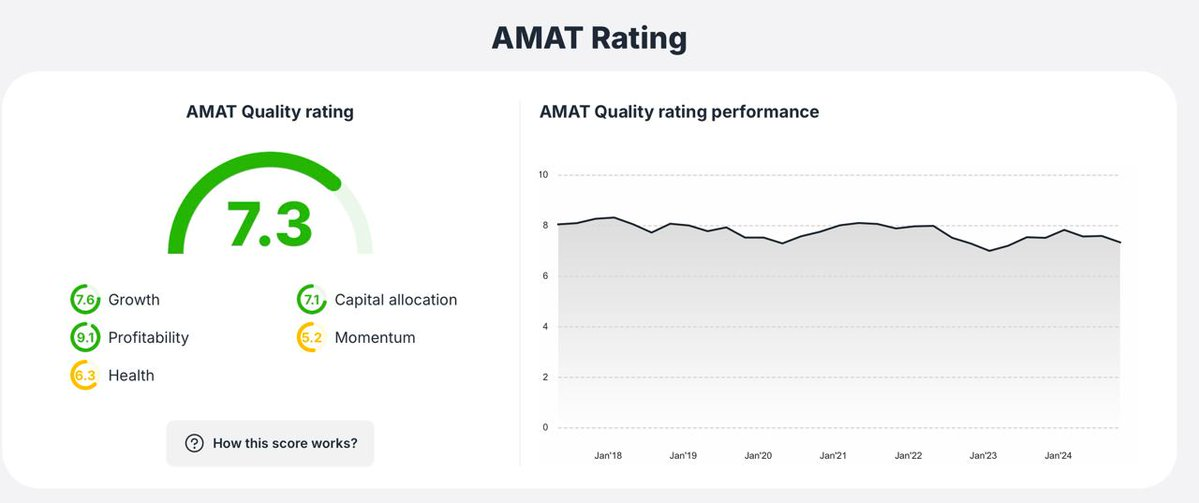

Applied Materials $AMAT

Growth Rating: 7.6 / 10

ROIC: 41.8%

FCF Yield: 5.4%

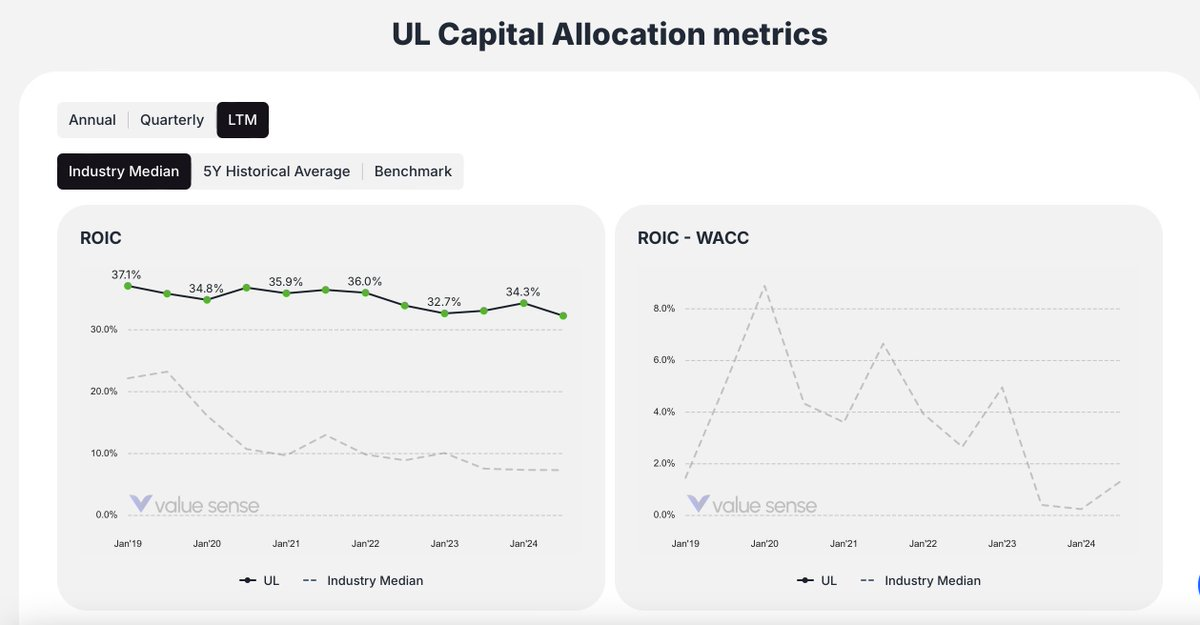

Unilever $UL

Growth Rating: 7.2 / 10

ROIC: 32.3%

FCF Yield: 10.4%

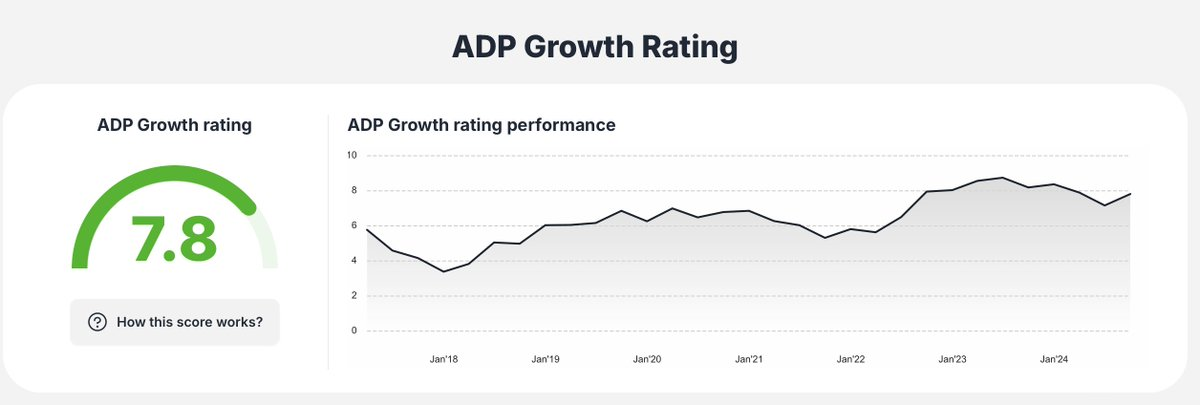

Automatic Data Processing $ADP

Growth Rating: 7.8 / 10

ROIC: 49.2%

FCF Yield: 3.5%

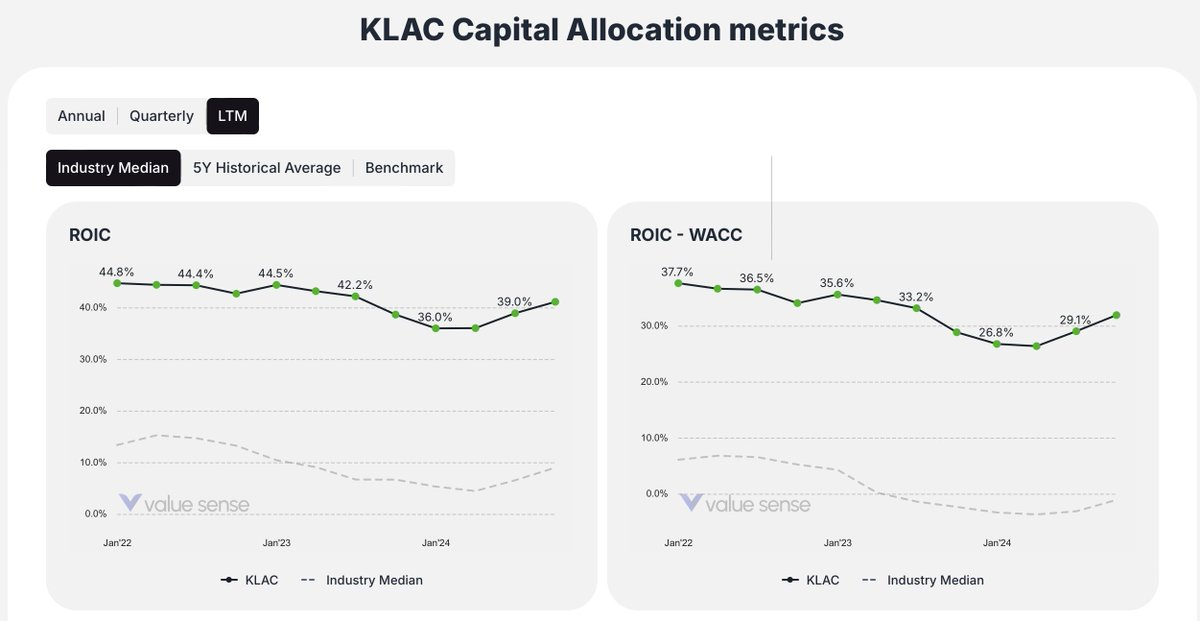

KLA Corporation $KLAC

Growth Rating: 7.2 / 10

ROIC: 41.2%

FCF Yield: 3.5%

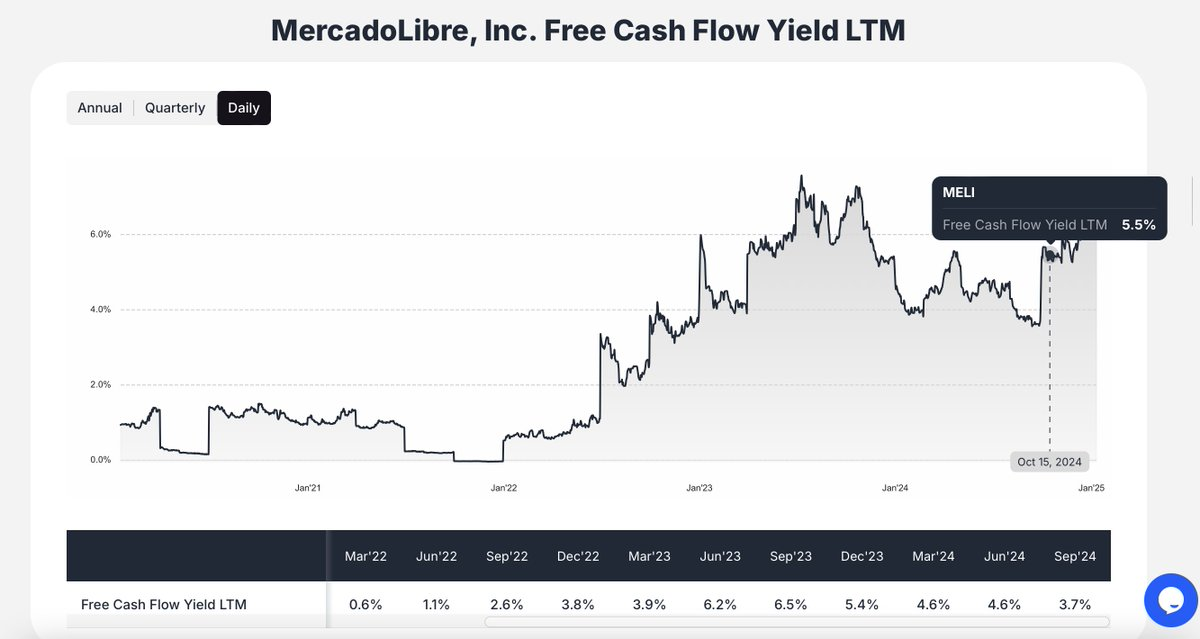

MercadoLibre $MELI

Growth Rating: 8.3 / 10

ROIC: 41.3%

FCF Yield: 6.3%

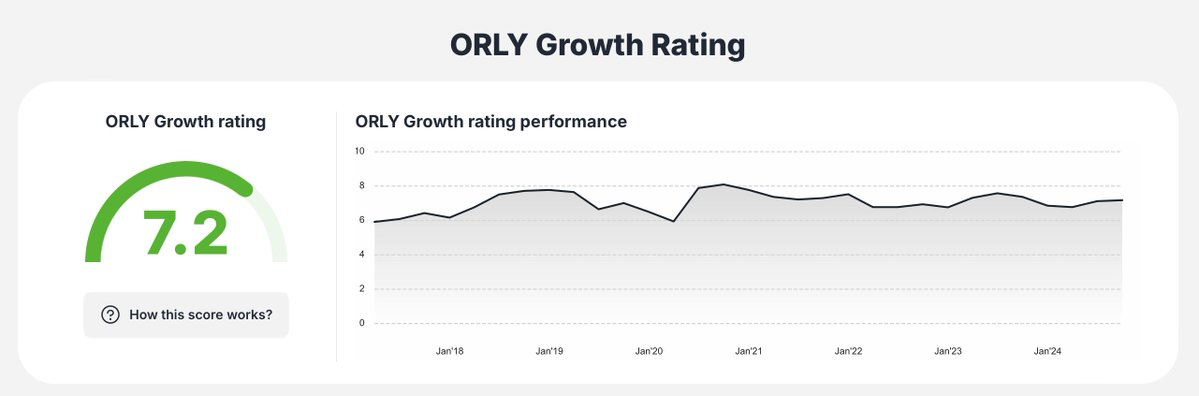

O'Reilly Automotive $ORLY

Growth Rating: 7.2 / 10

ROIC: 33.6%

FCF Yield: 3.5%

The Screening criteria for High Growth & Great Capital Allocation:

Growth Rating > 7 / 10

LTM ROIC > 20%

FCF Yield > 3%

You can check out the companies from the thread on the Value Sense platform. It's absolutely free.

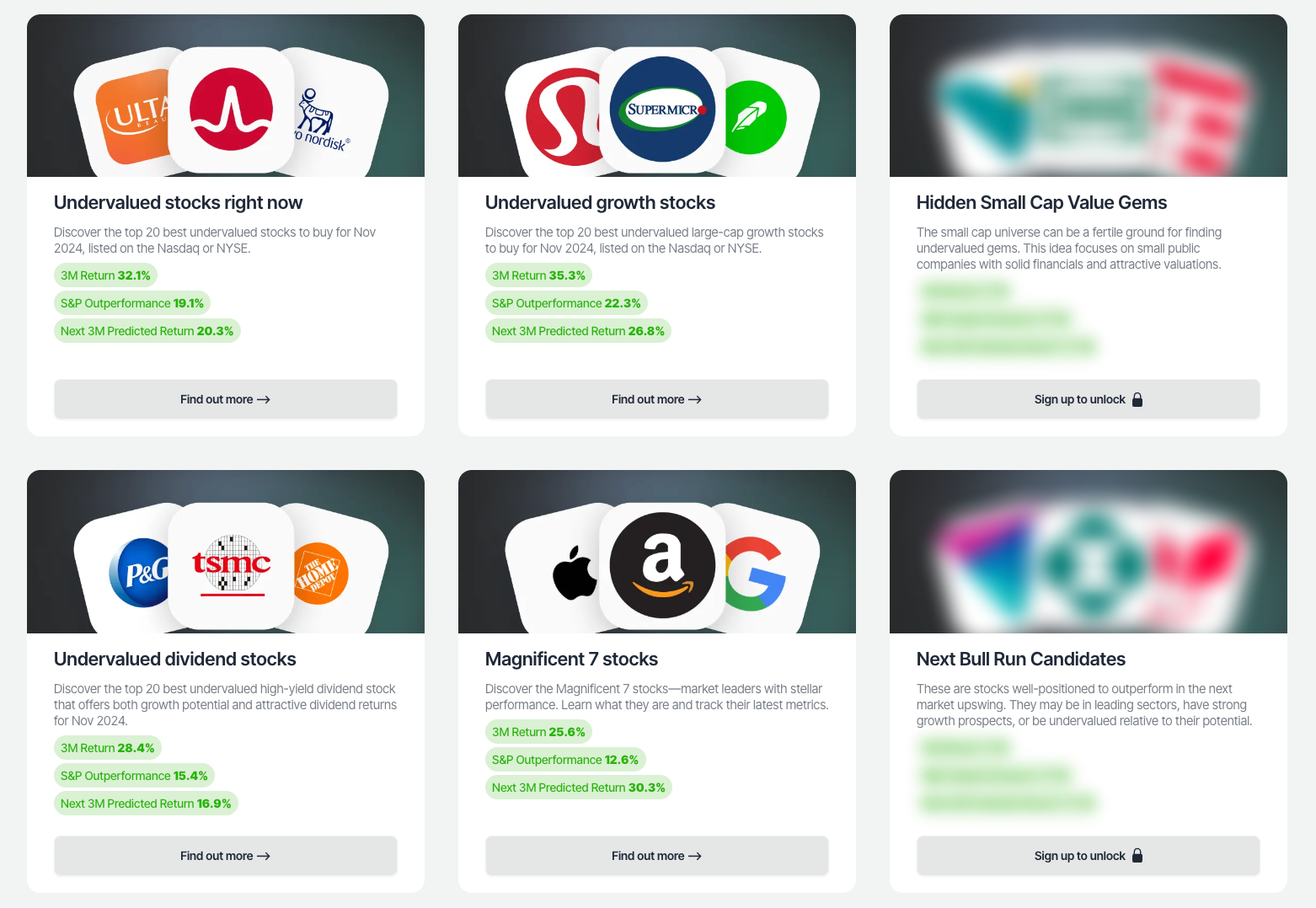

For investors seeking opportunities, our analytics team provides comprehensive lists of undervalued companies where the intrinsic value suggests potential undervaluation, combining fundamental analysis with quality metrics:

Ready to start?

Join 3,500+ value investors worldwide

FAQ

1. What criteria were used to select the high-growth stocks in this article?

The selection criteria for high-growth stocks included:

- Growth Rating greater than 7/10

- Return on Invested Capital (ROIC) exceeding 20%

- Free Cash Flow (FCF) Yield above 3%

These metrics ensure that the companies have both strong growth potential and efficient capital allocation.

2. Why is ROIC important for evaluating high-growth stocks?

ROIC (Return on Invested Capital) measures how efficiently a company generates returns from its invested capital. A high ROIC indicates that a company is allocating capital effectively, leading to sustained growth and higher shareholder value. In this article, all selected companies have an ROIC above 20%, signifying strong capital efficiency.

3. What makes free cash flow (FCF) yield an essential metric for investors?

FCF Yield represents the percentage of a company’s free cash flow relative to its market value. A higher FCF Yield (above 3% in this case) suggests that the company generates substantial cash profits, which can be used for reinvestment, dividends, or buybacks—benefiting long-term investors.

4. How can investors access more undervalued stock ideas from Value Sense?

Investors can explore comprehensive lists of undervalued stocks, including dividend and growth stocks, on the Value Sense platform for free. The platform provides fundamental analysis, intrinsic value insights, and quality metrics to help investors make informed decisions.

5. What are some examples of companies that meet the high-growth and capital allocation criteria?

Some companies highlighted in the article include:

- Meta Platforms (META) – ROIC: 36.2%, FCF Yield: 3.4%

- Adobe (ADBE) – ROIC: 36.0%, FCF Yield: 4.4%

- Applied Materials (AMAT) – ROIC: 41.8%, FCF Yield: 5.4%

- MercadoLibre (MELI) – ROIC: 41.3%, FCF Yield: 6.3%

These companies have strong growth ratings and capital efficiency, making them attractive investment opportunities.